2024 Election Housing Measures: What Passed, What Failed And What It Means For Supply, According To Redfin Chief Economist

Recent elections across the U.S. delivered mixed results for housing initiatives, with voters showing strong support for funding affordable housing while remaining skeptical of rent control measures, according to an analysis by Redfin Chief Economist Daryl Fairweather.

Rhode Island became a standout success story, with voters overwhelmingly approving a record-breaking $120 million housing bond. The measure, nearly doubling the state’s previous housing investment from three years ago, signals growing public recognition of the housing crisis.

Don’t Miss:

Several major cities also secured funding for affordable housing initiatives. Los Angeles voters approved a new half-cent sales tax for housing development, while Charlotte, North Carolina, passed a $100 million housing bond package. Baltimore followed with a $20 million bond measure for affordable housing projects.

San Francisco’s Proposition G secured $8.25 million annually for low-income rental subsidies, though Fairweather noted it might serve as a temporary fix rather than a long-term solution. “This helps low-income renters in the short term, but without adding more housing, it’s just a Band-Aid on the problem,” she said on X, formerly Twitter.

However, not all housing measures succeeded.

Denver voters narrowly rejected Ballot Issue 2R, which would have generated $100 million annually through a sales tax increase for new housing development. California saw the defeat of two significant proposals: Proposition 33, which would have loosened rent control restrictions and Proposition 5, which aimed to lower the supermajority threshold for housing bonds.

See Also: Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — you can become an investor for $0.80 per share today.

The rejection of rent control measures extended beyond California. Hoboken, New Jersey voters struck down a proposal to raise rent caps on vacant units. Fairweather views the outcomes as potentially positive for housing supply, stating, “strict rent control keeps existing tenants happy but limits new investment and leads to fewer rentals in the long run.”

Local initiatives employed various approaches to raise housing funds. According to the Institute on Taxation and Economic Policy, communities used diverse funding mechanisms, including sales taxes in Lawrence, Kansas, real estate transfer taxes in Berkeley and Mountain View, California and lodging taxes in several Colorado municipalities.

Berkeley bucked the trend against rent control by approving Measure BB’s 5% rent cap. However, Fairweather and other economists suggest rent control measures could discourage future development. “The best way to stabilize rents is to build more homes,” Fairweather said.

Trending: Invest in $20+ trillion home equity market today across cities like Austin, Miami, and Los Angeles through a unique 5-year term fund targeting a 14-20% IRR with minimums as low as $2,500

The election results demonstrated that voters recognize the need for housing investment while remaining divided on policy approaches. While many communities showed willingness to fund affordable housing initiatives, rejecting certain measures highlights ongoing debate about the most effective solutions to address housing affordability.

Fairweather emphasized that while the Federal government can aid in the housing crisis, “local initiatives have a profound impact on the housing market, even if they don’t make national headlines.”

The mix of successful and failed measures indicates that while voters broadly support addressing housing affordability, they remain selective about specific policy solutions and funding mechanisms.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Dave Ramsey Caller Opened Up 18 Credit Cards After Bankruptcy And Is $118,000 In Debt 'To Impress People.' Her Husband Has No Idea

A recent call on The Ramsey Show featured a woman who opened up to Dave Ramsey, admitting that despite filing for bankruptcy in 2019, she’s back in debt again – to the tune of $118,000, excluding the mortgage – and her husband is completely unaware of the mess they’re in.

Don’t Miss:

“We are the poster child of trying to impress people,” the caller confessed. After buying a new house, she felt pressured to fill it with “nice things,” but this urge spiraled into financial chaos, leading her to open a staggering 18 credit cards to fund the lifestyle she thought they needed to maintain.

Her husband, who earns $35,000 a year, has no idea about their financial issues because, as she explained, “He doesn’t even have access [to our finances].” She takes home $125,000 annually, plus another $15,000 from a side hustle, yet her spending habits have left them drowning in debt – all because of a desire to project an image of success.

The caller revealed that the $118,000 in debt was spread across various sources. She owes $1,300 to the IRS and $9,500 is tied up in “pay in 4” payment plans like PayPal (NASDAQ:PYPL) and Klarna. The biggest portion of the debt –$116,000 – comes from online personal loans through platforms like Prosper. On top of that, they have a $40,000 car loan and $5,500 in credit card balances.

