Retiring abroad? Why the best, happiest places to grow older and retire are not where you’d expect.

Those international “best places to retire” surveys typically point to warm, low-cost countries in Central and South America. But, in many ways, beautiful northern places like Norway, Denmark, Finland and Iceland may be even better.

That’s my conclusion after poring over the 2024 World Happiness Report, the Natixis 2023 Global Retirement Index and the Mercer CFA Institute Global Pension Index 2023, as well as speaking to their creators.

Most Read from MarketWatch

And after vacationing in Norway where I talked with an old friend who is a semi-retired U.S. expat married to a retired Norwegian, I came away even more persuaded that you might want to consider the Nordic region if you’re thinking about retiring abroad.

Really.

‘I’m happy to pay my taxes’

“To me, Norway is a magical place,” my pal Nina Berglund, a digital editor and former Californian, said. “We have good pensions and I feel very well taken care of here. But we also have contributed a lot [in taxes] of course.”

Added her husband Morten Most, a retired journalist: “You often hear Norwegians say, ‘I’m happy to pay my taxes,’ and to a certain extent that is true because of the expectation that your taxes will be worth it.”

Those steep Norwegian sales taxes, an annual wealth tax of 1.1% on assets over $160,000 and the national Norwegian Oil Fund help pay for government-provided retirement pensions plus nearly free health care, long-term care and college educations. Employers must provide pensions, too.

In Norway, Berglund said, if you need home care or a nursing home, “everything is covered.” The copay for a doctor’s appointment is around $25, she noted. Hospital stays, X-rays, MRIs and CAT scans are mostly covered by government health care.

Retirees living in Norway only pay taxes on income they earn there (22% to 39%). There’s no inheritance tax and property taxes are low by U.S. standards.

“I don’t feel stressed at all,” said Most. “Time flies very fast. I have a good retirement.”

Read MarketWatch’s Where Should I Retire? column

High rankings for retirement and happiness among people 60+

Indeed, Norway ranked No. 1 in Natixis’ Global Retirement Index for the third straight year. That index measures retirement security by looking at health, finances in retirement, quality of life and material wellbeing.

Norway was also the third happiest country for people 60 and older in the World Happiness Report, based on residents’ assessments of their lives. Denmark topped the World Happiness Report and the U.S. ranked No. 10.

Along with nearby Sweden, Norway scored a B in the Global Pension Index, calculated by crunching data on the adequacy, sustainability and integrity of each nation’s retirement income system. Denmark nailed an A.

Some Nordic countries are remarkably safe, too. In Numbeo’s 2024 Global Safety Index, Iceland ranked 18, Denmark 20, Finland 23, Norway 39; the United States is 88.

What makes the countries score so well

Why do Scandinavian countries of Norway, Denmark and Sweden plus Nordic ones like Finland and Iceland consistently show up so well in these types of surveys?

Countries at the top of the World Happiness rankings, said John Helliwell, a lead researcher for that study, are well-off and people have “good connections, high trust and high caring for each other.”

“I tend to think that it’s the holistic view of things they have,” said David Goodsell, executive director of the global research program, Natixis Center for Investor Insight, which publishes the Global Retirement Index. “If you’re not worried about your healthcare or about wanting to [afford to] go back to school in retirement,” he added, “those things are going to impact how you feel.”

David Knox, who heads up Mercer’s Global Pension Index, cites what he calls the “social compact” of these countries between their residents as well as between the residents and their governments.

“Each generation expects to support, and then receive from, the next generation,” he said. “It’s a less individualistic society” than in the United States, Knox added.

Two other factors Goodsell cited: stable economies and small populations — combined, Nordic countries have fewer people than Canada.

When setting retirement policies, said Knox, “I think it’s easier for a relatively smaller country to say: ‘This is what we are going to do.’”

Employers tend to be paternalistic in Nordic countries, too, which helps in retirement. “In Denmark, more than 80% of the working-age population has a pension account,” said Knox. “That’s much higher than in America.”

Good retirement systems, happy residents

Knox isn’t surprised that many Scandinavian and Nordic countries score so well in both the World Happiness Report and his Global Pension Index.

As people approach retirement, he said, if their government is under pressure financially, “they may worry, ‘Will they cut the state pension and can I afford to retire?’ But if I’m in a system like Norway, which has the confidence of the Oil Fund, there’s an element of ‘I’m happy I’m going to retire here’ and that there will be support from the government, whether it’s in pensions or health care or whatever.”

Absent from ‘best places to retire’ rankings

Interestingly, the annual Best Places to Retire surveys from International Living and Live and Invest Overseas don’t even include Nordic countries in their rankings. I asked their creators why.

Donal Lucey, head of digital content at International Living, cited the cost of living which, he said, “can be prohibitive for retirees.”

It’s true that gasoline and groceries can be high in that part of the world, but rents are significantly lower in Oslo, Copenhagen and Stockholm than New York City, according to Numbeo.

Lucey called visa and residency requirements in Nordic countries “stringent,” since these nations don’t have retirement visa programs like in Portugal and Mexico.

“U.S. retirees would need to navigate complex immigration laws,” said Lucey. “And without significant financial means, securing long-term residency can be difficult,” he said. In Norway, it takes three years to become a resident.

Live and Invest Overseas publisher Kathleen Peddicord said: “My quick, maybe flippant, response is that we don’t talk about that region because the weather is awful and the cost of everything is very high.”

“As a retiree shopping the world map for options for where to live better on whatever budget you’ve got,” she added, “you’ve got many better choices than those cold, dark, overpriced countries in Northern Europe that don’t really want you there anyway.”

