Sky Real Estate Acquires Osage Beach Outlet Marketplace

OSAGE BEACH, Mo., Nov. 22, 2024 /PRNewswire/ — Sky Real Estate is excited to announce its acquisition of the Osage Beach Outlet Marketplace from a subsidiary of Simon Property Group, Inc SPG. The 391,000-square-foot shopping center, located on a 60-acre parcel along Osage Beach Parkway, has been a cornerstone of the Lake of the Ozarks region for decades.

The outlet center features key tenants such as Polo Ralph Lauren, Under Armour, Bath & Body Works, and LOFT. Sky Real Estate looks forward to continuing operations and collaborating with the local community partners to create a long-term plan that enhances the property’s role as a vital regional destination.

For more information and updates on the Osage Beach Outlet Marketplace redevelopment, please visit: www.osagebeachoutletmarketplace.com

About Sky Real Estate

Founded in 2016, Sky Real Estate invests in commercial real estate properties across various sectors, with a focus on long-term value creation. Driven by an entrepreneurial spirit, Sky brings creativity and enthusiasm to every project. The company places a high value on fostering strong relationships with team members, partners, tenants, lenders, and the communities it serves.

For more information, please visit: www.skyre.com

![]() View original content:https://www.prnewswire.com/news-releases/sky-real-estate-acquires-osage-beach-outlet-marketplace-302313916.html

View original content:https://www.prnewswire.com/news-releases/sky-real-estate-acquires-osage-beach-outlet-marketplace-302313916.html

SOURCE Sky Real Estate

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

E.L.F. Beauty ALERT: Bragar Eagel & Squire, P.C. is Investigating e.l.f. Beauty, Inc. on Behalf of e.l.f. Beauty Stockholders and Encourages Investors to Contact the Firm

NEW YORK, Nov. 22, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized stockholder rights law firm, is investigating potential claims against e.l.f. Beauty, Inc. (“e.l.f. Beauty” or the “Company”) ELF on behalf of e.l.f. Beauty stockholders. Our investigation concerns whether e.l.f. Beauty has violated the federal securities laws and/or engaged in other unlawful business practices.

Click here to participate in the action.

On November 20, 2024, Muddy Waters Research issued a report in which it announced that it had a short position in e.l.f. Beauty, Inc. Muddy Waters stated that it believed that e.l.f. Beauty had “materially overstated revenue over the past three quarters,” and that it believed that in “Q2 FY24, ELF management realized its growth narrative was in trouble as its inventory built. It appears that ELF then began reporting inflated revenue and profits. Its reported inventory also appears materially inflated as a result – i.e., to account for cash that has not really come in.”

On this news, e.l.f. Beauty, Inc. stock fell as much as 15% in intraday trading on November 20, 2024.

If you purchased or otherwise acquired e.l.f. Beauty shares and suffered a loss, are a long-term stockholder, have information, would like to learn more about these claims, or have any questions concerning this announcement or your rights or interests with respect to these matters, please contact Brandon Walker or Marion Passmore by email at investigations@bespc.com, by telephone at (212) 355-4648, or by filling out this contact form. There is no cost or obligation to you.

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York and California. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Troubled Chains Need to Get Off the 'Watch List' ASAP

Ramping up real estate efficiency can help retailers be more competitive and avoid the high cost of bankruptcy restructurings, advises Andy Graiser of A&G Real Estate Partners

NEW YORK, Nov. 22, 2024 /PRNewswire/ — Retailers with worsening sales and traffic need to act now to stay off the growing “watch list” of troubled chains and avoid the rising costs of Chapter 11 bankruptcy filings, advised A&G Real Estate Partners Co-President Andy Graiser.

“By acting proactively and strategically to right the ship as quickly as possible, retailers can lower their restructuring costs and bolster their odds of emerging with less debt, higher cashflow and a nimbler and more productive real estate portfolio,” Graiser writes in a Chain Store Age Online “Expert Viewpoints” piece published on Nov. 5.

The real estate dimension is particularly important, the executive notes, and yet retailers often are too slow off the mark when it comes to portfolio optimization, leading them to head into out-of-court or Chapter 11 restructurings with inadequate clarity about:

- their supply chains;

- the individual stores they should close;

- how to engage landlords on lease restructurings and terminations;

- consumer trends; and

- what to do about non-store real estate such as office holdings and warehouses.

