Flappy Bird Is 'Officially Coming Back' After A Decade With October Web Launch

Flappy Bird, the mobile game that stormed the world in 2013, will return after its removal from app stores a decade ago.

The Flappy Bird Foundation Group, a team of dedicated fans, has acquired the Flappy Bird trademark from Gametech Holdings. This company obtained it from the game’s original creator, Dong Nguyen.

See Also: Mobile Games Captured $90.4B, 49% Of Global Market In 2023

“It’s not a rumour. I’m officially coming back, and I’ll be FREE to play,” the game’s official account posted on X.

What’s New In Flappy Bird?

Flappy Bird will launch a web version by the end of October and plans to release on iOS and Android in 2025. The new versions will introduce new characters and game modes.

Michael Roberts, chief creative at the Flappy Bird Foundation Group, expressed excitement about the project: “We are beyond excited to be bringing back Flappy Bird and delivering a fresh experience that will keep players engaged for years to come.”

The Flappy Bird Foundation Group has also secured the rights to Piou Piou vs. Cactus, a game that influenced the original Flappy Bird.

Background

Flappy Bird was released in 2013 and quickly became a viral hit. However, in February 2014, the game which was earning $50,000 a day, vanished unexpectedly from app stores.

At the time, Nguyen told Forbes: “Flappy Bird was designed to play in a few minutes when you are relaxed… But it happened to become an addictive product. To solve that problem, it’s best to take down Flappy Bird. It’s gone forever.”

Read Next:

Photo: Miljan Zivkovic/Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CaringKind Presents the 8th Annual Caring to Remember benefit: Raising Awareness and Funds for Alzheimer's and Related Dementias

New York City Real Estate Leaders Come Together to Honor Influential Figures in the Fight Against Alzheimer’s

NEW YORK, Sept. 13, 2024 /PRNewswire/ — CaringKind, New York City’s leading expert in Alzheimer’s and related dementia caregiving, is proud to announce the 8th Annual Caring to Remember Cocktail benefit, which will take place on Wednesday, September 18, 2024, at Tribeca 360. This prestigious event will bring together more than 500 influential leaders from New York City’s real estate and construction industries for an evening of networking, celebration, and raising crucial funds and awareness to support those impacted by Alzheimer’s disease and related dementias.

Founded in 2015 by Heidi Lohrfink Nigg, Geraldine Szabo of GKS Industries, and Andrea Tallent Spivak, VP of Development & Strategic Alliances at CaringKind, Caring to Remember was created to unite New York’s commercial real estate leaders in the fight against Alzheimer’s and related dementias. Since its inception, the event has raised over $1.5 million to support groundbreaking research, caregiving services, and advocacy efforts.

This year’s event aims to raise $550,000, which will support CaringKind’s vital work, including its partnership with the Blue Zones Project in the Bronx. The project focuses on improving community health and reducing the risk of Alzheimer’s and related dementias in the Bronx, a borough with one of the highest rates of the disease in the country.

Honoring Leaders Making a Difference

At this year’s event, CaringKind is honored to recognize three distinguished leaders whose exceptional contributions have made a lasting impact on the Alzheimer’s community:

- Frances Graham, Senior Managing Director, Project Management, Northeast Region at Newmark, Honoree

- Linda Foggie, Global Real Estate Executive, Vista Equity Partners, Honoree

- Joseph Szabo, SVP of Property Management at Paramount Group, recipient of the 2024 Caring to Remember Jerry Silecchia Legacy Award

These honorees have played an instrumental role in shaping a better future for individuals living with Alzheimer’s and their families, and their commitment to this cause is truly commendable.

A City Lit in Purple for Alzheimer’s Awareness

In honor of World Alzheimer’s Day on September 21, CaringKind is partnering with prominent New York City landmarks to light the skyline in purple. On the evening of September 18, the following buildings will illuminate in purple to show solidarity with those affected by Alzheimer’s and related dementias:

- The Helmsley Building

- One Vanderbilt

- One World Trade Center

- 151 W 42nd St

- One Bryant Park

- Sven in Long Island City

- Oculus

- Brookfield Place

This striking visual display serves as a powerful reminder of the need for greater awareness and support for Alzheimer’s and related dementia caregiving, research, and advocacy.

Additional Proceeds for Research and Advocacy

In addition to supporting CaringKind’s local care and educational initiatives, proceeds from the event will also benefit the Alzheimer’s Association to fund research toward finding a cure, and UsAgainstAlzheimer’s to support advocacy efforts focused on Medicare reform, ensuring better care and access for those affected by Alzheimer’s.

Get Involved

To purchase tickets, donate, or become a sponsor, visit https://C2R.givesmart.com. Your contribution helps ensure that those impacted by Alzheimer’s and related dementias receive the care, support, and resources they need.

“As we gather again for Caring to Remember, we are filled with hope,” said Andrea Tallent Spivak, VP of Development & Strategic Alliances at CaringKind. “Thanks to the ongoing support of New York’s real estate industry and our dedicated partners, we are one step closer to a future where Alzheimer’s and related dementias are better understood, treated, and ultimately prevented.”

