The first question to ask when a markets expert speaks

A version of this post was published on Tker.co. Subscribe here.

Liz Ann Sonders, chief investment strategist at Charles Schwab, compiled an outstanding list of quotes from history’s investing legends. (I recommend reading her post from start to finish.)

One quote that stuck out to me came from Edwin Lefevre, author of “Reminiscences of a Stock Operator”:

Speculators buy the trend; investors are in for the long haul; ‘they are a different breed of cats.’ One reason that people lose money today is that they have lost sight of this distinction; they profess to have the long term in mind and yet cannot resist following where the hot money has led.

Some people try to make money trading the stock market over short-term periods. Some aim to build wealth by investing in the stock market over long, multi-year timeframes. Many do some combination of both.

All of these people seek out information and insights that might help them get an edge and improve their returns.

Unfortunately, trading tips and investment advice come with a lot of the same jargon that make it easy to confuse the two if you’re not paying careful attention.

When a markets expert starts talking, the first question you should ask is: “What is the timeframe?”

Is it one month? One year? Several years? One day?

Why? Because it’s possible that the same person who’ll tell you stocks will fall in the coming weeks will also tell you they expect prices to be higher in the coming years. In fact, I can almost guarantee you that the Wall Street strategists who expect the S&P 500 to fall this year will also tell you it’ll be much higher in three to five years.

All this relates to Step 4 of TKer’s “5-step guide to processing ambiguous news in the markets and the economy”: “Beware the motivations of those communicating the information.”

The hot shot hedge fund manager on financial TV may present a compelling, eye-catching case for why the stock market could tumble from here. However, reporters don’t always follow up and ask what to expect when you stretch the timeframe, which may be more relevant to long-term investors. This lack of temporal context is common in the news industry, which tends to focus on the recent past and the near future.

This doesn’t mean that investors should completely ignore what the pros are saying about what could happen in the coming weeks or months. While expectations for volatility in the near-term might not affect how you position your long-term investments, they can serve as valuable reminders to keep your “stock market seat belts” fastened.

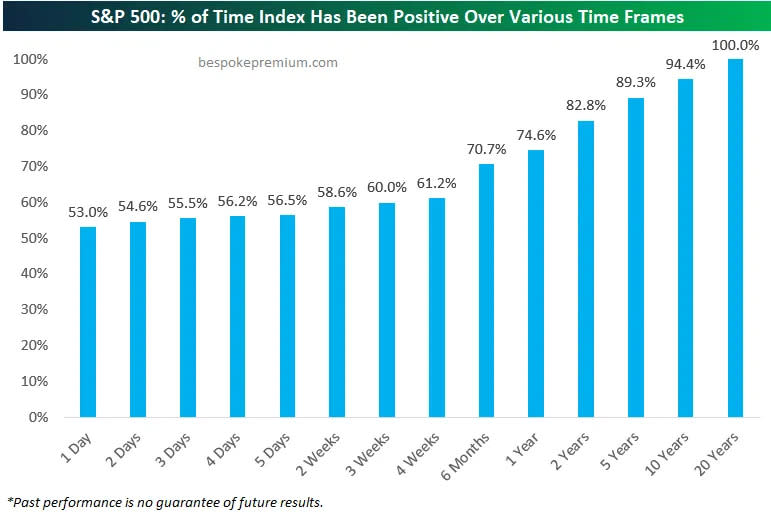

After all, the odds that stocks fall are relatively high when you look at short timeframes.

As my friend Joseph Fahmy says: “The majority of arguments on FinTwit have to do with timeframe. One person could be selling a stock because they think it will go down over the next 2 days and another could be buying because they think it will go up over the next 2 years. Don’t assume everyone trades like you.”

FinTwit, the community of people posting about finance on X, sees lots of heated bulls vs. bears debates about markets that come to no resolution. And it’s often the case that one side may be making the case for a short-term trade whereas the other side is making the case for a long-term investment — but the two sides aren’t aware of the disconnect. They’re not necessarily in disagreement; they’re just arguing about different things.

Zooming out 🔭

TKer Stock Market Truth No. 1 says: “The long game is undefeated.“ In other words, the stock market usually goes up over time.

Meanwhile, TKer Stock Market Truth No. 2 says: “You can get smoked in the short-term.” That is to say long-term investors should be prepared to experience a lot of sell-offs on the way up.

When I compiled this list of truths, I deliberately put these two next to each other because I wanted to make clear that bearish market developments can occur within a bullish long-term framework.

All of this is to say that it’s possible to be bullish and bearish simultaneously. The nuance is in the timeframe.

Related from TKer:

Reviewing the macro crosscurrents 🔀

There were a few notable data points and macroeconomic developments from last week to consider:

🏛️ “The time has come”: “The upside risks to inflation have diminished,” Fed Chair Jerome Powell said on Friday. “And the downside risks to employment have increased.”

Speaking at the Kansas City Fed’s economic symposium in Jackson Hole, Powell acknowledged how the unemployment rate had risen to 4.3% in July, saying: “We do not seek or welcome further cooling in labor market conditions.“

“The time has come for policy to adjust,” he added. “The direction of travel is clear.“

Fed watchers see this language as a signal that the central bank’s first rate cut could come as soon as its September 17-18 Federal Open Market Committee meeting.

For more on what this means and how we got here, read: Fed Chair Powell: ‘The time has come’ ⏰

🏚 Home sales rose. Sales of previously owned homes increased by 1.3% in July to an annualized rate of 3.95 million units. From NAR chief economist Lawrence Yun: “Despite the modest gain, home sales are still sluggish. But consumers are definitely seeing more choices, and affordability is improving due to lower interest rates.”

For more on housing, read: The U.S. housing market has gone cold 🥶

💸 Home prices cooled. Prices for previously owned homes declined from last month’s record levels, but they remain elevated. From the NAR: “The median existing-home price for all housing types in July was $422,600, up 4.2% from one year ago ($405,600). All four U.S. regions posted price increases.”

