VW considers closing German factory for first time in 87-year history

Volkswagen is considering closing factories in Germany for the first time in its 87-year history as the carmaker battles to cut costs and survive the transition to electric cars.

Volkswagen, which was founded in 1937, said on Monday that it could no longer rule out unprecedented plant closures in Germany as it seeks ways to save several billion euros.

The announcement has put the car giant on a collision course with unions, who called it a “black day” for the company.

VW, which also owns brands including Audi, Seat and Skoda, considers one large vehicle plant and one component factory in Germany to be obsolete, according to the powerful works council union. It vowed “fierce resistance” to the executive board’s plans.

Bosses are also planning to end the group’s job security programme, which has been in place since 1994 and prevented job cuts until 2029. VW said all measures would be discussed with the works council.

Chief executive Oliver Blume said: “The economic environment has become even tougher and new players are pushing into Europe. Germany as a business location is falling further behind in terms of competitiveness.”

The Volkswagen brand, which fuels most of the carmaker’s sales, is the first of the group’s marques to undergo a cost-cutting drive. It is targeting €10bn (£8.4bn) in savings by 2026 as it attempts to streamline spending.

Thomas Schaefer, head of the VW brand, warned: “The situation is extremely tense and cannot be overcome by simple cost-cutting measures.”

Pushing the changes through will be a delicate task. Volkswagen employs around 650,000 workers globally, almost 300,000 of whom are in Germany, and the threat of factory closures sparked an immediate fierce backlash from unions.

Half the seats on the company’s supervisory board are held by worker representatives, and the German state of Lower Saxony – which owns a 20pc stake – often sides with trade union bodies.

Daniela Cavallo, chief executive of the VW works council, said in an interview on Volkswagen’s intranet that management had made “many wrong decisions” in recent years, including not investing in hybrids or being faster at developing affordable battery-electric cars.

She argued that instead of plant closures, the board should be reducing complexity and taking advantage of synergies across the Volkswagen group’s plans, criticising the company’s “documentation madness” and “salami-slicing tactics”.

Fellow union IG Metall called the threat of job losses and factory closures an irresponsible decision that “shakes the foundation” of the company. In a statement, it said: “The austerity program has escalated and is resulting in a major conflict between management and the general works council.”

Chief financial officer Arno Antlitz is expected to speak to staff alongside Mr Schaefer at a works council meeting on Wednesday morning. Ms Cavallo said she expects chief executive Mr Blume to be involved in negotiations as well.

Volkswagen, Germany’s largest industrial employer and Europe’s top carmaker by revenue, has been stung by rising power prices after the loss of cheap Russian gas in the wake of the invasion of Ukraine.

The company has also been struggling with a faltering $200bn push into electric cars. Sales of EVs stalled in the first half of the year, while the company has delayed the US launch of its latest electric sedans indefinitely.

Earlier this year it revealed plans to invest up to $5bn in Tesla rival Rivian in an effort to catch up with its competitors.

Compounding matters is a worsening outlook for Germany’s economy, which is struggling to reverse a slump in its key manufacturing sector.

Manufacturing activity declined for the third consecutive month in August to 42.4, down from July’s 43.2 and the lowest since March, according to the HCOB Germany Manufacturing PMI released on Monday.

New orders, purchasing activity and employment all suffered steeper falls compared to the previous month.

Dr Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said: “The recession in Germany’s manufacturing sector is dragging on way longer than anyone expected.

“Just as Germany was on the verge of reaping the benefits of a tentative global manufacturing uptick, as hinted by the global PMI, the economic cycle seems to have taken another nosedive.”

Read the latest updates below.

06:48 PM BST

Signing off…

Thanks for joining us today.

We’ll be back tomorrow morning to cover all the latest from the markets. In the meantime, do check out The Telegraph’s full range of business stories here.

06:43 PM BST

Brazil’s supreme court panel unanimously upholds judge’s decision to block Musk’s X

A Brazilian Supreme Court panel today unanimously upheld the decision of one of its justices to block billionaire Elon Musk’s social media platform X nationwide, according to the court’s website.

The panel that voted in a virtual session was made up of five of the full bench’s 11 justices, including Judge Alexandre de Moraes, who last Friday ordered the platform blocked for having failed to name a local legal representative as required by law.

X will remain blocked until it complies with his orders and pays outstanding fines that as of last week exceeded $3m (£2.3m), according to his decision.

Mr de Moraes also set a daily fine of around £6,800 for people or companies using virtual private networks, or VPNs, to access X.

Brazil is one of the biggest markets for X, with tens of millions of users. Blocking it marked a dramatic escalation in a feud between Mr Musk and Mr de Moraes over free speech, far-Right accounts and misinformation.

“He violated the constitution of Brazil repeatedly and egregiously, after swearing an oath to protect it,” Mr Musk wrote of Mr de Moraes in the hours before the vote.

Mr de Moraes’ decision to quickly remit his order for panel approval served to obtain “collective, more institutional support that attempts to depersonalise the decision,” Conrado Hübner, a professor of constitutional law at the University of Sao Paulo, said.

06:04 PM BST

Kamala Harris says US steelmaker should remain in American hands

American vice president Kamala Harris will say that US Steel should remain in domestic hands during a campaign rally today as she ramps up outreach to voters, especially in battleground states such as Pennsylvania, Georgia, Michigan and Nevada.

Ms Harris, who replaced Joe Biden at the top of the Democratic ticket, will use her Labour Day remarks in Pittsburgh to underscore support for steel workers, a campaign aide said.

“The vice president is expected to say that US Steel should remain domestically owned and operated and stress her commitment to always have the backs of American steel workers,” the aide said.

Ms Harris’ position mirrors that of Mr Biden, who said in March that US Steel, which has agreed to be bought by Japan’s Nippon Steel for $14.9bn, must remain a domestically-owned American firm

It comes as Nippon Steel urgest the Japanese government to impose an anti-dumping tariff on Chinese steel.