About CaringKind:

CaringKind is your leading expert on Alzheimer’s and dementia caregiving. With over 45 years of experience, CaringKind works directly with community partners to develop the information, tools, and training to support individuals and families affected by dementia. CaringKind is dedicated to being your Trusted Partner in the journey through Alzheimer’s and related dementia care, providing guidance, support, and comprehensive services to every person, at every stage of the disease. From the moment of diagnosis to end-of-life care, their mission is to ensure that everyone, regardless of their background or the challenges they face, receive the Trusted Support they need, ensuring no one walks this path alone. Visit www.caringkindnyc.org

Sponsorship and Tickets:

Andrea Tallent Spivak

VP of Development & Strategic Alliances, CaringKind

Phone: (646) 744-2905

Email: aspivak@cknyc.org

![]() View original content:https://www.prnewswire.com/news-releases/caringkind-presents-the-8th-annual-caring-to-remember-benefit-raising-awareness-and-funds-for-alzheimers-and-related-dementias-302247837.html

View original content:https://www.prnewswire.com/news-releases/caringkind-presents-the-8th-annual-caring-to-remember-benefit-raising-awareness-and-funds-for-alzheimers-and-related-dementias-302247837.html

SOURCE CaringKind

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How To Earn $500 A Month From Broadcom Stock

On Sept. 5, Broadcom Inc. AVGO reported stronger-than-expected earnings and sales results for its third quarter.

The company’s quarterly revenue of $13.072 billion, beating analyst estimates of $12.96 billion, according to Benzinga Pro. The semiconductor company reported second-quarter earnings of $1.24 per share, beating analyst estimates of $1.20 per share.

With the recent buzz around Broadcom, some investors may be eyeing potential gains from the company’s dividends. As of now, Broadcom has a dividend yield of 1.34%. That’s a quarterly dividend amount of 53 cents a share ($2.12 a year).

To figure out how to earn $500 monthly from Broadcom, we start with the yearly target of $6,000 ($500 x 12 months).

Next, we take this amount and divide it by Broadcom’s $2.12 dividend: $6,000 / $2.12 = 2,830 shares

So, an investor would need to own approximately $465,705 worth of Broadcom, or 2,830 shares to generate a monthly dividend income of $500.

Assuming a more conservative goal of $100 monthly ($1,200 annually), we do the same calculation: $1,200 / $2.12 = 566 shares, or $93,141 to generate a monthly dividend income of $100.

Note that dividend yield can change on a rolling basis, as the dividend payment and the stock price both fluctuate over time.

The dividend yield is calculated by dividing the annual dividend payment by the current stock price. As the stock price changes, the dividend yield will also change.

For example, if a stock pays an annual dividend of $2 and its current price is $50, its dividend yield would be 4%. However, if the stock price increases to $60, the dividend yield would decrease to 3.33% ($2/$60).

Conversely, if the stock price decreases to $40, the dividend yield would increase to 5% ($2/$40).

Further, the dividend payment itself can also change over time, which can also impact the dividend yield. If a company increases its dividend payment, the dividend yield will increase even if the stock price remains the same. Similarly, if a company decreases its dividend payment, the dividend yield will decrease.

AVGO Price Action: Shares of Broadcom rose 4% to close at $164.56 on Thursday.

Read More:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

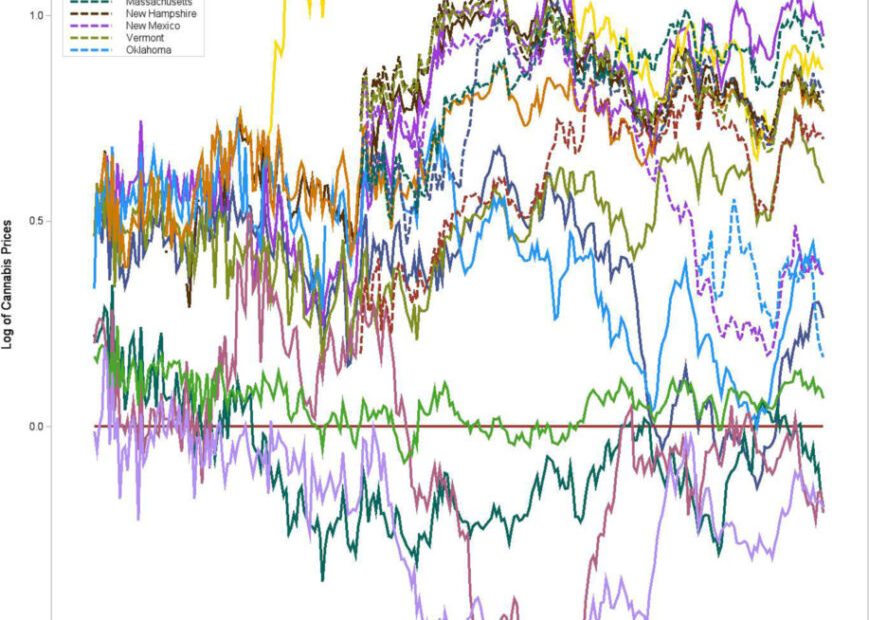

Cannabis Prices Would Be Significantly Lower In The US If Legalized, Study Finds

A new study published in the American Journal of Agricultural Economics reveals that national cannabis legalization could significantly lower weed prices, especially in higher-cost U.S. markets.

