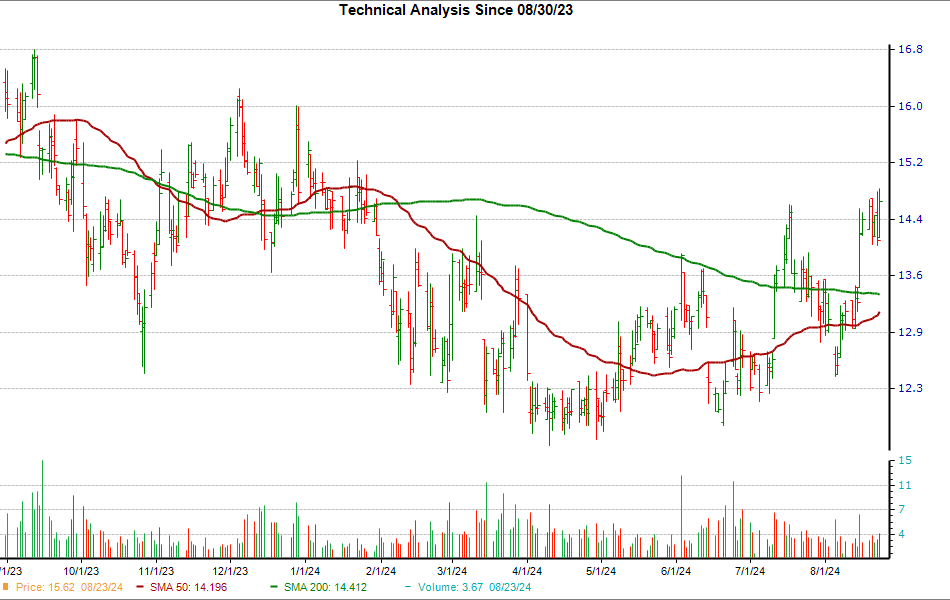

NexPoint's Technical Outlook is Bright After Key Golden Cross

After reaching an important support level, NexPoint Real Estate Finance, Inc. NREF could be a good stock pick from a technical perspective. NREF recently experienced a “golden cross” event, which saw its 50-day simple moving average breaking out above its 200-day simple moving average.

A golden cross is a technical chart pattern that can signify a potential bullish breakout. It’s formed from a crossover involving a security’s short-term moving average breaking above a longer-term moving average, with the most common moving averages being the 50-day and the 200-day, since bigger time periods tend to form stronger breakouts.

Golden crosses have three key stages that investors look out for. It starts with a downtrend in a stock’s price that eventually bottoms out, followed by the stock’s shorter moving average crossing over its longer moving average and triggering a trend reversal. The final stage is when a stock continues the upward climb to higher prices.

This kind of chart pattern is the opposite of a death cross, which is a technical event that suggests future bearish price movement.

NREF has rallied 15.7% over the past four weeks, and the company is a #1 (Strong Buy) on the Zacks Rank at the moment. This combination indicates NREF could be poised for a breakout.

The bullish case only gets stronger once investors take into account NREF’s positive earnings outlook for the current quarter. There have been 2 upwards revisions compared to none lower over the past 60 days, and the Zacks Consensus Estimate has moved up as well.

Given this move in earnings estimates and the positive technical factor, investors may want to keep their eye on NREF for more gains in the near future.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What Stocks Does Donald Trump Own? New Financial Disclosure Revealed

As Donald Trump campaigns for a return to the White House, his latest financial disclosure offers a look into the investment strategy of the businessman-turned-politician.

The Aug. 13, 2024, filing shows a portfolio that spans from high-flying tech stocks to reliable dividend payers. Outside of the individual stocks Trump owns, his disclosure lists real estate holdings valued in the hundreds of millions, and government bonds valued in the millions.

Don’t Miss:

If Trump were a money manager, he might be defined as one who balances growth potential with steady income.

While Trump’s 64.9% stake in Trump Media & Technology Group dwarfs his other holdings at $2.4 billion, his investments in other companies are substantial and diverse. The former president has placed large bets on multiple ‘magnificent seven’ stocks, with stakes valued between $500,001 and $1 million each in Apple, Microsoft and NVIDIA.

Trending:

Those holdings suggest Trump has embraced Wall Street’s enthusiasm for artificial intelligence (AI), the nascent sector that has driven much of the market’s gains in recent months. His portfolio also includes positions in other magnificent seven stocks, including Alphabet and Amazon, valued between $100,000-$250,000 and $250,000-$500,000 respectively.

But the former president’s strategy extends beyond Silicon Valley darlings. His disclosure lists hundreds of individual stocks, including positions in financials like JPMorgan Chase and Warren Buffett’s Berkshire Hathaway.

See Also:

Trump’s portfolio also features a significant number of dividend stocks, which include household names like Coca-Cola, Johnson & Johnson and Procter & Gamble.

Here’s a look at some of the stocks Trump owns that are valued at more than $15,000.

-

Apple Inc ($500,000 – $1,000,000)

-

Microsoft Corp ($500,000 – $1,000,000)

-

Nvidia Corp ($500,000 – $1,000,000)

-

Amazon.com, Inc ($250,000 – $500,000)

-

Alphabet Inc (Google) ($100,000 – $250,000)

-

Meta Platforms Inc ($100,000 – $250,000)

-

Berkshire Hathaway Inc ($100,000 – $250,000)

-

PepsiCo Inc ($100,000 – $250,000)

-

JPMorgan Chase & Co ($100,000 – $250,000)

-

Tesla Inc ($50,000 – $100,000)

-

Coca-Cola Co

-

Exxon Mobil Corp

-

Chevron Corp

-

Home Depot Inc

-

McDonald’s Corp

-

AbbVie Inc

-

Adobe Inc

-

Broadcom Inc

-

Booking Holdings Inc

-

Caterpillar Inc

-

Cisco Systems Inc

-

ConocoPhillips

-

Lockheed Martin Corp

-

Netflix Inc

-

Pfizer Inc

-

Qualcomm Inc

-

Union Pacific Corp

-

United Parcel Service, Inc.

As the 2024 election race goes on, Trump’s investment choices may face increased scrutiny. His stake in Trump Media & Technology Group, which owns the social media platform Truth Social, is likely to be the most talked about Trump holding.

