Wall Street Rebounds Without Its AI Darling's Boost, King Dollar Maintains Dominance While Bitcoin Defies Gravity: This Week In The Markets

Despite widespread anticipation that NVIDIA Corp. NVDA‘s quarterly results would dictate Wall Street’s year-end trajectory, the stock market delivered a robust weekly rebound — even in the absence of its AI darling.

While the semiconductor titan beat analyst expectations on both earnings and revenue for the third quarter, Nvidia’s stock remained flat for the week.

Alphabet Inc. GOOGLGOOG, the parent company of Google, faced sharp turbulence. Shares tumbled after the U.S. Department of Justice called for the divestiture of Chrome in a bid to curb Google’s dominance in search and digital advertising.

The sell-off wiped out over $120 billion in market capitalization on Thursday alone.

A recent Benzinga poll indicates 64% of respondents oppose breaking up Alphabet, with YouTube viewed as the company’s most valuable asset.

On the economic front, U.S. private sector activity expanded significantly in November, as reflected in S&P Global’s Purchasing Managers’ Index surveys. The services sector, in particular, surged at its fastest pace since March 2022, while price pressures continued to recede, creating less headwinds for the Federal Reserve.

Bitcoin’s BTC/USD rally shows no signs of cooling, with the cryptocurrency notching its fourth consecutive week of gains and hovering around the historic $100,000 threshold.

The U.S. dollar also maintained its upward momentum, rising for the eighth straight week to reach two-year highs. This latest rally, however, stemmed largely from external turmoil, as escalating geopolitical tensions between Russia and Ukraine, coupled with worsening economic momentum in Europe, triggered sharp weekly sell-offs in the euro and the British pound.

President-elect Donald Trump advocates for increased fossil fuel production with his “drill, baby, drill” policy. In contrast, Elon Musk, co-leader of the proposed Department of Government Efficiency (DOGE), envisions a future dominated by solar energy. UBS analysts recommend investors consider renewable energy stocks following their election-induced market dip.

Cathie Wood of Ark Invest anticipates the Trump administration will provide regulatory clarity for Bitcoin and other digital assets, potentially incorporating them into the Treasury’s strategic reserve.

General Motors GM is reportedly preparing to enter Formula One in 2026, potentially partnering with Andretti Autosport. This move would mark GM’s first foray into F1, aligning with its global motorsport expansion strategy.

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Silexion Therapeutics Announces 1-for-9 Reverse Share Split

GRAND CAYMAN, Cayman Islands, November 22, 2024 – Silexion Therapeutics Corp. SLXN (“Silexion” or the “Company”), a clinical-stage biotech developing RNA interference (RNAi) therapies for KRAS-driven cancers, today announced a 1-for-9 reverse share split of its ordinary shares. The reverse share split will become effective after market close on November 27, 2024, and the Company’s ordinary shares will begin trading on a split-adjusted basis on the Nasdaq Global Market at market open on November 29, 2024, under the existing ticker symbol “SLXN.” A new CUSIP number will be assigned to the post-reverse split shares.

As a result of the reverse share split, every nine ordinary shares of Silexion issued and outstanding will be automatically combined into one share. The par value of the ordinary shares will be proportionately increased, from $0.0001 per share to $0.0009 per share, and no fractional shares will be issued. Shareholders entitled to fractional shares will each receive a rounded-up whole share.

“Our decision to initiate a reverse share split aligns with Silexion’s commitment to maintaining our Nasdaq listing and ensuring a robust foundation for future growth,” said Ilan Hadar, Chairman and CEO of Silexion. “Given our recently reported milestones and strong pipeline, I am confident that we are well-positioned to advance our clinical programs and deliver value to our shareholders and to patients in the future. We believe this reverse split will help address the common short-term volatility in our share price that we experienced following our business combination and position us for long-term growth.”

Shareholders holding shares in book-entry form do not need to take any action in respect of the reverse share split, as their shares will be adjusted automatically. Those holding shares through a broker or nominee will also not need to take any action, as the number of shares held by them will be adjusted automatically, as reflected in their brokerage account. For further details, those shareholders should contact their broker.

The reverse share split is intended, among other things, to enable the Company to regain and maintain compliance with Nasdaq’s minimum bid price requirement, as outlined in Nasdaq Listing Rule 5450(a)(1). This adjustment is expected to help Silexion align with Nasdaq standards, enhance its market position, and support its strategic growth initiatives (including by enabling the Company to conduct equity financings).