“Attacking the problem when you still have liquidity is critical,” Graiser writes. On the front lines of portfolio-optimization on behalf of both healthy and distressed clients, his New York-based firm has achieved more than $13 billion in tenant savings through lease restructuring, selling more than $12 billion in leases and real estate assets along the way.

Identifying real estate market trends should be one of the first steps in a comprehensive portfolio-performance review, Graiser advises. “In some cases, individual stores run into trouble, not because of fatal flaws in the local market, merchandise or store manager, but because important co-tenants have exited or seen operational declines,” he observes. “This can happen regionally or nationally when a major co-tenant goes out of business.”

The potential for store closures to have cascading effects on the rest of the retailer’s portfolio is another key consideration. “Where will your existing customers go if you choose to close a particular location or locations?” Graiser writes. “Can you configure your in-market presence in such a way that it maximizes the transfer of your existing shoppers to your remaining locations, and not those of your competitors?”

Third-party real estate advisors can partner with retailers to review their portfolios and answer such questions. They can also make sure retailers have up-to-date and granular data at their fingertips in areas such as:

- sales trends and box sizes

- market rents

- occupancy costs

- barriers to entry

- geospatial traffic data, and

- the quality and trajectory of stores, shopping centers and submarkets.

Understanding the position of individual landlords is essential as well. “The well-heeled owners of top-tier shopping centers generally want a freer hand to execute redevelopments and/or remerchandising strategies,” Graiser writes, noting the need to “zero-in on valuable lease exclusives and site-control clauses that could serve as powerful bargaining chips” in such situations.

While conducting store-by-store reviews, meanwhile, “seemingly small nuances also can be important,” Graiser adds. “Problems with store management, parking, signage, labor, deferred maintenance or shoplifting/shrink should not be ignored in your real estate decisions.”

Portfolio reviews also should cover fee-owned properties and non-store assets, which can be downsized, sold, relocated or subleased to support the broader strategy. That could include corporate offices, warehouse distribution centers and transportation facilities. However, the effects on operations of shuttering a warehouse must be carefully considered.

“What will happen to logistics, fulfillment and customer service without that asset?” Graiser writes. “If it ultimately falls into the ‘keep’ column, what kind of lease term and structure would be best?”

The right strategy and information can help the entire team understand the “art of the possible” and act decisively, Graiser concludes. “Yes, information is power, but timing matters, too.”

The full column is available at:

https://chainstoreage.com/troubled-chains-need-get-watch-list-asap

Media Contacts: At Jaffe Communications, Elisa Krantz, (908) 789-0700, 386763@email4pr.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/troubled-chains-need-to-get-off-the-watch-list-asap-302313418.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/troubled-chains-need-to-get-off-the-watch-list-asap-302313418.html

SOURCE A&G Real Estate Partners

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin's Road To $100K: Why Thanksgiving, New SEC Policies, And Global Adoption Could Spark The Next Bull Run, According To This Portfolio Manager

Eric Jackson, the founder and portfolio manager at EMJ Capital, has shared his thoughts on the potential catalysts that could drive Bitcoin’s BTC/USD value to $100,000.

What Happened: On Friday, Jackson appeared on CNBC’s Closing Bell and suggested that the upcoming Thanksgiving holiday, new SEC policies, and global adoption could spark Bitcoin’s next bull run.

During the interview, Jackson stated, “I think a lot of people that I talk to say, well, it’s just going to kiss $100,000 and pull back.”

Adding, “But I do think there’s a chance like that $100,000 milestone could be a rethink for a lot of investors both institutional, sovereign retail, and there are a bunch of catalysts ahead I think.”

See Also: Will Shiba Inu Coin Reach 1 Cent By 2025? 47% Of Benzinga Readers Say…

He went on to explain that the new SEC regime and the potential for a strategic reserve could be significant catalysts for Bitcoin.

Jackson also said that the Thanksgiving period often acts as a springboard for bullish crypto periods, rather than a setback.