Takahiro Mori, executive vice-president at Nippon, told Bloomberg that many other countries, including in Europe, the US and South Korea have introduced protection, which means that “exports will pour into Japan if it’s the only one without them”.

05:59 PM BST

Volkswagen plant closure would be first since 1988

Shares of Volkswagen rose 1.7pc after the company said it was considering closing factories in Germany for the first time.

It comes as the company races to become more competitive as new Chinese rivals set up shop elsewhere in Europe.

A plant closing by VW would be the first since its US plant in Westmoreland, Pennsylvania, closed in 1988, according to the Deutsche Presse-Agentur news agency.

Top employee representative Daniela Cavallo said that “management has failed … The consequence is an attack on our employees, our locations and our labor agreements. There will be no plant closings with us.”

05:32 PM BST

Stock market starts September on the back foot

British stock market indexes have started the month on the back foot, with a spike in Rightmove shares failing to lift the FTSE 100 into positive territory.

The dip, of 0.2pc, was despite shares in property portal Rightmove soaring by more than a quarter during the day after it emerged that Australia’s REA Group was considering making an offer for the firm.

REA Group said there was a “transformational opportunity” to combine with Rightmove, which had a market value of about £4.4 billion at the end of last week.

The prospect of a takeover appeared to be good news for investors who piled cash into Rightmove stocks, with its share price closing 27.4pc higher.

Nevertheless, the FTSE was weighed down by firms including Rolls-Royce, which was down by 6.5pc.

It was a slightly stronger session for other top European stock markets. Germany’s Dax edged up 0.1pc while France’s Cac 40 closed 0.2pc higher.

05:21 PM BST

Harrods’ Quatari owners take £180m dividend as sales jump

Department store Harrods handed its Qatari owners £180m in dividends for the past year after it bucked weakness in luxury spending.

The Knightsbridge retailer is owned by the state of Qatar through its sovereign wealth fund – the Qatar Investment Authority – which bought the business in 2010.

Freshly filed Companies House accounts for the year to February showed the owners gave themselves a £180m payment for the second consecutive year.

It came as Harrods reported an increase in sales and operating profits for the year.

Harrods revealed that turnover grew by 8pc to £898.4m for the year, a record high for the retail business.

It comes despite pressure at department store rivals including John Lewis and Harvey Nichols amid a shift in shopping habits and pressure on consumer budgets in the luxury market.

In the latest accounts, it also reported that operating profits rose slightly to £162.9 million from £158.4 million for the year.

Harrods increased its staff numbers significantly as a result of the recent growth, adding more than 700 to its workforce, taking it to 4,550 at the end of the year.

The accounts also showed that its top paid director, understood to be managing director Michael Ward, was paid £2.1m for the year, down from £2.3m a year earlier.

05:16 PM BST

Rolls-Royce plunges after engine trouble

Rolls-Royce saw £2.7bn knocked off its stock market value on Monday after a major customer said it had discovered problems with one of its engines.

Cathay Pacific, Hong Kong’s flag carrier, cancelled 24 flights and said it was conducting “precautionary” inspections of all its Airbus A350 planes, which use Rolls-Royce engines, after identifying a fault.

The failure was identified in an aircraft that was forced to return to Hong Kong during a flight to Zurich earlier on Monday. Cathay did not describe the component in detail but said it was the first of its type to suffer such failure on any A350 aircraft worldwide.

“Thus far we have identified a number of the same engine components that need to be replaced. Spare parts have been secured and repair work is underway,” the airline said.

Cathay said it had “fully complied with all maintenance requirements of the engine manufacturer and stringent maintenance procedures are in place to ensure that our fleet is always operated safely”.

Rolls-Royce shares closed down 6.5pc in London on Monday after losing as much as 8.2pc following the news.

Investors may fear a return to the years of trouble faced by Rolls-Royce over its Trent 1000 engines, which suffered from turbine blades cracking and faster-than-expected wear and tear.

The problems, first discovered in 2016, led to costly inspections and redesigns, plus compensation for airlines whose aircraft were grounded while repairs took place. Rolls-Royce spent billions fixing the problems.

A spokesperson for Rolls-Royce said: “We are aware of an incident involving Cathay Pacific flight CX383 from Hong Kong to Zurich. We can confirm that the flight CX383 was powered by Rolls-Royce Trent XWB-97 engines.

“We are committed to working closely with the airline, aircraft manufacturer and the relevant authorities to support their investigation into this incident.”

The diverted aircraft on which the issue was identified was an A350-1000, according to Flightradar24 data, the larger of two models of twin-engined A350. These are powered by the XWB-97, Rolls’ largest jet engine.

The aircraft involved was delivered in January 2019, according to the same data.

It was not immediately clear when the affected Rolls-Royce XWB-97 engine was first placed on the aircraft. Experts say airlines and engine makers occasionally swap engines around to fit maintenance schedules.

A spokesman for European aviation regulator EASA said: “We will be monitoring any information coming out of the technical investigation and take decisions for any fleet level action as required.”

05:15 PM BST

Alcohol-free Guinness on draught to cost just 55p less than regular pint

Alcohol-free Guinness is to be sold on draught in the UK for the first time – but will cost just 55p less than a regular pint. Daniel Woolfson reports:

The Devonshire, a London pub famed for its Guinness, is introducing the alcohol-free stout on draught under a deal with Diageo, the drinks giant that brews it.

Until now, Guinness 0.0 was only available on draught in Ireland and in cans in the UK.

Anna MacDonald, Guinness marketing director at Diageo, said the company was “offering patrons more choice through the introduction of an alcohol-free alternative with the same smooth, recognisable taste”.

However, drinkers may be shocked to learn the price. A pint of alcohol-free Guinness at The Devonshire will cost £6.35 – just 55p cheaper than a regular pint of Guinness at the same pub.

Questions have been raised over the high prices charged for non-alcoholic beers, given the fact that brewers do not pay any alcohol duty on them. Producers have argued that the complex production process and research warrants their price.

Diageo said the non-alcoholic Guinness was made with the same ingredients before the alcohol in it was removed through a process called cold filtration, which is claimed to preserve the taste.

