Warren Buffett's Quiet Power Move: Why He's Betting $35 Billion On A 'Yet To Be Proven' Renewable Energy Solution

Warren Buffett is at it again, and the financial world is buzzing. He’s investing $35 billion into a renewable energy initiative that’s still “yet to be proven.” What’s surprising is that the famously cautious investor is doubling down on fossil fuels at the same time.

Don’t Miss:

We’re not talking pennies here. Chevron is one of the biggest holdings in Berkshire Hathaway’s portfolio – almost $19.1 billion. Buffett made his move during the 2020 energy downturn. Although he trimmed his position slightly this year, he remains heavily invested. Chevron’s not buying the “fossil fuels are fading” narrative. They’ve cranked up oil and gas production by 12% and are diving into major projects in the Gulf of Mexico and Israel.

But hold on, there’s more. Buffett’s got his eye on Occidental Petroleum too. His stake? Close to $15.7 billion. He’s been gobbling up shares like they’re going out of style. He’s even stated that Occidental is one of the few stocks Berkshire would consider holding indefinitely. Under CEO Vicki Hollub, Occidental’s making moves, like a $12 billion deal to acquire Crownrock, another oil and gas player.

Trending: With over 15k units already sold, this female-owned dog waste startup is targeting the $147 billion pet industry – here’s how to invest early at just $1 per share.

So, why’s Buffett all in on fossil fuels when everyone else is running the other way? It’s all about Carbon capture technology. Both Chevron and Occidental are investing heavily in this area. Hollub has even suggested that if carbon capture proves successful, “there’s no reason not to produce oil and gas forever.”

Buffett acknowledges the risk, stating that the “economic feasibility of this technique has yet to be proven.” However, Buffett has made risky bets before, and they’ve often paid off. He’s betting that Chevron and Occidental’s investments in carbon capture will sustain the oil and gas industry, even as the world shifts toward renewables.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Buffett isn’t just focused on short-term gains; he’s looking at the long-term potential, particularly with carbon capture technology. If successful, this could transform the industry, making fossil fuels cleaner and more sustainable. That’s why he’s willing to put so much on the line. Buffett has seen industries change before, and he’s positioning himself to be ahead of the curve once again.

In a world where many are following the crowd, Buffett is doing what he does best: going against the grain. Will this gamble pay off? Only time will tell. But if history is any guide, the “Oracle of Omaha” might just be onto something big again.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Warren Buffett’s Quiet Power Move: Why He’s Betting $35 Billion On A ‘Yet To Be Proven’ Renewable Energy Solution originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Has More Money Invested in This Than He Does Apple, AmEx, Bank of America, Coke, Chevron, and Oxy Combined

What’s Warren Buffett’s biggest position in his Berkshire Hathaway portfolio? If I were asked that question, my automatic response would be Apple (NASDAQ: AAPL). But I’d be wrong.

Yes, Apple remains Buffett’s biggest stock holding. However, it’s not his biggest position. Buffett has more money invested in one asset than he does in Apple, American Express, Bank of America, Coca-Cola, Chevron, and Occidental Petroleum combined.

Buffett’s biggest holding by far

Berkshire Hathaway has big bucks invested in its five largest stock holdings. Its stake in Apple is worth $90.7 billion even after Buffett nearly halved the conglomerate’s position in the iPhone maker. Berkshire’s stake in AmEx totals close to $38.5 billion. Bank of America is a close third, with Berkshire’s position weighing in at roughly $37 billion.

The next largest position in Berkshire’s portfolio is Coca-Cola, with Buffett’s 400 million shares worth around $28.3 billion. Two oil stocks round out the top six, Chevron and Occidental, with Berkshire’s stakes totaling nearly $17.6 billion and $14.6 billion, respectively.

In aggregate, Berkshire’s positions in these six stocks are currently valued at nearly $227 billion. That’s a lot of money, but it isn’t as much as Buffett has invested in another asset.