He concluded by saying, “I think those names, you know, and the fact that they … there’s a real structure that’s going to be coming into place, around crypto and Bitcoin, I think those will be catalysts in and of themselves.”

Why It Matters: Earlier, Galaxy Digital Holdings Ltd. CEO Mike Novogratz warned of a potential pullback due to excessive market leverage, but maintained that Bitcoin reaching $100,000 is “inevitable.”

Meanwhile, MicroStrategy Inc. MSTR executive chairman Michael Saylor has predicted that Bitcoin could hit $13 million by 2045, a valuation that would put Bitcoin’s market cap at around $250 trillion.

Companies like MicroStrategy, which owns more than 150,000 Bitcoins, are emerging as key players in this evolving market, effectively operating as a leveraged bet on the cryptocurrency.

In a note to Benzinga, Sumit Gupta, co-founder of CoinDCX, highlighted the surge in trading activity as a key driver. He also pointed to developments in the U.S. political landscape as a contributing factor.

The digital asset market has already benefited from the incoming administration of President-elect Donald Trump, with many speculating that a potential second term could bring more favorable regulatory policies for crypto.

Gupta added that speculation over SEC Chair Gary Gensler’s resignation and the possibility of crypto-friendly leadership has further fueled investor optimism.

Price Action: At the time of writing, Bitcoin was trading at $98,816, up nearly 0.2% in the last 24 hours, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ThinkCareBelieve: On The Verge of Tangible Peace

Palm Beach, Florida, Nov. 22, 2024 (GLOBE NEWSWIRE) —

ThinkCareBelieve’s Article: https://thinkcarebelieve.blog/2024/11/22/tangible-peace/

Palm Beach, Florida- ThinkCareBelieve has written an article about a potential peace talk meeting based on information given by Alex Jones at InfoWars. According to Jones, President Trump is currently holding a meeting at his Mar-a-Lago home in Palm Beach, Florida. The article reports that President Trump and Elon Musk have been working to attain a ceasefire between Ukraine and Russia leading to an agreement for Peace. https://x.com/RealAlexJones/status/1860020940635017390

ThinkCareBelieve’s article states that according to Reuters, Russian President Vladimir Putin is open to discussing a Ukraine ceasefire deal with Donald Trump but rules out making any major territorial concessions and insists Kyiv abandon ambitions to join NATO.

The article explains some of the background of the Russia~Ukraine War from the appoach of President Putin’s position on NATO expansion according to American professor and policy analyst Jeffrey Sachs. Per BRICS News, An announcement for a Cease Fire Agreement is expected soon from President Trump’s Mar-a-Lago home in Palm Beach, Florida. https://x.com/BRICSinfo/status/1860083101004910948

ThinkCareBelieve’s article also discusses the International Criminal Court’s arrest warrant for Prime Minister Benjamin Netanyahu and Defense Minister Yoav Gallant on charges of War Crimes and Crimes against Humanity. The article stresses that the media was meant to be independent of governments, to be a watchdog, holding them accountable. Julian Assange said that “If wars can be started by lies, peace can be started with truth.” He also said, “Nearly every war that has started in the past 50 years has been a result of media lies.” In line with ThinkCareBelieve’s mission of peace advocacy, the article lists 26 illegal CIA operations since its inception in 1947 which gives a thorough picture of why Peace is needed in the world and why endless wars had become the new normal, until now, because the article discusses the strong possibility that peace can be achieved.

ThinkCareBelieve is a mission of peace advocacy. ThinkCareBelieve will do its best to accentuate the possibilities for positive outcomes. To find the commonalities between diverse groups and bring the focus on common needs to work together toward shared goals. Activism is an important aspect of ThinkCareBelieve, because public participation and awareness to issues needing exposure to light leads to justice. Improved transparency in government can lead to changes in policy and procedure resulting in more fluid communication between the public and the government that serves them. America needs hope right now, and Americans need to be more involved in their government.

###

CONTACT: Joanne COMPANY: ThinkCareBelieve EMAIL: joanne@thinkcarebelieve.blog WEB: thinkcarebelieve.blog

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dwight Kay and Chay Lapin, Founders of Cove Capital Investments, Announce Sixth Consecutive Annual Distribution Rate Increase for Firm's "Cove Thistlewood Townhomes Delaware Statutory Trust"

The latest distribution increase aligns with the investment’s Private Placement Memorandum, highlighting the success of Cove Capital’s debt-free acquisition model, and overall property strategy emphasizing rental rate increases and strict expense controls.

