Trump Picks Hedge Fund Exec Scott Bessent As Treasury Secretary: What President-Elect's Choice Means For America's Economic Future

President-elect Donald Trump has picked hedge fund executive Scott Bessent as the U.S. Treasury Secretary.

What Happened: Bessent, 62 and founder of Key Square Group, was a leading candidate, competing with former Fed Governor Kevin Warsh and private equity executive Marc Rowan.

While sharing the decision on Friday via his social media platform Truth Social, Trump lauded Bessent as “one of the World’s foremost International Investors and Geopolitical and Economic Strategists.”

See Also: Trump’s Hush Money Sentencing Delayed As Legal Immunity Debate Escalates

Bessent is known for his support of gradual tariffs and deregulation, aligning with Trump’s economic vision, which includes reviving manufacturing and achieving energy independence.

Despite his previous role as chief investment officer for George Soros’ fund, Trump expressed confidence in Bessent’s ability to improve U.S. competitiveness and address trade imbalances.

Why It Matters: As Treasury Secretary, Bessent will replace outgoing Secretary Janet Yellen, overseeing financial institutions and combating financial crimes at a time when the national debt has ballooned to $36 trillion.

According to betting markets, Bessent was a frontrunner with an 82% probability of securing the nomination. His appointment could significantly impact Wall Street and the crypto sector.

In October, Bessent assured that a new Trump administration would support a strong dollar, countering previous suggestions of a weaker dollar to boost exports.

Despite Elon Musk’s support for Howard Lutnick, Trump favored Bessent’s business-as-usual approach.

In July, Bessent gained attention for his optimistic stance on cryptocurrency, suggesting he might support digital assets if confirmed. “Crypto is about freedom and the crypto economy is here to stay,” he stated at the time.

The latest 13F filing from Bessent’s Key Square Group fund shows a highly concentrated portfolio, with equal investments in two banking-focused ETFs: the SPDR S&P Regional Banking ETF KRE and the SPDR S&P Bank ETF KBE, each making up 50% of the fund.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PACS Group, Inc Class Action Alert: Wolf Haldenstein Adler Freeman & Herz LLP reminds investors that a securities class action lawsuit has been filed in the United States District Court for the Southern District of New York against PACS Group, Inc.

Upcoming Lead Plaintiff Deadline is January 13, 2025

CLICK HERE TO PROVIDE CONTACT INFORMATION AND JOIN THE CASE

NEW YORK, Nov. 22, 2024 (GLOBE NEWSWIRE) — Wolf Haldenstein Adler Freeman & Herz LLP (“Wolf Haldenstein”) announces that a federal securities class action lawsuit has been filed in the United States District Court for the Southern District of New York on behalf of persons and entities that purchased or otherwise acquired against PACS Group, Inc. (“PACS” or the “Company”) PACS.

The lawsuit is brought on behalf of investors who acquired PACS:

- common stock pursuant and/or traceable to the registration statement and prospectus (collectively, the “Registration Statement”) issued in connection with PACS’ April 11, 2024, initial public offering (the “IPO”); and/or

- securities between April 11, 2024, and November 5, 2024, inclusive (the “Class Period”).

All investors who purchased shares and incurred losses are advised to contact the firm immediately at classmember@whafh.com or (800) 575-0735 or (212) 545-4774. You may obtain additional information concerning the action or join the case on our website, www.whafh.com.

If you have incurred losses, you may, no later than January 13, 2025, request that the Court appoint you as the lead plaintiff of the proposed class. Please contact Wolf Haldenstein to learn more about your rights.

On November 4, 2024, Hindenburg Research (“Hindenburg”) published a report based on a 5-month investigation that included interviews with 18 former PACS employees, competitors, and an analysis of more than 900 PACS facility cost reports. The report alleged that the Company had “abused a COVID-era waiver” in a “scheme” that involved falsely submitting false Medicare claims which “drove more than 100% of PACS’ operating and net income from 2020 – 2023, enabling PACS to IPO in early 2024 with the illusion of legitimate growth and profitability.” The report further alleged that the Company engaged in a scheme to maintain revenue by “billing thousands of unnecessary respiratory and sensory integration therapies to Medicare Part B regardless of clinical need or outcomes.”

The report also alleged that PACS engaged in a widespread practice of falsifying documentation, including by engaging in a “scheme whereby PACS attempts to fool regulators by ‘renting’ licenses from third parties to ‘hang’ on buildings” and then “either employs unlicensed administrators or has administrators manage multiple buildings in excess of state mandated limits.” Similarly, the report alleged that the Company engaged in a scheme related to licensure and staffing of nurses, whereby “PACS secretly lists uncertified nurse aides (NAs) as certified in the system, in an apparent scheme to cheat staffing ratios” and “retroactively add fake RN hours” in order “to meet minimum staffing requirements, boost star ratings, and avoid costly penalties.”

Following publication of the Hindenburg report, PACS’s stock price fell $11.93 per share, or 27.78%, to close at $31.01 per share on November 4, 2024. Then, on November 6, 2024, PACS announced that it would postpone its fiscal third quarter 2024 earnings release. The Company further disclosed it had “received civil investigative demands from the federal government regarding the Company’s reimbursement and referral practices that may or may not be related to this week’s third-party report.”

On this news, PACS’s stock price fell an additional $11.45 per share, or 38.76%, to close at $18.09 per share on November 6, 2024.

Wolf Haldenstein has experience in the prosecution of securities class actions and derivative litigation in state and federal trial and appellate courts across the country. The firm has attorneys in various practice areas, and offices in New York, Chicago, Nashville and San Diego. The reputation and expertise of this firm in shareholder and other class litigation has been repeatedly recognized by the courts, which have appointed it to major positions in complex securities multi-district and consolidated litigation.

