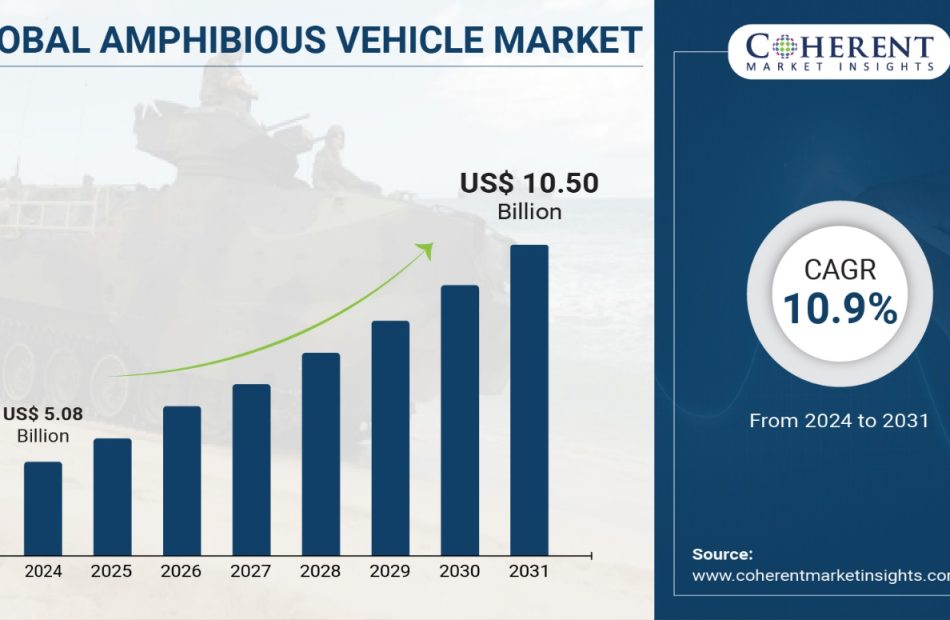

Global Amphibious Vehicle Market to hit $10.50 billion, Globally, by 2031 at 10.9% CAGR, says Coherent Market Insights

Burlingame, Sept. 11, 2024 (GLOBE NEWSWIRE) — The global Amphibious Vehicle Market Size to Grow from USD 5.08 Billion in 2024 to USD 10.50 Billion by 2031, at a Compound Annual Growth Rate (CAGR) of 19.5% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Amphibious vehicles provide unmatched mobility for diverse military operations such as rescue, patrol, surveillance, and counterinsurgency missions that require accessing both land and water theatres. Moreover, growing demand for amphibious vehicles in civil engineering projects such as wetland restorations and coastal protection works will further provide opportunities for market growth over the forecast period.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/6922

Market Dynamics:

The global amphibious vehicle market is witnessing high growth owing to growing defense budgets of various countries and increasing military modernization programs worldwide. According to Stockholm International Peace Research Institute (SIPRI), the global military expenditure witnessed a rise of 6.8% in 2021 to reach US$ 2.1 trillion. Growing government and defense spending on new amphibious vehicles for marine operations is a major factor driving the market growth. Furthermore, increasing upgradation of existing fleets to improve amphibious capabilities is also fueling the market demand.

Global Amphibious Vehicle Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $5.08 billion |

| Estimated Value by 2031 | $10.50 billion |

| Growth Rate | Poised to grow at a CAGR of 10.9% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Mode of Propulsion, By Application, By End User |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Military modernization programs • Civil applications and disaster response operations |

| Restraints & Challenges | • Harsh environmental regulations • High manufacturing cost |

Market Trends:

To tackle evolving threats on borders, focus on development of light amphibious vehicles is growing. Light amphibious vehicles have high tactical and strategic value due to their lightweight amphibious capabilities. For instance, in June 2022, BAE Systems was selected by the U.S. Army to deliver Light Amphibious Warships (LAWs). The 85-foot aluminum vessels are capable of transporting Marines and their equipment from sea to shore.

Procurement and modernization of amphibious assault vehicles by military forces worldwide is witnessing significant rise. Amphibious assault vehicles are critical for launching shore assaults from sea. In recent years, various countries have procured advanced amphibious assault vehicles to strengthen their amphibious warfare capabilities. For instance, in May 2022, the U.S. Marine Corps awarded contracts to BAE Systems and SAIC worth US$ 1 billion to supply 200 Amphibious Combat Vehicles (ACV).

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/6922

X-ray segment is expected to hold a dominant position over the forecast period, owing to increasing demand for X-ray based amphibious vehicles in military and defense applications. X-ray vehicles are the most commonly used type of amphibious vehicles for their ability to traverse both land and water.

Ancestry testing segment dominated the market in 2023 and is expected to continue its dominance during the forecast period due to rising popularity of ancestry testing services among customers to trace their family history and origins. Amphibious vehicles find significant usage in transporting equipment and samples for ancestry testing applications.

Key Market Takeaways:

The global amphibious vehicle market is anticipated to witness a CAGR of 10.9% during the forecast period 2024-2031, owing to rising defense budgets of countries and increasing utilization of amphibious vehicles in military, patrol and rescue operations.

