This Stock-Split Stock Just Ran Into Trouble. Here's Why It's Still a Buy.

Super Micro Computer (NASDAQ: SMCI) posted a fantastic first half of the year. Thanks to demand from artificial intelligence (AI) customers, in just one quarter, the company delivered sales that surpassed what it used to generate in a full year as recently as 2021. The S&P 500 and Nasdaq-100 even welcomed this 30-year-old tech company to join. And Supermicro’s share price reflected all this good news, climbing 188% to outperform market darling Nvidia.

In fact, the stock had reached such high levels — peaking at more than $1,100 early in the year — that in August, the company announced a stock split planned for later this month. This sort of operation involves the issuance of additional shares to current holders to bring down the per-share price, opening up the investment opportunity to a broader range of investors.

But in recent weeks, the story has lost some of its sparkle. A short report by Hindenburg Research alleging troubles at Supermicro hit the stock badly — it’s dropped 16% since the report’s late-August release. Separately, Supermicro delayed filing its 10-K annual report, another element that’s weighed on the shares. Despite these challenges, Supermicro still makes a great buy right now. Let’s find out why.

Hindenburg’s short position

First, let’s consider the bad news. In its report, Hindenburg alleged “glaring accounting red flags,” “evidence of undisclosed related party transactions,” and other potential issues. But it’s important to keep one thing in mind. Hindenburg holds a short position in Supermicro, meaning it will benefit if the stock declines. This bias makes it difficult to rely on Hindenburg as a source of information about the company.

Another point to keep in mind is that Supermicro addressed the report, saying it “contains false or inaccurate statements.” So, I wouldn’t base a decision on whether to buy or sell Supermicro on the Hindenburg report. Instead, it’s better to consider what we know, such as the company’s path so far, details from recent earnings reports, and market potential.

I mentioned that Supermicro has been around for quite some time, but it’s only over the past few years that its earnings have truly taken off. That’s because AI customers are busy building out their data centers, and they’re rushing to Supermicro for its workstations, servers, and other products.

Supermicro’s strategy

Why Supermicro? The company is able to quickly build products to suit a customer’s needs, including the very latest technology. This is because Supermicro uses building block technology, meaning its products contain a lot of common parts. Supermicro also works closely with top chip designers to immediately integrate their new releases into its products.

This has helped the equipment maker reach record revenue in recent quarters. On top of this, Supermicro may be at the start of a new high-growth opportunity thanks to its ability to solve a big problem with today’s AI data centers: the accumulation of heat. Supermicro makes direct liquid cooling (DLC) elements to handle this and sees demand here set to take off. The company predicts 25% to 30% of new data centers will use this technology in the coming 12 months and Supermicro will dominate the market.

Considering the AI market is forecast to reach more than $1 trillion by the end of the decade, it’s clear that heat could become a problem — and Supermicro may see a huge wave of growth from its expertise in DLC.

Finally, Supermicro recently said that though it’s delaying its 10-K filing, it doesn’t expect any major changes to its fourth-quarter or fiscal-year results. That’s another element that should ease our minds.

So, Supermicro offers us a solid track record, a strategy that sets it apart, and potential for growth ahead. In addition, due to the recent headwinds, the stock has fallen into dirt cheap territory at only about 13x forward earnings estimates. And that’s why now is a great time for long-term investors to consider scooping up shares of this company that may be heading for a whole new wave of growth.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

This Stock-Split Stock Just Ran Into Trouble. Here’s Why It’s Still a Buy. was originally published by The Motley Fool

The Ultimate Growth Stock to Buy With $200 Right Now

If you’re looking for a growth stock to help you build wealth for retirement, it’s not enough to just pick a stock of any growing company that is regularly hitting new highs. There are other important qualities you want to look for.

Obviously, you want a company with outstanding growth prospects, but it’s also beneficial to invest in a business that has a loyal base of customers that regularly spend money with the company. This adds resiliency to the business, especially during recessions and bear markets.

One company that immediately comes to mind is Amazon (NASDAQ: AMZN). Here are three reasons why.

1. Repeat revenue from millions of customers

Amazon has millions of retail customers that regularly use their Prime membership to order multiple items every month. Statista estimates the U.S. Prime member count at 167 million, and over 200 million worldwide, with an estimated 42% of U.S. Prime members making between two and four purchases every month. That’s a big reason why Amazon has grown into a massive business with $604 billion in trailing-12-month revenue as of June 30, 2024.