🏘️ New home sales rise. Sales of newly built homes jumped 10.6% in July to an annualized rate of 739,000 units.

🏠 Mortgage rates tick lower. According to Freddie Mac, the average 30-year fixed-rate mortgage declined to 6.46%, down from 6.49% last week. From Freddie Mac: “Although mortgage rates have stayed relatively flat over the past couple of weeks, softer incoming economic data suggest rates will gently slope downward through the end of the year. Earlier this month, rates plunged and are now lingering just under 6.5%, which has not been enough to motivate potential homebuyers. Rates likely will need to decline another percentage point to generate buyer demand.”

There are 146 million housing units in the U.S., of which 86 million are owner-occupied and 39% of which are mortgage-free. Of those carrying mortgage debt, almost all have fixed-rate mortgages, and most of those mortgages have rates that were locked in before rates surged from 2021 lows. All of this is to say: Most homeowners are not particularly sensitive to movements in home prices or mortgage rates.

For more on mortgages and home prices, read: Why home prices and rents are creating all sorts of confusion about inflation 😖

⛽️ Gas prices fall. From AAA: “Reaching a price point last seen on March 6, the national average for a gallon of gas fell six cents to $3.38 since last week. According to new data from the Energy Information Administration (EIA), gas demand crept higher last week from 9.04 million b/d to 9.19. Meanwhile, total domestic gasoline stocks fell from 222.2 to 220.6 million barrels, but gasoline production increased, averaging 9.8 million daily. Mild gasoline demand, steady supply, and low oil costs may cause pump prices to slide further.”

For more on energy prices, read: Higher oil prices meant something different in the past 🛢️

🛍️ Spending behavior is normalizing. From Apollo’s Torsten Slok: “During the pandemic, households increased spending on goods because they were shopping online, and services spending was lowered because they couldn’t go to restaurants and travel. The chart below shows that consumers have significantly increased spending on services over the past two years, and the current share at 68% is now close to pre-pandemic levels. The bottom line is that we are getting to the end of the catch-up effect for companies in the consumer services industry.“

💼 Unemployment claims ticked higher. Initial claims for unemployment benefits rose to 232,000 during the week ending August 17, up from 228,000 the week prior. While this metric continues to be at levels historically associated with economic growth, recent prints have been trending higher.

For more on the labor market, read: The labor market is cooling 💼

💵 People want more money to change jobs. From the New York Fed’s July SCE Labor Market Survey: “The average reservation wage—the lowest wage respondents would be willing to accept for a new job—increased to $81,147 from $78,645 in July 2023, though it is down slightly from a series high of $81,822 in March 2024.“

For more on why wages matter right now, read: Revisiting the key chart to watch amid the Fed’s war on inflation 📈

🌎 Immigration has helped boost growth. From Barclays: “Almost half a million people immigrated into the US in December, a record that was just the latest in a series of elevated inflows stretching back to spring 2022. While the surge has caused a public backlash and prompted political measures to curtail it, immigration has helped boost economic growth. It has helped relieve post-pandemic labor shortages and has been one of the factors behind the strength of the US economy. … Immigrants likely contributed nearly a third of economic growth. We estimate that new immigrants accounted for three quarters of the increase in private payroll employment over the past year. Their contribution of additional hours worked to output growth more than offset a drag from US-born workers.“

🐢 Survey signals growth, but cooling growth. From S&P Global’s August Flash U.S. PMI: “The solid growth picture in August points to robust GDP growth in excess of 2% annualized in the third quarter, which should help allay near-term recession fears. Similarly, the fall in selling price inflation to a level close to the pre-pandemic average signals a ‘normalization’ of inflation and adds to the case for lower interest rates.”

Keep in mind that during times of perceived stress, soft data tends to be more exaggerated than actual hard data.

For more on this, read: What businesses do > what businesses say 🙊

🇺🇸 Most U.S. states are still growing. From the Philly Fed’s July State Coincident Indexes report: “Over the past three months, the indexes increased in 36 states, decreased in 13 states, and remained stable in one, for a three-month diffusion index of 46. Additionally, in the past month, the indexes increased in 26 states, decreased in 17 states, and remained stable in seven, for a one-month diffusion index of 18.”

For more on economic growth, read: Economic growth: Slowdown, recession, or something else? 🇺🇸

Putting it all together 🤔

We continue to get evidence that we are experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to get inflation under control. Though, with inflation rates having come down significantly from their 2022 highs, the Fed has taken a less hawkish tone in recent months, even signaling that rate cuts could come later this year.

It would take a number of rate cuts before we’d characterize monetary policy as being loose, which means we should be prepared for relatively tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be relatively unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have recently had some bumpy years, the long-run outlook for stocks remains positive.

For more on how the macro story is evolving, check out the the previous TKer macro crosscurrents »

A version of this post was published on Tker.co. Subscribe here.

2 Best Artificial Intelligence (AI) Stocks to Buy Now: AI Chip Edition

Artificial intelligence (AI) is poised to be one of the biggest disruptive secular growth trends of all time. Most sources project the global AI market to have a compound annual growth rate (CAGR) in the 30% to 40% range through 2030, with 2030 market sizes ranging from over $800 billion to more than $1 trillion.

The AI revolution had been underway in recent years but just kicked into high gear in early 2023. This occurred following the advent of generative AI, which greatly expanded the potential use cases for AI. Generative AI wowed the tech world when OpenAI released its ChatGPT chatbot in late 2022.

There are several main ways to invest in AI. This article focuses on companies that are largely developing and supplying semiconductors, or “chips,” and other technology to enable AI capabilities.

