Protecting a billionaire CEO costs millions. Here’s how the world’s biggest companies measure up

The biggest tech companies in the world are shelling out millions of dollars every year to protect their CEOs—but some pay more than others, and for good reason.

Among the generous perks awarded to top executives, security costs can be among the priciest, especially when it comes to high-profile business leaders. These security costs include everything from home monitoring to personal bodyguards and security consulting which come at a big cost to companies, depending on the executive.

Bill Herzog, the CEO of Arizona-based LionHeart Security Services, told Fortune that it’s important for companies to invest in protecting their CEO, especially if they’re among the richest people in the world, like Meta’s Mark Zuckerberg and Tesla’s Elon Musk. Herzog, whose company has provided security for politicians and other high profile individuals, said that these kinds of celebrity CEOs could especially be targeted. And if something were to happen to them, the company may be the one to take the hit financially and reputationally, he added.

“When you’re talking about somebody who’s worth millions of dollars or billions of dollars, and they are in charge of an entire company, there is a real possibility of kidnapping, there’s a real possibility of extortion, there’s a real possibility of attempts on their lives,” Herzog said.

For round-the-clock security, a service that requires specially trained security experts and specific resources, Herzog said his company would charge $60 an hour or more, a sum that could bring the total bill to upwards of $1 million per year for two guards.

Yet, some companies pay out much more than that to protect their chief executives. Here are some of the tech companies that pay the most:

Meta

Meta pays over three times more than the next closest tech company on the list to protect its longtime CEO and founder Mark Zuckerberg. In 2023, the company spent a total of $23.4 million for Zuckerberg’s personal security, including $9.4 million in direct security costs and another $14 million in an annual pre-tax allowance meant to “cover additional costs related to Mr. Zuckerberg and his family’s personal security.”

In previous years, Meta has paid out even more to protect Zuckerberg, with the bill for his personal security exceeding $24 million and $25 million in 2022 and 2021, respectively, according to a filing with the Securities and Exchange Commission (SEC).

The company paid these large security payments, “for the company’s benefit because of the importance of Mr. Zuckerberg to Meta,” according to the filing. Zuckerberg is especially at risk because of his position, the company argues.

“We believe that Mr. Zuckerberg’s role puts him in a unique position: he is synonymous with Meta and, as a result, negative sentiment regarding our company is directly associated with, and often transferred to, Mr. Zuckerberg,” the company wrote in the SEC filing.

Luckily, Zuckerberg is also a big aficionado of mixed martial arts.

Alphabet

Alphabet CEO Sundar Pichai talks a lot about cybersecurity, but his personal security is also top of mind for his company. In 2023, the tech giant forked over $6.8 million for Pichai’s personal security, according to a filing with the SEC.

The company also pays for a company car and his use of “non-commercial aircraft,” e.g. the private jet.

View this interactive chart on Fortune.com

Tesla

Tesla’s Elon Musk is no stranger to the limelight, and his personal security bill reflects that. Tesla paid $2.4 million in 2023 to a security company owned by Musk for security services, along with another $500,000 through February of this year, according to an SEC filing.

The bombastic CEO’s steep security costs are apparently very necessary. In July, Musk said in a post on X that two separate people had tried to kill him in the last eight months.

“They were arrested with guns about 20 mins drive from Tesla HQ in Texas,” Musk wrote.

After the failed assassination attempt on Donald Trump in July, Musk mulled taking his security into his own hands.

“Maybe it’s time to build that flying metal suit of armor [sic],” Musk said in a post at the time.

Nvidia

For one of the star CEOs of the moment, Nvidia spends comparatively less than its tech peers on CEO Jensen Huang’s security. In its fiscal 2024, the company spent about $2.2 million on residential security and consultation fees for Huang, plus hundreds of thousands on security monitoring services and car and driver services, according to a filing with the SEC.

While Huang once said Jackie Chan would be best suited to play him in a movie, Huang definitely doesn’t have Chan’s martial arts skills.

Apple

Although Tim Cook is not as famous as his predecessor, the iconic Steve Jobs, he’s still Apple’s most successful CEO, and the company wants him around for many years more.

Apple paid $820,309 for expenses related to Tim Cook’s security in 2023, which, while not a pittance, was still less than the $1.6 million it paid for his private jet use.

This story was originally featured on Fortune.com

Are Investors Missing The Forest? 35% Stock Drop Masks The International Potential Of This Weed Company

InterCure Ltd. INCR has shown resilience in its H1 2024 performance despite facing significant challenges, according to equity research by Pablo Zuanic of Zuanic & Associates. The company reported revenues of 126 million NIS ($33.97 million), surpassing the estimated 121 million NIS.

However, this is still below pre-October 2023 levels of 414 million NIS, mainly due to the ongoing disruption at its southern Israeli facility, which has been occupied by the IDF. The company invested heavily in restoring this facility and expects it to return to full operational capacity in the coming quarters.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Cash Reserves Plummet: Government Compensation Boosts EBITDA

InterCure reported an EBITDA of 17.6 million NIS for H1 2024, compared to the 5 million NIS estimate. However, this includes government compensation for damages caused by the conflict, which makes comparisons difficult.

