HydroGraph Announces Two Patent Application Filings for its Innovative Graphene Application

VANCOUVER, British Columbia, Sept. 04, 2024 (GLOBE NEWSWIRE) — HydroGraph Clean Power Inc. HG HGRAF (FRA: M98) (the “Company” or “HydroGraph”), a sustainable commercial manufacturer of pristine graphene, has announced the filing of two new US patent applications for graphene-coated hollow glass microsphere technology (HGMS).

The first patent covers HGMS coated with pristine graphene whilst the second focuses on HGMS coated with reactive graphene. These two patents represent HydroGraph’s effort to innovate within large scale application areas by offering improvements in both sustainability and performance. As a stand-alone product, HydroGraph’s coated microspheres have already received customer attention and are effectively a drop-in solution for numerous application areas seeking lightweighting or strengthening capabilities.

HydroGraph’s technology can produce two types of graphene coated bubbles, using uncoated hollow glass bubbles, which are industrial commodity material. The finished graphene coated bubbles may be used in composites, such as lightweight electromagnetic interference (EMI) shields and lightweight filler in plastic parts across industries such as automotive, marine and aerospace. Glass bubbles can also be used in the production of lightweight, high-strength concrete. The rising demand and extensive use of this innovative technology have the potential to further increase the demand for glass microspheres, with estimates for the bare glass bubbles approaching $8 billion annually in 20241.

“Our new patent applications demonstrate our dedication to pushing the boundaries of what’s possible with graphene to deliver cutting-edge, customized solutions to meet the evolving needs of our partners,” said Kjirstin Breure, president and interim CEO of HydroGraph. “This innovation opens new possibilities for lightweight, high-strength materials, representing a significant leap in material science.”

The graphene coating converts the white insulating glass bubbles into black, electrically conducting, free-flowing powder. HGMS are mostly made of air and a thin glass spherical shell, so light in weight, they are able to float on water. The size of the glass shell is typically less than 100 microns thick, making HydroGraph’s nanoscale graphene the ideal coating material for preserving HGMS’ low-density feature. HGMS are extremely small in size, so are often mixed with resin to make lightweight composites. Because HGMS are spherical, they can also act as lubricants in flow. Graphene’s integration as a coating on bubbles can be thought of as a support material for graphene nanostructure, potentially useful as an absorption media of contaminants, thus, showing filtration capability. Graphene-coated bubbles are a multifunctional version of the bare HGMS and HydroGraph’s first stand-alone industrial product.

Currently, HydroGraph has 11 patent applications filed in the US and globally with two patents granted for its FGA-1 pristine graphene.

For more information about HydroGraph and how the company is producing sustainable, pristine graphene, visit www.HydroGraph.com.

ABOUT HYDROGRAPH CLEAN POWER INC.

HydroGraph Clean Power Inc is a leading producer of pristine graphene using an “explosion synthesis” process, which allows for exceptional purity, low energy use and identical batches. The quality, performance and consistency of HydroGraph’s graphene follows the Graphene Council’s Verified Graphene Producer® standards, of which very few graphene producers are able to meet. For more information or to learn about the HydroGraph story, visit: https://hydrograph.com/.

For company updates, please follow HydroGraph on LinkedIn and X.

Forward-Looking Statements

This release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “estimate”, “upon” “anticipate”, “believe”, “continue”, “plans” or similar terminology.

Forward-looking statements and information include, but are not limited to: statements in respect of the Private Placement, the use of the net proceeds from the Private Placement, the timing and ability of the Company to close the Private Placement, if at all, the gross proceeds of the Private Placement, the timing and ability of the Company to obtain all necessary regulatory approvals, if at all, and the terms and jurisdictions of the Private Placement; the statements in regards to existing and future products of the Company; the Company’s future personnel appointments; the Company’s plans and strategies.

Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of HydroGraph to control or predict, that may cause HydroGraph’s actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: HydroGraph’s ability to implement its business strategies; risks associated with general economic conditions; adverse industry events; stakeholder engagement; marketing and transportation costs; loss of markets; volatility of commodity prices; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; industry and government regulation; changes in legislation, income tax and regulatory matters; competition; currency and interest rate fluctuations; and other risks. HydroGraph does not undertake any obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available.

No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

CONTACTS

HydroGraph Investor Relations Contact

Salisha Ilyas, Target IR

salisha@targetir.com

Kjirstin Breure, HydroGraph President and Interim CEO

kjirstin.breure@hydrograph.com

408.267.2556

HydroGraph Media Contact

Raven Carpenter

hydrograph@fox.agency

646.665.1107

____________________

1 Coherent Market Insights, Microspheres Market Size and Trends, 2024.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prologis Declares Quarterly Dividend

SAN FRANCISCO, Sept. 3, 2024 /PRNewswire/ — The Board of Directors of Prologis, Inc. PLD declared a regular cash dividend for the quarter ending September 30, 2024, on the following securities:

- A dividend of $0.96 per share of the company’s common stock, payable on September 30, 2024, to common stockholders of record at the close of business on September 16, 2024; and

- A dividend of $1.0675 per share of the company’s 8.54% Series Q Cumulative Redeemable Preferred Stock, payable on September 30, 2024, to Series Q stockholders of record at the close of business on September 16, 2024.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. At June 30, 2024, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 1.2 billion square feet (115 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 6,700 customers principally across two major categories: business-to-business and retail/online fulfillment.