05:01 PM BST

FTSE closes down

The FTSE 100 closed down this afternoon. Rightmove was the biggest riser, up 27.4pc, followed by Barratt Developments, down 3.1pc. The top faller was Rolls-Royce, down 6.5pc, followed by BAE Systems, down 4.7pc.

Meanwhile, the FTSE 250 fell 0.5pc. The top riser was John Wood, up 2.8pc, followed by CMC Markets, up 1.9pc. The top faller was Kainos, down 9.9pc, followed by Watches of Switzerland, down 4.8pc.

04:16 PM BST

Hong Kong developer suffers historic loss in wake of Xi Jinping crackdown

One of Hong Kong’s biggest developers is bracing for its first loss in two decades, as President Xi Jinping’s crackdown on China’s property market and an exodus of Western businesses batter the sector. Pui-Guan Man reports:

New World Development, owned by the billionaire Cheng family, said it expected to make a loss of up to HK$20bn (£2bn) for its financial year ended in June.

The developer blamed losses on investments and developments, higher interest rates and “depreciation of the renminbi” for the steep decline. Core profit is expected to fall by as much as 23pc.

New World’s shares plunged to a 21-year low of around HK$6.80 on Monday following the update.

Founded in 1970, the company’s investments span residential developments, shopping malls, offices and hotels and, as such, can be viewed as a proxy for the economic health of Hong Kong.

The special administrative region has been in and out of recession since the pandemic, a period during which Beijing seized greater control over Hong Kong by pushing through a controversial security law.

The power grab has had a chilling effect on civic society, with pro-democracy campaigners forced into exile. Many Western businesses have been pulling back from Hong Kong as a result.

04:07 PM BST

European markets drift in quiet trading

European markets have drifted sideways in quiet trading. Chris Beauchamp, chief market analyst at online trading platform IG, said:

In London the FTSE 100 hovers near the lows of the day, as European markets drift as per usual on a US holiday.

August ended with stock markets shrugging off their early-month weakness, a remarkable recovery from the panic-like conditions that briefly prevailed four weeks ago.

All eyes are on the payrolls report this week, but there is a limited likelihood that markets are in for another dire number. Instead, a higher revision to last month’s figure could see the prospect of a US recession being pushed back once again.

04:02 PM BST

Klarna rival bags ex-Aviva boss

An British rival to Klarna lender has reportedly bagged the heavyweight former boss of Aviva as a non-executive director.

Zilch, which offers Klarna-style buy now pay later lending, along with app-based credit cards, is set to announce Mark Wilson as a board member this week.

Mr Wilson, who was chief executive of Aviva from 2013 to 2018, is currently on the board of BlackRock.

Sky News, which first reported the appointment said that it underlined Zilch’s growing stature.

Zilch has been approached for comment.

03:43 PM BST

Hewlett Packard Enterprise to pursue Mike Lynch’s estate in £3bn damages claim

Hewlett Packard Enterprise (HPE) has confirmed it plans to continue with its claim for up to £3bn in damages against the estate of tech tycoon Mike Lynch after his death in last month’s superyacht disaster.

The US tech giant won a UK High Court civil claim against Mr Lynch in 2022, accusing him and his former finance director, Sushovan Hussain, of fraud over its $11bn (£8.37bn) takeover of his software company Autonomy in 2011.

HPE is seeking damages of up to $4bn (£3bn), with the judge set to rule on the final sum soon.

Mr Lynch, who was cleared in a separate criminal fraud trial over the Autonomy case in the US in June, and his 18-year-old daughter Hannah were among seven people who died after the Bayesian superyacht sank off the coast of Sicily last month.

His death means his widow, Angela Bacares, could now be liable for the damages claim in London.

HPE said: “In 2022, an English High Court judge ruled that HPE had substantially succeeded in its civil fraud claims against Dr Lynch and Mr Hussain.

“A damages hearing was held in February 2024 and the judge’s decision regarding damages due to HPE will arrive in due course.

“It is HPE’s intention to follow the proceedings through to their conclusion.”

The judge in the UK civil case has already ruled the amount payable in damages would be “substantially less” than HPE had sought, which raised questions over HPE’s reasoning for pursuing the claim after the superyacht tragedy.

The boat trip was a celebration of Mr Lynch’s acquittal in the fraud case.

03:43 PM BST

Traders see a 33pc change of a super-sized US rate cut

The big event of the week is likely to be the US non-farm payrolls report on Friday, which is expected to show the world’s largest economy added 165,000 jobs in August, up from 114,000 in July.

Traders currently think a September Federal Reserve rate cut is nailed on and see a 33pc chance that it could be an super-sized half a percentage point reduction, but that could shift on Friday.

The weak July jobs report helped spark a sell-off in global stocks at the start of August, although the S&P 500 has since rebounded to sit 0.4pc off a record high.

03:40 PM BST

European shares dip

In Europe, the Stoxx 600 index, which includes some of Britain’s biggest companies, fell 0.2pc, after hitting a record high on Friday. Germany’s DAX is flat, while and the FTSE 100 is down 0.2pc.

Aneeka Gupta, equity strategist at WisdomTree, said:

European equities have opened on a weaker footing owing to weaker economic data from China. The industrials and consumer discretionary sector led the declines.

Survey data released on Saturday showed Chinese manufacturing activity sank to a six-month low in August, and data on Monday showed euro zone factories are also still struggling.

03:31 PM BST

VW made ‘many wrong decisions’, says works council chief

VW works council chief Daniella Cavallo said in an interview on Volkswagen’s intranet that management had made “many wrong decisions” in recent years, including not investing in hybrids or being faster at developing affordable battery-electric cars.

He argued that instead of plant closures, the board should be reducing complexity and taking advantage of synergies across the Volkswagen group’s plans, criticising the company’s “documentation madness” and “salami-slicing tactics”.

Chief financial officer Arno Antlitz will speak to staff alongside VW brand chief Thomas Schaefer at a works council meeting on Wednesday morning.