On the basis of type, X-ray segment is expected to hold a dominant position, owing to its wide application in military and defense organizations.

On the basis of application, ancestry testing segment is expected to hold the largest share owing to increasing popularity of ancestry tracing services.

On the basis of end user, hospitals segment is expected to hold a dominant position over the forecast period, due to growing usage of amphibious vehicles in emergency services.

Regionally, North America is expected to hold a dominant position over the forecast period, due to large defense spends and technological advancements in the region.

Key players operating in the global amphibious vehicle market include Hitachi Construction Machinery Co. Ltd., BAE System, Science Applications International Corporation, Wetland Equipment Company, General Dynamics Corporation, Lockheed Martin Corporation, Wilco Manufacturing, L.L.C, EIK Engineering Sdn Bhd, Marsh Buggies Incorporated, Rheinmetall AG, and EIK Engineering Sdn. Bhd. Strategic partnerships and collaborations between players is expected to help gain momentum in the market.

Recent Development:

In March 2023, BAE Systems received a contact from the U.S. Marine Corps to produce amphibious combat vehicles for personnel and command purposes.

In January 2023, IDV secure a deal with the Italian Navy to supply 36 Amphibious Armored Vehicels VBA personnel carriers.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/6922

Market Segmentation:

By Mode of Propulsion:

- Water-jet

- Track-based

- Screw propellers

By Application:

- Surveillance & Rescue

- Water Sports

- Water Transportation

- Excavation

By End User:

By Regional:

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Automotive and Transportation Domain:

Global Armored Vehicle Market is estimated to be valued at US$ 28.45 Bn in 2024 and is expected to reach US$ 42.21 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.8% from 2024 to 2031.

Global electric vehicle tire market is estimated to be valued at US$ 3.42 Bn in 2024 and is expected to reach US$ 13.71 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 21.9% from 2024 to 2031.

Global Automotive VVT System Market is estimated to be valued at USD 68.46 Bn in 2024 and is expected to reach USD 102.14 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.9% from 2024 to 2031.

CNG and LPG vehicle market is estimated to be valued at USD 5.33 Bn in 2024 and is expected to reach USD 12.11 Bn by 2031, growing at a compound annual growth rate (CAGR) of 12.4% from 2024 to 2031.

Autonomous Vehicle Market, By Application, By Region – Market Size And Share Analysis – Growth Trends And Forecasts (2024-2031)

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Owens & Minor Stock to Gain From New Collaboration With Google Cloud

Owens & Minor, Inc. OMI has announced a partnership with Google Cloud, owned by the parent holding company, Alphabet to enhance the existing capabilities of its cloud-based clinical inventory management system, QSight. The collaboration will combine the company’s expertise in optimizing the healthcare supply chain with Google Cloud’s Vertex AI platform, to tackle the modern supply chain management complexities and support the patients more effectively.

The latest development demonstrates the progress Owens & Minor has been making toward its strategic goals for the Products & Healthcare Services segment.

Following the news, shares of OMI edged up 0.2% to $14.42 at Tuesday’s close. By staying at the forefront of technology, including making investments with one of the most renowned innovators in the market, the company consistently delivers value to its customers and improves clinician efficiency. We expect the market sentiment on OMI stock to stay positive around this development.

Significance of OMI’s New Partnership

The implications of inefficient inventory management in healthcare can extend beyond the stockroom and into the operating room. This includes the risks of expired products being used in patient care and loss of inventory if products expire before. There is also an increasing pressure to deliver high-quality care while managing costs and optimizing efficiency — with less support from clinical staff.

However, traditional clinical inventory management systems often lack the real-time visibility and predictive capabilities to oversee the complex healthcare supply chains, leading to increasing costs and higher workloads for clinical staff.

Image Source: Zacks Investment Research

The partnership between Owens & Minor and Google Cloud aims to focus on enhancing QSight’s ability to help hospitals and health systems optimize how they manage the thousands of medical-grade supplies, high-value surgical implants and human tissue products required for patient care. The company will also lay the foundation for future platform and service innovations with the potential to improve the QSight customer experience.

Favorable Industry Prospects for Owens & Minor

A report by Research and Markets valued the healthcare inventory management software market at $331.5 million in 2021 and forecasts it to see a compound annual rate of 8.9% through 2028.

The rising complexity of the healthcare supply chain, such as worldwide sourcing, diversified product portfolios, regulatory constraints, and the demand for real-time monitoring, have increased the need for sophisticated inventory management systems. Healthcare organizations are implementing advanced inventory management solutions that provide greater visibility, automation and analytics.

Other Major Developments Within OMI

In July 2024, Owens & Minor announced a definitive agreement to acquire Rotech Healthcare Holdings, Inc., a home medical equipment provider based in the United States, for $1.36 billion in cash. The acquisition directly aligns with the company’s broader strategy to expand into the fast-growing home-based care space. In addition, it also bolsters its Patient Direct product offerings through expansion across a complementary portfolio including Respiratory, Sleep Apnea, Diabetes and Wound Care.

