Elevai Labs Inc. Announces Reverse Stock Split to Maintain Nasdaq Listing Compliance

NEWPORT BEACH, Calif., Nov. 22, 2024 (GLOBE NEWSWIRE) — Elevai Labs Inc. ELAB (Elevai” or the “Company”) announced today it will implement a 1-for-200 reverse stock split (“Reverse Stock Split”) of its common stock, which will be effective at midnight on November 27, 2024. This initiative aligns with the Company’s efforts to meet Nasdaq’s minimum bid price requirement of $1.00 per share under Listing Rule 5550(a)(2).

Key Details of the Reverse Stock Split:

– Conversion Ratio: Every 200 shares of issued and outstanding common stock will be automatically consolidated into one share, with no action required from shareholders.

– Fractional Shares: Shareholders entitled to fractional shares will receive one full share for each fractional portion.

– Updated Stock Identifier: While the trading symbol remains “ELAB”, the common stock now carries a new CUSIP number (28622K 203).

– Equity Adjustments: Outstanding stock awards, options, and the equity incentive plan have been adjusted proportionally to reflect the new share structure.

Purpose of the Reverse Stock Split:

The Reverse Stock Split is a critical step in ensuring compliance with Nasdaq’s listing requirements, allowing Elevai to maintain its presence on the Nasdaq Capital Market. A continued listing enhances the Company’s visibility, strengthens investor confidence, and positions Elevai for future growth.

Impact on Shareholders:

– No Immediate Action Required: Shareholders holding shares through a broker or in “street name” will see their holdings updated automatically.

– Certificate Holders: Shareholders with physical certificates can exchange them, if desired, through VStock Transfer, LLC, which will provide detailed instructions.

– Share Value: The Reverse Stock Split does not impact the overall value of shareholder equity; it only reduces the number of shares outstanding while proportionally adjusting the share price.

Impact on our Common Stock:

– Post Reverse Stock Split there will be approximately 3.07 million shares of common stock issued and outstanding

Looking Ahead:

“The reverse stock split is a required measure to preserve Elevai’s Nasdaq listing and set the stage for our continued progress in innovation and shareholder value creation,” said Graydon Bensler, Chief Executive Officer of Elevai. “We are optimistic about the future and committed to executing our growth strategy.”

For additional information, please refer to Elevai’s full Form 8-K filing available regarding the Reverse Stock Split, filed on November 22, 2024, on the SEC’s website, or contact Elevai directly at IR@elevailabs.com.

About Elevai Labs, Inc.

Elevai Labs Inc. ELAB specializes in medical aesthetics and biopharmaceutical drug development, focusing on innovations for skin aesthetics and treatments tied to obesity and metabolic health. The Company operates a diverse portfolio of three wholly owned subsidiaries across the medical aesthetics and biopharmaceutical sectors, Elevai Skincare Inc., Elevai Biosciences Inc., and Elevai Research Inc. For more information please visit www.elevailabs.com.

Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Words such as “believes,” “expects,” “plans,” “potential,” “would” and “future” or similar expressions such as “look forward” are intended to identify forward-looking statements. Forward-looking statements are made as of the date of this press release and are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, activities of regulators and future regulations and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results. Therefore, you should not rely on any of these forward-looking statements. These and other risks are described more fully in Elevai’s filings with the United States Securities and Exchange Commission (“SEC”), including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 29, 2024, and its other documents subsequently filed with or furnished to the SEC. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at www.sec.gov. All forward-looking statements contained in this press release speak only as of the date on which they were made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

IR Contact:

IR@ElevaiLabs.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of JD.com's Latest Options Trends

Deep-pocketed investors have adopted a bullish approach towards JD.com JD, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in JD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 12 extraordinary options activities for JD.com. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 41% bearish. Among these notable options, 10 are puts, totaling $365,631, and 2 are calls, amounting to $146,200.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $29.0 and $44.0 for JD.com, spanning the last three months.