As of June 30, 2024, Berkshire Hathaway’s short-term investments in U.S. Treasury Bills totaled $238.7 billion. This amount includes $4.1 billion of the conglomerate’s $42.3 billion in cash and cash equivalents invested in short-term U.S. Treasuries with maturities of three months or less.

Why does Buffett have so much money in U.S. Treasuries?

Berkshire has a standing policy to keep at least $30 billion in cash, cash equivalents, and Treasuries. However, that threshold is much lower than the current level, which is the highest ever for the conglomerate. Why does Buffett have so much money invested in U.S. Treasuries right now?

Buffett answered this question in his 2021 letter to Berkshire Hathaway shareholders. At the time, Berkshire’s balance sheet included $120 billion of U.S. Treasuries plus another $24 billion in cash. He wrote then that the large amount was “a consequence of my failure to find entire companies or small portions thereof (that is, marketable stocks) which meet our criteria for long-term holding.”

That begs the question: What are Buffett’s criteria for buying businesses and stocks? He has answered this one in the past, too. In the legendary investor’s 2013 letter to Berkshire shareholders, Buffett said he would only invest in businesses and stocks that:

-

He could “sensibly estimate” an earnings range for at least five years in the future.

-

Have a price that was reasonable compared to the lower boundary of the estimated earnings range.

-

Are in his “circle of competence.”

There are undoubtedly lots of stocks for which Buffett can determine sensible future earnings estimates. Plenty of stocks are in his “circle of competence” as well. I think Berkshire’s huge position in Treasuries is primarily due to stock valuations being too high for him to want to buy — with a few exceptions, of course.

Should you buy Treasuries, too?

Your investing goals are almost certainly different from Buffett’s. But while I doubt most investors will want their largest position to be in U.S. Treasuries, having some of your portfolio in the asset could be wise. Treasuries are a great place to park your cash over the short term while you wait for a potential opportunity to buy stocks at more attractive prices.

I think, though, that some areas of the market offer attractive valuations already. In particular, many small-cap stocks are bargains after lagging well behind large-cap stocks in recent years. With the likelihood that interest rate cuts are on the way, they could perform well going forward.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $19,766!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,977!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $371,270!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 26, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Keith Speights has positions in Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Chevron. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett Has More Money Invested in This Than He Does Apple, AmEx, Bank of America, Coke, Chevron, and Oxy Combined was originally published by The Motley Fool

Altria Just Hiked Its Dividend and Is Firing On All Cylinders, But Should You Buy It Now?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Over time, stock prices rise and fall, but predictably, most people will be extremely bearish near the bottoms and largely bullish near the tops. Only four months ago, many investors on social media predicted the demise of Altria Group Inc (NYSE:MO) as it once again traded below $40 per share. Altria had traded between $35.50 and $43.00 for many months.

But Altria broke out of its trading range in May and has been climbing ever since. Following last week’s dividend increase announcement, it recently closed at $52.44.

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Those who purchased during the toughest times in 2023 have been handsomely rewarded with nearly 40% appreciation and a double-digit dividend yield. Those who forecast the end of times for Altria and didn’t buy it may have wished they had.

But will investors get a second chance to buy Altria with a dividend yield that’s an income collector’s dream? Take a look:

Altria is a Richmond, VA-based tobacco company that, through its subsidiaries, manufactures and sells oral and smokable tobacco products throughout the U.S. Some of its products include Marlboro cigarettes, Black & Mild cigars and pipe tobacco and Copenhagen, Skoal and other smokeless tobacco and snus products. More recently, it developed on! nicotine pouches and acquired NJOY Holdings, Inc. to add the NJOY ACE brand of e-vapor products to its inventory of smokeless tobacco products. As of March 2024, Altria owned 10% of Anheuser-Busch InBev SA (NYSE:BUD), the Budweiser beer manufacturer, but planned to sell off about 35 million of its 197 million shares.