If you wish to discuss this action or have any questions regarding your rights and interests in this case, please immediately contact Wolf Haldenstein by telephone at (800) 575-0735 or via e-mail at classmember@whafh.com.

Contact:

Wolf Haldenstein Adler Freeman & Herz LLP

Gregory Stone, Director of Case and Financial Analysis

Email: gstone@whafh.com or classmember@whafh.com

Tel: (800) 575-0735 or (212) 545-4774

This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Statement for the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities for National Housing Day

OTTAWA, ON , Nov. 22, 2024 /CNW/ – National Housing Day is an important reminder that every Canadian deserves a place to call home. A home connects us to the communities where we live and work and gives us the stability to grow and thrive. It’s a place where we can feel safe and take care of our family, friends, and neighbours.

Today, we’re also reminded that, for too many, this still isn’t a reality. Indigenous Peoples are almost three times as likely as non-Indigenous populations to live in a home in need of major repairs. People with disabilities, persons with substance use issues, Veterans, and racialized groups also face higher rates of housing instability. While survivors of gender-based violence, women, and accompanied children are more likely to access shelters extensively over shorter periods.

I want to recognize the Canadians who face these hardships every day. But today is also an opportunity to come together with housing partners across all levels of government, non-profit sectors, Indigenous partners, and private organizations to be part of the solution.

Since 2017, the federal government has renewed its efforts to address Canada’s housing crisis with the launch of the National Housing Strategy and passage of the National Housing Strategy Act, which recognizes housing as a human right. Through the introduction of Canada’s Housing Plan last April, our government has continued to expand its leadership role in addressing the housing crisis to build more homes, make it easier to rent or own a home, and help Canadians who can’t afford a home.

The federal government is investing in building homes faster, streamlined city planning, reducing homebuilding costs, innovative construction methods, and infrastructure to build more housing at a price Canadians can afford. The Plan helps us puts the dream of homeownership in reach for younger generations and protects renters. It commits to providing affordable housing for students, seniors, and vulnerable communities. And it paves avenues for providing the supports necessary to help persons experiencing homelessness access housing.

This National Housing Day, the Government of Canada reaffirms its commitment to safe, quality, and affordable housing for everyone in Canada to raise their families, build their future, and reach their full potential.

Follow us on X, Facebook, Instagram and LinkedIn

Web: Housing, Infrastructure and Communities Canada

SOURCE Department of Housing, Infrastructure and Communities

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c3874.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c3874.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lawsuit alleging Target illegally collected biometric data can move forward, judge says

A federal judge has denied Target’s request to dismiss a lawsuit accusing the retailer of illegally collecting customers’ biometric data.

The class-action suit, filed in May in federal court in Illinois, charges Target with capturing and storing consumers’ biometric data, including “scans of their facial geometry,” without informing them in writing or obtaining consent as required by the Biometric Information Privacy Act (BIPA), passed in Illinois in 2008.

The lawsuit − filed by four Illinois women who shop at Target on behalf of Illinois shoppers – notes that Target has installed cameras to monitor stores for shoplifting and uses facial recognition software. The women say neither they nor consumers have been told how data, including their likeness, is used or how long it is stored − something they say is required by the Illinois law.

Target had asked that the lawsuit be dismissed because the women’s claims were not based on their own factual knowledge but on news reports, including a 2018 CBS Evening News story on Target’s National Investigation Center, located just north of Minneapolis, where investigators can see video from all Target stores.

One of the women alleges in the suit that a Target loss prevention employee followed her while she walked through a store and that a Target asset protection operations manager viewed her LinkedIn profile shortly after she entered the store.

Here’s what you need to know about the case, including more about the judge’s order.

A shopper checks out at Target.

More about judge’s order allowing lawsuit

In his order allowing the lawsuit to proceed on Thursday, District Judge Jeremy Daniel said that the “allegations present a story that holds together.”

“This is not a case where the complaint ‘offers no basis for the allegation that (the defendant) disclosed (the plaintiff’s) biometric data’; rather, it is one where the plaintiffs’ supply a legitimate reason why they believe Target violated BIPA, which is sufficient to survive the motion to dismiss,” he said.

Target Facial Recognition Amended Complaint by Mike Snider on Scribd

Target has until Dec. 13. to answer the complaint. USA TODAY has reached out to Target for comment.

A similar suit, filed in March, in Cook County Circuit Court in Illinois, was voluntarily dismissed in May.

Follow Mike Snider on X and Threads: @mikesnider & mikegsnider.

What’s everyone talking about? Sign up for our trending newsletter to get the latest news of the day

This article originally appeared on USA TODAY: Lawsuit accusing Target of collecting biometric data moves forward

Emergent's Vaccine Production Failure: Contamination Scandal, Investor Backlash, and $40M Settlement

- On June 1, 2020, Emergent announced a $628 million contract with the U.S. government to produce COVID-19 vaccines.

- The company started producing vaccine materials for Johnson & Johnson and AstraZeneca at its Baltimore facility in late 2020.

- In March 2021, the facility accidentally contaminated Johnson & Johnson vaccine doses with AstraZeneca ingredients.

- By April 2021, the FDA halted production at the site, citing quality issues, contamination risks, and poor training.

- Following the contamination crisis, Emergent stock price dropped by over 60% by November 2021, erasing over half the company’s market value in just months.

- Shortly after, shareholders filed multiple lawsuits against Emergent, claiming the company misrepresented its vaccine production capabilities and hid serious quality issues.

- Emergent BioSolutions recently agreed to pay a $40 million settlement to investors to resolve the lawsuits. Affected investors can now file a claim to receive the payout.