See Also: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – You can still get 4,000 of its pre-IPO shares for with $1,000 for just $0.25/share

This complicated mix of debt sources shows how far the situation has spiraled out of control. The buildup of loans, payment plans and credit lines has resulted in an impossible financial mess. The car loan by itself is already a big problem and with all the high-interest loans and credit card debt added on top, it’s really hard for them to make any progress without making big changes.

3 Reasons to Buy Domino's Pizza Stock Like There's No Tomorrow

People can debate their favorite toppings or preferred style of crust, but it’s hard to find someone who doesn’t love pizza. For more than 60 years, Domino’s Pizza (NYSE: DPZ) has translated that universal constant into a globally recognized brand and wildly successful franchise business.

Since the company’s initial public offering in July 2004 at $14 per share, the stock has returned 7,058%, including an ongoing 12-year streak of consecutive annual dividend increases. Indeed, there’s a lot to like about this restaurant industry pioneer which looks to be on sale, trading 20% below its 52-week high at the time of writing.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Here are three reasons Domino’s Pizza stock could be a tasty buy right now.

After emerging from a period of record growth during the pandemic’s height, Domino’s is navigating a more challenging macroeconomic environment. Rising costs, combined with budget-conscious consumers’ resistance to higher pricing, have pressured company sales and earnings, particularly between 2022 and 2023.

In response, Domino’s announced its “Hungry for MORE” strategy last year. The acronym “MORE” stands for Most Delicious Food, Operational Excellence, Renowned Value, and Enhanced by Best-in-Class Franchisees and Team Members. The strategy encompasses a series of organizational steps to jump-start growth and accelerate profitability. The recent results suggest the plan is working.

In the fiscal third quarter (ended Sept. 8), Domino’s U.S. store sales climbed by 3% year over year, reversing the 0.6% decline in Q3 2023. Improving margins have translated to a 16% increase in earnings per share (EPS) through the first nine months of the year, compared to the period in 2023.

Management is highlighting how its Hungry for MORE efforts, including a return of aggressive promotions and menu innovations, have allowed Domino’s to capture market share within the quick-service restaurant (QSR) pizza category this year.

The trends are a good sign that profitable growth can continue. Domino’s expects annual global retail sales to increase by approximately 6% in both 2024 and 2025, while targeting a stronger longer-term performance of 7% or more. The company also sees an upside in margins, allowing income from operations to outpace the top line over time.

|

Metric |

2024 estimate |

2025 estimate |

Longer-term (2026-2028) estimate |

|

Annual global retail sales growth |

6% |

6% |

7% |

|

Annual income from operations growth |

8% |

8% |

8% |

Data source: Domino’s Pizza.

This BlackRock Index Fund Could Soar 13,761%, According to MicroStrategy Chief and Billionaire Michael Saylor

Michael Saylor has had quite the year. MicroStrategy (NASDAQ: MSTR), the company he co-founded roughly 35 years ago, is up more than 500% in 2024. The billionaire has also seen his net worth climb by about $1 billion, according to Fortune.

Bitcoin (CRYPTO: BTC), the world’s largest cryptocurrency, is behind Saylor’s good fortune, as MicroStrategy is its largest publicly traded holder, and Saylor also owns a lot of Bitcoin personally. While the gains have been massive, Saylor thinks the good times are just starting to roll, and believes one BlackRock index fund could rise more than 13,760% over time.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Saylor is one of Bitcoin’s biggest bulls. MicroStrategy held the token through tougher times and is now reaping the rewards. However, Saylor sees a much brighter future for Bitcoin. In September, Saylor said he could see Bitcoin hitting $13 million by 2045.

Saylor’s logic is twofold. His first argument is that Bitcoin is only 0.1% of the world’s capital. By 2045, this number will increase to 7% of world capital, he predicts.

Saylor’s second argument concerns the growth rate of Bitcoin’s price. He said that Bitcoin has put up annual returns of 46% for the last four years. His base case assumes 29% annual returns moving forward, which is how he arrives at his $13 million target by 2045.