OMI Stock Price Performance

In the past year, Owens & Minor shares have plunged 10.8% against the industry’s 18.4% growth.

OMI Estimate Trend and EPS Surprise History

In the past 30 days, estimates for Owens & Minor’s 2024 earnings have remained constant at $1.57 per share. The company beat estimates in each of the trailing four quarters, the average surprise being 11.1%.

OMI’s Zacks Rank and Top MedTech Stocks

Owens & Minor currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Boston Scientific BSX and AxoGen AXGN, each carrying a Zacks Rank #2 (Buy) at present.

Boston Scientific’s shares have risen 55.9% in the past year. Estimates for the company’s earnings per share have remained constant at $2.40 in 2024 and $2.71 in 2025 in the past 30 days. BSX’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 7.2%. In the last reported quarter, it posted an earnings surprise of 6.9%.

Estimates for AxoGen’s 2024 loss per share have remained constant at 1 cent in the past 30 days. Shares of the company have surged 141.4% in the past year compared with the industry’s growth of 15.7%. AXGN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 96.5%. In the last reported quarter, it delivered an earnings surprise of 200%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Transocean Secures New Drilling Assignment in the Gulf of Mexico

Transocean Ltd. RIG has secured a new assignment with the British oil major, BP plc BP, in the U.S. Gulf of Mexico. The company’s Deepwater Atlas ultra-deepwater drillship has been contracted for the assignment. The contract, valued at $232 million, has a duration of 365 days, with a 365-day option. Work related to the assignment is expected to begin in the second quarter of 2028.

The Deepwater Atlas drillship is one of the two eighth-generation drillships to join Transocean’s fleet in 2022. Notably, it is known to be one of the first drillships to be equipped with 20,000-psi well control capabilities, along with a hoisting capacity of 3.4 million pounds. Another eighth-generation drillship, Deepwater Titan, joined Transocean’s fleet the same year. With the help of these drillships, the Gulf of Mexico region is entering a new exploration phase under high-pressure and high-temperature conditions.

The seventh-generation drillships have a hoisting capacity of 2.5-2.8 million pounds, while the sixth-generation ones have a hoisting capacity of up to 2.0 million pounds. Seventh-generation drillships are limited to 15,000 psi well control systems.

The new eighth-generation drillships offer unique features with improved capabilities and cutting-edge tools that are well-suited for drilling wells in deepwater environments. These drillships, in particular, can operate at water depths of 12,000 feet and drill up to a depth of 40,000 feet.

Designed to improve sustainability, these drillships help optimize fuel consumption and reduce greenhouse gas emissions. Consequently, they have a lower carbon footprint associated with their offshore operations.

The Deepwater Atlas drillship was built by Seatrium, erstwhile known as Sembcorp Marine. It was delivered to Transocean in June 2022. Before its delivery, Transocean secured a drilling assignment for the rig with Beacon Offshore in August 2021.

Zacks Rank and Key Picks

Currently, RIG carries a Zacks Rank #3 (Hold), while BP has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the energy sector are PEDEVCO Corp. PED and MPLX LP MPLX, presently sporting a Zacks Rank #1 (Strong Buy) each.

PEDEVCO is engaged in the acquisition and development of energy assets in the United States and Pacific Rim countries. The company stands to benefit significantly from its holdings in the Permian Basin, one of the most prolific oil-producing regions in the United States, as well as in the D-J Basin in Colorado, which includes more than 150 high-quality drilling locations. Combined with bullish oil prices, this is expected to boost PEDEVCO’s production and overall profitability.

MPLX LP owns and operates a wide range of midstream assets. The partnership’s midstream assets include oil and natural gas gathering systems and transportation pipelines for crude, natural gas and refined petroleum products. MPLX is least exposed to commodity price fluctuations as it generates stable fee-based revenues. Furthermore, it surpasses its industry peers in terms of distribution yield, reflecting its commitment to returning capital to its unitholders.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Franklin's August AUM Balance Improves on Favorable Markets

Franklin Resources, Inc. BEN reported its preliminary assets under management of $1.68 trillion as of Aug. 31, 2024. This reflected an increase of 1.1% from the prior month’s level.

The improvement in AUM balance was due to the impact of positive markets, partially offset by long-term net outflows. Outflows included $7.7 billion of long-term net outflows at Western Asset Management. As previously revealed, the Macro Opportunities strategy, included in Alternative AUM, is closing and had $1.1 billion of AUM as of Aug. 31, 2024, and $0.9 billion of net outflows in the month.

Break Down of BEN’s AUM Based on Asset Class

BEN recorded equity assets of $603.7 billion, which rose 2.5% from the previous month. Further, fixed income AUM of $574.5 billion at the end of August 2024 increased marginally from the prior month. Likewise, Multi-asset AUM was $172.9 billion, growing modestly from July 2024.

On the other hand, Alternative AUM decreased 1.5% to $251.2 billion from the prior month’s level. Alternative AUM in the reported month includes a $2 billion reduction related to the reclassification of assets under administration.