Overview

Emergent BioSolutions EBS secured over $1 billion in government and pharmaceutical contracts during the COVID-19 pandemic. However, in March 2021, workers at its Baltimore facility mistakenly mixed Johnson & Johnson and AstraZeneca vaccine ingredients, contaminating up to 15 million J&J doses and forcing AstraZeneca to discard tens of millions more. This error delayed J&J’s vaccine rollout and disrupted global distribution, causing Emergent stock to drop by over 50% by November 2021. Following these events, a group of shareholders sued Emergent, and recently, Emergent agreed to pay a $40 million settlement to all affected investors.

How It All Started: Manufacturing Failures

In the wake of the COVID-19 pandemic, Emergent BioSolutions positioned its Bayview facility as a critical vaccine production asset. In March 2020, the company secured over $1 billion in contracts with Johnson & Johnson and AstraZeneca, including a substantial government Operation Warp Speed contract.

On April 30, 2020, CEO Robert Kramer declared during an earnings call that the company had “proven manufacturing capabilities” and was prepared to scale up quickly to meet the demands of vaccine production.

In July 2020, following the AstraZeneca agreement, Emergent further bolstered its claims in a press release, with Kramer declaring, “Emergent is driven by our desire to advance solutions that will make an impact on this pandemic“.

The company’s CDMO business unit head, Syed T. Husain, added that “Emergent stands ready alongside leading innovators to rapidly deploy our CDMO services to help meet the substantial demand for a vaccine.“

By early 2021, Emergent shares were trading above $90, fueled by high expectations for the company’s role in vaccine production.

However, despite positive public messaging, internal audits and inspections in the summer of 2020 uncovered serious issues at Emergent BioSolutions’ manufacturing facilities.

Reports highlighted poor staff training, equipment failures, and inadequate quality control measures, revealing long-standing problems within the company’s operations. One audit found that “the flow of workers and materials through the plant was not adequately controlled to prevent mix-ups or contamination.” Another audit discovered that a manager had “knowingly deviated” from standard procedures.

After that, in November 2020, AstraZeneca representatives visiting Emergent’s Bayview facility raised concerns about poor oversight and GMP compliance.

Emergent’s VP of Manufacturing acknowledged these issues, mentioning trash buildup in hallways and lapses in GMP standards. An external consultant also warned that the facility was “NON-CGMP compliant” and at regulatory risk, but production still continued.

Contamination Crisis at Emergent’s Facility

In March 2021, a major contamination incident at Emergent’s Baltimore facility revealed significant oversight failures. Millions of Johnson & Johnson vaccine doses were mixed with AstraZeneca ingredients, an issue initially detected by Johnson & Johnson’s lab in the Netherlands, not Emergent.

The contamination forced the disposal of tens of millions of AstraZeneca doses and delayed the delivery of approximately 100 million Johnson & Johnson doses during a critical phase of the pandemic.

Following this disclosure, Emergent issued a press release, stating that their “quality control systems worked as designed” and that discarding a batch of bulk drug substance “occasionally happens during vaccine manufacturing.”

However, that same day the Associated Press released FDA documents obtained through FOIA requests, revealing a history of quality control issues at Emergent’s facilities dating back to 2017.

FDA leaders reported that the company “hired a lot of individuals not as familiar with vaccine manufacturing that did not have adequate training.”

Inspectors found several issues at Emergent’s facility, including mismanaged waste, peeling paint, and cluttered equipment. They also discovered that some quality checks were removed from vaccines before an FDA visit in February 2021.

Later, it came to light that Emergent had been forced to destroy vaccine materials equivalent to nearly 400 million doses — much more than the previously reported 85 million.

The situation worsened on November 4, 2021, when Emergent announced that the Department of Health and Human Services had cancelled its $628 million contract, requiring the company to reverse $86 million in Q3 2021 revenue and reduce its contract backlog by $180 million.

The impact on investors was clear as Emergent’s stock price dropped by over 60%, from more than $120 in early 2021 to below $45 by November 2021.

These disclosures and the sharp drop in stock price led shareholders to file multiple lawsuits against Emergent, accusing the company of misrepresenting its vaccine production capabilities and concealing serious quality issues.

Resolving The Case

After three years of legal proceedings, in September 2024, Emergent agreed to pay $40 million to settle the lawsuit from shareholders. If you invested in Emergent, you may be eligible to file for a portion of the settlement to recover your losses.

As of now, Emergent BioSolutions has made significant progress in its recovery, securing a $50 million settlement with Johnson & Johnson and driving a broader transformation under CEO Joe Papa. In Q3 2024, the company saw a 9% revenue increase to $293.8 million and secured vital government contracts, including a $250 million order to produce vaccines for anthrax, botulism, and smallpox. It also sold its Camden facility for $30 million to streamline operations. However, its stock remains far below previous highs, trading at $8 in November 2024 — a 93.6% decline from its $125 peak in 2021, showing that there is still a long road ahead for a recovery.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