After decades of lawsuits and a declining population of smokers which dropped the share price from over $70 to the mid $30s, Altria decided to expand its product line into non-smokeable tobacco products. Many health care professionals still caution users that these other products can be harmful to health, but many applaud Altria’s attempts to offer alternatives to smoking for adult customers.

Big News

On Aug. 22, Altria announced that its Board of Directors had approved a 4.1% increase to the quarterly dividend from $0.98 to $1.02 per share. The new dividend is payable to shareholders of record as of Sept. 16, with payment on October 10. This was the 55th consecutive year of dividend increases. The yield is now 7.78% as of its recent close at $52.44.

Over the past five years, Altria has raised its dividend six times with a total dividend growth of 27.5%. The dividend has tripled since the 2008 spinoff of Philip Morris International Inc. (NYSE:PM). Altria targets its dividend payout ratio at about 80% of adjusted earnings per share (EPS).

One factor that has helped Altria’s share price this year is the improvement in the share price of Anheuser-Busch following its marketing fiasco of Bud Light in 2023. Another factor is the reduction of 3.60% of outstanding shares this year from Altria’s share repurchase program.

Read More:

-

With returns as high as 300%, it’s no wonder this asset is the investment choice of many billionaires. Uncover the secret.

-

Commercial real estate has historically outperformed the stock market. This platform allows accredited investors to invest in commercial real estate, invest today for a 1% boost.

One reason Altria can be important in a balanced portfolio is that, as a defensive consumer stock, it provides a haven during volatile market periods. Of course, another reason to own it is for the income.

However, the question now is whether the present share price is sustainable. Technically, in the short term, Altria seems very overbought. The weekly 14-period Relative Strength Index (RSI) is now above 77 (70 or more is overbought) and the Full Stochastic is at 95.93 (80 or higher is overbought). Volume has recently declined on the up days as the rally has matured. The price has risen far from its 50-day moving average at $42.14 and the 200-day moving average at $39.30.

Of course, stocks can move higher even when overbought. The RSI moved into overbought territory in early July when the share price was $47.80. Overbought simply means that the stock is above its fair value. Therefore, the risk of a decline now exceeds the potential for further appreciation.

Since 2021, there have been two other times when the RSI touched or was above 70. In March 2021, the RSI reached the high 70s, and the stock peaked at $40.37. Within a month, the share price fell to $34.67. However, it rebounded, and in May 2022, the RSI again touched 71 as the price peaked at $47.04. What followed was an even greater sell-off to $34.50 by the end of June.

Therefore, history suggests a pullback could develop, perhaps as much as 10% to $47 or $48. However, the future continues to look bright for Altria, and if an investor purchases shares that are a few dollars too high, the dividend payments can compensate for that in just a few quarters. Most investors buy Altria for the income rather than the potential appreciation. However, younger investors may want to reinvest dividends to acquire more shares rather than collect the income.

The most recent analyst coverage for Altria was on Aug. 14, when Barclays analyst Gaurav Jain maintained it at Underweight and raised the price target from $37 to $44. However, the price is now well above the analyst’s price target.

Some investors avoid Altria because of the harmful effects of smoking and other tobacco forms. Owning this stock is not for everyone, but for those who want to own it, the three-year total return of 30.71% makes a compelling argument. Dollar-cost averaging into one’s total position to reduce the risk of paying too much can also be a prudent way to go.

Better Yields Than Altria?

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through dividend stocks… Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

For example, the Jeff Bezos-backed investment platform just launched its Private Credit Fund, which provides access to a pool of short-term loans backed by residential real estate with a target 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article Altria Just Hiked Its Dividend and Is Firing On All Cylinders, But Should You Buy It Now? originally appeared on Benzinga.com

Why Viking Therapeutics Stock Got Thrashed on Tuesday

News from a deep-pocketed rival put the hurt on biotech Viking Therapeutics‘s (NASDAQ: VKTX) stock on Tuesday. Said rival seems determined to dominate a very hot therapeutic area these days, and it might be tough for a relatively small fry like Viking to compete. On the back of such worries, investors sold out of the biotech, sending its share price down by more than 6% across the trading session. That was on a good day for stocks, generally, with the S&P 500 index inching up by 0.2%.