That’s something of an overstatement.

Cold? Often, but not in the summer. “I love the change of seasons,” said Berglund. “We’re still very active. We go skiing.” But, she conceded, “winter for many elderly, and a lot of Norwegians, is very hard.”

Dark? Yes, in some parts of the year, but not others.

Don’t want you there? That wasn’t my experience as a tourist, nor what I heard from my expat friend and her husband.

It helps, however, to live by what the Danish call “hygge” — enjoying the simple pleasures in life.

Advice for pre-retirees

World Happiness Report researcher Halliwell said that instead of looking for a great place in the world to retire, visit some of the happiest countries to see what explains that feeling and then try to emulate it after returning home.

“Apply the Nordic lessons where you already live,” he said. “It shouldn’t be about where you can get the most bang for your buck.”

Most Read from MarketWatch

A boomer who has had cancer and gets $2,200 a month in Social Security can't retire comfortably: 'It's a catch-22'

-

Wendy Jones, 71, and her husband, who has disabilities, face financial struggles despite Social Security.

-

Jones, a former paralegal, stopped working after a brain-tumor diagnosis in the mid-2000s.

-

They rely on a reverse mortgage and part-time work but worry about further medical costs.

Wendy Jones, 71, has been her husband Roy’s caregiver for the past three decades — even after her brain-tumor diagnosis. But the couple, who live in Palm Beach County, Florida, are running low on cash and are worried about how they’ll put food on the table.

Jones, who worked as a paralegal for decades, stopped working in the mid-2000s after being diagnosed with a brain tumor. Her husband was permanently disabled in a workplace accident in 1992. Even though both get Social Security payments, their savings have fallen over the years as they’ve paid thousands of dollars out of pocket in medical expenses, even with insurance, according to financial documents viewed by Business Insider.

Jones is one of millions of older Americans with health issues who are relying on Social Security to get by. Dozens of older Americans have told BI in recent months that they must continue working to supplement their Social Security and pensions, though it’s difficult for Jones and many others to hold a job given their medical conditions.

Jones, who works part time, said she and her husband resorted to buying only frozen food and getting a reverse mortgage loan. Still, she’s fearful that one more emergency medical expense could put them into the red.

Breadwinner of the family

Jones grew up in Fort Lauderdale, Florida, with three siblings, and she had a “very happy, normal, healthy upbringing,” she said. She became a civil trial paralegal in West Palm Beach, married, and had four children.

Her husband worked as a mechanic and liked to hunt in his free time. Jones said they were both very active and healthy for the first two decades of their careers.

In 1992, however, Roy was injured in a workplace accident and then got into a car crash. He was left permanently disabled and wasn’t able to return to work, receiving income from Social Security Disability Insurance. He had multiple major surgeries and took various medications, some of which they paid for out of pocket.

Jones was the sole breadwinner of the family, and her employer was accommodating when she needed to tend to her husband, she said. She received bonus payments, one of which she used for a down payment on a new home. She said she made between $70,000 and $90,000 a year, including bonuses, in the 1990s and early 2000s.

Still, she and her husband were worried about making ends meet. She said they always had food when her children were teenagers, but there were times when they would resort to ramen noodles or mac and cheese.

Once her children were in college or moved out of the house, she felt better about her and her husband’s finances, she said, adding that their 401(k)s, insurance, mortgage, and other financial components were “very secure.” Her children now range from 43 to 51 years old, and three went to college on full-ride scholarships or with help from their grandparents.

“They all went off on their own, got married, went to college, and so we thought things would get slower and easier for us,” Jones said. “The way things worked out, that didn’t happen.”

A devastating diagnosis

In the mid-2000s, Jones started having vision and concentration problems. She would sometimes pass out at her desk or blank out for minutes at a time. She was diagnosed with a brain tumor, but she said the cost of the insurance co-payments wasn’t a “horrible burden.” Eleven months after her first surgery, however, she got agonizing migraines again that felt like “a sword going through my head,” and she had to take more medication.

After three years of working on and off between medical appointments, she was forced to leave her job and went on disability. She said she was lucky to get approved on her first attempt, though it typically takes six to eight months for an initial decision after months of collecting all the paperwork.

“Somehow, I thought it would be the same as what I was making, but it was two-thirds of the income, so a huge cut there,” Jones said. “The insurance didn’t cover so much, so that’s when I had to start eating into my savings. The 401(k) went really quickly. I have really good health insurance, but nothing covers everything, apparently.”

She also waited two years after being approved for SSDI before she became eligible for Medicare, meaning she had to pay $500 a month out of pocket for one medication. She spent hours on the phone trying to get affordable insulin for her husband, who has diabetes, and the attorneys at her previous firm helped her secure additional assistance. They had to declare bankruptcy during this period.

“If I wasn’t educated and didn’t speak English, I couldn’t imagine ever getting any of this assistance,” Jones said. “I struggle with the forms and applications. I don’t know how people do that. People my age often don’t know how to use a computer.”

She said preparing for unexpected medical costs from the various forms of cancer she’d been diagnosed with over the past two decades had been perhaps the most difficult aspect of their finances. Recently, she’s had multiple ambulance bills charging her as much as $900 with insurance.

Recently, they got a letter saying their Medicare premiums weren’t being covered by the state of Florida anymore. Jones suspects it’s because she put money her mom gave her before she died into a savings account to pay for their home and car for this year. Though she gets $2,200 a month in Social Security, and her husband gets about $1,000, they’re forced to buy frozen entrées and vegetables, as cooking is a challenge, and they can’t afford meat. They also cut back to one car to save money.