One exchange-traded fund (ETF) that tracks spot Bitcoin prices is the iShares Bitcoin Trust (NASDAQ: IBIT). BlackRock, the largest asset manager in the world, launched the fund earlier this year once the Securities and Exchange Commission (SEC) gave the green light for spot Bitcoin ETFs.

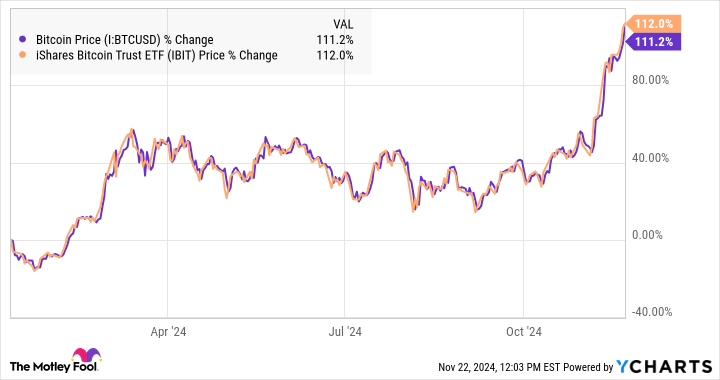

Spot Bitcoin ETFs attempt to mirror the price of Bitcoin by buying actual Bitcoin tokens to hold in reserve. Each ETF share is directly backed by a fraction of a Bitcoin, held in a custodial account on behalf of the fund manager. As expected, iShares Bitcoin Trust has almost exactly matched Bitcoin’s returns in 2024.

Purchasing a Bitcoin ETF helps investors avoid the operational, tax, and custody difficulties of purchasing actual tokens. ETFs have small fees investors must pay, which help cover things like marketing for the fund. The fee for iShares is 0.12% of each investor’s holdings until Jan. 11, 2025, or when iShares reaches $5 billion in assets, at which point the fee will double to 0.25%.

It’s impossible to know whether Saylor’s prediction will come true. Making price predictions is difficult for stable blue chip stocks, let alone volatile cryptocurrencies, and this price target is set more than two decades in the future. Additionally, the law of large numbers suggests that as Bitcoin’s price grows, it will be harder to realize the same incredible gains.

Debt Piles Up And Losses Mount – Spirit Airlines Finally Files For Bankruptcy After Struggling To Stay Afloat

Spirit Airlines has filed for Chapter 11 bankruptcy, a strategic move to stabilize its finances while keeping operations running smoothly. Known for its ultra-low-cost business model, the airline has faced mounting challenges, including over $1 billion in deferred debt, a $158 million quarterly loss this year and failed merger efforts with JetBlue and Frontier Airlines.

Don’t Miss:

According to a company statement, Spirit’s restructuring plan involves $300 million in new financing and $350 million in equity investments from bondholders, which will slash nearly $795 million in debt. The airline expects to emerge from bankruptcy by early 2025.

CEO Ted Christie assured passengers that the restructuring would not affect flights and bookings in an open letter to customers. “You can continue to book and fly confidently now and in the future,” Christie said. Spirit has pledged to maintain ticket sales, flights and loyalty programs without disruption throughout the process.

Spirit’s financial woes didn’t develop overnight. According to CNBC, the airline hasn’t turned a profit since 2019, when it lost $335 million. The COVID-19 pandemic significantly affected travel demand, hitting Spirit’s operations hard.

See Also: ‘Scrolling To UBI’ — Deloitte’s #1 fastest-growing software company allows users to earn money on their phones. You can invest TODAY for just $0.26/share with a $1000 minimum.

The recall of Pratt & Whitney engines in 2023 further strained the airline by disrupting fleet availability, while rising fuel costs and stiff competition from larger carriers put additional pressure on margins.

Regulatory hurdles compounded these challenges. In January, U.S. courts blocked Spirit’s $3.8 billion merger with JetBlue, citing concerns about reduced competition in the budget travel market.

Analysts warn, however, that more drastic measures, such as cutting routes or reducing flight frequencies, could still be necessary. Statista reported that Spirit’s total flight capacity declined by 33% to 27.7 billion available seat miles between 2019 and 2020.

