NEW YORK, Oct. 19, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that a lawsuit has been filed against Elanco Animal Health Incorporated ELAN and certain of the Company’s senior executives for potential violations of the federal securities laws.

If you invested in Elanco, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated.

Investors have until December 6, 2024 to ask the Court to be appointed to lead the case. The complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Elanco Animal Health Incorporated securities. The case is pending in the U.S. District Court of Maryland and is captioned Barpar v. Elanco Animal Health Incorporated, et al., No. 24-cv-02912.

What is the Lawsuit About?

The complaint alleges that Elanco develops products to treat diseases in animals. Two of the most important treatments in the company’s development pipeline are currently being reviewed by the U.S. Food and Drug Administration (“FDA”). The treatments are named Zenrelia, a drug for a type of dermatitis in dogs, and Credelio Quattro, which is a broad spectrum oral parasiticide covering fleas, ticks and internal parasites.

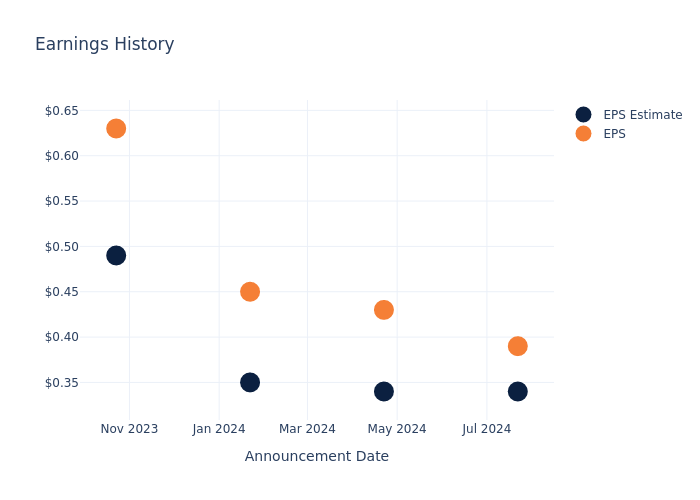

With respect to these treatments, the company stated that the FDA “has all data necessary to complete its review. All technical sections, including the label, are expected to be approved before the end of June [2024].” However, on June 27, 2024, Elanco announced that it expected the FDA would not approve either drug in June 2024 and that Zenrelia would come with a boxed warning on safety.

As a result of the news, Elanco’s stock price declined over 21%, from $17.97 per share on June 26, 2024 to $14.27 per share on June 27, 2024. BFA Law is investigating whether Elanco and certain of its executives made materially false and/or misleading statements to investors related to the FDA’s approval of its drugs.

Click here if you suffered losses: https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated.

What Can You Do?

If you invested in Elanco Animal Health Incorporated ELAN you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/elanco-animal-health-incorporated

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.