Trending:

The “lockup” agreement preventing insiders from selling shares is set to expire in late September, potentially allowing Trump to cash out some of his $2.4 billion position. According to the disclosures, Trump owns 114,750,000 shares of the media brand or 64.9% of the entire company.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article What Stocks Does Donald Trump Own? New Financial Disclosure Revealed originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

QQQ Has $1.2T in Inflows

Top 10 Creations (All ETFs)

|

Ticker |

Name |

Net Flows ($, mm) |

AUM ($, mm) |

AUM % Change |

|

3,602.18 |

78,441.42 |

4.59% |

||

|

1,255.82 |

561,815.29 |

0.22% |

||

|

1,201.54 |

286,744.51 |

0.42% |

||

|

507.31 |

31,824.15 |

1.59% |

||

|

465.39 |

35,542.41 |

1.31% |

||

|

303.21 |

503,123.44 |

0.06% |

||

|

276.92 |

7,507.86 |

3.69% |

||

|

215.24 |

62,145.48 |

0.35% |

||

|

137.74 |

548.94 |

25.09% |

||

|

122.16 |

31,508.76 |

0.39% |

Top 10 Redemptions (All ETFs)

|

Ticker |

Name |

Net Flows ($, mm) |

AUM ($, mm) |

AUM % Change |

|

-4,084.82 |

4,096.82 |

-99.71% |

||

|

-608.33 |

69,175.30 |

-0.88% |

||

|

-596.16 |

596.16 |

-100.00% |

||

|

-533.15 |

516,256.30 |

-0.10% |

||

|

-205.97 |

5,545.52 |

-3.71% |

||

|

-204.58 |

17,171.76 |

-1.19% |

||

|

-164.49 |

34,787.38 |

-0.47% |

||

|

-124.25 |

14,909.83 |

-0.83% |

||

|

-113.73 |

9,038.21 |

-1.26% |

||

|

-107.75 |

36,824.97 |

-0.29% |

ETF Daily Flows By Asset Class

|

|

Net Flows ($, mm) |

AUM ($, mm) |

% of AUM |

|

Alternatives |

-63.94 |

8,271.20 |

-0.77% |

|

Asset Allocation |

49.05 |

19,709.62 |

0.25% |

|

Commodities |

195.03 |

151,474.61 |

0.13% |

|

Currency |

-132.45 |

63,076.91 |

-0.21% |

|

International Equity |

59.66 |

1,558,937.90 |

0.00% |

|

International Fixed Income |

161.99 |

214,195.92 |

0.08% |

|

Inverse |

57.30 |

12,970.28 |

0.44% |

|

Leveraged |

-23.79 |

105,663.56 |

-0.02% |

|

U.S. Equity |

6,809.32 |

6,033,978.25 |

0.11% |

|

U.S. Fixed Income |

-3,357.49 |

1,523,160.67 |

-0.22% |

|

Total: |

3,754.69 |

9,691,438.94 |

0.04% |

Disclaimer: All data as of 6 a.m. Eastern time the date the article is published. Data is believed to be accurate; however, transient market data is often subject to subsequent revision and correction by the exchanges.

JENNER LAW, GRANT & EISENHOFER, BAIRD, MANDALAS, BROCKSTEDT & FEDERICO: Upcoming Maryland Supreme Court Hearing on Constitutionality of Historic Child Victims Act of 2023 (CVA) Focus of Thursday, September 5th News Conference-Litigation Update

BALTIMORE, Aug. 31, 2024 (GLOBE NEWSWIRE) —

Summary

The consortium of Greater Baltimore law firms comprised of civil rights litigators from Jenner Law, Grant & Eisenhofer, and Baird Mandalas Brockstedt & Federico will hold a comprehensive litigation update-news conference on September 5th prior to the upcoming (September 10th) Maryland Supreme Court arguments on the constitutionality of the Child Victims Act of 2023 (CVA). Joined by several survivors-plaintiffs, advocates and the team will review the history of the legislation, and litigation (in state and federal courts), and the devastating impacts on generations of childhood sexual abuse survivors. They will also present the inaugural screening of “Survivors Stories: At the Crossroads of Justice,” a video featuring several leaders in the fight for CVA passage and survivors’ rights. To the survivors – many now elderly, unable to come forward for decades after their horrific abuse – the CVA is a beacon of hope that represents possibly their last chance for justice after a lifetime of dislocation and suffering. The Court’s ruling is expected to have profound ramifications in Maryland as well as nationally. The case Valerie Bunker v. The Key School, et al. is one of three lead cases before the Court; the argument follows a federal court’s request that the state Supreme Court decide the pivotal question of constitutionality.

When & Where

| Time/Date: | 10:00 a.m. ET / Thursday, September 5, 2024 |

| Place: | Jenner Law / Meadow Mill, 3600 Clipper Mill Rd., Suite 240, Baltimore, Maryland 21211 |

| Note: | Media set up starts at 9 a.m.; on-site parking available |

Program – Participants (partial list)

- “Survivors Stories: At the Crossroads of Justice”, first showing, featuring survivors and advocates.

- Survivors-Plaintiffs, including those that were among the first to file claims against Maryland defendants under the CVA.

- Attorneys-Advocates: Including counsel for named plaintiffs and attorneys from civil-children’s rights organizations among those filing Amicus briefs urging retention, as enacted, of the CVA.

- Survivor-Advocate David Lorenz, SNAP, Maryland

- Advocate Gemma Hoskins (‘The Keepers’)

Contacts

| • Robert K. Jenner, Jenner Law: | 410-413-2155 | |

| • Steven J. Kelly, Grant & Eisenhofer: | 410-204-4528 | |

| • Phil Federico, Baird Mandalas Brockstedt & Federico: | 410-421-7777 |

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

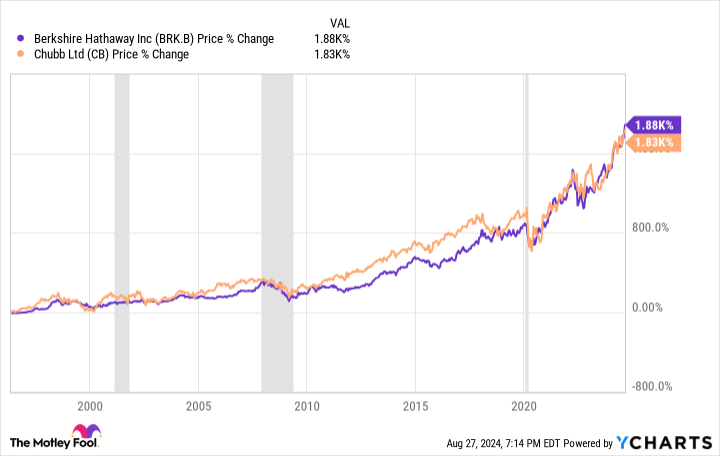

Forget Berkshire Hathaway, Buy This Magnificent Insurance Stock Instead

Throughout history, there has almost never been a bad time to buy shares of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). The company, led by legendary investor Warren Buffett, has simply been one of the best investments of all time.

However, now valued at nearly $1 trillion, Berkshire isn’t the same company it used to be. The future is still very bright, but there are other similar options investors should strongly consider. Even Buffett agrees with this. Over the past 12 months, he’s plowed billions of dollars into a company with a lot of similarities to Berkshire.

Buffett is betting billions on this insurance company

At the core of Berkshire’s empire is a portfolio of insurance companies. These businesses have been the foundation of Buffett’s investment strategy for decades. The value of operating an insurance company is that you regularly have investable cash available. That’s because insurance providers collect cash whenever a policy premium is paid, but they only have to pay out that cash when a claim is filed. In the interim, they get to keep the capital free of interest. Industry experts call these interest-free capital “float.”

Float is available to insurance companies regardless of economic or market conditions. It gives the owner of that float the ability to invest capital when it’s in scarce supply. In other words, it gives Buffett a huge capital advantage when prices fall and outside capital dries up. Suffice it to say that Buffett understands the insurance industry incredibly well, and it’s been key to Berkshire’s long-term success. It should come as no surprise, then, that Berkshire has been plowing billions into one of the largest, highest-quality insurance operators in the world: Chubb Ltd (NYSE: CB).

