7 Examples of Financial Advisor Branding Statements

Cultivating a personal brand can help advisors stand out in a competitive landscape. The most successful businesses understand the value of a highly recognizable, trusted brand image for attracting new clients. An impactful financial advisor branding statement can help you clearly convey what your business stands for and the value you offer to prospective clients.

Do you need help expanding the marketing of your financial advisor practice? Try SmartAsset AMP, a holistic client prospecting and marketing automation platform.

A branding statement is a concise statement that neatly encapsulates who you are, what you do and what makes your business unique. A well-crafted branding statement conveys your firm’s mission, values and key selling points.

Financial advisors may develop a branding statement that represents their firm as a whole. They could also write a separate personal branding statement for themselves.

Your firm’s branding statement communicates what your business does and how you meet your clients’ needs. A personal brand statement is an opportunity to demonstrate your personality and what you’re most passionate about when it comes to helping clients.

Financial services is a highly competitive industry. If you want to succeed, you have to give prospective clients clear reasons to choose your business over another advisor’s. A branding statement helps you to crystallize your messaging for maximum impact.

Developing a brand statement allows you to:

-

Emphasize your expertise to your target audience

-

Put your skills and unique value proposition in the spotlight

-

Demonstrate the value you offer to your clients

The best brand statements for advisors are memorable or “sticky,” meaning their message lingers with prospective clients. Stickiness is an important characteristic in building your advisor brand, as prospects who remember you may be more likely to seek out your services.

It’s important to remember that a brand statement is different from a slogan or tagline. Brand statements are concise, but still detailed. Meanwhile a slogan or tagline is usually a catchy phrase that’s designed to grab attention.

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

A branding statement is typically brief, no more than one to three sentences. So it’s important to choose your words carefully. Having some examples of financial advisor branding statements to follow can help you decide what to include:

Meet the Newest Stock-Split Stock in the Dow Jones. It Has Soared 910% Since Early Last Year, and It's Still a Buy Right Now, According to Wall Street

The Dow Jones Industrial Average is the oldest stock market index in the U.S. It is a price-weighted index that tracks the performance of 30 of the largest publicly traded companies in the country. Its member companies span a variety of sectors and industries, and it is considered by many to be a reliable indicator of stock market performance and the health of the overall economy. There are only a few broad criteria for a company’s inclusion:

-

Be incorporated and headquartered in the U.S.

-

Have the largest percentage of revenue derived from the U.S.

-

Be a member of the S&P 500.

-

Be a non-transportation or non-utility company.

-

Because it’s price-weighted, the highest-priced stock should be no more than 10 times that of the lowest-priced stock in the index.

-

The company must have “an excellent reputation, demonstrate sustained growth, and is of interest to a large number of investors,” according to S&P Global.

Nvidia (NASDAQ: NVDA) is the most recent addition to the Dow Jones, joining the benchmark on Nov. 8 and replacing chipmaker Intel. That makes it one of only three companies to make the cut so far this year.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Over the past decade, Nvidia’s revenue has climbed 2,300%, while its net income has surged 8,460%. This, in turn, has fueled stock price gains of 28,940% (as of this writing). As a result of its meteoric rise, the artificial intelligence (AI) chipmaker recently completed a 10-for-1 forward stock split after years of strong business and financial results. The new, lower share price paved the way for Nvidia’s inclusion in the Dow.

Despite Nvidia’s parabolic move higher, many on Wall Street believe the stock still has further to run.

Nvidia has long been known for its prowess in developing top-notch graphics processing units (GPUs) that are the first choice among serious gamers. In 1999, the company pioneered the use of parallel computing in its chips, which allows them to run a multitude of mathematical computations simultaneously. By breaking up these massive compute jobs into smaller, more manageable pieces, the company reinvented the gaming industry. In fact, as recently as early 2022, gaming still represented the majority of Nvidia’s revenue. But a paradigm shift was coming.

It didn’t take long before Nvidia realized it could use this technology in a variety of other applications. By 2006, scientists and data researchers discovered that GPUs could be used for other computationally intensive processes, including high-performance computing (HPC), machine learning (a subset of AI), and data centers.

Can Anything Stop Nvidia?

We’re now two years removed from OpenAI’s launch of ChatGPT, and there’s no doubt which company has been the biggest winner of the generative AI revolution so far.