LOS ANGELES, Nov. 22, 2024 /PRNewswire/ — Dwight Kay and Chay Lapin, Managing Members and Founding Partners of Cove Capital Investments—a Delaware Statutory Trust sponsor company specializing in debt-free DST offerings—announced an increase in annual distributions, paid monthly, for investors in the Cove Thistlewood Townhomes Delaware Statutory Trust offering, a Regulation D, Rule 506c offering. The offering consists of a high quality townhome community in the heart of Clarkesville, TN. Acquired in 2018, this offering is believed to be the first-ever all-cash/debt-free multifamily Delaware Statutory Trust offering.

According to Kay, the most recent annualized distribution rate for the Thistlewood Townhomes DST, a debt free DST with no risk of lender foreclosure, increased by 2.72% over the same period a year ago. This marks the sixth consecutive DST distribution rate increase for these 1031 exchange investors in the past six years.

* Past performance does not guarantee future results. Please read full disclosures of risk in each offerings Private Placement Memorandum (PPM) prior to considering any DST investment.

“When we acquired the Cove Thistlewood Townhomes DST, we quickly identified it as an attractive asset that could potentially benefit from our institutional level of management and operational expertise. Since bringing this multifamily DST community into our portfolio, we have focused on reducing Loss-to-Lease (LTL) and aligning rents to market rate, enhancing curb appeal, and expanding marketing efforts to raise visibility of the asset. As a result, we have increased our Net Operating Income, tenant occupancy, expense reduction and management control – all of which has allowed us to consistently increase distributions to our 1031 exchange DST investors. In addition, we anticipate potentially seeing continued distribution increases throughout the hold period,” said Dwight Kay, Managing Member and Co-Founder of Cove Capital Investments.

“For our DST investors, we consider this an incredible win to be able to deliver an increasing distribution rate as outlined in our PPM, payable monthly, in a time where many multifamily real estate sponsor companies have had to lower monthly distributions due to unforeseen expense increases and rent growth stagnation. Of course, there are no guarantees for positive returns in the future however we feel confident that the Cove Capital debt-free Thistlewood Townhomes Delaware Statutory Trust strategy will continue to serve us and our 1031 exchange investors well over the bright future ahead,” said Chay Lapin, Managing Member and Co-Founder of Cove Capital Investments.

About Cove Capital Investments

Cove Capital Investments is a Delaware Statutory Trust sponsor company that operates a portfolio of over 2.4 million square feet of real estate in 33 states nationwide. Over 1,800 investors have trusted Cove Capital with their 1031 exchange and investment dollars, many of them being repeat investors in multiple DST offerings over the years. Our offerings are attractive to those investors seeking to lower risk potential as the majority of Cove Capital’s DST offerings are debt free (no mortgage – no lender foreclosure risk). To sign up for a list of the current Cove Capital offerings available for 1031 exchange and direct investments please visit www.covecapitalinvestments.com.

For further information, please visit www.covecapitalinvestments.com or contact Cove Capital at (877) 899-1315 and via email at info@covecapitalinvestments.com.

Diversification does not guarantee profits or protect against losses. All real estate investments provide no guarantees for cash flow, distributions or appreciation as well as could result in a full loss of invested principal. Please read the entire Private Placement Memorandum (PPM) prior to making an investment. This material is not to be considered tax or legal advice. Please speak with your attorney and CPA before considering an investment. All offerings discussed, if any, are Regulation D, Rule 506c offerings. Past performance is not a guarantee of future results. Securities offered through FNEX Capital, member FINRA, SIPC.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/dwight-kay-and-chay-lapin-founders-of-cove-capital-investments-announce-sixth-consecutive-annual-distribution-rate-increase-for-firms-cove-thistlewood-townhomes-delaware-statutory-trust-302313767.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/dwight-kay-and-chay-lapin-founders-of-cove-capital-investments-announce-sixth-consecutive-annual-distribution-rate-increase-for-firms-cove-thistlewood-townhomes-delaware-statutory-trust-302313767.html