Best AI chip/technology stocks

|

Company |

Market Cap |

Forward P/E Ratio |

Wall Street’s Projected 5-Year Annualized EPS Growth |

Year-to-Date 2024 Return |

10-Year Return |

|---|---|---|---|---|---|

|

Nvidia (NASDAQ: NVDA) |

$3.2 trillion |

47 |

46.4% |

161% |

28,220% |

|

Arm Holdings (NASDAQ: ARM) |

$142 billion |

86 |

31.2% |

80% |

N/A* |

|

S&P 500 Index |

N/A |

N/A |

N/A |

19% |

241% |

Data sources: Yahoo! Finance and YCharts. Data to Aug. 23, 2024. P/E = price-to-earnings. EPS = earnings per share. *Arm held its initial public offering (IPO) in September 2023.

Let’s put the 10-year percentage gains in monetary terms. Here’s how much $1,000 invested a decade ago in each of the following would be worth now:

-

Broader market (S&P 500): $3,410

-

Nvidia: $283,200 (yep, more than a quarter of a million dollars)

1. Nvidia

To call Nvidia “dominant” in the AI chip space is an understatement. The company’s graphics processing units (GPUs) are the gold standard for accelerating the processing of AI workloads in data centers.

By all accounts, Nvidia has well over a 90% share of the market for AI GPU chips for data centers and over 80% share of the overall data center AI chip market. Advanced Micro Devices CEO Lisa Su projects the fast-growing data center AI chip market will reach $400 billion in revenue by 2027, which equates to an average annual growth rate of about 73%.

Nvidia isn’t a pure play on AI, but it’s as close as you can get in the semiconductor space. Its data center market platform accounted for 87% of its revenue in its quarter ended in late April, and this business largely supplies chips and related technology (including networking tech and software) for enabling AI and high-performance computing.

AI is also enhancing Nvidia’s offerings in its other platforms, which include computer gaming (10% of last quarter’s revenue), professional visualization (1.9%), and auto and robotics (1.5%).

Nvidia is scheduled to report its results for the second quarter of fiscal 2025 (ended late July) on Wednesday, Aug. 28, after the market close. Management guided for revenue to grow 107% year over year to $28 billion. It also guided (indirectly by providing a bunch of inputs) for adjusted earnings per share (EPS) of $6.22, or 130% growth.

2. Arm Holdings

Arm, based in the U.K., designs architectures for central processing units (CPUs) and licenses those designs and related intellectual property (IP) to customers. Its customers include many of the biggest names in consumer technology and semiconductors, including Apple, Nvidia, and Qualcomm.

Arm, founded in 1990, was critical in enabling the smartphone revolution. Its chip architecture is very energy-efficient, allowing smartphones to have good battery performance, which led to their fast adoption. Arm-based chips are found in about 99% of smartphones, as well as in countless other small form-factor products.

In recent years, the company has expanded into higher-value markets, such as data center servers, AI accelerators, and smartphone applications (apps) processors. AI is driving growth in all these markets. The company said in its most recent earnings report that “AI’s substantial energy requirements are driving growth in Arm’s compute platform, which is the most power-efficient solution available.”

In late July, Arm reported its results for its first quarter of fiscal 2025, which ended in late June 2024. Revenue surged 39% year over year to $939 million, sprinting by the $908 million Wall Street consensus estimate. License revenue rocketed 72% to $472 million, and royalty revenue jumped 17% to $467 million.

The even better news for investors is that Arm’s profit grew even more than its revenue, which means its profit margin continued to expand. Adjusted for one-time items, its net income was $419 million, or $0.40 per share, up a whopping 67% year over year. That result easily beat the $0.34 analysts had expected.

I included the adjusted net income figure to highlight how extremely profitable Arm is. Its adjusted profit margin in the quarter was 44.6% ($419 million divided by $939 million).

What about valuations for Nvidia and Arm stocks?

Nvidia stock is trading at 47 times its projected earnings for the current fiscal year. That’s high in a vacuum — but reasonable for a company that Wall Street expects to grow earnings at an average annual rate of 46.4% over the next five years. Moreover, Nvidia regularly exceeds earnings estimates easily, so 46.4% is likely to prove too low.

Arm’s stock is incredibly pricey. It’s trading at 86 times its projected earnings for the current fiscal year. This is very high not only in a vacuum but also for a company that Wall Street projects will grow earnings at an average annual pace of 31.2% over the next five years.

So, why do I consider Arm stock the second-best (behind Nvidia) AI tech stock to buy now? I’m working on a full article on why it’s worth paying up for Arm stock, so suffice it to say that there are good reasons to believe that Wall Street is significantly underestimating Arm’s earnings growth potential. In each of the company’s four quarters as a public company, it has cruised by the analyst consensus earnings estimate.

That said, before making an investment decision, some investors might want to watch Arm for another couple of quarters to see whether it keeps churning out robust top- and bottom-line growth and sailing by Wall Street’s estimates.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Beth McKenna has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Qualcomm. The Motley Fool has a disclosure policy.

2 Best Artificial Intelligence (AI) Stocks to Buy Now: AI Chip Edition was originally published by The Motley Fool

3 Dividend Stocks Yielding 5% to Buy Right Now for Passive Income

Investing in dividend stocks can be a fantastic way to generate passive income. Many high-quality companies offer higher-yielding payouts. Furthermore, several of these top-notch income producers steadily increase their payouts yearly, making them better than the fixed income you could earn from a bond.

Brookfield Renewable (NYSE: BEPC)(NYSE: BEP), Kinder Morgan (NYSE: KMI), and Vici Properties (NYSE: VICI) stand out as great income stocks to buy right now. They all offer dividend yields of at least 5%, putting them several times higher than the S&P 500’s sub-1.5% dividend yield. Meanwhile, they have solid records of increasing their payouts each year, which seems very likely to continue.