About Silexion Therapeutics:

Silexion Therapeutics SLXN is a pioneering clinical-stage, oncology-focused biotechnology company developing innovative RNA interference (RNAi) therapies to treat solid tumors driven by KRAS mutations, the most common oncogenic driver in human cancers. The company’s first-generation product, LODER™, has shown promising results in a Phase 2 trial for non-resectable pancreatic cancer. Silexion is also advancing its next-generation siRNA candidate, SIL-204, designed to target a broader range of KRAS mutations and showing significant potential in preclinical studies. The company remains committed to pushing the boundaries of therapeutic innovation in oncology, with a focus on improving outcomes for patients with difficult-to-treat cancers. For more information please visit: https://silexion.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact contained in this communication, including statements regarding Silexion’s share price, business strategy, research and development plans, anticipated milestones, expected clinical and preclinical advancements, the potential benefits of the reverse share split, and management’s objectives for future operations, are forward-looking statements. These forward-looking statements are generally identified by terminology such as “may,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential,” or “continue,” or the negatives of these terms or variations of them or similar terminology. Forward-looking statements include, without limitation, Silexion’s expectations regarding the progression of its clinical and preclinical programs, anticipated benefits of the reverse share split, financing prospects, future market conditions, expected regulatory filings, and other potential developments related to its research pipeline and business strategy. Forward-looking statements involve a number of risks, uncertainties, and assumptions, and actual results or events may differ materially from those projected or implied in such statements. Important factors that could cause such differences include, but are not limited to: (i) Silexion’s ability to realize the anticipated benefits of being a public company, which may be impacted by competition, operational challenges, the retention of key personnel, and the costs associated with public listing; (ii) risks related to Silexion’s ability to advance its lead programs, including LODER™ and SIL-204, through clinical development successfully and in a timely manner; (iii) the potential impact of the reverse share split on the Company’s share price and its ability to maintain compliance with Nasdaq listing requirements; (iv) the potential impact of the reverse share split on Silexion’s ability to successfully raise capital in the near future; (v) changes in regulatory requirements or the potential for regulatory delays; (vi) Silexion’s ability to maintain and expand its intellectual property portfolio; (vii) the availability and terms of additional capital needed to fund ongoing research and development activities and operational expenses; (viii) the evolving market for RNA interference (RNAi) therapies and the competitive landscape in oncology; (ix) the possibility that Silexion may not achieve anticipated milestones within expected timelines, including initiation of Phase 2/3 clinical trials for SIL-204; (x) risks associated with reliance on third-party manufacturers and collaborators for development and commercialization efforts; and (xi) other risks and uncertainties as detailed in the documents filed or to be filed with the SEC by Silexion, including the definitive proxy statement on Schedule 14A filed on October 22, 2024, the proxy supplement filed under cover of Schedule 14A on November 13, 2024, and the Form S-1 registration statement filed on October 31, 2024. Silexion cautions you against placing undue reliance on forward-looking statements, which reflect current beliefs and are based on information available as of the date a forward-looking statement is made. Forward-looking statements set forth herein speak only as of the date they are made. Silexion undertakes no obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs, except as otherwise required by law.

Company Contact

Silexion Therapeutics Corp

Ms. Mirit Horenshtein Hadar, CFO

mirit@silexion.com

Investor Contact

ARX | Capital Markets Advisors

North American Equities Desk

silexion@arxadvisory.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Zeta Global Holdings Corp. Investors: Company Investigated by the Portnoy Law Firm

Investors can contact the law firm at no cost to learn more about recovering their losses

LOS ANGELES, Nov. 22, 2024 (GLOBE NEWSWIRE) — The Portnoy Law Firm advises Zeta Global Holdings Corp. (“Zeta” or “the Company”) ZETA investors that the firm has initiated an investigation into possible securities fraud and may file a class action on behalf of investors. Zeta investors that lost money on their investment are encouraged to contact Lesley Portnoy, Esq.

Investors are encouraged to contact attorney Lesley F. Portnoy, by phone 310-692-8883 or email: info@portnoylaw.com, to discuss their legal rights, or click here to join the case. The Portnoy Law Firm can provide a complimentary case evaluation and discuss investors’ options for pursuing claims to recover their losses.