Just scraping by

Though their credit is good now, Jones said a few years ago, she would get calls from bill collectors many times daily. She and her husband live much leaner now than a few years ago.

Despite everything, they were able to keep their “very tiny” house, though the cost of living in Palm Beach has risen fast over the past few years. They got a reverse mortgage loan, which lets older homeowners access some of their home’s equity for tax-free payments. Jones said it was their only option to cling onto their house — she estimated their mortgage would have been $1,500 to $2,000 a month. They haven’t been able to afford to fix their sprinkler system, and when they had a pipe burst, they shelled out nearly $1,200.

She said it was “horrendous” having to pay her car insurance, property tax, and homeowners insurance in the same month. Their homeowner’s insurance is $4,000 yearly, their property tax is nearly $2,000, and their car insurance is $1,900.

“People have suggested we move, but we have lived here 35 years,” Jones said. “Besides emotional and social support, moving is very expensive.”

Jones works a minimum-wage, part-time job at a bird clinic — one of the few jobs she could do given her medical conditions. She gets at most $300 a month, which she said was handy. She knows if she quits her job, she will qualify for extra assistance, but she said she would rather work for her money — and get discounts on food for her birds at home.

“It’s a catch-22: People say, just get a job, but I tried that, and everything else was taken away from me,” Jones said, adding that she would work as long as she could drive, walk, and answer phones. “I didn’t get ahead. I wasn’t able to save or progress in any way whatsoever.”

Her children have helped her fund vacations, allowing her to attend a memorial service for her mother in the Outer Banks or travel to Alaska. Her children give them financial advice and frequently check in on them.

Jones said she was taking one day at a time, especially because her oncologist gave her a worrisome update at her last appointment. She said her goal going forward was to make sure her husband was taken care of, as he was dealing with depression and pain.

“I’m trying to find a way that we can live comfortably without making somebody else uncomfortable,” Jones said.

Are you worried about retirement? Reach out to this reporter at nsheidlower@businessinsider.com.

Read the original article on Business Insider

Prediction: 1 Semiconductor Stock That Will Catch Up to Nvidia Within 10 Years

Semiconductor stocks have captivated Wall Street since the start of 2023. Advances in the chip market have allowed dozens of other industries to take their technologies to the next level. Sectors like artificial intelligence (AI), cloud computing, virtual/augmented reality, consumer tech, self-driving cars, and more have all benefited from new chip designs from companies like Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD). As a result, semiconductor companies have become some of the best options for investing in tech.

Nvidia’s and AMD’s stocks have climbed 782% and 132% since the start of 2023, when a boom in AI kicked off. Nvidia managed to get a headstart in the industry and was able to immediately begin supplying its chips to AI developers worldwide. Meanwhile, AMD required more time to produce competitive hardware.

However, AMD has made promising strides in AI in 2024 and could be on track to deliver significant gains in the coming years. It’s one semiconductor stock that I predict will catch up to Nvidia’s market cap of $3 trillion within 10 years.

AMD is scaling up to better meet AI demand

AMD stock has popped 12% since its second quarter of 2024 earnings were released on July 30, rallying investors with a win in AI that proves the market has become its biggest growth driver.

Total revenue increased 7% year over year to just under $6 billion, mainly fueled by a 115% spike in its AI-driven data center segment and a 49% increase in its client division. The quarter benefited from a ramp-up in AI graphics processing unit (GPU) and central processing unit (CPU) sales.

Over the last year, AMD has gone full force into AI, expanding into multiple areas of the industry that will likely pay over the next decade. The company has unveiled its most powerful GPUs to date and announced plans to purchase server builder ZT systems for $5 billion. Both moves make the company more competitive against Nvidia, with the acquisition allowing AMD to more quickly roll out its AI GPUs at a scale necessary for cloud providers.

AMD’s chips have already attracted some of AI’s biggest players, with the company signing on Microsoft‘s Azure, Meta Platforms, and Oracle as clients. These cloud giants are in steep competition with each other, requiring powerful hardware to stay competitive. As a result, AI chip demand is only likely to continue rising for the foreseeable future, with AMD well-positioned to enjoy major gains.

AI opportunities outside of GPUs

In addition to GPUs, AMD is planting seeds throughout the AI market to diversify its positions and profit from growth catalysts far into the future.

The company has a massive opportunity in AI central processing units. CPUs have been AMD’s specialty for years, with its CPU market share rising from 18% in 2017 to 34% this year, as it has consistently taken market share from Intel. Meanwhile, data from Verified Market Reports shows that the AI CPU sector was valued at $15 billion last year and is projected to hit $410 billion by the end of the decade, expanding at a compound annual growth rate (CAGR) of 29%.

Expertise in CPUs also grants AMD a potentially lucrative role in the quickly expanding AI-capable PC market. As demand for AI services has risen, so has the need for more powerful hardware. As a result, AI-enabled PCs are projected to make up about 40% of all global PC shipments in 2025, with the market developing at a CAGR of 44% through 2028.

Nvidia’s market cap was $359 billion at the start of 2023. Yet, it hit $3 trillion in June 2024, just 18 months later, after a rally that boosted its stock by 738%. The company’s success was primarily fueled by a massive spike in its AI GPU sales. Nvidia has shown what is possible with success in one facet of AI. Meanwhile, AMD has laid the foundation in multiple areas of the industry that could deliver significant stock gains.

