Global Theme Park Market Poised for Remarkable Growth: Projected to Reach USD 119 Billion by 2034 at a CAGR of 5.2% | FMI

NEWARK, Del, Sept. 11, 2024 (GLOBE NEWSWIRE) — The global theme park market is set to witness significant growth, with revenues projected to soar from USD 71.4 billion in 2024 to an impressive USD 119.0 billion by 2034, achieving a compound annual growth rate (CAGR) of 5.2% over the next decade.

As tourism continues to evolve, the theme park industry is emerging as a focal point in the conversations about fun, experience, and leisure. Whether it’s the adrenaline-pumping rides, serene nature-inspired environments, up-close animal encounters, or thrilling water adventures, theme parks offer a blend of excitement and escapism that resonates with people across all age groups. In today’s fast-paced world, these attractions provide a perfect balance between fun and relaxation, catering to diverse preferences.

The rise of theme parks highlights a dynamic shift toward a customer-centric model that prioritizes experiences over material authenticity. Unlike traditional tourism, where the focus was often on historical landmarks or physical objects, modern theme parks emphasize immersive, interactive experiences that foster connection and joy.

With this evolving trend, theme parks are set to redefine the future of leisure and entertainment, offering an antidote to the stresses of modern life. The market’s promising growth trajectory underscores its importance as a key driver in the global tourism and recreation industry.

As the theme park market gears up for a remarkable decade of expansion, industry leaders are expected to innovate continuously, delivering enhanced experiences that will captivate the hearts of millions worldwide.

Market CAGR Value of Theme Park by Country:

| Countries | CAGR from 2024 to 2034 |

| Japan | 7.00% |

| South Korea | 6.80% |

| United Kingdom | 6.30% |

| China | 6.00% |

| United States | 5.50% |

Surge in Market Demand: Explore Comprehensive Trends and Analysis in Our Full Report!

“Theme parks have become much more than just destinations; they represent a dynamic fusion of thrill, relaxation, and discovery,” says Nandini Roy Choudhury, Client Partner at Future Market Insights. “In an era where consumers seek meaningful and engaging experiences, theme parks have successfully carved out a niche that delivers both joy and escapism, ensuring their enduring appeal.”

Prominent Drivers of the Theme Park Market:

The theme park market is driven by several prominent factors that fuel its growth and development. Key drivers include:

- Rising Disposable Income and Consumer Spending: As global incomes rise, especially in emerging markets, more people have the financial means to visit theme parks, contributing to increased attendance and higher spending within parks.

- Tourism Growth: Theme parks are often major tourist attractions. The growth of international and domestic tourism directly supports the expansion of the theme park market.

- Increased Demand for Family Entertainment: With a focus on multi-generational family activities, theme parks provide an ideal destination for family entertainment, leading to higher visitor numbers and diversified offerings.

- Technological Innovations: The use of immersive technologies such as virtual reality (VR), augmented reality (AR), and advanced ride systems enhances the visitor experience, driving repeat visits and customer satisfaction.

- Strategic Collaborations and Licensing Agreements: Partnerships between theme parks and entertainment companies (e.g., Disney, Universal) for exclusive rights to popular franchises (movies, TV shows, video games) attract fans and expand the audience base.

- Urbanization and Infrastructure Development: Expanding urban areas and improved transport networks make theme parks more accessible, leading to higher foot traffic.

- Diversification of Offerings: Parks are offering year-round attractions, themed accommodations, shopping experiences, and dining options to enhance guest satisfaction and extend the time spent at the park.

Challenges Faced by the Theme Park Market:

The theme park market faces several challenges, which impact both operational and financial aspects. Here are some of the key challenges:

- High Operating Costs: Maintenance, staffing, and energy consumption contribute to significant expenses. Keeping attractions safe and functional requires constant investment.

- Seasonality and Weather Dependency: Theme parks typically see fluctuating attendance based on seasons and weather. Bad weather can drastically reduce visitor numbers, affecting revenue.

- Rising Competition: The rise of virtual entertainment options, such as VR and online gaming, presents new competition, particularly for younger audiences.

- Economic Downturns: During economic recessions, theme park attendance drops as families cut down on non-essential leisure activities.

- Safety and Security Concerns: Managing large crowds while ensuring safety is a logistical challenge, particularly after incidents like accidents or health crises (e.g., COVID-19).

- Sustainability Pressures: There is growing pressure to adopt sustainable practices, from reducing water and energy consumption to minimizing waste.

- Technological Advancements: Keeping up with technological trends, such as virtual queues and digital enhancements, requires continual investment.

Key Companies in the Market:

- Cedar Fair Entertainment Company

- Comcast Corporation

- Fantawild

- Hershey Entertainment and Resorts Company

Regional Analysis Theme Park Market:

The theme park market shows varied growth trends across different regions:

- North America: Dominates the global theme park market due to well-established parks like Disney and Universal Studios, with strong visitor numbers and high per capita spending.

- Europe: Home to major parks like Disneyland Paris, the market is stable but faces growth challenges due to economic factors and seasonal tourism.

- Asia-Pacific: Fastest-growing region, led by China and Japan. Rising disposable incomes, urbanization, and investments in new parks are driving expansion.

- Middle East & Africa: Emerging market with growing interest, driven by tourism initiatives, especially in the UAE with attractions like Dubai Parks and Resorts.

- Latin America: Moderate growth with potential in countries like Brazil and Mexico, but hindered by economic instability.

Market Segmentation:

By Type:

- Theme Parks

- Water Parks

- Adventure Parks

- Zoo Parks

By Ride:

- Mechanical Rides

- Water Rides

- Others

By Age-Group:

- Up to 18 years

- 19 to 35 years

- 36 to 50 years

- 51 to 65 years

- Above 65 years

By Revenue Source:

- Tickets

- Food & Beverage

- Merchandise

- Hotel & Resorts

- Others

By Region:

- North America

- Latin America

- Asia Pacific

- Middle East and Africa (MEA)

- Europe

Authored by:

Nandini Roy Choudhury (Client Partner for Food & Beverages at Future Market Insights, Inc.) has 7+ years of management consulting experience. She advises industry leaders and explores off-the-eye opportunities and challenges. She puts processes and operating models in place to support their business objectives.

She has exceptional analytical skills and often brings thought leadership to the table.

Nandini has vast functional expertise in key niches, including but not limited to food ingredients, nutrition & health solutions, animal nutrition, and marine nutrients. She is also well-versed in the pharmaceuticals, biotechnology, retail, and chemical sectors, where she advises market participants to develop methodologies and strategies that deliver results.