TD Cowen’s senior research analyst, Helane Becker, told CNBC, “Spirit Airlines’ goal should be to preserve value as much as they can.”

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

In response to its financial struggles, Spirit has begun implementing cost-saving measures. The Associated Press reported that the airline plans to sell 23 older planes for $519 million and cut jobs, saving an estimated $80 million annually.

The Wall Street Journal revealed that Spirit Airlines and Frontier Airlines have resumed talks about a potential merger, causing their stock prices to climb. However, investor confidence has faltered amid these setbacks. According to CNBC, Spirit’s stock price dropped from $3.22 to $1.15 after The Wall Street Journal reported that the company was set to file for bankruptcy.

Tom Fitzgerald, an analyst at TD Cowen, recently highlighted Spirit Airlines’ precarious situation on UPI. He stated that balancing cost-cutting measures with maintaining passenger confidence is critical for the airline’s survival. He noted that customers might begin avoiding the airline if its financial struggles intensify.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Realtor.com® October Rental Report: Rents Fall Again, With More New Units Expected in 2025

Growing supply of multifamily housing suggests a 1.1% increase in rental stock to more than 49 million units by next fall, with the biggest increases in the South and West.

SANTA CLARA, Calif., Nov. 22, 2024 /PRNewswire/ — Rents fell by -0.8% to $1,720 in October, marking their fifteenth consecutive month of year-over-year declines and falling the most for smaller-sized units, according to the Realtor.com® October Rental Report released today. Looking ahead, new rental properties coming onto the market are expected to put continued downward pressure on rents next year.

“New multifamily construction projects started in the last two years have hit the market in 2024, with a greater supply of units helping to soften rents and bring renters some relief,” said Danielle Hale, chief economist at Realtor.com®. “While we expect fewer multifamily homes to be finished in 2025, we still anticipate enough to increase supply, which will keep downward pressure on rents.”

Growing rental supply remains key for 2024 and 2025 rental market

More completed multi-family homes made their way to the market in 2024 as projects begun in 2022 and 2023 were finished. Between January and September 2024, the average seasonally adjusted annual rate of multi-family completions reached 606,000 units, up from 445,000 units in the same period in 2023, and higher than the 2017-19 pre-pandemic average of 359,000 units. While a lower rate of completions is anticipated for next year, rental housing stock is still expected to rise by 1.1% to more than 49 million units by fall 2025, which would be 6.7% higher than in the fall of 2019, before the pandemic.

Rental stock is expected to increase most in the South by fall 2025

New multifamily completions rose in all regions of the country this year, with the biggest year-over-year gains seen in the South (49.1%) followed by the Midwest (44.9%), West (23.9%) and Northeast (7.4%). That has translated to lower median asking rents. In the South, the biggest annual drops in median asking rent in October were seen in Memphis, Tenn. (-5.4%), and Nashville, Tenn. (-5.2%). In the Midwest, the biggest annual decline was in Chicago (-4.1%) and in the West, rent declines were led by Denver (-5.6%) and Phoenix (-4.5%). Large Northeastern metro areas, such as New York (0.4%), have seen small increases in rent due to relatively slower increases in the supply of new rental homes.

By fall 2025 rental stock is estimated to increase most in the South, with a 1.5% year-over-year increase, followed by the West (1.2%), Midwest (0.9%) and Northeast (0.7%). That will translate to increases in the overall rental stock by 8.9% in the South, 8.6% in the West, 5.0% in the Northeast and 1.7% in the Midwest compared to pre-pandemic levels.

Rents decline across all unit sizes

October saw the fifteenth straight month of year-over-year rent declines for 0-2 bedroom properties. The median asking rent fell by $14, or -0.8%, to $1,720. That’s still just $40 (-2.3%) lower than its August 2022 peak, and is $272 (18.8%) higher than the same time period in 2019.

All unit sizes saw rent declines in October, with the biggest drops in smaller-sized units. The median rent for studios fell -1.2% year-over-year, to $1,436. That’s down -3.6% from its October 2022 peak but is 12.5% higher than five years ago. The median rent for one-bedroom units fell -0.9% to $1,600, 17.1% higher than five years ago. And the median rent for two-bedroom units fell -0.7% to $1,908, which is 21.1% higher than five years ago.