Over the last four quarters, Amazon generated $42 billion from subscriptions and $237 billion from its online store. The company has continued to expand its same-day delivery and grocery delivery to Prime members, which shows the potential to find more ways to increase purchase frequency and grow revenue.

Amazon also generates repeat revenue from its enterprise cloud service. Amazon Web Services (AWS) is the top cloud computing provider in the world, with millions of customers in over 190 countries. AWS contributes less than 20% of Amazon’s total revenue, but importantly, it’s the most profitable business, contributing around two-thirds of the company’s operating profit.

2. Amazon has tremendous growth opportunities

Amazon’s online store and cloud business have a huge market to expand into that can keep the company growing for decades.

The global e-commerce market is set to reach $6 trillion this year, according to eMarketer. It’s expected to reach $8 trillion by 2028, so Amazon has the benefit of chasing a growing market.

As for AWS, the opportunity is even more lucrative for shareholders. Revenue from AWS grew 19% year over year last quarter, reaching $98 billion in trailing-12-month revenue. However, it’s estimated that at least 80% of enterprise data has yet to move from on-premises servers to the cloud.

With that much opportunity, AWS could grow into a very large business one day — potentially Amazon’s largest revenue source. The high margins from cloud services would significantly increase Amazon’s profitability and send the stock higher.

3. The stock has great upside potential

Amazon always looks expensive on the basis of price-to-earnings. That’s because management doesn’t manage the business to maximize earnings per share but to maximize long-term cash flows from operations.

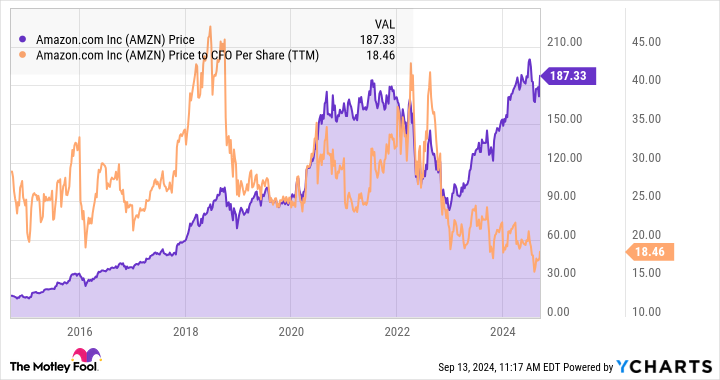

Using Amazon’s cash from operations (CFO) per share, the stock trades at a price-to-CFO multiple of 18.4. Despite the stock doubling in value in the last five years, it is trading at the lowest P/CFO valuation in over 10 years.

Amazon’s cash from operations has tripled in the last five years to $107 billion. In the chart, notice how the stock has soared in value as it followed the growth in the company’s cash from operations, but the shares continue to trade within the same range on a P/CFO basis. With the opportunities Amazon has in e-commerce and cloud services, its cash from operations will continue to grow over time, and that likely means more new highs for the share price.

The stock is currently trading slightly off its recent high of $201, so for an investor that only has a few hundred dollars, now is a great opportunity to buy it.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The Ultimate Growth Stock to Buy With $200 Right Now was originally published by The Motley Fool

China's homeowners are rushing to pay off mortgages early as outlook on the economy dims

Li Wen, a human resources director at a state-owned enterprise in Nanchang, Jiangxi province, paid off an outstanding 200,000 yuan (US$28,170) on her home loan ahead of schedule in January, soon after she received her annual bonus at work.

The 36-year-old had been repaying her loans, totalling 600,000 yuan, in advance for the past few years, even after the interest rate was reduced to 4.3 per cent from the original 5.39 per cent following a few rounds of rate cuts since last year.

“Depositing the money in banks does not do anything for me,” Li said. “Deposit rates are far lower, and we do not have any ideal high-yield investment options.”

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

“I would rather pay my loans earlier to save the interest cost, especially when salary and job cuts are getting common.”

Li’s concerns are shared by many homeowners in China, who had bought homes in a red-hot market in high hopes of appreciation, before prices started to slide.