Her core expertise lies in corporate growth strategy, sales and marketing effectiveness, acquisitions and post-merger integration and cost reduction. Nandini has an MBA in Finance from MIT School of Business. She also holds a Bachelor’s Degree in Electrical Engineering from Nagpur University, India.

Nandini has authored several publications, and quoted in journals including Beverage Industry, Bloomberg, and Wine Industry Advisor.

Explore FMI’s related ongoing Coverage on Travel and Tourism Market Insights Domain:

The global tourism market size is expected to develop at a CAGR of 5% over the next ten years. By the end of this forecast year in 2032, analysts anticipate the tourism market size would be worth USD 17.1 Trillion.

The spanish sports tourism market share is estimated to reach USD 18,135.6 million in 2024. As per the analysis, sales are forecast to increase at a robust 13.5% CAGR during the forecast period from 2024 to 2034 and it is projected to reach USD 64,341.3 million by the end of 2034.

The South Africa faith-based tourism market demand is estimated to reach ~USD 86.5 million in the year 2024. The market is forecast to reach a valuation of ~USD 193.8 million by the year 2034 with a CAGR of ~8.4% from the years 2024 to 2034.

The Germany culinary tourism market growth is estimated to reach ~USD 6,062.3 million in the year 2024. It is forecast to reach a valuation of ~USD 19,511.9 million by the year 2034 with a CAGR of 12.4% from the years 2024 to 2034.

The India sustainable tourism market forecast is estimated to reach ~USD 37.1 million in the year 2024 and is further forecasted to reach a valuation of ~USD 216.7 million in the year 2034 with a market CAGR of 19.3% between the years 2024 and 2034.

The Japan sports tourism market outlook registered a market value of USD 9,577.8 million in 2023 and is expected to grow at a steady CAGR of 8.5% during the forecast period from 2024 to 2034. The target market is anticipated to be valued at USD 23,561.0 million by 2034.

As per newly released data, the Japan faith-based tourism market overview is estimated at ~USD 548.3 million in 2024. The market is projected to grow at a significant CAGR of ~10.3% during the forecast period from 2024 to 2034 and reach a market valuation of ~USD 1,461.4 million by 2034 end.

The global tech savvy hotel chains market opportunity is estimated at ~USD 70,898.5 million in the year 2024 and is anticipated to reach an industry valuation of ~USD 294,394.8 million in the year 2034 with a market CAGR of 15.3% between the years 2024 and 2034.

The global ecotourism market development has been estimated at USD 2,51,188.1 million in the year 2024 and is expected to reach an industry valuation of USD 9,79,128.7 million in the year 2034 with a market CAGR of 14.6% between the years 2024 and 2034.

The yoga and meditation market trends is expected to progress strongly, with an estimated CAGR of 13.5% over the forecast period. As of 2024, it is valued at USD 6,942.8 million and is anticipated to go beyond USD 24,631.6 million by 2034, reflecting a 3.5X increase in its value.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Future Market Insights Inc. Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, USA T: +1-347-918-3531 For Sales Enquiries: sales@futuremarketinsights.com Website: https://www.futuremarketinsights.com LinkedIn| Twitter| Blogs | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

IRG Names Long-Time Senior Executive Greg Hipp as Chief Operating Officer

IRG Realty Advisors’ President steps into an expanded role

LOS ANGELES, Sept. 11, 2024 /PRNewswire/ — Industrial Realty Group, LLC (IRG), a national leader in industrial redevelopment and adaptive reuse, announced today the promotion of Greg Hipp, formerly the President of IRG Realty Advisors (IRGRA), to Chief Operating Officer (COO) of IRG. In his new role, Hipp will oversee the company’s operations at a national level, leading both IRG and IRGRA through the next phase of growth.

“Greg has been an incredible asset to IRG and a key contributor to the success of our real estate portfolio,” said Stuart Lichter, President of IRG. “As we continue to expand, both in the scale of our projects and our workforce, we are confident that Greg will provide the same level of dedication and strategic insight that he has applied to shape the trajectory of our company over the past two decades.”

In this expanded role, Hipp will spearhead national operations across the IRG group of companies, providing leadership in strategic planning and execution for both IRG and their service company, IRGRA.

“Since joining the company in 2005, I’ve had the privilege of contributing to IRG’s exponential growth and evolution,” said Hipp. “I am honored to have been part of IRG’s long-standing history and excited to help steer the company toward an even brighter future.”

During Hipp’s tenure, IRG has grown its portfolio to over 100 million square feet of space and expanded its workforce to over 300 associates across the country.

About IRG

IRG is a nationwide real estate development and investment firm specializing in the acquisition, development, and management of commercial and industrial real estate throughout the United States. IRG, through its affiliated partnerships and limited liability companies, operates a portfolio containing over 150 properties in 31 states with over 100 million square feet of rentable space. IRG is nationally recognized as a leading force behind the adaptive reuse of commercial and industrial real estate, solving some of America’s most difficult real estate challenges.

Learn more at www.industrialrealtygroup.com.

For more information, contact:

Lauren Crumrine | Vice President Marketing | IRG

614-562-9252

lcrumrine@industrialrealtygroup.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/irg-names-long-time-senior-executive-greg-hipp-as-chief-operating-officer-302245228.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/irg-names-long-time-senior-executive-greg-hipp-as-chief-operating-officer-302245228.html

SOURCE Industrial Realty Group, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MIND TECHNOLOGY, INC. REPORTS FISCAL 2025 SECOND QUARTER RESULTS

THE WOODLANDS, Texas, Sept. 11, 2024 /PRNewswire/ — MIND Technology, Inc. MIND (“MIND” or the “Company”) today announced financial results for its fiscal 2025 second quarter ended July 31, 2024.

Revenues from continuing operations for the second quarter of fiscal 2025 were approximately $10.0 million compared to approximately $7.6 million in the second quarter of fiscal 2024. The Company reported operating income from continuing operations of approximately $1.4 million for the second quarter of fiscal 2025 compared to an operating loss of $767,000 for the second quarter of fiscal 2024. Net income for the second quarter of fiscal 2025 amounted to $798,000 compared to a loss of approximately $1.5 million in the second quarter of fiscal 2024. Second quarter of fiscal 2025 net loss attributable to common shareholders (after declared and undeclared preferred stock dividends) was $149,000, or a loss of $0.11 per share compared to a loss of approximately $2.4 million, or a loss of $1.74 per share in the second quarter last year. Adjusted EBITDA from continuing operations for the second quarter of fiscal 2025 was approximately $1.8 million compared to a loss of $120,000 in the second quarter of fiscal 2024.