A discount offering rocks the obesity drugs segment

That giant competitor is Eli Lilly (NYSE: LLY), which on Tuesday announced that its Zepbound weight loss drug would be made available to patients in single-dose vials containing either 2.5 milligrams or 5 milligrams of the product. According to the pharmaceutical giant, the price for these new offerings is at least 50% cheaper than that of competing GLP-1 treatments for obesity.

“This new option helps millions of adults with obesity access the medicine they need, including those not eligible for the Zepbound savings card program, those without employer coverage, and those who need to self-pay outside of insurance,” Eli Lilly said in the press release touting the new dosages.

This affects Viking because the biotech is approaching the final stages of development of its own weight-loss drug. This will soon be put through its paces in a phase 3 clinical trial.

The right products for the right market

As GLP-1 drugs offer the tantalizing possibility of weight loss without exercise, they have become wildly popular in the U.S. — a country with a great many overweight individuals. There are very few approved obesity drugs on the market, hence Eli Lilly’s clear attempts at establishing an early toehold in the segment. Viking certainly has its work cut out for it if and when its own weight loss products make it to pharmacy shelves.

Should you invest $1,000 in Viking Therapeutics right now?

Before you buy stock in Viking Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Viking Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why Viking Therapeutics Stock Got Thrashed on Tuesday was originally published by The Motley Fool

If You'd Invested $10,000 in Berkshire Hathaway Stock 10 Years Ago, Here's How Much You'd Have Today

Just about everyone who might read this article probably knows that Warren Buffett, CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), has been a phenomenal investor — for decades. He displays his company’s growth and performance over the years in each annual report, and per the last one (for 2023), the overall gain from 1965 to 2023 was 4,384,748%. Yes, that’s 4.3 million! Annualized, it’s 19.8% per year. Of course, few of us invested in this amazing company way back in 1965.

So what would you have now if you’d invested $10,000 in Berkshire Hathaway just 10 years ago? Well, the answer might surprise you: You’d have $31,797 — which is 12.26% annually, on average. If you’re disappointed, know that you’d still be ahead of the S&P 500 — which averaged 11.61% over the same period.

Berkshire is simply growing more slowly in recent years, in part because it has grown so big. Its market value was recently $950 billion. Buffett is sitting on some $277 billion in cash, much of which he can deploy by buying more businesses, but he’s picky, insisting on high quality and a reasonable valuation.

Should you invest in Berkshire Hathaway now? Well, don’t do so if you’re looking for annual gains in the 20% range year after year. The stock is up about 23% year to date as of this writing, but its three-year average is 15%, and it may average only 8% or 10% over the next few years. No one knows.

But if you’re looking for a solid investment that’s very likely to grow over time, do consider the stock. Berkshire is a big conglomerate, with a wide range of businesses — including insurance, energy, homebuilding, jewelry, candy, transportation, and much more. And it owns a lot of stock in other companies — recently 21% of American Express, 9% of Coca-Cola, 2.5% of Apple, and nearly 12% of Bank of America.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Selena Maranjian has positions in American Express, Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has positions in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool has a disclosure policy.

If You’d Invested $10,000 in Berkshire Hathaway Stock 10 Years Ago, Here’s How Much You’d Have Today was originally published by The Motley Fool

This Stock-Split Stock Could Soar If Nvidia Delivers a Blowout Q2 Update

Which company is the center of attention this week? It’s Nvidia (NASDAQ: NVDA), hands down. The chipmaker will announce its second-quarter earnings results following the market close on Wednesday.

I fully expect Nvidia’s numbers to delight investors again, enabling it to extend its already impressive gains this year. But there’s another stock-split stock that could also soar if Nvidia delivers a blowout Q2 update.