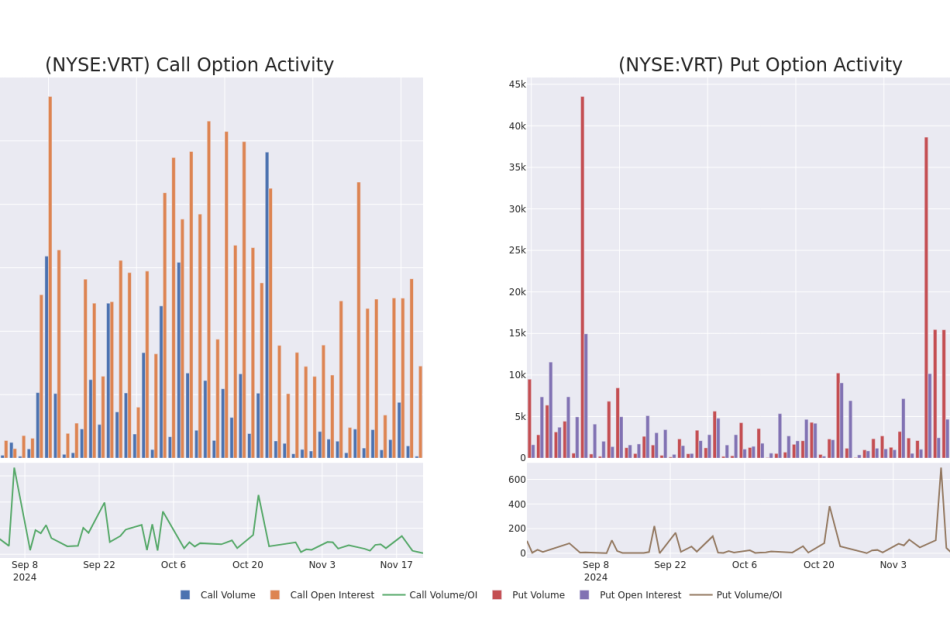

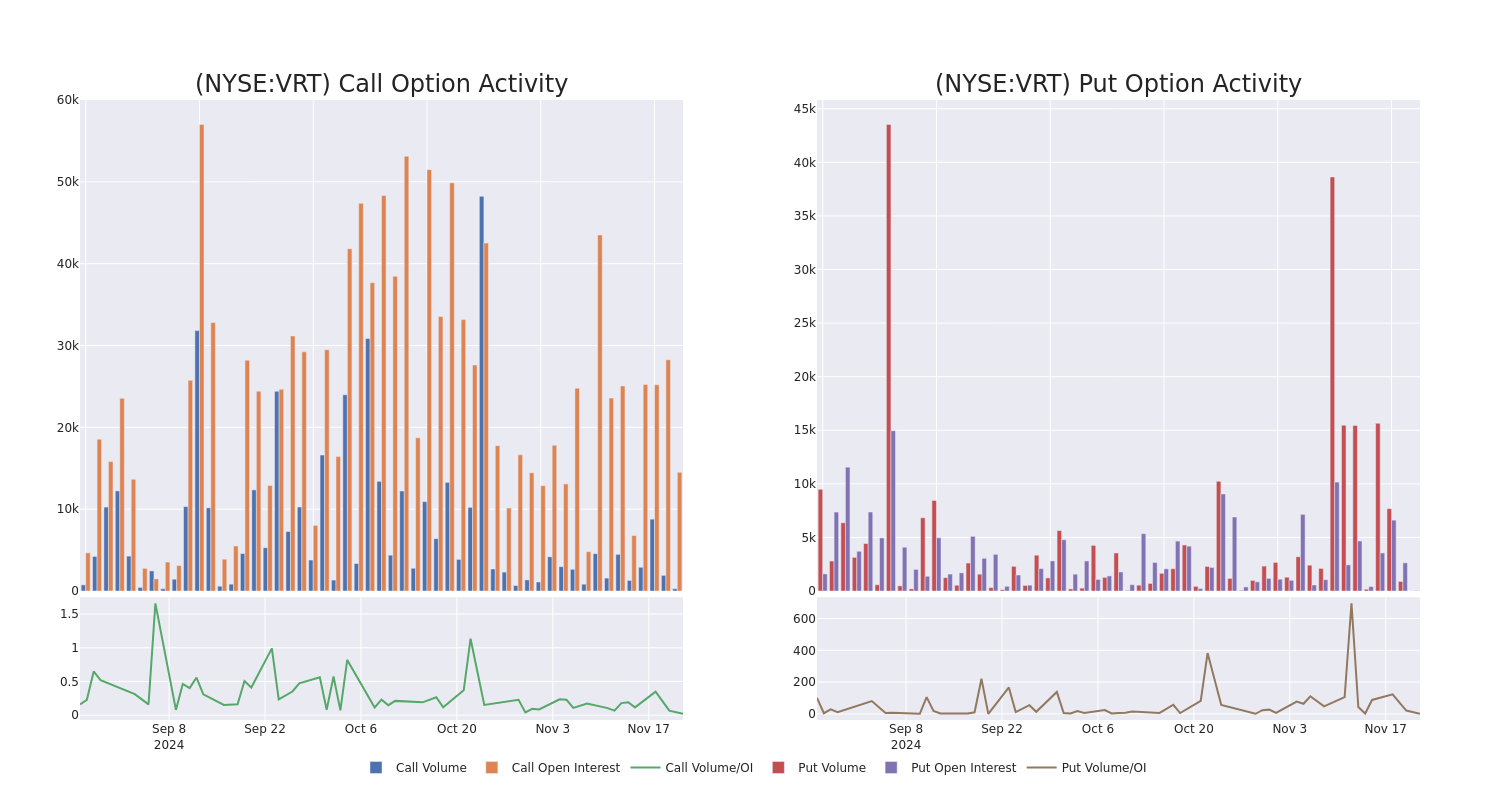

A Closer Look at Vertiv Hldgs's Options Market Dynamics

Investors with a lot of money to spend have taken a bearish stance on Vertiv Hldgs VRT.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with VRT, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 11 options trades for Vertiv Hldgs.

This isn’t normal.

The overall sentiment of these big-money traders is split between 18% bullish and 45%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $30,470, and 10, calls, for a total amount of $762,525.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $155.0 for Vertiv Hldgs during the past quarter.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Vertiv Hldgs’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vertiv Hldgs’s whale trades within a strike price range from $50.0 to $155.0 in the last 30 days.

Vertiv Hldgs Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | TRADE | BULLISH | 06/20/25 | $58.9 | $58.4 | $58.9 | $87.50 | $235.6K | 511 | 40 |

| VRT | CALL | SWEEP | BEARISH | 11/22/24 | $14.7 | $14.0 | $14.6 | $126.00 | $146.0K | 458 | 108 |

| VRT | CALL | TRADE | BULLISH | 01/16/26 | $57.1 | $56.4 | $56.82 | $100.00 | $113.6K | 920 | 22 |

| VRT | CALL | TRADE | BEARISH | 12/20/24 | $31.6 | $30.4 | $30.75 | $110.00 | $61.5K | 1.3K | 20 |

| VRT | CALL | TRADE | NEUTRAL | 12/20/24 | $84.6 | $80.5 | $82.51 | $60.00 | $41.2K | 115 | 0 |

About Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

After a thorough review of the options trading surrounding Vertiv Hldgs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Vertiv Hldgs

- Currently trading with a volume of 3,591,027, the VRT’s price is up by 0.71%, now at $142.5.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 89 days.

Professional Analyst Ratings for Vertiv Hldgs

5 market experts have recently issued ratings for this stock, with a consensus target price of $130.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Oppenheimer has decided to maintain their Outperform rating on Vertiv Hldgs, which currently sits at a price target of $121.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Vertiv Hldgs with a target price of $141.

* An analyst from TD Cowen has decided to maintain their Buy rating on Vertiv Hldgs, which currently sits at a price target of $115.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Vertiv Hldgs, targeting a price of $140.

* An analyst from Citigroup persists with their Buy rating on Vertiv Hldgs, maintaining a target price of $134.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vertiv Hldgs with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elevai Labs Inc. Announces Reverse Stock Split to Maintain Nasdaq Listing Compliance

NEWPORT BEACH, Calif., Nov. 22, 2024 (GLOBE NEWSWIRE) — Elevai Labs Inc. ELAB (Elevai” or the “Company”) announced today it will implement a 1-for-200 reverse stock split (“Reverse Stock Split”) of its common stock, which will be effective at midnight on November 27, 2024. This initiative aligns with the Company’s efforts to meet Nasdaq’s minimum bid price requirement of $1.00 per share under Listing Rule 5550(a)(2).

Key Details of the Reverse Stock Split:

– Conversion Ratio: Every 200 shares of issued and outstanding common stock will be automatically consolidated into one share, with no action required from shareholders.

– Fractional Shares: Shareholders entitled to fractional shares will receive one full share for each fractional portion.

– Updated Stock Identifier: While the trading symbol remains “ELAB”, the common stock now carries a new CUSIP number (28622K 203).

– Equity Adjustments: Outstanding stock awards, options, and the equity incentive plan have been adjusted proportionally to reflect the new share structure.

Purpose of the Reverse Stock Split:

The Reverse Stock Split is a critical step in ensuring compliance with Nasdaq’s listing requirements, allowing Elevai to maintain its presence on the Nasdaq Capital Market. A continued listing enhances the Company’s visibility, strengthens investor confidence, and positions Elevai for future growth.

Impact on Shareholders:

– No Immediate Action Required: Shareholders holding shares through a broker or in “street name” will see their holdings updated automatically.

– Certificate Holders: Shareholders with physical certificates can exchange them, if desired, through VStock Transfer, LLC, which will provide detailed instructions.

– Share Value: The Reverse Stock Split does not impact the overall value of shareholder equity; it only reduces the number of shares outstanding while proportionally adjusting the share price.

Impact on our Common Stock:

– Post Reverse Stock Split there will be approximately 3.07 million shares of common stock issued and outstanding

Looking Ahead:

“The reverse stock split is a required measure to preserve Elevai’s Nasdaq listing and set the stage for our continued progress in innovation and shareholder value creation,” said Graydon Bensler, Chief Executive Officer of Elevai. “We are optimistic about the future and committed to executing our growth strategy.”

For additional information, please refer to Elevai’s full Form 8-K filing available regarding the Reverse Stock Split, filed on November 22, 2024, on the SEC’s website, or contact Elevai directly at IR@elevailabs.com.

About Elevai Labs, Inc.

Elevai Labs Inc. ELAB specializes in medical aesthetics and biopharmaceutical drug development, focusing on innovations for skin aesthetics and treatments tied to obesity and metabolic health. The Company operates a diverse portfolio of three wholly owned subsidiaries across the medical aesthetics and biopharmaceutical sectors, Elevai Skincare Inc., Elevai Biosciences Inc., and Elevai Research Inc. For more information please visit www.elevailabs.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Words such as “believes,” “expects,” “plans,” “potential,” “would” and “future” or similar expressions such as “look forward” are intended to identify forward-looking statements. Forward-looking statements are made as of the date of this press release and are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, activities of regulators and future regulations and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results. Therefore, you should not rely on any of these forward-looking statements. These and other risks are described more fully in Elevai’s filings with the United States Securities and Exchange Commission (“SEC”), including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 29, 2024, and its other documents subsequently filed with or furnished to the SEC. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at www.sec.gov. All forward-looking statements contained in this press release speak only as of the date on which they were made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

IR Contact:

IR@ElevaiLabs.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

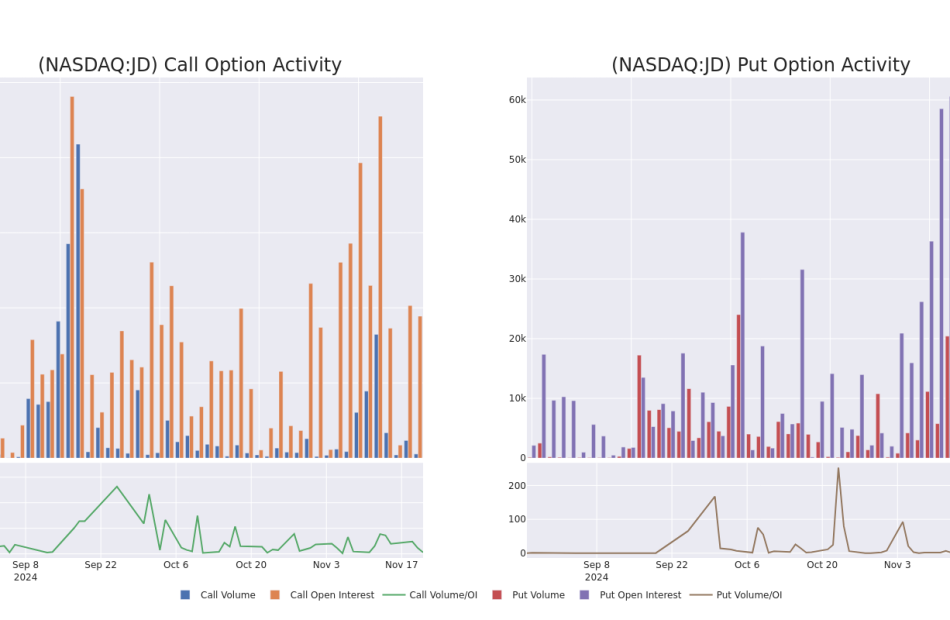

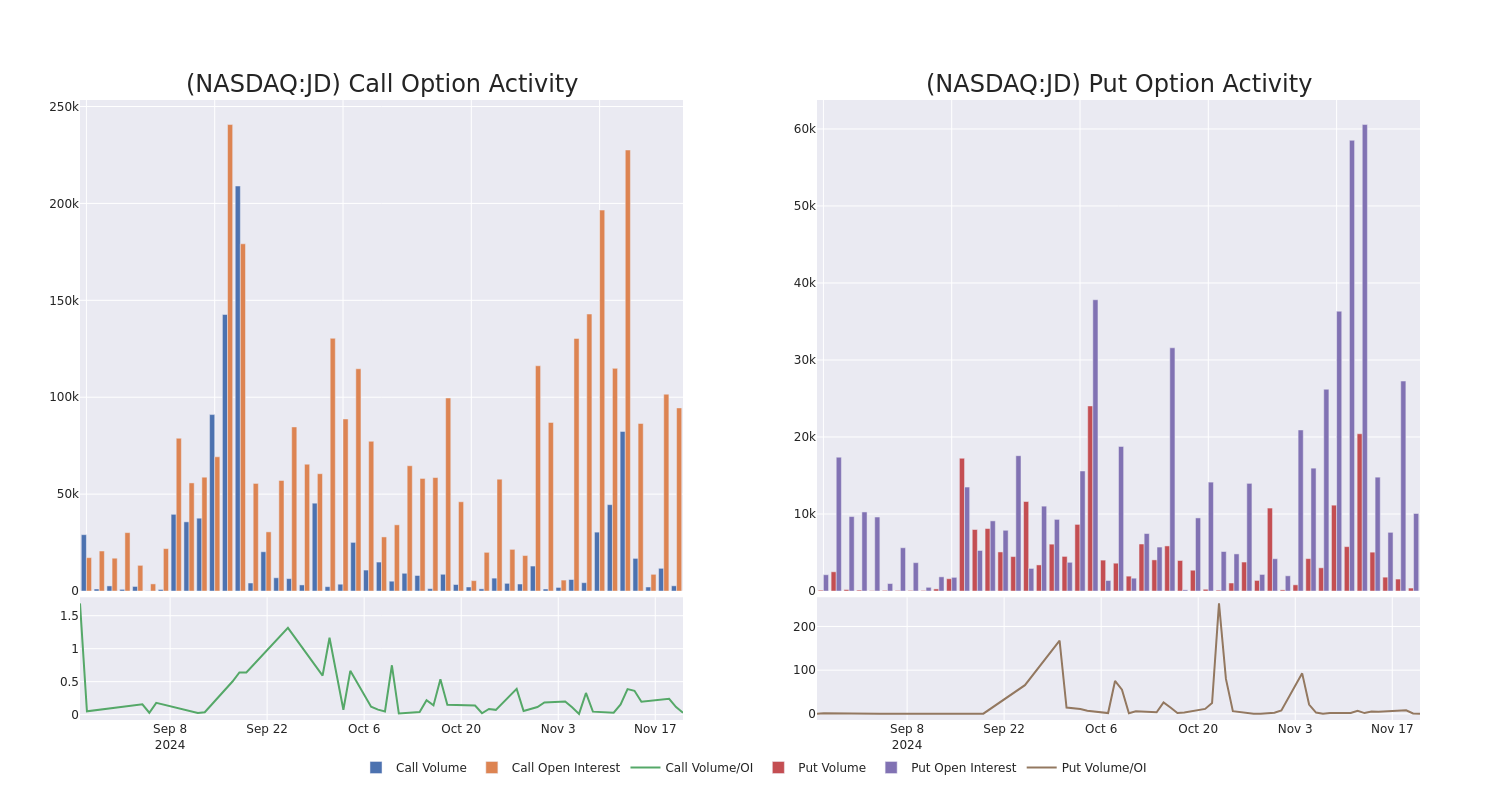

Behind the Scenes of JD.com's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards JD.com JD, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in JD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 12 extraordinary options activities for JD.com. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 41% bearish. Among these notable options, 10 are puts, totaling $365,631, and 2 are calls, amounting to $146,200.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $29.0 and $44.0 for JD.com, spanning the last three months.