Adjusted EBITDA from continuing operations, which is a non-GAAP measure, is defined and reconciled to reported net income (loss) from continuing operations and cash used in operating activities in the accompanying financial tables. These are the most directly comparable financial measures calculated and presented in accordance with United States generally accepted accounting principles, or GAAP.

The backlog of Marine Technology Products related to our Seamap segment as of July 31, 2024 was approximately $26.2 million compared to approximately $17.0 million at July 31, 2023.

Rob Capps, MIND’s President and Chief Executive Officer, stated, “We delivered positive results for our fiscal second quarter that were in line with our expectations and achieved further operational efficiencies that drove margin improvement. In addition to streamlining our operations and narrowing our strategic focus with the sale of Klein, we have been able to implement various cost containment initiatives that have meaningfully enhanced our financial results over the last twelve months. Our backlog remains strong, and is over 50% above the year ago amount. Furthermore, our pipeline of pending orders and prospects is also strong, with over $6 million of orders having been added since quarter end or that we expect shortly. This activity and ongoing discussions regarding other pending orders demonstrate the significant customer demand we are seeing across our differentiated product lines.

“Given our enhanced cost structure, current visibility, and robust customer engagement, we fully expect to achieve year-over-year revenue growth, positive Adjusted EBITDA and greater full year profitability in fiscal 2025.

“As announced last week, we have completed the conversion of our preferred stock to common stock. This is an important step for MIND. It simplifies our capital structure and, in my opinion, sets the stage for creating meaningful stockholder value,” concluded Capps.

CONFERENCE CALL

Management has scheduled a conference call for Thursday, September 12, 2024 at 9:00 a.m. Eastern Time (8:00 a.m. Central Time) to discuss the Company’s fiscal 2025 second quarter results. To access the call, please dial (412) 902-0030 and ask for the MIND Technology call at least 10 minutes prior to the start time. Investors may also listen to the conference call live on the MIND Technology website, http://mind-technology.com, by logging onto the site and clicking “Investor Relations”. A telephonic replay of the conference call will be available through September 19, 2024 and may be accessed by calling (201) 612-7415 and using passcode 13748560#. A webcast archive will also be available at http://mind-technology.com shortly after the call and will be accessible for approximately 90 days. For more information, please contact Dennard Lascar Investor Relations by email at MIND@dennardlascar.com.

ABOUT MIND TECHNOLOGY

MIND Technology, Inc. provides technology to the oceanographic, hydrographic, defense, seismic and security industries. Headquartered in The Woodlands, Texas, MIND has a global presence with key operating locations in the United States, Singapore, Malaysia, and the United Kingdom. Its Seamap unit designs, manufactures, and sells specialized, high performance, marine exploration and survey equipment.

Forward-looking Statements

Certain statements and information in this press release concerning results for the quarter ended July 31, 2024 may constitute “forward-looking statements“ within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “should,” “would,” “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts of our existing operations and do not include the potential impact of any future acquisitions or dispositions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. These risks and uncertainties include, without limitation, reductions in our customers‘ capital budgets, our own capital budget, limitations on the availability of capital or higher costs of capital and volatility in commodity prices for oil and natural gas.

For additional information regarding known material factors that could cause our actual results to differ from our projected results, please see our filings with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, unless required by law, whether as a result of new information, future events or otherwise. All forward-looking statements included in this press release are expressly qualified in their entirety by the cautionary statements contained or referred to herein.

Non-GAAP Financial Measures

Certain statements and information in this press release contain non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company‘s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with United States generally accepted accounting principles, or GAAP. Company management believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. Company management also believes that these non-GAAP financial measures enhance the ability of investors to analyze the Company’s business trends and to understand the Company’s performance. In addition, the Company may utilize non-GAAP financial measures as guides in its forecasting, budgeting, and long-term planning processes and to measure operating performance for some management compensation purposes. Any analysis of non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Reconciliation of Backlog, which is a non-GAAP financial measure, is not included in this press release due to the inherent difficulty and impracticality of quantifying certain amounts that would be required to calculate the most directly comparable GAAP financial measures.

-Tables to Follow-

|

MIND TECHNOLOGY, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except per share data) (unaudited) |

||||||||

|

July 31, 2024 |

January 31, 2024 |

|||||||

|

ASSETS |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ |

1,904 |

$ |

5,289 |

||||

|

Accounts receivable, net of allowance for credit losses of $332 at each of July 31, 2024 |

9,586 |

6,566 |

||||||

|

Inventories, net |

19,069 |

13,371 |

||||||

|

Prepaid expenses and other current assets |

2,075 |

3,113 |

||||||

|

Total current assets |

32,634 |

28,339 |

||||||

|

Property and equipment, net |

782 |

818 |

||||||

|

Operating lease right-of-use assets |

1,732 |

1,324 |

||||||

|

Intangible assets, net |

2,566 |

2,888 |

||||||

|

Deferred tax asset |

122 |

122 |

||||||

|

Total assets |

$ |

37,836 |

$ |

33,491 |

||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ |

4,387 |

$ |

1,623 |

||||

|

Deferred revenue |

428 |

203 |

||||||

|

Customer deposits |

2,726 |

3,446 |

||||||

|

Accrued expenses and other current liabilities |

1,905 |

2,140 |

||||||

|

Income taxes payable |

2,171 |

2,114 |

||||||

|

Operating lease liabilities – current |

747 |

751 |

||||||

|

Total current liabilities |

12,364 |

10,277 |

||||||

|

Operating lease liabilities – non-current |

985 |

573 |

||||||

|

Total liabilities |

13,349 |

10,850 |

||||||

|

Stockholders’ equity: |

||||||||

|

Preferred stock, $1.00 par value; 2,000 shares authorized; 1,683 shares issued and |

37,779 |

37,779 |

||||||

|

Common stock, $0.01 par value; 40,000 shares authorized; 1,406 shares issued and |