Led by economist Barry Goodwin from North Carolina State University, the analysis suggests that legalizing cannabis nationwide would allow cheaper weed from states like California to flow into other markets, benefiting consumers across the country, reported Leafly.

California Sets The Standard For Cannabis Prices

Goodwin’s study tracked cannabis prices across 15 states with various degrees of legalization. The research found that California plays a leading role in setting cannabis prices nationwide. As one of the largest producers, California grows far more cannabis than it can consume, and this surplus often flows illegally into other states. Thus, prices in California have dropped significantly, with ounces of shake going for as low as $23 in Los Angeles this month.

“California’s influence on cannabis prices extends far beyond its borders,” the report notes. Much of the price integration between states can be attributed to the illegal trade of California, which competes with regulated markets and keeps values down in states where cannabis is still illegal.

Transporting cannabis across state lines is currently illegal at the federal level; the study suggests that national legalization would create a more cohesive market. “Policy changes that relax restrictions on interstate trade would likely further integrate markets, bringing higher-priced markets more in line to form a national cannabis market,” Goodwin explains.

Chart from Goodwin (2024)

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Read Also: Cannabis Investor Sentiment Softens As Institutional Confidence Wanes, Survey Shows

Further Impacts

For the investor community, these findings are crucial since the price crunch will be of consequence.

States that have legalized cannabis, like Oregon and Washington, already boast some of the lowest values in the country.

However, many states, particularly in the Midwest and Northeast, continue to experience much higher costs due to limited supply and market restrictions.

If national cannabis legalization were to pass, prices in these high-cost states could drop significantly. Currently, high transportation costs and legal risks prevent cannabis from fully equalizing across states. But legalization would allow markets to open up impacting competition dynamics in a profound manner.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Forget Nvidia: Buy This Unstoppable Growth Stock Instead

Investors hoping to score returns from artificial intelligence (AI) turned heavily toward Nvidia. Its leadership in the chip industry led the stock to massive gains, and investors who missed out likely remain on the sidelines hoping to buy.

Unfortunately, it appeared priced for perfection, and even a strong earnings report could not stop it from falling.

Still, investors can benefit from AI while gaining additional support from the consumer sector. If you want to enjoy the best that both tech and the consumer sectors offer, Amazon (NASDAQ: AMZN) could serve you well.

The state of Amazon

Although investors should consider today’s Amazon a conglomerate, most appear to associate it with its massive retail operations. Yet despite an enormous $1.9 trillion market cap, Amazon remains in growth mode.

Under most circumstances, the law of large numbers would indicate slowing growth due to Amazon’s size. However, it has circumvented this issue with an ingenious business model. The most sizable part of its business, online sales, has become a slow-growing business that appears to act as a loss leader.

Instead, Amazon derives most of its operating income from Amazon Web Services (AWS), its cloud computing business. AWS pioneered this industry, which grew to $600 billion as of 2023, according to Grand View Research. Grand View also estimates it will expand at a compound annual growth rate (CAGR) of 21% through 2030, taking the market’s size to $2.3 trillion by that year. AWS also gives Amazon a critical role in supporting AI, making it an essential part of the world’s IT infrastructure.

Profit levels are not reported for most of its businesses on the consumer side. Nonetheless, it is likely the positive operating income from its other sectors comes from advertising, third-party seller services, and subscriptions. These enterprises have successfully leveraged the benefits of retailing and IT, resulting in double-digit revenue growth for several quarters.

Amazon by the numbers

Moreover, despite its massive size, Amazon can still grow overall revenue at double-digit levels. In the first two quarters of 2024, it reported $291 billion in revenue, rising 11% compared with the same period in 2023. Of that, AWS made up $51 billion, or 18% of total revenue, compared with $110 billion generated by online stores, its original business.

However, as mentioned before, AWS continues to make up the majority of operating income, accounting for $19 billion of Amazon’s $30 billion in operating income reported for the first half of 2024. After including non-operating expenses and income taxes, Amazon earned $24 billion in net income during the period, compared with just $10 billion in the first half of 2023.

Amazon stock continues to climb, rising by just over 25% over the last year. Additionally, between its stock and the rising profits, Amazon’s P/E ratio has fallen to a surprisingly low 43, close to a multiyear low.

Admittedly, the triple-digit net income growth over the last year is likely unsustainable. Still, analysts forecast 31% average annual profit growth over the next five years. Although that is a way-too-early prediction, if earnings growth is close to that level, Amazon’s current valuation could make it resemble a faster-growing value stock, making its investment case all the more compelling.

Amazon stock is a buy

If you’re looking for a safe consumer and AI-oriented stock at an affordable price, you may have a hard time clicking on a more fitting stock than Amazon.