A construction site in Beijing. Photo: Agence France-Presse alt=A construction site in Beijing. Photo: Agence France-Presse>

The Chinese property market, once a major pillar of the national economy, has been in the doldrums since August 2020, when the government put in place a policy dubbed “the three red lines”, aimed at curbing a borrowing binge by property developers.

Since then, some homeowners, suffering from heavy loan burdens and an uncertain economic outlook, sold their homes. Others, like Li, saved up and took advantage of interest rate cuts to pay down mortgages or home loans.

This year, the People’s Bank of China has twice lowered the five-year loan prime rate, which commercial banks use as a benchmark to adjust their mortgage rates, by a total of 35 basis points to 3.85 per cent. The central bank has also lifted the lower cap for mortgages on new and second-hand homes nationwide.

That led dozens of Chinese cities to cut their mortgage rates to 3.2 per cent, and some others to below 3 per cent. The average rate for newly issued mortgages was 3.45 per cent in June, down from 4.27 per cent last September, according to government data.

Homeowners seized the chance.

In each month last year, an average of 450 billion yuan worth of mortgages was paid off prematurely, according to data compiled by Australia and New Zealand Banking Group (ANZ). That number rose to 600 billion yuan in the first seven months of this year, equivalent to 15 per cent of China’s retail sales or 12 per cent of the population’s disposable income during the period.

Residential buildings in Beijing. Photo: Bloomberg alt=Residential buildings in Beijing. Photo: Bloomberg>

Outstanding mortgages in China dropped to 37.79 trillion yuan as of the end of June, the lowest level in almost three years, official data showed.

Amid calls to reduce the rate gap between existing and new mortgages, China could slash rates on outstanding mortgages by up to 50 basis points as early as this month, working up to a total reduction of 80 basis points by next year, according to a recent report from Bloomberg, citing unnamed sources.

The prospective relief measures lifted the hopes of some homeowners. “Once that is implemented, I will relax my budget and withdraw my application for early mortgage payments,” wrote one user on Xiaohongshu, an Instagram-like Chinese social media platform also known as Red.

“A further reduction on the outstanding mortgage rate will decrease costs for existing homeowners and spur consumption and investment,” said Chen Wenjing, director of market research at China Index Academy. “It will also ease the wait-and-see sentiment dragged on by expectations of further rate cuts, and shore up consumption, including home purchases.”

But while such measures may bring a short-term rebound in consumption, in the long run it may do little to boost the property market, according to some analysts.

“If this mortgage rate cut materialised, we believe the potential impact would be quite limited in spurring demand in China’s property market,” said Ricky Tsang, a director at S&P Global Ratings.

“The loan burdens of existing homeowners may be lessened with a rate cut, [but] demand for property is still constrained by the weakening economy and decline in home prices,” he said.

A building project under construction in Beijing. Photo: EPA-EFE alt=A building project under construction in Beijing. Photo: EPA-EFE>

While a reduction of 80 basis points is “generally in line” with expectation, said Xing Zhaopeng, a senior China strategist at ANZ, “the effect may be limited”.

“It may help decrease early mortgage payments, but it is not enough to bring the property market back to normal,” he said, citing the low rental yields across the country – about 3 per cent in major second and third-tier cities, and around 2 per cent in first-tier cities – as one of the major hurdles for home purchase.

Buyers also remain cautious about plunging home prices.

Prices of new homes in China declined by the most in nine years last month, sinking 5.7 per cent from a year ago, according to official data released on Saturday. Meanwhile, contracted sales generated by the top 100 Chinese developers plunged 10 per cent in August from a month earlier, and 27 per cent from a year earlier, according to China Real Estate Information Corporation.

“If there is no major stimulus to reverse the expectation on home prices and lift rental yields to a level higher than mortgage rates, China’s properties may remain uninvestable,” said ANZ’s Xing.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Michaël Van De Poppe Predicts Massive Bitcoin Surge, Says Price May Soar By 890%

Crypto analyst Michaël van de Poppe has forecast that Bitcoin BTC/USD could potentially skyrocket by a staggering 890% in the current cycle, reaching a value between $300,000 and $600,000.

What Happened: Van de Poppe shared his optimistic prediction with his 724,700 followers on social media platform X.

He expressed his belief that Bitcoin’s current market value is significantly underpriced and could witness a substantial surge if investors consider the digital asset as a safe haven against geopolitical uncertainties, banking instability, and currency debasement.