Joined at the hip

Super Micro Computer (NASDAQ: SMCI), also called Supermicro, is arguably joined at the hip with Nvidia. The company provides server and storage solutions that are especially popular in data centers.

The same artificial intelligence (AI) tailwind fueling Nvidia’s growth also helps Supermicro. Charles Liang, Supermicro’s president and CEO, said earlier this month that his company “continues to experience record demand of new AI infrastructures.” As a result, Supermicro’s revenue in the fourth quarter of its fiscal 2024 soared 110% year over year.

If Nvidia handily beats expectations with its Q2 results on Wednesday (and, more importantly, if the company’s guidance is strong), it will bode well for Supermicro’s fortunes over the near term. I look for Nvidia to also provide some clarity on the timing of when chips based on its new Blackwell architecture will begin shipping. This should also help Supermicro, which has liquid-cooled AI superclusters ready to support Blackwell.

Sure, Liang maintains that a delay for Blackwell won’t impact Supermicro much because it does business with other chipmakers. Make no mistake about it, though: Good news from Nvidia will translate to good news for Supermicro.

Will Supermicro’s stock split provide another catalyst?

I don’t think there’s much doubt that a blow-out Nvidia Q2 update would provide a catalyst for Supermicro. But what about the company’s 10-for-1 stock split scheduled for Oct. 1? It’s iffy, in my view.

For one thing, Supermicro’s stock split won’t change anything at all about the company’s underlying business or its growth prospects. On the other hand, spectacular guidance from Nvidia would likely mean stronger growth ahead for Supermicro.

Any investor who really wanted to buy shares of Supermicro could do so even with its share price trading in the ballpark of $600. Many online brokerages support buying fractional shares.

However, this will be Supermicro’s first stock split. I’ll admit that it’s possible some investors who have remained on the sidelines could view the split as a great opportunity to buy the stock. I suspect the allure to invest in Supermicro could be even greater if the stock indeed soars as I expect it will following Nvidia’s quarterly update this week.

Is Supermicro a better stock to buy than Nvidia?

Now for an even more important question: Is Supermicro a better stock to buy than Nvidia? Wall Street seems to think so.

The consensus 12-month price target for Supermicro of analysts surveyed by LSEG in August reflects an upside potential of over 50%. By comparison, the average price target for Nvidia is slightly lower than its current price.

I agree that Supermicro is a better pick than Nvidia. My primary reasoning is valuation. Supermicro’s shares trade at a much lower forward earnings multiple than Nvidia’s. But if Nvidia gives great news to investors on Wednesday, both of these stocks should be big winners.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

This Stock-Split Stock Could Soar If Nvidia Delivers a Blowout Q2 Update was originally published by The Motley Fool

Billionaire Stanley Druckenmiller Goes Bargain Hunting: 2 Stocks He Just Bought

Stanley Druckenmiller might not be as well known as some other hedge fund billionaires, but if you’re looking to learn from the best, it’s hard to do better than Druckenmiller.

A protege of George Soros, Druckenmiller helped make the famous bet with Soros that broke the Bank of England, crashing the British pound and making more than $1 billion in 1992.

Even better, as the manager of Duquesne Capital Management, Druckenmiller has generated a compound annual average return of 30% from the fund’s founding in 1981 to its closure in 2010. Druckenmiller continues to invest through his family office, and his moves are closely followed. Druckenmiller stresses position sizing in his strategy, saying, “It’s not whether you’re right or wrong; it’s how much you make when you’re right and how much you lose when you’re wrong.” He’s also known for following macro trends, and being quick to change his mind as situations change.

So what was Druckenmiller buying in the second quarter? Let’s take a look at a couple of his most intriguing buys.

1. Philip Morris

One of Duquesne Capital Management’s biggest new positions in the quarter was Philip Morris International (NYSE: PM), the international tobacco giant.

Duquesne bought nearly 900,000 shares in Philip Morris, worth roughly $110 million. It also bought calls in the stock, indicating even more bullishness on the tobacco asset. Druckenmiller’s bet appears to have paid off as the stock has jumped by more than a third since its bottom on April 12, a big move from a recession-proof industry known for dividends and safety.