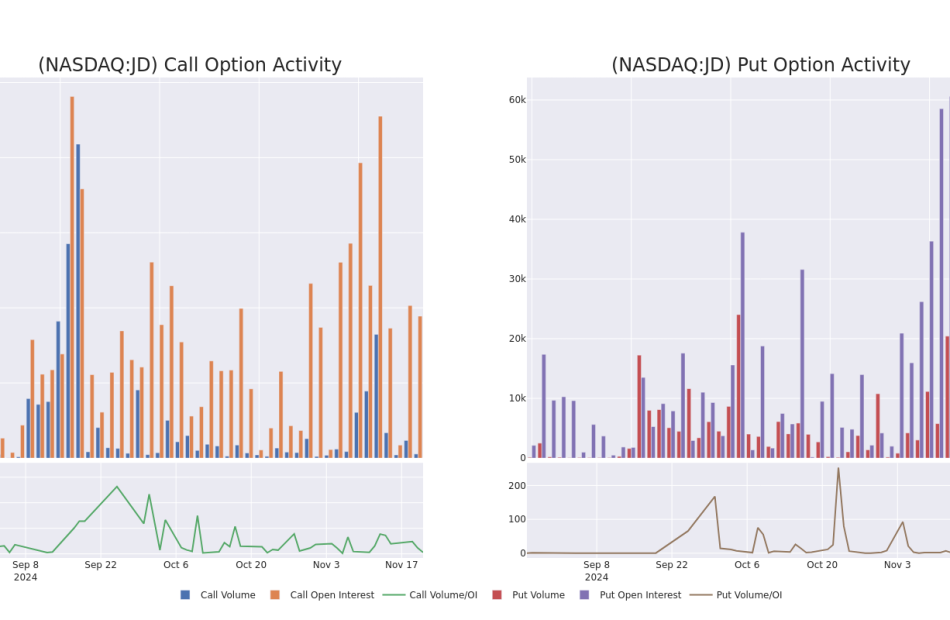

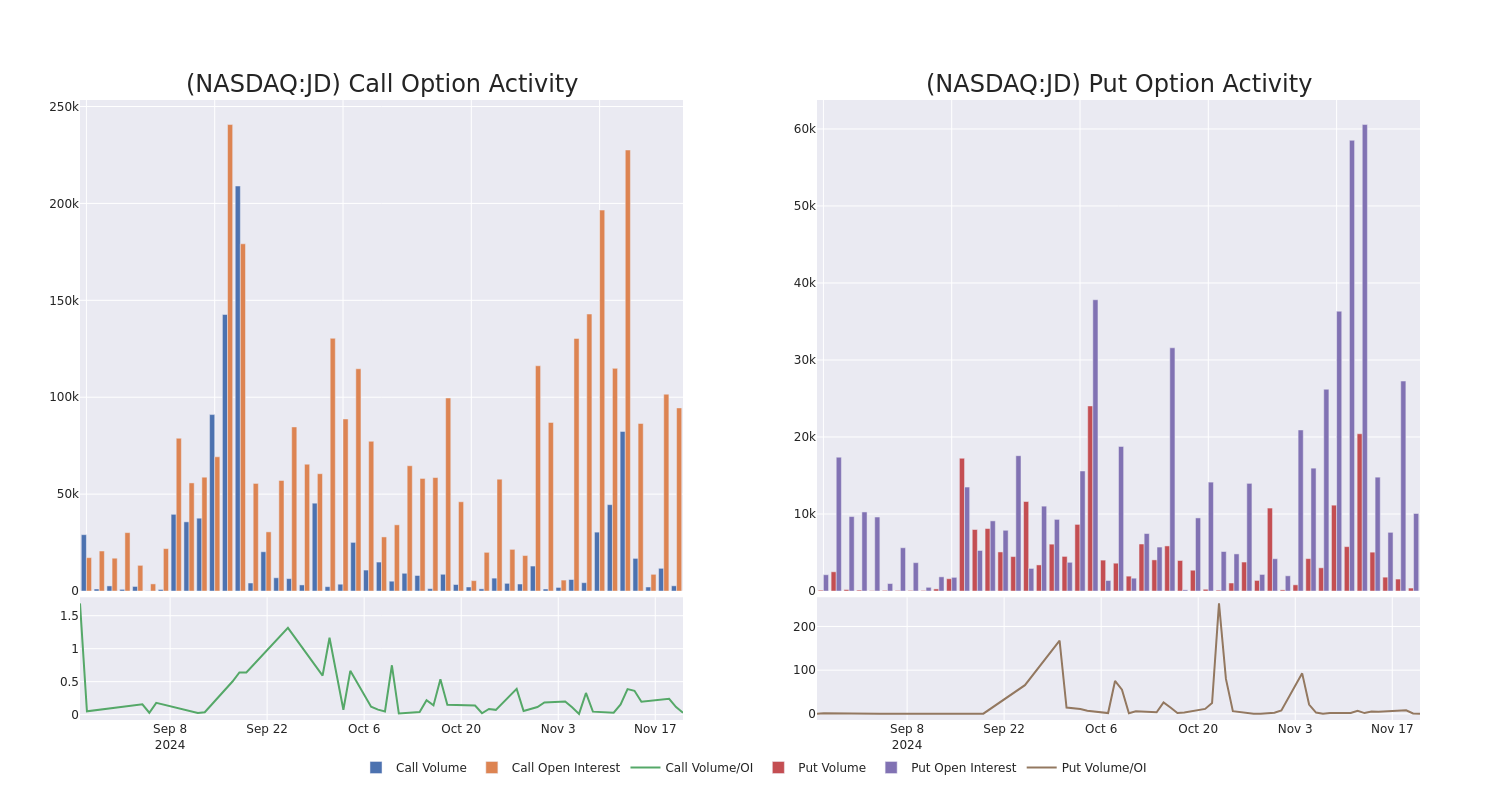

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JD.com’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com’s whale activity within a strike price range from $29.0 to $44.0 in the last 30 days.

JD.com Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | SWEEP | BULLISH | 04/17/25 | $4.25 | $4.05 | $4.21 | $35.00 | $84.2K | 122 | 200 |

| JD | PUT | SWEEP | BEARISH | 01/17/25 | $9.55 | $9.4 | $9.45 | $44.00 | $67.1K | 1.0K | 80 |

| JD | CALL | TRADE | BULLISH | 12/20/24 | $1.55 | $1.49 | $1.55 | $35.00 | $62.0K | 3.9K | 411 |

| JD | PUT | SWEEP | BEARISH | 03/21/25 | $2.84 | $2.81 | $2.84 | $34.00 | $56.8K | 1.0K | 243 |

| JD | PUT | TRADE | BULLISH | 02/21/25 | $2.27 | $2.25 | $2.25 | $34.00 | $35.3K | 1.8K | 200 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

Having examined the options trading patterns of JD.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

JD.com’s Current Market Status

- Trading volume stands at 7,562,490, with JD’s price down by -1.94%, positioned at $34.7.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 103 days.