National Rental Data – October 2024

|

Unit Size |

Median Rent |

Rent YoY |

Rent Change – 5 years |

|

Overall |

$1,720 |

-0.8 % |

18.8 % |

|

Studio |

$1,436 |

-1.2 % |

12.5 % |

|

1-bed |

$1,600 |

-0.9 % |

17.1 % |

|

2-bed |

$1,908 |

-0.7 % |

21.1 % |

50 Largest Metropolitan Areas – October 2024

|

Metro |

Median rent (0-2 bedrooms) |

YOY (0-2 bedrooms) |

|

Atlanta-Sandy Springs-Alpharetta, GA |

$1,583 |

-3.4 % |

|

Austin-Round Rock-Georgetown, TX |

$1,495 |

-4.2 % |

|

Baltimore-Columbia-Towson, MD |

$1,827 |

0.1 % |

|

Birmingham-Hoover, AL |

$1,253 |

-2.3 % |

|

Boston-Cambridge-Newton, MA-NH |

$2,944 |

-1.7 % |

|

Buffalo-Cheektowaga, NY |

NA |

NA |

|

Charlotte-Concord-Gastonia, NC-SC |

$1,520 |

-3.8 % |

|

Chicago-Naperville-Elgin, IL-IN-WI |

$1,780 |

-4.1 % |

|

Cincinnati, OH-KY-IN |

$1,397 |

4.2 % |

|

Cleveland-Elyria, OH |

$1,222 |

0.0 % |

|

Columbus, OH |

$1,210 |

1.1 % |

|

Dallas-Fort Worth-Arlington, TX |

$1,462 |

-4.3 % |

|

Denver-Aurora-Lakewood, CO |

$1,836 |

-5.6 % |

|

Detroit-Warren-Dearborn, MI |

$1,319 |

-0.8 % |

|

Hartford-East Hartford-Middletown, CT |

NA |

NA |

|

Houston-The Woodlands-Sugar Land, TX |

$1,375 |

-1.0 % |

|

Indianapolis-Carmel-Anderson, IN |

$1,306 |

-0.1 % |

|

Jacksonville, FL |

$1,549 |

0.1 % |

|

Kansas City, MO-KS |

$1,348 |

0.4 % |

|

Las Vegas-Henderson-Paradise, NV |

$1,486 |

-1.2 % |

|

Los Angeles-Long Beach-Anaheim, CA |

$2,848 |

-0.3 % |

|

Louisville/Jefferson County, KY-IN |

$1,249 |

0.2 % |

|

Memphis, TN-MS-AR |

$1,204 |

-5.4 % |

|

Miami-Fort Lauderdale-Pompano Beach, FL |

$2,365 |

-1.3 % |

|

Milwaukee-Waukesha, WI |

$1,641 |

1.6 % |

|

Minneapolis-St. Paul-Bloomington, MN-WI |

$1,539 |

1.1 % |

|

Nashville-Davidson–Murfreesboro–Franklin, TN |

$1,556 |

-5.2 % |

|

New Orleans-Metairie, LA |

NA |

NA |

|

New York-Newark-Jersey City, NY-NJ-PA |

$2,881 |

0.4 % |

|

Oklahoma City, OK |

$1,021 |

0.7 % |

|

Orlando-Kissimmee-Sanford, FL |

$1,690 |

-1.2 % |

|

Philadelphia-Camden-Wilmington, PA-NJ-DE-MD |

$1,784 |

-0.2 % |

|

Phoenix-Mesa-Chandler, AZ |

$1,512 |

-4.5 % |

|

Pittsburgh, PA |

$1,462 |

-0.2 % |

|

Portland-Vancouver-Hillsboro, OR-WA |

$1,720 |

3.4 % |

|

Providence-Warwick, RI-MA |

NA |

NA |

|

Raleigh-Cary, NC |

$1,527 |

-1.5 % |

|

Richmond, VA |

$1,486 |

-1.5 % |

|

Riverside-San Bernardino-Ontario, CA |

$2,105 |

-2.6 % |

|

Rochester, NY |

NA |

NA |

|

Sacramento-Roseville-Folsom, CA |

$1,932 |

2.5 % |

|

San Antonio-New Braunfels, TX |

$1,250 |

-4.1 % |

|

San Diego-Chula Vista-Carlsbad, CA |

$2,764 |

-3.8 % |

|

San Francisco-Oakland-Berkeley, CA |

$2,766 |

-2.5 % |

|

San Jose-Sunnyvale-Santa Clara, CA |

$3,333 |

2.5 % |

|

Seattle-Tacoma-Bellevue, WA |

$1,998 |

-1.8 % |

|

St. Louis, MO-IL |

$1,335 |

1.4 % |

|

Tampa-St. Petersburg-Clearwater, FL |

$1,709 |

-2.0 % |

|

Virginia Beach-Norfolk-Newport News, VA-NC |

$1,524 |

0.6 % |