Nvidia (NASDAQ: NVDA), now best known for making cutting-edge chips capable of powering AI applications like ChatGPT, has seen its stock jump by 10 times since the beginning of 2023, making plenty of investors significantly richer. This month, it again became the world’s most valuable company, with a market cap of more than $3.5 trillion.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

Despite concerns that competition would bring it to heel or that the AI megatrend was inflating a bubble that would eventually burst, Nvidia has continued to deliver blowout results, and that pattern was on display once again in the fiscal 2025 third-quarter earnings report it delivered Wednesday.

Total revenue in the quarter jumped 94% year over year to $35.1 billion, topping the consensus estimate of $33.1 billion. The data center segment, where revenue jumped 112% to $30.8 billion, drove that growth, as demand for its graphics processing units (GPUs) continues to outstrip supply.

Profits also surged as the company continued to gain leverage on its operating expenses. On a generally accepted accounting principles (GAAP) basis, operating income jumped by 110% to $21.9 billion, and adjusted earnings per share surged from $0.40 to $0.81, ahead of the consensus estimate of $0.75.

Never before in history has a company as big as Nvidia grown so fast. Remarkably, its 94% revenue growth was its slowest pace on a percentage basis in six quarters, but it’s sustaining blistering growth rates for much longer than analysts had expected. The amount of revenue in dollar terms that it’s adding each quarter is also increasing sequentially, so the real growth of the business is accelerating even as its percentage growth moderates.

Earlier this year, some analysts were questioning whether the level of dominance Nvidia has established in the AI chip sector was sustainable. Advanced Micro Devices and Intel have launched their own competing AI accelerators. However, they have struggled to make a dent in Nvidia’s dominant market share. AMD disappointed the market with its latest earnings report and announced layoffs earlier this month, while Intel began a massive restructuring after its stock hit a 20-year low.

At this point, the key constraint on Nvidia’s growth is on the supply side, as CEO Jensen Huang recently said demand for its latest GPUs, built using its new Blackwell architecture, is “insane.”

Tesla says it has reached a ‘conditional’ settlement in Rivian trade secrets lawsuit

Tesla and Rivian may have resolved a lawsuit in which Tesla accused Rivian of poaching employees and stealing trade secrets.

Bloomberg reports that Tesla told a California statement judge that the companies have reached a “conditional” settlement, and that it expects to seek dismissal of the lawsuit by December 24.

Tesla filed the suit, which was set to got to trial in March, back in 2020. The EV maker alleged that it had discovered an “alarming pattern” in which Rivian was recruiting Tesla employees and encouraging them to take proprietary information with them as they left.

In response, Rivian filed to dismiss the suit, arguing that it was an “improper and malicious attempt to slow” the Rivian’s momentum and to scare Tesla employees who might be thinking of leaving.

Tesla did not immediately respond to TechCrunch’s request for comment. A Rivian spokesperson said the company does not comment on litigation.

Treasury pick Scott Bessent scored billion-dollar wins with these bets on Wall Street

Key Square Capital Management founder Scott Bessent was tapped late Friday by President-elect Donald Trump to be Treasury secretary, bringing a long track record from his time at Wall Street hedge funds.

Little has been reported about Bessent’s personal wealth. And unlike hedge fund peers such as Ray Dalio and Ken Griffin, he doesn’t appear on billionaire lists from Bloomberg or Forbes. But some details on his net worth will emerge later as he’s required to divest certain holdings to avoid any conflicts of interest while Treasury chief.

Key Square didn’t immediately respond to a request for comment in his wealth or assets to be divested.

For now, a look at Bessent’s winning bets while working in finance offer some insight into how me made his fortune.

The South Carolina native and Yale graduate started off as a securities analyst and options trader at a Saudi family’s investment arm, according to the Wall Street Journal. He later interned with Jim Rogers, worked for short-seller James Chanos, and then joined Soros Fund Management in 1991.

That’s when Bessent made one of his most famous wagers. While at the firm’s London office, he helped engineer a short against the British pound in 1992, netting Soros a profit of more than $1 billion. In the U.K., the trade is infamous and led to “Black Wednesday,” when the pound was de-linked from European currencies.

After working for Soros, he became a senior partner at Protege Partners and then started his own firm but had to return clients’ funds in 2005, the Journal reported.

In 2011, he returned to Soros and served as chief investment officer for the hedge fund turned family office. During his second stint, he made about $10 billion in profit for Soros, according to Bloomberg. Among his big bets was a short against Japan’s yen that produced a $1 billion windfall in 2013.