What Analysts Are Saying About JD.com

2 market experts have recently issued ratings for this stock, with a consensus target price of $49.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for JD.com, targeting a price of $51.

* Reflecting concerns, an analyst from Benchmark lowers its rating to Buy with a new price target of $47.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for JD.com with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

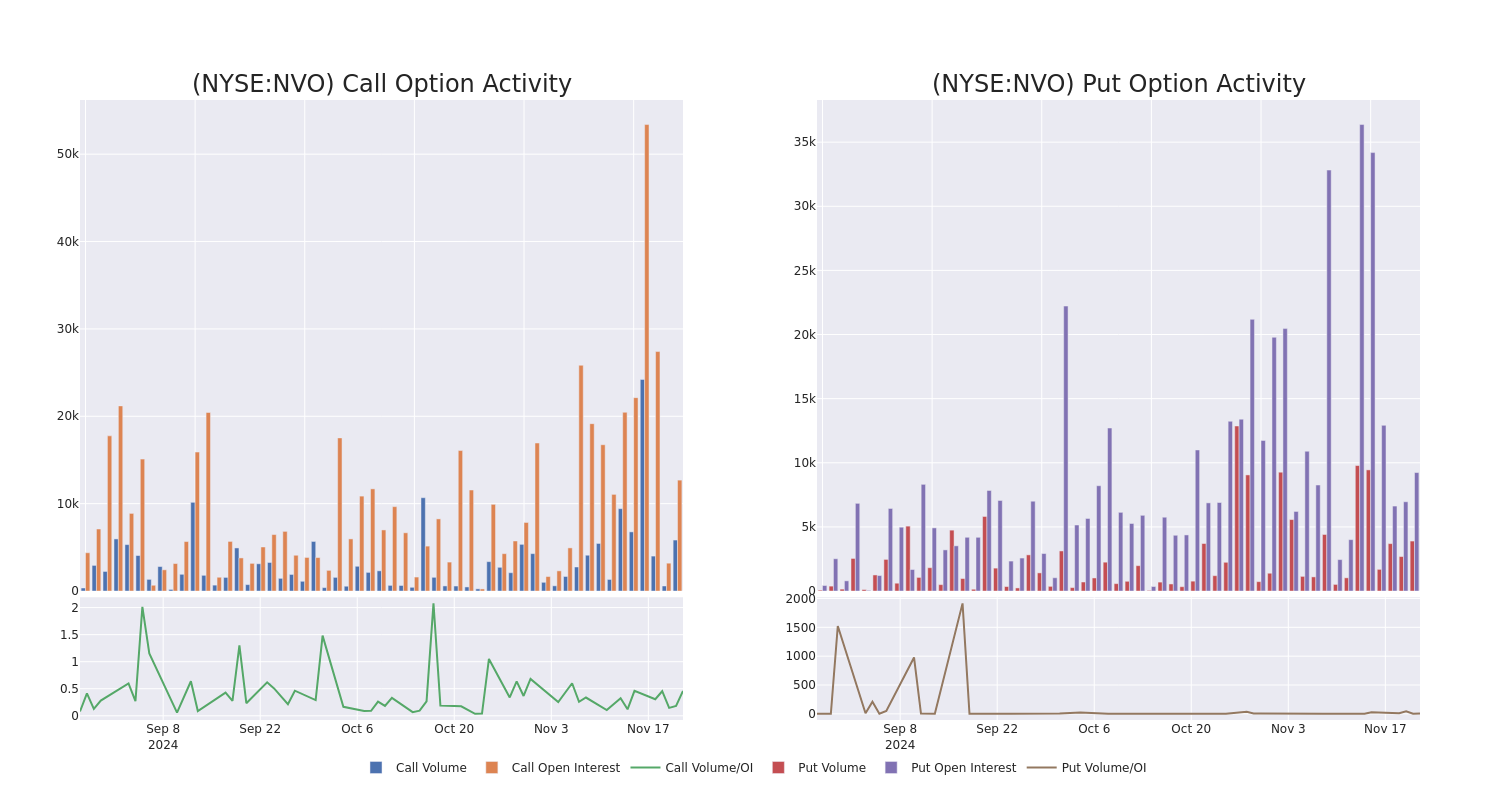

Smart Money Is Betting Big In NVO Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Novo Nordisk.

Looking at options history for Novo Nordisk NVO we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 40% of the investors opened trades with bullish expectations and 48% with bearish.

From the overall spotted trades, 11 are puts, for a total amount of $1,872,600 and 14, calls, for a total amount of $3,590,645.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $65.0 to $145.0 for Novo Nordisk during the past quarter.