AMD’s market cap is currently about $251 billion. The company’s stock would need to rise 1,200% to hit $3 trillion over the next 10 years. It’s a lofty target, but not an unreachable one. Since AMD’s stock is up more than 3,000% since 2014, it might not be too far a reach.

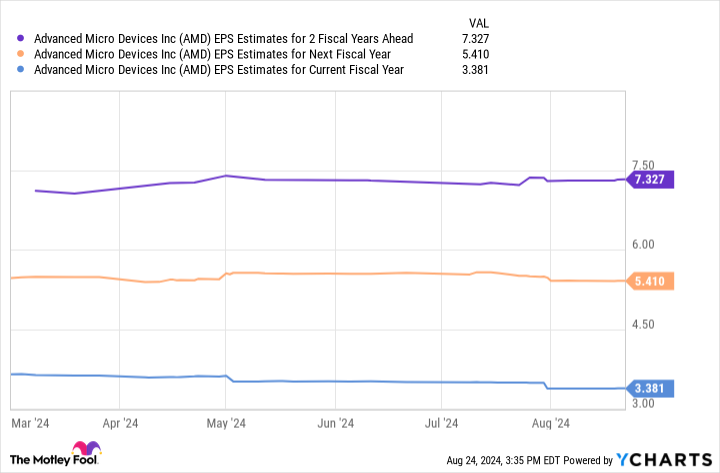

The chart above projects AMD’s earnings to hit just over $7 per share by fiscal 2026. Multiplying this figure by the company’s forward price-to-earnings ratio of 46 yields a share price of $336, projecting potential stock growth near 115% by 2026.

Yet, Nvidia’s spectacular rise in AI and AMD’s performance over the last 10 years suggest that growth could be conservative. As a result, AMD could be on a growth path to achieve that coveted $3 trillion market cap over the next decade. The company is expanding quickly, and you won’t want to miss out.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: 1 Semiconductor Stock That Will Catch Up to Nvidia Within 10 Years was originally published by The Motley Fool

Trump vs. Harris: 4 ways the next president could impact your bank accounts

Last month, President Biden announced the end of his presidential reelection campaign. This move not only changed the dynamics of the 2024 presidential race but also opened the door for new ideas and political agendas — some of which will directly impact your finances.

With fewer than 70 days until voters head to the polls, Republican presidential nominee and former President Donald Trump and Democratic presidential nominee and current Vice President Kamala Harris have been laser-focused on gaining support from voters, sharing some of their key policy initiatives as we approach Election Day.

It should be noted that Harris was confirmed as the Democratic nominee less than a month ago. So, many of her policies and plans have yet to be formally revealed.

Still, both candidates have shared ideas about what they envision for the next four years. And the next president will undoubtedly have a major influence on your financial life and the banking industry as a whole.

4 ways the next president could influence banking

We can’t predict how the election will play out, but we can examine each candidate’s statements around banking and finance to surmise how their policies may impact Americans’ wallets if elected.

Banking regulation

Trump and Harris differ on many issues, and banking regulation is one of them.

Trump favors a more relaxed approach; he will likely work to reinstate his deregulation policies that were originally signed into law in 2018. The legislation was meant to ease regulatory rules and requirements placed on small and medium-size institutions by the Dodd-Frank Act, which aimed to curb risky lending practices and increase bank oversight in light of the 2008 financial crisis.

“President Trump’s pro-growth, deregulatory agenda ignited the greatest economy in history,” wrote Karoline Leavitt, national press secretary for the Trump campaign, in an email to Reuters.

However, critics have claimed that this deregulation has weakened the stability of the banking industry and led to recent bank failures like that of Silicon Valley Bank.

The Biden-Harris administration has pushed to reinstate “common sense” banking oversight, and Harris has a track record of voting against deregulation. However, while her campaign speech, which revealed her economic agenda, focused on plans to tackle price gouging, housing issues, capping prescription drug costs, and a new child tax credit, she did not mention a plan to address banking regulation specifically.

Read more: How do banks make money?

Bank fees

Between 2018 and 2020, Americans paid roughly $120 billion per year in credit card interest and fees, according to the Consumer Financial Protection Bureau (CFPB). That translates to an average of $1,000 annually for each American household.

Under the Biden administration, Harris has had a hand in tackling junk fees by capping credit card late fees and banning fees for essential bank account services, such as checking bank account balances, obtaining a payoff amount for a loan, or getting account information needed for applications.

Bank fees haven’t been a central topic in the current presidential race, and Trump has not said much about whether this will be a priority for his administration if elected. However, looking at Trump’s first term as president, it appears he favored leaving bank fee decisions in the hands of banks.

Read more: What are bank fees, and how do I avoid them?

Interest rates

The federal funds rate has been a major topic of discussion since the post-pandemic inflation rate reached a 40-year high and led to sharply increased costs for goods and services.

In an effort to control inflation, the Federal Reserve can raise or lower its target rate to influence the cost of everyday goods. The federal funds rate also influences the interest rates banks offer on savings accounts, credit cards, and loans.

Ultimately, the federal funds rate isn’t set by any one individual. The Federal Open Market Committee (FOMC) meets multiple times throughout the year to evaluate key economic indicators, gauge the overall health of the economy, and determine whether or not a rate change is appropriate.

While the president can nominate key Fed officials, appoint the chair, and discuss concerns related to monetary policy, presidents do not directly influence the Fed’s rate decisions.

But Trump has stated he believes the president should have a greater say in setting interest rates. “In my case, I made a lot of money, I was very successful, and I think I have a better instinct than, in many cases, people that would be on the Federal Reserve or the chairman,” the former president said during a recent press conference.