Philip Morris stock has broken out as the company has been more successful at pivoting to smoke-free products than peers like Altria and British American Tobacco. In fact, roughly 40% of Philip Morris’ revenue now comes from next-gen products like Zyn nicotine pouches and Iqos heat-not-burn devices. It even acquired the license to sell Iqos sticks in the U.S., opening up a potentially large market for the smoke-free product.

In its second quarter, Philip Morris saw solid growth with organic revenue up 9.6% to $9.5 billion and a 10.6% increase in adjusted earnings per share of $1.77. Growth from its smoke-free categories was even more impressive as organic revenue rose 18% and gross profit was up 22%. As smoke-free products make up more of the business, it should drive increased revenue growth.

Philip Morris also remains a strong dividend stock with a dividend yield of 4.3%.

2. Coherent

Druckenmiller’s biggest holding is now Coherent (NYSE: COHR), which comes after he sold a significant stake in Coupang and sold most of his shares of Nvidia.

Coherent makes lasers and develops laser-based technology and electro-optic switches. Its technology has become valuable in semiconductor manufacturing, which has connected the company to the artificial intelligence (AI) boom.

The company is seeing strong growth in its Datacom transceiver business, a key part of fiber-optic networks, which is being driven by growth in generative AI. That also helped expand Coherent’s gross margin in the quarter, which rose 440 basis points to 32.9%.

Wall Street expects profits to continue to ramp up as it capitalizes on the emerging technology. Coherent’s own guidance calls for adjusted earnings per share of $0.53 to $0.69, up from just $0.16 in the quarter a year ago, while revenue is expected to grow 24.7% at the midpoint of its guidance range of $1.27 billion to $1.35 billion.

Like Philip Morris, Coherent also rallied in the second quarter, jumping more than 50% from its low point in April.

Druckenmiller was early to invest in Nvidia after ChatGPT launched, buying that stock in the fourth quarter of 2022, so he has sharp insight into the artificial intelligence industry, and that could explain his aggressive bet on Coherent. The laser technology company is an under-the-radar AI stock and could be a long-term winner if it can continue to ramp up profits.

Should you invest $1,000 in Philip Morris International right now?

Before you buy stock in Philip Morris International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Philip Morris International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Coupang and Nvidia. The Motley Fool recommends British American Tobacco P.l.c., Coherent, and Philip Morris International and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

Billionaire Stanley Druckenmiller Goes Bargain Hunting: 2 Stocks He Just Bought was originally published by The Motley Fool

Forget Amazon And Tesla. This Non-Magnificent Seven Stock Is Soaring.

While it doesn’t earn the Magnificent Seven moniker, Costco Wholesale (COST) has outpaced all of those tech titans this year, except Nvidia (NVDA) and Meta Platforms (META). Plus, the performance of Costco stock has more than doubled that of Amazon.com (AMZN) and Tesla (TSLA) — and tripled that of Microsoft (MSFT) — since January. Now the big box retailer is expanding that lead with a fresh breakout.

↑

X

Hone Your Stock Market Investing Skills With IBD Meetup Groups

Costco Smashing Amazon, Tesla, Microsoft This Year

With Nvidia set to report today after the close, Wall Street eagerly awaits what one analyst called the “most important tech earnings in years.” Nvidia stock has already delivered the best performance among the Magnificent Seven stocks this year with a 159% gain as of Tuesday’s close.

Meta Platforms is next, up 47% this year.

But then comes non-Magnificent Seven company Costco, which has delivered a 38% year-to-date gain as of Tuesday’s close. The big box retailer doesn’t just top Alphabet, Apple, Tesla, Amazon and Microsoft. It more than doubles all of them. Costco has even more than tripled the 10% gain for Microsoft stock while Tesla is actually down 16% for the year.

And to add insult to injury, as Amazon, Tesla and Microsoft remain mired below their 50-day moving averages, Costco has just joined the IBD Breakout Stocks Index as it launches a move to fresh highs.

| Company | Symbol | % Gain YTD* | Comp Rating | EPS Rating | RS Rating | SMR Rating |

|---|---|---|---|---|---|---|

| Nvidia | NVDA | 159% | 97 | 99 | 98 | A |

| Meta Platforms | META | 47 | 93 | 97 | 91 | A |

| Costco Wholesale | COST | 38 | 92 | 89 | 91 | B |

| Alphabet | GOOGL | 18 | 74 | 98 | 61 | A |

| Apple | AAPL | 18 | 90 | 86 | 86 | A |

| Amazon.com | AMZN | 14 | 76 | 81 | 55 | A |

| Microsoft | MSFT | 10 | 62 | 93 | 52 | A |

| Tesla | TSLA | -16 | 52 | 57 | 38 | B |

*As of Aug. 27, 2024

See Who Joins Costco On The IBD Breakout Stocks Index

Costco Stock Shops For A Breakout — And Finds One

With its relative strength line already hitting a 52-week high, Costco stock popped into buy range this week, where it remains. The retail giant cleared an 896.67 buy point in an early stage cup pattern and currently trades 1% above that entry.

While never a highflying and flashy growth stock in the vein of Nvidia, Meta or Tesla, Costco has a long track record of delivering solid and steady growth. Boosted by its reliable and recurring membership fees, the retailer has posted sales growth ranging from 2% to 15% over the last eight quarters.

In its latest quarterly report on May 30, Costco generated $58.5 billion in revenue, marking a 9% year-over-year gain.

Bottom-line growth has ranged from 4% to 18% over the last eight quarters. In the May report, Costco drove a 10% rise in earnings to $3.78 per share for the quarter.

IBD Breakout Opportunities ETF

The IBD Breakout Opportunities ETF (BOUT) from Innovator Capital Management tracks the IBD Breakout Stocks Index. As with other index ETFs, this fund allows you to invest in the entire index in addition to, or rather than, buying individual stocks. Learn more here about the ETF and Innovator.

Follow Matthew Galgani on X (formerly Twitter) at @IBD_MGalgani.

YOU MAY ALSO LIKE:

Nvidia Stock Faces Two Tests This Week. Investors Face A Third.

Microsoft, Nvidia Shunned. Meet The New Big ‘Daddy’ On Wall Street.

Step Aside, Tesla. This Stock Wants Your Mag 7 Card.

Generate New Stock Ideas With IBD Stock Screener

Identify Bases And Buy Points With This Pattern Recognition Tool

Ozempic Could Have a Terrible Side Effect. Is Novo Nordisk in Trouble?

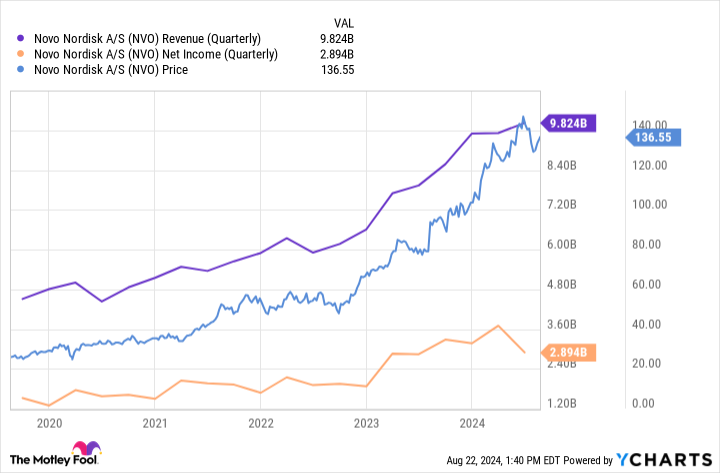

The diabetes medicine Ozempic has been a veritable cash cow for Novo Nordisk (NYSE: NVO). The company’s revenue, earnings, and stock price have been on a tear in recent years — and no single drug has contributed more to its performance than Ozempic.