SOURCE Cove Capital Investments

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

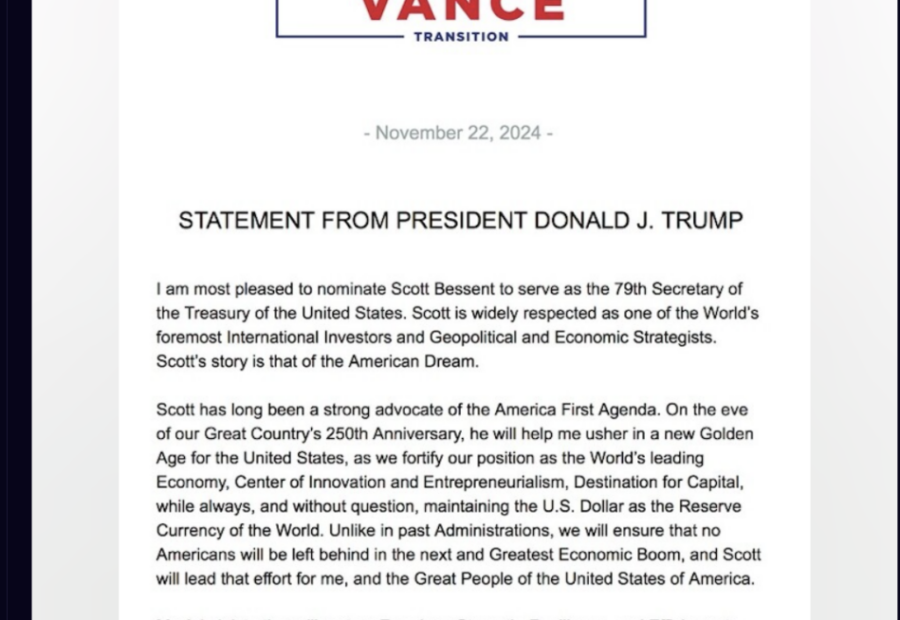

Trump Picks Hedge Fund Exec Scott Bessent As Treasury Secretary: What President-Elect's Choice Means For America's Economic Future

President-elect Donald Trump has picked hedge fund executive Scott Bessent as the U.S. Treasury Secretary.

What Happened: Bessent, 62 and founder of Key Square Group, was a leading candidate, competing with former Fed Governor Kevin Warsh and private equity executive Marc Rowan.

While sharing the decision on Friday via his social media platform Truth Social, Trump lauded Bessent as “one of the World’s foremost International Investors and Geopolitical and Economic Strategists.”

See Also: Trump’s Hush Money Sentencing Delayed As Legal Immunity Debate Escalates

Bessent is known for his support of gradual tariffs and deregulation, aligning with Trump’s economic vision, which includes reviving manufacturing and achieving energy independence.

Despite his previous role as chief investment officer for George Soros’ fund, Trump expressed confidence in Bessent’s ability to improve U.S. competitiveness and address trade imbalances.

Why It Matters: As Treasury Secretary, Bessent will replace outgoing Secretary Janet Yellen, overseeing financial institutions and combating financial crimes at a time when the national debt has ballooned to $36 trillion.

According to betting markets, Bessent was a frontrunner with an 82% probability of securing the nomination. His appointment could significantly impact Wall Street and the crypto sector.

In October, Bessent assured that a new Trump administration would support a strong dollar, countering previous suggestions of a weaker dollar to boost exports.

Despite Elon Musk’s support for Howard Lutnick, Trump favored Bessent’s business-as-usual approach.

In July, Bessent gained attention for his optimistic stance on cryptocurrency, suggesting he might support digital assets if confirmed. “Crypto is about freedom and the crypto economy is here to stay,” he stated at the time.

The latest 13F filing from Bessent’s Key Square Group fund shows a highly concentrated portfolio, with equal investments in two banking-focused ETFs: the SPDR S&P Regional Banking ETF KRE and the SPDR S&P Bank ETF KBE, each making up 50% of the fund.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PACS Group, Inc Class Action Alert: Wolf Haldenstein Adler Freeman & Herz LLP reminds investors that a securities class action lawsuit has been filed in the United States District Court for the Southern District of New York against PACS Group, Inc.