Harris countered this statement by saying, “the Fed is an independent entity, and as president, I would never interfere in the decisions that the Fed makes.”

Read more: How much control does the president have over the Fed and interest rates?

Cryptocurrency

Cryptocurrency is decentralized, meaning it isn’t backed by a central bank, agency, or government. This autonomy has been a major selling point for crypto enthusiasts who distrust traditional financial systems. On the other hand, some experts believe cryptocurrencies lack important safeguards, leaving users at risk and opening up the door to increased illegal activity.

Harris has yet to make an official statement about whether cryptocurrency legislation will be part of her platform. However, a policy adviser to her campaign said Harris will back measures to help grow digital assets during a Bloomberg News roundtable at the Democratic National Convention.

In the past, Trump referred to cryptocurrency as a scam. However, he has seemingly changed his mind, now holding an estimated $1 million in digital currency. In its official 2024 policy platform, Republicans vow to “end Democrats’ unlawful and unAmerican Crypto crackdown” and “defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their Digital Assets, and transact free from Government Surveillance and Control.”

It may come as no surprise then that crypto companies account for nearly half of the corporate money contributed to this year’s races, according to data from consumer rights advocacy nonprofit Public Citizen. Both candidates have been seemingly open to supporting regulatory frameworks and growth within this industry; the next president’s approach to crypto could shake things up in the banking sector and encourage more Americans to move toward digital currencies as an alternative to traditional banking.

Read more: Is this a good time to invest in bitcoin?

Trump Soon Free To Sell All His Stake In Trump Media. Here's What Happens If He Does – 'He's Stepped On Just About Every Rake'

Former President Donald Trump is about to face a major decision that could shake up the financial world and his fortune. By the end of September, Trump will be free to sell his entire stake in Trump Media & Technology Group, which owns his social media platform, Truth Social. But what happens if he decides to cash out?

Don’t Miss:

Trump currently owns more than 114 million shares in Trump Media, a stake valued at about $2.5 billion. That’s a big chunk of his estimated $4.3 billion net worth. Until now, he hasn’t been able to sell these shares because of a lockup agreement – a rule that prevents company insiders from selling their stock right after the company goes public. But that restriction is set to end in late September.

See Also: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

If Trump decides to sell, it could have major consequences. For one, the stock price might plummet. Financial experts are already worried that if Trump dumps his shares, there might not be enough buyers willing to snap them up, which could cause the stock to drop even more.

As Steve Sosnick, Chief Strategist at Interactive Brokers, pointed out, the overall stock market has been doing well, but Trump Media’s stock has been trending downward. It closed at $21.42 recently, its lowest since going public. “The rising tide hasn’t lifted that boat,” he said.

Trending: With over 15k units already sold, this female-owned dog waste startup is targeting the $147 billion pet industry – here’s how to invest early at just $1 per share.

Why is this happening? Trump Media’s fortunes are closely tied to Trump’s reputation and popularity. As the 2024 election heats up, Trump’s standing in the polls has taken a hit after Kamala Harris took the lead as the Democratic nominee.

Matthew Tuttle, CEO of Tuttle Capital Management, didn’t mince words, telling Politico that Trump has “stepped on just about every rake he possibly could” since his acceptance speech at the Republican National Convention. This has been “hammering the stock.”

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $100

According to its latest earnings report, the company is having a tough time financially, losing over $16 million in just three months. It’s clear to almost everyone that Trump Media’s future depends on the 2024 election. If Trump wins the election, that alone could boost the company’s stock and do a complete 180.

Investors are worried that Trump might sell his shares to cover his growing legal bills or fund his campaign. But selling such a large stake could flood the market with too many shares, pushing the price down further. And with Truth Social not generating much revenue compared to bigger platforms like X (formerly Twitter) and Facebook, Trump Media’s sky-high valuation doesn’t match its actual financial performance.

Trending: General Motors and other leaders revealed to be investing in this revolutionary lithium start-up — allowing easy entry by launching at just $9.50/share with a $1,000 minimum.

Trump hasn’t said what he plans to do once he’s free to sell his shares, and his team isn’t giving any hints. Meanwhile, Trump Media is trying to expand its business, recently adding in-app streaming to Truth Social. The company says it has $344 million in cash and no debt, which gives it some breathing room.

For now, all eyes are on Trump as he prepares to make a decision that could affect not just his fortune but also the future of his media empire and the investors who have big bets on him.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Trump Soon Free To Sell All His Stake In Trump Media. Here’s What Happens If He Does – ‘He’s Stepped On Just About Every Rake’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Drone Maker Stock Flies On A Near-$1 Billion U.S. Army Contract; Analysts Cheer

AeroVironment (AVAV) surged Wednesday after winning a $990 million U.S. Army contract for its Switchblade “suicide” drones. Two analysts upgraded the drone maker.

↑

X

When Market Conditions Are Rough, This Investing Strategy Can Be A Game Changer

The Department of Defense announced Tuesday the nearly $1 billion hybrid (cost-plus-fixed-fee and firm-fixed-price) contract was awarded to AeroVironment. The contract is for “an organic, stand-off capability to dismounted infantry formations capable of destroying tanks, light armored vehicles, hardened targets, defilade and personnel targets.” The agreement runs through August 2029.

Following the contract news, Baird upgraded AeroVironment stock to outperform from neutral with a price target of 220, up from its previous 161. The firm wrote that the SwitchBlade contract “locks in visibility” for the product through 2029 and that it will enable significant inventory levels of the drone.