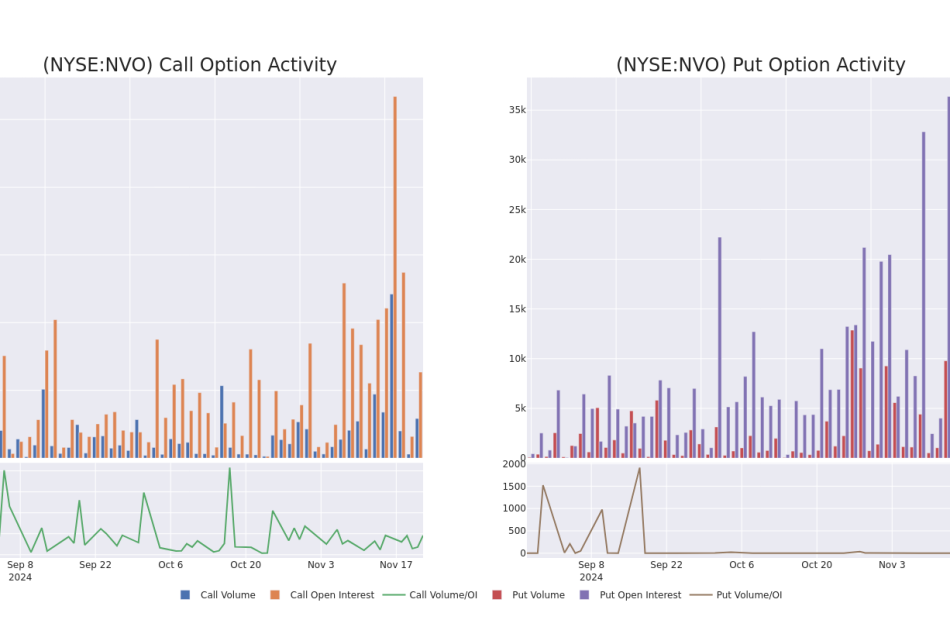

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk’s substantial trades, within a strike price spectrum from $65.0 to $145.0 over the preceding 30 days.

Novo Nordisk Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | CALL | TRADE | BULLISH | 12/20/24 | $7.8 | $7.6 | $7.8 | $102.00 | $1.3M | 270 | 1.7K |

| NVO | PUT | TRADE | BEARISH | 01/17/25 | $5.2 | $4.9 | $5.2 | $100.00 | $780.0K | 4.6K | 2.0K |

| NVO | CALL | SWEEP | BULLISH | 01/17/25 | $3.85 | $3.65 | $3.84 | $115.00 | $686.9K | 2.9K | 1.9K |

| NVO | CALL | TRADE | BEARISH | 06/20/25 | $13.45 | $13.1 | $13.15 | $105.00 | $636.4K | 1.1K | 984 |

| NVO | PUT | SWEEP | BEARISH | 01/17/25 | $5.25 | $5.15 | $5.15 | $100.00 | $257.5K | 4.6K | 500 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

Where Is Novo Nordisk Standing Right Now?

- With a volume of 4,857,497, the price of NVO is up 2.5% at $105.2.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 68 days.

What Analysts Are Saying About Novo Nordisk

1 market experts have recently issued ratings for this stock, with a consensus target price of $160.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $160.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Novo Nordisk, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Essence Atkins, Terri J Vaughn, Vanessa Bell Calloway, Hannah Whitley, Tyler Whitley, Aasha Davis to star in BET+ Holiday Comedy "Queens of Christmas"

LOS ANGLES, Nov. 22, 2024 (GLOBE NEWSWIRE) — Worldwide Entertainment and Media reports Essence Atkins (Poppa’s House), Terri J Vaughn (The Steve Harvey Show), Vanessa Bell Calloway (Coming to America), Tyler Whitley (Father of The Bride), Hannah Whitley (Encounters), and Aasha Davis (Friday Night Lights) star in the upcoming BET+ Holiday Comedy “Queens of Christmas”.

Written by Chad Quinn (Christmas Party Crashers) and Kenny Young (Never Alone For Christmas), “Queens of Christmas” is directed by Kenny Young (Merry Ex-Mas) the movie is and is slated to premiere on BET+ December 19th, 2024.

Doris and Julia, life-long friends and feuding neighbors, engage in a hilarious competition for the annual ‘Queen of Christmas’ title, which has been won by their annoying neighbor Nancy every year! But will this year be their year? Doris and Julia will soon discover the true spirit of the holiday and the value of their sisterly bond along the way.

“Queens of Christmas” will make you laugh and want to hug your best friend while showing the true meaning of sisterhood, said Julie Solinger, Producer.

A Media Snippet accompanying this announcement is available by clicking on this link.

BET+ Original Movie | Queens of Christmas | Trailer

Rounding out the cast is Russell G Jones, Carl Gilliard, Marjorie Johnson, Curtis Wiley, Isaiah Romain, Danielle Baez, Jada Elena Wooten, Bear Jackson and Gary Budoff.

The film is produced by Worldwide Entertainment and Media and Choice Films for BET+. Produced by Pierre Romain, Julie Solinger, Summer Crockett Moore, and Tony Glazer. Executive Produced by Michael Laundon and Michael Bassick. Associate Produced by Anthony Commodore, Taleo Coles, Brandon Scott and Bree Michael Warner.

Contact:

Worldwide Entertainment and Media, LLC.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/47f454c7-e676-497f-a8f6-1524bb8ac4c2

https://www.globenewswire.com/NewsRoom/AttachmentNg/de4f8fc9-df0c-4425-92ac-5443f94260d4

A video accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/be80c04d-d5ed-4635-bae5-9ba98d2861af

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Netflix Boxing Battle Decided In The Ring, But Paul's $16M Mansion Takes The Real Estate Crown

Jake Paul was victorious in Friday’s highly anticipated Netflix boxing match against Mike Tyson and his real estate portfolio seems to outshine the boxing legend’s holdings too.

The 27-year-old YouTuber-turned-boxer won unanimously and bought a $16 million compound that dwarfs Tyson’s Nevada residence.