|

Washington-Arlington-Alexandria, DC-VA-MD-WV |

$2,271 |

2.2 % |

Methodology

Rental data as of October 2024 for studio, 1-bedroom, or 2-bedroom units advertised as for-rent on Realtor.com®. Rental units include apartments as well as private rentals (condos, townhomes, single-family homes). We use rental sources that reliably report data each month within the top 50 largest metropolitan areas. Realtor.com began publishing regular monthly rental trends reports in October 2020 with data history stretching back to March 2019.

About Realtor.com®

Realtor.com® is an open real estate marketplace built for everyone. Realtor.com® pioneered the world of digital real estate more than 25 years ago. Today, through its website and mobile apps, Realtor.com® is a trusted guide for consumers, empowering more people to find their way home by breaking down barriers, helping them make the right connections, and creating confidence through expert insights and guidance. For professionals, Realtor.com® is a trusted partner for business growth, offering consumer connections and branding solutions that help them succeed in today’s on-demand world. Realtor.com® is operated by News Corp NWS NWSA]) [ASX: NWS, NWSLV] subsidiary Move, Inc. For more information, visit Realtor.com®.

Media Contact: Mallory Micetich, press@realtor.com

![]() View original content:https://www.prnewswire.com/news-releases/realtorcom-october-rental-report-rents-fall-again-with-more-new-units-expected-in-2025-302313765.html

View original content:https://www.prnewswire.com/news-releases/realtorcom-october-rental-report-rents-fall-again-with-more-new-units-expected-in-2025-302313765.html

SOURCE Realtor.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here Are My Top Artificial Intelligence (AI) Stocks to Buy Right Now (Hint: Not Nvidia)

There are many ways to buy into the artificial intelligence (AI) frenzy. Many investors look to AI hardware designer Nvidia, making the former video gaming accelerator maven one of the most valuable companies in the world.

Nvidia is a great company, but the stock may have soared too high, too fast. There are more reasonable AI ideas out there right now. Let me tell you why IBM (NYSE: IBM), Micron Technology (NASDAQ: MU), and Fiverr International (NYSE: FVRR) strike me as stronger AI investments in the fall of 2024.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

This trio may not be the most obvious AI investments on the market. But they have deep connections to the surging generative AI market, just from slightly unusual angles:

-

IBM lets other companies focus on consumer-friendly AI tools and services while it doubles down on enterprise-class variants instead. Features like auditable data flows and integration with business intelligence tools don’t write headlines, but they do inspire long-term service contracts with deep-pocketed corporations. As a result, Big Blue’s generative AI platform already has $3 billion of service contracts, less than two years after its launch.