Van de Poppe also pointed out a potential breakout in the TOTAL3 chart, which monitors the market capitalization of all crypto assets excluding Bitcoin, Ethereum ETH/USD, and stablecoins. He observed a bullish divergence on the weekly time frame with the relative strength index (RSI), indicating a possible reversal could be on the horizon.

Also Read: Is Bitcoin Really Out Of The Danger Zone? Crypto Analyst Predicts Potential Dip

A breakout in the TOTAL3/BTC ratio would suggest that the broader altcoin market is outperforming Bitcoin.

At the time of writing, Bitcoin was trading at $60,013.74, up by almost 10% in the last seven days.

Why It Matters: Van de Poppe’s prediction, if realized, could signify a monumental shift in the crypto market. Bitcoin’s potential surge could attract a new wave of investors, further solidifying its position as a leading digital asset.

Additionally, a breakout in the TOTAL3/BTC ratio could indicate a growing interest in altcoins, potentially leading to a more diversified crypto market.

Read Next

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Black-Owned Coffee Chain In Oakland Files For Bankruptcy Amid Multiple Lawsuits

Red Bay Coffee Roasters has officially filed for Chapter 11 Bankruptcy. The Black-owned coffee chain in Oakland will begin this process as multiple lawsuits against the company wage on.

San Francisco Business Times reported that Red Bay filed in late August. The notable franchise, which boast five stores across the Bay Area, stated that Covid-19’s impact and the ongoing lawsuits played the biggest roles. Specifically, the paperwork noted “spiraling costs and related uncertainties” surrounding the lawsuits as a push toward Chapter 11 protections.

The owner and current debtor-in-possession, Keba Konte, founded Red Bay in his garage in 2014. In his declaration for first-day motions filed on Sept. 5, Konte released his asset valuation at $251,000. He also listed his liabilities at $3.3 million, with two loans valued at $550,000 each. On the other hand, the company had a net loss of more than $850,000 in a six-month period starting January 2024.

Through its expansion, Konte appointed the space as unapologetically welcoming to Black and Brown people, hosting panels and workshops to uplift its local community. Red Bay has also featured exclusive coffee blends that shed light on social causes, one most recently dedicated to the conflict in Democratic Republic of Congo conflict as well as sickle cell disease awareness. However, lawsuits accusing the employees of sexual harassment and wage theft have stunted the company.

In 2018, a former employee sued Red Bay, alleging that several coworkers engaged in sexual harassment against them. The employee further claims that they were demoted and then fired for retaliation. Moreover, they accused the business of not paying the full amount of wages owed.

A former landlord also filed another lawsuit against Red Bay. The filing stated the franchise breached a contract surrounding one of its now-defunct locations in Southern California. To add to their legal woes, the filing also claimed Equal Employment Opportunity Commissions (EEOC) launched an investigation into their business practices based on claims made by a former employee. THe EEOC has yet to confirm the investigation given federal policies.

As the Oakland-based chain enters bankruptcy, the future of its five operating storefronts remain in limbo.

RELATED CONTENT: Coffee Choice May Predict Election

Fed rate cut: Experts warn big moves would be a mistake

Wall Street’s great debate — a Fed rate cut — is back in the spotlight.

This time, it’s not whether the Jerome Powell led central bank will act at its September meeting, but rather, the size of the cut: 25 basis points or 50.

The case for a 50 basis point reduction has grown louder in recent weeks, as a weakening jobs market has prompted calls for more aggressive Fed action to avoid further economic deterioration.

Yet despite the handwringing and doomsday scenarios, strategists and economists told me this week a 50 basis point cut would send the wrong message to the market — one that signals the central bank is too late to act.

“A 50 basis point cut would reek of panic, and it’s almost like we’re totally behind the curve at this point,” BMO Capital Markets senior economist Jennifer Lee warned.

She added, “We’re tapping on the brakes… But the fact that the US economy has held up all this time speaks to the resilience of it all.”

Lee points to the upwardly revised second quarter GDP, resilient consumer spending, and lack of mass layoffs among factors supporting her call for a more measured approach, adding a soft landing is “in the cards.”

A larger cut could also raise the alarm for investors. Yardeni Research’s Eric Wallerstein told me a jumbo cut would likely spark volatility and signal the economy is “heading in the wrong direction.”