Indeed, at a $1.9 trillion market cap, most companies would struggle to achieve high-percentage growth. Yet Amazon has almost defied the law of large numbers by establishing a number of smaller, higher-profit businesses centered around a popular but possibly unprofitable online sales enterprise.

Such a business model serves investors because it offers the safety of a large, multifaceted enterprise, yet contains smaller businesses that drive significant growth.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

Forget Nvidia: Buy This Unstoppable Growth Stock Instead was originally published by The Motley Fool

Pacemaker Devices Market Size to Reach USD 6.9 Billion by 2034, Driven by Minimally Invasive Techniques and Personalized Medicine | Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Sept. 13, 2024 (GLOBE NEWSWIRE) — The global pacemaker devices market (심장박동기 장치 시장) is estimated to surge at a CAGR of 3.8% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for pacemaker devices is estimated to reach US$ 6.9 billion by the end of 2034.

A prominent factor is the growing focus on personalized medicine. As medical technology advances, there’s a trend toward tailoring pacemaker solutions to individual patient needs. This includes factors like patient demographics, lifestyle, and underlying health conditions. Personalized pacemaker devices not only improve patient outcomes but also enhance device compatibility and longevity.

The rise of telemedicine is influencing the pacemaker market in unexpected ways. With the increasing adoption of remote monitoring technologies, healthcare providers can now track patients’ heart rhythms and device performance remotely. This not only improves patient convenience but also allows for early detection of potential issues, reducing the need for in-person clinic visits and enhancing overall patient care.

Environmental sustainability is emerging as a significant driver in the pacemaker industry. Manufacturers are increasingly exploring eco-friendly materials and manufacturing processes to reduce the environmental footprint of pacemaker devices. From biodegradable components to energy-efficient production methods, sustainability initiatives are gaining traction and reshaping the future of pacemaker technology.

Download Sample Copy of the Report: https://www.transparencymarketresearch.com/pacemaker-market.html

Pacemaker Devices Market: Competitive Landscape

In the dynamic landscape of the pacemaker devices market, competition thrives among leading players striving for innovation and market dominance.

Established companies like Medtronic, Abbott Laboratories, and Boston Scientific Corporation command significant market share with their extensive product portfolios and global reach. Emerging players such as Biotronik and LivaNova are disrupting the market with advanced technologies and strategic partnerships.

Regulatory approvals, product differentiation, and pricing strategies are key battlegrounds, while advancements in remote monitoring and connectivity drive competition in patient care solutions. Amidst this competitive fervor, continuous R&D and strategic acquisitions remain pivotal for sustaining growth and market leadership. Some prominent players are as follows:

- Medtronic plc

- Boston Scientific Corporation

- Abbott Laboratories

- Biotronik

- Oscor Inc.

- ZOLL Medical Corporation

- Lepu Medical Technology

- Shree Pacetronix Limited

- OSYPKA AG

Product Portfolio

- Offering cutting-edge cardiac rhythm management solutions, Biotronik leads with innovative pacemakers, defibrillators, and remote monitoring technologies, ensuring optimal patient care and outcomes.

- Oscor Inc. specializes in high-quality medical devices, delivering superior performance and reliability. Their product portfolio includes advanced electrophysiology and vascular access systems, empowering clinicians with precision and efficiency.

- ZOLL Medical Corporation leads in innovative resuscitation and critical care technologies. From advanced defibrillators to automated CPR devices, ZOLL’s solutions are designed to save lives and improve patient outcomes with unmatched reliability and ease of use.

Key Findings of the Market Report

- Implantable pacemaker devices lead the market due to their widespread adoption and superior efficacy in managing cardiac conditions effectively.

- Dual chamber technology leads the pacemaker devices market due to its ability to synchronize heart rhythms, enhancing patient outcomes significantly.

- Bradycardia remains the leading application segment in the pacemaker devices market, driving demand for implantable cardiac devices globally.

Pacemaker Devices Market Growth Drivers & Trends

- Aging population globally increases demand for pacemakers.

- Technological advancements in remote monitoring and connectivity enhance patient care.

- Rising prevalence of cardiovascular diseases drives market growth.

- Growing adoption of minimally invasive procedures boosts pacemaker implantations.

- Increasing healthcare expenditure supports market expansion.

Global Pacemaker Devices Market: Regional Profile

- North America stands as a frontrunner, fueled by robust healthcare infrastructure, high prevalence of cardiovascular diseases, and significant investments in advanced medical technologies. Market leaders like Medtronic and Abbott Laboratories dominate this region, leveraging their expansive product portfolios and strong distribution networks.

- Europe, characterized by a growing aging population and increasing adoption of innovative healthcare solutions, presents lucrative opportunities for market players.

- Stringent regulatory standards drive product advancements and foster competition among key players such as Boston Scientific Corporation and Biotronik. Strategic collaborations with research institutions and healthcare providers enhance market penetration and drive innovation.