A high-powered income stream

Brookfield Renewable is one of the world’s leading renewable power producers. It has a globally diversified portfolio of hydro, wind, and solar energy assets that generate clean electricity. It sells that power to utilities and large corporate buyers under long-term power purchase agreements. Those contracts supply the company with stable and growing income (70% link power rates to inflation).

The company pays out a reasonable amount of its stable cash flow to support its high-yielding dividend (less than 75% of its funds from operations (FFO) in the first half of this year). That gives it a nice cushion while enabling it to retain cash to help fund new investments. Brookfield Renewable also has a strong investment-grade balance sheet.

The leading renewable energy company expects to grow its FFO per share by more than 10% annually through at least 2028. Powering that forecast is a combination of inflation-linked rate increases, margin enhancement activities, development projects, and acquisitions. Those catalysts should give it ample power to achieve its plan of increasing its dividend by 5% to 9% each year. Brookfield has raised its payout by at least 5% for 13 straight years.

Lots of fuel to grow this high-yielding dividend

Kinder Morgan operates North America’s largest gas pipeline network and other energy infrastructure assets. These businesses generate very stable cash flow. Roughly 68% comes from take-or-pay and hedging contracts, meaning it gets paid a set amount regardless of volumes and market pricing. Fee-based agreements (fixed-price contracts with variable volumes) comprise another 27% of its earnings mix, leaving only 5% of its earnings exposed to commodity prices.

The pipeline giant pays out a little more than half of its stable cash flow in dividends, retaining the rest to fund expansion projects, repurchase shares, and maintain a strong balance sheet. The company currently has $5.2 billion of expansion projects under construction, with half expected to enter service by the end of next year and supply near-term income growth. Kinder Morgan can supplement its solid organic growth rate with accretive acquisitions.

The company’s growing cash flows should give it the fuel to continue increasing its dividend. It delivered its seventh consecutive annual dividend increase earlier this year.

A low-risk wager on a growing income stream

Vici Properties is a real estate investment trust (REIT) focused on owning experiential properties like gaming, hospitality, and entertainment destinations. It leases these properties back to the operators under long-term net leases. Those leases supply it with predictable cash flow that rises over time due to contractual rental escalation clauses.

The REIT pays out about 75% of its stable rental income in dividends. It retains the rest to help fund new income-generating real estate investments. It also has a strong balance sheet, giving it additional flexibility to make new investments.

Vici Properties has multiple growth drivers in addition to rent growth. It will acquire experiential properties in sale-leaseback transactions with the operators, buy properties from other investors, and even acquire rival REITs. In addition, it provides partners with funding for development and expansion projects, which can open the door to future property acquisitions.

The company’s growing cash flow helps support a steadily rising dividend. Vici Properties has increased its payout in all six years since it came public, growing the dividend at a peer-leading 7.9% compound annual pace.

Top-notch income stocks

Brookfield Renewable, Kinder Morgan, and Vici Properties offer high-yielding dividends that have steadily grown over the years. With strong financial profiles and solid growth prospects, those upward trends should continue. That makes them great stocks to buy right now for passive income.

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Matt DiLallo has positions in Brookfield Renewable, Brookfield Renewable Partners, Kinder Morgan, and Vici Properties. The Motley Fool has positions in and recommends Brookfield Renewable, Kinder Morgan, and Vici Properties. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

3 Dividend Stocks Yielding 5% to Buy Right Now for Passive Income was originally published by The Motley Fool

This 5%-Yielding Dividend Stock Just Made Investors Even More Money. Here's How.

Realty Income (NYSE: O) has been a money-making investment over the years. The real estate investment trust (REIT) has paid dividends like clockwork. It recently paid its 650th consecutive monthly dividend.

The REIT routinely raises its dividend payment. It most recently delivered its 126th dividend increase since coming public in 1994, pushing its dividend yield further above 5%. That was its fourth dividend increase already this year. It has now given investors a raise in 107 straight quarters and 30 consecutive years, growing its payout at a 4.3% annual rate during that timeframe, including by more than 3% over the past year.

Here’s how it’s able to continue paying its investors even more money.

Built to produce stable income

Realty Income focuses on owning a portfolio of income-generating commercial real estate. The company owns a diversified portfolio of 15,450 retail, industrial, gaming, and other properties across the U.S. and Europe. It primarily owns properties leased to tenants in industries resilient to economic downturns and isolated to the pressures of e-commerce, such as grocery, convenience, dollar, and drug stores.

The REIT signs long-term net leases for these properties with high-quality tenants. That lease structure requires tenants to cover building insurance, real estate taxes, and routine maintenance expenses. Its leases also typically feature some form of annual rental rate escalation clause. They provide the REIT with very stable income that tends to rise by about 1% annually when factoring in bad debt expenses.

Realty Income typically pays out a conservative percentage of its income in dividends, less than 75% of its adjusted funds from operations (FFO). That gives it a nice cushion while enabling it to retain a meaningful percentage of its cash flow to fund new investments.

It also has an elite balance sheet. It’s one of only eight REITs in the S&P 500 with two A3/A- credit ratings or better. Realty Income also has very low leverage ratios, giving it even more financial flexibility.

Multiple growth drivers

Realty Income’s strong financial profile enables it to steadily expand its portfolio. The company’s retained cash flow after paying dividends alone can help fund enough new investments to grow its adjusted FFO by around another 1% per year after factoring in the impact of refinancing maturing debt in today’s higher-interest-rate environment. Add in rent growth, and the REIT can internally deliver around 2% annual growth.

Meanwhile, Realty Income’s elite balance sheet gives it plenty of financial flexibility to externally fund accretive acquisitions. The REIT estimates that for every $1 billion of additional real estate investments it makes, it can add 0.5% to its annual adjusted FFO. It conservatively expects externally funded acquisitions will add another 2% to 3% to its adjusted FFO each year. Add in its internal growth drivers, and Realty Income should grow its adjusted FFO per share by 4% to 5% per year. Factor in its high-yielding dividend, and its total return should be around 10% annually.