The cash management balance was $64.35 billion, up 4.6% from the previous month.

Our Viewpoint on BEN

Franklin’s efforts to diversify business through buyouts, solid AUM balance and a strong distribution platform will aid its top line. However, elevated expenses and volatility in investment management fees, which bring in the majority of its revenues, are near-term concerns.

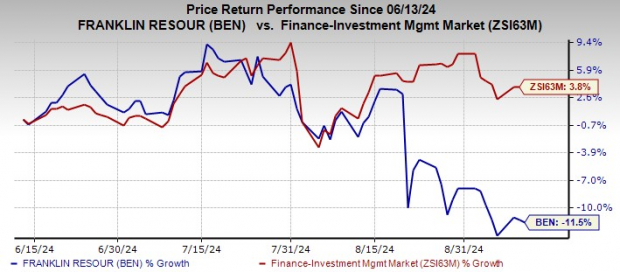

Over the past three months, shares of BEN have plunged 11.5% against the industry’s 3.8% rise.

Image Source: Zacks Investment Research

Currently, BEN carries a Zacks Rank #3 (Hold).

Performance of Other Asset Managers

Cohen & Steers, Inc. CNS reported a preliminary AUM of $88.1 billion as of Aug. 31, 2024. This reflected a rise of 4.1% from the prior month’s level.

The increase in CNS’ AUM balance was driven by the market appreciation of $3.7 billion and net inflows of $8 billion, partially offset by distributions of $152 million.

Invesco IVZ reported a preliminary month-end AUM of $1.75 trillion in August 2024. This represented a 1.1% increase from the previous month.

IVZ reported net long-term inflows of $2.4 billion in August. Non-management fee-earning net inflows were $0.9 billion, while money market net outflows totaled $6.4 billion. Further, Invesco’s AUM was favorably impacted by solid market returns, which boosted its AUM by $16 billion. Further, FX increased the AUM balance by $7.3 billion.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chainlink Up More Than 3% In 24 hours

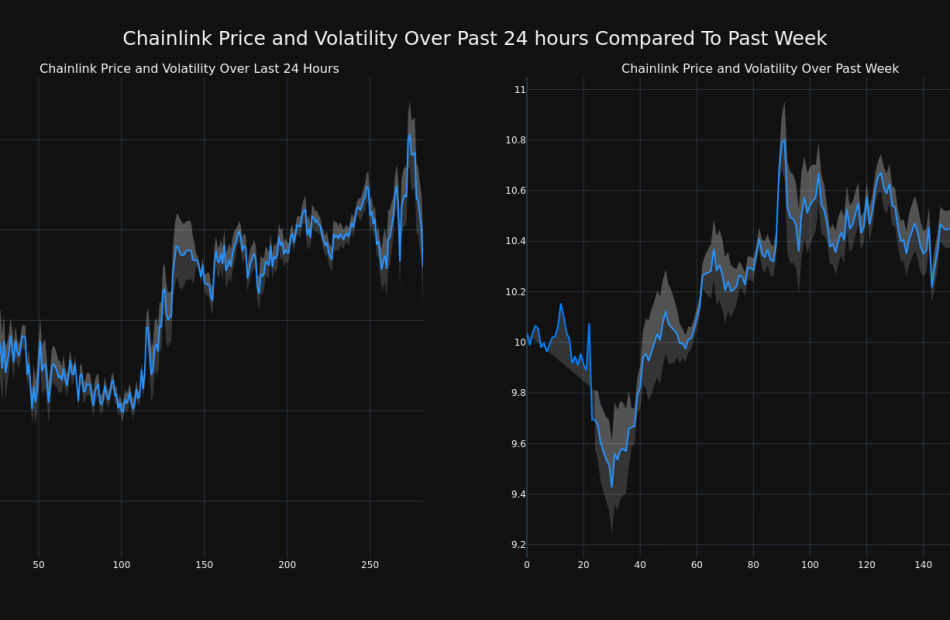

Over the past 24 hours, Chainlink’s LINK/USD price has risen 3.04% to $10.59. This continues its positive trend over the past week where it has experienced a 6.0% gain, moving from $10.04 to its current price. As it stands right now, the coin’s all-time high is $52.70.

The chart below compares the price movement and volatility for Chainlink over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has tumbled 1.0% over the past week along with the circulating supply of the coin, which has fallen 0.1%. This brings the circulating supply to 608.10 million, which makes up an estimated 60.81% of its max supply of 1.00 billion. According to our data, the current market cap ranking for LINK is #19 at $6.44 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Solar Shares Climb As Harris Gains Momentum Post-Debate Against Trump: 7 Top Gainers In Clean Energy

Solar stocks rallied Wednesday, rebounding from recent four-year lows, following Vice President Kamala Harris‘s strong showing against former President Donald Trump at their highly anticipated presidential debate on ABC.

Investors appeared buoyed by Harris’s performance during the debate, which signaled potential stability for clean energy policies under a future administration, sparking renewed interest in the solar sector.