What makes Chubb better than Berkshire?

Over the long term, Chubb and Berkshire have posted very similar performances, although a recent surge in Berkshire’s value has pushed it over the top so far this year. Where Chubb truly shines, however, is during times of turmoil. From 2008 through 2009, for example — the worst years of the financial crisis — Chubb outperformed Berkshire by 12%.

It hasn’t been a perfect performance, however. Berkshire’s diversified business model allowed it to sail through the 2020 flash crash more easily. But over the last five years, Chubb has generated a beta of 0.67 versus Berkshire’s beta of 0.87. As a measurement of volatility, these numbers suggest that Chubb stock is likely a safer place to be if markets suddenly plunge.

Still, Berkshire and Chubb’s long-term performance and volatility are very similar, even if Chubb has proven a slightly superior option during bear markets. In reality, perhaps the best reason to buy Chubb over Berkshire right now is the valuation. Chubb stock trades at just 1.8 times book value, while the industry average for property and casualty insurers is above 2 times book value. The average return on equity for the industry is also around 10% — lower than Chubb’s latest result of 14.7%. The valuation becomes even more attractive when you consider Chubb is buying back huge sums of stock, an act that creates shareholder value but tends to depress accounting book value. More than $3 billion remains under its current share repurchase program.

Want proof that Chubb’s current valuation is too good to pass up? Right now, Berkshire’s cash hoard of $277 billion is at an all-time high. This comes at a time when Buffett continues to buy back Berkshire stock, which trades at a slight discount to Chubb on a price-to-book basis. Yet instead of buying back more Berkshire stock or keeping the capital as cash, Buffett opted to build a $7 billion stake in Chubb. Last quarter, Berkshire invested just $2.6 billion in share repurchases, suggesting that Buffett views Chubb as a superior investment right now.

Will Chubb be a far more superior investment in the years to come than Berkshire? Likely not. But Buffett is clearly a fan, and the company’s reasonable valuation, strong returns on equity, and long-term record of performance make it easy to understand why. If you’re a fan of Berkshire, strongly consider adding Chubb to your portfolio.

Should you invest $1,000 in Chubb right now?

Before you buy stock in Chubb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chubb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Forget Berkshire Hathaway, Buy This Magnificent Insurance Stock Instead was originally published by The Motley Fool

Harris's proposed unrealized capital gains tax is unlikely to pass: CIO

Unrealized capital gains tax proposals may be floating back into the zeitgeist as the Harris presidential campaign marches on, but for some, the noise around it is much ado about nothing.

“I don’t think this unrealized thing is going to have much momentum because it is a very onerous process to come up with those numbers,” Raymond James chief investment officer Larry Adam told Yahoo Finance Executive Editor Brian Sozzi on Yahoo Finance’s Opening Bid podcast (see video above or listen here).

“You start putting biases of what you think [something] is worth versus the reality,” said Adam. “That becomes a very difficult equation to really put into a place.”

We’ve seen unrealized capital gains tax proposals before, but they’ve met plenty of resistance.

Most recently, the Biden administration proposed an unrealized capital gains tax for those with a net worth of over $100 million. The proposal could affect more than 10,600 people in the US, according to estimates.

But, unlike a capital gains tax, which is imposed on a sold item, deploying an unrealized capital gains tax is a trickier move.

Stifel chief Washington strategist Brian Gardner said in a recent client note that under an unrealized capital gains tax system, “ranking illiquid assets would not only be complicated but controversial,” adding that there would also need to be a way to provide taxpayers with “rebates for future losses.”

While analysts scratch their heads about the subject, an unrealized capital gains tax also has plenty of tomato throwers. Donald Trump called it “beyond socialism,” telling a crowd of small-business owners, “You will be forced to sell your restaurant immediately.”

Trump’s onetime US Commerce Secretary, Wilbur Ross, concurred.

“Frankly, I think it’s a ridiculous proposal,” Ross said on Opening Bid.

Tesla (TSLA) CEO Elon Musk also had negative statements to share on the topic, proclaiming an unrealized capital gains tax would lead to “bread lines and ugly shoes.”

While Trump and Musk might deliver their messages to pack a wallop and make voters think, concerns aren’t necessarily unfounded.

Raymond James’s Adam has considered tax proposals made by both candidates, and thinks that regardless of the administration in office, higher taxes could impact households by almost $2,000. “[It] could be a big impact and a drag on the economy,” he said.

Both Harris and Trump face challenges given the expiration of a significant portion of the 2017 tax cuts at the end of 2025. Trump has proposed an additional extension of provisions from 2017 and potentially more tax cuts.

Harris proposed expanding the child tax credit and supported no increase in the capital gains tax, while taxing those making over $400,000 annually more.

While the presidential race is anyone’s game at this point, Adam isn’t that worried about an unrealized capital gains tax and the potential market losses. “[There’s] a low probability of it passing,” he said. “It’s pretty hard to mark to market every single year for your taxes.”

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

In the below Opening Bid episode, former Trump nominee to the Federal Reserve Judy Shelton shares her outlook for the economy.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Best cash-back credit cards for September 2024

If you want to maximize your spending power, a cash-back credit card can be a helpful financial tool, even with today’s current inflated prices. After all, building credit is integral to your financial journey — and doing so with a cash-back credit card gives you added perks such as rewards, bonus cash back, and redemption options that you might not get with other cards. To help you find the best cash-back credit card for your wallet, we’ve included plenty of factors to consider, including annual fees, welcome offers, and rewards categories that we believe can offer you the best returns today.

Before applying for a cash-back credit card, familiarize yourself with different categories of cash-back credit cards.

-

Flat-rate cash-back cards come at a fixed earning rate, meaning you will always get that amount of cash back as you make purchases.

-

There are also tiered cash-back credit cards, which give a different percentage of cash back on different categories of purchases, like groceries or gas.

-

And then there are rotating cash-back credit cards, which rotate the categories that get higher cash-back percentages on monthly or quarterly schedules. Whatever card you choose is a personal preference based on your purchasing habits.

Cash-back credit cards are often designed to reward everyday spending. Our list is made up of the cash-back cards we believe can offer maximum savings on the purchases you make most often.

In this article:

Annual fee: $95 (after a $0 intro fee the first year)

Welcome offer: Earn $250 after spending $3,000 within the first 6 months

APR: 0% intro APR on purchases and balance transfers for 12 months; ongoing 19.24%-29.99% variable APR thereafter (see rates & fees)

How cash-back works*:

-

6% cash back at U.S. supermarkets (up to $6,000 spent per year, then 1%)

-

6% cash back on select U.S. streaming subscriptions

-

3% cash back at U.S. gas stations

-

3% cash back on transit (taxis, rideshare, parking, tolls, trains, buses, and more)

-

1% cash back on all other spending

*Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout.