The company ended June with 21 million NIS in cash, down from 111 million NIS in December 2023. Additionally, Zuanic noted the net debt increased from 60 million NIS to 112 million NIS over the same period, although the company has access to an unused credit line of over 22 million NIS.

Double-Digit Growth On The Horizon

Looking ahead, InterCure is guiding for double-digit sales growth in H2 2024, with revenues expected to reach around 140 million NIS, lower than previous estimates of 180 million NIS.

The company’s expansion strategy includes launching more than 30 new GMP SKUs in collaboration with brands such as Cookies, Binske and Organigram OGI. InterCure plans to introduce Cookies products in Germany by Q4 2024, in addition to ongoing sales in the UK.

Stock Performance And Valuation

The stock has experienced a drop from its May 2024 peak of $3.12 to $1.97. Despite the decline, Zuanic notes that the company’s valuation remains attractive, with the stock trading at 1x sales and 8x EBITDA for CY25.

InterCure’s enterprise value is currently estimated by Zuanic at $132 million, including $96 million in market capitalization and $36 million in net debt.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

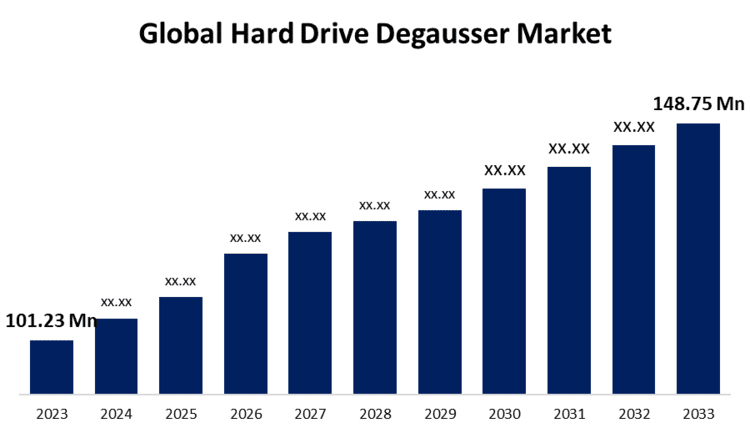

Global Hard Drive Degausser Market Size To Worth USD 148.75 Million by 2033 | CAGR Of 3.92%

New York, United States , Sept. 14, 2024 (GLOBE NEWSWIRE) — The Global Hard Drive Degausser Market Size is to Grow from USD 101.23 Million in 2023 to USD 148.75 Million by 2033, at a Compound Annual Growth Rate (CAGR) of 3.92% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5921

Degaussing is a technique for permanently wiping data from a hard drive that involves employing a powerful magnetic pulse to disrupt the magnetic domains on the disk platters. This procedure is often referred to as demagnetizing. Degaussing removes the magnetic field that stores data on a hard disk. This eliminates the local magnetic domains that hold the data, removing any traces. This procedure safely destroys data on hard drives that are no longer in use or are being disposed of. This protects against data breaches and is an NSA-approved technique of data deletion. Drives containing secret data from the Department of Defense (DOD) must be degaussed before shredding. Degaussing can save money since it allows you to reuse the hard disk rather than purchasing a replacement. However, this technique is only effective on magnetic media because it does not operate on solid-state drives (SSDs), memory cards, or USB flash drives which limits its usage.

Browse key industry insights spread across 210 pages with 140 Market data tables and figures & charts from the report on the “Global Hard Drive Degausser Market Size, Share, and COVID-19 Impact Analysis, By Type (Permanent Magnet Degaussers, Capacitive Discharge Degaussers, Coil Degaussers), By Application (Financial Companies, Data Storage Companies, Defense & Government, Hospitals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.”

Buy Now Full Report: https://www.sphericalinsights.com/checkout/5921

The capacitive discharge degaussers segment is anticipated to hold the greatest share of the global hard drive degausser market during the projected timeframe.

Based on the type, the global hard drive degausser market is divided into permanent magnet degaussers, capacitive discharge degaussers, and coil degaussers. Among these, the capacitive discharge degaussers segment is anticipated to hold the greatest share of the global hard drive degausser market during the projected timeframe. Capacitive discharge degaussers possess high power and strong magnetic fields which are essential for data security in the government, banking, and healthcare sectors, driving market growth.

The data storage companies segment is anticipated to grow at the fastest pace in the global hard drive degausser market during the projected timeframe.

Based on the application, the global hard drive degausser market is divided into financial companies,

data storage companies, defense & government, and hospitals. Among these, the data storage companies segment is anticipated to grow at the fastest pace in the global hard drive degausser market during the projected timeframe. Data storage companies are increasing their investment in degaussing technology to manage enormous amounts of sensitive information, driven by fears about data breaches, regulatory compliance, and correct disposal of obsolete storage devices.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/5921

North America is expected to hold the largest share of the global hard drive degausser market over the forecast period.