The Invesco Solar ETF TAN, a benchmark for the solar industry, surged by 3.7% by 11:05 a.m. ET, even as broader market sentiment remained bearish following a concerning August inflation report.

Harris’s Debate Performance Boosts Clean Energy Optimism

In a CNN/SSRS poll of 600 registered voters who tuned into the debate, 63% said Harris outperformed Trump, while 37% favored the former president. Prior to the debate, the same group of voters had been evenly split on their expectations of who would deliver a stronger performance.

Coco Zhang, an ESG research analyst at ING Group, noted that Harris is “likely to preserve the Biden administration’s most important climate legacy, emphasizing a more efficient implementation of the Inflation Reduction Act (IRA).”

Harris has long been a vocal advocate for clean energy. During a 2023 speech at Coppin State University, she reiterated her administration’s long-term goals: “We set an ambitious goal to cut our greenhouse gas emissions in half by 2030 and to reach net-zero emissions by 2050,” she said.

Harris’s Climate Legacy

Zhang emphasized that Harris’s campaign proposals in 2020 included an aggressive $10 trillion investment in decarbonizing the U.S. economy, the establishment of a carbon tax, and a ban on fracking. “We expect her to propose expanded clean energy spending, with a greater focus on environmental justice and affordable energy,” said Zhang.

Furthermore, a Harris-led administration would likely enforce stricter regulations on vehicles, oil, and gas industries, aligning with her vision to advance U.S. climate leadership on the global stage, particularly through continued participation in key climate summits like the United Nations Conference of the Parties.

Solar Stocks: Wednesday’s Top 7 Gainers

Below are the top gainers in the solar sector on Wednesday:

| Name | 1-day % chg |

| First Solar, Inc. FSLR | 7.98% |

| Shoals Technologies Group, Inc. SHLS | 7.80% |

| Canadian Solar Inc. CSIQ | 6.47% |

| Array Technologies, Inc. ARRY | 6.33% |

| Nextracker Inc. NXT | 5.80% |

| Sunrun Inc. RUN | 5.00% |

| SolarEdge Technologies, Inc. SEDG | 4.43% |

Read Next:

Photo created using Shutterstock and Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Forget Apple: Billionaires Are Buying Up This "Magnificent Seven" Stock Instead

With a market cap of over $3.3 trillion, Apple is the world’s largest public company.

Yet, it’s time for investors to forget it. Well, not literally — just figuratively.

That’s because, while billionaires like Warren Buffett have been selling shares of Apple, several other famous billionaires have been stocking up on a different stock: Amazon (NASDAQ: AMZN).

Here’s what’s happening and what it means for investors.

Billionaires are buying Amazon

Every three months, large investment managers, hedge funds, and company insiders are required to file 13F forms with the Securities and Exchange Commission (SEC). These forms disclose what stocks are held, thus providing the public with a glimpse behind the curtain to see which stocks prominent billionaires are buying and selling.

Last month, the most recent 13F filings were released, with data from the three months ending on June 30, 2024. And it revealed that several well-known billionaires are adding to their positions in Amazon.

For example, Bridgewater Associates, a hedge fund run by billionaire Ray Dalio, purchased more than 1.6 million shares of Amazon. That more than doubled the fund’s total holdings of Amazon to some 2.65 million shares, worth roughly $500 million.

What’s more, Citadel Advisors, the hedge fund run by billionaire Ken Griffin, increased its holdings of Amazon by around 1.1 million shares. It now controls about 7.7 million shares, valued at almost $1.5 billion.

Why billionaires are buying Amazon

All this buying begs the question: “Why are billionaires racing to buy up shares of Amazon?”

First off, let’s remember that 13F disclosures are not a perfect indication of how billionaires really think. For one thing, they’re a snapshot. Funds may have already reduced or sold out of stock positions before their 13Fs are even made public.

Second, funds are only forced to disclose their long positions, not their short positions. Therefore, it’s difficult to know a fund manager’s true intentions. Are they really bullish on a given stock, or is their big new position just a hedge? There’s no way to know for sure.

However, assuming that the Amazon positions are bullish bets, what are the reasons for being bullish on Amazon right now?

I can think of more than a few. But let’s focus on the company’s impressive growth.

Despite already generating well over $500 billion in annual sales, Amazon continues to increase its sales at a breakneck pace. In its most recent quarter (the three months ending on June 30, 2024), the company reported revenue growth of 10%.

At that pace, the company may add close to $50 billion to its sales total over the next 12 months. For context, that’s the same amount of annual sales generated by Nike, a titan within the sports apparel industry and an iconic American company for more than four decades. In other words, Amazon’s revenue is so big and growing so fast, that its growth alone is equivalent to adding a company like Nike — every year.

Is Amazon still a buy now?

Amazon remains a wonderful company. It has both the world’s largest e-commerce business and the largest cloud-services business (Amazon Web Services). Furthermore, it continues to innovate in new and exciting fields, like robotics and artificial intelligence (AI).