Ms Cavallo said she expects chief executive Oliver Blume to get involved in negotiations as well.

With that, I will pass over the reins to Alex Singleton, who will keep sending live updates into the evening.

03:14 PM BST

VW shares jump despite unions vowing opposition to plant closures

Volkswagen shares were up as much as 2pc after its potential factory closure plans were announced.

German union IG Metall called Volkswagen’s announcement an irresponsible decision that “shakes the foundation” of the company, which is Germany’s largest industrial employer and Europe’s top carmaker by revenue.

A statement on its website said:

The austerity program has escalated and is resulting in a major conflict between management and the general works council.

The brand board led by chief executive Thomas Schäfer admitted severe setbacks to the earnings improvement program launched in 2023 at management meetings on Monday.

Further savings worth billions would have to be made, otherwise the core brand would fall into the red.

As a result, the company management is now questioning German plants, the VW company tariff and the job security that will run until the end of 2029.

The general works council led by its chairwoman Daniela Cavallo has announced bitter resistance to this, is calling for an extension of employment security and is countering the board’s lack of concept with its own master plan for the future of the brand.

02:52 PM BST

VW’s struggles ‘cannot be overcome by simple cost-cutting’

VW faces a hefty dispute with unions over its reforms, which also include trying to end the company’s pact with unions to keep jobs secure until 2029.

The company employs about 650,000 workers globally, almost 300,000 of which are in Germany.

Half the seats on the company’s supervisory board are held by worker representatives, and the German state of Lower Saxony — which owns a 20pc stake — often sides with trade union bodies.

Volkswagen chief executive Oliver Blume said that a difficult economic environment, new competitors in Europe, and the falling competitiveness of the German economy meant the carmaker needed to do more.

Meanwhile, VW brand chief Thomas Schaefer said: “The situation is extremely tense and cannot be overcome by simple cost-cutting measures.”

02:42 PM BST

VW considers closing German factory for first time in 87-year history

Volkswagen is considering closing factories in Germany for the first time in its 87-year history as the carmaker battles to cut costs and survive the transition to electric cars.

Union bosses bemoaned a “black day” as they accused the company’s board of escalating its “austerity programme”.

The company, founded in 1937, said today that it can no longer rule out unprecedented plant closures in Germany as it seeks ways to save several billion euros.

The carmaker considers one large vehicle plant and one component factory in Germany to be obsolete, its works council said, vowing “fierce resistance” to the executive board’s plans.

VW chief executive Oliver Blume said: “The economic environment has become even tougher and new players are pushing into Europe.

“Germany as a business location is falling further behind in terms of competitiveness.”

The Volkswagen brand, which fuels most of the carmaker’s sales, is the first of the group’s marques to undergo a cost-cutting drive targeting €10bn (£8.4bn) in savings by 2026 as it attempts to streamline spending.

Volkswagen said that it also felt forced to end its job security programme, which has been in place since 1994 and which prevents job cuts until 2029, adding all measures would be discussed with the works council.

02:08 PM BST

Lloyds mobile app back up and running

Lloyds Bank has overcome the issue with its online banking services

A spokesman said:

Our mobile app is back to normal.

We’re sorry some of our customers had issues viewing transactions and it may have been running slower earlier today.

01:59 PM BST

Manufacturers ‘rationing petrol cars’ to avoid breaking green rules

Car makers are rationing sales of petrol and hybrid vehicles in Britain to avoid hefty net zero fines, according to one of the country’s biggest dealership chains.

Our industry editor Matt Oliver has the details:

Robert Forrester, chief executive of Vertu Motors, said manufacturers were delaying deliveries of cars until next year amid fears they will otherwise breach quotas set for them by the Government.

This means someone ordering a car today at some dealerships will not receive it until February, he said.

At the same time, Mr Forrester warned manufacturers and dealers were grappling with a glut of more expensive electric vehicles (EVs) that are “not easily finding homes”.

Read on for details of the targets faced by the industry.

01:40 PM BST

Virgin Money services return to normal

Virgin Money has said that its online banking services are fully back up and running after the outages that hit the lender today:

Apologies for any issues you may have had with viewing your transactions online this morning, but the good news is everything is now back to normal. https://t.co/JMJvkMH4pn

— Ask Virgin Money (@AskVirginMoney) September 2, 2024

01:29 PM BST

Virgin Money apologises for online banking issues

Virgin Money has posted on X to apologise for some of its customers also having problems viewing their transactions through online banking.

The bank wrote:

We’re aware that some customers are having issues with our mobile banking app and internet banking service this morning with customers not being able to view their transactions.

We apologise for the inconvenience this is causing – we’re investigating and will keep you updated.

— Ask Virgin Money (@AskVirginMoney) September 2, 2024

In June, major technology outages affecting the digital services of several UK banks left some customers unable to send or receive money.

The problems stemmed from the “faster payment system” which enables digital transactions to be sent between banks and building societies within seconds.

Banks were also caught up in a global IT outage caused by a faulty update to widely-used cybersecurity software in July.

Lloyds chief executive Charlie Nunn recently said that IT failures and cyber attacks were a “really important issue” for the bank, which has about 22m customers using its digital services.

01:08 PM BST

Bank apps down as Microsoft hit by fresh outage

Microsoft has revealed that it has been hit by a fresh outage as banking apps across Britain reported being hit by a “third party issue”.

Hundreds of Lloyds Bank customers said they were unable to see their transactions through online banking while Nationwide said some customers experienced intermittent issues with its website this morning and apologised for any inconvenience caused.

It comes as Microsoft announced it is experiencing “issues accessing the Azure portal in UK regions” just months after its systems were sent into turmoil during the global IT outage caused by a faulty update by virus software business CrowdStrike.

A Nationwide spokesman said the lender was “aware of a third-party issue that is impacting a number of organisations”.

The outage tracking website Downdetector, which revealed more than 600 complaints by Lloyds Bank customers today, said the Microsoft problems “could be the cause of the multiple issues reported by UK consumers” on its platform.