Potential annual cash back: $513.33 (after accounting for annual fee)

Recommended credit score: Good to Excellent

Pros:

Cons:

-

Has an annual fee

-

Cash back can only be redeemed as a statement credit on Amazon

-

Requires good to excellent credit

-

Has an annual cap of $6,000 on grocery earnings

-

Potentially high APR, after intro period

More card details: You can get $7 back per month in statement credits (up to $84 per year) when you spend at least $9.99 on an auto-renewing Disney Bundle subscription (valid only at Disney Plus.com, Hulu.com or Plus.espn.com in the U.S. Terms apply; see rates and fees.

Why this is the best cash-back credit card for groceries

You’ll be hard-pressed to find a credit card today that can beat the Blue Cash Preferred’s 6% back at U.S. supermarkets. Even with the $6,000 annual cap, that’s a potential $360 back on just your grocery bills each year.

Plus, this card is one of the top options for potential rewards based on our spending calculations, with more than $500 back each year even after accounting for the $95 annual fee (though it’s waived the first year).

Whether you do the monthly shopping for your family, have roommates, or just tend to eat and spend time at home often, you can get a ton of value from this card — as long as you can outpace the annual fee.

Read more: See our picks for the best American Express credit cards

Annual fee: $0

Welcome offer: Earn a $200 bonus after spending $500 within the first 3 months of account opening

APR: 0% intro APR on purchases and balance transfers for 15 months; ongoing 19.99%-29.99% variable APR thereafter

How cash-back works:

-

8% cash back on Capital One Entertainment purchases

-

5% cash back on hotels and rental cars booked through Capital One Travel

-

3% cash back on dining

-

3% cash back on entertainment

-

3% cash back at grocery stores (excluding superstores like Walmart and Target)

-

3% cash back on popular streaming services

-

1% cash back on all other spending

Potential annual cash back: $447.38

Recommended credit score: Good to Excellent

Pros:

-

Multiple cash-back opportunities across many spending categories

-

No annual fee

-

0% introductory APR for first 15 months

-

$200 welcome offer

-

Complimentary Uber One membership

Cons:

-

Requires good to excellent credit

-

Potentially high APR after intro period

-

Limits which grocery stores you can earn at

More card details: The SavorOne card charges no foreign transaction fees, making it a good choice for trips abroad. Through Nov. 14, 2024, you can also earn 10% back on Uber and Uber Eats and get a monthly statement toward Uber One membership if you pay using your card.

Why this is the best cash-back credit card for restaurants

We like the SavorOne card for restaurants thanks to its 3% rewards rate — unmatched among most cash-back credit cards. But it can be ideal for both nights out and nights in, with other rewards on entertainment spending (including movie theaters and tourist attractions), grocery stores, and streaming subscriptions.

According to our calculations, the average consumer can get more value from this no annual fee card than its $95 sister card, the Capital One Savor Rewards Credit Card, which has an average potential value of $404.08. But if the majority of your budget goes toward entertainment and dining out, the boosted 4% earning rate in those categories may justify the added fee.

Annual fee: $0

Welcome offer: Earn $200 after spending $2,000 within the first 6 months

APR: 0% intro APR on purchases and balance transfers for 15 months; ongoing 19.24%-29.99% variable APR thereafter (See rates & fees)

How cash-back works*:

-

3% cash back at U.S. supermarkets (up to $6,000 spent per year, then 1%)

-

3% cash back at U.S. gas stations (up to $6,000 spent per year, then 1%)

-

3% cash back on U.S. online retail purchases (up to $6,000 spent per year, then 1%)

-

1% cash back on all other spending

*Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit or on Amazon.com at checkout.

Potential annual cash back: $406.38

Recommended credit score: Good to Excellent

Pros:

Cons:

-

Requires good to excellent credit

-

Cash back can only be redeemed on Amazon or as a statement credit

-

Potentially high APR after intro period

-

Has annual earning caps on several spending categories

More details: After spending at least $9.99 on an eligible Disney Bundle subscription, get $7 back as a statement credit each month. Plus, earn up to $15 back each month when you sign up for an auto-renewing Home Chef subscription. Terms apply; see rates and fees.

Why this is the best cash-back credit card for gas stations

This card offers among the highest cash-back rates available on gas station spending, with a potential $180 back each year if you meet the spending cap. But we also love the versatility of the Blue Cash Everyday. It offers rewards at supermarkets, and you can earn 3% back on your online shopping — which may include everything from huge retail sites to small online shops by your favorite sellers. That’s not a common bonus category among other cash-back cards today, and it can offer some major savings for frequent online shoppers.

Annual fee: $0

Welcome offer: Earn $200 cash back after spending at least $1,500 within the first 6 months

APR: 0% intro APR on balance transfers only for 18 months; ongoing 19.24%-29.24% variable APR

How cash-back works:

-

5% cash back on hotel, car rentals, and attractions booked on the Citi Travel portal (through the end of 2024)

-

2% cash back on all general spending: 1% when you spend, another 1% when you pay it off

Potential annual cash back: $459.84

Pros:

Cons:

-

Potentially high APR, after intro period

-

No 0% intro offers on balance transfers

Why this is the best cash-back credit card for flat cash back

The Citi Double Cash takes our spot for the best flat cash-back card for several reasons. For one, it offers up to 2% cash back on every purchase — which is about as high as you’ll find flat cash back rates today.

But we also like the structure of this card’s earnings, which encourages you to pay your balances in full and on time each month. You’ll only earn half of your 2% cash back when you make a purchase with your card. The other 1% requires you to pay off the purchase in full.

Annual fee: $0

Welcome offer: Get an unlimited match of all the cash back you earn over the first year

APR: 0% intro APR on purchases and balance transfers for 15 months; ongoing 17.24%-28.24% variable APR thereafter

How cash-back works:

-

5% cash back on purchases in rotating quarterly categories (up to $1,500 in combined quarterly purchases, then 1%)

-

1% cash back on all other spending

Potential annual cash back: $446.32 (based on 2023 categories)

Pros:

Cons:

-

Higher cash-back rate is limited to certain rotating categories, so it may be unpredictable

-

Potentially high APR after intro period

-

Rotating rewards categories require manual activation

More details: It’s important to keep track of bonus categories each quarter to make sure you take advantage of your rotating 5% cash back. Discover doesn’t announce its full annual calendar in advance; categories are typically released the month prior to the start of a new quarter. It also pays to activate early. If you wait until the quarter’s already started, you’ll only earn 5% for qualifying purchases made after you activate.

Why this is the best cash-back credit card welcome bonus

The Discover it Cash Back card’s welcome bonus is unique among cash-back cards today — and can potentially be worth much more than other offers. Instead of a specific dollar amount, Discover will make an unlimited cash-back match of all the rewards you earn over your first year. So if you earn the potential $446.32 we predict based on average American spending, you could double that to a total of $892.60 cash back in your first year.

Like with any new card, just remember not to spend more than you can afford just to get a bigger bonus. If you carry a balance and take on the card’s high APR.