- In the Asia Pacific, rapid urbanization, changing lifestyles, and improving healthcare access contribute to market expansion. Countries like China and India emerge as key growth hubs, propelled by rising healthcare expenditure and growing awareness of cardiovascular diseases.

- Local players like LivaNova and Japan Lifeline Co., Ltd. compete alongside global giants, capitalizing on regional market nuances and customer preferences. Varying regulatory landscapes and healthcare infrastructure across countries pose challenges for market entry and expansion.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=6586<ype=S

Pacemaker Devices Market: Key Segments

By Product Type

By Technology

- Single Chamber

- Dual Chamber

- Biventricular

By Application

- Arrhythmia

- Atrial Fibrillation

- Bradycardia

- Tachycardia

By End User

- Hospitals

- Cardiology Clinics

- ASCs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Explore More Trending Report by Transparency Market Research:

- Wearable Heart Monitoring Devices Market – The global wearable heart monitoring devices market size (웨어러블 심장 모니터링 장치 시장) to Hit US$ 5.8 Billion, Globally, by 2031, Expanding at a CAGR of 12.5% Says, Transparency Market Research

- Lactate Meter Market – The global lactate meter market size (젖산염 측정기 시장) was worth USD 141.3 Mn in 2022 and is expected to reach USD 299.5 Mn by 2031 with a CAGR of 8.5%

- Patient Monitoring and Ultrasound Devices Display Market – The global patient monitoring and ultrasound devices display market (환자 모니터링 및 초음파 기기 디스플레이 시장) is projected to grow at a CAGR of 5.9% from 2024 to 2034 and reach more than US$ 10.6 Billion by the end of 2034.

- Electrosurgical Devices Market – The global electrosurgical devices market (전기 수술 장치 시장) is projected to grow at a CAGR of 5.3% from 2024 to 2034 and reach more than US$ 10.4 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jessica Hopfield At Insulet Decides to Exercises Options Worth $1.53M

In a new SEC filing on September 12, it was revealed that Hopfield, Board Member at Insulet PODD, executed a significant exercise of company stock options.

What Happened: Hopfield, Board Member at Insulet, made a strategic move by exercising stock options for 7,628 shares of PODD as detailed in a Form 4 filing on Thursday with the U.S. Securities and Exchange Commission. The transaction value amounted to $1,533,151.

The Friday morning market activity shows Insulet shares up by 0.18%, trading at $230.86. This implies a total value of $1,533,151 for Hopfield’s 7,628 shares.

All You Need to Know About Insulet

Insulet was founded in 2000 with the goal of making continuous subcutaneous insulin infusion therapy for diabetes easier to use. The result was the Omnipod system, which consists of a small disposable insulin infusion device and that can be operated through a smartphone to control dosage. Since the Omnipod was approved by the U.S. Food and Drug Administration in 2005, approximately 425,000 insulin-dependent diabetics are using it worldwide.

Unraveling the Financial Story of Insulet

Revenue Growth: Insulet’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 23.2%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Navigating Financial Profits:

-

Gross Margin: The company excels with a remarkable gross margin of 67.74%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Insulet’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 2.69.

Debt Management: Insulet’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.4. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 41.68 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 9.29 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Indicated by a lower-than-industry-average EV/EBITDA ratio of 43.84, the company suggests a potential undervaluation, which might be advantageous for value-focused investors.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

A Closer Look at Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Insulet’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Why You Should Retain Wingstop Stock in Your Portfolio Now

Wingstop Inc. WING is likely to benefit from unit expansion, franchise model and technological initiatives. The company’s focus on enhancing shareholder value bodes well. However, a challenging macroeconomic environment and elevated costs are concerns.

Growth Catalysts for Wingstop Stock

Wingstop focuses on unit expansion to drive growth. Over the last 12 months, the company has opened more than 300 net new restaurants, demonstrating its ability to grow both domestically and internationally at a rapid pace. In the second quarter of 2024, WING opened 73 new restaurants. The company has revised its outlook for 2024, projecting the opening of between 285 and 300 new restaurants, up from the previous guidance of 275 to 295. These expansion efforts signal strong future revenue potential, as Wingstop continues to penetrate new markets and grow its global footprint.

Wingstop’s franchise model continues to generate strong returns. The company’s average unit volume has grown from $1.5 million (two years ago) to over $2 million. This growth is fueling record demand for new restaurants. Wingstop’s franchisees are reporting unlevered cash-on-cash returns of over 70%, making it an attractive investment for current and potential brand partners.

Increased focus on digitalization bode well. During the second quarter, digital sales accounted for 68.3% of Wingstop’s total sales, thereby showcasing strength in leveraging technology to enhance the customer experience. With over 45 million digital users, Wingstop is capitalizing on its proprietary MyWingstop platform to improve engagement and conversion rates through hyper-personalization. The company’s investment in data-driven marketing and digital transformation is setting the stage for sustained long-term growth. As more transactions shift to digital platforms, Wingstop is well-positioned to capture a larger market share while enhancing operational efficiency.