-

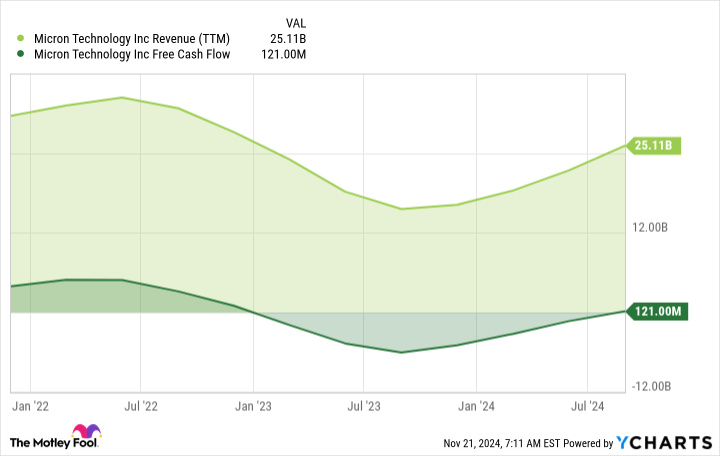

Micron doesn’t make AI accelerators. It designs and manufactures high-speed memory chips instead. The massive systems that train and then operate generative AI platforms require enormous amounts of memory, and so do the next-generation smartphones that launch with their own AI features. Micron’s chips are in high demand thanks to these AI-based connections.

-

Fiverr isn’t working on the infrastructure side of the AI boom, but it takes advantage of generative AI in two distinct ways. The company’s platform for matching freelancers with freelance service buyers makes heavy use of various AI technologies. The company also sells AI-related freelance services to a wide range of clients — those AI systems won’t build or run themselves, and it takes a human touch to squeeze business value out of generative AI tools. AI-related services have become a key growth driver for Fiverr.

|

AI Stock |

2-Year Total Return |

Price to Free Cash Flow |

Forward Price to Earnings |

|---|---|---|---|

|

Nvidia |

848% |

76.5 |

33.9 |

|

IBM |

58% |

15.8 |

20.0 |

|

Micron |

70% |

901.4 |

7.7 |

|

Fiverr |

(18%) |

13.9 |

11.6 |

Data collected from YCharts and Finviz on Nov. 21, 2024.

Nvidia has been crushing the rest of the stock market since key client OpenAI introduced ChatGPT almost exactly two years ago. That’s great for longtime Nvidia owners, but the galloping gains left the stock hanging at uncomfortably high valuation ratios. No matter how you slice it, Nvidia stock is priced for perfection. The chart may still point upward from here, but there’s a real risk of painful price corrections if Nvidia doesn’t hold on to its early lead in AI accelerators.

Where Will Ultra-High Yield British American Tobacco Be in 5 Years?

There’s one very specific feature of British American Tobacco‘s (NYSE: BTI) stock that keeps investors interested: the dividend yield. At a time when the S&P 500 index is offering a tiny 1.2% yield and the average consumer staples stock 2.6%, British American Tobacco’s yield is a lofty 8.1%.

“Wow” is a fair response to hearing about that return, but that huge yield comes with risks and long-term income investors need to think about what the future might look like here. Will this company offer such an enviable return in five years?

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

British American Tobacco’s name is fairly descriptive, given that it is one of the largest cigarette makers on the planet. Combustible products accounted for around 80% of revenue in the first half of 2024. That total includes both cigarettes and other things that, effectively, burn tobacco. Cigarettes accounted for roughly 98% of volume. So, while the company does other things, British American Tobacco is at its core a cigarette company.

What makes British American Tobacco unique among its peers is that it has a truly global cigarette business. Its prime competitors Altria and Philip Morris International don’t. Altria operates only in North America. Philip Morris International was spun out of Altria to operate Altria’s brands in foreign markets. Being global is good and bad, however, because selling cigarettes is a tough business, particularly in North America where volumes have been falling for years. Essentially, consumers are turning away from smoking.

The numbers are pretty daunting. In the case of British American Tobacco, cigarette volume fell 5.1% in 2022, 5.3% in 2023, and 6.8% through the first six months of 2024. If anything it looks like the declines are starting to pick up speed.

Like its peers, British American Tobacco has been able to offset volume declines with price increases. Given the nature of tobacco, consumers tend to be fairly loyal to the product. The frequent purchases are why cigarettes are classified as a consumer staple. However, the declines continue largely thanks to health concerns. That said, price increases can only be pushed so far before they, too, start to negatively impact volume. The future is not bright here given the current volume trajectory.

To be generous, and to make the math easy, assume that British American Tobacco manages to keep volume declines at 5% a year for the next five years. In the first half of 2024, the company sold roughly 250 billion units.