North America is expected to hold the largest share of the global hard drive degausser market over the forecast period. The increasing demand for data destruction solutions in the region is driven by strict regional laws, advanced techniques, and the presence of leading technology providers and a well-established IT infrastructure are some of the factors contributing to the hard drive degaussers demand.

Asia Pacific is predicted to grow at the fastest pace in the global hard drive degausser market during the projected timeframe. The region’s IT and data storage industries are quickly increasing, particularly in China, Japan, and India, as a result of improved digital infrastructure, enhanced data security awareness, and regulatory requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Hard Drive Degausser Market include Garner Products, Inc., VS Security Products Ltd., Proton Data Security, Data Security, Inc., Whitaker Brothers, ZhongChao Weiye, Sichuan Jiamei Xincheng, EDR Solutions, Security Engineered Machinery (SEM), Intimus International, HSM GmbH + Co. KG, Verity Systems Ltd., Applied Magnetics Laboratory, Inc., ACE Equipment Company, Kroll Ontrack, LLC, and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/5921

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global hard drive degausser market based on the below-mentioned segments:

Global Hard Drive Degausser Market, By Type

- Permanent Magnet Degaussers

- Capacitive Discharge Degaussers

- Coil Degaussers

Global Hard Drive Degausser Market, By Application

- Financial Companies

- Data Storage Companies

- Defense & Government

- Hospitals

Global Hard Drive Degausser Market, Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global FinFET Technology Market Size, Share, and COVID-19 Impact Analysis, By Technology (22nm, 20nm, 16nm, 14nm, 10nm, 7nm), By Product (CPU, SoC, FPGA, GPU, MCU, Network Processor), By Application (Computers and Tablets, Wearables, Smartphones, High-end Networks, Automotive, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Global Wide Format Printers Market Size, Share, and COVID-19 Impact Analysis, By Type (Inkjet-based printers, and Laser printers), By Application (Residential and Commercial), By Connectivity (Wired and Wireless), By Printing Material (Porous and Non-Porous), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Wireless Charging Market Size, Share, and COVID-19 Impact Analysis, By Technology (Inductive Charging, Resonant Charging, Radio Frequency Charging, and Others), By Component (Transmitters, Receivers, and Others), By Industry Vertical (Consumer Electronics, Automotive, Aerospace & Defense, Industrial, Healthcare, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Global Micro Server IC Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Hardware), By Processer Type (x86, ARM), By Application (Analytics & Cloud Computing, Web Hosting & Enterprise Applications, Edge Computing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company’s mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Interest rates are dropping. Why so many investors are clinging to cash, CDs and savings accounts.

When the Federal Reserve began raising interest rates in 2022, financial adviser David Flores Wilson needed time convincing clients to put their cash in places where it would produce yield — like CDs, money-market funds, T-bills BX:TMUBMUSD06M and high-yield savings accounts.

Now, the opposite is true. Wilson says it’s a challenge persuading some of them to reduce their money in those positions.

Most Read from MarketWatch

For the past year or so, these supersafe investments were fetching investors 4% or 5% on their cash. But when the Fed starts cutting rates, that return is expected to diminish. Yet even when Wilson’s clients know this, some are still hesitant to budge.

“It’s a little bit of fighting city hall,” said Wilson, managing partner of Sincerus Advisory, where he’s compromised with certain clients on smaller allocations out of cash. “The certainty of a return is so attractive to so many people, and particularly to my client base.”

There’s plenty of people who have learned to love cash in recent years, and they don’t plan to break-up with it anytime soon. The coming Fed cuts aren’t going to change that, financial advisors and cash investment experts agree.

See also: Most retail investors are holding on to their cash these days. Here’s why.

What’s playing out on a big scale is “ambiguity aversion,” according to Vicki Bogan, a professor at Duke University’s Sanford School of Public Policy where she specializes in behavioral finance.

People tend to prefer what’s known and familiar, avoiding actions with an uncertain range of outcomes. Cash is a conservative asset, but Bogan said this isn’t “risk aversion.” That’s where people avoid risk — but at least they know the distribution of outcomes and odds.

Questions surrounding the Fed’s rate moves, the economy’s health and presidential election are clouding the range of scenarios, Bogan said. “As the dominoes start to fall, investors will become more confident or certain about what the distribution could be.”

Until then, guaranteed yield is still going to look pretty good.

Automated investing company Wealthfront currently offers up to 5.5% APY on its high-yield cash account. Leading into rate cuts, the company said it’s still seeing clients open new high-yield cash accounts and more money flowing into current accounts.

Betterment, another fintech company that offers high-yield cash accounts, also confirmed that it’s still seeing money flow into these accounts from new and existing clients.

Where to put your cash now

Some financial advisors think this money is better off invested elsewhere.

“I would not be in short-duration fixed income or money markets,” Elliot Dornbusch, the chief executive and chief investment officer of CV Advisors, told MarketWatch.