14 |

14 |

||||||

|

Additional paid-in capital |

113,215 |

113,121 |

||||||

|

Accumulated deficit |

(126,555) |

(128,307) |

||||||

|

Accumulated other comprehensive gain |

34 |

34 |

||||||

|

Total stockholders’ equity |

24,487 |

22,641 |

||||||

|

Total liabilities and stockholders’ equity |

$ |

37,836 |

$ |

33,491 |

||||

|

MIND TECHNOLOGY, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data) (unaudited) |

||||||||||||||||

|

For the Three Months |

For the Six Months |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

Revenues: |

||||||||||||||||

|

Sales of marine technology products |

$ |

10,036 |

$ |

7,561 |

19,714 |

18,158 |

||||||||||

|

Cost of sales: |

||||||||||||||||

|

Sales of marine technology products |

5,258 |

4,620 |

10,718 |

10,681 |

||||||||||||

|

Gross profit |

4,778 |

2,941 |

8,996 |

7,477 |

||||||||||||

|

Operating expenses: |

||||||||||||||||

|

Selling, general and administrative |

2,784 |

2,913 |

5,543 |

6,219 |

||||||||||||

|

Research and development |

328 |

493 |

790 |

971 |

||||||||||||

|

Depreciation and amortization |

236 |

302 |

503 |

635 |

||||||||||||

|

Total operating expenses |

3,348 |

3,708 |

6,836 |

7,825 |

||||||||||||

|

Operating income (loss) |

1,430 |

(767) |

2,160 |

(348) |

||||||||||||

|

Other income (expense): |

||||||||||||||||

|

Interest expense |

— |

(163) |

— |

(367) |

||||||||||||

|

Other, net |

40 |

238 |

509 |

310 |

||||||||||||

|

Total other income (expense) |

40 |

75 |

509 |

(57) |

||||||||||||

|

Income (loss) from continuing operations before income taxes |

1,470 |

(692) |

2,669 |

(405) |

||||||||||||

|

Provision for income taxes |

(672) |

(66) |

(917) |

(477) |

||||||||||||

|

Net income (loss) from continuing operations |

798 |

(758) |

1,752 |

(882) |

||||||||||||

|

Loss from discontinued operations, net of income taxes |

— |

(736) |

— |

(852) |

||||||||||||

|

Net income (loss) |

$ |

798 |

$ |

(1,494) |

$ |

1,752 |

$ |

(1,734) |

||||||||

|

Preferred stock dividends – declared |

— |

— |

— |

— |

||||||||||||

|

Preferred stock dividends – undeclared |

(947) |

(947) |

(1,894) |

(1,894) |

||||||||||||

|

Net loss attributable to common stockholders |

$ |

(149) |

$ |

(2,441) |

$ |

(142) |

$ |

(3,628) |

||||||||

|

Net loss per common share – Basic and Diluted |

||||||||||||||||

|

Continuing operations |

$ |

(0.11) |

$ |

(1.21) |

$ |

(0.10) |

$ |

(1.97) |

||||||||

|

Discontinued operations |

$ |

— |

$ |

(0.52) |

$ |

— |

$ |

(0.61) |

||||||||

|

Net loss |

$ |

(0.11) |

$ |

(1.74) |

$ |

(0.10) |

$ |

(2.58) |

||||||||

|

Shares used in computing net income (loss) per common share: |

||||||||||||||||

|

Basic and diluted |

1,406 |

1,406 |

1,406 |

1,406 |

||||||||||||

|

MIND TECHNOLOGY, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (unaudited) |

||||||||

|

For the Six Months Ended July 31, |

||||||||

|

2024 |

2023 |

|||||||

|

Cash flows from operating activities: |

||||||||

|

Net income (loss) |

$ |

1,752 |

$ |

(1,734) |

||||

|

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

||||||||

|

Depreciation and amortization |

503 |

940 |

||||||

|

Stock-based compensation |

95 |

158 |

||||||

|

Provision for inventory obsolescence |

45 |

— |

||||||

|

Gross profit from sale of other equipment |

(457) |

(336) |

||||||

|

Changes in: |

||||||||

|

Accounts receivable |

(3,032) |

(3,238) |

||||||

|

Unbilled revenue |

75 |

31 |

||||||

|

Inventories |

(5,742) |

(333) |

||||||

|

Prepaid expenses and other current and long-term assets |

1,042 |

1,329 |

||||||

|

Income taxes receivable and payable |

54 |

63 |

||||||

|

Accounts payable, accrued expenses and other current liabilities |

2,465 |

(1,556) |

||||||

|

Deferred revenue and customer deposits |

(495) |

1,199 |

||||||

|

Net cash used in operating activities |

(3,695) |

(3,477) |

||||||

|

Cash flows from investing activities: |

||||||||

|

Purchases of property and equipment |

(146) |

(102) |

||||||

|

Sale of other equipment |

457 |

336 |

||||||

|

Net cash provided by investing activities |

311 |

234 |

||||||

|

Cash flows from financing activities: |

||||||||

|

Payment on short-term loan |

— |

2,947 |

||||||

|

Net cash provided by financing activities |

— |

2,947 |

||||||

|

Effect of changes in foreign exchange rates on cash and cash equivalents |

(1) |

12 |

||||||

|

Net change in cash and cash equivalents |

(3,385) |

(284) |

||||||

|

Cash and cash equivalents, beginning of period |

5,289 |

778 |

||||||

|

Cash and cash equivalents, end of period |

$ |

1,904 |

$ |

494 |

||||

|

MIND TECHNOLOGY, INC. Reconciliation of Net Income (Loss) and Net Cash Used in Operating Activities to EBITDA and Adjusted EBITDA from Continuing Operations (in thousands) (unaudited) |

||||||||||||||||

|

For the Three Months |

For the Six Months |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

Reconciliation of Net income (loss) to EBITDA and Adjusted EBITDA from continuing operations |

(in thousands) |

|||||||||||||||

|

Net income (loss) |

$ |

798 |

$ |

(1,494) |

$ |

1,752 |

$ |

(1,734) |

||||||||

|

Interest expense, net |

— |

163 |

— |

367 |

||||||||||||

|

Depreciation and amortization |

236 |

459 |

503 |

940 |

||||||||||||

|

Provision for income taxes |

672 |

66 |

917 |

477 |

||||||||||||

|

EBITDA (1) |

1,706 |

(806) |

3,172 |

50 |

||||||||||||

|

Stock-based compensation |

46 |

108 |

95 |

158 |

||||||||||||

|

Loss from discontinued operations net of depreciation and amortization |

— |

578 |

— |

546 |

||||||||||||

|

Adjusted EBITDA from continuing operations (1) |

$ |

1,752 |

$ |

(120) |

$ |

3,267 |

$ |

754 |

||||||||

|

Reconciliation of Net Cash Provided by (Used in) Operating Activities to EBITDA |

||||||||||||||||

|

Net cash provided by (used in) operating activities |

$ |

1,058 |

$ |

(490) |

$ |

(3,695) |

$ |

(3,477) |

||||||||

|

Stock-based compensation |

(46) |

(108) |

(95) |

(158) |

||||||||||||

|

Provision for inventory obsolescence |

(22) |

— |

(45) |

— |

||||||||||||

|

Changes in accounts receivable (current and long-term) |

111 |

(244) |

2,957 |

3,207 |

||||||||||||

|

Interest paid, net |

— |

203 |

— |

407 |

||||||||||||

|

Taxes paid, net of refunds |

508 |

236 |

938 |

425 |

||||||||||||

|

Gross profit from sale of other equipment |

— |

198 |

457 |

336 |

||||||||||||

|

Changes in inventory |

2,930 |

1,312 |

5,742 |

333 |

||||||||||||

|

Changes in accounts payable, accrued expenses and other current liabilities and deferred revenue |

