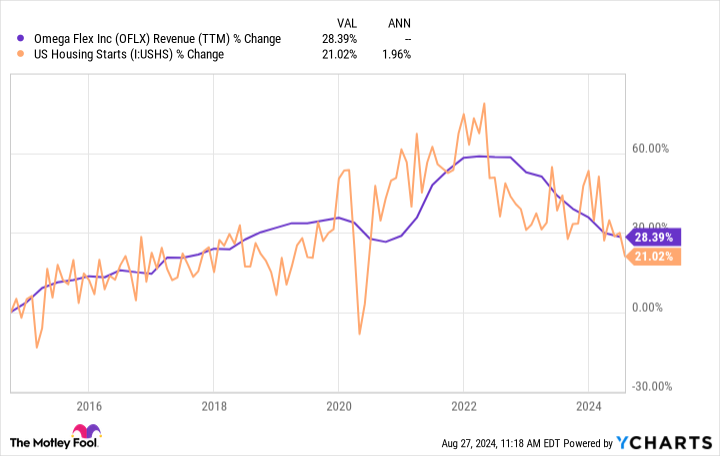

The U.S. housing market has been tumultuous due to persistent interest rate hikes.

However, an upward revision of U.S. gross domestic product growth in the second quarter has led speculators to reconsider their bets on a substantial 50-basis-point rate cut next month.

With mortgage rates expected to decrease, experts advise homebuyers to act swiftly to secure the best deals before the opportunity closes.

Looking ahead, several dynamic trends are set to shape the housing market.

According to a note by Norada Real Estate Investments, the market will remain strong over the next five years, though it will experience some dramatic shifts. Home prices are projected to continue rising, but at a slower pace than in recent years, offering a more gradual increase. While the supply of homes is expected to grow, addressing the previous shortage should ease the inventory crunch that has driven prices up.

Also Read: A Ton Of Landlords Are About To Raise Rents This Year

Despite the Federal Reserve’s past rate hikes raising borrowing costs and dampening buyer enthusiasm, a gradual rate decline could rekindle demand and revitalize the market.

However, competition will remain fierce due to robust job growth, population expansion, and limited land availability.

2024 Forecast

The U.S. housing market is anticipated to slow, with home prices either stabilizing or seeing a slight decline. Zillow’s latest forecast for 2024 projects a 1.8% national increase in home values, indicating a period of market stability, Norada Real Estate Investments added.

Stock Opportunities

As home prices are expected to remain stable or increase modestly, homebuilders are likely to benefit from sustained demand and favorable conditions. This stability should support their revenue growth through ongoing construction and sales.

According to a June report by the National Association of Home Builders, the top three homebuilders by revenue, closings, and home types are:

- D.R. Horton, Inc. DHI: DHI stock has surged over 58% in the past year. Wells Fargo recently raised its price forecast to $220 from $210 while maintaining an Overweight rating. Investors can consider the iShares U.S. Home Construction ETF ITB for exposure.

- Lennar Corporation LEN: LEN stock has risen more than 52% in the past year. Wells Fargo increased its price forecast to $195 from $185, also maintaining an Overweight rating. The AdvisorShares Gerber Kawasaki ETF GK offers a way to invest in Lennar.

- Toll Brothers, Inc. TOL: TOL stock has jumped over 75% in the past year. Wedbush raised its price forecast to $148 from $120, keeping a Neutral rating. The Invesco Dorsey Wright Consumer Cyclicals Momentum ETF PEZ provides investment exposure.

Overall, the U.S. housing market is poised for stability this year, with modest price increases and benefits for homebuilders. Prices are projected to rise 3-5% annually through 2029, while mortgage rates are expected to stabilize above pre-pandemic levels, Norada reported. This evolving landscape, marked by a shift towards suburban and rural demand and technological advancements, will require buyers and investors to remain informed and adaptable, the report added.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.