The REIT should have no shortage of investment opportunities. It estimates that the total addressable global net lease real estate market is $14 trillion. That gives it a long growth runway. Meanwhile, it has steadily expanded its opportunity set by adding new property verticals. In recent years, it has added data centers, gaming properties, and new European markets to its portfolio. It has also launched a credit investment platform. These new platforms have opened the doors to additional growth opportunities.

Realty Income should continue making investors more money

Realty Income built a money-making real estate empire. The company’s durable and growing portfolio prints cash, which it distributes to investors via a steadily rising dividend. With a sound financial profile and a long growth runway ahead, this REIT should continue making money for its investors in the coming years.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Matt DiLallo has positions in Realty Income. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

This 5%-Yielding Dividend Stock Just Made Investors Even More Money. Here’s How. was originally published by The Motley Fool

These Prominent Billionaires Just Invested $700 Million in 2 Dow Jones Dividend Stocks

Bill Ackman of Pershing Square Holdings and Andreas Halvorsen of Viking Global Investors are two highly regarded billionaire-level investment managers. In the second quarter, their companies added new positions in two stocks that just happen to be members of the prestigious Dow Jones Industrial Average, an index that tracks 30 blue chip stocks.

Ackman’s firm reported a position worth $229 million in Nike (NYSE: NKE), while Viking Global disclosed a $478 million investment in McDonald’s (NYSE: MCD). Let’s explore why these billionaires like these stocks even as both are navigating headwinds in the apparel and restaurant industries right now.

1. Nike

Ackman has a knack for spotting value where others don’t. Over the last 20 years, Pershing Square delivered annualized returns of 16%, and his net worth has grown to $9 billion in recent years, according to Forbes.

Share prices of Nike are down 53% from highs set in 2021, which led Ackman’s Pershing Square to start a new position in Q2. The top athletic apparel brand was hit by weak consumer spending trends that challenged several retailers over the past couple of years.

Nike is a large company that generates $51 billion in annual revenue, two-thirds of which is from footwear. Fiscal 2024 (which ended in May) revenue was flat year over year. However, most of the weak sales trends are associated with Nike’s lifestyle products. Its performance products for several sports its services are still posting a double-digit sales increase last quarter.

This suggests Nike has a clear path to improvement if it shifts more of its sales mix to performance products, like running and basketball shoes, which have been the heart of the brand for 50 years.

Meanwhile, Nike is keeping profits up to fuel dividend payments to shareholders. Its net income grew 12% in fiscal 2024, and it paid out 38% of its earnings in dividends. At its current quarterly payout of $0.37 per share, Nike’s forward dividend yield is 1.76% — its highest yield in a decade.

The stock still trades at a fair valuation, but its forward price-to-earnings (P/E) ratio is at 26, which isn’t cheap. Still, it’s a reasonable price for a top brand that can still grow its earnings at double-digit rates over the long term.

The recent investment suggests Ackman believes Nike’s brand is undervalued by investors right now. Nike has a clear solution to return to growth by doubling down on innovation within its sports categories, and good execution against this strategy could send the stock back toward its previous highs within the next two years.

2. McDonald’s

Viking Global Investors founding partner and CEO Andreas Halvorsen has a net worth of $7.2 billion, according to Forbes. The company manages a large U.S. equity portfolio, worth $26 billion at the end of Q2. One of its new positions is a $480 million stake in McDonald’s.

Like Nike, McDonald’s reported weak sales under macroeconomic headwinds this year. Because this weakness is spreading across multiple industries, it doesn’t reflect anything negative about McDonald’s competitive position. This environment plays to McDonald’s strength as a value-based brand.

The Golden Arches reported a 1% year-over-year decrease in global comparable sales in Q2. Despite this soft performance, the stock held up well this year and is close to hitting new highs. The reason for the stock’s performance in light of weak sales might explain why Viking Global likes it.

McDonald’s is more than just fast food. It’s also a real estate company. It has a long history of owning the land its franchised restaurants sit on, which provides lucrative opportunities in leveraging these property values to ultimately deliver profitable growth for shareholders.

As of Dec. 31, 2023, the company held $20 billion of buildings and improvements on owned land on its balance sheet. It owned approximately 57% of the land and approximately 80% of the buildings used by its restaurants.

McDonald’s plans to increase its global restaurant base to 50,000 by 2027, which obviously will take advantage of its real estate expertise.

The combination of its franchise model, where 95% of its global restaurants are run by local owners, and its real estate strategy is why McDonald’s generated a high margin of $8 billion in net profit on $25 billion of revenue over the last year.

While McDonald’s posted an 11% year-over-year decline in earnings last quarter, it pays out around half of its earnings in dividends. It currently pays a quarterly dividend of $1.67, bringing its forward yield to 2.3%. That dividend appears very safe, given the manageable payout relative to earnings and McDonald’s profitable franchise business strategy.

The stock’s above-average dividend yield and attractive forward P/E of 24 make it a solid buy for the long term.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

These Prominent Billionaires Just Invested $700 Million in 2 Dow Jones Dividend Stocks was originally published by The Motley Fool

Wall Street Got It Wrong About Plug Power. Here's Why.

The stock of hydrogen fuel developer Plug Power (NASDAQ: PLUG) has been a bumpy ride. But since the start of 2021, that ride has been consistently lower. Back then, the stock was valued as high as $70 per share. Today, the share price is below $3.

Wall Street has been consistently wrong about where the stock price is headed next. In 2021, right before shares collapsed, nearly a dozen firms had a buy rating on the stock.