He left in 2015 to launch Key Square, which makes bets on global macroeconomic trends, and raised $4.5 billion, including $2 billion from Soros. Key’s main fund saw returns surge 13% in 2016 after Bessent bet again on the British pound falling, this time after the Brexit vote to leave the European Union, sources told Reuters.

Bessent scored another win later in 2016 by correctly anticipated a U.S. stock and dollar rally following Trump’s first presidential election victory. Returns were mixed from 2017 to 2022 but notched double-digit gains in 2023 and 2024, according to Reuters.

This year, like in 2016, Key Square bet that U.S. stocks and the dollar would jump after a Trump victory, contributing to the firm’s big 2024 profit, the report said. Despite the recent returns, Key Square has seen assets under management decline to $577 million as of December 2023 from a peak of $5.1 billion at the end of 2017, the report said.

Prediction: This Company Will Be the Biggest Beneficiary of Super Micro Computer's Problems

Furious investments in data centers are spurred by our growing need for data storage and processing power and the tremendous requirements of artificial intelligence (AI) programs. While some data centers are relatively small, others are larger than 100,000 square feet (often millions of square feet). Tech titans like Microsoft, Amazon, Alphabet, and Meta typically construct these hyperscale data centers.

For instance, in 2025, Meta will break ground on an $800 million, 715,000-square-foot campus in South Carolina, and Microsoft will begin a $1 billion project in La Porte, Indiana.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

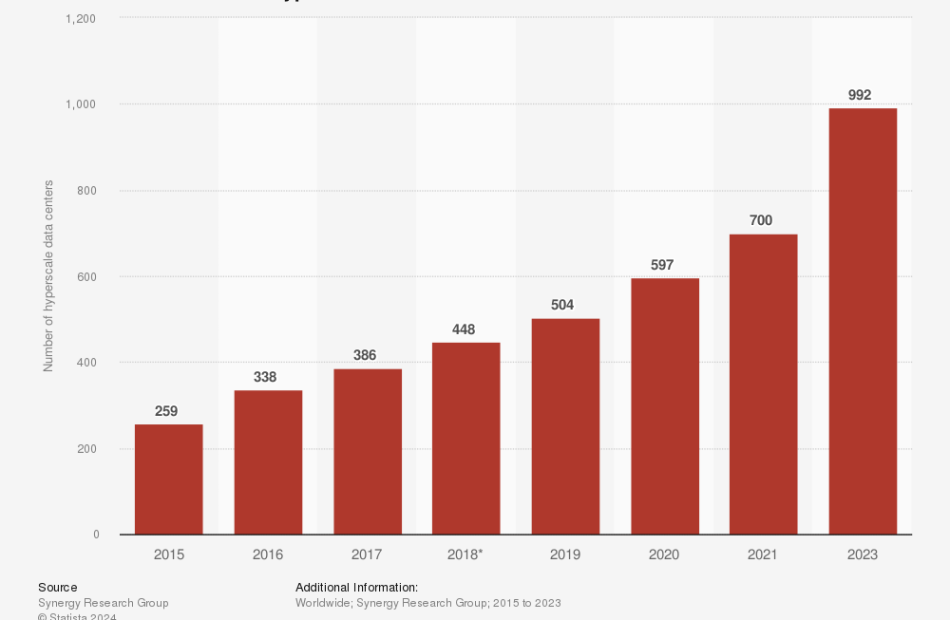

As shown below, Hyperscale centers have spiked recently.

This number eclipsed 1,000 in 2024 and is forecast to grow by 120 to 130 annually. These centers require infrastructure like servers, storage, and racking, so investors should be excited about the opportunity.

Dell Technologies (NYSE: DELL) is a major supplier to the industry, along with Super Micro Computer. Supermicro has some well-documented challenges now, and Dell could be a key beneficiary. Here are some things to know.

Supermicro’s setbacks are well documented, so I won’t dwell too much on them. Here is a brief timeline:

-

August: Hindenburg Research released a scathing short report, and Supermicro delayed its annual 10-K filing.

-

September: Nasdaq notified the company that it could be delisted for its delayed filing.

-

October: Supermicro’s audit firm, Ernst & Young, resigned.

-

November: The company delayed its quarterly 10-Q filing.

As of this writing, the stock trades 84% off its 2024 high.

None of these are smoking guns alone; however, these are serious concerns.

It makes sense for a data center operator to avoid the noise and choose Dell for its infrastructure needs over Supermicro, which reported $5.3 billion in sales in the fiscal 2024 fourth quarter ($15 billion for the fiscal year), with 64% attributed to large data centers. Dell’s Infrastructure Solutions Group earned $11.6 billion in its most recent quarter, so potentially picking up billions of dollars in revenue from a competitor would be an enormous boon.