On November 13, 2024, Culper Research released a report alleging that Zeta has been engaging in deceptive data collection practices. The publication claims that Zeta created a network of misleading websites, referred to as “consent farms,” designed to trick a large number of consumers each month. The report suggests that these websites mislead users into providing their personal information to Zeta through false promises, offering non-existent rewards such as job offers and financial incentives as enticements.

Please visit our website to review more information and submit your transaction information.

The Portnoy Law Firm represents investors in pursuing claims against caused by corporate wrongdoing. The Firm’s founding partner has recovered over $5.5 billion for aggrieved investors. Attorney advertising. Prior results do not guarantee similar outcomes.

Lesley F. Portnoy, Esq.

Admitted CA, NY and TX Bars

lesley@portnoylaw.com

310-692-8883

www.portnoylaw.com

Attorney Advertising

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New York City's Maman coming to The Commodore in Transformation of Courthouse Neighborhood

ARLINGTON, Va., Nov. 22, 2024 /PRNewswire/ — Greystar, a global leader in the investment, development, and management of real estate, including rental housing, logistics and life sciences, announced today that The Commodore in Courthouse will welcome New York City based café & bakery Maman to its community.

“We are proud to welcome Maman to The Commodore,” John Clarkson, Managing Director of Development, said. “We have been a big believer in Courthouse and the promise it always held. The success of The Commodore—which is already stabilized—has surpassed our own expectations, and the addition of Maman further validates that the promise has become reality.”

“We are thrilled to bring Maman to the heart of the Courthouse neighborhood,” said Elisa Marshall, co-founder of Maman. “With The Commodore’s vision for a vibrant community, we look forward to offering Arlington our signature blend of French-inspired, comforting cuisine and carefully crafted ambiance that so many have come to love.”

Maman opened its doors in Soho, NYC in October 2014. Quickly embraced by New York locals and international visitors, the café, restaurant and event space flourished with now over 30+ locations across multiple cities; Manhattan, Washington DC, Jersey City, Toronto and South Florida. Maman (“mother” in French) is a melding of the founding partners’—Benjamin Sormonte and Elisa Marshall—fondest childhood memories in the kitchen—especially recipes from their mothers—combined with their mutual passion for delivering quality food and a flawless experience within an artful and warm setting.

Maman will join an excellent group of retailers at the community including YogaSix, Playabowls, Rumble Boxing, and SAKI. The Commodore’s collective ground floor retail mix has brought a new sense of place to the Courthouse neighborhood, bolstering the existing retail base.

The Commodore offers apartments in studio, one-, two- and three-bedroom floorplans. Residences features chef-inspired kitchens, soft close cabinets, keyless entry, GE appliances and Samsung washers and dryers. Select micro apartments feature Ori Cloud Beds and/or Ori Closets. Selected residences feature upgraded finishes and a choice between the standard navy and gray design or a white design. Community amenities include a pool with sundeck and waterfall, fire pits and grills, an art studio, fitness center, demonstration kitchen and dining room, clubroom, co-working space, a coffee station, pet spa, outdoor lounge and concierge service.

Located adjacent to the Court House Metro station, living and dining at The Commodore allows for ease of access to D.C., Ballston, Tysons Corner and both Reagan National and Dulles International airports. There are plenty of shopping options within minutes including Apple, Lululemon, Pottery Barn and Whole Foods, as well as numerous dining and nightlife options along Clarendon and Wilson Boulevards.

Residents can relax at the pool with a waterfall and sundeck or enjoy games on the recreational lawn, entertain guests in a courtyard with a fire pit and grills or create masterpieces in the art studio. Building amenities include an expansive fitness center, a demonstration kitchen and dining room, a clubroom, an outdoor lounge, co-working spaces, a coffee station, pet spa and concierge service.

Maman’s national real estate advisor, Brand Urban, in partnership with Jennifer Price and Kim Stein at KNLB, guided the café’s co-founders, Elisa Marshall and Benjamin Sormonte, in selecting The Commodore in Arlington as their newest location. With their expertise, the Brand Urban and KLNB team helped Maman find a prime spot near the Courthouse Metro, ensuring it will be a vibrant addition to the community.

CBRE’s Jared Meier and Taylor Hayes acted as exclusive retail advisor for the Commodore, brokering the Maman lease and successfully guiding the project through its retail marketing campaign.