To sum up, it can be hard to really understand what billionaires are thinking (despite what their 13F filings reveal). Nevertheless, Amazon stock remains a buy now thanks to its excellent fundamentals and solid prospects for the future.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Apple, and Nike. The Motley Fool has a disclosure policy.

Forget Apple: Billionaires Are Buying Up This “Magnificent Seven” Stock Instead was originally published by The Motley Fool

Daktronics Board Member Trades $84K In Company Stock

Lance D. Bultena, Board Member at Daktronics DAKT, reported an insider buy on September 11, according to a new SEC filing.

What Happened: Bultena made a significant move by purchasing 7,160 shares of Daktronics as reported in a Form 4 filing with the U.S. Securities and Exchange Commission. The transaction’s total worth stands at $84,989.

Daktronics shares are trading down 0.0% at $12.19 at the time of this writing on Thursday morning.

Get to Know Daktronics Better

Daktronics Inc designs and manufactures electronic scoreboards, programmable display systems, and large-screen video displays for sporting, commercial, and transportation applications. It is engaged in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. The company offers a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. The company has five reportable segments: Commercial, Live Events, High School Park and Recreation, Transportation, and International. The company makes the majority of its revenue from Live events.

Daktronics’s Financial Performance

Revenue Growth: Daktronics’s revenue growth over a period of 3 months has faced challenges. As of 31 July, 2024, the company experienced a revenue decline of approximately -2.77%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: The company shows a low gross margin of 26.4%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, Daktronics exhibits below-average bottom-line performance with a current EPS of -0.11.

Debt Management: With a below-average debt-to-equity ratio of 0.32, Daktronics adopts a prudent financial strategy, indicating a balanced approach to debt management.

Evaluating Valuation:

-

Price to Earnings (P/E) Ratio: Daktronics’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 58.05.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.7, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 6.15 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Daktronics’s Insider Trades.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ADF GROUP INC. ANNOUNCES RESULTS FOR THE THREE-MONTH AND SIX-MONTH PERIODS ENDED JULY 31, 2024

HIGHLIGHTS

(All amounts are in Canadian dollars unless otherwise noted.)

- Revenue of $182.3 million recorded during the 6-month period ended July 31, 2024, up 13.6% compared with the same period a year earlier.

- Net income of $16.0 million and $31.3 million recorded for the 3-month and 6-month periods ended July 31, 2024, up 51.8 % and 96.5% respectively from the same periods a year ago.

- Cash flow from operating activities of $60.1 million for the 6-month period ended July 31, 2024.

- Order backlog (1) at $402.3 million as at July 31, 2024.

TERREBONNE, QB, Sept. 12, 2024 /CNW/ – ADF GROUP INC. (“ADF” or the “Corporation”) DRX, recorded revenues of $74.9 million during the second quarter ended July 31, 2024, compared with $80.2 million for the same period a year earlier. After the first six months of the fiscal year, revenues totalled $182.3 million, which is $21.8 million or 13.6% more than for the same period a year earlier.

Although revenues to date are $21.8 million higher than a year ago, those for the second quarter were impacted by one client’s delays in construction site preparation. The Corporation estimates that had it not been for these delays, revenues for the quarter and the 6-month period ended July 31, 2024, would have been approximately $35.0 million higher, revenues coming from additional steel erecting (installation) work. In fact, more than 300 truck loads of fabricated structural steel and steel components are waiting for delivery to the construction site. These revenues are naturally not lost but rather pushed forward in time. Given that installation schedules are difficult to compress over time, these missing revenues risk being pushed forward to the next fiscal year.

Gross margin, as a percentage of revenues (1) went from 22.2% for the 3-month period ended July 31, 2023, to 36.9% for the same period ended July 31, 2024. Gross margin, as a percentage of revenue (1) went from 19.5% during the first semester ended July 31, 2023, to 32.3% in the same period ended July 31, 2024.

The improvement in margins is in line with the increase observed in recent quarters and is largely attributable to a better absorption of fixed costs, in line with the increase in fabrication volume, the continued favorable impact of the investments in automation at ADF’s plant in Terrebonne, Quebec, and a favorable mix of projects. For the second consecutive quarter, the mix of products in fabrication was particularly favorable.

Adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) (2) for the 6-month period ended July 31, 2024, at $48.0 million, was $25.3 million higher than at the same date a year ago.

For the quarter ended July 31, 2024, ADF recorded net income of $16.0 million ($0.51 per basic and diluted share) compared with net income of $10.5 million ($0.32 per share, basic and diluted) a year earlier. At the close of the first semester on July 31, 2024, net income totalled $31.3 million ($0.98 per share, basic and diluted) compared with net income of $15.9 million ($0.49 per share, basic and diluted) for the same period a year ago.

The Corporation’s order backlog (1) stood at $402.3 million as at July 31, 2024. Projects currently in the order backlog will extend until the end of the fiscal year ending January 31, 2026.