Wall Street expectations have come down sharply since those highs, but the average price target remains at nearly $5 per share — more than double the current share price. Could analysts finally be right? Is now the time to bet big on Plug Power? The answer might surprise you. (NYSE: GS)

This is why Wall Street can’t predict Plug

One of the biggest reasons why Wall Street has struggled to accurately predict the direction of Plug Power stock is that its cash flow inflection point could be years, if not decades, into the future. Goldman Sachs analysts have specifically called the company out for its distant cash flow projections. According to those analysts, Plug Power has an equity duration of 25.8 years. That means that the weighted average of the company’s expected cash flows is around 26 years. Take note that a bond of similar duration would be considered very long-term.

Because Wall Street often uses a discounted cash flow model to value a company, they must estimate and then discount projected cash flows back to the present. The more distant a cash flow is, the more sensitive it is to changes in assumptions.

Barring a sudden change in regulatory policy, it’s likely that hydrogen fuel cell demand won’t reach its biggest inflection point until 2030 at the earliest. As global consultancy McKinsey recently concluded, “Global clean hydrogen demand is projected to grow significantly to 2050, but infrastructure scale-up and technology advancements are needed to meet projected demand.” These infrastructure gaps will take many years to resolve. Until then, Plug Power will likely be spending billions in capital expenditures despite operating a money-losing business. Over the last year, for example, the company has spent between $100 million and $200 million per quarter building new plants and other infrastructure required for growth. Yet over that time period, net losses totaled well over $1 billion — more than half of the company’s entire market cap today.

This all adds up to why Wall Street has been so wrong about Plug Power over the years. Analysts were required to project cash flows that were far into the future. With mounting losses, increased competition, and higher interest rates, these projected cash flows have been pushed out even further into the future, having an outsized negative effect on the share price.

Can Plug Power stock really rise by 130%?

There’s one important question to ask right now: Is this time different? The average one-year price target for Plug Power stock right now is $4.91. That’s around 130% higher than the current stock price. But it’s important to know that there’s a huge variance between predictions. One price target, for instance, is nearly $19 per share, while others are as low as $1.52 per share.

Can Plug Power stock actually rise by 130%? It’s doubtful. All of the pressures that led to the company’s share price collapse in recent years persist to this day. In fact, they may be stronger than ever before. While new regulations and incentives are growing more accommodating for hydrogen demand growth, it’s clear that a potential transition would still take decades. The economics and infrastructure to scale clear hydrogen fuel simply aren’t in place yet. Meanwhile, Plug Power’s financial resources continue to dwindle. Last year, the company’s auditors issued a going concern notice, indicating that insolvency was imminent if drastic measures weren’t taken. Plug Power addressed those concerns by massively diluting shareholders, something it continued to do in recent quarters.

Plug Power is simply between a rock and a hard place right now. Its persistent losses force it to continually tap the debt and equity markets. Yet positive cash flows remain many years away. This limits its ability to invest in new innovation, allowing competitors to develop newer, cheaper, more efficient solutions. Wise investors should stick to the sidelines for now.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and JPMorgan Chase. The Motley Fool has a disclosure policy.

Wall Street Got It Wrong About Plug Power. Here’s Why. was originally published by The Motley Fool

Swiss finance minister chides US, Europe over 'time bomb' debt levels

ZURICH (Reuters) – Debt levels in the United States and Europe are a risk for international financial stability and for Switzerland, Swiss Finance Minister Karin Keller-Sutter said in a newspaper interview published on Saturday.

In an interview with Swiss daily Blick, Keller-Sutter extolled Switzerland’s “disciplined” finances, which she said had enabled the country to deal with the economic challenges posed by the COVID-19 pandemic and Russia’s invasion of Ukraine.

By contrast, other countries are “so indebted they’re hardly able to act any more”, she said, giving France as an example.

“Or take a look at America. That’s a time bomb. The mini-crash on the stock markets at the start of August was a warning shot,” the minister was quoted as saying.

“It was an expression of investors’ fear of a recession. Debt levels in the U.S. and Europe are a risk to international financial stability and a risk for Switzerland,” she added.

Keller-Sutter also discussed a government proposal to make Swiss bank UBS hold more capital in the wake of its acquisition of former rival Credit Suisse following its collapse last year.

She defended the additional capital requirements as necessary to protect Switzerland from another banking meltdown.

UBS CEO Sergio Ermotti has criticised the proposal, and she was asked whether she was in touch with him about it, saying:

“No, I haven’t been in contact with him any more. This is now a normal political process.”

The paper also asked what she thought about speculation that UBS could shift its headquarters abroad if it felt conditions in Switzerland were no longer right for it.

“The Federal Council (cabinet) believes it’s good for the economy to have a large Swiss bank. But the bank must decide for itself how it wants to position itself.”

UBS has said repeatedly it is committed to Switzerland.

(Reporting by Oliver Hirt; Writing by Dave Graham; Editing by Helen Popper)

Got $5,000? 2 Top Growth Stocks to Buy That Could Double Your Money.

While $5,000 might not seem like much to some, with the power of investing, that money can turn into $10,000, $20,000, and $50,000 over time. Thanks to compounding, your money will grow faster the longer it’s invested, so it’s always a good idea to get started investing sooner rather than later.

If you’re looking to double your money — and have some patience — keep reading to see two stocks that could turn $5,000 into $10,000 in due time.

1. Redfin

Redfin (NASDAQ: RDFN) was a big winner during the pandemic, but shares of the real estate platform tumbled in the bear market as interest rates spiked, and it has stayed down since then.

However, economic conditions are starting to change, and Redfin looks poised to capitalize on it. First, a recent settlement with the National Association of Realtors will change the way commissions in the real estate industry work, which could benefit Redfin, as it has led the fight against high commission fees.

More importantly, the company is set to benefit from falling interest rates as the housing market is showing signs of finally turning. Interest rates on 30-year fixed mortgages have fallen to 6.5%, the lowest rate in more than a year, and mortgage rates look set to come down further when the Federal Reserve is expected to start lowering interest rates at its September meeting.