The Commodore delivered first units in October 2023 and is fully stabilized.

For more information, or to schedule a tour, please visit livethecommodore.com or call 571-444-2062.

About Greystar

Greystar is a leading, fully integrated global real estate company offering expertise in property management, investment management, development, and construction services in institutional-quality rental housing, logistics, and life sciences sectors. Headquartered in Charleston, South Carolina, Greystar manages and operates nearly $315 billion of real estate in approximately 250 markets globally with offices throughout North America, Europe, South America, and the Asia-Pacific region. Greystar is the largest operator of apartments in the United States, manages over 1,000,000 units/beds globally, and has a robust institutional investment management platform comprised of over $78 billion of assets under management, including approximately $36 billion of development assets. Greystar was founded by Bob Faith in 1993 to become a provider of world-class service in the rental residential real estate business. To learn more visit our website.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-york-citys-maman-coming-to-the-commodore-in-transformation-of-courthouse-neighborhood-302314424.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-york-citys-maman-coming-to-the-commodore-in-transformation-of-courthouse-neighborhood-302314424.html

SOURCE Greystar

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Massive Insider Trade At Vertex

Revealing a significant insider sell on November 21, ITEM SECOND IRR TRUST FBO KYLE R WESTPHAL ua of JEFFREY R WESTPHAL dated October , 10% Owner at Vertex VERX, as per the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, sold 72,000 shares of Vertex. The total transaction value is $3,785,736.

Monitoring the market, Vertex‘s shares down by 0.69% at $53.07 during Friday’s morning.

Delving into Vertex’s Background

Vertex Inc is a provider of tax technology and services. Its software, content, and services help customers stay in compliance with indirect taxes that occur in taxing jurisdictions all over the world. Vertex provides cloud-based and on-premise solutions to specific industries for every line of tax, including income, sales, consumer use, value-added, and payroll. The company offers solutions such as tax determination, Tax Data Management, document management, and compliance and reporting among others. The company derives revenue from software subscriptions.

Vertex’s Economic Impact: An Analysis

Revenue Growth: Vertex displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 17.52%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Evaluating Earnings Performance:

-

Gross Margin: The company maintains a high gross margin of 64.85%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Vertex’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.05.

Debt Management: Vertex’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.36. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Vertex’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 281.26.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 13.24 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 90.19, the company’s EV/EBITDA ratio outperforms industry norms, reflecting positive market perception. This positioning indicates optimistic expectations for the company’s future performance.

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Vertex’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