As at July 31, 2024, the Corporation had working capital (1) of $90.1 million. The Corporation’s operating activities generated cash of $60.1 million during the first 6 months ended July 31, 2024. The Corporation remains in a good position to continue its current operations and carry out its development projects.

|

________________________________ |

|

|

(1) |

Gross margin, as a percentage of revenues, working capital, as well as the order backlog are additional financial measures. Refer to the “Non-GAAP Financial Measures and Other Financial Measures” section of this press release for the definition of these indicators. |

|

(2) |

Adjusted EBITDA is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures and Other Financial Measures” section of this press release for the definition of this indicator. |

Financial Highlights

|

3 months |

6 months |

|||

|

Periods ended July 31, |

2024 |

2023 |

2024 |

2023 |

|

(In thousands of dollars, and dollars per share) |

$ |

$ |

$ |

$ |

|

Revenues |

74,881 |

80,215 |

182,281 |

160,486 |

|

Adjusted EBITDA (1) |

24,914 |

12,644 |

48,013 |

22,675 |

|

Income before income tax expense |

22,226 |

10,949 |

43,484 |

18,874 |

|

Net income for the period |

16,000 |

10,542 |

31,265 |

15,913 |

|

— Per share (basic and diluted) |

0.51 |

0.32 |

0.98 |

0.49 |

|

(In thousands) |

Number |

Number |

Number |

Number |

|

Weighted average number of outstanding shares (basic and diluted) |

31,197 |

32,640 |

31,911 |

32,640 |

|

(1) |

Adjusted EBITDA is a non-GAAP financial measure. Refer to the “Non-GAAP Financial Measures and Other Financial Measures” section of this press release for the definition of this indicator. |

Outlook

“We closed the periods ended July 31, 2024, with higher net income while increasing our liquidities, even with the decrease in revenues during the quarter closed on July 31, 2024, compared with last fiscal year. We are therefore maintaining the same objectives that have guided us for the past few quarters, namely the order backlog growth, cash generation and operational excellence, in order to continue to grow our Corporation in the coming quarters” said Mr. Jean Paschini, Chairman of the Board and Chief Executive Officer.

Dividend

On September 11, 2024, the Board of Directors of ADF Group approved the payment of a semi-annual dividend of $0.02 per Subordinate Voting Share and per Multiple Voting Share, payable on October 17, 2024, to Shareholders of Record as at September 27, 2024.

Conference call with Investors

An investor conference call will be held this morning, September 12, 2024, at 10 a.m. (EST) to discuss results for the second quarter and 6-month period ended July 31, 2024.

To join the conference call without operator assistance, you can register with your phone number on https://link.meetingpanel.com/?id=64653 to receive an instant automated call back. You can also join the conference call with operator assistance by dialing 1 (888) 510-2154 a few minutes prior to the conference call scheduled start time.

A replay of the conference call will be available from 1:00 p.m. September 12, 2024, until midnight, September 19, 2024, by dialing 1 (888) 660-6345; followed by the access code 64653 #.

The conference call (audio) will also be available at www.adfgroup.com. Members of the media are invited to join in listening mode.

About ADF Group Inc. | ADF Group Inc. is a North American leader in the design and engineering of connections, fabrication, including the application of industrial coatings, and installation of complex steel structures, heavy steel built-ups, as well as in miscellaneous and architectural metals for the non-residential infrastructure sector. ADF Group Inc. is one of the few players in the industry capable of handling highly technically complex mega projects on fast-track schedules in the commercial, institutional, industrial and public sectors. The Corporation operates two fabrication plants and two paint shops, in Canada and in the United States, and a Construction Division in the United States, which specializes in the installation of steel structures and other related products.

Forward-Looking Information | This press release contains forward-looking statements reflecting ADF’s objectives and expectations. These statements are identified by the use of verbs such as “expect” as well as by the use of future or conditional tenses. By their very nature these types of statements involve risks and uncertainty. Consequently, reality may differ from ADF’s expectations.

Non-GAAP Financial Measures and Other Financial Measures | Are measures derived primarily from the consolidated financial statements but are not a standardized financial measure under the financial reporting framework used to prepare the Corporation’s financial statements. Therefore, readers should be careful not to confuse or substitute them with performance measures prepared in accordance with GAAP. In addition, readers should avoid comparing these non-GAAP financial measures to similarly titled measures provided or used by other issuers. The definition of these indicators and their reconciliation with comparable International Financial Reporting Standards measure is as follows:

Adjusted EBITDA

Adjusted EBITDA shows the extent to which the Corporation generates profits from operations, without considering the following items:

- Net financial expenses;

- Income tax expense;

- Foreign exchange (gains) losses, and

- Depreciation and amortization of property, plant and equipment, intangible assets, and right-of-use assets.