FORWARD-LOOKING STATEMENTS

The statements in this document that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which we operate as well as management’s beliefs and assumptions. Such statements involve uncertainties that could significantly impact our financial results. Words such as “expects” “anticipates,” “intends,” “plans,” “believes,” “seeks,” and “estimates” including variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future—including statements relating to rent and occupancy growth, acquisition and development activity, contribution and disposition activity, general conditions in the geographic areas where we operate, expectations regarding new lines of business, our debt, capital structure and financial position, our ability to earn revenues from co-investment ventures, form new co-investment ventures and the availability of capital in existing or new co-investment ventures—are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and, therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) international, national, regional and local economic and political climates and conditions; (ii) changes in global financial markets, interest rates and foreign currency exchange rates; (iii) increased or unanticipated competition for our properties; (iv) risks associated with acquisitions, dispositions and development of properties, including the integration of the operations of significant real estate portfolios; (v) maintenance of Real Estate Investment Trust status, tax structuring and changes in income tax laws and rates; (vi) availability of financing and capital, the levels of debt that we maintain and our credit ratings; (vii) risks related to our investments in our co-investment ventures, including our ability to establish new co-investment ventures; (viii) risks of doing business internationally, including currency risks; (ix) environmental uncertainties, including risks of natural disasters; (x) risks related to global pandemics; and (xi) those additional factors discussed in reports filed with the Securities and Exchange Commission by us under the heading “Risk Factors.” We undertake no duty to update any forward-looking statements appearing in this document except as may be required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/prologis-declares-quarterly-dividend-302237292.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/prologis-declares-quarterly-dividend-302237292.html

SOURCE Prologis, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

$1.5M Bet On Elastic? Check Out These 4 Stocks Executives Are Buying

Although U.S. stocks closed lower on Tuesday, there were a few notable insider trades.

When insiders purchase shares, it indicates their confidence in the company’s prospects or that they view the stock as a bargain. Either way, this signals an opportunity to go long on the stock. Insider purchases should not be taken as the only indicator for making an investment or trading decision. At best, it can lend conviction to a buying decision.

Below is a look at a few recent notable insider purchases. For more, check out Benzinga’s insider transactions platform.

Elastic

- The Trade: Elastic N.V. ESTC Director Paul R. Auvil III acquired a total of 20,000 shares at an average price of $74.25. To acquire these shares, it cost around $1.48 million.

- What’s Happening: On Aug. 29, Elastic reported quarterly earnings of 35 cents per share, which beat the analyst consensus estimate of 25 cents per share.

- What Elastic Does: Elastic is a software company based in Mountain View, California, focusing on search-adjacent products.

U.S. Physical Therapy

- The Trade: U.S. Physical Therapy, Inc. USPH Director Kathleen A Gilmartin acquired a total of 2,000 shares at an average price of $86.09. To acquire these shares, it cost around $172,180.

- What’s Happening: On Aug. 13, US Physical Therapy posted downbeat quarterly earnings.

- What U.S. Physical Therapy Does: US Physical Therapy Inc through its subsidiaries operates outpatient physical therapy clinics that provide pre-and post-operative care and treatment for orthopedic-related disorders, sports-related injuries, preventative care, rehabilitation of injured workers, and neurological-related injuries.

CECO Environmental

- The Trade: CECO Environmental Corp. CECO Director Richard F Wallman bought a total of 10,000 shares at an average price of $28.77. To acquire these shares, it cost around $1.98 million. The company’s President and CEO also bought $287,722 shares.

- What’s Happening: On July 30, CECO Environmental reported worse-than-expected second-quarter revenue results and raised its FY24 revenue guidance above estimates.

- What CECO Environmental Does: CECO Environmental Corp serves the energy, industrial, and other niche markets.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Citymark Capital Appoints Michael McRoberts to the Firm's Advisory Board

CLEVELAND, Sept. 3, 2024 /PRNewswire/ — Citymark Capital, a leading US real estate private equity platform headquartered in Cleveland, Ohio, is pleased to announce that Michael McRoberts has been appointed to the firm’s advisory board.

McRoberts recently retired as Chairman of the Agency Lending Platform at PGIM Real Estate. In that role, McRoberts oversaw a national team of 150 professionals and expanded the company’s leadership position in Multifamily lending. In addition, he was responsible for running a “fund of funds” where he directed investments into Multifamily-focused private equity funds. Prior to PGIM Real Estate, McRoberts spent 20 years at Freddie Mac in the Multifamily Division, with his last position as a senior leader responsible for all Multifamily loan production. Currently, McRoberts consults with firms in the Multifamily industry and acts as the Hunter Mill District Commissioner for the Fairfax County Redevelopment and Housing Authority.

“Mike has a stellar reputation as a highly respected and admired pillar of the national Multifamily finance industry. We are thrilled to welcome him to our Advisory Board,” said Daniel Walsh, Founder and CEO of Citymark.

McRoberts said, “I am honored and excited to work with Dan Walsh and the Citymark team and look forward to helping them extend their leadership position in the Multifamily industry. Having known Dan for more than two decades, I am highly confident in him and the business strategies that we will deploy.”