(1,813) |

(1,825) |

(1,970) |

357 |

||||||||||||

|

Changes in prepaid expenses and other current and long-term assets |

(942) |

(21) |

(1,042) |

(1,329) |

||||||||||||

|

Other |

(78) |

(67) |

(75) |

(51) |

||||||||||||

|

EBITDA (1) |

$ |

1,706 |

$ |

(806) |

$ |

3,172 |

$ |

50 |

||||||||

|

1. |

EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA is defined as net income before (a) interest income and interest expense, (b) provision for (or benefit from) income taxes and (c) depreciation and amortization. Adjusted EBITDA excludes non-cash foreign exchange gains and losses, stock-based compensation, impairment of intangible assets and other non-cash tax related items. We consider EBITDA and Adjusted EBITDA to be important indicators for the performance of our business, but not measures of performance or liquidity calculated in accordance with GAAP. We have included these non-GAAP financial measures because management utilizes this information for assessing our performance and liquidity, and as indicators of our ability to make capital expenditures, service debt and finance working capital requirements and we believe that EBITDA and Adjusted EBITDA are measurements that are commonly used by analysts and some investors in evaluating the performance and liquidity of companies such as us. In particular, we believe that it is useful to our analysts and investors to understand this relationship because it excludes transactions not related to our core cash operating activities. We believe that excluding these transactions allows investors to meaningfully trend and analyze the performance of our core cash operations. EBITDA and Adjusted EBITDA are not measures of financial performance or liquidity under GAAP and should not be considered in isolation or as alternatives to cash flow from operating activities or as alternatives to net income as indicators of operating performance or any other measures of performance derived in accordance with GAAP. In evaluating our performance as measured by EBITDA, management recognizes and considers the limitations of this measurement. EBITDA and Adjusted EBITDA do not reflect our obligations for the payment of income taxes, interest expense or other obligations such as capital expenditures. Accordingly, EBITDA and Adjusted EBITDA are only two of the measurements that management utilizes. Other companies in our industry may calculate EBITDA or Adjusted EBITDA differently than we do and EBITDA and Adjusted EBITDA may not be comparable with similarly titled measures reported by other companies. |

|

Contacts: |

Rob Capps, President & CEO |

|

MIND Technology, Inc. |

|

|

281-353-4475 |

|

|

Ken Dennard / Zach Vaughan |

|

|

Dennard Lascar Investor Relations |

|

|

713-529-6600 |

|

|

MIND@dennardlascar.com |

![]() View original content:https://www.prnewswire.com/news-releases/mind-technology-inc-reports-fiscal-2025-second-quarter-results-302245348.html

View original content:https://www.prnewswire.com/news-releases/mind-technology-inc-reports-fiscal-2025-second-quarter-results-302245348.html

SOURCE MIND Technology, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oxford Industries, Parent Company Of Tommy Bahama And Lilly Pulitzer, Sees Stock Drop Following Q2 Results

Oxford Industries, Inc. OXM reported its second-quarter financial results after Wednesday’s closing bell. Here’s a look at the details from the report.

The Details: Oxford Industries reported quarterly earnings of $2.77 per share which missed the analyst consensus estimate of $3.00 by 7.67%. Quarterly sales of $419.886 million missed the analyst consensus estimate of $438.176 million by 4.17% and is a slight decrease in sales from the same period last year.

- Full-price direct-to-consumer (DTC) sales increased 1% to $305 million versus the second quarter of fiscal 2023.

- Full-price retail sales of $152 million were 1% higher than the prior-year period.

- E-commerce sales of $153 million were comparable to last year.

- Outlet sales were $21 million, a 4% increase versus prior-year results.

- Food and beverage sales of $29 million were comparable to last year.

- Wholesale sales of $65 million were 5% lower than the second quarter of fiscal 2023.

“Consumer sentiment in the second quarter continued to decline from levels earlier in the year reaching an eight month low in July. The decline led to market conditions that were weaker than expected with more consumers looking for deals and promotions as evidenced by increased sales in our outlet locations and during promotional events,” said Tom Chubb, Chairman and CEO.

“Despite the challenging consumer environment, our teams continue to focus on our strategy of delivering new and compelling products and experiences for our customers,” he added.

Outlook: Oxford Industries lowered its third-quarter guidance to earnings of between 0 cents and 20 cents per share and net sales in a range of $310 million to $325 million. The company sees fiscal year 2024 earnings of between $7.00 and $7.30 per share and net sales in a range of $1.51 billion to $1.54 billion.

OXM Price Action: According to Benzinga Pro, Oxford Industries shares are down 7.68% after-hours at $77.20 at the time of publication Wednesday.

Read Also:

Image: Courtesy of Oxford Industries, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Jones Sells Off On Surprise Inflation Report; GameStop Plunges On Sales Miss, Share Offering

The Dow Jones Industrial Average sold off 470 points Wednesday, as Wall Street digested inflation news with a surprise reading on the consumer price index, or CPI. An early earnings loser on the stock market today was GameStop (GME), which plunged 14%.

↑

X

Interest Rate Cuts Coming: Implications For Investors Ahead Of The September Fed Meeting

After the opening bell, the Dow Jones Industrial Average fell 1.2%, while the S&P 500 dropped 0.7%. The tech-focused Nasdaq composite inched lower in early trading.

Early Wednesday, the 10-year Treasury yield ticked higher to 3.66%. Oil prices rebounded more than 2%, lifting West Texas Intermediate futures to around $67.30 per barrel, as Hurricane Francine caused production shutdowns in the Gulf of Mexico.

Among exchange traded funds, the Invesco QQQ Trust (QQQ) was down a fraction, as the SPDR S&P 500 ETF (SPY) moved down 0.5% after the open.

Apple Seeks Support As Netflix Tries To Stop Buffering And Break Out

Stock Market Today: CPI Report, GameStop

Early Wednesday, the CPI rose 0.2% for the month of August, with an annual increase of 2.5%. Econoday estimates expected a 0.2% monthly rise, with a yearly increase of 2.6%. The core CPI, excluding food and energy, climbed 0.3% on the month, hotter than the 0.2% estimate. Year over year, the core CPI rose 3.2%, in line with estimates.