Azure is Microsoft’s public cloud computing platform.

Microsoft said: “We are investigating reports of customers having issues accessing the Azure portal in UK regions. More details will be provided as they become available.”

Lloyds Bank, meanwhile, said it is continuing to experience issues with its online banking services:

We know some of our customers are having issues viewing their recent transactions. We’re sorry about this and we’re working to have everything back to normal soon.

— Lloyds Bank (@LloydsBank) September 2, 2024

12:41 PM BST

Lloyds apologises for delays with online banking

Lloyds Bank customers are still having issues viewing their transactions, as the lender admitted its app is running slower than usual.

Hundreds of customers have reported issues with its online banking service today.

A spokesman for the bank said:

We know some of our customers are having issues viewing their recent transactions and our app may be running slower than usual.

We’re sorry about this and we’re working to have everything back to normal soon.

12:10 PM BST

Pound inches higher as manufacturing sector grows

The pound has edged up today amid signs that a strong UK economy could deter the Bank of England from cutting interest rates quickly.

Closely watched manufacturing PMI figures showed Britain’s factories enjoyed their best month in more than two years in August.

Sterling was up 0.1pc against the dollar at $1.313, making it the best performer against the greenback among major currencies this year. The pound was flat against the euro at 84.2p.

Enrique Díaz-Alvarez, chief economist at Ebury, said:

Resilient domestic demand, an economy that is performing better than expected and hopes for an improvement in relations with the European Union under a Labour government, along with sterling’s undeniably attractive valuation, continue to buoy the British currency.

There is little news of note out of the UK this week, but we expect that relatively high UK rates still mean that the path of least resistance for the pound is up.

The Bank of England is clearly in easing mode, although the resilience of the UK economy suggests that the pace of MPC rate cuts will be a gradual one.

Markets are assigning no more than a 1-in-4 chance of another cut from the Bank of England in September, though this may change should upcoming data on the labour market, GDP and inflation surprise expectations.

11:52 AM BST

Oil prices fall amid China demand fears

Oil edged lower amid worries about Chinese demand and signs the Opec cartel will progress with a plan to lift output from October.

Global benchmark Brent crude slipped 0.2pc to less than $77 a barrel after losing more than 2pc on Friday.

US-produced West Texas Intermediate traded down 0.2pc near $73 as prices were also hit by worries about demand from China.

Chinese data showed factory activity contracted for a fourth month in August

Meanwhile, Opec could increase production as planned in October as a political crisis in Libya may have given the alliance the space to add more barrels.

Warren Patterson, head of commodities strategy for ING said:

There are still concerns over whether the market needs this supply.

Chinese demand worries are not disappearing anytime soon.

11:30 AM BST

Record bookings for ‘axe-throwing’ bars as drinkers seek experiences

Novelty bar activities like axe throwing, mini golf and escape rooms are more popular than ever among Britons heading towards the end-of-year season, according to bar chain XP Factory.

The company said it has “record advance bookings” between now and the end of 2024, after revenue more than doubled in the 15 months to March 31 to £57.3m.

XP Factory runs two brands of so-called experiential entertainment, Boom Battle Bar and Escape Hunt.

The first offers activities like shuffleboard, beer pong, axe throwing, “crazier” golf and karaoke, while the second offers themed escape rooms.

The company charges £50 for one half-hour session of axe throwing for six people at its Oxford Street location, while its crazy golf activity is £10 per person.

Richard Harpham, chief executive of XP Factory, said it was an “exceptional period of growth”.

Three new so-called Boom sites opened last year in Dubai, Canterbury and Southend.

Operating profit was £1.9m, which came in £7m ahead of 2022, while it increased its cash pile to £3.9m.

11:12 AM BST

Top North Sea oil field in jeopardy after Miliband crackdown

One of the North Sea’s biggest oil field developments is in jeopardy after developers put the project on hold following a crackdown by Ed Miliband.

Our energy editor Jonathan Leake has the details:

NEO Energy today announced a slowdown of investment in various UK schemes, including the large Buchan Horst redevelopment, 93 miles off the coast of Aberdeen.

Buchan is the third-biggest upcoming North Sea project and is conservatively expected to yield about 70m barrels of oil, with peak production likely to hit about 35,000 barrels per day. It was expected to begin production in 2027.

But NEO claimed a tax raid and new consultation launched by the Labour Government had plunged the scheme into uncertainty.

Read the implications for investment.

10:49 AM BST

Gas prices fall amid supply deal between Turkey and Shell

Gas prices have fallen back from levels close to their eight-month highs after Turkey and Shell announced a 10-year supply deal.

The agreement for liquefied natural gas includes an option to redirect shipments to Europe as Ankara pushes to become a key player in the market for the fuel.

Shell will sell Turkey’s state-owned Botas the equivalent of around 4bn cubic meters of gas per year starting in 2027, Energy Minister Alparslan Bayraktar said.

It comes as Europe continues to wean itself from Russian gas following the outbreak of war in Ukraine.

Russian energy giant Gazprom’s average daily natural gas supplies to Europe declined in August by 2pc from July and 2.3pc compared to the same month last year according to Reuters calculations.

Dutch front-month futures, the benchmark for Europe, were down as much as 2.7pc today, to less than €39 per megawatt hour, while the UK equivalent also dropped as much as 2.7pc.

10:33 AM BST

Historic UK investment trust announces takeover amid wave of consolidation

One of the UK’s oldest investment trusts is merging with a large rival amid a wave of consolidation in the sector.

Our reporter Michael Bow has the details:

The Artemis Alpha Trust, a pre-war investment vehicle founded in 1931, will be rolled into larger rival Aurora Investment Trust to reap the benefits of greater scale.

Being a larger investment trust will allow shareholders to benefit from lower fees and more liquidity for the shares, which makes it easier for investors to buy and sell.

The new trust will be 64pc larger and have assets of £353m. The tie-up is the latest trust merger in a record breaking year for consolidation. According to the Association of Investment Companies, seven mergers took place between investment trusts in the first half of 2024.

Alliance Trust and Witan agreed a merger this year to create a new £5bn giant eligible for the FTSE 100.

The Artemis Alpha Trust was founded in 1931 as the MKJ Trust and later changed its name to the Piccadilly Growth Trust. The Aurora trust is managed by pension fund Phoenix. Alpha Trust shareholders will be offered new shares in the enlarged Aurora vehicle and the option to take 25pc of their stake in cash.

The trust said shareholders would benefit from “reduced ongoing charges ratio and enhanced secondary market liquidity”.

10:12 AM BST

Lloyds banking goes down for hundreds of customers

Lloyds Bank is dealing with an outage with its online banking for hundreds of its customers a little over a month after its boss said cyber problems are a “really important issue” for the lender.

Customers have reported being unable to move money between accounts and said transactions were not showing on the app or through online banking.

There were more than 600 complaints on the Downdetector tracking website.

Lloyds tweeted that its IT team is working to resolve the issues but said there is no timeframe for it to be resolved.

In July, Lloyds Bank chief executive Charlie Nunn said the global IT outage caused by the CrowdStrike update debacle showed “why we need to stay focused on resilience around tech”.

He said: “We have got 22 million digitally active customers. We, I think, have the biggest digital service in the UK outside social media.”

Hello, I do apologise and am very sorry for any inconvenience caused. We are aware there is an issue and our IT team are currently working to fix this as soon as possible. If you can use the ‘September’ tab, you should be able to see all transactions. ^ Kerri

— Lloyds Bank (@LloydsBank) September 2, 2024

We don’t have a timeframe I’m sorry Susan, but our tech team are working hard to get this resolved ASAP.

If you click ‘support’ on the app and then ‘message us’ an agent will be happy to check any transactions for you. Thank you for your patience. ^Indi

— Lloyds Bank (@LloydsBank) September 2, 2024

10:01 AM BST

Miners slump amid weaker metal prices

Industrial metal miners have dropped across UK stock markets as a result of weaker prices across most base metals.

The sector was down as much as 2pc, with Rio Tinto one of the heaviest drags on the FTSE 100 as it fell 1.2pc.

Iron ore slumped back below $100 a ton amid pessimism over China’s economic prospects.

The steel-making material rose almost 10pc over the past two weeks on tentative signs that the worst of China’s summer steel rout might be over.

However, weaker than expected manufacturing activity and another round of downbeat news from the country’s property sector stung prices today.

09:44 AM BST

Britain’s factory activity at two-year high

Britain’s factories recorded their best month in two years amid a rise in homegrown demand, according to a closely watched survey.

The S&P Global UK Manufacturing PMI rose to a 26-month high of 52.5 in August, up from 52.1 in July, meaning the sector has expanded for five out of the last six months.

Output, new orders and employment all rose but new export orders decreased for the 31st consecutive month.

Rob Dobson, director at S&P Global Market Intelligence, said:

The upturn continues to be driven by the domestic market, which is helping to compensate for lost export orders.

The trend in export orders a key cause for concern, with new business from overseas having fallen continuously since early in 2022.

UK manufacturers are experiencing difficulties in securing new contract wins overseas due to weaker demand from Europe, a slowdown in mainland China, freight delays, competitiveness issues, high shipping costs, global conflicts and political uncertainty.

Many of these issues are also impeding imports which, while benefiting domestic suppliers, is causing supply chain-related production constraints as witnessed by a further marked lengthening of supplier delivery times.

09:27 AM BST

Pound remains best performing major currency

Sterling is still the best performing major currency against the dollar this year amid doubts over how fast the Bank of England will cut interest rates.

The pound has risen 3.2pc against the dollar so far in 2024 to $1.314. The euro is up 0.3pc versus the greenback.

09:13 AM BST

Eurozone factories ‘stuck in a rut’ of recession

The eurozone’s manufacturing sector continued its long slump last month, according to a key measure of activity, as the bloc was dragged down by poor performances in France and Germany.

The HCOB Eurozone Manufacturing PMI, which measures the overall health of the bloc’s factories, remained rooted at 45.8 in August, remaining in the contraction territory where it has stood since July 2022.

It comes after manufacturing conditions worsened in both Germany and France.

Dr Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

Things are going downhill, and fast. The manufacturing sector has been stuck in a rut, with business conditions worsening at the same solid pace for three straight months, pushing the recession to a gruelling 26 months and counting.

New orders, both domestic and international, are slowing down even more, dashing any short-term hopes for a rebound. Adding insult to injury, input prices have been creeping up again since June.

There is a silver lining insofar as companies managed to pass some of these higher costs onto their customers in August.

09:03 AM BST

German manufacturing recession deepens

The German manufacturing sector suffered steeper declines across the board last month, a closely watched survey showed.

There were sharper and faster falls in new orders, purchasing activity and employment in August, according to the HCOB Germany Manufacturing PMI.

The guage dropped for a third month in a row to 42.4, down from July’s 43.2 and the lowest since March.

Goods producers in the eurozone’s largest economy were also less optimistic about their growth prospects in the coming year.

Dr. Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said:

The recession in Germany’s manufacturing sector is dragging on way longer than anyone expected.

August saw an even steeper drop in incoming orders, killing off any hope for a quick bounce back.

08:52 AM BST

UK stocks fall at start of big month for interest rates

Britain’s main stock index fell in thin trading at the start of a major month for central bank interest rate decisions.

The blue-chip FTSE 100 index was down 0.2pc after hitting a three-month high on Friday and logging its third straight weekly rise.

Meanwhile, the domestically-focused mid-cap FTSE 250 slipped 0.4pc, having logged its steepest monthly decline in August since October last year.

Trading volumes are expected to be light throughout the day due to holidays in the United States and Canada.

US employment data, including the payrolls report for August out on Friday, could help determine the size of an all-but-certain September interest rate cut by the Federal Reserve.

Back home, the closely-watched purchasing managers’ index (PMI) and housing data is due this week.