Don’t Miss:

Paul’s recently acquired estate in Dorado, Puerto Rico, shows the social media star’s success outside the ring. The eight-bedroom, eight-bathroom compound underwent $2.1 million in renovations after its 2023 purchase.

In a recent YouTube tour titled “My new $20,000,000 house tour,” Paul highlighted his changes, including a redesigned entrance for improved energy flow.

According to Realtor.com, the property includes several distinctive amenities, such as a 40-person hot tub and dedicated office space for Paul’s content production team. His garage also received a custom makeover to accommodate his growing car collection.

By comparison, Tyson’s real estate footprint appears modest.

The former heavyweight champion’s current residence, a $2.5 million mansion in Henderson, Nevada, has appreciated to an estimated $4.7 million, according to Realtor.com. The 8,000-square-foot home, where he lives with his wife, Lakiha Spicer and their children, has six bedrooms and six bathrooms.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, with minimum investments as low as $100 for properties like the Byer House from Stranger Things.

According to the report, Tyson’s real estate history includes a previous 19,500-square-foot estate in Southington, Ohio, which he sold for $1.3 million during financial difficulties in the late 1990s.

The 58-acre property’s subsequent owner never occupied it, serving time in prison for money laundering.

The record-breaking boxing match, which earned Paul roughly $40 million and Tyson $20 million, further widens the wealth gap between the two fighters. According to CBS News, Paul said he wanted to fight again after the victory, targeting a championship title within two years. “I truly believe in my skills, my ability and my power,” he said, setting his sights on the cruiserweight division.

While Tyson acknowledged the loss gracefully, posting “This is one of those situations when you lost but still won” on X, formerly Twitter.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Options Movement At Carlisle Companies: David W Smith Exercises Worth $80K

On November 21, it was revealed in an SEC filing that David W Smith, VP at Carlisle Companies CSL executed a significant exercise of company stock options.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Smith, VP at Carlisle Companies, a company in the Industrials sector, just exercised stock options worth 275 shares of CSL stock with an exercise price of $150.0.

Carlisle Companies shares are trading, exhibiting up of 0.2% and priced at $442.41 during Friday’s morning. This values Smith’s 275 shares at $80,412.

Delving into Carlisle Companies’s Background

Carlisle Companies Inc is a holding company. The company manufactures and sells single-ply roofing products and warranted systems and accessories for the commercial building industry. The company is organized into two segments including Carlisle Construction Materials and Carlisle Weatherproofing Technologies. The company’s product portfolio includes moisture protection products, protective roofing underlayments, integrated air and vapor barriers, spray polyurethane foam and coating systems, and others. The majority of the company’s revenue comes from the Carlisle Construction Materials segment, and more than half of the total revenue is earned in the United States.

Carlisle Companies: Delving into Financials

Revenue Growth: Carlisle Companies displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 5.86%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company sets a benchmark with a high gross margin of 38.57%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Carlisle Companies’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 5.31.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.83.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 23.69 is lower than the industry average, implying a discounted valuation for Carlisle Companies’s stock.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 4.22 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Carlisle Companies’s EV/EBITDA ratio at 14.94 suggests potential undervaluation, falling below industry averages.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

A Closer Look at Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Carlisle Companies’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