A broad array of stocks were in motion following Tuesday night’s presidential debate between former President Donald Trump and Vice President Kamala Harris. Solar and some EV-related stocks rallied in early trade. Shares of Trump Media & Technology Group (DJT) dived 13%.

Also early Wednesday, meme stock GameStop plunged around 14% after the company beat profit targets, but missed sales estimates in its second quarter. The company also disclosed an “at-the-market” stock offering of up to 20 million shares.

Nvidia Stumbles, Tesla Skids While This Mag 7 Stock Is Ripe For A Breakout

Dow Jones Falls

On Tuesday, the Dow Jones Industrial Average moved down 0.2%, while the S&P 500 moved up 0.5%. The tech-heavy Nasdaq composite gained 0.8%.

During Tuesday’s IBD Live show, the IBD Live team discussed the current trading conditions and how investors should handle the stock market today.

Now is an important time to read The Big Picture column amid the ongoing market action. Also, be sure to read how to adjust to changing market conditions, with IBD’s new exposure levels.

Nvidia Loses Ground To Apple And Microsoft. Tesla Takes Out Broadcom.

Stock Market Today: Best Stocks To Watch

Among the best companies to watch on the stock market today are Costco Wholesale (COST), Netflix (NFLX), Taiwan Semiconductor Manufacturing (TSM) and Uber Technologies (UBER).

Notable Dow Jones components are Amazon.com (AMZN), Apple (AAPL), Home Depot (HD), IBM (IBM) and Microsoft (MSFT), which regained its 200-day moving average Tuesday.

Apple and Uber were featured in the Stocks Near A Buy Zone column.

There was only one new stock on IBD MarketSurge‘s “Breaking Out Today” list Tuesday despite the stock market rebound. Tyler Technologies (TYL) is trying to break out past a 593.50 flat-base entry.

Further, there are only a handful of stock ideas on the site’s “Near Pivot” list. To find more stock ideas, check IBD Stock Lists like IBD 50, Big Cap 20 and Stocks Near A Buy Zone.

Get Real-Time Buy And Sell Alerts On Stock Market Leaders With IBD Leaderboard

Dow Jones: Home Depot, IBM

Among Dow Jones components, Home Depot is approaching a new handle buy point at 378.58, according to MarketSurge pattern recognition. Shares were down 0.8% early Wednesday.

Meanwhile, IBM is trading at the top of its buy range past its latest entry, a cup-with-handle buy point at 196.26. IBM stock rose 0.4% Wednesday.

Outside the Dow Jones index, retailer Costco continues to flirt with a 896.67 cup-base entry. The stock edged down Wednesday morning.

Streaming giant Netflix remains under its late-stage base’s 697.49 buy point following recent declines. Netflix stock was up a fraction Wednesday.

And Taiwan Semiconductor Manufacturing is building a cup with handle that has a 175.45 entry, and it gained 1.9% Wednesday morning.

Finally, Uber stock is about 5% away from a 75.40 double-bottom entry. Uber shares were off 0.5% early Wednesday.

Find The Best Stocks To Buy And Watch With IBD Stock Screener And IBD Screen Of The Day

Stock Market Today: Companies To Watch

These are four stocks in or near buy zones in today’s stock market.

| Company Name | Symbol | Correct Buy Point | Type Of Buy Point |

|---|---|---|---|

| Ferrari | (RACE) | 442.80 | Flat base |

| Taiwan Semiconductor | (TSM) | 175.45 | Cup with handle |

| ServiceNow | (NOW) | 850.33 | Flat base |

| Uber Technologies | (UBER) | 75.40 | Double bottom |

Source: IBD Data as of Sept. 10

Join IBD Experts As They Analyze Leading Stocks In The Stock Market Today On IBD Live

Magnificent Seven Stocks: Nvidia, Tesla, Alphabet

Among Magnificent Seven stocks, Alphabet (GOOGL), Nvidia (NVDA) and Tesla (TSLA) traded mixed in early trading.

Google parent Alphabet gave up support around the 200-day line in recent sessions. After falling Tuesday, shares bounced 0.4% in early trades Wednesday.

On Tuesday, Nvidia tried to rebound from its lowest level since its early August lows. Shares rallied 2.7% in Wednesday’s action.

And Tesla fell 2.1% Wednesday morning, set to snap a two-day win streak. Shares of the electric-vehicle leader are attempting to regain their 50-day line.

Dow Jones Leaders: Amazon, Microsoft

Among Dow Jones components in the Magnificent Seven, Amazon, Apple and Microsoft traded mixed after Wednesday’s stock market open.

Amazon shares are again rebounding from support at their 200-day moving average. The stock was down 1% Wednesday morning.

Apple stock is forming a V-shaped cup with handle that has a 232.92 buy point. Shares rose 0.1% early Wednesday.

Microsoft shares closed back above the 200-day line Tuesday, and on Wednesday morning the stock inched higher.

Be sure to follow Scott Lehtonen on X at @IBD_SLehtonen for more on growth stocks, the Dow Jones Industrial Average and the stock market today.

YOU MAY ALSO LIKE:

Check Out IBD’s New Exposure Levels To Help You Stay In Step With The Market Trend

Top Growth Stocks To Buy And Watch

Learn How To Time The Market With IBD’s ETF Market Strategy

Find The Best Long-Term Investments With IBD Long-Term Leaders

Spot Buy Points And Sell Signals With MarketSurge Pattern Recognition

3 Stocks That Haven't Been This Cheap in More Than 5 Years

If you’re a bargain hunter, there are some deeply discounted stocks you might want to consider buying right now. These stocks aren’t trading at just 52-week lows, they are trading at multiyear lows. They haven’t been trading at these levels in more than five years — and some have never been this low.

Of course, there is a risk that comes with these stocks. They are trading down for good reasons, but there’s also a lot of potential upside. Ultimately, it can come down to how much risk you’re willing to tolerate.

Grocery Outlet (NASDAQ: GO), Dollar General (NYSE: DG), and Spirit Airlines (NYSE: SAVE) are three cheap stocks right now for various reasons. Are they worth a closer look as turnaround plays?

1. Grocery Outlet

Grocery stocks are generally stable investments investors want to hang on to. But that hasn’t been the case with Grocery Outlet. This retailer exclusively manages supermarket locations offering discounted, overstocked, and closeout products from name-brand and private-label suppliers.

Grocery Outlet’s stock was already trading off a bit from mid-2022 highs, but then it made a sizable acquisition in April 2024 that boosted investor worries. On April 2, the company bolstered its presence in multiple markets when it finalized the purchase of United Grocery Outlet. However, investors were unimpressed with the combined company’s performance. Shares are down 37% since January and trade at an all-time low for Grocery Outlet, which went public in 2019.