McRoberts has held several industry leadership positions throughout his distinguished career including multi-year chairman of the Fannie Mae DUS® Advisory Council, member of the Multifamily Committee of the Mortgage Bankers Association (MBA), Chairman of the National Multifamily Housing Council (NMHC) Finance Committee; he continues to participate as a member of the Urban Land Institute’s Multifamily Council Silver Flight.

About Citymark

Citymark Capital is a leading US real estate private equity investment platform that seeks to create attractive and durable risk-adjusted returns throughout economic cycles by investing in equity and debt positions. The firm has over 200 years of commercial real estate and banking industry experience across its team, and a national network of experienced operating partners, brokers, banks, and financial intermediaries. Citymark’s disciplined investment approach is guided by an unwavering commitment to its investors and a focus on fundamental value. The firm serves a highly regarded investor base comprised of public and private pension plans, insurance companies, foundations, financial institutions, family offices, and high net worth individuals. For further information on Citymark Capital, visit www.citymarkcapital.com, LinkedIn or contact us at 216-453-8092.

Disclaimer

The information contained in this communication should not be regarded as an offer to sell or a solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be in violation of any local laws. The general information discussed is not a guarantee, prediction, or projection of real estate investments. There are risks associated with investing in real estate assets, such as inflation, interest rates, real estate tax rates, changes in the general economic climate, local conditions such as population trends and neighborhood values, and supply and demand for similar property types. This communication may contain forward-looking statements identified by the use of words such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/citymark-capital-appoints-michael-mcroberts-to-the-firms-advisory-board-302237151.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/citymark-capital-appoints-michael-mcroberts-to-the-firms-advisory-board-302237151.html

SOURCE Citymark

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: Nasdaq drops 3% as weak manufacturing data renews US growth fears

-

US indexes fell steeply Tuesday as weak manufacturing data prompted fresh fears about the economy.

-

The ISM Manufacturing index failed to meet expectations, and investors are now awaiting August jobs data.

-

The tech-heavy Nasdaq fell over 3%, weighed down by a big drop in Nvidia shares.

Stocks plunged Tuesday as manufacturing data chipped at confidence in the US economy.

The S&P 500 and Dow Jones Industrial Average shed 2% and 1.5%, respectively. The tech-heavy Nasdaq tumbled over 3%, as a sharp drop in Nvidia compounded the index’s decline.

Tuesday’s fallout marks the worst day for stocks since the market meltdown in early August and offered a grim introduction to September, which is historically a bad month for the stock market.

A weak manufacturing print intensified pressure on Tuesday’s sell-off, as the ISM Manufacturing Purchasing Managers Index failed to meet expectations. The index rose 47.2% in August, under 47.9% consensus forecasts.

“Manufacturing employment shrank for the third consecutive month as manufacturing activity slowed in recent months. Although the manufacturing sector holds a smaller portion of the macro economy now than in previous cycles, investors should still position themselves for a broader slowdown throughout the balance of this year,” LPL Financial chief economist Jeffrey Roach said.

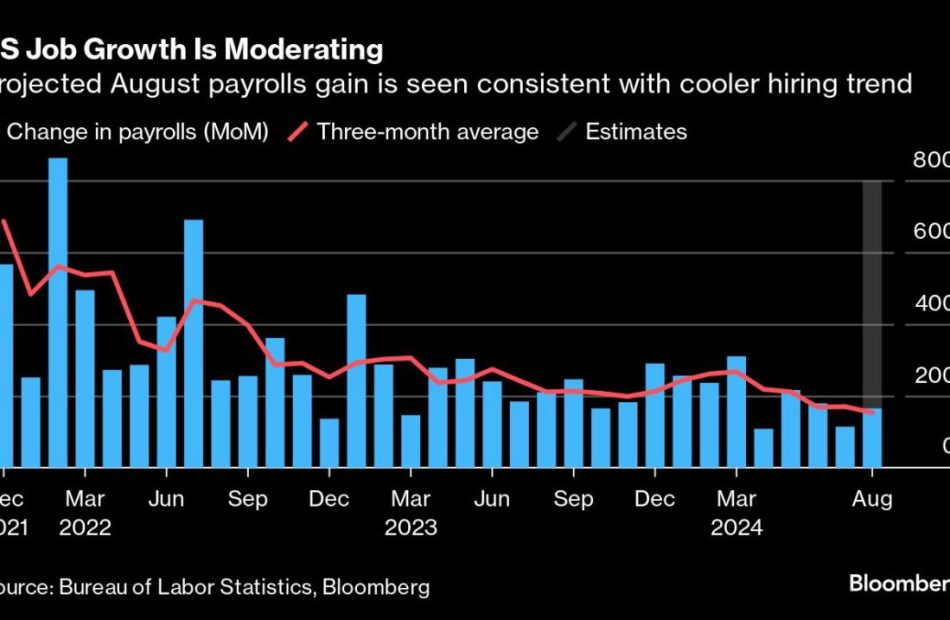

As wavering manufacturing activity amplifies fears that the US may be facing a cooldown, investors have more reason to hope for a strong payrolls report on Friday.

All eyes are on this jobs print, and any surprise in the labor data could make or break the soft landing narrative.

Currently, economists anticipated that the US added 162,000 jobs last month, which suggests that the unemployment rate will edge down modestly from 4.3% to 4.2%.

If forecasts are correct, the Federal Reserve should be able to cut interest rates by a gradual quarter point in its upcoming September meeting. But a weaker-than-expected payrolls print would prompt the bank to slash rates by more than the market is currently pricing in.