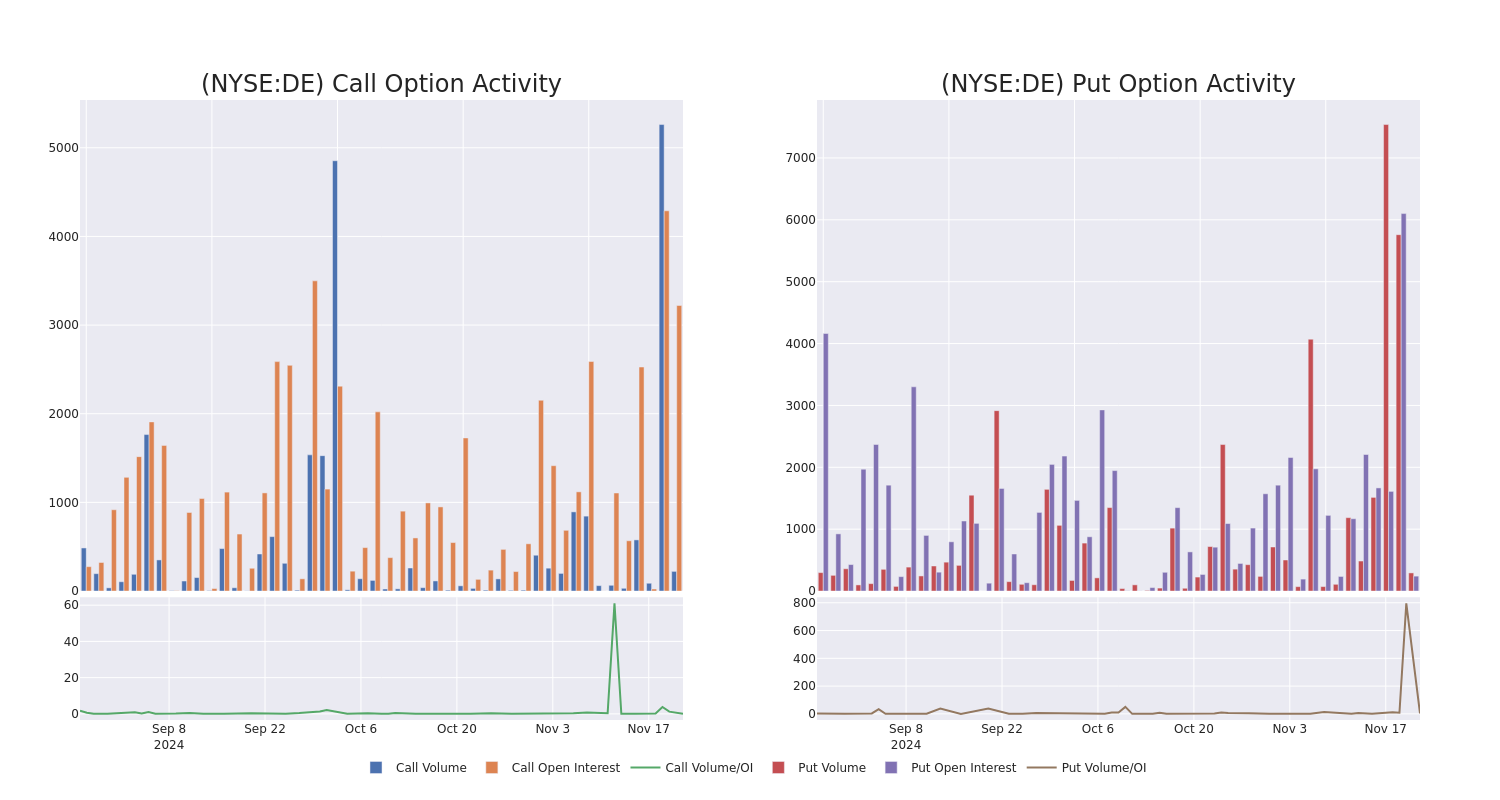

Behind the Scenes of Deere's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Deere DE.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 16 uncommon options trades for Deere.

This isn’t normal.

The overall sentiment of these big-money traders is split between 43% bullish and 43%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $301,147, and 10 are calls, for a total amount of $1,023,353.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $185.0 to $470.0 for Deere over the last 3 months.

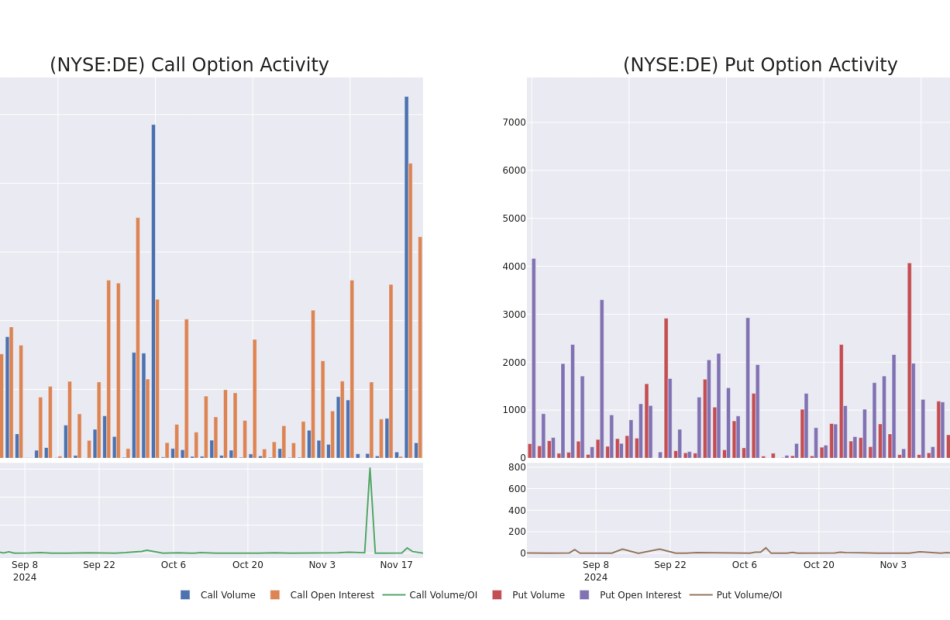

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Deere’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Deere’s whale trades within a strike price range from $185.0 to $470.0 in the last 30 days.

Deere 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | CALL | TRADE | BEARISH | 06/20/25 | $265.4 | $261.2 | $261.2 | $185.00 | $444.0K | 1 | 17 |

| DE | CALL | TRADE | BEARISH | 11/22/24 | $41.15 | $33.7 | $33.75 | $397.50 | $168.7K | 88 | 50 |

| DE | CALL | SWEEP | BULLISH | 06/20/25 | $23.0 | $22.5 | $23.0 | $470.00 | $138.0K | 239 | 60 |

| DE | CALL | TRADE | NEUTRAL | 01/17/25 | $43.85 | $42.85 | $43.28 | $400.00 | $60.5K | 904 | 20 |

| DE | PUT | TRADE | BULLISH | 12/06/24 | $7.05 | $5.5 | $6.1 | $430.00 | $51.8K | 104 | 89 |

About Deere

Deere is the world’s leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

In light of the recent options history for Deere, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Deere Standing Right Now?

- With a trading volume of 1,458,238, the price of DE is up by 1.71%, reaching $445.02.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 83 days from now.

Professional Analyst Ratings for Deere

In the last month, 4 experts released ratings on this stock with an average target price of $485.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Neutral rating on Deere with a target price of $450.