Upcoming Lead Plaintiff Deadline is January 13, 2025

CLICK HERE TO PROVIDE CONTACT INFORMATION AND JOIN THE CASE

NEW YORK, Nov. 22, 2024 (GLOBE NEWSWIRE) — Wolf Haldenstein Adler Freeman & Herz LLP (“Wolf Haldenstein”) announces that a federal securities class action lawsuit has been filed in the United States District Court for the Southern District of New York on behalf of persons and entities that purchased or otherwise acquired against PACS Group, Inc. (“PACS” or the “Company”) PACS.

The lawsuit is brought on behalf of investors who acquired PACS:

- common stock pursuant and/or traceable to the registration statement and prospectus (collectively, the “Registration Statement”) issued in connection with PACS’ April 11, 2024, initial public offering (the “IPO”); and/or

- securities between April 11, 2024, and November 5, 2024, inclusive (the “Class Period”).

All investors who purchased shares and incurred losses are advised to contact the firm immediately at classmember@whafh.com or (800) 575-0735 or (212) 545-4774. You may obtain additional information concerning the action or join the case on our website, www.whafh.com.

If you have incurred losses, you may, no later than January 13, 2025, request that the Court appoint you as the lead plaintiff of the proposed class. Please contact Wolf Haldenstein to learn more about your rights.

On November 4, 2024, Hindenburg Research (“Hindenburg”) published a report based on a 5-month investigation that included interviews with 18 former PACS employees, competitors, and an analysis of more than 900 PACS facility cost reports. The report alleged that the Company had “abused a COVID-era waiver” in a “scheme” that involved falsely submitting false Medicare claims which “drove more than 100% of PACS’ operating and net income from 2020 – 2023, enabling PACS to IPO in early 2024 with the illusion of legitimate growth and profitability.” The report further alleged that the Company engaged in a scheme to maintain revenue by “billing thousands of unnecessary respiratory and sensory integration therapies to Medicare Part B regardless of clinical need or outcomes.”

The report also alleged that PACS engaged in a widespread practice of falsifying documentation, including by engaging in a “scheme whereby PACS attempts to fool regulators by ‘renting’ licenses from third parties to ‘hang’ on buildings” and then “either employs unlicensed administrators or has administrators manage multiple buildings in excess of state mandated limits.” Similarly, the report alleged that the Company engaged in a scheme related to licensure and staffing of nurses, whereby “PACS secretly lists uncertified nurse aides (NAs) as certified in the system, in an apparent scheme to cheat staffing ratios” and “retroactively add fake RN hours” in order “to meet minimum staffing requirements, boost star ratings, and avoid costly penalties.”

Following publication of the Hindenburg report, PACS’s stock price fell $11.93 per share, or 27.78%, to close at $31.01 per share on November 4, 2024. Then, on November 6, 2024, PACS announced that it would postpone its fiscal third quarter 2024 earnings release. The Company further disclosed it had “received civil investigative demands from the federal government regarding the Company’s reimbursement and referral practices that may or may not be related to this week’s third-party report.”

On this news, PACS’s stock price fell an additional $11.45 per share, or 38.76%, to close at $18.09 per share on November 6, 2024.

Wolf Haldenstein has experience in the prosecution of securities class actions and derivative litigation in state and federal trial and appellate courts across the country. The firm has attorneys in various practice areas, and offices in New York, Chicago, Nashville and San Diego. The reputation and expertise of this firm in shareholder and other class litigation has been repeatedly recognized by the courts, which have appointed it to major positions in complex securities multi-district and consolidated litigation.

If you wish to discuss this action or have any questions regarding your rights and interests in this case, please immediately contact Wolf Haldenstein by telephone at (800) 575-0735 or via e-mail at classmember@whafh.com.

Contact:

Wolf Haldenstein Adler Freeman & Herz LLP

Gregory Stone, Director of Case and Financial Analysis

Email: gstone@whafh.com or classmember@whafh.com

Tel: (800) 575-0735 or (212) 545-4774

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Statement for the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities for National Housing Day

OTTAWA, ON , Nov. 22, 2024 /CNW/ – National Housing Day is an important reminder that every Canadian deserves a place to call home. A home connects us to the communities where we live and work and gives us the stability to grow and thrive. It’s a place where we can feel safe and take care of our family, friends, and neighbours.