Non-equity assets also suffered on Tuesday. While oil prices tumbled, the 10-year Treasury yield shed six points to 3.846%. Investors may need to brace for more volatility ahead, as September is famously a challenging month for stocks.

Here’s where US indexes stood shortly after the 4:00 p.m. closing bell on Tuesday:

Here’s what else is going on:

In commodities, bonds, and crypto:

-

West Texas Intermediate crude oil shed 4.38% to $70.33 a barrel. Brent crude, the international benchmark, plummeted 4.86% to $73.75 a barrel.

-

Gold stayed essentially flat at $2,523.1 an ounce.

-

The 10-year Treasury yield dropped six points to 3.846%.

-

Bitcoin shed 0.66% to $58,077.

Read the original article on Business Insider

Move Over, Nvidia and Advanced Micro Devices: Billionaires Are Selling Them and Scooping Up Shares of 2 Artificial Intelligence (AI) Stock-Split Stocks Instead

Since the advent of the internet in the mid-1990s, investors have pretty much always had a next-big-thing innovation, technology, or trend to captivate their attention. However, no addressable market has seemingly loomed larger since the arrival of the internet than the current rise of artificial intelligence (AI).

What makes AI so special is the ability for software and systems to learn and evolve over time without human intervention. This means AI-driven software and systems can become more proficient at assigned tasks, as well as grow to learn new skills. On paper, this gives artificial intelligence utility in almost every sector and industry around the globe.

The massive addressable market associated with AI — an estimated $15.7 trillion lift to the global economy by 2030, according to the analysts at PwC — isn’t lost on Wall Street’s top investment minds. However, quarterly Form 13F filings with the Securities and Exchange Commission show that billionaire money managers have mixed feelings about the most-popular AI stocks.

In the June-ended quarter, more than a half-dozen billionaire investors were active sellers of the “brains” behind AI-accelerated data centers. But interestingly enough, numerous billionaire asset managers were avid buyers of two other key AI players that have announced or completed a stock split this year.

Data-center hardware kingpins Nvidia and AMD were shown to the door

Although enterprise demand for the graphics processing units (GPUs) that power generative AI solutions, train large language models, and oversee split-second decision-making for AI-driven software and systems, has been off the charts, billionaires haven’t been afraid to ring the register and take profits on the two most-prominent AI-GPU developers: Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD).

The June-ended quarter marked the third consecutive quarter that more than a half-dozen billionaires were sellers of Nvidia’s stock. The seven well-known sellers in the latest quarter include (total shares sold in parenthesis):

-

Ken Griffin of Citadel Advisors (9,282,018 shares)

-

David Tepper of Appaloosa (3,730,000 shares)

-

Stanley Druckenmiller of Duquesne Family Office (1,545,370 shares)

-

Cliff Asness of AQR Capital Management (1,360,215 shares)

-

Israel Englander of Millennium Management (676,242 shares)

-

Steven Cohen of Point72 Asset Management (409,042 shares)

-

Philippe Laffont of Coatue Management (96,963 shares)

By some combination of fate and coincidence, AMD also had seven billionaire money managers that sent its shares to the chopping block in the second quarter (total shares sold in parenthesis):

-

Ken Fisher of Fisher Asset Management (5,716,366 shares)

-

Ole Andreas Halvorsen of Viking Global Investors (3,952,088 shares)

-

Ken Griffin of Citadel Advisors (2,649,937 shares)

-

Israel Englander of Millennium Management (977,904 shares)

-

Jeff Yass of Susquehanna International (536,689 shares)

-

Philippe Laffont of Coatue Management (502,688 shares)

-

David Tepper of Appaloosa (260,000 shares)

While profit-taking is certainly one reason we’ve likely witnessed notable selling in Nvidia and AMD from billionaires, historic precedent might be an even bigger catalyst.

For 30 years, numerous can’t-miss technologies, innovations, and trends have come and gone, and not a one has avoided an early innings bubble-bursting event. Investors have a tendency to become wide-eyed with the potential for game-changing technologies, and almost always overlook that it takes time for new innovations to mature and be adopted by consumers and/or businesses.

The simple fact that most companies lack a well-defined game plan for their AI investments is a clear signal that AI euphoria has likely overshot the technology’s current utility.

Competitive pressures are another reason billionaire investors might be headed for the exit with Nvidia and AMD. Nvidia can’t keep up with enterprise demand for its H100 GPU and is liable to lose valuable data center “real estate” with its top four customers (all members of the “Magnificent Seven”) developing in-house AI-GPUs. While AMD can chip away at Nvidia’s monopoly like AI-GPU market share with its substantially cheaper MI300X AI-GPU, the end result of both companies ramping production is less AI-GPU scarcity and, over time, weaker pricing power.

Though billionaires were decisive sellers of the brains behind high-compute data centers, they were clear-cut buyers of two other AI stock-split stocks.