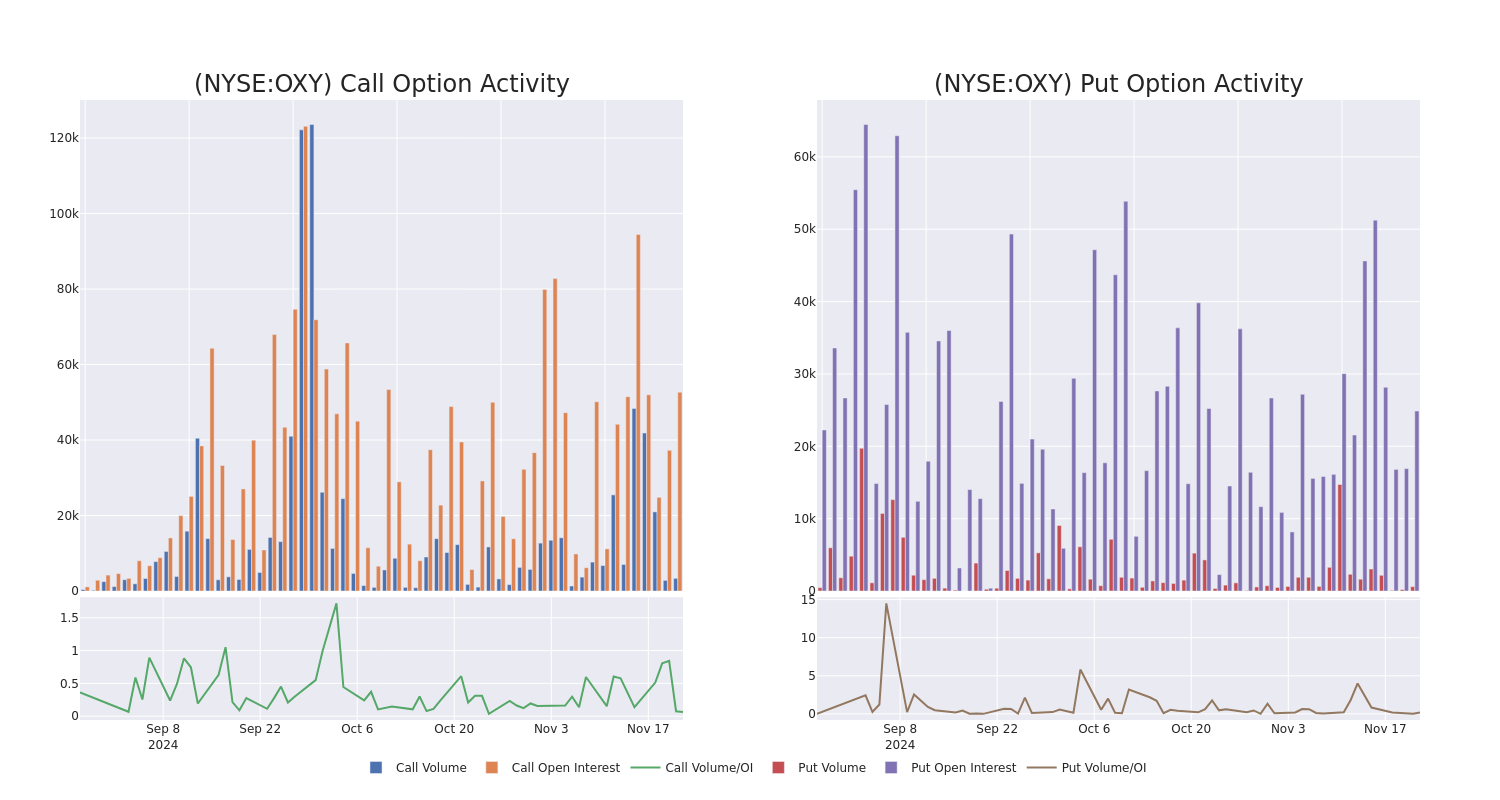

What the Options Market Tells Us About Occidental Petroleum

Whales with a lot of money to spend have taken a noticeably bearish stance on Occidental Petroleum.

Looking at options history for Occidental Petroleum OXY we detected 10 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 60% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $146,300 and 6, calls, for a total amount of $255,160.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $55.0 for Occidental Petroleum over the last 3 months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Occidental Petroleum’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Occidental Petroleum’s substantial trades, within a strike price spectrum from $50.0 to $55.0 over the preceding 30 days.

Occidental Petroleum 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | CALL | TRADE | BULLISH | 01/17/25 | $3.45 | $3.35 | $3.45 | $50.00 | $69.0K | 9.7K | 255 |

| OXY | PUT | SWEEP | BEARISH | 09/19/25 | $6.4 | $6.25 | $6.35 | $55.00 | $63.5K | 1.0K | 106 |

| OXY | CALL | TRADE | BEARISH | 12/27/24 | $2.75 | $2.68 | $2.69 | $50.00 | $53.8K | 452 | 411 |

| OXY | CALL | TRADE | BEARISH | 12/20/24 | $0.49 | $0.46 | $0.47 | $55.00 | $47.0K | 18.5K | 2.3K |

| OXY | PUT | SWEEP | BEARISH | 02/21/25 | $4.5 | $4.45 | $4.5 | $55.00 | $31.0K | 2.9K | 73 |

About Occidental Petroleum

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

In light of the recent options history for Occidental Petroleum, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Occidental Petroleum

- With a trading volume of 4,452,147, the price of OXY is up by 0.61%, reaching $51.85.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 82 days from now.

What Analysts Are Saying About Occidental Petroleum

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $65.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Susquehanna has decided to maintain their Positive rating on Occidental Petroleum, which currently sits at a price target of $65.

* Maintaining their stance, an analyst from Raymond James continues to hold a Strong Buy rating for Occidental Petroleum, targeting a price of $78.

* An analyst from Stephens & Co. has decided to maintain their Overweight rating on Occidental Petroleum, which currently sits at a price target of $71.

* An analyst from JP Morgan downgraded its action to Neutral with a price target of $56.