However, various potential headwinds have popped up that could disrupt Ozempic’s progress. One of them is competition. Novo Nordisk’s longtime foe in the diabetes market, Eli Lilly, developed Mounjaro, a diabetes medicine whose sales are growing incredibly fast.

Elsewhere, the side effects of Novo Nordisk’s crown jewel have come under increased scrutiny, and a recent study suggests that Ozempic could have a dangerous safety issue. Let’s look at what it could mean for Novo Nordisk.

Could Ozempic cause suicidal thoughts?

One of Ozempic’s side effects that has generated quite a bit of attention is muscle loss. However, an even more dangerous potential drawback that some researchers have warned about is the possibility that Ozempic could increase suicidal thoughts.

A recent study claims to shed more light on this topic. The study looked at two medicines in the GLP-1 receptor agonist class, to which semaglutide, the active ingredient in Ozempic, belongs. The other GLP-1 medicine featured was liraglutide, the generic name for Victoza and Saxenda, which treat diabetes and obesity, respectively.

Liraglutide was another one of Novo Nordisk’s discoveries. Through a database from the World Health Organization that tracks suspected adverse reactions from medicines and vaccines, the researchers found that Ozempic was associated with a higher rate of reported suicidal thoughts compared to other drugs. Liraglutide did not seem to be linked with higher rates of suicidal thoughts.

What should investors make of these findings? Should you sell the healthcare stock?

No reason to hit the panic button

Regulatory authorities are already aware of the potential association between Ozempic — or at least its active ingredient, semaglutide — and suicidal thoughts. Wegovy, an obesity medicine that shares this same active ingredient, has a warning for precisely that in the U.S.

Researchers sometimes learn even more about a therapy and its side effects after years of use in real-life settings. If studies establish a robust causal link between Ozempic or Wegovy and suicidal thoughts, that could cause regulators to take action. Perhaps they would add additional warnings or, in the worst-case scenario, take the medicine off the market. Either way, it would mean lower (or nonexistent) sales for Novo Nordisk’s biggest growth driver, dragging down its revenue, earnings, and stock price.

But there’s no reason to think this study will lead to that morbid scenario. Other studies have reached different conclusions. One published in Nature Medicine, one of the world’s most prestigious science journals, found that semaglutide had a lower risk of producing suicidal thoughts than other non-GLP-1 anti-obesity medicines in real-life settings. This study, unlike the previous one, compared patients based on factors that can influence suicidal behavior, including sex, socioeconomic status, ethnicity, and mental health.

It would take a lot to reverse these findings. So, for now, investors can continue focusing on how Novo Nordisk is performing. And on that front, there aren’t too many complaints.

Financial results continue to be strong. In the first half of the year, the company’s net sales grew by 24% year over year to 133.4 billion Danish kroner ($19.8 billion). Ozempic’s sales increased 36% year over year, while Wegovy’s jumped 74%. Notably, Novo Nordisk continues to lead the GLP-1 market — its share was 56% as of May, compared to 54% a year before.

Ozempic could win several label expansions, including in the exciting area of nonalcoholic steatohepatitis, where it’s being investigated in a phase 3 study. Novo Nordisk has many more promising candidates. CagriSema, a next-gen GLP-1 drug, could be yet another multibillion-dollar medicine. The drugmaker is also looking to diversify, with several programs across a range of therapeutic areas.

Though various challenges to Ozempic will continue to appear, the recent study doesn’t pose too much of a problem for the medicine and its maker. Novo Nordisk should continue delivering strong financial results and stock-market performance for the foreseeable future. I believe the stock is still worth buying.

Should you invest $1,000 in Novo Nordisk right now?

Before you buy stock in Novo Nordisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novo Nordisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Ozempic Could Have a Terrible Side Effect. Is Novo Nordisk in Trouble? was originally published by The Motley Fool