Dell’s recent results are solid, but it’s what analysts estimate for the next several years that is most exciting. Revenue grew 9% in the second quarter of fiscal 2025 to $25 billion, while diluted earnings per share (EPS) rose 86% to $1.17. As expected, the Infrastructure Solutions Group, which serves data centers, hit record sales of $11.6 billion on impressive 38% year-over-year growth.

3 No-Brainer Fintech Stocks to Buy Right Now for Less Than $1,000

Given that money — and technology — make the world go round, it’s not surprising that the combination can make for some of the world’s most rewarding investments. Here’s a closer look at three fantastic fintech stocks you can buy in quantity, even if you’ve only got $1,000 to work with.

Even if you haven’t heard of Bill Holdings (NYSE: BILL), there’s a very good chance your employer has. Bill offers a range of accounting software to enterprises of all sorts and sizes.

Are You Missing The Morning Scoop? Breakfast News delivers it all in a quick, Foolish, and free daily newsletter. Sign Up For Free »

It’s a seemingly crowded market dominated by brands like QuickBooks, NetSuite, and ZipBooks. Bill is still something of a standout within this space, though. Its software is built from the ground up to meet the unique needs of accounts receivable and accounts payable departments, accounting firms, and supervisors who just need to keep a handle on employees’ spending. The company monetizes this cloud-based technology by charging subscription fees for access to it, or by charging a small fee for every processed payment it facilitates.

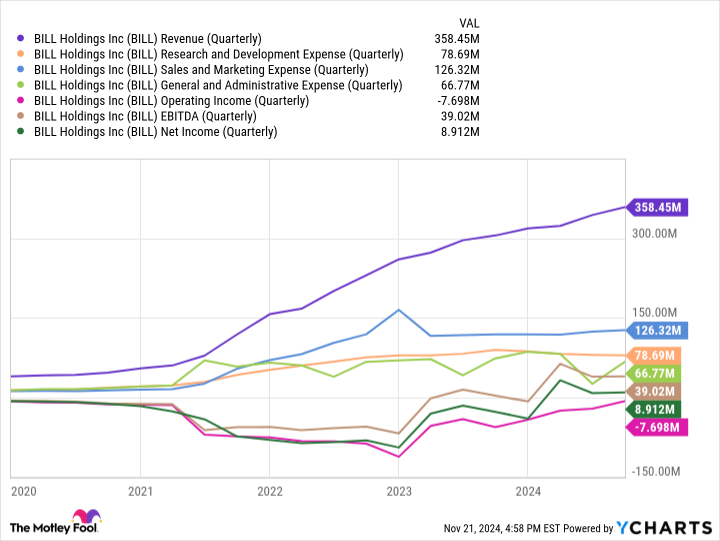

Last quarter’s revenue was up 18% year over year, extending the company’s well-established top-line progress.

There’s no getting around the fact that Bill’s revenue growth is slowing down. Its revenue-retention rate is also falling, from better than 100% just a couple years ago to only 92% at the end of fiscal 2024 on June 30. It means at least some customers are discontinuing their service, or at least using its technology less. This slowdown could also be the result of economic headwinds that are forcing small businesses to cut costs whenever and however they can. Bill should at least be actively addressing both challenges, while sharing its plans with shareholders about how it’s doing that.

Just keep things in perspective. This company’s high-growth phase in 2022 and 2023 wasn’t exactly sustainable in light of the way it was being driven. Although top-line growth may be slowing now, profit margins are widening faster because sales have been growing much faster than spending has. This new norm makes for a higher-margin business, providing Bill Holdings with the fiscal flexibility it needs to navigate the two aforementioned challenges.

The stock is still relatively expensive by almost all measures. It’s also trading a bit above the consensus price target around $82. These could seem to hold the stock back.

The thing is, the stock’s present price and analysts’ collective pessimism reflect more of the past than the plausible future. The more this stock bounces back from the big pullback following its pandemic-promoted 2021 peak, the more likely it is that the market will start pricing in this bright future. Bill’s solutions are what many enterprises and businesses have been waiting on for a long while.

Michael Saylor Reveals MicroStrategy Is 'Making $500M A Day' With Bitcoin

MicroStrategy Inc. (NASDAQ:MSTR) co-founder Michael Saylor has revealed that the company is minting $500 million a day as Bitcoin (CRYPTO: BTC) inches closer to $100,000 for the first time in its history.