The problem is that expenses are rising and already thin margins are getting squeezed even further. Getting bigger has not led to a stronger bottom line. In the most recent quarter, which ended in June, Grocery Outlet’s profits fell by 43% to just $14 million on revenue of $1.1 billion. Profits are down, in part, because the retailer is making system upgrades. CEO RJ Sheedy Jr. said the upgrades are now in place and financials should improve from this point, but investors remain hesitant.

Investors considering this stock will need to have some faith that the CEO can turn things around. I would hold off on buying this food stock for at least a couple more quarters until Grocery Outlet proves Sheedy is right in his assertion and its financials are in better shape.

2. Dollar General

Discount stores are defensive stocks. They tend to offer investors stability during tough economic times. They also tend to be good options for long-term growth. Defensive stock Dollar General, however, has been underwhelming in this regard lately. Along with labor issues and safety problems at its stores, its results show some weakness, especially when compared to its peers.

In August, Dollar General reported Q2 results that showed net sales up roughly 4% year over year to $10.2 billion, but same-store sales were only up by 0.5%. The company appears to be relying heavily on new store openings for growth. That has not translated into a better bottom line: Dollar General’s operating profit in Q2 fell by 21% year over year to $550 million. While Dollar General is still reporting growth, it’s also reporting that its core customers are “financially constrained.”

This is not a phrase investors want to hear and, as a result, Dollar General stock hasn’t traded at lower levels since 2017.

This can be a turbulent time to buy the stock, but it can potentially be a good long-term play because as economic conditions improve and its core customer is in better shape, that could turn the tide for the stock. The big question is how long that process could take. If you’re willing to be patient and hold on for what could be a bumpy ride with the stock, Dollar General might be a good contrarian investment to add to your portfolio today.

3. Spirit Airlines

Share prices of low-cost carrier Spirit Airlines went over a cliff in January after a judge blocked its merger with JetBlue Airways. Spirit’s stock hasn’t recovered from that decision. It has since gone into an even steeper tailspin as investor concerns mount that the airline might not be able to survive in the long run.

Operating revenue through the most recent period, which ended on June 30, totaled $1.3 billion and was down 11% year over year. More concerning was Spirit’s $152.5 million operating loss. It has also burned through $270 million in cash through its day-to-day operations over the past six months.

The company says it has $1.1 billion of available liquidity, but its operations don’t appear to be sustainable right now, and that’s the big risk for investors. Spirit Airlines trades at an all-time low (it went public in 2011), and the danger is that without a reason to believe its operations will improve or that an acquisition can save the business, things might not get a whole lot better for the stock anytime soon.

Investors should tread carefully with Spirit Airlines stock — it could be the riskiest one on this list.

Should you invest $1,000 in Grocery Outlet right now?

Before you buy stock in Grocery Outlet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Grocery Outlet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

3 Stocks That Haven’t Been This Cheap in More Than 5 Years was originally published by The Motley Fool

Tetra Tech Secures $39.3M Single-Award Contract From USAID

Tetra Tech, Inc. TTEK recently announced that it has secured a $39.3 million contract from the United States Agency for International Development (“USAID”). The latest deal will involve the company supporting USAID’s Engendering Industries program.

As part of the single-award deal, Tetra Tech will work on enhancing gender equality and women’s economic empowerment opportunities in multiple industries throughout the world. These industries include water, infrastructure, power, transportation as well as information and communications technology.

Under the USAID Engendering Industries program, the company’s professionals will utilize data-driven change management tactics to help companies and organizations boost gender equality and economic opportunities for women globally. As part of the Engendering Industries program since 2018, TTEK has been offering technical support services to more than 68 organizations in 39 countries.

Tetra Tech’s Other Notable Contracts

Lately, Tetra Tech has received a series of deals, which are likely to drive its growth. In July 2024, the company received a $73 million deal from the USAID to enhance the availability of cost-effective and dependable electricity across 18 nations in West Africa. Also, in March 2024, it secured a $375 million multiple-award contract from National Aeronautics and Space Administration (“NASA”). Per the five-year contract, Tetra Tech will offer environmental restoration and compliance services at NASA facilities across the United States.

In January 2024, the company secured a $34 million contract from the USAID. Per the deal, TTEK will support the USAID Integrated Land and Resource Governance II project, which is aimed at promoting sustainable economic development through better land rights governance. Also, in the same month, it secured a $24 million, single-award deal from USAID to conserve biodiversity and natural resources in Cambodia.

TTEK’s Zacks Rank and Price Performance

Image Source: Zacks Investment Research

Tetra Tech currently carries a Zacks Rank #2 (Buy). Shares of the company gained 50.1% in the past year against the industry‘s 11% decline.

Other Stocks to Consider

Other top-ranked companies from the same space are discussed below.

Flowserve Corporation FLS currently carries a Zacks Rank of 2.

FLS delivered a trailing four-quarter average earnings surprise of 18.2%. In the past 60 days, the Zacks Consensus Estimate for Flowserve’s 2024 earnings has increased 3.8%.

Crane Company CR presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 11.2%.

In the past 60 days, the Zacks Consensus Estimate for CR’s 2024 earnings has increased 2%.

Parker-Hannifin Corporation PH currently carries a Zacks Rank of 2. PH delivered a trailing four-quarter average earnings surprise of 2.6%.

In the past 60 days, the consensus estimate for Parker-Hannifin’s fiscal 2025 earnings has increased 1.1%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

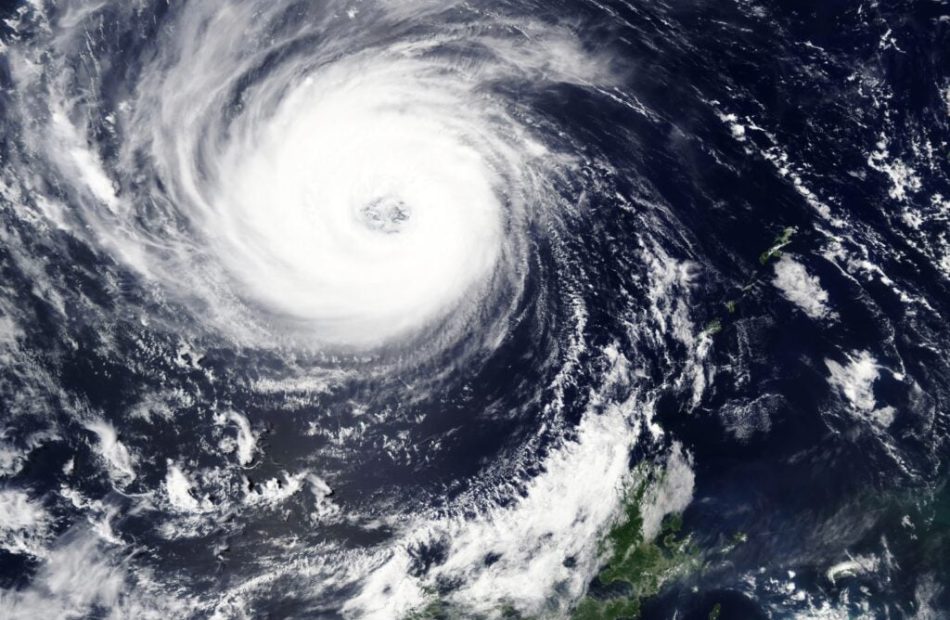

Hurricane Francine Approaches Louisiana Coast With Category 2 Storm Potential, Local Oil Refineries Cut Production

Hurricane Francine, currently approaching Louisiana’s coast, is expected to make landfall in the late afternoon and early evening as a Category 1 storm.