More than a half-dozen billionaires piled into Broadcom

While prominent billionaires were busy dumping shares of Nvidia and AMD during the second quarter, there were piling into AI networking solutions specialist Broadcom (NASDAQ: AVGO), which completed a 10-for-1 forward-stock split in July. To somewhat keep with the theme, a total of seven billionaire investors were buyers of Broadcom stock, including (total shares purchased in parenthesis):

-

Ole Andreas Halvorsen of Viking Global Investors (2,930,970 shares)

-

Jeff Yass of Susquehanna International (2,347,500 shares)

-

Israel Englander of Millennium Management (2,096,440 shares)

-

Ken Griffin of Citadel Advisors (1,880,740 shares)

-

David Siegel and John Overdeck of Two Sigma Investments (1,332,230 shares)

-

Ken Fisher of Fisher Asset Management (865,090 shares)

Broadcom made its grand entrance into the AI space with the release of the Jericho3-AI fabric in April 2023. Jericho3 is capable of connecting up to 32,000 GPUs, with a purpose of reducing tail latency and helping businesses maximize the computing capacity of their GPUs.

But in spite of the clear boost Broadcom has received from artificial intelligence, billionaires might be even more impressed with its operating diversity. For instance, it’s one of the leading providers of wireless chips and accessories used in next-generation smartphones. Telecom companies continuing to expand the reach of 5G have lifted demand for Broadcom’s smartphone solutions.

Broadcom has also leaned on acquisitions as a way to expand its ecosystem of products and services and promote cross-selling opportunities. This includes buying information technology management software and solutions provider CA Technologies, gobbling up cybersecurity company Symantec, and paying $69 billion for cloud-based virtualization software provider VMware. The latter will help Broadcom meet the private- and hybrid-cloud needs of businesses.

Having true revenue diversity means that Broadcom would almost certainly fare better than Nvidia and AMD if the AI bubble were to burst, as history suggests it will.

Six billionaire money managers scooped up shares of Super Micro Computer

The other high-flying AI stock-split stock that had billionaires mashing the buy button in the June-ended quarter is rack server and storage solutions provider Super Micro Computer (NASDAQ: SMCI). Six billionaires opened a position or added to their existing stakes in Super Micro, including (total shares purchased in parenthesis):

-

Israel Englander of Millennium Management (553,323 shares)

-

Jeff Yass of Susquehanna International (508,814 shares)

-

Ken Griffin of Citadel Advisors (98,752 shares)

-

Steven Cohen of Point72 Asset Management (45,066 shares)

-

Ray Dalio of Bridgewater Associates (15,777 shares)

-

Cliff Asness of AQR Capital Management (1,040 shares)

On Aug. 6, when Super Micro lifted the hood on its fiscal fourth-quarter operating results, its board announced the approval of a 10-for-1 stock split, which will take effect after the close of trading on Sept. 30.

While investors have been placing a lot of emphasis on the GPUs that make AI-driven software and systems tick, Super Micro Computer is reminding Wall Street just how important AI infrastructure is for enterprise data centers. The company’s customizable rack servers, which incorporate Nvidia’s leading H100 GPU, have been in high demand, as evidenced by the 110% sales growth Super Micro recorded in fiscal 2024 (ended June 30). The midpoint of Super Micro’s sales guidance — $28 billion — for fiscal 2025 implies nearly triple-digit year-over-year sales growth.

The downside for Super Micro Computer is that it’s heavily tied to Nvidia’s fortune. Supply constraints have made it impossible for Nvidia to meet all of its customer’s demands, which means Super Micro likely isn’t reaching its potential.

Moreover, we’ve been here before with Super Micro. This is a company that soared during the initial enterprise cloud-computing boom, only to have orders fail to meet Wall Street’s lofty expectations not long thereafter. If AI needs time to mature as a technology, Super Micro’s stock could give back most of its gains.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Move Over, Nvidia and Advanced Micro Devices: Billionaires Are Selling Them and Scooping Up Shares of 2 Artificial Intelligence (AI) Stock-Split Stocks Instead was originally published by The Motley Fool

Report: 96% of Health Tech Leaders Recognize AI's Competitive Edge

BOSTON, Sept. 04, 2024 (GLOBE NEWSWIRE) — Arcadia® (arcadia.io), a leading data platform for healthcare, today announced findings from a new study showing 96% of healthcare technology leaders believe effectively leveraging AI provides a competitive edge.1 Additionally, 33% of surveyed decision-makers view AI as vital today, and that increases to 73% who think AI will be essential in the next five years.1

The research aligns with market analyses that quantify AI’s potential impact on healthcare. Accenture predicts AI can save the U.S. healthcare economy $150 billion annually by 2026,2 and a modest estimate from McKinsey projects AI can automate 15% of healthcare work hours.3

Arcadia’s research, conducted with The Harris Poll, also revealed how healthcare leaders use AI. 63% say it can analyze large patient data sets to identify trends and create population health intervention strategies, 58% say AI can analyze individual patient data to identify opportunities to improve health outcomes, and 47% say AI can optimize the management and analysis of electronic health records.1

“Healthcare leaders are thoughtfully preparing to harness the full value of AI in care delivery reform,” said Aneesh Chopra, Arcadia’s Chief Strategy Officer. “As safe, secure data sharing scales in healthcare, technology leaders prioritize data platforms that can organize fragmented patient records into clinically relevant insights at each step of a patient’s journey.”