Net income is reconciled with adjusted EBITDA in the table below:

|

3 months |

6 months |

|||

|

Periods Ended July 31, |

2024 |

2023 |

2024 |

2023 |

|

(In thousands of dollars) |

$ |

$ |

$ |

$ |

|

Net income |

16,000 |

10,542 |

31,265 |

15,913 |

|

Income taxes expense |

6,226 |

407 |

12,219 |

2,961 |

|

Net financial expenses |

268 |

628 |

666 |

1,467 |

|

Amortization |

1,528 |

1,434 |

3,017 |

2,878 |

|

Foreign exchange loss (gain) |

892 |

(367) |

846 |

(544) |

|

Adjusted EBITDA |

24,914 |

12,644 |

48,013 |

22,675 |

Gross Margin as a Percentage of Revenues

Gross margin as a percentage of revenue indicator is used by the Corporation to assess the level of profitability for a given period based on the project mix for that same period. This indicator is subject to fluctuations in project prices and also in the operational efficiency of the Corporation. The indicator of gross margin as a percentage of revenues results from dividing gross margin by revenues.

Order Backlog

The order backlog is a measure used by the Corporation to assess future revenue levels. The order backlog includes firm orders obtained by the Corporation, either through a firm contract or a formal notice to proceed confirmed by the client. The order backlog disclosed by the Corporation therefore includes the portion of confirmed contracts that have not been put into production.

Working Capital

The working capital indicator is used by the Corporation to assess whether current assets are sufficient to meet current liabilities. Working capital is equal to current assets, less current liabilities.

SOURCE ADF Group Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/12/c6590.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/12/c6590.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amphenol's Options Frenzy: What You Need to Know

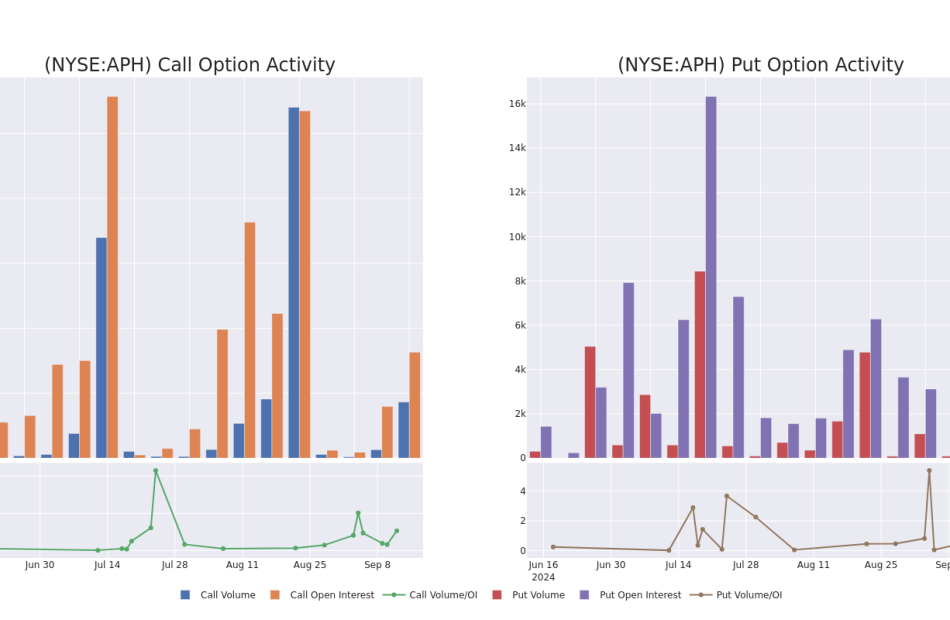

High-rolling investors have positioned themselves bearish on Amphenol APH, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in APH often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 8 options trades for Amphenol. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $84,000, and 7 calls, totaling $565,780.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $70.0 for Amphenol over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Amphenol’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amphenol’s whale activity within a strike price range from $55.0 to $70.0 in the last 30 days.

Amphenol Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APH | CALL | TRADE | BULLISH | 10/18/24 | $1.5 | $1.3 | $1.45 | $65.00 | $145.0K | 3.5K | 1.0K |

| APH | CALL | TRADE | NEUTRAL | 10/18/24 | $0.45 | $0.35 | $0.4 | $70.00 | $104.8K | 3.7K | 2.6K |

| APH | CALL | SWEEP | BULLISH | 04/17/25 | $11.2 | $10.5 | $11.2 | $55.00 | $88.4K | 54 | 80 |

| APH | PUT | TRADE | BEARISH | 10/18/24 | $1.2 | $1.05 | $1.2 | $60.00 | $84.0K | 3.0K | 700 |

| APH | CALL | TRADE | BEARISH | 01/17/25 | $6.8 | $6.7 | $6.7 | $60.00 | $67.0K | 205 | 102 |

About Amphenol

Amphenol is a global supplier of connectors, sensors, and interconnect systems. Amphenol holds the second-largest connector market share globally and sells into the end markets of automotive, broadband, commercial air, industrial, IT and data communications, military, mobile devices, and mobile networks. Amphenol is diversified geographically, with operations in 40 countries.

After a thorough review of the options trading surrounding Amphenol, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Amphenol

- Trading volume stands at 1,503,286, with APH’s price up by 1.78%, positioned at $63.16.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 41 days.

What Analysts Are Saying About Amphenol

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $71.0.

- Reflecting concerns, an analyst from B of A Securities lowers its rating to Neutral with a new price target of $71.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Amphenol, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.