* An analyst from UBS has decided to maintain their Neutral rating on Occidental Petroleum, which currently sits at a price target of $58.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Occidental Petroleum options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Harri U Kulovaara Executes Sell Order: Offloads $763K In Royal Caribbean Gr Stock

Harri U Kulovaara, EVP at Royal Caribbean Gr RCL, disclosed an insider sell on November 21, according to a recent SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Kulovaara sold 3,256 shares of Royal Caribbean Gr. The total transaction amounted to $763,922.

The latest market snapshot at Friday morning reveals Royal Caribbean Gr shares up by 0.21%, trading at $238.06.

Discovering Royal Caribbean Gr: A Closer Look

Royal Caribbean is the world’s second-largest cruise company, operating 68 ships across five global and partner brands in the cruise vacation industry. Brands the company operates include Royal Caribbean International, Celebrity Cruises, and Silversea. The company also has a 50% investment in a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. The selection of brands in the portfolio allows Royal to compete on the basis of innovation, quality of ships and service, variety of itineraries, choice of destinations, and price. The company completed the divestiture of its Azamara brand in 2021.

Breaking Down Royal Caribbean Gr’s Financial Performance

Positive Revenue Trend: Examining Royal Caribbean Gr’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 17.45% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Navigating Financial Profits:

-

Gross Margin: The company shows a low gross margin of 51.06%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Royal Caribbean Gr’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 4.22.

Debt Management: With a high debt-to-equity ratio of 3.06, Royal Caribbean Gr faces challenges in effectively managing its debt levels, indicating potential financial strain.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 23.8, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 4.14 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 14.54 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Deciphering Transaction Codes in Insider Filings

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Royal Caribbean Gr’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

80% Leverage, 5.5x EBITDA: Is Cresco The High-Risk, High-Reward Play Investors Need?

Despite flat earnings and challenging market conditions, Cresco Labs Inc. CRLBF remains an “Overweight” stock, according to analysis firm Zuanic & Associates. In his latest report, Zuanic underscores Cresco’s strong positioning in emerging adult-use markets such as Pennsylvania and Ohio while identifying valuation advantages that set the company apart.

Cresco trades at 5.5x forward EBITDA, below Green Thumb Industries Inc. GTBIF at 7x and Curaleaf Holdings Inc. CURLF at 10x.

“This discount presents an appealing entry point for investors looking beyond short-term volatility,” Zuanic writes.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Market Dynamics: Cresco In The Tier 1 Landscape

Zuanic’s report benchmarks Cresco against other Tier 1 multi-state operators (MSOs), including Green Thumb, Trulieve Cannabis Corp. TCNNF, Verano Holdings Corp. VRNOF, and Curaleaf.

While Cresco’s third-quarter revenue of $180 million fell 2% sequentially, the decline aligns with broader industry trends, with peers like Curaleaf and Verano posting declines of 3% and 5%, respectively. By contrast, Green Thumb achieved a 2% increase, reaching $287 million.

Adjusted EBITDA margins further illustrate Cresco’s position: the company held steady at 29% in Q3, compared to Green Thumb at 31% (-200 basis points) and Trulieve at 34% (-100 basis points). However, Cresco lags in adjusted cash flow.

Its negative $3 million adjusted figure for the first nine months of 2024, factoring in tax liabilities, contrasts sharply with Green Thumb’s $139 million (17% of sales) and Trulieve’s $37 million (4% of sales). Zuanic highlights cash flow conversion as a critical area where Cresco ‘lags’ its competitors.”

Read Also: Nebraska’s Cannabis Legalization Faces Courtroom Showdown Over Alleged Fraud

Valuation Analysis: Digging Into The Numbers

Cresco’s valuation metrics reveal potential upside. Its enterprise value (EV) to current sales ratio stands at 1.6x, lower than Curaleaf and Green Thumb, both at 2.2x. This discount extends to EV-to-EBITDA multiples, with Cresco trading at 5.5x compared to Green Thumb at 7x and Curaleaf at 10x.

These figures include tax liabilities, financial net debt, and other obligations. “Cresco’s lower EV multiples, alongside its gross cash holdings of $157 million, make it a compelling value play among Tier 1 operators,” Zuanic explains.