Annual fee: $95 (after a $0 intro fee the first year)

Welcome offer: Earn $250 after you spend $2,000 within the first 120 days of account opening

APR: 19.74%-29.74% variable APR

How cash-back works:

-

6% cash back on your first $1,500 in quarterly combined eligible spending with two choice retailers (eligible retailers include Apple, Amazon.com, Chewy.com, Home Depot, Ikea, Kohl’s, Lowe’s, Lululemon, Macy’s, Pottery Barn, Target, and Walmart)

-

3% cash back on your first $1,500 in eligible purchases each quarter in one choice everyday category (bills and home utilities, gas and EV charging stations, or wholesale clubs)

-

1.5% cash back on all other spending

Potential annual cash back: $553.32 (after annual fee; assuming groceries bought at retailers included in 6% category)

Pros:

Cons:

Why this is the best cash-back credit card for customization

If you use the Shopper Cash Rewards card from U.S. Bank wisely, it has the potential to offer the most value of any cash-back credit cards on our list — but you’ll also need to put in some extra work to maximize this card.

Based on average spending data, we assume that most people spend the greatest amount each month on groceries, for example. With this card, you can earn as much as 6% back on groceries if you buy them at Target or Walmart each month (two retailers typically excluded from supermarket rewards categories).

But the benefit of customizable rewards is that you can switch things up when necessary. Maybe you’re planning a home improvement project and want to purchase new appliances from Home Depot or Lowe’s — you can change one of your choice 6% retailers for the quarter to maximize your current spending.

Plus, after you max out the 6% and 3% quarterly spending caps, this card offers even more as a flat cash-back card, with a minimum 1.5% cash back on every purchase.

Best cash-back card for rotating rewards categories: Chase Freedom Flex®

Annual fee: $0

Welcome offer: $200 after spending $500 within the first 3 months; 5% cash back at gas stations and grocery stores (excluding Target and Walmart) for the first year, up to a combined $12,000 spent

APR: 0% intro APR on purchases and balance transfers for 15 months; ongoing 20.49%-29.24% variable APR thereafter

How cash-back works:

-

5% cash back on rotating bonus categories (up to $1,500 spent each quarter; requires activation)

-

5% cash back on travel purchased through Chase Ultimate Rewards

-

3% cash back on dining

-

3% cash back on drugstore purchases

-

1% cash back on all other spending

Potential annual cash back: $402.22 (based on 2023 categories)

Pros:

-

Multiple cash-back opportunities across many spending categories

-

No annual fee

-

0% introductory APR for first 15 months

-

$200 welcome offer

-

Complimentary DoorDash and Instacart+ memberships

-

Can transfer points between other Chase credit cards

Cons:

-

Potentially high APR after intro period

-

Higher cash-back rate limited to certain spending categories

-

Limits which grocery stores you can earn at

More details: In addition to its variety of cash-back categories, Chase Freedom Flex can help you earn 5% back on Lyft rides through March 2025. Plus, get three free months of DoorDash’s DashPass membership (automatic enrollment at 50% off for the next nine months after that; enroll by December 2024) and three free months of Instacart+ membership (automatic enrollment after that unless you cancel). After you enroll, also earn $10 in quarterly statement credits through July 2024 when you make Instacart purchases with your card.

Why this is the best cash-back credit card for rotating rewards

The Chase Freedom Flex offers a wide range of rotating categories each quarter. Over the past year, these have ranged from specific retailers like Target and Amazon to broader everyday spending like wholesale clubs, fitness clubs and gym memberships, and more. We also like this card for its ongoing cash-back rates on dining, at drugstores, and on Chase Ultimate Rewards Travel.

Plus, it makes a smart pairing for cardholders who have other Chase cards in their wallets. You can transfer the cash rewards you earn as Chase Ultimate Rewards points to either of the Chase Sapphire cards and earn their boosted rewards rates when you redeem for travel. If you’re already using a Chase travel credit card, the Freedom Flex can help expand your rewards categories and let you rack up points even faster.

Annual fee: $0

Welcome offer: None

APR: 30.74% variable APR

How cash-back works:

Potential annual cash back: $344.88

Recommended credit score: (No credit history)

Pros:

Cons:

-

No welcome offer or introductory APR

-

Is a secured card, so it requires a deposit

-

Lower potential savings than others on our list

More details: For this secured card, you’ll need to put down at least a $200 security deposit upon opening, which will act as your credit line. You’ll be automatically considered for a higher credit line after a minimum six months, and can earn your deposit back and potentially upgrade to the unsecured Quicksilver card with responsible use over time.

Why this is the best cash-back credit card for building credit

If you’re trying to build your credit history or rebuild your score, you probably know how difficult it can be to qualify for cards with any rewards at all — which is why we like the Quicksilver Secured for cardholders looking to build credit while still earning cash rewards.

Not only can you get 1.5% back on every purchase from the start, but Capital One offers a clear path towards graduating to an unsecured version of the card and a higher credit line. If you show that you’re using your card responsibly, you can get valuable cash back and the credit score required to help you qualify for other cards.

More cash-back cards to consider

Wells Fargo Active Cash® Card

The Active Cash Card is another 2% flat cash-back card that can make a great option for a wide range of cardholders. This card has no annual fee, and a welcome offer of $200 after you spend $500 within the first three months. There’s also an introductory 0% APR for 15 months on purchases and balance transfers (with a 20.24%, 25.24%, or 29.99% variable APR thereafter).

There are few other ongoing rewards or benefits, but 2% cash back alone is at the high end of flat cash-back rewards you’ll find among any card today.

Prime Visa

For the most part, we didn’t include co-branded cash-back cards on this list — but this card is an exceptionally versatile version of a retail card. For frequent Amazon shoppers, the Prime Visa card can offer many savings and cash back in other everyday categories. There’s no annual fee, but you need a Prime membership ($14.99 per month or $139 per year). Here are the rewards categories:

-

5% cash back at Amazon.com, Amazon Fresh, Whole Foods Market, and on Chase Travel purchases with an eligible Prime membership

-

2% cash back at gas stations, restaurants, and on local transit and commuting (including rideshare)

-

1% cash back on all other spending

After you sign up, you can get an instant $200 Amazon gift card. Throughout the year, you’ll also earn a boosted 10% back on select products and categories when you shop with Amazon.

Chase Freedom Unlimited®

The Chase Freedom Unlimited is another no annual fee card that combines rotating categories with flat cash back for a solid potential max value. You’ll earn:

-

5% cash back on travel purchased through Chase Travel

-

3% cash back on dining and drugstore purchases

-

1.5% cash back on all other spending

New cardholders can earn an extra 1.5% cash back (up to $300) on all purchases for the first year (up to $20,000 in spending). And like the Freedom Flex, this card also pairs well with Chase’s travel card options. You can transfer your cash back as points between different card accounts to get even more value when you redeem for travel.

Recommended credit score: Good to Excellent

Types of cash-back credit cards

Cash-back credit cards can carry a wide range of rewards, but they tend to fall in one of three categories.

Flat cash back

Flat cash-back cards earn a standard amount of cash back on everything. There’s no need to keep track of bonus categories or percentages, because you’ll get the exact same amount back no matter what type of purchase you make.

Flat cash-back cards usually offer 1.5% or 2% cash back on every purchase.

This type of card may be best for someone who doesn’t have a single top spending category each month or iqs looking for an easy way to earn rewards without putting too much thought into maximization.