Meanwhile, Alembic Global also upgraded AVAV on Wednesday, handing the stock an overweight rating, up from a neutral designation. Alembic Global analyst Pete Skibitski has a 216 price target on AVAV.

AeroVironment Stock

AeroVironment stock jumped 9% to 193.86, hitting an intraday high of 211.44, during market action on Wednesday after gaining 0.2% to 177.76 on Tuesday. Shares have a 224 consolidation buy point. But investors could use a short-term high of 191.77 as an early entry.

Before Wednesday’s market open, the stock was down 0.4% in August.

AeroVironment Earnings Upcoming

AeroVironment makes drones used by the Air Force for research, and the company reportedly is the U.S. military’s top drone supplier overall. It also sells to NASA and developed an early model electric vehicle.

AeroVironment is also involved in missile production. The company manufactures Switchblade drones, which have been utilized in Ukraine since the beginning of Russia’s invasion, as well as Puma hand-launched recon drones.

The Arlington, Va.-based outfit reports fiscal 2025 first-quarter earnings and revenue on Sept. 4. Analyst consensus has Q1 EPS falling 38% to 62 cents with sales increasing 20% to $183.2 million, according to FactSet.

AeroVironment forecasts full-fiscal year earnings of $3.18-$3.49 per share, which would represent a 6%-17% jump vs. fiscal 2024. The company also projects 2025 revenue totaling $790 million-$820 million, up from $716.7 million in fiscal 2024.

AeroVironment stock has a 78 Composite Rating out of a best-possible 99. Shares also have an 89 Relative Strength Rating and a 52 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Is Rivian Stock A Buy Or A Sell As The EV Startup Targets Profit Per Vehicle By Q4?

Nvidia stock slips after earnings, forecasts top estimates amid 'incredible' demand for its next-gen chip

AI juggernaut Nvidia (NVDA) reported second quarter earnings after the bell on Wednesday that beat expectations on the top and bottom line, while its forecast for the current quarter also came in ahead of expectations.

Nvidia reported adjusted earnings per share of $0.68 on revenue of $30 billion in its fiscal second quarter. Analysts were expecting EPS of $0.64 and revenue of $28.8 billion. That marks a 122% increase on the top line from a year ago; earnings rose 168% from the same quarter last year.

The company also provided third quarter revenue guidance of $32.5 billion plus or minus 2%. Analysts were looking for $31.9 billion.

Shares of the chip giant were down about 3% in pre-market trading on Thursday following the results. The stock fell as much as 6% in immediate reaction to the numbers.

The bulk of that revenue came from Nvidia’s all-important data center business, which brought in $26.3 billion in the quarter versus Wall Street’s expectations of $25 billion in revenue. That’s a 154% increase from the same period last year when the segment brought in $10.3 billion.

In a statement, CEO Jensen Huang said anticipation for the company’s next-generation Blackwell chip is “incredible.”

CFO Colette Kress said in a statement, “Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026. In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue.”

Kress’s statement added that the company “executed a change to the Blackwell GPU mask to improve production yield.”

The company expects shipments of its current Hopper chips to “increase” in the second half of the year.

Nvidia also announced Wednesday a $50 billion increase in its share buyback authorization. The company had $7.5 billion remaining on its existing authorization at the end of the quarter.

Nvidia’s gaming division, which used to stand as the company’s breadwinner, saw revenue of $2.8 billion up 16% year over year.

Nvidia is the world leader in AI chip design and software, controlling between 80% and 95% of the market, according to Reuters.

The company has also been key to the current AI trade on Wall Street, with almost half of its revenue tied directly to tech giants like Microsoft, Amazon, Google, and Meta.

Nvidia’s rivals aren’t resting on their laurels. Earlier this month, AMD announced it is acquiring ZT Systems in a deal valued at $4.9 billion. The move gives AMD more firepower to build out AI system servers, something that’s been a major catalyst for Nvidia’s own sales.

And while it could provide AMD with a boost in sales, it doesn’t mean Nvidia will face any major threats to its reign as the AI king anytime soon.

“There are emerging competitors like AMD that are starting to take a little bit of market share,” Stifel managing director Ruben Roy told Yahoo Finance Monday. “But when you look at the overall infrastructure spend cycle … which we think is going to continue to increase, Nvidia appears to us as the best positioned to benefit from [spending].”

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance.

Prediction: This Under-the-Radar Tech Stock Will Outperform Nvidia and Apple by 2030

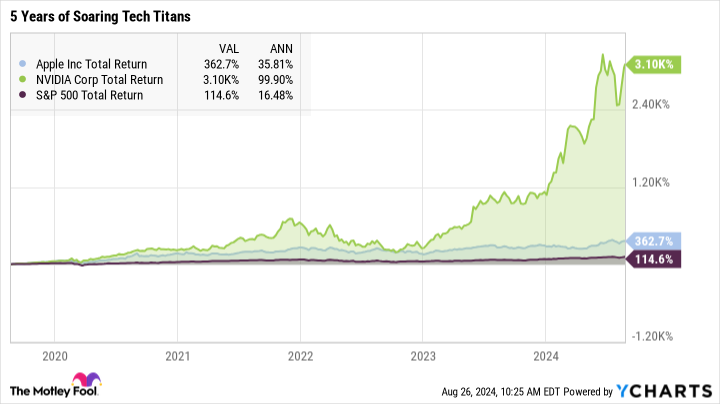

Tech giants Apple (NASDAQ: AAPL) and Nvidia (NASDAQ: NVDA) are on top of the world nowadays. They are the two most valuable stocks on the market, looking back at market-beating returns in the past five years. Apple’s total returns delivered a compound average growth rate (CAGR) of 36% in that period. Nvidia soared even higher with a 100% five-year CAGR. The artificial intelligence (AI) boom has been mighty kind to Nvidia’s investors.