The Fed, European Central Bank and Bank of England are set to announce their policy decisions later this month, with the Bank of England expected to be the only one holding rates.

Among major stocks, Rightmove jumped 25pc to its highest level since March 2022, as REA Group said it was considering an offer for Britain’s largest property portal. Homebuilders Barratt and Bellway were up as much as 3.87pc and 1.3pc, respectively.

08:32 AM BST

Slowdown in China manufacturing hits Asian markets

Asian markets were mixed today amid worries over the Chinese economy following the release of more disappointing data.

Tokyo, Sydney, Singapore, Seoul, Mumbai, Manila, Wellington and Jakarta rose but Hong Kong, Bangkok and Taipei fell.

Investor sentiment was jolted by worries over China’s economy after a PMI report showed ouput prices in the country’s manufacturing sector contracted for a fourth consecutive month in August and more than expected.

Exports declined for the first time in eight months, dragged down “by weakening demand for consumer products”, according to Dr Wang Zhe, senior economist at Caixin Insight Group.

The news comes as leaders face calls to unveil fresh stimulus measures, particularly for the troubled property industry, with observers warning the government’s 5pc GDP growth target could be missed this year.

Analyst Stephen Innes said:

The world’s second-largest economy is sputtering, with factory activity lagging, deflationary pressures mounting, and the call for stimulus growing louder.

The services sector tried to pick up the slack, but growth there is almost invisible… signalling an economy barely managing a pulse.

08:15 AM BST

Rightmove shares surge as Murdoch group considers bid

Shares in Rightmove surged by a record 25pc in early trading after Australia’s REA Group said it is mulling a takeover offer for the online property portal.

REA Group, which is majority-owned by Rupert Murdoch’s News Corp, said in a statement today that there are “clear similarities” between the companies, which have “highly aligned cultural values”.

Founded in a garage in Melbourne, REA Group has become Australia’s largest property website with operations across the country as well as in India and south-east Asia.

According to its website, it employs more than 2,800 people.

08:09 AM BST

German borrowing costs rise as far-Right win first state election since Nazi era

German government borrowing costs have risen to a one-month higher as a far-Right party is on course to win an election in a state parliament for the first time since the Nazi era.

Exit polls predicted the anti-immigration AfD gained some 33pc of the vote in Thuringia, with the mainstream conservative Christian Democrat (CDU) party polling at around 23pc.

The CDU, however, ruled out a coalition on Sunday evening, meaning the AfD was locked out of power.

Germany’s 10-year bond yield, the benchmark for the eurozone, rose 3.5 basis points to 2.33pc, its highest level since July 31. Bond yields move inversely with prices.

But while there might be a short-term impact, Commerzbank does not expect any long-lasting damage to Germany’s governing coalition.

Commerzbank rates strategist Rainer Guntermann said:

Domestic political headlines after the disappointing results for the federal government’s coalition parties in the regional elections probably won’t have a lasting impact.

While the election results could further exacerbate the conflicts within the coalition and within the coalition parties, a break-up of the coalition and new elections are unlikely.

08:04 AM BST

UK markets mixed at the open

Stock indexes in London lacked direction at the start of the week, with US markets due to be closed today for the Labor Day holiday.

The FTSE 100 was down 0.1pc to 8,371.35 while the midcap FTSE 250 was up 0.1pc to 21,106.70.

07:57 AM BST

China warns Japan about retaliation for chip restrictions

China has reportedly warned Japan that it faces severe economic retaliation if it further restricts sales and servicing of chipmaking equipment to its businesses.

Toyota Motor privately told Japanese officials that Beijing could react to the curbs by cutting Japan’s access to minerals required for automotive production, according to Bloomberg News.

Several Chinese officials had repeatedly outlined the position with their Japanese counterparts in recent meetings, the report added.

Japan began restricting exports of 23 types of semiconductor manufacturing equipment, aligning its technology trade controls with a US push to curb China’s ability to make advanced chips in July.

07:52 AM BST

Car dealer Vertu warns of lower profits amid weaker electric vehicle sales

Car dealership Vertu Motors has cautioned over lower half-year profits as demand for new cars and in particular more expensive electric vehicles remains under pressure.

The group, which has 192 showrooms across the UK, said new car sales by volume fell 5.8pc in the five months to July 31.

Used car sales were more resilient, up 5pc by volume in the five months, helping overall group revenues lift 3.3pc on a like-for-like basis.

Vertu said while first-half profits were expected to be lower, its performance is set to improve year on year in the final six months thanks to a stronger used car market.

It added it remains “highly focused on cost and efficiency” as higher staff wage bills push up cost pressures, with plans to roll out trials automating some admin and finance tasks in the coming months.

07:41 AM BST

Murdoch’s online property group considers £4.4bn swoop for Rightmove

Australia’s online property advertising group REA has said it is mulling a takeover offer for Rightmove in a deal which could be worth about £4.4bn.

REA Group, which is majority owned by Rupert Murdoch’s News Corp, said in a statement that there are “clear similarities” between the companies, which have “highly aligned cultural values”.

Listed on the London Stock Exchange, Rightmove is the UK’s largest online real estate property portal and had a market value of £4.4bn at Friday’s close.

REA Group said:

REA sees a transformational opportunity to apply its globally-leading capabilities and expertise to enhance customer and consumer value across the combined portfolio, and to create a global and diversified digital property company, with number one positions in Australia and the UK.

There can be no certainty that an offer will be made, nor as to the terms on which any offer may be made.

07:35 AM BST

Pound to surge against dollar, says US bank

The pound is expected to be one of the strongest performing major currencies over the next year, according to a Wall Street investment giant, as a tight jobs market risks slowing down the pace of interest rate cuts by the Bank of England.

Bank of America said sterling is on track to hit $1.41 by the end of 2025, having touched a two-year high of $1.323 last week.

The pound, which is worth about $1.313 today, will be boosted by “above trend growth” in Britain’s economy.

Sterling is expected to reach $1.35 by the end of this year as a potential tightening of the UK jobs market slows down the pace of interest rate cuts by the Bank of England, with the next cut expected in November by Bank of America.