CV Advisors provides investing advisory services and asset management for high-net worth individuals. Dornbusch said that many of CV Advisors’ new clients come to the firm with portfolios that are filled with short-term fixed income securities or cash parked in money-market funds. Getting them to move their money out of those positions takes a little persuasion.

“They were afraid of investing. We’re trying to take away that idea of being afraid,” Dornbusch said. “If they’re very conservative, we’ll put them in longer-duration fixed income. And if they have more appetite for risk, we can combine that with some equities.”

Dornbusch believes that the best way to take advantage of high rates isn’t by maximizing yield through short-duration bonds or by collecting interest on cash assets, but instead by investing in long-term Treasurys BX:TMUBMUSD10Y and investment-grade bonds. Although the yield might not seem quite as high, those rates can stick around for years.

Dornbusch tells clients that long-term fixed income securities have all the benefits of the yield-generating assets that investors love — they are conservative assets that offer reliable returns — but they’re more insulated from rate cuts.

“When you explain it in simple terms, people can understand. It’s a matter of just having the conversation,” he said.

Investing strategies should depend on personal risk tolerance, as well as someone’s age. Maybe locking away money for 10 years or longer isn’t the best idea if an investor is of an advanced age. Others might be hesitant about migrating into riskier investments like stocks while they’re close to record highs.

When the market changes, it’s important to adjust your investing strategies as needed. Even without a financial adviser, retail investors can choose to shift their strategies as the market shifts.

Or not.

Yields on cash will fall, but how quickly will hinge on the size of the Fed’s first rate cut in four years, which is expected at next week’s central bank meeting. It also depends on if economic data allows for a slow, or swift pace, of future rate cuts.

“A lot of people have been rewarded for having way too much in cash. Those day seems to be numbered,” Daniel Masuda Lehrman, a Honolulu-based financial adviser, told MarketWatch.

There’s over $6.3 trillion sitting in money-market funds right now and roughly $2.6 trillion comes from retail investors, according to the Investment Company Institute.

Even if the Fed eventually brings its rate to 2.5% or 3%, that’s still a relatively good-looking yield that keeps money pouring into money-market funds, said Shelly Antoniewicz, deputy chief economist at the asset management industry association.

As rates decline, she said, “retail investors certainly may slow the pace of their investment in money-market funds as they decide where to put newly available cash to work. We’ve already seen this happening this year, but we don’t expect widespread outflows.”

So whether retail investors will break up with their interest yielding assets is to be determined. Maybe people will be happy collecting 2.5% interest — as long as that return is reliable.

Most Read from MarketWatch

The 4% Rule Isn't for Everyone – Here's Another Type of Strategy to Consider

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

The 4% rule has long provided guidance to retirees on how to maintain a safe withdrawal rate from retirement accounts. But with today’s low bond yields and stock market volatility, this once-steady rule of thumb looks increasingly open to change. An approach detailed by John Hancock Investment Management suggests using diversified multi-asset income portfolios. The idea is to provide more durable and ample income streams, while better protecting nest eggs through volatile markets.

Do you want help building a retirement plan for the future? Speak with a financial advisor today.

What Are Multi-Asset Income Portfolios?

Multi-asset income portfolios combine a variety of assets with the objective of generating steady cash flows. They typically hold an array of bonds, including government, investment-grade corporate and high-yield issues. They may also include dividend-paying stocks, real estate investment trusts (REITs), master limited partnerships (MLPs) and alternative income generators, like private equity and infrastructure securities.

Diversification across many income sources is the hallmark of multi-asset strategies. This aims to deliver higher yields for investors, while controlling for the risk of overexposure to any single asset class or market sector. Portfolios mix higher-risk, higher-yield securities with lower-risk securities to balance pursuing returns and managing risks.

Multi-asset income strategies offer ordinary investors, savers and retirees today the opportunity to develop greater resilience to market downturns compared to simply relying on the 4% rule over the long term. This rule of thumb suggests withdrawing 4% of retirement savings the first year of retirement and increasing the withdrawal amount annually by the inflation rate.

With long-term bond yields still depressed compared to historical norms, however, a traditional 60/40 stock/bond portfolio may produce overall returns insufficient to support a 4% withdrawal rate. Stock market volatility also adds uncertainty around the idea that 4% will be a safe withdrawal rate for decades into retirement.

In contrast, multi-asset income portfolios have delivered steadier payouts and lower volatility through three recent market downturns, according to John Hancock’s report. These include the 2008 financial crisis, the 2020 pandemic-driven selloff and the 2022 stock and bond correction. Investors in these portfolios enjoyed average annual payouts slightly exceeding 4% throughout most of this turbulence, according to an analysis by Manulife Investment Management referenced in the report.

Who Should Consider This Approach?

Multi-asset income investing isn’t necessarily right for everyone facing retirement. The wide mix of assets across stocks, bonds and alternative investments increases portfolio costs and complexity versus holding just an index fund. It also requires active management of the asset allocation, as market risks shift over time. And yields will fluctuate, so income cannot be guaranteed the way a bond’s coupons promise fixed interest.