Wingstop’s focus on enhancing shareholder value is evident through its stock repurchase program and dividend policy. In the second quarter, the company repurchased 75,862 shares at an average price of $381.29. As of the end of the second quarter, WING reported $96.1 million remaining under the current repurchase authorization. Additionally, Wingstop increased its quarterly dividend by 23%, further underscoring its commitment to returning capital to shareholders. The combination of repurchase programs and dividend payouts makes it an attractive option for investors seeking both growth and income.

Concerns for WING Stock

Image Source: Zacks Investment Research

In the past three months, Wingstop’s shares have lost 0.8% against the industry’s 4.8% growth. The downside was driven by macroeconomic headwinds.

WING has been grappling with rising costs. Its selling, general and administrative (SG&A) expenses have been rising significantly, increasing by $6 million year over year to a total of $28.1 million in the second quarter. While some of this increase can be attributed to long-term investments in digital platforms like MyWingstop, the rapid rise in short-term incentive compensation and stock-based compensation is concerning. With the company’s total SG&A expenses projected to reach up to $116 million by 2024-end, up from $111 million, cost control could become an issue. If growth stalls, Wingstop may find itself burdened by these escalating expenses.

Conclusion

Wingstop’s ability to open new restaurants at a record pace, combined with its high franchisee returns and increasing digital sales, underscores its long-term growth potential. Moreover, its focus on shareholder value through stock buybacks and dividend increases enhances its appeal for investors seeking both capital appreciation and income.

However, investors should be mindful of the challenges posed by rising operational costs and a challenging macroeconomic environment. As the company continues to invest heavily in technology and expansion, cost management will be crucial to sustaining profitability. The company’s growth drivers and strategic initiatives make it a compelling stock to retain for now, as it navigates the headwinds and capitalizes on future opportunities.

Zacks Rank & Key Picks

Wingstop currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Retail-Wholesale sector include Texas Roadhouse, Inc. TXRH, Potbelly Corporation PBPB and El Pollo Loco Holdings, Inc. LOCO, each carrying a Zacks Rank #2 (Buy).

Texas Roadhouse has a trailing four-quarter earnings surprise of 0.4%, on average. TXRH shares have gained 58.7% in the past year. The Zacks Consensus Estimate for TXRH’s 2024 sales and EPS indicates 15.6% and 39.2% growth, respectively, from the year-earlier actuals.

Potbelly Corporation has a trailing four-quarter earnings surprise of 77.5%, on average. The stock has dropped 3.6% in the past year. The Zacks Consensus Estimate for PBPB’s fiscal 2024 EPS implies 33.3% growth on 6.5% lower revenues from the year-ago levels.

El Pollo Loco Holdings has a trailing four-quarter earnings surprise of 21.6%, on average. LOCO shares have gained 44.3% in the past year. The Zacks Consensus Estimate for LOCO’s fiscal 2024 sales and EPS indicates 2% and 12.7% growth, respectively, from the prior-year figures.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Step Aside, Nvidia: Billionaires Are Selling It in Favor of 2 Other High-Growth Stock-Split Stocks

Although artificial intelligence (AI) has been all the rage on Wall Street since 2023 began, excitement surrounding stock splits has given AI a run for its money this year.

A stock split gives publicly traded companies the ability to superficially alter their share price and outstanding share count by the same magnitude. Splits are surface-scratching in the sense that they don’t change a company’s market cap or in any way affect underlying operating performance.

Although there are two types of stock splits — forward and reverse — investors usually gravitate to companies conducting forward splits. This type of split is designed to lower a company’s share price to make it more nominally affordable for investors who are unable to purchase fractional shares through their broker. Companies enacting forward splits are usually outpacing their competition from an execution and innovation standpoint.

Since 2024 began, a little over a dozen leading businesses have announced or completed a stock split — all but one of which was of the forward-split variety.

However, the outlook for some of these premier stock-split stocks is mixed among Wall Street’s brightest and richest investors. Based on the latest round of form 13F filings with the Securities and Exchange Commission, billionaires were decisive sellers of cutting-edge AI stock Nvidia (NASDAQ: NVDA) in the second quarter, but were avid buyers of two other high-growth stock-split stocks.

Billionaires continue to reduce their stakes in Wall Street’s AI darling

For three consecutive quarters, dating back to the start of October 2023, no fewer than seven billionaire money managers have reduced their respective stakes in Nvidia. The June-ended quarter featured seven billionaire sellers, including (total shares sold in parenthesis):

-

Ken Griffin of Citadel (9,282,018 shares)

-

David Tepper of Appaloosa Management (3,730,000 shares)

-

Stanley Druckenmiller of Duquesne Family Office (1,545,370 shares)

-

Cliff Asness of AQR Capital Management (1,360,215 shares)

-

Israel Englander of Millennium Management (676,242 shares)

-

Steven Cohen of Point72 Asset Management (409,042 shares)

-

Philippe Laffont of Coatue Management (96,963 shares)

With Nvidia completing its largest-ever forward split (10 for 1) in June, these billionaires might have chosen to ring the register and diversify their respective portfolios. But there looks to be more to this story than simple profit taking.