Need For Health Analytics Platforms to Support Patient Care

To succeed in a new era of innovation, 83% of health tech decision-makers agree that effectively harnessing data helps organizations stay competitive and resilient despite financial and digital transformation forces.1 Consequently, 84% say their organization’s current priorities are tech-related.1

Specifically, 44% prioritize an enterprise approach to data and analytics, 41% focus on augmenting decision-making with AI, and 32% aim to simplify their technical ecosystems.1 Improving the patient experience is a high priority for 40% of respondents, with 35% focused on improving patient outcomes and 29% on bettering patient engagement and care.1

“CIOs and their teams are setting the stage for an AI-powered revolution in patient care and healthcare operations,” said Michael Meucci, Arcadia’s President and CEO. “Our findings point to strong consensus among healthcare CIOs that a solid data foundation is required to make the AI-enabled future a reality. CIOs also recognize that a human workforce with evolving talent and skills will shape the real-world impact of AI in healthcare.”

Advancing Strategic Goals with AI

Arcadia’s study found that 96% of health tech leaders are confident in adopting AI but feel pressured to act quickly.1 82% say the heat comes from data and analytics teams, 78% feel pressure from IT and tech teams, and 73% cite urgency from executive leadership.1

However, 40% of leaders cite lack of talent as a top challenge for adopting AI, indicating a shift in the talents and skills CIOs expect from their teams.1 IT leaders surveyed point to increased demand for data-driven decision-making skills (71%), data analysis, machine learning, and systems integration skills (66%), and training and support roles for healthcare staff (59%).1

Evolving Role of Health System CIOs

Healthcare CIOs say their roles also evolve as data and AI play larger roles in their organizations’ strategies. 87% consider themselves a strategy influencer or leader, emphasizing their involvement in setting, refining, and executing business strategy.1 In contrast, only 13% see themselves as merely strategy implementers.1

While the modern CIO shifts from execution to strategy, some feel restrained by day-to-day operations. 58% are primarily focused on tactical execution, with an emphasis on the day-to-day over long-term strategy development.1 Yet, to be effective, respondents say roughly three-fourths of their time should focus on developing and implementing strategy.1 Foundry’s latest State of the CIO Study supports this sentiment, noting that CIOs’ stature as a strategic business advisor continues to blossom—with 88% of CIOs they surveyed saying their role is becoming more innovation-focused.4

Read Arcadia’s report, “The Healthcare CIO’s Role in the Age of AI,” to discover AI’s transformative potential in healthcare, uncover industry leaders’ key priorities, and explore how CIOs are evolving to become strategic visionaries.

____

1 The Healthcare CIO’s Role in the Age of AI, Arcadia and The Harris Poll, 2024

2 AI: Healthcare’s New Nervous System, Accenture, 2020

3 Transforming healthcare with AI: The impact on the workforce and organizations, McKinsey & Company, 2020

4 State of the CIO 2024, Foundry, 2024

About Arcadia

Arcadia helps payers and providers put their data to work so they can transform healthcare. We do that through an interoperable data platform that uses advanced analytics to shape strategies, inform decisions, and facilitate actions. In turn, payers and providers can focus on what matters most — whether that’s patient outcomes, operational efficiencies, or financial performance. We’re trusted by the institutions driving the future of healthcare, including Southwestern Health Resources, Tandigm, Castell, Rush Health, and Beth Israel Lahey Health. To learn how Arcadia is shaping the future of healthcare with innovative solutions that deliver data-driven insights, visit arcadia.io.

Arcadia® is a registered trademark of Arcadia Solutions, LLC.

Drew Schaar Arcadia drew.schaar@arcadia.io

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Essex Property Rises 23.1% in 6 Months: Will the Trend Last?

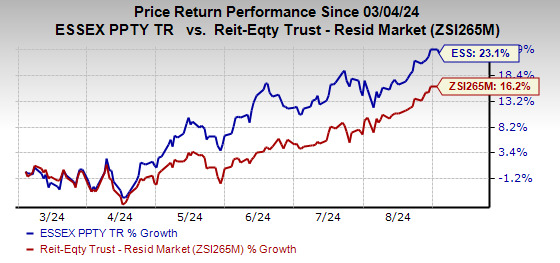

Shares of Essex Property Trust, Inc. ESS have rallied 23.1% in the past six months, outperforming the industry’s growth of 16.2%.

This residential REIT, which has a robust property base in the West Coast market, is poised to benefit from the healthy demand for its residential units. It is also banking on technology, scale and organizational capabilities to drive growth.

Analysts also seem bullish on this Zacks Rank #2 (Buy) stock. The Zacks Consensus Estimate for the company’s 2024 FFO per share has been revised two cents upward over the past week to $15.53.

Image Source: Zacks Investment Research

Let us now decipher the factors behind the surge in the stock price.

This residential REIT’s substantial exposure to the West Coast market has offered ample scope to enhance its top line. The West Coast is home to several innovation and technology companies that drive job creation and income growth. The West Coast region has higher median household incomes, an increased percentage of renters than owners and favorable demographics.

With layoffs in the tech industry slowing and return to office gaining momentum, the West Coast markets are likely to see an increase in renter demand in the near term. Also, due to the high cost of homeownership amid high interest rates, the transition from renter to homeowner is difficult in its markets, making renting apartment units a more flexible and viable option.

Essex Property is also banking on its technology, scale and organizational capabilities to drive margin expansion across its portfolio and bring about operational efficiency by lowering costs. It is making good progress on the technology front, and leasing agents are becoming more productive by leveraging these tools. These efforts are likely to have an incremental effect on the top-line and bottom-line growth, positioning Essex Property to ride the growth curve.