But for retirees seeking to generate durable cash flow to support their lifestyle, multi-asset income strategies merit consideration. For those uncomfortable with depending on dividend stocks or high-yield bonds alone to fund retirement, multi-asset diversity spreads risk. These portfolios have delivered steady payouts for years according to Manulife Investment Management’s aforementioned data, with likely lower levels of volatility than stocks. Consider talking to a financial advisor about your investment options and what may be appropriate for your goals.

Individual investors’ income needs, withdrawal rate requirements and risk tolerance all determine whether or not a multi-asset income portfolio would be a good fit. While past performance doesn’t guarantee future results, the record of resilience through recent stock and bond storms suggests multi-asset funds could be a viable option for many.

Limitations and Risks of Multi-Asset Income Portfolios

While multi-asset income portfolios contain risks better than relying on the 4% rule, limitations remain. Income isn’t guaranteed year-to-year, and future returns could fall short of historical averages. Additionally, the variety of securities involved leads to higher management fees than simple index funds, as investors pay for active oversight of these more complex strategies.

Finding the right mix of assets that aligns with your income goals and risk tolerance takes guidance. No standard portfolio allocation meets every investor’s needs, so it may be prudent to consult a financial advisor. And shifting some holdings like private equity or real estate into income-generating assets can take time and involve transactional costs.

Retirement Tips

-

If you have a questions about how to parse out your money in retirement, a financial advisor can help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

SmartAsset’s investment and return calculator helps you project how large your portfolio will grow over time.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/kate_sept2004, ©iStock.com/Paperkites

The post Do You Follow the 4% Rule for Retirement Income? You May Want to Consider This Style of Portfolio appeared first on SmartReads by SmartAsset.

Why Medical Properties Stock Rocketed Nearly 14% Higher Today

Although Friday was something of a sleepy news day for Medical Properties Trust (NYSE: MPW), the latest analyst moves concerning the stock motivated investors to plow into it. As a result, shares of the specialized real estate investment trust (REIT) surged during the trading session. They closed the day almost 14% higher in price, absolutely trouncing the 0.5% increase of the S&P 500 index.

Good deal inspires positive reactions

Two professional Medical Properties Trust-watchers weighed in with new takes on the stock Friday. Of the two, the more weighty came from Colliers Security’s David Toti. He up-shifted his recommendation on the REIT to buy from the previous neutral, placing a $6.50 per-share price target on the stock.

Toti’s peer Michael Lewis at Truist Securities also got notably more optimistic about Medical Properties Trust’s future. He cranked his price target 20% higher, raising it to $6 per share from $5.

The timing is not coincidental. Both moves came mere days after Medical Properties Trust’s news that it had reached a settlement with its most problematic tenant, the financially strapped Steward Health Care (which filed for Chapter 11 bankruptcy in May). Under the terms of the deal, the REIT will regain control over the 23 properties rented by Steward; it has already lined up new tenants for 15 of them.

A necessary exit

The Steward arrangement is a milestone for Medical Properties Trust that helps remove a millstone. The situation with the failing tenant was much of the reason for the pronounced slide in the REIT’s popularity, and the satisfying resolution has been — and will likely continue to be — an incentive for investors to re-evaluate their own takes on the company.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Eric Volkman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Colliers International Group and Truist Financial. The Motley Fool has a disclosure policy.

Why Medical Properties Stock Rocketed Nearly 14% Higher Today was originally published by The Motley Fool

$12M In Rental Income: Why Investors Should Watch This Stock That's Crushing Averages

In a volatile cannabis market driven by regulatory uncertainty and the upcoming U.S. elections, New Lake Capital Partners NLCP stands out as a stable option for investors seeking consistent returns.

With its cannabis-focused real estate portfolio, NLCP offers strong dividend yields and steady rental income growth, making it an attractive choice amid market turbulence.

According to Pablo Zuanic of Zuanic & Associates, NLCP’s financial performance and dividend yield make it a potentially attractive option for investors navigating the volatile cannabis sector.

Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Rental Income Growth And AFFO Strength

NLCP’s rental income for the first half of 2024 increased by 10% year-over-year, reaching $12.2 million, noted Zuanic. The company’s net real estate portfolio (NREP) grew by 2.4% since the end of 2023, bringing its total portfolio yield to an annualized 12.7%.

This is slightly behind its peer, Innovative Industrial Properties (IIPR), which posted a 14.6% yield on its portfolio after a 5% growth since year-end 2022. Despite the slower growth, NLCP’s Adjusted Funds from Operations (AFFO) rose by 17% year-over-year in Q2 2024, compared to a modest 1% increase for Innovative Industrial Properties, Inc. IIPR.

Dividend Security And Yield Comparison

NLCP’s quarterly dividend of $0.43 per share provides an 8.7% yield, significantly higher than IIPR’s 5.9% yield and 500 basis points above the U.S. 10-year Treasury rate.