Falling rates will lower monthly payments, spurring increased demand and encouraging more housing inventory to come on the market, which will benefit Redfin. There’s substantial pent-up homebuying demand in the market, and home sales could spike as rates come down because many would-be sellers are waiting for rates to fall enough to justify giving up a low-rate mortgage.

During the downturn, Redfin has cut costs and shuttered its iBuying program, which should help improve margins in the recovery. Additionally, the company has invested in digital businesses that have already started to pay off, as it’s added a self-service platform for agents, homeowners, and renters.

Redfin currently has a market capitalization of just $1 billion, meaning it trades at a price-to-sales ratio of around 1. If the housing market cooperates and the company returns to growth, the stock could easily double from here.

2. Super Micro Computer

Another stock with a lot of potential to double is Super Micro Computer (NASDAQ: SMCI), the fast-growing maker of servers that are popular for running artificial intelligence (AI) applications.

In order for the stock to double, Supermicro would only have to recoup its losses since March. The stock skyrocketed through the end of 2023 and the beginning of 2024 as investors discovered its rapid AI-driven growth. However, the stock has given up some of those gains as it fell following a surge when it was admitted to the S&P 500. Broader concerns about the AI boom and falling gross margins have also weighed on the stock.

Still, its most recent earnings report shows the stock is still putting up blockbuster growth numbers. Revenue jumped 143% in its recently reported fiscal fourth quarter to $5.3 billion, and it expects even faster growth in the current quarter, forecasting a top-line increase of 183%-230%. Adjusted earnings per share in the quarter nearly doubled from $3.51 to $6.25.

Supermicro looks like a great candidate to double because the company expects margins to expand this year as it monetizes earlier investments, and it benefits from the launch of a new direct liquid cooling system.

Super Micro Computer stock is also cheap, especially for a company growing as fast as it is. It currently trades at a price-to-earnings ratio of just 31, which seems to reflect recent skepticism about the long-term potential of AI.

However, Supermicro is growing quickly, and there’s a long runway of growth as companies continue to invest in AI infrastructure to develop artificial general intelligence. At its current price, the stock looks like a good bet to turn $5,000 into $10,000.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Jeremy Bowman has positions in Redfin. The Motley Fool has positions in and recommends Redfin. The Motley Fool recommends the following options: short August 2024 $11 calls on Redfin. The Motley Fool has a disclosure policy.

Got $5,000? 2 Top Growth Stocks to Buy That Could Double Your Money. was originally published by The Motley Fool

Prediction: Nvidia Will Deliver Record Results on Aug. 28, Which Will Supercharge the Stock

Recent advances in artificial intelligence (AI) are causing a paradigm shift in technology, and the consequences will likely be far-reaching. Nvidia (NASDAQ: NVDA) has become the de facto standard bearer for the AI revolution, as its state-of-the-art graphics processing units (GPUs) have become the gold standard for training AI models and conducting AI inference.

The accelerating adoption of generative AI has been the catalyst that has sparked parabolic growth for the chipmaker, generating triple-digit sales and profit growth in each of the past four quarters.

Nvidia is scheduled to report the results of its fiscal 2025 second quarter (ended July 30) after market close on Wednesday, Aug. 28, and shareholders will be watching with keen interest. I predict the company will deliver record results, sending Nvidia stock to record heights. Here’s why.

You can’t spell Nvidia without AI

Nvidia made a name for itself as a pioneer in the video game industry, developing chips that used parallel processing, or the ability to run a multitude of complex computations simultaneously. This generated lifelike images in video games, revolutionizing the industry. Nvidia adapted this same technology to handle the raw, number-crunching needs of AI and quickly cornered the market in this emerging technology.

The vast majority of AI processing takes place in data centers, and Nvidia has already proven its worth at zipping information through the ether. The company controlled an estimated 98% of the data center GPU market last year, according to data compiled by semiconductor analysts at TechInsights.

The growing demand for AI has data center and cloud operators spending heavily to upgrade their capabilities to handle the rigors of AI processing. Making AI available to the masses is expected to unleash a wave of productivity that’s expected to add trillions of dollars to the global economy.

While Nvidia had a head start in this emerging industry, the company isn’t resting on its laurels. Earlier this year, the company unveiled its Blackwell architecture, which contained a host of new technology that promises to take AI to the next level.

Perhaps more impressive is the GB200 Grace Blackwell Superchip, which connects two B200 GPUs with an Nvidia Grace CPU to form “the world’s most powerful chip” for AI.

While there have been reports of a potential launch delay, more recent reports suggest Nvidia is still on track to begin shipping its next-generation AI chip early next year.

This all helps to illustrate that Nvidia has no plans of ceding its strategic advantage or market-leading position anytime soon.

Why its second-quarter financial report will be a key catalyst

Nvidia has proven its mettle over the past year, but investors are looking to the future. Concerns about inflation and the growth of the economy have taken center stage in recent weeks, with economists debating whether the Federal Reserve Bank has waited too long to lower interest rates or whether it can still engineer a soft landing — bringing inflation under control, without tipping the economy into a recession. Those fears have begun to subside, so investors are turning their sights to Nvidia, which is widely viewed as a bellwether for the state of AI adoption.

A look back at Nvidia’s outlook in recent quarters can provide much-needed insight into what investors should expect next week. In each of the past four quarters, Nvidia has delivered triple-digit growth, which has outpaced its own guidance, and in each instance by a fair margin. Nvidia’s revenue growth has sailed past its outlook by a margin of between 8% and 19%, which suggests the company’s current forecast is equally conservative.