The storm’s northern eyewall was about 95 miles southwest of Morgan City, Louisiana at 2 p.m. ET. NBC News reports sustained wind speeds of 90 miles per hour as it moves northeast at 16 miles per hour.

Francine may develop into a Category 2 storm with winds between 96 and 110 miles per hour, according to meteorologists. It’s expected to reach land between Avery Island and Houma, Louisiana between 4 p.m. and 8 p.m. ET.

Read Also: As Tropical Storm Debby Hits South Carolina, Bettors Predict An Aggressive Hurricane Season

Hurricane Francine is likely to make landfall between Avery Island and Houma, Louisiana, between 4 p.m. and 8 p.m. ET Wednesday.

A hurricane warning is in effect across most of the Louisiana coastline, while a storm surge warning covers the area from High Island, near Houston, all the way to the Mississippi and Alabama border.

A state of emergency has been declared by the governors of both Louisiana and Mississippi, with many local leaders ordering or strongly recommending that towns and cities evacuate low-lying, coastal areas.

Flights from New Orleans International Airport were canceled at 12 p.m. ET.

President Joe Biden approved an emergency declaration for Louisiana, making federal disaster assistance available to the state, the Federal Emergency Management Agency said Wednesday.

“The President’s action authorizes FEMA to coordinate disaster relief efforts to alleviate the hardship and suffering caused by the emergency on the local population and to provide appropriate assistance to save lives, to protect property, public health and safety and to lessen or avert the threat of a catastrophe in the designated areas,” the agency said.

Exxon Mobil Corporation XOM said earlier on Wednesday that it plans to cut production at its Baton Rouge, Louisiana, refinery to as low as 20% of its 522,500 barrel-per-day capacity by Wednesday in anticipation of the hurricane.

Price Action: Oil companies that operate refineries on the Louisiana coast mostly fell into Wednesday’s late-afternoon trading.

- Exxon Mobil slipped 0.66% to $110.08

- Marathon Petroleum Corporation MPC slipped 2.64% to $159.22

- Shell plc SHEL gained 0.55% to $66.26

- Valero Energy Corporation VLO went down 2.24% to $133.04

- Phillips 66 PSX declined 1.29% to $125.242

Read Now:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What a bigger-than-expected Fed rate cut would mean for the stock market

After a hotter-than-expected inflation reading on Wednesday, markets have quickly moved to price in a higher likelihood that the Federal Reserve will opt for a smaller, more conservative interest rate cut at its September meeting. A bigger reduction could send stocks reeling.

As of Wednesday, investors were placing the probability of the Fed lowering rates by 50 basis points at its meeting next week at just 13%, down from the 44% chance seen a week prior, per the CME FedWatch Tool.

Some strategists have said that a 25 basis point cut would be a more welcome sign from the Federal Reserve.

Yardeni Research chief markets strategist Eric Wallerstein reasoned the Fed likely wouldn’t cut by more than 25 basis points “absent recessionary conditions or a financial crisis emerging.”

Read more: What the Fed rate decision means for bank accounts, CDs, loans, and credit cards

“For everyone who’s asking for a 50 basis point cut, I think they should really reconsider the amount of volatility that would cause in short-term funding markets,” Wallerstein told Yahoo Finance. “It’s just not something the Fed wants to risk.”

To Wallerstein’s point, while the most recent jobs report showed continued signs of slowing in the labor market, economists largely reasoned it didn’t reveal the substantial cooling that many believed would be needed to prompt a deeper cut from the Fed. The risk is that significant deterioration in the job market indicates a recession.

Meanwhile, Wednesday’s Consumer Price Index (CPI) report showed that on a “core” basis, which strips out the more volatile costs of food and gas, prices in August climbed 0.3% over the prior month, above Wall Street’s expectations for a 0.2% increase.

“The unwelcome news on inflation will distract slightly from the Fed’s renewed focus on the labor market and makes it more likely that officials stick with a more measured approach to easing, beginning with a 25 [basis point] cut next week,” Oxford Economics deputy chief US economist Michael Pearce wrote in a note to clients on Wednesday.

Some on Wall Street have also pointed out that a 50 basis point interest rate cut could create a more ominous sign about the health of the US economy than the central bank would like to portray.

“A 50 basis point cut would reek of panic, and it’s almost like we’re totally behind the curve at this point,” Jennifer Lee, BMO Capital Markets senior economist, told Yahoo Finance.

DataTrek co-founder Nicholas Colas analyzed each Federal Reserve rate-cutting cycle since 1990. Among the five cutting cycles over that time period, both times the Fed began its cycle with a 50 basis point cut (in 2001 and 2007), a recession soon followed.

“While the data here is sparse, there is something to be said for associating an initial cut of 25 basis points with a midcycle policy correction and 50 basis point as signaling the Fed is too far behind the curve to avoid a recession,” Colas wrote in a note to clients on Wednesday morning. “Chair Powell and the rest of the FOMC certainly know this history. Their first cut will almost certainly be 25 basis points.”

As of Wednesday morning, markets are expecting 100 basis points of cuts from the Federal Reserve this year. More clues on the Fed’s thinking will come on Sept. 18 when the Federal Reserve releases its Summary of Economic Projections, including its “dot plot,” which maps out policymakers’ expectations for where interest rates could be headed in the future.

Wallerstein reasoned that if the total amount of Fed cuts this year falls short of the market’s expectations, that isn’t necessarily a bad thing for stocks.

“If those rate cuts get priced out because growth is stronger than expected and GDP comes in strong for the third quarter and the labor market indicators aren’t too bad, and we keep seeing consumer spending [increasing], then stocks will have more room to run as earnings continue to grow,” Wallerstein said.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance