Behind the Scenes of Deere's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Deere DE.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 16 uncommon options trades for Deere.

This isn’t normal.

The overall sentiment of these big-money traders is split between 43% bullish and 43%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $301,147, and 10 are calls, for a total amount of $1,023,353.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $185.0 to $470.0 for Deere over the last 3 months.

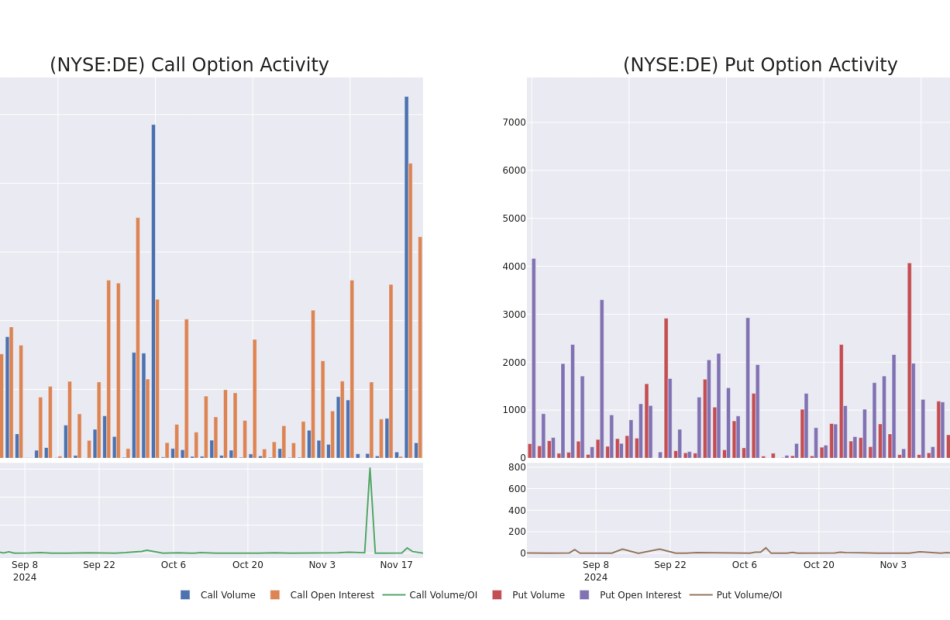

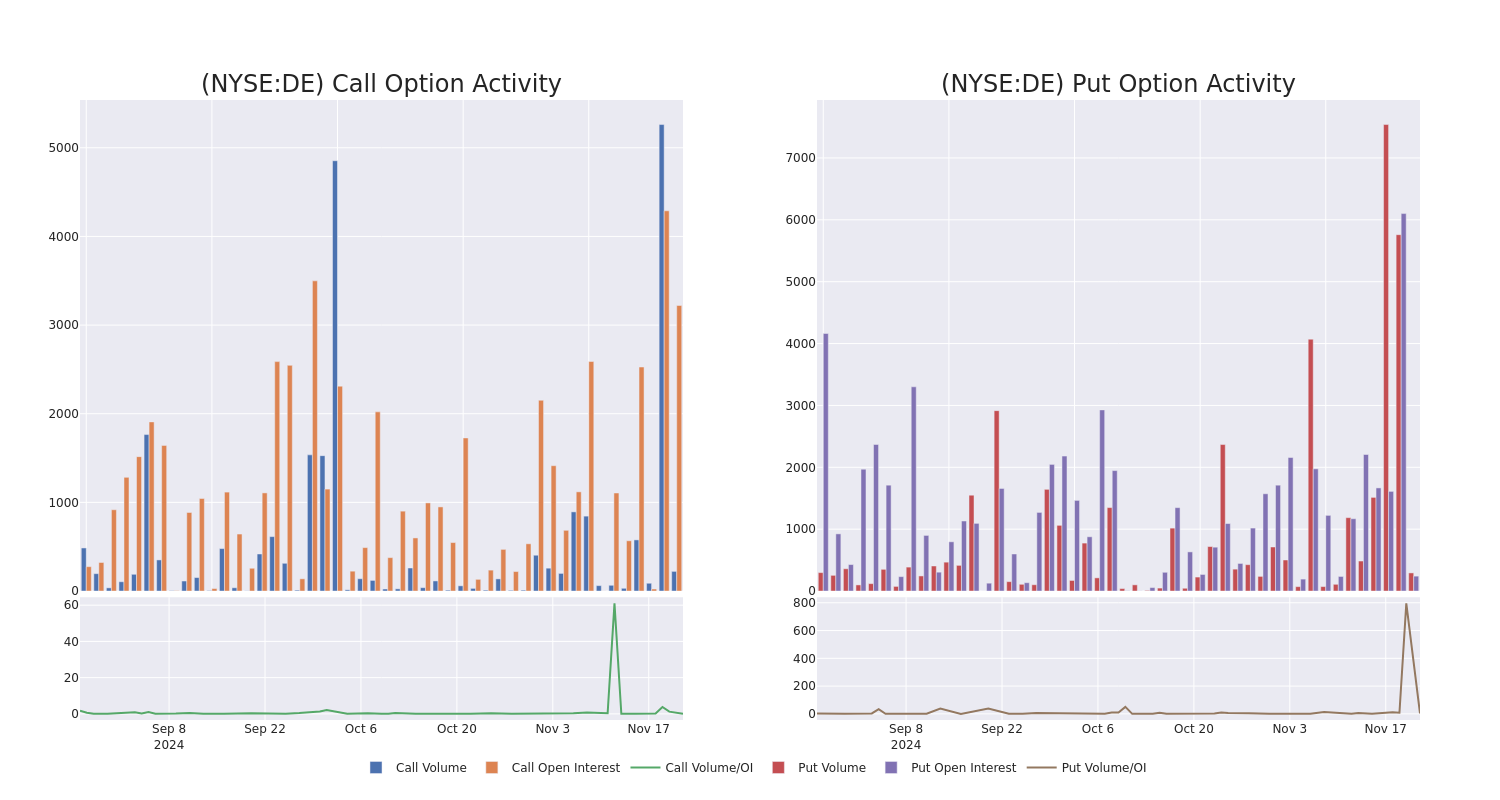

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Deere’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Deere’s whale trades within a strike price range from $185.0 to $470.0 in the last 30 days.

Deere 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | CALL | TRADE | BEARISH | 06/20/25 | $265.4 | $261.2 | $261.2 | $185.00 | $444.0K | 1 | 17 |

| DE | CALL | TRADE | BEARISH | 11/22/24 | $41.15 | $33.7 | $33.75 | $397.50 | $168.7K | 88 | 50 |

| DE | CALL | SWEEP | BULLISH | 06/20/25 | $23.0 | $22.5 | $23.0 | $470.00 | $138.0K | 239 | 60 |

| DE | CALL | TRADE | NEUTRAL | 01/17/25 | $43.85 | $42.85 | $43.28 | $400.00 | $60.5K | 904 | 20 |

| DE | PUT | TRADE | BULLISH | 12/06/24 | $7.05 | $5.5 | $6.1 | $430.00 | $51.8K | 104 | 89 |

About Deere

Deere is the world’s leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

In light of the recent options history for Deere, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Deere Standing Right Now?

- With a trading volume of 1,458,238, the price of DE is up by 1.71%, reaching $445.02.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 83 days from now.

Professional Analyst Ratings for Deere

In the last month, 4 experts released ratings on this stock with an average target price of $485.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Deere with a target price of $450.

* An analyst from Truist Securities has decided to maintain their Buy rating on Deere, which currently sits at a price target of $538.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Deere, targeting a price of $475.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Deere with a target price of $477.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deere options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gamblers Are Sinking Billions Into a Leveraged Market Fringe

(Bloomberg) — The buy-everything mania that greeted Donald Trump’s election is cooling in the tried-and-tested world of stocks and corporate credit. Yet on Wall Street’s speculative fringes, the risk-taking frenzy is only getting bigger by the day.

Most Read from Bloomberg

Heavy trading — and big price moves — in everything from crypto to leveraged exchange-traded funds was the story in a week where swings in the S&P 500 and Nasdaq 100 finally started to abate.

Ground zero for the casino crowd: The $140 billion complex of amped-up exchange-traded funds tracking the likes of Big Tech stocks, Michael Saylor’s Bitcoin proxy MicroStrategy Inc., and more. Gamblers are flocking to vehicles that boost gains and losses across indexes and companies including the Magnificent Seven darlings. Single-name leveraged products have been trading $86 billion this week — a record.

It’s the latest frothy chapter in a marquee year for risky assets, courtesy of the booming economy and Trump’s election pledges — no matter how long the Federal Reserve is taking to cut interest rates.

The gains have fattened brokerage accounts just in time for the holiday shopping season. Yet at this rate, the gambling spirits are running high enough to give market pros pause.

“This euphoria is rampant speculation on par with the 2000 peak,” said Michael O’Rourke, chief market strategist at JonesTrading. “These levels of momentum and turnover are hard to maintain for an extended period of time.”

Gyrations are slowing down in the less-exotic assets. While the S&P 500 gained at a healthy clip — 1.7% this week — it was the smallest move since before election day. Daily changes in 10-year Treasury yields have averaged less than 2 basis points since Nov. 14, compared with more than 7 basis points in the two weeks prior.

No corner of the juiced-up ETF world saw more action this week than funds centered on MicroStrategy, the software firm Saylor has transformed into what amounts to a pure-play bet on Bitcoin. Two leveraged funds based on the company saw a combined $420 million inflow amid a 24% surge for the underlying stock this week.

The popularity of the two funds has led some market-observers to point to a leveraged-loop buying frenzy. It goes like this: Investor demand for the ETFs pushes up the price of MicroStrategy, allowing it to raise more money and further prop up Bitcoin itself. The world’s biggest digital token is up more than 40% in November alone and climbed each day this week to get within a few hundred dollars of $100,000.

Franklin Templeton Canada Announces ETF Cash Distributions and Estimated Annual Reinvested Distributions

TORONTO, Nov. 22, 2024 /CNW/ – Franklin Templeton Canada today announced cash distributions for certain ETFs and ETF series of mutual funds available to Canadian investors.

As detailed in the table below, unitholders of record as of November 29, 2024, will receive a per-unit cash distribution payable on December 9, 2024.

|

Fund Name |

Ticker |

Type |

Cash ($) |

Payment Frequency |

|

Franklin Brandywine Global Sustainable Income Optimiser Fund – ETF Series |

FBGO |

Active |

0.090153 |

Monthly |

|

Franklin ClearBridge Sustainable Global Infrastructure Income Fund – ETF Series |

FCII |

Active |

0.011902 |

Monthly |

|

Franklin Canadian Government Bond Fund – ETF Series |

FGOV |

Active |

0.049478 |

Monthly |

|

Franklin Canadian Ultra Short Term Bond Fund – ETF Series |

FHIS |

Active |

0.066623 |

Monthly |

|

Franklin Canadian Corporate Bond Fund – ETF Series |

FLCI |

Active |

0.066540 |

Monthly |

|

Franklin Canadian Core Plus Bond Fund – ETF Series |

FLCP |

Active |

0.049906 |

Monthly |

|

Franklin Global Core Bond Fund – ETF Series |

FLGA |

Active |

0.036584 |

Monthly |

|

Franklin Canadian Short Term Bond Fund – ETF Series |

FLSD |

Active |

0.061568 |

Monthly |

|

Franklin Canadian Low Volatility High Dividend Index ETF |

FLVC |

Passive |

0.056133 |

Monthly |

|

Franklin International Low Volatility High Dividend Index ETF |

FLVI |

Passive |

0.068600 |

Monthly |

|

Franklin U.S. Low Volatility High Dividend Index ETF |

FLVU |

Passive |

0.037867 |

Monthly |

Estimated Annual Reinvested Distributions

Unitholders of record on December 31, 2024, will receive a per-unit reinvested distribution payable on January 9, 2025. These annual reinvested distributions, detailed in the table below, are estimates only as of September 30, 2024. The final year-end distribution amounts will be announced on December 20, 2024.

|

Fund Name |

Ticker |

Type |

Estimated |

|

Franklin Core ETF Portfolio – ETF Series |

CBL |

Active |

0.345380 |

|

Franklin Conservative Income ETF Portfolio – ETF Series |

CNV |

Active |

– |

|

Franklin All-Equity ETF Portfolio – ETF Series |

EQY |

Active |

0.068630 |

|

Franklin Brandywine Global Sustainable Income Optimiser Fund – ETF Series |

FBGO |

Active |

– |

|

Franklin ClearBridge Sustainable Global Infrastructure Income Fund – ETF Series |

FCII |

Active |

– |

|

Franklin ClearBridge Sustainable International Growth Fund – ETF Series |

FCSI |

Active |

– |

|

Franklin Global Growth Fund – ETF Series |

FGGE |

Active |

– |

|

Franklin Canadian Government Bond Fund – ETF Series |

FGOV |

Active |

– |

|

Franklin Canadian Ultra Short Term Bond Fund – ETF Series |

FHIS |

Active |

– |

|

Franklin Innovation Fund – ETF Series |

FINO |

Active |

– |

|

Franklin FTSE U.S. Index ETF |

FLAM |

Passive |

0.158483 |

|

Franklin FTSE Canada All Cap Index ETF |

FLCD |

Passive |

– |

|

Franklin Canadian Corporate Bond Fund – ETF Series |

FLCI |

Active |

– |

|

Franklin Canadian Core Plus Bond Fund – ETF Series |

FLCP |

Active |

– |

|

Franklin Emerging Markets Equity Index ETF |

FLEM |

Passive |

– |

|

Franklin Global Core Bond Fund – ETF Series |

FLGA |

Active |

– |

|

Franklin FTSE Japan Index ETF |

FLJA |

Passive |

– |

|

Franklin Canadian Short Term Bond Fund – ETF Series |

FLSD |

Active |

– |

|

Franklin International Equity Index ETF |

FLUR |

Passive |

0.029145 |

|

Franklin U.S. Large Cap Multifactor Index ETF |

FLUS |

Smart Beta |

2.299712 |

|

Franklin Canadian Low Volatility High Dividend Index ETF |

FLVC |

Passive |

0.127420 |

|

Franklin International Low Volatility High Dividend Index ETF |

FLVI |

Passive |

0.287091 |

|

Franklin U.S. Low Volatility High Dividend Index ETF |

FLVU |

Passive |

0.040207 |

|

Franklin Growth ETF Portfolio – ETF Series |

GRO |

Active |

0.598660 |

The annual reinvested distributions, as applicable, will not be paid in cash but reinvested in additional units and reported as taxable distributions, with a corresponding increase in each unitholder’s adjusted cost base of their units of the respective ETF. The additional ETF units will be immediately consolidated so that the number of units held by the unitholder, the outstanding units and the net asset value of the ETFs will not change as a result of the annual reinvested distribution. The annual reinvested distributions, as applicable, are expected to be capital gains in nature for each of the ETFs.

The actual taxable amounts of cash and reinvested distributions for 2024, including the tax characteristics of the distributions, will be reported to brokers through CDS Clearing and Depository Services Inc. in early 2025.

Franklin Templeton’s diverse and innovative ETF platform was built to provide better client outcomes for a range of market conditions and investment opportunities. The product suite offers active, smart beta and passive ETFs that span multiple asset classes and geographies. For more information, please visit franklintempleton.ca/etf.

About Franklin Templeton

Franklin Resources, Inc. BEN is a global investment management organization with subsidiaries operating as Franklin Templeton and serving clients in over 150 countries. In Canada, the company’s subsidiary is Franklin Templeton Investments Corp., which operates as Franklin Templeton Canada. Franklin Templeton’s mission is to help clients achieve better outcomes through investment management expertise, wealth management and technology solutions. Through its specialist investment managers, the company offers specialization on a global scale, bringing extensive capabilities in fixed income, equity, alternatives and multi-asset solutions. With more than 1,500 investment professionals, and offices in major financial markets around the world, the California-based company has over 75 years of investment experience and over US$1.6 trillion (over CAN$2.2 trillion) in assets under management as of October 31, 2024. For more information, please visit franklintempleton.ca.

Commissions, management fees and expenses all may be associated with investments in ETFs and ETF series. Investors should carefully consider an ETF’s and ETF series’ investment objectives and strategies, risks, fees and expenses before investing. The prospectus and ETF facts contain this and other information. Please read the prospectus and ETF facts carefully before investing. ETFs and ETF series trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF and ETF series expenses will reduce returns. ETFs and ETF series are not guaranteed, their values change frequently, and past performance may not be repeated.

Copyright © 2024. Franklin Templeton. All rights reserved.

SOURCE Franklin Templeton Investments Corp.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c5240.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c5240.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Options Movement At Aramark: James Tarangelo Exercises Worth $148K

A large exercise of company stock options by James Tarangelo, SVP and CFO at Aramark ARMK was disclosed in a new SEC filing on November 21, as part of an insider exercise.

What Happened: Tarangelo, SVP and CFO at Aramark, exercised stock options for 8,365 shares of ARMK stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The exercise price of the options was $20.67 per share.

As of Friday morning, Aramark shares are down by 4.85%, with a current price of $38.46. This implies that Tarangelo’s 8,365 shares have a value of $148,813.

Discovering Aramark: A Closer Look

Aramark provides food, facilities, and uniform services to a variety of clients and institutions. The majority of company revenue comes from its North American food and support services segment. Smaller but substantial segments include food and support services international, food and support services united states and uniform and career apparel. The food and support services segments provide food for school districts; colleges; healthcare facilities; correctional institutions; and business, sports, and entertainment venues. The uniform segment rents, delivers, cleans, and maintains work clothes and ancillary items like towels and mats to customers in North America and Japan. The company has hundreds of service locations and distribution centers across the United States and Canada.

A Deep Dive into Aramark’s Financials

Positive Revenue Trend: Examining Aramark’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.16% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Exploring Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 8.99%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Aramark exhibits below-average bottom-line performance with a current EPS of 0.46.

Debt Management: Aramark’s debt-to-equity ratio is below the industry average. With a ratio of 1.83, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 40.83 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.62 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 13.05 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Aramark’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fidelity Investments Canada ULC Announces Estimated 2024 Annual Reinvested Capital Gains Distributions for Fidelity ETFs and ETF Series of Fidelity Mutual Funds

TORONTO, Nov. 22, 2024 /CNW/ – Fidelity Investments Canada ULC (“Fidelity”) today announced the estimated 2024 annual reinvested capital gains distributions for Fidelity’s suite of ETFs (“Fidelity ETFs”) and ETF Series units of Fidelity mutual funds (“Fidelity Funds”). Please note that these are estimated amounts only, as of the date set out in the tables below, and reflect forward-looking information, which means the estimates may change.

These estimates are for the annual capital gains distributions only, which will be reinvested, and the resulting units immediately consolidated, so that the number of units held by each investor will not change. These estimates do not include estimates of ongoing periodic cash distribution amounts, which are reported separately.

We expect to announce the annual reinvested distribution amounts, as well as the monthly cash distribution amounts, on or about December 18, 2024. The ex-dividend date for the 2024 annual distributions will be December 27, 2024. The record date for the 2024 annual distributions will be December 27, 2024 and those distributions will be payable on December 31, 2024.

The actual taxable amounts of reinvested and cash distributions for 2024, including the tax characteristics of the distributions, will be reported to the brokers through CDS Clearing and Depository Services Inc. in early 2025.

|

Fidelity ETF Name |

Ticker |

Net asset value (NAV) per unit as of October 16, 2024 ($) |

CUSIP |

ISIN |

Estimated annual capital gain per unit as of October 16, 2024 ($) |

Estimated annual capital gain per unit as a % of NAV at October 16, 2024 |

|

Fidelity Canadian High Dividend ETF |

FCCD |

30.5855 |

31608M102 |

CA31608M1023 |

– |

– |

|

Fidelity U.S. High Dividend ETF |

FCUD/ FCUD.U |

38.6317 |

31645M107 |

CA31645M1077 |

0.06994 |

0.18104 % |

|

Fidelity U.S. High Dividend Currency Neutral ETF |

FCUH |

33.9863 |

315740100 |

CA3157401009 |

– |

– |

|

Fidelity U.S. Dividend for Rising Rates ETF |

FCRR/ FCRR.U |

43.5301 |

31644M108 |

CA31644M1086 |

– |

– |

|

Fidelity International High Dividend ETF |

FCID |

27.4370 |

31623D103 |

CA31623D1033 |

– |

– |

|

Fidelity Systematic Canadian Bond Index ETF |

FCCB |

22.7420 |

31644F103 |

CA31644F1036 |

– |

– |

|

Fidelity Canadian Short Term Corporate Bond ETF |

FCSB |

25.5315 |

31608N100 |

CA31608N1006 |

– |

– |

|

Fidelity Global Core Plus Bond ETF |

FCGB/ FCGB.U |

22.1376 |

31623G106 |

CA31623G1063 |

– |

– |

|

Fidelity Canadian Monthly High Income ETF |

FCMI |

13.3488 |

31609T106 |

CA31609T1066 |

– |

– |

|

Fidelity Global Monthly High Income ETF |

FCGI |

14.1577 |

31623K107 |

CA31623K1075 |

0.00969 |

0.06844 % |

|

Fidelity Global Investment Grade Bond ETF |

FCIG/ FCIG.U |

21.8159 |

31624P105 |

CA31624P1053 |

– |

– |

|

Fidelity Equity Premium Yield ETF |

FEPY/ FEPY.U |

26.0725 |

31613F100 |

CA31613F1009 |

0.00795 |

0.03049 % |

|

Fidelity ETF Name |

Ticker |

Net asset value (NAV) per unit as of September 13, 2024 ($) |

CUSIP |

ISIN |

Estimated annual capital gain per unit as of September 13, 2024 ($) |

Estimated annual capital gain per unit as a % of NAV at September 13, 2024 |

|

Fidelity Canadian Low Volatility ETF |

FCCL |

35.5930 |

31608H103 |

CA31608H1038 |

0.36779 |

1.03332 % |

|

Fidelity U.S. Low Volatility ETF |

FCUL/ FCUL.U |

49.5615 |

31647B109 |

CA31647B1094 |

0.73937 |

1.49182 % |

|

Fidelity Canadian High Quality ETF |

FCCQ |

35.7181 |

31610C100 |

CA31610C1005 |

1.23441 |

3.45598 % |

|

Fidelity U.S. High Quality ETF |

FCUQ/ FCUQ.U |

59.2350 |

31647C107 |

CA31647C1077 |

1.96091 |

3.31039 % |

|

Fidelity U.S. High Quality Currency Neutral ETF |

FCQH |

55.0663 |

31648J101 |

CA31648J1012 |

0.94267 |

1.71188 % |

|

Fidelity Canadian Value ETF |

FCCV |

14.5178 |

31609U103 |

CA31609U1030 |

0.19424 |

1.33794 % |

|

Fidelity U.S. Value ETF |

FCUV/ FCUV.U |

17.6805 |

31647E103 |

CA31647E1034 |

0.78098 |

4.41718 % |

|

Fidelity U.S. Value Currency Neutral ETF |

FCVH |

16.9022 |

31646E104 |

CA31646E1043 |

0.80408 |

4.75725 % |

|

Fidelity ETF/ Fund Name |

Ticker |

Net asset value (NAV) per unit as of October 31, 2024 ($) |

CUSIP |

ISIN |

Estimated annual capital gain per unit as of October 31, 2024 ($) |

Estimated annual capital gain per unit as a % of NAV at October 31, 2024 |

|

Fidelity International Low Volatility ETF |

FCIL |

29.9627 |

31624M102 |

CA31624M1023 |

0.36141 |

1.20620 % |

|

Fidelity International High Quality ETF |

FCIQ/ FCIQ.U |

38.7658 |

31623X109 |

CA31623X1096 |

– |

– |

|

Fidelity International Value ETF |

FCIV |

34.2295 |

31622Y108 |

CA31622Y1088 |

1.56630 |

4.57588 % |

|

Fidelity Sustainable World ETF |

FCSW |

45.957 |

31642F105 |

CA31642F1053 |

0.80747 |

1.75701 % |

|

Fidelity Canadian Momentum ETF |

FCCM |

12.6438 |

31609W109 |

CA31609W1095 |

0.22387 |

1.77059 % |

|

Fidelity U.S. Momentum ETF |

FCMO/ FCMO.U |

16.1196 |

31649P106 |

CA31649P1062 |

1.12776 |

6.99620 % |

|

Fidelity International Momentum ETF |

FCIM |

12.6547 |

31623V103 |

CA31623V1031 |

0.47878 |

3.78342 % |

|

Fidelity All-in-One Balanced ETF |

FBAL |

12.7233 |

315818104 |

CA3158181048 |

0.24165 |

1.89927 % |

|

Fidelity All-in-One Growth ETF |

FGRO |

14.4152 |

31581P106 |

CA31581P1062 |

0.36718 |

2.54717 % |

|

Fidelity Advantage Bitcoin ETF® |

FBTC/ FBTC.U |

32.2683 |

31580V104 |

CA31580V1040 |

– |

– |

|

Fidelity All-in-One Conservative ETF |

FCNS |

11.2096 |

31581E101 |

CA31581E1016 |

0.16380 |

1.46125 % |

|

Fidelity All-in-One Equity ETF |

FEQT |

13.6541 |

31581D103 |

CA31581D1033 |

0.39853 |

2.91876 % |

|

Fidelity Advantage Ether ETF® |

FETH/ FETH.U |

46.8092 |

31580Y702 |

CA31580Y7028 |

– |

– |

|

Fidelity Global Innovators® ETF |

FINN/ FINN.U |

17.0973 |

316241108 |

CA3162411084 |

0.66936 |

3.91500 % |

|

Fidelity All-Canadian Equity ETF |

FCCA |

8.3755 |

315813105 |

CA3158131050 |

0.19733 |

2.35604 % |

|

Fidelity All-International Equity ETF |

FCIN |

7.999 |

31581R102 |

CA31581R1029 |

0.27874 |

3.48469 % |

|

Fidelity All-American Equity ETF |

FCAM |

9.077 |

315812107 |

CA3158121077 |

0.48030 |

5.29140 % |

|

Fidelity Canadian Large Cap Fund (ETF Series) |

FCLC |

11.6691 |

31606J788 |

CA31606J7886 |

0.83867 |

7.18710 % |

|

Fidelity Global Small Cap Opportunities Fund (ETF Series) |

FCGS/ FCGS.U |

14.2129 |

31624Q822 |

CA31624Q8222 |

0.10361 |

0.72899 % |

|

Fidelity Greater Canada Fund (ETF Series) |

FCGC |

11.8295 |

31620X730 |

CA31620X7302 |

0.46339 |

3.91724 % |

|

Fidelity Canadian Long/Short Alternative Fund (ETF Series) |

FCLS |

11.6112 |

31610F822 |

CA31610F8221 |

– |

– |

|

Fidelity Long/Short Alternative Fund (ETF Series) |

FLSA/ |

11.2839 |

31624U823 |

CA31624U8234 |

– |

– |

|

Fidelity Global Value Long/Short Fund (ETF Series) |

FGLS |

8.8318 |

31623A828 |

CA31623A8288 |

– |

– |

|

Fidelity Market Neutral Alternative Fund (ETF Series) |

FMNA |

10.1879 |

31623B701 |

CA31623B7016 |

– |

– |

|

Fidelity Global Equity+ Fund (ETF Series) |

FGEP/ |

10.5463 |

316215102 |

CA3162151029 |

0.69836 |

6.62185 % |

|

Fidelity Tactical High Income Fund (ETF Series) |

FTHI |

10.4252 |

31642L664 |

CA31642L6641 |

0.15984 |

1.53321 % |

|

Fidelity Emerging Markets Fund (ETF Series) |

FCEM |

10.3874 |

31613T795 |

CA31613T7950 |

0.15170 |

1.46042 % |

|

Fidelity Global Equity+ Balanced Fund (ETF Series) |

FGEB |

10.4932 |

316220102 |

CA3162201022 |

0.41011 |

3.90834 % |

Forward-looking information

This press release contains forward-looking statements with respect to the estimated December 2024 capital gains distributions for the Fidelity ETFs and Fidelity Funds. By their nature, these forward-looking statements involve risks and uncertainties that could cause the distributions to differ materially from those contemplated by the forward-looking statements. Material factors that could cause the actual distributions to differ from the estimated distributions include, but are not limited to, the actual amounts of distributions received by the Fidelity ETFs and Fidelity Funds, portfolio transactions, currency hedging transactions, and subscription and redemption activity.

About Fidelity Investments Canada ULC

At Fidelity Investments Canada, our mission is to build a better future for our clients. Our diversified business serves financial advisors, wealth management firms, employers, institutions and individuals. As the marketplace evolves, we are constantly innovating and offering our clients choice of investment and wealth management products, services and technological solutions all backed by the global strength and scale of Fidelity. With assets under management of $269 billion (as at October 31, 2024), Fidelity Investments Canada is privately held and committed to helping our diverse clients meet their goals over the long term. Fidelity funds are available through financial advisors and online trading platforms.

Read a fund’s prospectus and consult your financial advisor before investing. Exchange-traded funds are not guaranteed; their values change frequently and past performance may not be repeated. Commissions, management fees, brokerage fees and expenses may all be associated with investments in exchange-traded funds and investors may experience a gain or loss.

Find us on social media @FidelityCanada

https://www.fidelity.ca

Listen to FidelityConnects on Apple or Spotify

SOURCE Fidelity Investments Canada ULC

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/22/c6834.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/22/c6834.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: Palantir Stock Is Going to Soar After Nov. 26

2024 has been a milestone year for data analytics company Palantir Technologies (NYSE: PLTR). Perhaps most important event for the company was its addition to the S&P 500 earlier this year — an achievement few thought was possible just four years ago when Palantir went public and was quickly written off as a glorified government contracting and consulting operation with no real technology capabilities.

That narrative has come to an end. Over the last couple of years, Palantir has entered a new phase of growth thanks to the company’s successful launch of a new software suite called the Artificial Intelligence Platform (AIP).

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

All of these factors have contributed to notable interest in Palantir stock over the last several months. At the time of this writing, shares of Palantir have gained 283% year to date. With the stock hovering around an all-time high valuation, can it possibly keep climbing higher?

In my eyes, I think Palantir stock is set to continue running. Below, I’ll break down the company’s latest announcement and point to why investors should have their eyes on Palantir stock on Nov. 26.

One thing that often goes overlooked with stocks is the exchange that they trade on. But, believe it or not, trading on the New York Stock Exchange (NYSE) versus the Nasdaq Stock Market can actually have some pretty big implications for a company.

A few days ago, Palantir announced that it is moving its listing from the NYSE to the Nasdaq. Shares of Palantir are expected to begin trading on the Nasdaq on Nov. 26.

On the surface, this may seem like mundane news. But below I’m going to break down a number of examples of other companies that have switched to the Nasdaq and illustrate how their share prices moved following the transition.

Below, I’ve outlined two companies that have moved from their original stock exchange to the Nasdaq in recent years.

Workday: On Sept. 1, 2017, software company Workday announced that it was switching from the NYSE to the Nasdaq. Shares of Workday began trading on the Nasdaq a couple of weeks later, on Sept. 20. Here is how Workday stock has moved since becoming a Nasdaq-traded security:

-

Between Sept. 1, 2017, and Sept. 20, 2017, shares declined by a nominal 2%.

-

Between Sept. 20, 2017, and Sept. 20, 2018, the stock gained more than 30%.

-

Since becoming a member of the Nasdaq, the stock has increased 144%.

Trident Reports First Half 2024 Unaudited Financial Results

SINGAPORE, Nov. 23, 2024 (GLOBE NEWSWIRE) — Trident Digital Tech Holdings Ltd ((“Trident” or the “Company, NASDAQ:TDTH), a leading digital transformation facilitator in the e-commerce enablement and digital optimization services market for small and medium enterprise (SMEs) in Singapore, today announced its unaudited financial results for the six months ended June 30, 2024.

Initial Public Offering

On September 11, 2024, the Company closed the initial public offering of 1,800,000 American Depositary Shares (“ADSs”) at a price to the public of US$5.00 per ADS. Each ADS represents eight Class B Ordinary Shares of the Company. Trident’s ADSs began trading on the Nasdaq Capital Market on September 10, 2024, under the symbol “TDTH.”

First Half of 2024 Financial Highlights

- Total revenues were US$378,839, compared to US$481,165 for the six months ended June 30, 2023.

- Net loss was US$1,927,027, compared to US$1,861,412 for the six months ended June 30, 2023.

Soon Huat Lim, Trident’s Founder, Chairman, and Chief Executive Officer, commented, “Our recent performance comes as we continue our ongoing business transformation, marked by our successful listing on Nasdaq this September. While we’re pleased with this important milestone in our corporate journey, we’re equally encouraged by the growing momentum of Tridentity, our Web 3.0 e-commerce platform launched in December 2023. As we navigate our business transition, we’re strategically investing in innovation and market expansion while maintaining disciplined resource allocation. The increasing adoption of our solutions across key verticals such as food and beverage, fintech, and retail validates our vision of bridging businesses to a secure and trusted digital commerce ecosystem. Looking ahead, we remain focused on leveraging our position as a U.S.-listed company to accelerate our growth and deliver long-term shareholder value.”

Haiyan Huang, Trident’s Chief Financial Officer, added, “Our first half results reflect the ongoing transformation of our business model and the investments we are making to position ourselves for future growth. Our total revenues declined 21.3% year over year as we sought to prioritize the shift towards our Web 3.0 e-commerce platform. Our strategic investments in the business transformation, while impacting our near-term profitability, are essential to ensuring the security, functionality, and overall success of our platform. We remain focused on the disciplined execution of our transition strategy as we seek to become a leader in Web 3.0 enablement.”

Key Financial Results

| For the six months ended June 30 |

Change in | % of | ||||||||||||

| 2024 | 2023 | amount | change | |||||||||||

| Revenues | $ | 378,839 | $ | 481,165 | $ | (102,326 | ) | -21.27 | % | |||||

| Cost of revenues | (360,390 | ) | (389,569 | ) | 29,179 | -7.49 | % | |||||||

| Gross profit | 18,449 | 91,596 | (73,147) | -79.86 | % | |||||||||

| Selling expenses | (264,326 | ) | (253,343 | ) | (10,983 | ) | 4.34 | % | ||||||

| General and administrative expenses | (1,528,022 | ) | (1,551,710 | ) | 23,688 | -1.53 | % | |||||||

| Research and development expenses | (172,519 | ) | (192,855 | ) | 20,336 | -10.54 | % | |||||||

| Total operating expenses | (1,964,867) | (1,997,908) | 33,041 | -1.65 | % | |||||||||

| Loss from operations | (1,946,418) | (1,906,312) | (40,106) | 2.10 | % | |||||||||

| Total other income, net | 19,391 | 44,900 | (25,509 | ) | -56.81 | % | ||||||||

| Loss before income tax expense | (1,927,027) | (1,861,412) | (65,615) | 3.53 | % | |||||||||

| Income tax expense | – | – | – | N/A | ||||||||||

| Net loss | $ | (1,927,027 | ) | $ | (1,861,412 | ) | $ | (65,615 | ) | 3.53 | % | |||

Unaudited Financial Results for the Six Months Ended June 30, 2024

Revenues

| For the six months ended June 30, |

Variances | |||||||||||

| 2024 | 2023 | Amount | % | |||||||||

| Business consulting | $ | 111,318 | $ | 113,764 | $ | (2,446 | ) | -2.15 | % | |||

| IT customization | 265,649 | 367,401 | (101,752 | ) | -27.70 | % | ||||||

| (i) IT consulting | – | 130,289 | (130,289 | ) | -100.00 | % | ||||||

| (ii) Management software | 265,649 | 237,112 | 28,537 | 12.04 | % | |||||||

| Others | 1,872 | – | 1,872 | N/A | ||||||||

| Total revenues | $ | 378,839 | $ | 481,165 | $ | (102,326 | ) | -21.27 | % | |||

The Company’s revenues decreased by 21.27% from US$481,165 for the six months ended June 30, 2023, to US$378,839 for the six months ended June 30, 2024. The decrease was primarily due to the Company’s strategic shift towards prioritizing its Web 3.0 e-commerce platform, Tridentity, a core growth area for its long-term vision in the future. As a result, the Company allocated fewer resources to its consulting and IT customization business. This realignment allows the Company to concentrate on expanding its presence in Tridentity, positioning Trident to capture new opportunities in a rapidly advancing digital ecosystem.

Tridentity, the Company’s flagship product, is a cutting-edge identity app built on blockchain technology, designed to provide secure single sign-on capabilities to integrated third-party systems in various industries, which was launched in December 2023. Tridentity currently includes three primary business modules: Tri-event for NFT (Non-Fungible Token) event ticketing, Tri-food for block-chain powered food delivery, and Tri-verse for virtual community connecting its users. As the platform remains in the development, optimization, and gradual testing stages, the Company generated only US$1,872 in revenue from providing technical support for selling event tickets on behalf of merchants through Tridentity for the six months ended June 30, 2024.

Cost of Revenues

| For the six months ended June 30, |

Variances | |||||||||||

| 2024 | 2023 | Amount | % | |||||||||

| Service fees | $ | 358,534 | $ | 246,572 | $ | 111,962 | 45.41 | % | ||||

| Direct labor costs | – | 122,142 | (122,142 | ) | -100.00 | % | ||||||

| Miscellaneous cost | 1,856 | 20,855 | (18,999 | ) | -91.10 | % | ||||||

| Total cost of revenues | $ | 360,390 | $ | 389,569 | $ | (29,179 | ) | -7.49 | % | |||

The Company’s cost of revenues decreased by 7.49% from US$389,569 for the six months ended June 30, 2023 to US$360,390 for the six months ended June 30, 2024, primarily due to a decrease in direct labor cost and miscellaneous costs in total of US$141,141 as a result of a significant reduction in headcount in response to lower business volumes and cost controls, and partially offset by an increase of service fees in the amount of US$111,962 as a result of the fulfillment of slightly increased number of management software solutions projects since the second half of 2023.

Gross profit and margin

As a result of the factors described above, the Company recorded a gross profit of US$0.09 million and US$0.02 million for the six months ended June 30, 2023 and 2024, representing a gross profit margin of 19.0% and 4.9%, respectively. The decrease in gross profit margin was primarily due to the decrease in IT consulting services with relatively higher gross margin and high proportion of revenues in the first half of 2023, which had no revenue in the first half of 2024.

Operating expenses

Selling expenses

The Company’s selling and marketing expenses slightly increased from US$253,343 for the six months ended June 30, 2023 to US$264,326 for the six months ended June 30, 2024. The increase was primarily due to hiring of additional business development personnel to support the launch, operation and promotion of Tridentity since the second half of 2023, which was partially offset by the decrease in marketing and advertising expenses due to the Company’s strict control over discretionary spending.

General and administrative expenses

The Company’s general and administrative expenses decreased slightly from US$1,551,710 for the six months ended June 30, 2023 to US$1,528,022 for the six months ended June 30, 2024. The decrease was primarily due to a decrease in professional service fees and other overhead expenses, which was partially offset by an increase in payroll expenses due to additional headcount in management.

Research and development expenses

The Company’s research and development expenses decreased from US$192,855 for the six months ended June 30, 2023 to US$172,519 for the six months ended June 30, 2024, primarily due to the decrease in system development expenses for which there will be no further related expenses in 2024. This decrease was partially offset by the increase in payroll expenses, outsource service fees and the technical support expenses for Tridentity.

Other income, net

The Company’s other income, net decreased from US$44,900 for the six months ended June 30, 2023 to US$19,391 for the six months ended June 30, 2024. The decrease was primarily due to the decrease of interest income and the depreciation of the Singapore dollar against the U.S. dollar in the Company’s reporting currency translation from S$1.3523 to US$1.00 for the six months ended June 30, 2023 to S$1.3552 to US$1.00 for the six months ended June 30, 2024, leading to a decrease in unrealized gain as the foreign currency exposures are liabilities.

About Trident

Trident is a leading digital transformation facilitator in the e-commerce enablement and digital optimization services market for SMEs in Singapore. The Company offers business and technology solutions that are designed to optimize clients’ experiences with their customers by driving digital adoption and self-service.

Tridentity, the Company’s flagship product, is a cutting-edge identity app built on blockchain technology, designed to provide secure single sign-on capabilities to third-party integrated systems in industry verticals such as e-commerce, food and beverage, fintech, healthcare and health services, and wholesale and retail. Tridentity endeavors to offer unparalleled security features, ensuring the protection of sensitive information and safeguarding against potential threats, which promises a new and better age in the digital landscape.

Orchestrating with and beyond Tridentity, Trident’s mission is to be the leader in Web 3.0 enablement, bridging businesses to a trusted and secure e-commerce platform with curated customer experiences.

Safe Harbor Statement

This announcement contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to,” and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in announcements and other written materials, and in oral statements made by its officers, directors, or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs, plans, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s strategies, future business development, and financial condition and results of operations; the expected growth of the digital solutions market; the political, economic, social and legal developments in the jurisdictions that the Company operates in or in which the Company intends to expand its business and operations; the Company’s ability to maintain and enhance its brand. Further information regarding these and other risks is included in the Company’s filings with the SEC. All information provided in this announcement is as of the date of this announcement, and the Company does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For Investor/Media Enquiries

Investor Relations

Robin Yang, Partner

ICR, LLC

Email: investor@tridentity.me

Phone: +1 (212) 321-0602

| TRIDENT DIGITAL TECH HOLDINGS LTD UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (In U.S. dollars, except for share and per share data, or otherwise noted) |

|||||||

| As of June 30, |

As of December 31, |

||||||

| 2024 | 2023 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash | $ | 10,868 | $ | 1,808,603 | |||

| Accounts receivable, net | 2,140 | 2,198 | |||||

| Contract cost assets | 194,417 | 341,808 | |||||

| Deferred offering costs | 2,000,195 | 1,046,187 | |||||

| Amounts due from related parties | 92,827 | 337,920 | |||||

| Prepaid expenses and other current assets | 435,512 | 451,217 | |||||

| Total current assets | 2,735,959 | 3,987,933 | |||||

| Non-current assets: | |||||||

| Property and equipment, net | 168,422 | 202,777 | |||||

| Operating lease right-of-use assets | 1,119,503 | 1,639,233 | |||||

| Total non-current assets | 1,287,925 | 1,842,010 | |||||

| TOTAL ASSETS | 4,023,884 | 5,829,943 | |||||

| Liabilities | |||||||

| Current liabilities: | |||||||

| Current portion of long-term borrowings | 58,885 | 68,987 | |||||

| Accounts payable | 129,158 | 202,289 | |||||

| Deferred revenue | 463,980 | 572,186 | |||||

| Amounts due to related parties, current | 635,161 | 4,820 | |||||

| Accrued expenses and other liabilities | 314,951 | 733,189 | |||||

| Operating lease liabilities, current | 333,641 | 430,554 | |||||

| Total current liabilities | 1,935,776 | 2,012,025 | |||||

| Non-current liabilities: | |||||||

| Amounts due to related parties, non-current | 723,140 | – | |||||

| Long-term borrowings | 126,963 | 176,589 | |||||

| Operating lease liabilities, non-current | 785,863 | 1,208,679 | |||||

| Total non-current liabilities | 1,635,966 | 1,385,268 | |||||

| TOTAL LIABILITIES | 3,571,742 | 3,397,293 | |||||

| COMMITMENTS AND CONTINGENCIES | |||||||

| Shareholders’ equity | |||||||

| Ordinary Shares (par value $0.00001 per share; 1,000,000,000 Class A ordinary shares authorized, 50,000,000 and 50,000,000 Class A ordinary shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively; 4,000,000,000 Class B ordinary shares authorized, 451,964,286 and 451,964,286 Class B ordinary shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively.)* | 5,020 | 5,020 | |||||

| Additional paid-in capital | 8,426,684 | 8,426,684 | |||||

| Accumulated deficit | (8,110,572 | ) | (6,183,545 | ) | |||

| Accumulated other comprehensive income | 131,010 | 184,491 | |||||

| Total shareholders’ equity | 452,142 | 2,432,650 | |||||

| TOTAL LIABILITIES AND EQUITY | $ | 4,023,884 | $ | 5,829,943 | |||

* The shares and per share information are presented on a retroactive basis to reflect the reorganization.

| TRIDENT DIGITAL TECH HOLDINGS LTD UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (In U.S. dollars, except for share and per share data, or otherwise noted) |

|||||||

| For the six months ended June 30, |

|||||||

| 2024 | 2023 | ||||||

| Net revenue | $ | 378,839 | $ | 481,165 | |||

| Cost of revenue | (360,390 | ) | (389,569 | ) | |||

| Gross profit | 18,449 | 91,596 | |||||

| Operating expenses: | |||||||

| Selling expenses | (264,326 | ) | (253,343 | ) | |||

| General and administrative expenses | (1,528,022 | ) | (1,551,710 | ) | |||

| Research and development expenses | (172,519 | ) | (192,855 | ) | |||

| Total operating expenses | (1,964,867 | ) | (1,997,908 | ) | |||

| Other income, net: | |||||||

| Financial expenses, net | (5,015 | ) | 23,742 | ||||

| Other income | 24,406 | 21,158 | |||||

| Total other income, net | 19,391 | 44,900 | |||||

| Loss before income tax expense | (1,927,027 | ) | (1,861,412 | ) | |||

| Income tax expenses | – | – | |||||

| Net loss | (1,927,027 | ) | (1,861,412 | ) | |||

| Other comprehensive (loss)/income: | |||||||

| Foreign currency translation adjustment | (53,481 | ) | 34,853 | ||||

| Total comprehensive loss | (1,980,508 | ) | (1,826,559 | ) | |||

| Weighted average number of Ordinary Shares – basic and diluted* | 501,964,286 | 410,205,000 | |||||

| Basic and diluted loss per ordinary share | (0.00 | ) | (0.00 | ) | |||

* The shares and per share information are presented on a retroactive basis to reflect the reorganization.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

iA Clarington Investments announces November 2024 distributions for Active ETF Series as well as arrangements to address mailing delays resulting from Canada Post strike

TORONTO, Nov. 22, 2024 /CNW/ – IA Clarington Investments Inc. (“iA Clarington“) today announced the November 2024 distributions for its Active ETF Series. Unitholders of record as of November 29, 2024 will receive cash distributions payable on December 10, 2024.

Per-unit distributions are detailed below:

|

Active ETF Series |

Ticker |

Distribution |

CUSIP |

|

IA Clarington Core Plus Bond Fund |

ICPB |

0.04376 |

44931X109 |

|

IA Clarington Floating Rate Income Fund |

IFRF |

0.04756 |

44932R101 |

|

IA Clarington Loomis Global Allocation Fund |

IGAF |

0.00915 |

45075W104 |

|

IA Clarington Loomis Global Multisector Bond Fund |

ILGB |

0.03337 |

45076L107 |

|

IA Clarington Strategic Income Fund |

ISIF |

0.02659 |

44933N109 |

|

IA Clarington Loomis Global Equity Opportunities Fund |

IGEO |

0.00000 |

44934G103 |

|

IA Clarington Strategic Corporate Bond Fund |

ISCB |

0.04630 |

44934C102 |

|

IA Wealth Enhanced Bond Pool |

IWEB |

0.03772 |

44934M100 |

For more information about IA Clarington Active ETF Series, please visit iaclarington.com/ETF

iA Clarington is also providing an update to unitholders on the potential impact of the strike by the Canadian Union of Postal Workers on iA Clarington’s ability to comply with its obligations to deliver to unitholders its interim financial statements and management reports of fund performance.

As a result of the strike, and pursuant to l’Autorité des marchés financiers general decision on the exemption from the obligation to transmit certain continuous disclosure documents in the event of interruption of regular postal services issued November 15, 2024, iA Clarington is advising unitholders that:

a. the interim financial statements and corresponding management reports of fund performance, if any, have been filed electronically and are available on the SEDAR+ website at www.sedarplus.ca;

b. a copy of the interim financial statements, together with the corresponding management reports on fund performance, if any, will be sent to each unitholder upon request;

c. unitholders may contact Client Services 1-800-530-0204 to obtain the documents indicated above or for any information required; and

d. iA Clarington will mail copies of the interim financial statements and corresponding management reports of fund performance as soon as possible and, in any case, within 10 days of the end of the interruption of regular postal services, unless the necessary arrangements to transmit the documents by other means at the unitholder’s request have been made.

About IA Clarington Investments Inc.

A subsidiary of Industrial Alliance Insurance and Financial Services Inc. – Canada’s fourth-largest life and health insurance company – iA Clarington offers a wide range of investment products, including actively managed mutual funds, managed portfolio solutions, Active ETF Series and socially responsible investments. As of October 31, 2024, iA Clarington has over $21 billion in assets under management. For more information, please visit iaclarington.com

Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. The information presented herein may not encompass all risks associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The iA Clarington Funds are managed by IA Clarington Investments Inc. iA Clarington and the iA Clarington logo, iA Wealth and the iA Wealth logo, and iA Global Asset Management and the iA Global Asset Management logo are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license. iA Global Asset Management Inc. (iAGAM) is a subsidiary of Industrial Alliance Investment Management Inc. (iAIM).

The payment of distributions and distribution breakdown, if applicable, is not guaranteed and may fluctuate. The payment of distributions should not be confused with a Fund’s performance, rate of return, or yield. Distributions paid as a result of capital gains realized by a Fund and income and dividends earned by a Fund are taxable in the year they are paid.

SOURCE IA Clarington Investments Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c2611.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c2611.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Wolfspeed Stock Skyrocketed Today

Wolfspeed (NYSE: WOLF) stock posted explosive gains in Friday’s trading. The company’s share price ended the day’s trading up 31% and had been up as much as 35.4% earlier in the daily session.

Wolfspeed stock gained ground in conjunction with news about the compensation for executive chairman Thomas Werner and filings with the Securities and Exchange Commission (SEC) showing that insiders had recently acquired shares. In addition to these catalysts, the company’s share price also appears to have benefited from a surge of bullish momentum for meme stocks.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Earlier this week, Wolfspeed announced that its CEO, Gregg Lowe, would be stepping back from the role this month and also departing from the company’s board of directors. In conjunction with the announcement, the company stated that board chairman Thomas Werner would also step into the executive chairman role as the tech specialist works to select its next CEO.

In a filing with the SEC yesterday, details about Werner’s compensation as executive chairman were shared. Werner is scheduled to receive $150,000 in cash on a monthly basis in addition to $250,000 worth of restricted stock units. The executive chairman acquired 37,500 shares on Nov. 20.

In addition to details about Werner’s pay package and acquisition filing, filings with the SEC also showed that other members of the company’s board of directors had acquired significant amounts of stock the same day. Board member Duy-Loan T. Le acquired 20,000 shares on Nov. 20. Meanwhile, Darren Jackson acquired 36,795 shares, and Stacy Smith acquired 30,376 shares.

With board members moving to acquire shares and receiving stock as a substantial component of their compensation packages, investors are seeing signs that company insiders are bullish on Wolfspeed’s future. As famous investor Peter Lynch once said, “Insiders might sell their shares for any number of reasons, but they buy them for only one: They think the price will rise.” Recent share acquisitions by board members are a positive indicator for the shareholder base at large.

On the other hand, Wolfspeed’s explosive stock growth also appears to have been aided by a broader rally for meme stocks. Even after today’s big pop, the company’s share price is still down 81% year to date. While the stock could continue to enjoy a comeback rally in the near term, there hasn’t been any news about the core business to propel the recent rally — and that opens the door for volatile trading if more substantive bullish catalysts aren’t forthcoming.

Click Holdings Limited Reports Strong Growth in the First Half of 2024 Financial Results

Hong Kong, Nov. 22, 2024 (GLOBE NEWSWIRE) — Click Holdings Limited ((“Click Holdings” or “we” or “us”, NASDAQ:CLIK) and its subsidiaries (collectively, the “Company”), a human resources solutions provider based in Hong Kong, announced its unaudited financial results for the six months ended June 30, 2024.

In the first half of 2024, total revenue increased by approximately 14.3%

We achieved steady growth over the past six months and continued to consolidate its market position in the human resources solutions sector. In the first half of 2024, the Company achieved total revenue of approximately $3.2 million.

In the first half of 2024, net income increased by approximately 25.0%

We have realized an improvement in our gross profit margin within our business. During the first half of 2024, the Company reported a net income of approximately $0.5 million, marking a notable increase of approximately 25.0% compared to that of approximately $0.4 million for the same period in 2023.

Updates on principal sectors

Professional solution services: This sector contributed approximately 31.7% of the Company’s total revenue, amounting to approximately $1.0 million. The services provided by us include (i) the secondment of senior executives such as chief financial officers and company secretaries to perform compliance, financial reporting and financial management functions for customers; (ii) the provision of accounting and audit professionals to perform audit work under the instruction of Certified Public Accountant firms; and (iii) the provision of corporate finance experts to assist in drafting of documents including circulars, announcements and others for Hong Kong listed companies and listing documents for private companies planning to go public.

Nursing solution services: This sector generated approximately $0.7 million in revenue, representing approximately 21.3% of the Company’s total revenue. We provide human resources solutions to social service organizations and nursing homes by matching both temporary and permanent vacancies with candidates in our extensive talent pool.

Logistics and other solution services: This sector brought in approximately $1.5 million in revenue, representing approximately 47.0% of the Company’s total revenue. We provide human resources solutions by matching workers such as packaging staff and movers from our talent pool with both temporary and permanent vacancies offered by our customers. The strong growth in revenue from this sector of approximately 72.6% reflected the rapid expansion of this sector during the six months ended June 30, 2024 in particular the additional demand for placement of works from a major customer starting in April 2024.

Outlook

Amid a challenging but promising market environment in Hong Kong, we will continue to focus on enhancing service quality and fulfillment capabilities to meet the ever-changing needs of our customers. Furthermore, we will actively pursue fresh business prospects to extend its market presence. Moving forward, our management holds a positive outlook on the long-term potential of the Company.

About Click Holdings Limited

We are a human resources solutions provider, specializing in offering comprehensive human resources solutions in three principal sectors, namely (i) professional solution services, (ii) nursing solution services, and (iii) logistics and other solution services. We are primarily focused on talent sourcing and the provision of temporary and permanent personnel to customers. Our primary market is in Hong Kong and our diverse clientele includes accounting and professional firms, Hong Kong listed companies, nursing homes, individual patients, logistics companies and warehouses.

For more information on the Company and its filings, which are available for review at www.sec.gov.

Safe Harbor Statement

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC, which are available for review at www.sec.gov.

For enquiry, please contact:

Click Holdings Limited

Unit 709, 7/F., Ocean Centre

5 Canton Road

Tsim Sha Tsui, Kowloon

Hong Kong

Email: admin@clickholdings.com.hk

Phone: +852 2691 8200

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.