Tiered cash back

Tiered cash-back cards may be what you imagine when you think of a cash-back credit card. These cards earn cash back at different rates across different spending categories. Typically, you’ll see a tiered cash-back card with 2-3 eligible bonus categories that earn anywhere from 2%-6% cash back.

Some tiered cash-back cards — especially those with very high 5%-6% bonus categories — may limit earnings to purchases under a certain spending cap (monthly, quarterly, or annually). For example, you might earn 5% back on dining with a cash-back card , but only on the first $1,500 you spend at restaurants each quarter.

Tiered cash-back cards can be great for maximizing your spending if you choose a card with great rewards where you spend most. Just make sure you understand your card’s rewards structure, as well as its limitations, before you start spending.

Rotating cash back

Rotating cash-back cards are unique among rewards credit cards, since your top rewards categories are constantly changing. These cards generally earn 5% cash back each quarter in specific rotating categories, up to certain limits.

The rotating categories can differ year-to-year, but they tend to center around everyday spending. You may, for instance, see categories like groceries, gas, and dining, as well as specific retailers like Target, Walmart, and Amazon.

The rewards caps are important to remember with this type of card. If you spend much more than the quarterly cap (often around $1,500), you may not get the best value for your spending. You’ll also need to keep up with and activate the new categories each time they roll around.

How to choose a cash-back card

Before you open a cash-back credit card, compare the details below to your goals, budget, and what you’re looking for in your new card.

Annual fee

Many cash-back cards charge no annual fee. However, if you are willing to pay an annual fee for your cash-back card, you may get boosted cash-back rates in return.

Whether an annual fee is worth it for you depends on your individual spending and the value you’ll get out of a card. When we calculated average cash rewards earnings, all the cards with annual fees far outpaced their annual fees in rewards value. But if you don’t spend as much as the average across bonus categories, that may not be true for you.

The good news is that many of the best cash-back cards available charge no annual fee at all — making it easy to find one that works with any budget.

Welcome offer

Cash-back credit cards often offer cash sign-up bonuses after you meet a spending threshold within a certain amount of time after opening your account.

You’ll most frequently see bonuses for $150 or $200 after spending a minimum of $500 to $2,000 on your card within about three months of account opening. Like with any new card, avoid spending more than you usually would just to meet the bonus threshold. The potential interest charges could quickly eliminate any added value if you have to carry a balance.

In addition to cash welcome offers, many cash-back cards also have introductory 0% APR offers on new purchases (and some on balance transfers). You can earn 0% on purchases you make with your card for anywhere from 6 to 18 months, after which any remaining balance will take on your ongoing variable interest rate.

Cash-back rewards categories

Perhaps the most important thing to factor into your cash-back card choice is the categories in which you’ll earn rewards. Here are a few common bonus categories offered today:

Review your receipts and statements from the past several months to get an idea of where you spend most. Do you tend to eat at restaurants or order takeout most nights? Or do you stick to a weekly grocery shop for most of your meals? Do you have a car that takes a lot of miles on for your weekly commute? Or do you rely more on public transportation, supplemented by Uber and Lyft rides?

Knowing the details of your own spending habits can help you make the best choice of rewards. Don’t forget about flat cash-back cards and cards with rotating categories. These can be among the most lucrative options, especially if your spending falls outside common categories.

Benefits and more

You won’t find as many added benefits and perks from cash-back cards as you will on travel and rewards credit cards. But some cash-back options do offer extra benefits that can help you save even more throughout the year.

Often, cash-back credit card benefits come from brands that partner with credit card issuers. For example, you may get a small monthly credit toward a subscription or membership. Alternatively, you might be eligible for a few months’ trial membership for a service.

If you don’t already use the services these benefits help subsidize, it could cost you more money over time. But if you are already a member or subscriber, they may give you an extra savings boost over time.

How to make the most of cash back

Here are a few things to consider while you earn and redeem cash-back rewards:

Track your rewards

Make sure you keep regular track of the cash rewards you earn. While they probably won’t expire (unless you close your account), you don’t want to let them sit unused for too long, either.

Consider redeeming your cash back every few months, unless you’re saving for a big redemption. If your rewards are simply sitting in your account unused, you’re not gaining any value from them. Unlike a savings account, for example, they don’t earn any interest — so you could even lose potential value if you account for inflation.

Keep in mind, some issuers have thresholds (like a $25 minimum) you must meet before you can redeem. You may even be able to set up automatic redemptions once you meet a certain amount of rewards earned

Combine with other cards

Cash-back cards can be ideal for pairing with other cash-back cards or travel rewards cards to maximize your earnings.

For example, say you already have a travel card you use to earn bonus points on flights, hotels, and rental cars when you travel. You can also open a cash-back card for savings on dining at restaurants, your favorite streaming services, and supermarket shopping. Now, between both cards, you can optimize the majority of your spending while traveling and at home.

If you prefer the simplicity of only cash back, you could do something similar with two cash-back cards. Maybe, instead, you already have a cash-back card that earns top rewards at supermarkets and gas stations, but you only get 1% back elsewhere. A flat cash-back card that earns 2% on every purchase could be a good option to help increase your baseline rewards every time you swipe.

Strategizing card use like this can take some time, but it will help you earn a lot higher cash-back value in the long run.

Just remember to pay your balance off in full and on time each month to get your maximum value. Otherwise, the high interest rates these cards carry could wipe out the amount you earn in rewards — and leave you with mounting debt balances.

Pros and cons of cash-back credit cards

Pros

Among different types of reward cards, cash-back credit cards can be some of the simplest to use. You don’t have to worry about converting points to currency or maximizing redemptions. Instead, you can simply redeem the cash back you earn for statement credits, a deposit into your bank account, or a check.

Cash-back cards are also perfect for saving on everyday purchases. If you don’t travel much, you may find many rewards cards don’t offer a lot of value for you. But cash-back cards tend to reward purchases in essential categories for many Americans: gas, groceries, streaming services, and more.

Despite their simplicity, cash-back cards can also be powerful tools. You can get hundreds of dollars in value each year just by spending the amount normally within your budget on a cash-back card. And the extra features — such as an intro 0% APR on new purchases or balance transfers, purchase protections, and more — can offer a lot of benefits and protections to help make the most of your spending.

Cons

Cash-back cards may hold a lot of value, but that doesn’t mean they’re for everyone. Like any type of rewards card, you shouldn’t opt for a cash-back card if you’re going to carry a balance. These cards can charge very high variable APRs, and any revolving balance on your account can quickly turn into high-interest debts. If you want to get any return on your spending with cash back, avoiding taking on debt with your card is important.

In some cases, there may be better options than cash-back cards for your spending. Spending caps for rewards earnings can hinder some people with very large monthly budgets, for example. And for frequent travelers who spend a lot of time on the go, cash-back cards don’t offer nearly as many perks as some travel rewards cards. Before you choose, compare your individual spending and budget to multiple card options to find the best one for you.

Should you open a cash-back credit card?

As long as you pay your balance in full and on time each month, we believe a cash-back card can play an important role in nearly every shopper’s wallet — whether you’re looking to supplement the other cards in your wallet, maximize your everyday spending, or begin building credit.