They achieved these massive gains in a strong era for the general market, but the S&P 500 index looks downright sleepy by comparison:

It would be cool if Nvidia and Apple were poised to continue their market-beating ways from here. Invest in the biggest, baddest names on the market, sit back and relax, and let them deliver more of the same good stuff for years to come. Unfortunately, I’m afraid that both stocks are a bit overvalued at today’s massive market caps — $3.1 trillion for Nvidia and $3.4 trillion for Apple. I know it’s like comparing mountains of cash to rivers of revenues, but these two market caps add up to about 23% of America’s gross domestic product.

I think that’s too much. Apple and Nvidia may be overdue for a painful correction. At best, I don’t expect them to rise much higher in the foreseeable future.

At the same time, good old International Business Machines (NYSE: IBM) is gaining ground in the AI space, and its stock is undervalued today. I don’t expect IBM’s stock to pass the trillion-dollar mark in the next five years, but it should most certainly rise as Big Blue’s enterprise-class AI tools add value to the stock. Most investors don’t see this traditional computing giant as a promising AI investment yet. That’s a big mistake.

Don’t forget IBM’s cash-profit chops

IBM’s valuation ratios don’t look terribly exciting at first glance. The stock is changing hands at 22 times trailing earnings and 2.9 times sales. Those are perfectly acceptable middle-of-the-road values for mature companies, just below the averages seen in the S&P 500 and Dow Jones Industrial Average market indices.

Then your eye slides over to IBM’s price-to-free cash flow (P/FCF) ratio, and the stock suddenly looks different. When you calculate IBM’s values based on its massive cash profit, the stock seems to belong in Wall Street’s bargain bin instead. This ratio stops at 14 times free cash flows, just over half of the S&P 500’s or Dow Jones‘ readings.

Cash is king, and IBM has plenty of it. The company’s rich cash profits and relatively modest bottom-line earnings show that Big Blue’s accountants are very good at lowering taxable profits while putting lots of real greenbacks in the bank. I see cash flow as a higher-quality measure of profitability, so it’s easy to look away from IBM’s moderate price-to-earnings ratio.

IBM’s place in the AI boom

Remember the five-year chart I showed you? IBM’s chart for the same period is a different animal:

The stock has underperformed broad market indices for many years as it transformed a hardware-heavy business model into a more profitable software and services plan. In particular, you should know that the revamped Big Blue comes with a heavy focus on cloud computing, data security, and AI tools.

Yes, this company was a leading AI researcher long before ChatGPT’s release opened the floodgates for AI investments. Many investors seem to have missed that connection since IBM’s business results didn’t immediately skyrocket in this soaring AI era. The big AI contracts are coming, just a bit late.

You see, IBM is happy to leave consumer-friendly ideas such as ChatGPT-style chatbots to other tech providers. This company will always go after large corporate contracts instead, adding extra layers of security, business-friendly data analytics, and lawsuit-repellant data tracking to the mix. Potential clients may take several quarters to test and approve the resulting AI recipe, but the end result is a lucrative long-term deal that won’t be easy to replace.

The approvals are rolling in now, building a robust revenue stream for the long run. Market makers are still not paying attention, so IBM’s stock keeps trading at incredibly low cash flow ratios. I can’t wait to see what happens in a couple of years, when the AI contracts have become generous and highly profitable revenue streams.

One more thing…

I’ll admit that Nvidia and Apple are making solid cash profits, too. However, their sky-high stock prices already account for these high-quality profits. Apple’s P/FCF ratio stands at 33 today, and Nvidia’s is soaring at 79 times free cash flows.

Thanks, but no thanks. I’d much rather buy IBM’s undervalued stock instead.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Anders Bylund has positions in International Business Machines and Nvidia. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

Prediction: This Under-the-Radar Tech Stock Will Outperform Nvidia and Apple by 2030 was originally published by The Motley Fool

Lowe's becomes latest company to scrap DEI policies amid 'woke' backlash

Lowe’s (LOW) is scaling back some of its diversity initiatives, becoming one of the largest companies yet to make such an about-face as activist pressure mounts.

The home improvement retailer reportedly communicated a decision to stop participating in diversity surveys issued by LGBTQ civil rights advocate Human Rights Campaign in a memo to employees Monday.

Lowe’s also reportedly told employees in the memo that the company would stop sponsoring and participating in community parades, festivals, and fairs.

Similar changes discarding so-called DEI (diversity, equity, and inclusion) initiatives have been picking up momentum at major US corporations in recent months as critics target what they describe as “woke” policies.

In June, under pressure from shareholders, rural retailer Tractor Supply (TSCO) announced that it would retire its DEI goals. In July, tractor maker John Deere (DE) announced that it would continue to track workforce diversity but end participation in cultural and social awareness-focused events.

Harley-Davidson, Jack Daniel’s maker Brown-Foreman (BF-A), Polaris (PII), and its motorcycle subsidiary Indian Motorcycle have also scrapped DEI policies.