ESS’ Balance Sheet Position

Essex Property maintains a healthy balance sheet and enjoys financial flexibility. As of July 26, 2024, the company had $1.1 billion of liquidity through an undrawn capacity on its unsecured credit facilities, cash, cash equivalents and marketable securities.

In the second quarter of 2024, its net debt-to-adjusted EBITDAre remained unchanged at 5.4X from the prior quarter. Over the years, it has made efforts to increase its unencumbered net operating income (NOI) to an adjusted total NOI, which stood at 93% at the end of the second quarter of 2024. With a high percentage of such assets, the company can access secured and unsecured debt markets and maintain availability on the line. With a solid liquidity position, the company is well-poised to ride its growth curve.

In addition, its trailing 12-month return on equity is 9.14% compared with the industry’s average of 3.17%. This reflects that the company is more efficient in using shareholders’ funds than its peers.

ESS’ Dividend Payouts

Solid dividend payouts are arguably the biggest attraction for REIT investors, and Essex Property has been steadily raising its payout. ESS has increased its dividend five times in the last five years, and its five-year annualized dividend growth rate is 4.34%. With a low dividend payout ratio, a solid operating platform and decent balance sheet strength, the dividend payment is expected to be sustainable over the long run.

Negatives Likely to Affect ESS Stock

However, the elevated supply of apartment units in some of the company’s markets is likely to fuel competition and curb pricing power. A flexible working environment and high interest rates add to its woes.

Other Stocks to Consider

Some other top-ranked stocks from the retail REIT sector are Modiv Industrial, Inc. MDV and Equity Lifestyle Properties ELS. While Modiv Industrial sports a Zacks Rank #1 (Strong Buy) at present, Equity Lifestyle carries a Zacks Rank #2.

The Zacks Consensus Estimate for MDV’s current-year FFO per share has been raised 6.5% over the past month to $1.32.

The Zacks Consensus Estimate for ELS 2024 FFO per share has moved marginally northward over the past two months to $2.91.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Tumble Most Since August Selloff, Oil Slips: Markets Wrap

(Bloomberg) — US stock futures indicated a weaker open on Wall Street as traders awaited data on job openings to guide their outlook on the economy. Nvidia Corp. dropped 1.6% in pre-market trading.

Most Read from Bloomberg

Contracts on the S&P 500 dipped 0.3%, a sign that the decline may moderate after yesterday’s 2.1% selloff. Losses in Europe and Asia were deeper, with traders still rattled by the speed and severity of the US retreat. The Cboe Volatilty Index climbed above 23, while a gauge of the dollar weakened for the first time in six days.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

A US job openings report due on Wednesday is expected to show further cooling in the labor market, following yesterday’s data showing a fifth consecutive month of contraction in manufacturing activity. As the market’s focus shifts from inflation to concerns over economic growth, negative macro data is increasingly translating into pain for stocks and other risk assets.

For now, traders are anticipating the Federal Reserve will start easing policy in September and reduce rates by more than two full percentage points over the next 12 months — the steepest drop outside of a downturn since the 1980s. Payrolls data due on Friday is considered crucial in shaping the magnitude of the initial rate cut.

“A disappointing number will spook markets a little bit,” said Neil Birrell, chief investment officer at Premier Miton Investors. “There’s just a lack of certainty around. I’m not brave enough to say buy the dip on Wednesday when the numbers are out on Friday.”

Treasuries gained for a second day as traders added to bets on a jumbo cut from the Fed, with the yield on two-year notes down to 3.86%. The chance of a half-point reduction later this month has increased to about 30% from 20% last week, according to swaps.

Oil rose slightly after crashing to a nine-month low as OPEC+ discussed delaying its plans to increase supplies. Brent futures, the international benchmark, were trading near $74 a barrel following a near 5% meltdown on Tuesday. West Texas Intermediate rose 0.5%, after dropping under $70 for the first time since early January.

Corporate Highlights:

-

The Nordstrom family has offered to buy the Nordstrom department store chain for $23 per share in cash, according to a statement on Wednesday.

-

Volvo Car AB abandoned a target to sell only fully electric cars by the end of this decade, the latest manufacturer to walk back its EV ambitions due to waning demand.

-

US Steel would close mills and likely move its headquarters out of Pittsburgh if its planned sale to Nippon Steel falls apart, CEO David Burritt told the Wall Street Journal.

-

Volkswagen AG defended plans to consider unprecedented factory closures in Germany, saying flagging car sales have left the company with about two plants too many.

-

The US Justice Department sent subpoenas to Nvidia Corp. and other companies as it seeks evidence that the chipmaker violated antitrust laws.