1 Ultra-High-Yield Dividend Stock (I Just Bought) That You Can Buy and Hold for a Decade

Mr. Market, a construct of the famous value investor Benjamin Graham, is a fickle individual. Sometimes he offers up opportunities that look attractively priced, only to change his mind far more quickly than you’d expect, running the price right back up again.

When shopping for potential investments, I occasionally get access to the attractive price, which is what happened with my investment in WEC Energy (NYSE: WEC). But after the subsequent share price rally over just a few months, I decided to sell the utility and use those funds to invest in a higher yield that remains out of favor.

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

I bought WEC Energy in July 2024, when the dividend yield was north of 4%. The yield, the history of dividend growth, and the opportunity presented by the utility’s ongoing shift toward cleaner energy was more than enough to get me in the door.

And then, shortly after I bought WEC Energy, utility stocks rallied. The yield from WEC Energy is now around 3.4%.

That’s not high enough for me to add to my position. Add in the roughly 20% stock advance in just a few months, and I’m worried that WEC Energy has gone too far, too fast. At the very least, I see it as fairly valued and no longer cheap. In fact, I was kind of expecting that 20% stock advance would be spread over three years, not four months or so. I decided to lock in the profits and shift into a different utility-related investment.

What I bought to replace WEC Energy was a unique clean energy-focused business with a 5.6% yield. That’s 4.5 times larger than the yield on the S&P 500. It is twice as high as the average utility, using Utilities Select Sector SPDR ETF (NYSEMKT: XLU) as an industry proxy. And it is 1.6 times that of WEC Energy. That’s a worthwhile increase compared to WEC, and definitely attractive relative to the broader utility space and the market.

But the real reason I bought Brookfield Renewable Partners (NYSE: BEP) is the opportunistic nature of its investment approach. To start, I believe there’s a long runway for growth ahead as the world continues to shift toward cleaner energy alternatives. Brookfield Renewable has its fingers in just about every pie, with exposure to solar, wind, hydroelectric, storage, and nuclear. And its portfolio is globally diversified, so it can put money to work just about anywhere there’s an opportunity.

Volkswagen's Affordable ID.2 EV Set For 2025 Launch, SUV Variant To Follow: 'Stable And Likable With Our Secret Sauce'

Volkswagen VWAGY is gearing up to introduce its budget-friendly ID.2 electric vehicle by the end of 2025, with an SUV version to follow. This move marks a significant step in Volkswagen’s strategy to expand its electric vehicle lineup.

What Happened: Volkswagen is on schedule to release its budget-friendly ID.2 electric vehicle by late 2025, reported Autocar. This model is expected to be the most economical in the company’s lineup, priced under $27,000 (€25,000).

At the LA Auto Show, Volkswagen’s tech development head, Kai Grünitz, confirmed that the ID.2 will lead a major overhaul of the brand’s “ID” electric car series. Grünitz indicated that significant advancements are anticipated, starting in 2026, with a fresh design approach.

“It’s matching 100% to our brand values: it will be stable and likable with our secret sauce—but in a different way,” Grünitz said, according to the report.

The ID.2 will be the first vehicle to utilize Volkswagen’s new MEB Entry Platform. An SUV version is slated for a reveal at the Munich Motor Show in September 2025, with a GTI model also in development.

Grünitz emphasized that the ID.2 will mark a new beginning for Volkswagen, with customers noticing a substantial transformation. The vehicle promises a range of up to 279 miles (450 km) and combines the spaciousness of a Golf with the affordability of a Polo.

Why It Matters: Volkswagen’s push to launch the ID.2 comes amid a challenging period for the company.

In the third quarter of 2024, the automaker experienced a 10% decline in electric vehicle sales, primarily in the U.S. and Europe, although China showed a 5% growth. This underscores the importance of the ID.2 as a strategic move to capture a larger market share.

Meanwhile, Volkswagen has been making strategic investments, such as increasing its stake in Rivian Automotive Inc. RIVN. Analysts see this as a vital step for both companies, aiding in production and cost efficiency. The collaboration is expected to provide capital for future growth, enhancing vehicle offerings and software integration.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Volkswagen

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.