* An analyst from Truist Securities has decided to maintain their Buy rating on Deere, which currently sits at a price target of $538.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Deere, targeting a price of $475.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Deere with a target price of $477.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deere options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gamblers Are Sinking Billions Into a Leveraged Market Fringe

(Bloomberg) — The buy-everything mania that greeted Donald Trump’s election is cooling in the tried-and-tested world of stocks and corporate credit. Yet on Wall Street’s speculative fringes, the risk-taking frenzy is only getting bigger by the day.

Most Read from Bloomberg

Heavy trading — and big price moves — in everything from crypto to leveraged exchange-traded funds was the story in a week where swings in the S&P 500 and Nasdaq 100 finally started to abate.

Ground zero for the casino crowd: The $140 billion complex of amped-up exchange-traded funds tracking the likes of Big Tech stocks, Michael Saylor’s Bitcoin proxy MicroStrategy Inc., and more. Gamblers are flocking to vehicles that boost gains and losses across indexes and companies including the Magnificent Seven darlings. Single-name leveraged products have been trading $86 billion this week — a record.

It’s the latest frothy chapter in a marquee year for risky assets, courtesy of the booming economy and Trump’s election pledges — no matter how long the Federal Reserve is taking to cut interest rates.

The gains have fattened brokerage accounts just in time for the holiday shopping season. Yet at this rate, the gambling spirits are running high enough to give market pros pause.

“This euphoria is rampant speculation on par with the 2000 peak,” said Michael O’Rourke, chief market strategist at JonesTrading. “These levels of momentum and turnover are hard to maintain for an extended period of time.”

Gyrations are slowing down in the less-exotic assets. While the S&P 500 gained at a healthy clip — 1.7% this week — it was the smallest move since before election day. Daily changes in 10-year Treasury yields have averaged less than 2 basis points since Nov. 14, compared with more than 7 basis points in the two weeks prior.

No corner of the juiced-up ETF world saw more action this week than funds centered on MicroStrategy, the software firm Saylor has transformed into what amounts to a pure-play bet on Bitcoin. Two leveraged funds based on the company saw a combined $420 million inflow amid a 24% surge for the underlying stock this week.

The popularity of the two funds has led some market-observers to point to a leveraged-loop buying frenzy. It goes like this: Investor demand for the ETFs pushes up the price of MicroStrategy, allowing it to raise more money and further prop up Bitcoin itself. The world’s biggest digital token is up more than 40% in November alone and climbed each day this week to get within a few hundred dollars of $100,000.

Franklin Templeton Canada Announces ETF Cash Distributions and Estimated Annual Reinvested Distributions

TORONTO, Nov. 22, 2024 /CNW/ – Franklin Templeton Canada today announced cash distributions for certain ETFs and ETF series of mutual funds available to Canadian investors.

As detailed in the table below, unitholders of record as of November 29, 2024, will receive a per-unit cash distribution payable on December 9, 2024.

|

Fund Name |

Ticker |

Type |

Cash ($) |

Payment Frequency |

|

Franklin Brandywine Global Sustainable Income Optimiser Fund – ETF Series |

FBGO |

Active |

0.090153 |

Monthly |

|

Franklin ClearBridge Sustainable Global Infrastructure Income Fund – ETF Series |

FCII |

Active |

0.011902 |

Monthly |

|

Franklin Canadian Government Bond Fund – ETF Series |

FGOV |

Active |

0.049478 |

Monthly |

|

Franklin Canadian Ultra Short Term Bond Fund – ETF Series |

FHIS |

Active |

0.066623 |

Monthly |

|

Franklin Canadian Corporate Bond Fund – ETF Series |

FLCI |

Active |

0.066540 |

Monthly |

|

Franklin Canadian Core Plus Bond Fund – ETF Series |

FLCP |

Active |

0.049906 |

Monthly |

|

Franklin Global Core Bond Fund – ETF Series |

FLGA |

Active |

0.036584 |

Monthly |

|

Franklin Canadian Short Term Bond Fund – ETF Series |

FLSD |

Active |

0.061568 |

Monthly |

|

Franklin Canadian Low Volatility High Dividend Index ETF |

FLVC |

Passive |

0.056133 |

Monthly |

|

Franklin International Low Volatility High Dividend Index ETF |

FLVI |

Passive |

0.068600 |

Monthly |

|

Franklin U.S. Low Volatility High Dividend Index ETF |

FLVU |

Passive |

0.037867 |

Monthly |

Estimated Annual Reinvested Distributions

Unitholders of record on December 31, 2024, will receive a per-unit reinvested distribution payable on January 9, 2025. These annual reinvested distributions, detailed in the table below, are estimates only as of September 30, 2024. The final year-end distribution amounts will be announced on December 20, 2024.

|

Fund Name |

Ticker |

Type |

Estimated |

|

Franklin Core ETF Portfolio – ETF Series |

CBL |

Active |

0.345380 |

|

Franklin Conservative Income ETF Portfolio – ETF Series |

CNV |

Active |

– |

|

Franklin All-Equity ETF Portfolio – ETF Series |

EQY |

Active |

0.068630 |

|

Franklin Brandywine Global Sustainable Income Optimiser Fund – ETF Series |

FBGO |

Active |

– |

|

Franklin ClearBridge Sustainable Global Infrastructure Income Fund – ETF Series |