Strategic Hurdles And Growth Catalysts

Despite these advantages, Zuanic identifies several hurdles. Cresco’s total leverage, including financial and tax liabilities, amounts to 80% of trailing sales, the highest among Tier 1 MSOs. In contrast, Green Thumb’s leverage is just 9%. Moreover, while Cresco holds promising positions in Pennsylvania and Ohio, Zuanic emphasizes the need for a strategic partner to close the scale gap with peers like Green Thumb and Curaleaf. “A partnership would help Cresco achieve operational efficiencies and capitalize on upcoming recreational markets,” he notes.

Zuanic’s projections account for regulatory uncertainty, including delays in Pennsylvania’s adult-use legalization timeline to mid-2026 and the potential impact of federal rescheduling challenges. Nonetheless, he remains optimistic about Cresco’s long-term prospects. “We see Cresco as a buy for investors with a one-to-two-year horizon, particularly given its discounted valuation,” he concludes.

For a deeper dive into his methodology and projections, visit Zuanic & Associates’ research portal.

Read Next: DEA Slammed For Unlawful Talks With Cannabis Opponents – The Plot Thickens

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

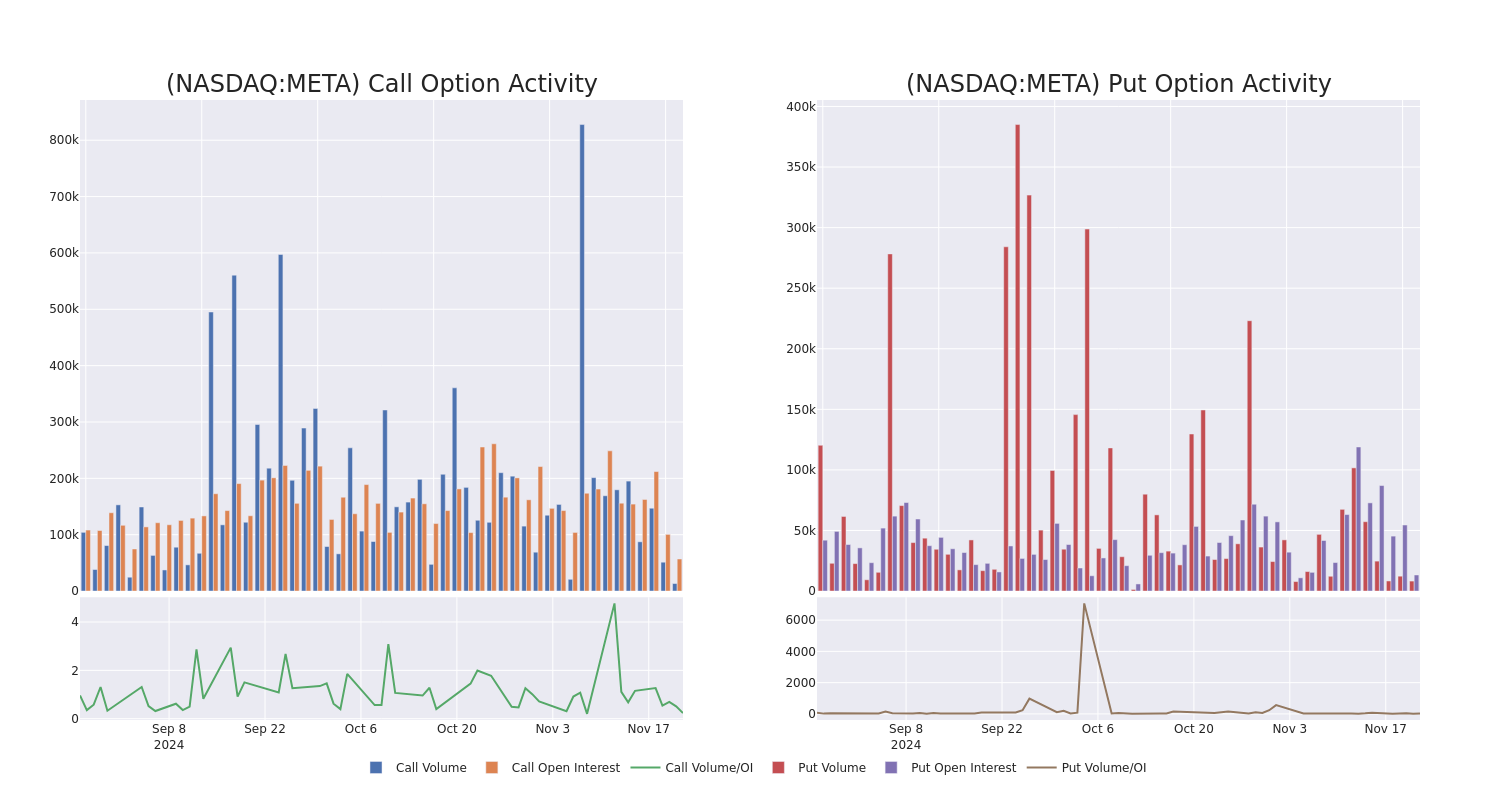

Looking At Meta Platforms's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Meta Platforms. Our analysis of options history for Meta Platforms META revealed 34 unusual trades.

Delving into the details, we found 52% of traders were bullish, while 32% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $1,346,507, and 29 were calls, valued at $1,577,731.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $5.0 to $700.0 for Meta Platforms over the recent three months.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Meta Platforms’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Meta Platforms’s significant trades, within a strike price range of $5.0 to $700.0, over the past month.

Meta Platforms Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | PUT | TRADE | BEARISH | 06/20/25 | $47.65 | $47.3 | $47.65 | $550.00 | $1.1M | 4.7K | 250 |

| META | CALL | SWEEP | BULLISH | 06/18/26 | $553.9 | $550.0 | $552.75 | $5.00 | $276.3K | 222 | 48 |

| META | CALL | SWEEP | BULLISH | 12/20/24 | $18.25 | $18.05 | $18.2 | $560.00 | $138.3K | 3.9K | 613 |

| META | CALL | SWEEP | BULLISH | 12/20/24 | $17.7 | $17.7 | $17.7 | $560.00 | $100.8K | 3.9K | 694 |

| META | CALL | SWEEP | BEARISH | 11/29/24 | $6.85 | $6.7 | $6.7 | $560.00 | $85.0K | 2.2K | 1.5K |

About Meta Platforms

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm’s “Family of Apps,” its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta’s overall sales.

In light of the recent options history for Meta Platforms, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Meta Platforms

- Trading volume stands at 6,535,996, with META’s price down by -0.59%, positioned at $559.77.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 69 days.