Zuanic’s projections estimate an AFFO per share of $2.10 for 2024, translating to a price-to-AFFO ratio of 9.4x, compared to 14.1x for IIPR, indicating a potential value for NLCP investors.

Portfolio Risks

Although NLCP’s portfolio is fully rented, certain risks remain. Zuanic reports that Revolutionary Clinics, a tenant accounting for 10% of NLCP’s rental income, missed 50% of its June and July 2024 rent payments. The company is negotiating with the tenant to resolve the issue, possibly through rent deferrals or other concessions. Additionally, five operators account for 62% of NLCP’s rental income, with Curaleaf CURLF representing 22%.

By comparison, IIPR’s top five tenants contribute 48% of its rental revenue, highlighting potential concentration risks in both companies.

Debt Leverage Among REITS

Within the cannabis real estate investment trust (REIT) sector, mortgage REITs like Chicago Atlantic REFI and AFCG AFCG have experienced different growth rates. REFI’s loan book grew by 22% year-over-year in Q2 2024, while AFCG saw some notable exits during the quarter, resulting in a smaller loan book.

Despite these differences, NLCP maintains a conservative debt strategy, with only $7.6 million drawn from its $90 million credit facility, representing 1.9% of equity. In contrast, IIPR carries $297 million in debt, or 15% of its equity, but boasts a 17x debt service coverage ratio, signaling a strong ability to meet its obligations.

Valuation And Outlook

While NLCP currently trades near its book value of $19.54 at $19.76 per share, IIPR trades at 1.82 times its book value, reflecting a premium tied to its perceived growth potential.

Although NLCP lacks a listing on a major U.S. exchange, Zuanic’s report suggests the company could achieve a premium valuation if the cannabis industry’s growth continues, particularly given its solid dividend yield and strong AFFO performance.

Read Next: New Laws Could Unleash $1.7B Demand For Cannabis Loans, This Real Estate Stock Is Set To Capitalize

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rewarding Dividends: 3 Stocks That Pay Out No Matter What

Companies around the world paid a record $606.1 billion in dividends to their shareholders during the second quarter — 8.2% more than the prior-year period. Nearly 90% of dividend-paying companies have either held their payments steady or raised them over the past year.

This data suggests that right now is a great time for dividends. However, that’s not always the case. Downturns and recessions can severely impact the ability of some companies to continue making those payments.

While some companies might at some point be unable to maintain their dividends, Enterprise Products Partners (NYSE: EPD), Enbridge (NYSE: ENB), and American States Water (NYSE: AWR) are models of dividend durability. They’ve continued doling out those payments to investors over the years no matter what. Because of that, they stand out to a few Fool.com contributors as great stocks to buy for those seeking reliable dividend payments.

Enterprise is ready to pay you (well)

Reuben Gregg Brewer (Enterprise Products Partners): The honest truth is that most investors will probably find Enterprise Products Partners’ 7.2% distribution yield to be the main attraction of its stock. Given the S&P 500‘s miserly current yield of just 1.2%, that’s not shocking. But when it comes to creating a passive income stream, there’s a lot more than that to like about Enterprise Products Partners.

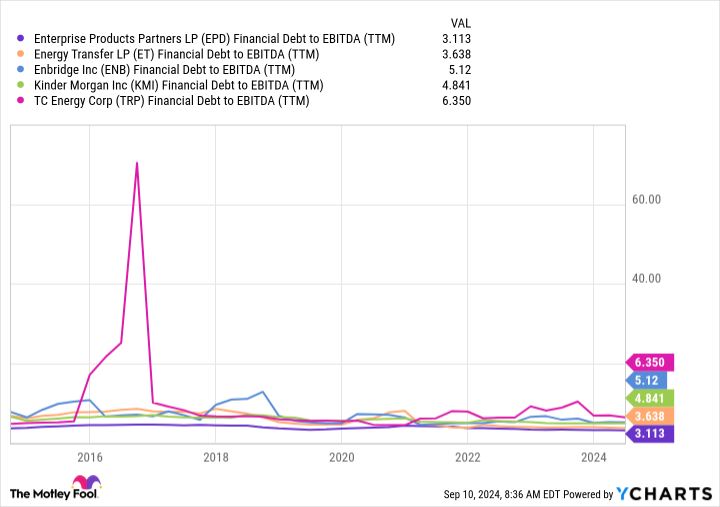

For starters, there’s its position as one of the largest midstream energy businesses in North America. It owns a virtually unduplicatable network of energy infrastructure assets — pipelines, storage facilities, processing facilities, and more — that produces reliable fee income over time. That is what supports the dividend, and its distributable cash flow covers its distribution by a safe 1.7 times. On top of that, Enterprise’s balance sheet is investment-grade rated, so there’s little reason to worry about it needing to cut its distribution. Also notable is the fact that Enterprise is one of the most financially conservative players in its peer group, and has been for years. So what you see today is really what you’ll be getting for the long term.