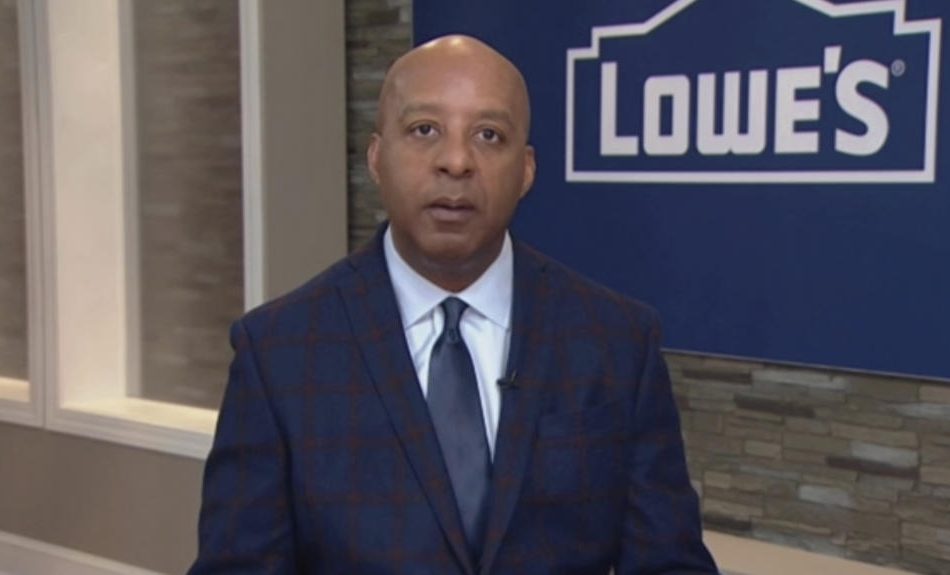

Lowe’s reversal is the only one from a company run by a black CEO. Its boss, Marvin Ellison, is the only black executive to have run two Fortune 500 companies: Lowe’s and JCPenney.

Conservative activist Robby Starbuck said in a post on X that Lowe’s and the other companies that discarded diversity initiatives did so after he communicated plans to “expose” woke policies.

“So far you’ve helped me change corporate policy at Tractor Supply, John Deere, Harley Davidson, Polaris, Indian Motorcycle and now Lowe’s,” Starbuck wrote Monday in a post on X.

Lowe’s did not respond to Yahoo Finance’s request for comment.

Big news: I messaged @Lowes executives last week to let them know that I planned to expose their woke policies. This morning I woke up to an email where they preemptively made big changes.

Here are the changes:

• Ending participation in the @HRC’s woke Corporate Equality Index… pic.twitter.com/qOUr2JLGV7

— Robby Starbuck (@robbystarbuck) August 26, 2024

A US Supreme Court ruling last year has been cited as a factor in corporate decisions to alter diversity policies.

The court specifically ruled against race-conscious student admissions programs at Harvard University and the University of North Carolina, saying the programs violated the Equal Protection Clause of the Fourteenth Amendment.

Lowe’s reportedly cited this ruling in its memo to employees, saying that it began reviewing its programs following that decision.

Ellison, Lowe’s CEO, has diversified the executive ranks of Lowe’s since becoming the boss and also had meetings with employees to discuss race following the police killing of George Floyd.

Ellison is also a member of the Business Roundtable, an association of more than 200 CEOs that posted an essay this month re-endorsing a stance that a company’s purpose is to serve “all” stakeholders.

That philosophy adopted in 2019 includes shareholders, customers, employees, and suppliers, along with the communities where a company operates.

Business Roundtable CEO Joshua Bolten said that purpose has been misinterpreted as an endorsement for ESG (environmental, social, and governance) initiatives, which include DEI.

The ideological left and right both incorrectly interpreted the position to mean that companies had decided to commit resources to solving every societal ill, he added.

“Right from the beginning, there’s been a fair amount of misunderstanding about what the statement was about,” he said.

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on X @alexiskweed.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Correction: A previous version of this article had a misspelling of Joshua Bolten’s name. We regret the error.

US senator presses Intel CEO on chips award after job cut plan

By David Shepardson

WASHINGTON (Reuters) – Republican Senator Rick Scott on Wednesday asked Intel CEO Pat Gelsinger for more details on the company’s plans to cut more than 15,000 jobs despite being set to receive nearly $20 billion in U.S. grants and loans to boost chip production.

In a letter seen by Reuters, Scott questioned if the Commerce Department’s planned awards had failed “to include real metrics that would protect taxpayer dollars from going to companies that could not meet high standards for U.S. manufacturing and job creation.”

The Commerce Department in May announced a preliminary agreement for $8.5 billion in grants and up to $11 billion in loans for Intel as well as access to a 25% investment tax credit. The chips award has not been finalized.

The agency declined to comment on Scott’s letter and Intel did not immediately respond to requests for comment.

The Commerce Department said in May the funding will support the creation of more than 10,000 manufacturing jobs and nearly 20,000 construction jobs for projects in Arizona, New Mexico, Ohio and Oregon.

Intel said this month it would cut costs by $10 billion in 2025 and reduce its workforce by more than 15%, with a majority of the exits completed this year.

Gelsinger said at the time Intel’s workforce is 10% larger than it was in 2020, when its revenue was $24 billion higher than in 2023 and he needed fewer people at headquarters and more in the field supporting customers.

Scott wants Intel to detail how many U.S. employees will lose their jobs and whether the cuts will impact Intel’s planned semiconductor manufacturing investments.

“What is Intel trying to achieve with these job cuts, and why have billions of U.S. taxpayer dollars in investments not been sufficient support to avert the need for lay-offs?” Scott asked.

(Reporting by David Shepardson; Editing by Jamie Freed)