What Happened: Saylor, who has been all-in on Bitcoin for years now, has revealed an insane statistic – MicroStrategy’s holdings of the top cryptocurrency have appreciated by as much as $5.4 billion over the last two weeks.

In an interview with CNBC, Saylor broke down MicroStrategy’s gains, saying, “We’re making $500 million a day. I’m staring at my screen and we’re selling dollar bills for $3, sometimes a million times a minute.”

Don’t Miss:

To put things into perspective, MicroStrategy’s stock delivered a whopping 97% gain in the last month, while Bitcoin has gained nearly 47%.

Year-to-date, MicroStrategy’s stock has gained over 515% while Bitcoin prices have increased by 122%.

Nvidia, the AI bellwether and the world’s most valuable company by market capitalization, has seen its stock rise by nearly 195% during this period.

“We may very well be the most profitable company in the U.S. growing the fastest right now. There’s not many companies making $500 million a day,” Saylor said.

Trending: If you invested $100 in DOGE when Elon Musk first tweeted about it in 2019, here’s how much you’d have today.

Why It Matters: The surge in MicroStrategy’s stock is not just a reflection of Bitcoin’s rising value but also highlights the company’s strategic bet on the cryptocurrency.

Research from BitMEX has shown that MicroStrategy is trading at a 256% premium to the net asset value of its Bitcoin holdings, suggesting a significant valuation disparity driven by its aggressive acquisition strategy.

"I Knew If I Bought a Sink": What Does Elon Musk's Cryptic Tweet Mean?

Elon Musk on Saturday shared a cryptic tweet on X, hinting at a significant turning point in human history.

What Happened: Musk responded to a post on X by Bojan Tunguz, which referred to an unspecified event as “one of the major inflection points of human history.” Musk’s reply was enigmatic, stating, “I knew if I brought a sink they would have to let that sink in. How could they not?”

The Tesla and SpaceX CEO’s post on X has left his followers intrigued, as they attempt to decipher the meaning behind his cryptic words.

Also Read: Musk Tweet Sparks Dogecoin Surge, Fuels Speculation On X Payments

Why It Matters: Musk is known for his cryptic tweets, which often lead to widespread speculation. His recent tweet, which suggests a significant turning point in human history, has sparked a flurry of theories among his followers.

While the exact meaning behind Musk’s tweet remains unclear, it underscores his reputation as a thought leader in the tech industry, known for pushing boundaries and challenging conventional thinking.

Read Next

Judge Rejects SEC Bid to Penalize Musk Over Missed Deposition

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Satellite Images Reveal North Korea Reportedly Receiving Illicit Oil from Russia

Satellite images have reportedly revealed that Russia has supplied North Korea with over one million barrels of oil since March, violating United Nations sanctions that restrict oil sales to North Korea.

These transfers are part of a broader arrangement in which North Korea sends weapons, artillery shells, and even troops to aid Russia’s war in Ukraine, the BBC reports.

The oil deliveries, tracked by the UK-based Open Source Centre, are seen as a direct quid pro quo for North Korea’s military support, with the oil serving to fuel Pyongyang’s own operations and provide stability amid ongoing sanctions.

According to satellite imagery analyzed by UK-based non-profit research group the Open Source Centre and shared exclusively with the BBC, North Korean oil tankers have made 43 trips to Russia’s Far East, with vessels arriving empty and leaving full.

Despite UN sanctions capping the amount of oil North Korea can receive at 500,000 barrels per year, Russia’s illicit shipments have far exceeded this limit, with experts estimating more than a million barrels have been supplied since March.

The BBC added that these transfers not only breach UN sanctions but also involve ships that are themselves under sanction, some of which should have been impounded upon entering Russian waters, citing Go Myong-hyun, a senior research fellow at South Korea’s Institute for National Security Strategy.

The situation marks a new level of contempt for international regulations, as Russia has actively circumvented the UN panel responsible for monitoring such violations, disbanding it through its veto at the Security Council in March.

Experts worry this cooperation between two autocratic regimes may lead to even more dangerous collaborations, potentially involving military technology transfers that could further destabilize the region, the BBC adds.

While the oil deliveries provide crucial fuel for North Korea’s military, which relies on oil for its missile launchers and munitions factories, concerns are growing over the potential for more military technology exchanges, particularly in satellite and ballistic missile advancements.

Both the US and South Korea are closely monitoring the evolving ties between Russia and North Korea, with the possibility of these exchanges further threatening global security.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.