Although Nvidia has undeniably benefited from its first-mover advantages as the standout supplier of AI graphics processing units (GPUs), competition is now coming at it from all angles.

With the debut of Nvidia’s Blackwell chip delayed by at least three months due to reported design flaws and supply chain issues, and the company’s prized H100 GPU backlogged, it should be relatively easy for external competitors like Advanced Micro Devices to find strong demand for their AI GPUs.

Moreover, Nvidia’s top customers are signaling an eventual reduced reliance on the AI kingpin. Its four largest clients by net sales are all developing AI GPUs that they plan to use in their data centers. Even with Nvidia’s chips maintaining their computing advantage, the writing is on the wall that these customers intend to use their cheaper internally developed hardware.

Billionaires might also be spooked by the persistent insider selling at Nvidia. While not all insider selling is necessarily nefarious (e.g., insiders sometimes sell stock to pay their tax bill), it is noteworthy that not one executive or board member has purchased shares on the open market since December 2020.

Lastly, billionaire asset managers might be concerned about what history tells us. Since the advent of the internet roughly three decades ago, every next-big-thing trend has worked its way through an early-stage bubble. It’s unlikely that AI is going to be the exception.

But while billionaires were showing Nvidia to the door, they were busy scooping up shares of two other high-growth stock-split stocks.

Super Micro Computer

The first stock-split stock that struck the fancy of six billionaire money managers during the second quarter is Super Micro Computer (NASDAQ: SMCI), a specialist in customizable rack server and storage solutions. These billionaire buyers were:

-

Israel Englander of Millennium Management (553,323 shares)

-

Jeff Yass of Susquehanna International Group (508,814 shares)

-

Ken Griffin of Citadel (98,752 shares)

-

Steven Cohen of Point72 Asset Management (45,066 shares)

-

Ray Dalio of Bridgewater Associates (15,777 shares)

-

Cliff Asness of AQR Capital Management (1,040 shares)

With the stock catapulting to north of $1,200 during the first quarter, it’s not in the least bit surprising to see Supermicro’s board approving a 10-for-1 forward split, to take effect after trading ends on Sept. 30.

However, the prospect of a stock split isn’t the primary draw for billionaires to Supermicro. The lure is the seemingly insatiable demand from businesses wanting to be among the first to capitalize on the AI revolution by training large language models and running generative Ai solutions. To do so, they’ll need the necessary infrastructure in place, which Supermicro can provide.

The company’s operating results have also given billionaires reason to be excited. Net sales jumped 110% to $14.9 billion in fiscal 2024 (the company’s fiscal year ends on June 30), and the midpoint of its guidance calls for $28 billion in net revenue for the current year. This forecast screams that demand is exceptional at the moment.

But it won’t be an easy ride. With its use of Nvidia’s H100 GPUs in its customizable data-center rack servers, and the H100 backlogged, Supermicro finds itself at the mercy of its suppliers.

Furthermore, the company is the target of a short-seller report from Hindenburg Research, which has alleged accounting manipulation. Despite denying these allegations, management did delay the annual filing of its operating results, which did little to soothe investor concerns.

Despite its relatively inexpensive valuation, Super Micro Computer has a lot to prove to Wall Street and investors.

Broadcom

The other stock-split stock that billionaires very clearly favored over Nvidia in the June-ended quarter is AI networking solutions and services providers Broadcom (NASDAQ: AVGO). Seven billionaire investors took the plunge in the second quarter, including:

-

Ole Andreas Halvorsen of Viking Global Investors (2,930,970 shares)

-

Jeff Yass of Susquehanna International Group (2,347,500 shares)

-

Israel Englander of Millennium Management (2,096,440 shares)

-

Ken Griffin of Citadel (1,880,740 shares)

-

John Overdeck and David Siegel of Two Sigma Investments (1,332,230 shares)

-

Ken Fisher of Fisher Investments (865,090 shares)

Keeping with the theme of this list, Broadcom also announced a 10-for-1 forward split (the first in the company’s history), which was completed in mid-July.

Broadcom’s AI ties have certainly been the fuel behind its recent uptick in growth. In particular, the company’s networking solutions are responsible for connecting large numbers of AI GPUs in order to reduce tail latency and maximize the computing potential of AI-accelerating hardware. Presumably, demand for its AI networking solutions will remain robust as long as businesses keep gobbling up AI GPUs.

However, billionaires might be equally excited about Broadcom having a solid foundation that extends well beyond artificial intelligence. It generates a significant amount of revenue and profits from the wireless chips and accessories it provides for next-generation smartphones. And it’s a key provider of optical components used in automated industrial equipment, as well as networking solutions for next-gen vehicles.

Lastly, billionaires might be impressed with the company’s track record of earnings-accretive acquisitions. For example, the $69 billion purchase of cloud-based virtualization software company VMware in November 2023 perfectly positions Broadcom to be an important player in helping businesses with their private- and hybrid-cloud needs.