What The Experts Say On Meta Platforms

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $642.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for Meta Platforms, targeting a price of $705.

* An analyst from Susquehanna has decided to maintain their Positive rating on Meta Platforms, which currently sits at a price target of $675.

* Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Meta Platforms with a target price of $719.

* Maintaining their stance, an analyst from BMO Capital continues to hold a Market Perform rating for Meta Platforms, targeting a price of $530.

* An analyst from Scotiabank has decided to maintain their Sector Perform rating on Meta Platforms, which currently sits at a price target of $583.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Meta Platforms with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brandon Moss Of Shoals Technologies Gr Shows Optimism, Buys $101K In Stock

On November 21, a substantial insider purchase was made by Brandon Moss, Chief Executive Officer at Shoals Technologies Gr SHLS, as per the latest SEC filing.

What Happened: Moss made a significant move by purchasing 22,300 shares of Shoals Technologies Gr as reported in a Form 4 filing with the U.S. Securities and Exchange Commission. The transaction’s total worth stands at $101,465.

The latest update on Friday morning shows Shoals Technologies Gr shares up by 5.0%, trading at $4.62.

About Shoals Technologies Gr

Shoals Technologies Group is a provider of electrical balance of system solutions for solar energy projects, primarily in the United States. EBOS encompasses components that are necessary to carry electric current produced by solar panels to an inverter. The products are sold principally to engineering, procurement, and construction firms that build solar energy projects.

Financial Milestones: Shoals Technologies Gr’s Journey

Decline in Revenue: Over the 3 months period, Shoals Technologies Gr faced challenges, resulting in a decline of approximately -23.88% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 24.84%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Shoals Technologies Gr exhibits below-average bottom-line performance with a current EPS of -0.001596.

Debt Management: Shoals Technologies Gr’s debt-to-equity ratio is below the industry average. With a ratio of 0.26, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: Shoals Technologies Gr’s P/E ratio of 22.0 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 1.76, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an EV/EBITDA ratio lower than industry averages at 10.98, Shoals Technologies Gr could be considered undervalued.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Essential Transaction Codes Unveiled

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Shoals Technologies Gr’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.