Just make sure you take the time to find the right cash-back option for you. Between flat, rotating, and tiered cash rewards (and cards that offer any combination of the three), there are plenty of options that may be better suited for your top spending categories than others.

Cash-back credit card FAQs

What credit score do you need for a cash-back credit card?

Many cash-back cards require at least good credit, or a FICO Score of at least 670, for approval. Some cash-back cards are designed for cardholders who are building credit, but they may not offer as robust rewards as others.

Before you apply, consider seeing whether you’re pre-approved for a card, so you don’t undergo a hard credit inquiry only to not get approved.

How do cash-back cards work?

Cash-back credit cards work like any other credit card. What’s unique about them is the potential to earn rewards. When you charge a purchase to your cash-back card, you’ll receive a percentage of each purchase back. As those amounts add up, you can redeem them for statement credits toward your card balance or physical cash. You may get boosted cash back percentages on specific purchases depending on the card you have.

Cash-back cards can offer a simpler rewards structure than some other points-and-miles rewards programs, which make them popular among cardholders who want to maximize their spending without too much extra work.

How do I get the best cash-back rewards?

The best cash-back rewards for you will depend on your spending habits and how you use your cash-back credit card. If the majority of your budget is focused in a few different categories (buying groceries, filling up your car’s gas tank), you’ll probably get the best value from a card with higher earnings in those categories. On the other hand, if you don’t want to worry about categories or when to use your card for maximum value, you may find a flat cash-back card that earns 1.5% or 2% back on every purchase will be a much better value for you.

Before you apply for a cash-back card, look at your overall spending and budget — and get realistic about how much you’re willing to maximize different spending categories.

Does cash back expire?

In many cases, the cash back you earn does not expire until your account is closed. However, individual issuers may have different standards for how long your cash back lasts. Always make sure to read your card agreement for expiration dates that may apply for your cash-back card.

What doesn’t count toward cash back?

Most cash-back cards offer at least 1% back on every purchase — but there are some transactions you can make that may not qualify. For example, issuers often exclude lottery ticket or gambling chip purchases from earning cash back, as well as items you return or unauthorized spending. You also won’t earn cash back for balance transfers, cash advances, and other types of non-purchase transactions.

Methodology

Our list of the best cash-back cards is designed to highlight the best overall cards with cash rewards as well as those with the most potential return on your spending.

We began by calculating average annual rewards for more than three dozen cash-back credit cards. This included every card from major issuers that earn cash back, as well as student and secured options with cash rewards. Retail cards and co-branded card options were excluded to keep this list focused on general cash-back earnings.

To determine average annual rewards, we used the most recent Consumer Expenditure data from the Bureau of Labor Statistics to get an idea of the amount Americans spend each year. We excluded housing, vehicle purchases, healthcare, cash contributions, personal insurance, and pension spending from the total, since these purchases don’t typically apply to credit card spending. That left us with a total average annual expenditure of $22,992 per year, or $1,916 per month.

From there, we broke out several categories and calculated how much the average spender could earn with each card. All non-category spending earned 1% cash back.

The cash-back totals we found were also integrated into the overall criteria we used to give each cash-back card a rating and determine the final picks on our list. In addition to total cash back value, we factored for the cards’ annual fees, rewards structures, 0% intro APR offers, ongoing APRs, any added benefits, and more — in addition to standard factors among all of our best cards ratings, like issuer transparency, mobile app use, credit score access, and others.

Our final best cash-back picks represent the top rated from this list, as well as the cards with the maximum cash-back value according to spending averages.

Editorial Disclosure: The information in this article has not been reviewed or approved by any advertiser. All opinions belong solely to Yahoo Finance and are not those of any other entity. The details on financial products, including card rates and fees, are accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information. This site doesn’t include all currently available offers. Credit score alone does not guarantee or imply approval for any financial product.

Merrill Lynch to Triple Total of Active ETFs: FT

Bank of America’s Merrill Lynch plans to triple its active ETF lineup over the next three to five years, evidence of financial services firms’ efforts to address surging demand for these products.

The wirehouse is aiming to increase its active ETF offerings from 100 to 300, according to a story, which first appeared in the FT’s sister publication Ignites.

The move comes amid a record-breaking year for ETF launches. According to ETFGI data, issuers introduced 1,063 new ETFs in the first seven months of 2024, surpassing the previous record of 988 set over the same period in 2021. Actively managed funds led with 461 new products.

Stephen Patrickakos, head of traditional investments told Ignites that the firm intends to select ETFs for its platform by evaluating their size and performance.

“With a firm our size, if [financial advisers] start engaging and putting money to work, we could become overly concentrated in an ETF, or any structure, very quickly,” he told Ignites.

ETF Surge Continues

Merrill’s expansion plans include adding ETF versions of mutual funds already featured on its platform, as well as new strategies focused on large-cap, small-cap, and growth value stocks. However, Patrickakos noted to Ignites that certain strategies, such as small-cap emerging markets, face capacity constraints in the ETF structure that don’t exist for mutual funds “because ETFs cannot close to new investors like mutual funds can.”

The wirehouse’s move aligns with broader industry trends. Active ETFs listed globally reached a new milestone in July, with assets under management climbing to $974.3 billion, according to ETFGI data. This represents a 32% increase in assets year-to-date, up from $739.9 billion at the end of 2023.

“We’re happy to do that, provided we’re given enough lead time and if it makes more sense to operate a strategy in an active ETF,” Patrickakos said of featuring ETF versions of existing mutual funds, Ignites reported. “We’re very, very supportive.”

Merrill’s plans reflect the growing acceptance of active ETFs among major wirehouses. Nate Geraci, president of The ETF Store, told Ignites that wirehouses have become increasingly comfortable with the ETF wrapper, and issuers are now providing their top portfolio managers and flagship investment strategies via the structure.

Ignites also reported that Merrill is monitoring applications for ETF share classes. More than 20 firms have filed to offer ETFs as share classes for their existing mutual funds, and 72% of advisors say they want access to ETF share classes, according to Ignites Research.

Patrickakos told Ignites that regulatory approval for ETF share classes would allow for “far less complexity” in offering these products.

4 Reasons I Think Warren Buffett Just Increased His Position in This Forgotten Stock-Split Stock by 262%

Last week, I took some time to study Berkshire Hathaway‘s quarterly 13F filing, a regulatory report that shows what stocks institutional investors are buying and selling. In the case of Berkshire, I was curious to see what its leader, Warren Buffett, had been up to during the past few months.

During the second quarter, some of Buffett’s more headline-grabbing moves included trimming his position in Apple by nearly half as well as completely exiting artificial intelligence (AI) software company Snowflake.

However, he made another investment that puzzled me at first glance. The Oracle of Omaha’s company purchased 96.2 million shares in satellite radio service Sirius XM (NASDAQ: SIRI), increasing his position by 262%.

To say that Sirius XM has been a clunker for some time would be an understatement. The stock has fallen more than 50% during the past three years, dramatically underperforming the S&P 500‘s 35% gain.

Although I was a little confused by the reasoning here, I’ve come to think that Buffett may have just found his next multibagger opportunity.