That all leads up to the next big number on the distribution front, which is 26. That’s the number of consecutive years that the energy company has increased its distribution. If you are looking for a reliable high-yield income stock, Enterprise Products Partners should be on your short list.

Proven dividend durability

Matt DiLallo (Enbridge): Enbridge pays one of the most reliable dividends in the energy sector. The Canadian pipeline and utility company has made dividend payments for more than 69 years, and increased those payments for 29 straight years. That streak should continue no matter the market conditions.

Driving that view is the overall durability and predictability of Enbridge’s earnings. The company has met its annual financial guidance for 18 straight years. That period included two major recessions and two other periods of oil market turbulence. Enbridge has an extremely stable earnings profile, with 98% of its income coming from cost-of-service or contracted assets. It also gets more than 95% of its earnings from investment-grade rated customers. Meanwhile, about 80% of its earnings come from contracts with inflation protections in place.

Enbridge’s target is to pay out 60% to 70% of its stable earnings in dividends. That enables it to retain a meaningful percentage of its cash flow to fund expansion projects. The company also has a solid investment-grade balance sheet. Its leverage ratio was 4.7 at the end of the second quarter, and is on pace to slide toward the low end of its 4.5 to 5.0 target range by next year as the company captures the full benefit of its recent natural gas utility acquisitions.

Those deals will help it grow its earnings over several years. In addition, the company has an extensive backlog of capital projects. These help support management’s view that it can grow its earnings at an annual rate of around 5% over the medium term.

With a strong financial profile and visible growth coming down the pipeline, Enbridge should have plenty of fuel to continue increasing its dividend, which yields more than 6.5% these days. Those features make Enbridge an excellent option for those seeking a dividend they can bank on.

70 years of dividend raises and counting

Neha Chamaria (American States Water): When it comes to dividends, American States Water has achieved something no other publicly listed stock in the U.S. has — it has increased its dividend every year for the past 70 consecutive years. That makes American States Water stock the Dividend King with the longest active streak of dividend increases. Yes, this is one stock that doesn’t just pay you a dividend, but also sends ever-fatter checks your way every year, no matter what.

It doesn’t take much to guess why American States Water has been such a bankable dividend stock. It’s a regulated water utility and generates stable and predictable cash flows from its services. It provides water services to more than 1 million people across nine states, and also has an electric utility subsidiary. That aside, American States Water’s contracted services subsidiary provides water and wastewater services to 12 military bases in the U.S. under 50-year contracts and one under a 15-year contract.

What’s truly remarkable about American States Water’s dividend is its pace of growth. It has grown its dividend at a compound annual rate of 8.8% over the past five years, and 8% over the past 10. Its latest hike, announced in August, was an 8.3% boost. That’s rock-solid dividend growth coming from a utility. With American States Water also targeting at least 7% payout growth in the long term, this 2.3%-yielding dividend stock is the kind every income investor would want to own.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Matt DiLallo has positions in Enbridge and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Rewarding Dividends: 3 Stocks That Pay Out No Matter What was originally published by The Motley Fool

OnlyFans Beats Apple, Google, Netflix, And Other Big Tech Companies In Revenue Per Employee: Here's The Down Low

Content-sharing platform OnlyFans has come out on top against big tech companies like Apple Inc., Alphabet Inc.’s Google, Netflix Inc., and others in terms of revenue generation per employee.

What Happened: OnlyFans reported revenue of $1.3 billion for the financial year 2023.

While its revenue is a fraction of that of big tech companies like Apple, Google, and Microsoft, its revenue per employee is magnitudes higher than these tech giants, as pointed out by Trung Phan.

| Company | Revenue | No. Of Employees | Revenue Per Employee |

| OnlyFans | $1.3 billion | 42 | $30.95 million |

| Craigslist* | $0.694 billion | 50 | $13.88 million |

| Netflix | $33.7 billion | 13,000 | $2.59 million |

| Apple | $383 billion | 161,000 | $2.38 million |

| Meta Platforms | $134 billion | 67,317 | $1.99 million |

| $305 billion | 182,502 | $1.67 million | |

| Microsoft | $245 billion | 221,000 | $1.1 million |

Source: Company reports | *Craigslist’s revenue is from 2022, as data for 2023 was not immediately available

On average, each OnlyFans employee contributed to nearly $31 million to the company’s top line, while Microsoft’s average revenue per employee was the lowest in this last at just $1.1 million – almost 28 times lower than that of OnlyFans.

For context, Apple, Microsoft, Alphabet, and Meta are four of the five most valuable companies in the world in terms of market capitalization.

See Also: Mark Zuckerberg Live Event Sold Out Stadium: Meta CEO Attracted Thousands Eager To Hear Him Speak

Craigslist, a privately held classifieds platform, continued to remain among the top companies in terms of revenue per employee. Although its revenue has shrunk from its peak of $1 billion in the late 2010s, its revenue per employee remains among the highest in the list due to its relatively small team.

The story is completely different, however, for tech giants who have thousands of employees on their payrolls.