FCII |

Active |

– |

|

Franklin ClearBridge Sustainable International Growth Fund – ETF Series |

FCSI |

Active |

– |

|

Franklin Global Growth Fund – ETF Series |

FGGE |

Active |

– |

|

Franklin Canadian Government Bond Fund – ETF Series |

FGOV |

Active |

– |

|

Franklin Canadian Ultra Short Term Bond Fund – ETF Series |

FHIS |

Active |

– |

|

Franklin Innovation Fund – ETF Series |

FINO |

Active |

– |

|

Franklin FTSE U.S. Index ETF |

FLAM |

Passive |

0.158483 |

|

Franklin FTSE Canada All Cap Index ETF |

FLCD |

Passive |

– |

|

Franklin Canadian Corporate Bond Fund – ETF Series |

FLCI |

Active |

– |

|

Franklin Canadian Core Plus Bond Fund – ETF Series |

FLCP |

Active |

– |

|

Franklin Emerging Markets Equity Index ETF |

FLEM |

Passive |

– |

|

Franklin Global Core Bond Fund – ETF Series |

FLGA |

Active |

– |

|

Franklin FTSE Japan Index ETF |

FLJA |

Passive |

– |

|

Franklin Canadian Short Term Bond Fund – ETF Series |

FLSD |

Active |

– |

|

Franklin International Equity Index ETF |

FLUR |

Passive |

0.029145 |

|

Franklin U.S. Large Cap Multifactor Index ETF |

FLUS |

Smart Beta |

2.299712 |

|

Franklin Canadian Low Volatility High Dividend Index ETF |

FLVC |

Passive |

0.127420 |

|

Franklin International Low Volatility High Dividend Index ETF |

FLVI |

Passive |

0.287091 |

|

Franklin U.S. Low Volatility High Dividend Index ETF |

FLVU |

Passive |

0.040207 |

|

Franklin Growth ETF Portfolio – ETF Series |

GRO |

Active |

0.598660 |

The annual reinvested distributions, as applicable, will not be paid in cash but reinvested in additional units and reported as taxable distributions, with a corresponding increase in each unitholder’s adjusted cost base of their units of the respective ETF. The additional ETF units will be immediately consolidated so that the number of units held by the unitholder, the outstanding units and the net asset value of the ETFs will not change as a result of the annual reinvested distribution. The annual reinvested distributions, as applicable, are expected to be capital gains in nature for each of the ETFs.

The actual taxable amounts of cash and reinvested distributions for 2024, including the tax characteristics of the distributions, will be reported to brokers through CDS Clearing and Depository Services Inc. in early 2025.

Franklin Templeton’s diverse and innovative ETF platform was built to provide better client outcomes for a range of market conditions and investment opportunities. The product suite offers active, smart beta and passive ETFs that span multiple asset classes and geographies. For more information, please visit franklintempleton.ca/etf.

About Franklin Templeton

Franklin Resources, Inc. BEN is a global investment management organization with subsidiaries operating as Franklin Templeton and serving clients in over 150 countries. In Canada, the company’s subsidiary is Franklin Templeton Investments Corp., which operates as Franklin Templeton Canada. Franklin Templeton’s mission is to help clients achieve better outcomes through investment management expertise, wealth management and technology solutions. Through its specialist investment managers, the company offers specialization on a global scale, bringing extensive capabilities in fixed income, equity, alternatives and multi-asset solutions. With more than 1,500 investment professionals, and offices in major financial markets around the world, the California-based company has over 75 years of investment experience and over US$1.6 trillion (over CAN$2.2 trillion) in assets under management as of October 31, 2024. For more information, please visit franklintempleton.ca.

Commissions, management fees and expenses all may be associated with investments in ETFs and ETF series. Investors should carefully consider an ETF’s and ETF series’ investment objectives and strategies, risks, fees and expenses before investing. The prospectus and ETF facts contain this and other information. Please read the prospectus and ETF facts carefully before investing. ETFs and ETF series trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF and ETF series expenses will reduce returns. ETFs and ETF series are not guaranteed, their values change frequently, and past performance may not be repeated.

Copyright © 2024. Franklin Templeton. All rights reserved.

SOURCE Franklin Templeton Investments Corp.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c5240.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/22/c5240.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Options Movement At Aramark: James Tarangelo Exercises Worth $148K

A large exercise of company stock options by James Tarangelo, SVP and CFO at Aramark ARMK was disclosed in a new SEC filing on November 21, as part of an insider exercise.

What Happened: Tarangelo, SVP and CFO at Aramark, exercised stock options for 8,365 shares of ARMK stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The exercise price of the options was $20.67 per share.

As of Friday morning, Aramark shares are down by 4.85%, with a current price of $38.46. This implies that Tarangelo’s 8,365 shares have a value of $148,813.

Discovering Aramark: A Closer Look

Aramark provides food, facilities, and uniform services to a variety of clients and institutions. The majority of company revenue comes from its North American food and support services segment. Smaller but substantial segments include food and support services international, food and support services united states and uniform and career apparel. The food and support services segments provide food for school districts; colleges; healthcare facilities; correctional institutions; and business, sports, and entertainment venues. The uniform segment rents, delivers, cleans, and maintains work clothes and ancillary items like towels and mats to customers in North America and Japan. The company has hundreds of service locations and distribution centers across the United States and Canada.

A Deep Dive into Aramark’s Financials

Positive Revenue Trend: Examining Aramark’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 5.16% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Exploring Profitability:

-

Gross Margin: The company faces challenges with a low gross margin of 8.99%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Aramark exhibits below-average bottom-line performance with a current EPS of 0.46.

Debt Management: Aramark’s debt-to-equity ratio is below the industry average. With a ratio of 1.83, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 40.83 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.62 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 13.05 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Aramark’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.