Let’s dig into Sirius XM’s business and draw some connections to Buffett’s investment philosophy. After a thorough look at the entire picture, you might come away more aligned with Buffett’s purchase of Sirius XM stock and be inspired to scoop up shares for your own portfolio.

1. Cash flow is king

Sirius XM is not your traditional radio company. Although the company generates some revenue from advertising, the majority of Sirius XM’s sales comes from subscriptions. Subscription-based revenue models tend to command high margins, which can flow straight to the bottom line.

The table below breaks down a number of key performance indicators and financial metrics for Sirius XM over the last year.

|

Category |

2Q23 |

3Q23 |

4Q23 |

1Q24 |

2Q24 |

|---|---|---|---|---|---|

|

Revenue |

$2.2 billion |

$2.3 billion |

$2.3 billion |

$2.2 billion |

$2.2 billion |

|

Income from operations |

$479 million |

$564 million |

$490 million |

$437 million |

$505 million |

|

Gross profit margin |

53% |

54% |

54% |

53% |

54% |

|

Adjusted EBITDA margin |

31% |

33% |

31% |

30% |

32% |

|

Free cash flow |

$323 million |

$291 million |

$445 million |

$132 million |

$343 million |

|

Ending subscribers |

34 million |

34 million |

34 million |

33 million |

33 million |

|

Average revenue per user |

$15.66 |

$15.69 |

$15.63 |

$15.36 |

$15.24 |

Data Source: Sirius XM investor relations.

At first glance, the performance illustrated above doesn’t look great. Sirius XM is experiencing noticeable churn among its subscriber base, which has taken a direct toll on revenue growth — or lack thereof.

However, the company’s average revenue per user (ARPU) hasn’t changed too dramatically during this time frame. By not sacrificing subscription fees, Sirius has been able to maintain and even slightly widen its gross profit margin and earnings before interest, taxes, depreciation, and amortization (EBITDA) margin. Subsequently, the company’s free cash flow has continued to grow — letting Sirius make some new investments in emerging opportunities (more of that below).

A hallmark of Buffett’s investment protocols is identifying businesses with predictable revenue streams that flow to the bottom line. Sirius is a clear example of this dynamic. Although revenue hasn’t been increasing much, Sirius still has an enormous subscriber base that it has been able to profit from consistently. At the end of the day, Sirius still has some pretty strong unit economics despite some blemishes when it comes to revenue growth.

2. Monopolies and moats

Another cornerstone of Buffett’s investment philosophy is identifying companies that have moats. Investors could argue that Sirius XM is essentially a monopoly because the company does not have any direct competition in satellite radio in its core market of North America.

This gives Sirius significant pricing power, since subscribers don’t have many options. It’s this dynamic that helps Sirius maintain its ARPU levels and strong margins despite little revenue growth.

3. A new strategy that could add more customers

Although Sirius doesn’t have direct competitors, the company does face some headwinds. Namely, audio streaming services such as Spotify, Amazon, and Apple all indirectly compete with Sirius. While each of those services offers unique perks and appeals to different demographics, Sirius has been investing heavily in a new strategy that I think is geared toward taking on its larger audio counterparts.

During the past few years, Sirius has acquired podcasts hosted by celebrities and influencers in an effort to broaden its content and appeal to a new range of potential customers. Some of the newer content on Sirius XM’s platform includes Jason Bateman, Sean Hayes, and Will Arnett’s “Smartless” podcast, as well as Team Coco, a media business created by late-night comedian Conan O’Brien.

4. Contrarian investing at its finest

The last pillar supporting my thesis about why Buffett purchased Sirius XM stock revolves around him being a contrarian investor. Contrarian investors might see a lot of value where others see a falling knife. In addition to the business having struggled to acquire new subscribers for some time now, I think investors may be selling Sirius stock for another reason.

Sirius is doing a reverse stock split. Reverse splits often elicit negative sentiment because they are often used as a financial engineering workaround to raise share prices and avoid being delisted from an exchange. In the case of Sirius, though, delisting is far from reality.

The reverse stock split is actually related to the company’s pending merger with Liberty SiriusXM Group. Following the completion of this deal, which is scheduled for Sept. 9, Sirius XM stock will undergo a 1-for-10 reverse stock split. I doubt that most investors actually understand the mechanics of the upcoming merger but are incorrectly assuming that Sirius is doing its reverse split from a position of weakness.

The merger with Liberty SiriusXM Group has been in the works for a while; it was initially announced in December 2023. I do not find it surprising that shortly after the announcement of this deal, Sirius XM’s price-to-earnings (P/E) ratio went into free fall. Furthermore, with a forward P/E of just 10.1 compared to 22.4 for the S&P 500, I’d wager that investors are not too enthusiastic about the company’s growth prospects.

It seems that investors have really soured on Sirius XM and do not see the company as a winning opportunity. But given its beaten-down valuation, consistent cash flow, and investments in new growth opportunities, I can actually understand what may have driven Buffett’s conviction.

Investors who are looking for a potentially underpriced opportunity in an overall financially healthy company might want to follow Buffett’s lead and consider buying shares of Sirius XM before the reverse split occurs next month.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Apple. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Snowflake, and Spotify Technology. The Motley Fool has a disclosure policy.

4 Reasons I Think Warren Buffett Just Increased His Position in This Forgotten Stock-Split Stock by 262% was originally published by The Motley Fool

FIRSTFUND REPORTS 2024 SECOND QUARTER RESULTS

TSXV Trading Symbol: FFP

VANCOUVER, BC, Aug. 29, 2024 /CNW/ – The financial results of Consolidated Firstfund Capital Corp. FFP (the “Company” or “Firstfund”) for the three months ended June 30, 2024 show a net loss of $59,522 or $0.01 per share (2023 – net loss of $54,599 or $0.01 per share). The Company recorded an unrealized net loss of $70,086 for the three months ended June 30, 2024 (2023 – unrealized net loss of $35,044) on the revaluation of the investments in Vitality Products Inc. VPI measured at fair value through profit or loss. The Company’s fee income increased to $94,812 for the three months ended June 30, 2024 (2023 – $85,086).

The Company’s condensed consolidated interim financial statements and management’s discussion and analysis for the six months ended June 30, 2024 and 2023 are available on SEDAR+ at www.sedarplus.com.

About Firstfund

Consolidated Firstfund Capital Corp. FFP is a venture capital company. The Company is primarily engaged in financial consulting relating to real estate development and venture capital activities in Canada and the United States. The Company is an investment issuer listed on the TSX Venture Exchange. Firstfund has invested its capital in both private companies and publicly traded companies since 1983. The Company continues to investigate other investment opportunities for its portfolio. Firstfund earns fee income for real estate development and property management activities performed on properties owned by other companies and limited partnerships managed by companies under common control.

On behalf of the Board of

CONSOLIDATED FIRSTFUND CAPITAL CORP.

“W. Douglas Grant” (signed)

______________________________

W. Douglas Grant, President & CEO

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Consolidated Firstfund Capital Corp.

![]() View original content: http://www.newswire.ca/en/releases/archive/August2024/29/c4663.html

View original content: http://www.newswire.ca/en/releases/archive/August2024/29/c4663.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.