Key events this week:

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Canada rate decision, Wednesday

-

US job openings, factory orders, Beige Book, Wednesday

-

Eurozone retail sales, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.3% as of 8:20 a.m. New York time

-

Nasdaq 100 futures fell 0.6%

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The Stoxx Europe 600 fell 1%

-

The MSCI World Index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1046

-

The British pound was unchanged at $1.3114

-

The Japanese yen rose 0.3% to 145.09 per dollar

Cryptocurrencies

-

Bitcoin fell 2.8% to $56,575.39

-

Ether fell 2.6% to $2,399.7

Bonds

-

The yield on 10-year Treasuries was little changed at 3.83%

-

Germany’s 10-year yield declined four basis points to 2.24%

-

Britain’s 10-year yield declined four basis points to 3.95%

Commodities

-

West Texas Intermediate crude rose 0.5% to $70.66 a barrel

-

Spot gold fell 0.1% to $2,489.57 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Aline Oyamada and Joel Leon.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Departing Salesforce CFO pulled off an ‘extremely rare’ C-suite move

Good morning. Longtime Salesforce executive Amy Weaver is stepping down from her role as president and CFO after a three-and-a-half-year tenure in the position. Her CFO tenure coincided with a period of growth at the company, and came after Weaver undertook a very unusual C-suite shift—one that involved trading in the role of top legal officer for top financial officer.

In a LinkedIn post on Aug. 28, Weaver said she decided to step down “after nearly 11 wonderful years at Salesforce” and she’s “excited about my next chapter and the new opportunities ahead.” Weaver also pointed to a pivotal career move she made at the company.

“My time at Salesforce has been an incredible experience—from joining as general counsel to leading the legal and corporate affairs teams to taking the truly unprecedented step to jump over to become CFO,” Weaver wrote. She also noted Salesforce CEO Marc Benioff’s “expansive vision” of her career.

Weaver joined Salesforce, the cloud-based software giant, in 2013 as SVP and general counsel. In January 2020, she became president and chief legal officer. The company announced on Dec. 1, 2020, that Weaver would become president and CFO in February 2021, succeeding CFO Mark Hawkins, who was retiring. The same day in 2020 that Salesforce announced the CFO transition, it also reported it would acquire the workplace messaging app Slack for $27.7 billion.

Before joining Salesforce, Weaver was EVP and general counsel of Univar Solutions Inc., SVP and deputy general counsel at Expedia, Inc., and practiced as an attorney at Cravath, Swaine & Moore and at Perkins Coie. Before entering private practice, she served as a legislative aide for the Hong Kong Legislative Council and as a clerk in the U.S. Ninth Circuit Court of Appeals.

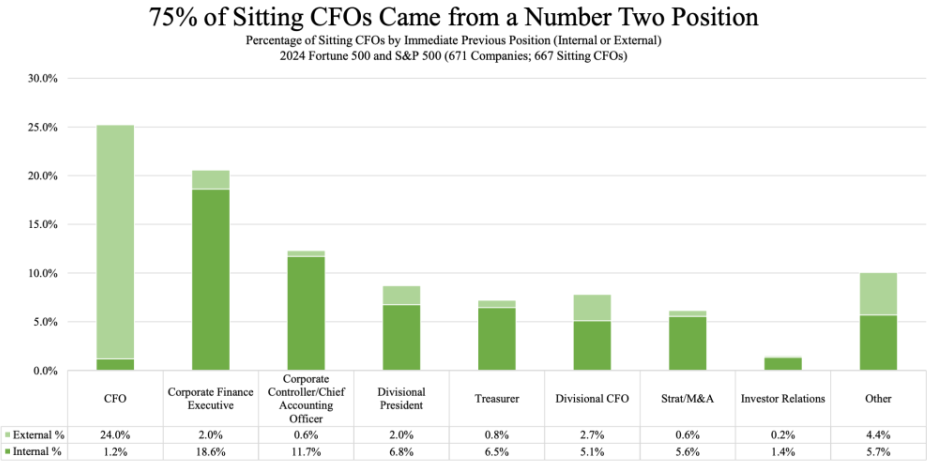

I asked Scott W. Simmons, co-managing partner of Crist Kolder Associates, a senior-level executive search firm, what he’s seen regarding general counsels moving into CFO roles. “It is not at all common,” Simmons told me. The legal route to CFO “doesn’t even register as a path” in the firm’s most recent Volatility Report,” he said.

The firm’s report is based on data from 671 Fortune 500 and S&P 500 companies through Aug. 1. The research finds that three-quarters of CFOs came directly from a number two finance position, such as a corporate finance executive, controller, and chief accounting officer.

Simmons also conducted a search on S&P Capital IQ of 1,478 publicly traded companies in the U.S. earning over $1 billion in revenue. Less than 3% of CFOs in that data set have a JD degree. Even taking into account a margin for error in this data, “it does prove the point that it is extremely rare for CFOs to also be lawyers,” he said.

However, Simmons noted that the most important trait for any CFO position is strong leadership.

“Amy has been an incredible executive at Salesforce, leading many of the company’s most important strategic and operational initiatives over the last decade,” Benioff said in a statement in the announcement. “And, she has been an amazing partner to me personally.”

Since Weaver began her tenure as finance chief in 2021, Salesforce has moved up 14 spots in the Fortune 500. The company’s annual revenue for its fiscal year 2023 was $31.4 billion, an 18% increase year over year. On Aug. 28, Salesforce reported revenue of $9.33 billion for the quarter ended July 31, up 8% year over year. “Operating margins closed at record highs with GAAP operating margin of 19.1%, up 190 basis points year over year, and Non-GAAP operating margin of 33.7%, up 210 basis points year over year,” Weaver said in a statement.

A successor for Weaver has not yet been appointed. “I’ll be at the company while we conduct an internal and external search, so no goodbyes for now,” she wrote on LinkedIn.

Sheryl Estrada

sheryl.estrada@fortune.com

This story was originally featured on Fortune.com