“For everyone who’s asking for a 50 basis point cut, I think they should really reconsider the amount of volatility that would cause in short-term funding markets,” Wallerstein said.

The pair of veteran assessments is in line with Goldman Sachs chief economist Jan Hatzius, who told Yahoo Finance executive editor Brian Sozzi this week he expects a series of 25 basis point rate cuts (though didn’t completely rule out a 50 basis point cut next week).

With less than a week until the Fed decision, traders are pricing in near-even odds of a 25 versus 50 basis point cut. As of Friday, the probability of a 50 basis point cut rose to 49%, up from 30% one week ago.

At the heart of the rate cut debate is the risk of a recession, a concern that’s plagued Wall Street for years.

Long-time market strategist Jim Paulsen told me on Opening Bid (video above; listen here) the ongoing fear of recession isn’t necessarily a reflection of deteriorating economic prints. Rather, it’s attributable to multiple factors: the shock of the pandemic, the polarizing political environment, and the breakdown of recession forecasting tools.

“Every recession tool that we’ve ever used to predict recessions has blown up or just has quit working,” Paulsen warned. ”We’re left rudderless on how to assess recession risk.”

The inverted yield curve, slowing rates of money supply growth, and the Conference Board’s Leading Economic Index (LEI) have all signaled a recession, leaving Wall Street anxious.

While it’s unlikely the Federal Reserve’s rate cut decision on Wednesday will resolve Wall Street’s ongoing recession debate, it should offer some near-term clarity for investors.

If the market pros are right, the size of the rate cut could signal whether the economy is at greater risk of weakening, which could potentially rattle financial markets and sway recession calls firmly in one direction.

Buckle up.

Seana Smith is an anchor at Yahoo Finance. Follow Smith on Twitter @SeanaNSmith. Tips on deals, mergers, activist situations, or anything else? Email seanasmith@yahooinc.com.

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

In the below Opening Bid episode, former Trump nominee to the Federal Reserve Judy Shelton shares her outlook for the economy.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

China touts home-grown chip lithography machines amid semiconductor self-sufficiency drive

The Chinese government is promoting two domestically made chip-making machines that it says have achieved significant advances, as the country strives towards technology self-sufficiency amid US sanctions.

The lithography machines, which print highly complex circuit patterns onto silicon wafers, “have achieved significant technological breakthroughs, own intellectual property rights but have yet to perform on the market”, according to the Ministry of Industry and Information Technology (MIIT), which did not name the companies behind the two machines.

One of the deep ultraviolet (DUV) lithography machines operates at a wavelength of 193 nanometres (nm), with a resolution below 65nm and an overlay accuracy below 8nm, according to a new list of “major technological equipment” published by the MIIT earlier this week. The other DUV machine has a wavelength of 248nm, with 110nm resolution and 25nm overlay accuracy, according to the list.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

The two machines are still far behind the most advanced options available on the market. One of Dutch equipment maker ASML Holding’s most advanced DUV machines, for instance, can operate at a resolution of below 38nm with an overlay accuracy of 1.3nm.

DUV machines also lag behind extreme ultraviolet (EUV) machines, which use light with a wavelength of just 13.5nm – almost 14 times sharper than DUV’s 195nm.

China has spent years pursuing technology self-sufficiency in semiconductors, but its progress in producing the lithography systems required to reliably mass produce advanced chips remains slow.

An engineer works on a deep-ultraviolet lithography system at ASML in Veldhoven, Netherlands, on June 16, 2023. Photo: Reuters alt=An engineer works on a deep-ultraviolet lithography system at ASML in Veldhoven, Netherlands, on June 16, 2023. Photo: Reuters>

Nearly all of the country’s lithography machines still come from the ASML, which has already cut off Chinese clients’ access to its cutting-edge EUV machines and is facing increased pressure from the US to withhold its DUV machines from China-based customers.

State-owned enterprise Shanghai Micro Electronics Equipment Group (SMEE), the country’s best hope to develop its own advanced lithography systems, still lags far behind its global peers such as ASML. The company, which was added to a trade blacklist by the US in December 2022, would need breakthroughs across multiple technologies and supplier networks to overcome restrictions, according to experts.

But SMEE has made some progress despite sanctions. The company in March last year filed a patent for “EUV radiation generators and lithography equipment”, according to corporate registry data published earlier this week.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2024 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2024. South China Morning Post Publishers Ltd. All rights reserved.

Trump Stumbles Again Over Health Care Issues Involving Abortion And Obamacare

In his recent debate with Vice President Kamala Harris, former President Donald Trump‘s stance on key health care issues, including the Affordable Care Act (ACA) and abortion, came under intense scrutiny. His responses, often vague and contradictory, highlighted his ongoing struggle with these critical topics.

What Happened: Trump’s handling of the ACA, also known as ObamaCare, and his inconsistent positions on abortion were brought into sharp focus during the debate.

Trump remained noncommittal about his plans for both subjects, leading Republican strategist Chuck Coughlin to comment that Trump “absolutely stepped on every possible land mine in both of those.”

According to the report by The Hill, On the subject of ObamaCare, Trump hinted at a potential attempt to repeal the law again but did not commit to having a replacement plan. He criticized the law as “lousy,” but reluctantly pledged to manage it “as good as it can be run” until a better and cheaper option is available.

Trump’s lack of a concrete plan to replace ObamaCare if repealed was also exposed during the debate. “I have concepts of a plan. I’m not president right now,” Trump said.

Also Read: Trump Vs Harris: New Poll Reveals Post-Debate Swing Towards This Candidate In Key State

Coughlin found Trump’s comments revealing, stating, “I think it spoke to the reason McCain gave the thumbs down is they never had an alternative plan.”

Trump’s shifting positions on abortion were also on display during the debate. He avoided committing to vetoing a national abortion ban and made several false claims about Democrats’ stance on abortion.

Read Also

Why It Matters: These issues are crucial in the upcoming election, with Democrats focusing on health care and polls indicating voters’ interest in plans to lower health costs.

Trump’s inconsistent positions on these issues could potentially impact his campaign. The debate has brought these topics to the forefront, and the public will be watching closely to see how Trump’s positions evolve in the lead up to the election.

Read Next

Trump Vs Harris: New Polls Reveal This Candidate Is Outperforming In Swing States

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Vs. Harris: Vice President's Strong Debate Showing, Taylor Swift Endorsement Do Not Move Needle On Her Poll Numbers As Pollster Cites This Reason

The presidential debate held last week did little to alter the equation between Republican candidate Donald Trump and his Democratic rival Kamala Harris, new poll results published on Sunday showed.

The Head-to-Head Tally: Harris received 51% support among registered voters compared to 47% support for Trump, the poll conducted by ABC News, who hosted the debate, along with Ipsos showed. The former’s slight lead is statistically unchanged from the previous ABC/Ipsos poll conducted before the debate.

The survey was conducted between Sept. 11-13 and 3,276 adults were surveyed for the purpose.

Among likely voters, the tally was 52%-46% in favor of Harris, unchanged from the numbers seen before the debate.

The share of Harris supporters who strongly backed her was 62%, while Trump supporters who strongly backed him was at 56%, down from 60% at the end of August.

The survey found that Taylor Swift’s endorsement had little impact. Merely 6% said the popular singer-songwriter’s endorsement of Harris makes them more likely to vote for her. While 13% said it makes them less likely to support her, 81% saying it makes no difference.

Debate Performance: Harris won hands down, according to the respondents, with 58% picking her as the winner and 36% opining that Trump won. Thirty-seven of the respondents said the debate made them think more favorably about the vice president, more than double that of the 17% who felt the same about Trump. Thirty percent of the respondents said the debate made them feel less favorably about the former president.

The benefit for Harris came from her voter base, as 60% of the Democratic and Democratic-leaning independent voters said the debate made them feel more favorably toward her. On the other hand, only 34% of the Republican and Republican-leaning independent voters said the debate made them see Trump more favorably.

“The absence of movement in vote preferences, despite a 22-point tilt to Harris as having won the debate, marks the sharply polarized nature of the electorate,” the pollster said. “Almost everyone has a preference between Harris or Trump, and among those who do, few say they’d even consider the other,” it added.

Among demographics, Harris led Trump among women, while among men, both were neck-on-neck. She had a 13-point lead over Trump among registered voters in the 18-29 years age category and a stronger 19-point lead among likely voters. The vice president’s good showing in this category is primarily attributable to strong support among women in this age group.

Harris had a thumping 81% support among Black registered voters and 89% support among likely voters in this racial group. She also led among Hispanic voters, with 7% support, while among white registered voters, she trailed by a 43%-54% margin.

Voter Issues: The economy and inflation continue to dominate as the top issues in the election, and Trump led Harris by seven points in voter trust in his ability to handle both. He had a 10-point lead over Harris in voter trust to handle immigration.

On the other hand, Harris had a seven-point lead on “protecting American democracy” and a 9-point lead on handling health care. The two remain evenly matched on crime and safety.

Check This Out:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Starbucks' New Superstar CEO Just Released His Plan to Fix the Business. Here's What Investors Need to Know.

On Aug. 13, coffee giant Starbucks (NASDAQ: SBUX) shocked the investing world when it named Brian Niccol as its new CEO. Niccol was formerly CEO at Chipotle Mexican Grill. And to lure him away, Starbucks was willing to absolutely break the bank. His total pay package is reportedly worth over $110 million.

With one of the largest pay packages on Wall Street, Niccol is now a superstar CEO. But Starbucks didn’t bring him in to maintain the status quo. On the contrary, the company is desperate to turn things around.

On Sept. 10, Niccol laid out a 100-day plan to start fixing things at Starbucks. And it all starts with its business in the U.S.

What’s the problem with Starbucks?

Niccol just wrote an open letter to all of Starbucks’ stakeholders, and he didn’t mince words. He said that in the chain’s U.S. coffee shops, “It can feel transactional, menus can feel overwhelming, product is inconsistent, the wait too long or the handoff too hectic.”

These observations — particularly the final one — aren’t necessarily new. In the second quarter of 2024, then-CEO Laxman Narasimhan said that some of Starbucks’ most loyal customers “sometimes chose not to complete their order, citing long wait times of product and availability.”

Former longtime Starbucks CEO Howard Schultz echoed Niccol’s thoughts in a social media post earlier this year. Schultz specifically used the term “transactional” to describe a feeling to be avoided, as did Niccol in his open letter. But Schultz would also approve of Niccol’s plan to start with the U.S. side of the business, since he said that “U.S. operations are the primary reason for the company’s fall from grace.”

In Starbucks’ North America segment (most of which is the U.S.), transactions have dropped during the last two quarters. This happens from time to time with a restaurant business. But in this case, the company believes the drop could have been avoided just by addressing things within its control. And that’s why it’s imperative to turn things around.

So what’s the plan now?

If this sounds like a small problem for Starbucks, I believe it’s fair to say that’s because it is. The company finished its fiscal third quarter in June. During the first three quarters of its fiscal 2024, it generated revenue of over $20 billion in North America, which was up 3% from the same three quarters of its fiscal 2023.

Also during the first three quarters of fiscal 2024, North America had over $4.1 billion in operating income, which was up 5%.

In short, North America is still a huge and growing business for Starbucks, and it’s profitable. The company isn’t experiencing an outright disaster. But the problems it does have are of its own making, which is why it’s imperative to fix things.

For Niccol, part of the plan for Starbucks is perfecting the morning experience, which is crucial. After all, management says roughly half of its sales come during the morning hours. And starting someone’s day off with a bad coffee experience is an easy way to lose a customer’s loyalty.

Niccol also wants to invest in the company’s baristas. He wants to get customers interested in dining in its cafes again rather than just carrying out. And he wants customers to better connect with the brand. But all of these sound like the suggestions that Schultz made earlier this year.

This is why I believe Starbucks’ shareholders should be hopeful about the future. While Starbucks stock has been one of the greatest investments over the last 30 years, the company has struggled each time Schultz has stepped away. It’s seemed like he has a firm grasp of what makes Starbucks great, whereas others haven’t. Niccol’s plan sounds a lot like something that Schultz would come up with. And so I think Starbucks’ prospects without Schultz in charge are finally improving.

To be clear, Niccol’s plan only addresses the next three months in the U.S.; there are problems elsewhere in the business that must eventually be resolved, especially in China. In short, there’s plenty more work to do. But I believe Starbucks has quickly returned to the right path under Niccol’s leadership, which is something to get excited about.

Should you invest $1,000 in Starbucks right now?

Before you buy stock in Starbucks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Starbucks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Jon Quast has positions in Starbucks. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Starbucks’ New Superstar CEO Just Released His Plan to Fix the Business. Here’s What Investors Need to Know. was originally published by The Motley Fool