While their revenue is also several magnitudes higher than OnlyFans and Craigslist, the significantly higher number of employees brings down the average revenue to single digits.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Dividend King Consumer Staples Stocks That Could Make You a Millionaire

It is unlikely that any one single stock will get your portfolio to millionaire status, at least not without you taking on a huge amount of risk. A far better (and less-risky) approach is to buy a collection of well-run stocks. What better place to look than Dividend Kings, which have proven their ability to reward investors by increasing dividends for five decades (or more).

Right now you might want to look at consumer staples icons Coca-Cola (NYSE: KO), PepsiCo (NASDAQ: PEP), and Hormel Foods (NYSE: HRL). There’s a different reason to like each one of these three Dividend Kings.

1. Coca-Cola is a steady grower

Every company’s business waxes and wanes over time. But some seem to manage to keep steadily growing with a normal sine curve that moves reliably higher over time. Coca-Cola is one of those companies, and it’s a big reason why it’s been a long-term holding for Warren Buffett’s Berkshire Hathaway for decades. The fact that the Coca-Cola name is one of the best-known beverage brands in the world means you probably already know what it does.

Because it’s well known, Coca-Cola stock rarely goes on sale and it isn’t exactly cheap today. The stock’s price-to-sales and price-to-earnings ratios are both a little above their five-year averages. The 2.7% dividend yield is also below the five-year average. A big price rally over the past year or so is largely responsible for this. However, the company’s clout in the industry and its long history of growth make it a worthwhile foundational investment choice.

Notably, Coca-Cola’s earnings growth has averaged 10% annualized over the past five years. That may not last, but it speaks to what the company can do when it is hitting on all cylinders. If you don’t mind paying a fair price for a great company, Coca-Cola should be in your millionaire-maker portfolio. And if the stock price falls, well, take the opportunity to increase your stake in this beverage giant.

2. PepsiCo is more attractively priced

PepsiCo is No. 2 to Coca-Cola on the beverage front, but it is the No. 1 in salty snacks (with its Frito-Lay brand). On top of those two businesses, it also has a packaged food division (Quaker Oats). It is a food industry giant, with the kind of scale, distribution, and marketing prowess that makes it a vital partner to retailers around the world. It, too, has proven its ability to steadily grow its business over the long term. Remember, like Coca-Cola and Hormel, PepsiCo is a Dividend King.

Another key reason to add PepsiCo to the consumer staples mix in your portfolio is that it is more reasonably priced today. The stock’s P/S ratio is below its five-year average and its P/E ratio is basically at the five-year average. The stock’s 3% dividend yield, meanwhile, is above the five-year average. All in, PepsiCo looks fairly priced to a little cheap right now.

PepsiCo’s business isn’t growing as strongly as Coca-Cola’s at the moment. That said, over the past decade revenue has grown at 3% a year with earnings expanding at 4%. That’s pretty solid for a consumer staples company. And while PepsiCo’s earnings growth has been weaker than Coca-Cola’s of late, even great companies go through weak periods. That’s often a good time for long-term investors to jump aboard.

3. Hormel is in the dog house

Hormel is a pure-play food maker. It has been shifting its portfolio around over the past few years to focus on branded food items, adding brands like Wholly Guacamole, Planters, and Columbus to its already strong roster of iconic brands, like SPAM and its namesake Hormel, among others. Innovation has long been a strong suit for Hormel and is one of the many reasons why it is such a valuable partner to retailers.

That said, Hormel hasn’t been hitting it out of the park lately, as it is stuck in a bit of a rut. The consumer staples company hasn’t been as successful at passing its rising costs on to consumers, has been hampered by the impact of avian flu, has struggled with a slow pandemic recovery in China, and bought Planters right as the nut segment of the snack category started to slow down. Any one of these issues could be brushed off, but all four at once have Wall Street concerned about the future. Still, it seems highly likely that Dividend King Hormel will, eventually, muddle through just fine. But it may take a little time.

That’s an opportunity for investors who think in decades and not days. Hormel’s P/S and P/E ratios are both below their five-year averages. Its 3.5% dividend yield is well above its five-year average. It is the value play in this trio, with recovery potential as management slowly deals with the list of problems that currently have investors down.

Slow and steady wins the race

If you are looking at the companies here, Coca-Cola, PepsiCo, and Hormel, and thinking that they aren’t going to get you to millionaire status overnight, well, you’re right. They won’t. They are reliable businesses that throw off cash to investors year in and year out, allowing shareholders to build wealth over time. They are the kind of boring, foundational stocks that underpin seven-figure portfolios all across Wall Street (remember, Buffett has owned Coca-Cola for decades). Each one is slightly different. Each one trades at a slightly different valuation. But all three are the kinds of stocks that will let you sleep well at night while you build generational wealth and a reliable income stream, particularly if you put them all together in one diversified portfolio.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Reuben Gregg Brewer has positions in Hormel Foods. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

3 Dividend King Consumer Staples Stocks That Could Make You a Millionaire was originally published by The Motley Fool