Today, we’re also reminded that, for too many, this still isn’t a reality. Indigenous Peoples are almost three times as likely as non-Indigenous populations to live in a home in need of major repairs. People with disabilities, persons with substance use issues, Veterans, and racialized groups also face higher rates of housing instability. While survivors of gender-based violence, women, and accompanied children are more likely to access shelters extensively over shorter periods.

I want to recognize the Canadians who face these hardships every day. But today is also an opportunity to come together with housing partners across all levels of government, non-profit sectors, Indigenous partners, and private organizations to be part of the solution.

Since 2017, the federal government has renewed its efforts to address Canada’s housing crisis with the launch of the National Housing Strategy and passage of the National Housing Strategy Act, which recognizes housing as a human right. Through the introduction of Canada’s Housing Plan last April, our government has continued to expand its leadership role in addressing the housing crisis to build more homes, make it easier to rent or own a home, and help Canadians who can’t afford a home.

The federal government is investing in building homes faster, streamlined city planning, reducing homebuilding costs, innovative construction methods, and infrastructure to build more housing at a price Canadians can afford. The Plan helps us puts the dream of homeownership in reach for younger generations and protects renters. It commits to providing affordable housing for students, seniors, and vulnerable communities. And it paves avenues for providing the supports necessary to help persons experiencing homelessness access housing.

This National Housing Day, the Government of Canada reaffirms its commitment to safe, quality, and affordable housing for everyone in Canada to raise their families, build their future, and reach their full potential.

Follow us on X, Facebook, Instagram and LinkedIn

Web: Housing, Infrastructure and Communities Canada

SOURCE Department of Housing, Infrastructure and Communities

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c3874.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c3874.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lawsuit alleging Target illegally collected biometric data can move forward, judge says

A federal judge has denied Target’s request to dismiss a lawsuit accusing the retailer of illegally collecting customers’ biometric data.

The class-action suit, filed in May in federal court in Illinois, charges Target with capturing and storing consumers’ biometric data, including “scans of their facial geometry,” without informing them in writing or obtaining consent as required by the Biometric Information Privacy Act (BIPA), passed in Illinois in 2008.

The lawsuit − filed by four Illinois women who shop at Target on behalf of Illinois shoppers – notes that Target has installed cameras to monitor stores for shoplifting and uses facial recognition software. The women say neither they nor consumers have been told how data, including their likeness, is used or how long it is stored − something they say is required by the Illinois law.

Target had asked that the lawsuit be dismissed because the women’s claims were not based on their own factual knowledge but on news reports, including a 2018 CBS Evening News story on Target’s National Investigation Center, located just north of Minneapolis, where investigators can see video from all Target stores.

One of the women alleges in the suit that a Target loss prevention employee followed her while she walked through a store and that a Target asset protection operations manager viewed her LinkedIn profile shortly after she entered the store.

Here’s what you need to know about the case, including more about the judge’s order.

A shopper checks out at Target.

More about judge’s order allowing lawsuit

In his order allowing the lawsuit to proceed on Thursday, District Judge Jeremy Daniel said that the “allegations present a story that holds together.”

“This is not a case where the complaint ‘offers no basis for the allegation that (the defendant) disclosed (the plaintiff’s) biometric data’; rather, it is one where the plaintiffs’ supply a legitimate reason why they believe Target violated BIPA, which is sufficient to survive the motion to dismiss,” he said.

Target Facial Recognition Amended Complaint by Mike Snider on Scribd

Target has until Dec. 13. to answer the complaint. USA TODAY has reached out to Target for comment.

A similar suit, filed in March, in Cook County Circuit Court in Illinois, was voluntarily dismissed in May.

Follow Mike Snider on X and Threads: @mikesnider & mikegsnider.

What’s everyone talking about? Sign up for our trending newsletter to get the latest news of the day

This article originally appeared on USA TODAY: Lawsuit accusing Target of collecting biometric data moves forward