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JD.com’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com’s whale activity within a strike price range from $29.0 to $44.0 in the last 30 days.

JD.com Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | SWEEP | BULLISH | 04/17/25 | $4.25 | $4.05 | $4.21 | $35.00 | $84.2K | 122 | 200 |

| JD | PUT | SWEEP | BEARISH | 01/17/25 | $9.55 | $9.4 | $9.45 | $44.00 | $67.1K | 1.0K | 80 |

| JD | CALL | TRADE | BULLISH | 12/20/24 | $1.55 | $1.49 | $1.55 | $35.00 | $62.0K | 3.9K | 411 |

| JD | PUT | SWEEP | BEARISH | 03/21/25 | $2.84 | $2.81 | $2.84 | $34.00 | $56.8K | 1.0K | 243 |

| JD | PUT | TRADE | BULLISH | 02/21/25 | $2.27 | $2.25 | $2.25 | $34.00 | $35.3K | 1.8K | 200 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

Having examined the options trading patterns of JD.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

JD.com’s Current Market Status

- Trading volume stands at 7,562,490, with JD’s price down by -1.94%, positioned at $34.7.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 103 days.

What Analysts Are Saying About JD.com

2 market experts have recently issued ratings for this stock, with a consensus target price of $49.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for JD.com, targeting a price of $51.

* Reflecting concerns, an analyst from Benchmark lowers its rating to Buy with a new price target of $47.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

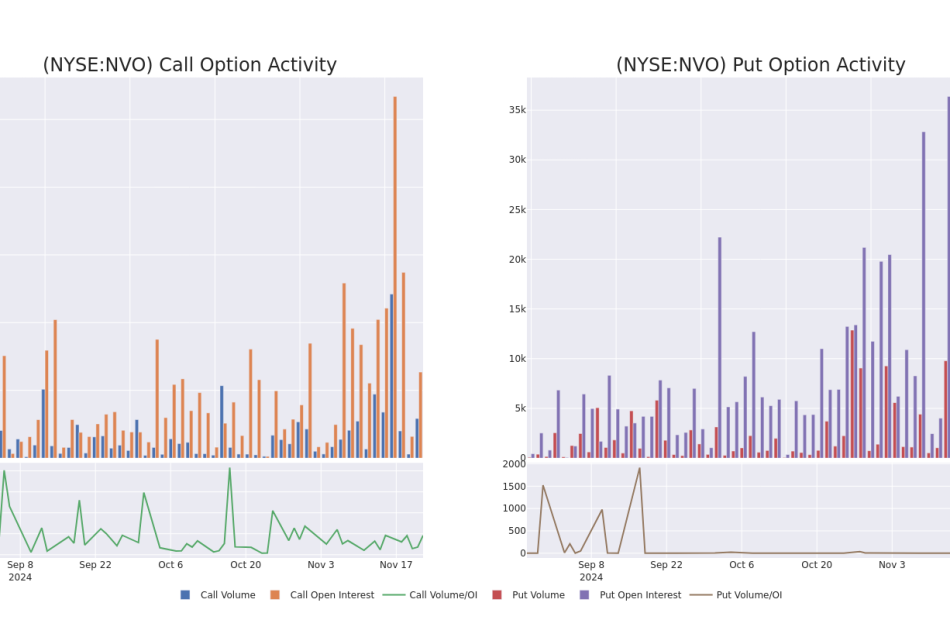

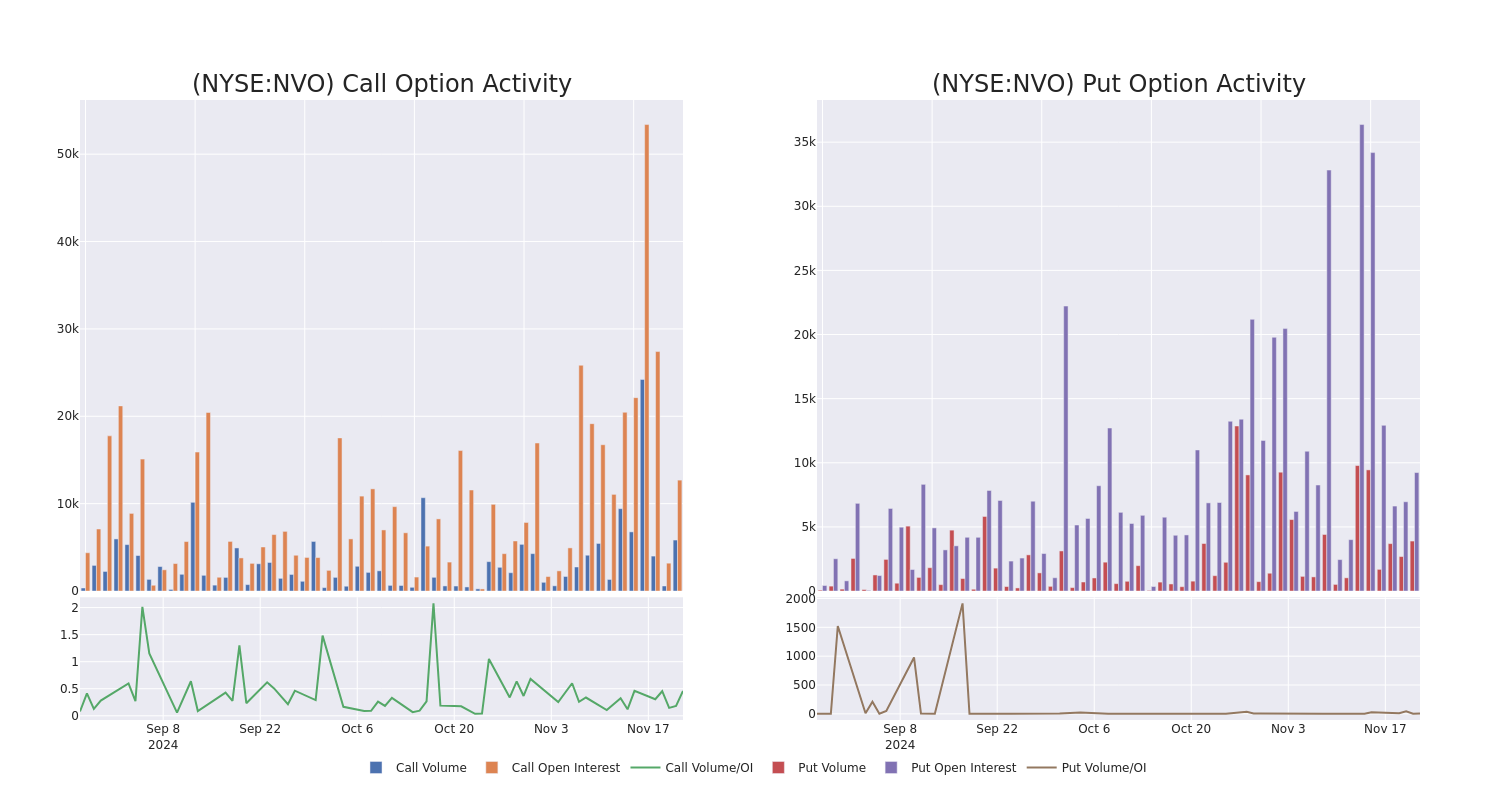

Smart Money Is Betting Big In NVO Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Novo Nordisk.

Looking at options history for Novo Nordisk NVO we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 48% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $1,872,600 and 14, calls, for a total amount of $3,590,645.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $145.0 for Novo Nordisk during the past quarter.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk’s substantial trades, within a strike price spectrum from $65.0 to $145.0 over the preceding 30 days.

Novo Nordisk Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | CALL | TRADE | BULLISH | 12/20/24 | $7.8 | $7.6 | $7.8 | $102.00 | $1.3M | 270 | 1.7K |

| NVO | PUT | TRADE | BEARISH | 01/17/25 | $5.2 | $4.9 | $5.2 | $100.00 | $780.0K | 4.6K | 2.0K |

| NVO | CALL | SWEEP | BULLISH | 01/17/25 | $3.85 | $3.65 | $3.84 | $115.00 | $686.9K | 2.9K | 1.9K |

| NVO | CALL | TRADE | BEARISH | 06/20/25 | $13.45 | $13.1 | $13.15 | $105.00 | $636.4K | 1.1K | 984 |

| NVO | PUT | SWEEP | BEARISH | 01/17/25 | $5.25 | $5.15 | $5.15 | $100.00 | $257.5K | 4.6K | 500 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

Where Is Novo Nordisk Standing Right Now?

- With a volume of 4,857,497, the price of NVO is up 2.5% at $105.2.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 68 days.

What Analysts Are Saying About Novo Nordisk

1 market experts have recently issued ratings for this stock, with a consensus target price of $160.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $160.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Novo Nordisk, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Essence Atkins, Terri J Vaughn, Vanessa Bell Calloway, Hannah Whitley, Tyler Whitley, Aasha Davis to star in BET+ Holiday Comedy "Queens of Christmas"

LOS ANGLES, Nov. 22, 2024 (GLOBE NEWSWIRE) — Worldwide Entertainment and Media reports Essence Atkins (Poppa’s House), Terri J Vaughn (The Steve Harvey Show), Vanessa Bell Calloway (Coming to America), Tyler Whitley (Father of The Bride), Hannah Whitley (Encounters), and Aasha Davis (Friday Night Lights) star in the upcoming BET+ Holiday Comedy “Queens of Christmas”.

Written by Chad Quinn (Christmas Party Crashers) and Kenny Young (Never Alone For Christmas), “Queens of Christmas” is directed by Kenny Young (Merry Ex-Mas) the movie is and is slated to premiere on BET+ December 19th, 2024.

Doris and Julia, life-long friends and feuding neighbors, engage in a hilarious competition for the annual ‘Queen of Christmas’ title, which has been won by their annoying neighbor Nancy every year! But will this year be their year? Doris and Julia will soon discover the true spirit of the holiday and the value of their sisterly bond along the way.

“Queens of Christmas” will make you laugh and want to hug your best friend while showing the true meaning of sisterhood, said Julie Solinger, Producer.

A Media Snippet accompanying this announcement is available by clicking on this link.

BET+ Original Movie | Queens of Christmas | Trailer

Rounding out the cast is Russell G Jones, Carl Gilliard, Marjorie Johnson, Curtis Wiley, Isaiah Romain, Danielle Baez, Jada Elena Wooten, Bear Jackson and Gary Budoff.

The film is produced by Worldwide Entertainment and Media and Choice Films for BET+. Produced by Pierre Romain, Julie Solinger, Summer Crockett Moore, and Tony Glazer. Executive Produced by Michael Laundon and Michael Bassick. Associate Produced by Anthony Commodore, Taleo Coles, Brandon Scott and Bree Michael Warner.

Contact:

Worldwide Entertainment and Media, LLC.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/47f454c7-e676-497f-a8f6-1524bb8ac4c2

https://www.globenewswire.com/NewsRoom/AttachmentNg/de4f8fc9-df0c-4425-92ac-5443f94260d4

A video accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/be80c04d-d5ed-4635-bae5-9ba98d2861af

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.