With a more diverse revenue stream than Nvidia or Super Micro Computer, Broadcom would be best-positioned to navigate an AI bubble-bursting event, should one occur.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Step Aside, Nvidia: Billionaires Are Selling It in Favor of 2 Other High-Growth Stock-Split Stocks was originally published by The Motley Fool

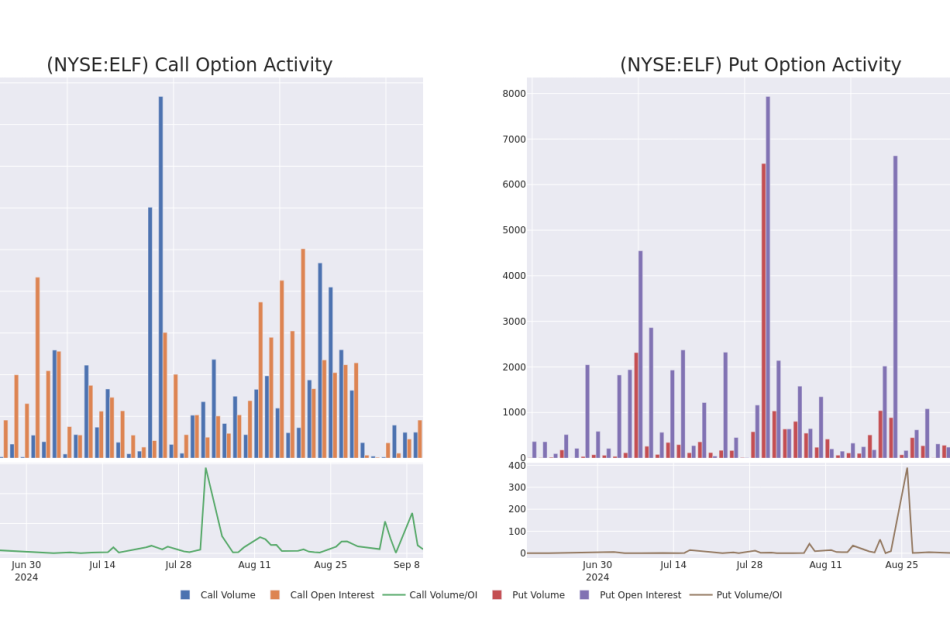

What the Options Market Tells Us About e.l.f. Beauty

Investors with a lot of money to spend have taken a bearish stance on e.l.f. Beauty ELF.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ELF, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 8 uncommon options trades for e.l.f. Beauty.

This isn’t normal.

The overall sentiment of these big-money traders is split between 25% bullish and 62%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $85,560, and 6 are calls, for a total amount of $205,694.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $110.0 to $240.0 for e.l.f. Beauty over the recent three months.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for e.l.f. Beauty’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across e.l.f. Beauty’s significant trades, within a strike price range of $110.0 to $240.0, over the past month.

e.l.f. Beauty Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ELF | PUT | TRADE | BULLISH | 04/17/25 | $122.3 | $120.2 | $121.0 | $240.00 | $60.5K | 5 | 5 |

| ELF | CALL | TRADE | BEARISH | 11/15/24 | $16.7 | $15.5 | $15.85 | $120.00 | $55.4K | 235 | 48 |

| ELF | CALL | SWEEP | BEARISH | 01/17/25 | $22.0 | $21.5 | $21.5 | $115.00 | $32.2K | 91 | 18 |

| ELF | CALL | SWEEP | BULLISH | 10/18/24 | $1.55 | $1.45 | $1.5 | $155.00 | $31.8K | 166 | 233 |

| ELF | CALL | TRADE | BEARISH | 09/19/25 | $28.8 | $28.0 | $28.08 | $125.00 | $30.8K | 4 | 11 |

About e.l.f. Beauty

e.l.f. Beauty Inc is a multi-brand beauty company that offers inclusive, accessible, clean, vegan and cruelty-free cosmetics and skin care products. The Company’s mission is to make the best of beauty accessible to every eye, lip, face, and skin concern. The company offers cosmetic accessories for women which include eyeliner, mascara, false eyelashes, lipstick, the foundation for the face, moisturizer, cleanser, and other tools through its stores and e-commerce channels. The products that the company sells are marketed under the e.l.f. Cosmetics, W3LL PEOPLE and Keys Soulcare brands. It carries out sales within the US and internationally, out of which maximum revenue is generated from the US.

Having examined the options trading patterns of e.l.f. Beauty, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of e.l.f. Beauty

- Trading volume stands at 1,630,815, with ELF’s price down by -1.08%, positioned at $113.43.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 47 days.

What The Experts Say On e.l.f. Beauty

5 market experts have recently issued ratings for this stock, with a consensus target price of $192.2.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for e.l.f. Beauty, targeting a price of $190.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on e.l.f. Beauty with a target price of $150.

- An analyst from B. Riley Securities downgraded its action to Buy with a price target of $175.

- Maintaining their stance, an analyst from DA Davidson continues to hold a Buy rating for e.l.f. Beauty, targeting a price of $223.

- An analyst from DA Davidson persists with their Buy rating on e.l.f. Beauty, maintaining a target price of $223.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest e.l.f. Beauty options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.