For its fiscal 2025 second quarter (ended July 30), Nvidia is guiding for revenue of $28 billion, representing an increase of 107% year over year. Wall Street is even more enthusiastic, with analysts’ consensus estimates rising to $28.6 billion. Even that may end up being conservative, as Nvidia has surpassed investor expectations for sales and profits in each of the past four quarters — again by a fair margin.

If Nvidia beats its own revenue guidance by at least 8% or more — which it has done in each of the preceding four quarters — that would put its revenue at $30 billion or more. If that’s the case, it will likely come with a commensurate increase in its guidance, resulting in a classic “beat and raise.” Since this is almost always a bullish signal, the stock price will likely jump in response.

To be clear, investors will be watching Nvidia’s forward-looking guidance for evidence the secular tailwind of AI is still blowing strong. Based on the available evidence and using history as a guide, I predict that Nvidia will deliver record-breaking results and surpass expectations, sending its stock to new heights.

Is the stock worth the price?

Thanks to Nvidia’s superb results, there’s been a commensurate increase in its valuation. Analysts and investors alike have been scrambling to decide how best to value Nvidia stock, but we’re in unchartered territory here. Nvidia generated revenue of $61 billion in fiscal 2024 (ended Jan. 28), an increase of 126%. Growth of that magnitude is certainly deserving of a premium, but there’s no consensus regarding the size of said premium.

Nvidia is currently selling for 75 times earnings, but that number is about to see a dramatic reset after the company delivers its financial report, as new, higher profits are factored into the ratio. The chart clearly shows the stark decline in the wake of each of its three previous financial reports in November, February, and May, respectively.

While some investors might balk at paying in the neighborhood of 50 times earnings (represented by the dips in the stock chart), I would argue that’s a fair price to pay for a company delivering triple-digit growth and leading the fourth industrial revolution.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Danny Vena has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Prediction: Nvidia Will Deliver Record Results on Aug. 28, Which Will Supercharge the Stock was originally published by The Motley Fool

Chevron Continues to Take Steps to Capture This Potentially $4 Trillion Opportunity (But it Remains Well Behind Rival ExxonMobil)

Carbon dioxide emissions are a big problem for the environment. Oil and gas combustion is a key source of this climate-changing gas. Because of that, many energy companies are looking for ways to be part of the solution instead of only contributing to the problem.

That’s leading big oil giants Chevron (NYSE: CVX) and ExxonMobil (NYSE: XOM) to explore the potential of carbon capture and storage (CCS). They believe CCS will not only be a major part of the solution (according to the International Energy Agency, it’s nearly impossible for the world to reach net zero without it) but also a very lucrative business opportunity. Exxon believes CCS could grow into a $4 trillion global market by 2050.

Slowly building its CCS portfolio

Chevron has been working to build out its CCS capabilities. The oil giant recently won an assessment permit in offshore Western Australia to evaluate the potential of building a hub to store carbon dioxide emissions from third parties and its operated liquefied natural gas (LNG) assets in the region. The permit involves a joint venture between Chevron (70% interest) and Woodside Energy (30%).

Chevron has agreed to farm down 5% of its equity in the permit to Korea’s GS Caltex. The partners have unique assets, capabilities, and customer relationships to support a potential CCS development at this site.

This project could expand Chevron’s CCS operations in Australia, which includes its currently operating Gorgon CCS project. The platform has the potential to enable the oil company to lower the carbon intensity of its existing operations. It can also provide opportunities for customers to help reduce or offset some of their emissions.

Chevron has a bold goal to capture 25 million metric tons of carbon dioxide annually by the end of the decade. That’s equivalent to taking 5 million cars off the road each year. It’s working on several projects worldwide to achieve that goal, including the Bayou Bend CCS Hub in the U.S. (one of the largest in the country with the potential capacity to store more than 1 billion metric tons of carbon dioxide). However, other than Gorgon CCS, most of Chevron’s projects are very early in development.

A slightly different game plan

Chevron’s initial CCS focus is on reducing the emissions of its operations by building projects to capture those produced at its sites for storage at its sequestration hubs. Exxon is taking a slightly different approach. While it’s working on CCS developments to reduce its emissions, it’s also focusing on capturing and storing third-party emissions volumes.

For example, the company recently signed an agreement with CF Industries to transport and permanently store up to 500,000 metric tons of carbon dioxide per year from its complex in Yazoo City, Mississippi. That project will cut emissions from this site in half when it starts up in 2028.

It’s Exxon’s second commercial contract with CF Industries. It now has contracts to store up to 5.5 million tons of carbon dioxide annually for several customers. That’s equal to replacing 2 million gas-powered cars with electric vehicles (EVs), more than the total number of EVs sold in the country last year.

No other company has come close to the magnitude of commercial CCS contracts signed by Exxon. A big driver has been its nearly $5 billion acquisition of Denbury Resources last year, which bolstered its carbon transportation infrastructure capabilities.

Exxon believes its CCS business could generate billions of dollars in annual revenue in the next five years, with much greater potential in the coming decades. Further, this revenue would be more stable than its oil and gas earnings, which fluctuate with commodity prices. Because of that, it could put a firm and growing floor under its earnings.

Working to cash in on a potentially lucrative opportunity

CCS will be crucial in helping the world reduce carbon emissions. Oil giants Chevron and Exxon want to be at the forefront of this technology, leading both to invest heavily in its development.

While Exxon is farther along, especially in commercializing third-party volumes, Chevron continues to build out its global CCS portfolio in hopes of capturing a share of this potentially massive opportunity. Their success in developing commercial CCS projects could enable these oil giants to create a lot of value for their investors in the coming decades.

Should you invest $1,000 in ExxonMobil right now?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Matt DiLallo has positions in Chevron and Woodside Energy Group. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

Chevron Continues to Take Steps to Capture This Potentially $4 Trillion Opportunity (But it Remains Well Behind Rival ExxonMobil) was originally published by The Motley Fool