Bank of America strategist Adarsh Sinha said: “We look for four quarterly cuts in 2025, and two cuts in 2026 for a 3.25pc terminal rate by mid-2026.

By contrast, he expects the US Federal Reserve to cut interest rates twice by the end of this year, four times this year and twice in 2026.

He added: “With activity remaining solid and inflation coming in just a little stickier than the Fed would like, we do not see the need for super-sized or accelerated (once per meeting rather than once per quarter) rate cuts.”

07:25 AM BST

Good morning

Thanks for joining me. Sterling is expected to forge higher by the end of next year amid “above trend growth” in the UK economy, according to a Wall Street bank.

The pound will hit $1.41 by the end of next year, up from $1.31 today, according to Bank of America.

5 things to start your day

1) Miliband’s North Sea tax raid will drive £13bn of investment abroad, warns industry | Oil and gas producers to pay 78pc tax on profits under new levy plans

2) Public splashes out on mood-boosting small luxuries in ‘sweet treat economy’ | Consumer card spending rises despite high interest rates and looming tax rises

3) Government to probe ‘dynamic pricing’ after Oasis fans pay over £300 for tickets | Ticketmaster under fire as surge system sees some tickets sold for more than double face value

4) Executive confidence plummets as Reeves plots tax raid | 40pc of business leaders feel pessimistic about UK economy, finds survey

5) Sir Jacob Rees-Mogg to share in £4m payout from Somerset Capital shutdown | Shareholders claw back money from failed fund manager following liquidation

What happened overnight

Asian shares were mixed in cautious trading Monday ahead of the Labor Day holiday in the US, when stock exchanges will be closed.

Investors were also looking ahead to the U.S. employment report set for release Friday for an indication of the strength of the American economy.

Japan’s Nikkei 225 gained 0.4pc in morning trading to 38,797.61, after the Finance Ministry reported capital spending by Japanese companies in the April-June quarter increased 7.4pc from the previous year.

After a period of stagnation, Japan’s economy is showing signs of a recovery. Next week, Japan will release revised gross domestic product, or GDP, data, a measure of the value of a nation’s goods and services. The preliminary data released earlier showed the first growth in two quarters.

Australia’s S&P/ASX 200 declined 0.3pc to 8,067.00, while South Korea’s Kospi gained nearly 0.1pc to 2,676.28. Hong Kong’s Hang Seng slipped 1.3pc to 17,752.09. The Shanghai Composite dipped 0.5pc to 2,828.84.

3 No-Brainer Artificial Intelligence (AI) Stocks to Buy With $200 Right Now

Some of the biggest winners during the current bull market have been artificial intelligence (AI) stocks. The booming demand for AI infrastructure, software, and development tools has made some companies and their investors a ton of money over the past two years. Despite the strong growth in AI, there may be a lot more left to come.

Businesses will spend a whopping $235 billion on AI this year, according to a report by market researcher IDC. But those same analysts expect spending to climb to $631 billion by 2028. By 2032, spending on generative AI alone could climb to $1.3 trillion, according to an analysis from Bloomberg Intelligence.

Now that many companies connected to the AI boom have seen their share prices zoom higher, it may feel impossible to find an AI stock you can buy with just $200. While many brokerages allow for fractional share trading, there’s something great about owning an entire share of a company. Here are three AI stocks you can buy trading at less than $200 per share that look like no-brainer investments right now.

1. Broadcom ($163/share)

Broadcom‘s (NASDAQ: AVGO) stock price recently dropped below $200 per share for the first time since 2020 — not because investors are selling shares or because the business is struggling, but because it conducted a 10-for-1 stock split in July. Its market cap has climbed by nearly 10 times from its 2020 low, but it could have more room to run.

The chipmaker specializes in a couple of types of semiconductors that are extremely valuable amid the AI boom. It makes networking chips, which help route workloads across the computing power available in a data center. For example, its Jericho3-AI Fabric can connect up to 32,000 chips in a data center. That helps ensure that big tech companies spending tens of billions on GPUs and other chips are getting their money’s worth out of those investments.

It also makes AI accelerator chips specifically tailored to training or using large language models. It works closely with big tech companies like Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Meta Platforms to design these application-specific integrated circuits, or ASICs. They can be less expensive and require less energy to run than GPUs for the same tasks, and they make up a growing share of the hardware in the biggest data centers in the world.

Broadcom also makes chips for other applications, including smartphones, which has proven a stable and growing business. On top of that, it sports a portfolio of enterprise software for mainframe software and virtualization, anchored by the assets it gained in its acquisition of VMware last year. Its broad portfolio combined with its chip business allows it to focus on locking in customers with multiple offerings that all work together well, protecting it from competition.

Despite the stock’s strong performance over the last few years, shares currently trade at just 27.7 times forward earnings. That’s a slight premium to the S&P 500‘s average valuation, but far below other AI chipmakers. Given the multiple sources the company has for potential growth, Broadcom shares should prove a solid investment at their current price.

2. Qualcomm ($175/share)

Qualcomm (NASDAQ: QCOM) is best known for making the wireless communication chips that allow your smartphone to connect to your carrier’s 5G network. While its business faces a major headwind as one of its biggest customers — Apple — moves toward building its own next-generation modems, its business with Android phone makers is growing.

Beyond the stranglehold Qualcomm has on most of the connectivity chips in smartphones, it also makes the core processors inside many Android phones. Its Snapdragon application processing unit is one of the highest-end chips for smartphones, offering manufacturers easy integration with its modems. Additionally, it makes chips for automotive and Internet of Things applications, both growing markets with increasingly high computation and connectivity needs.

Qualcomm took a step toward the PC market with its AI-focused CPUs earlier this year. While its efforts in the area likely won’t have a large impact on its revenue in the near term, they could result in great diversification eventually.

Importantly, Qualcomm stands to benefit from the push to start providing the computing power for generative AI on devices instead of having all of that processing done in the cloud. The upcoming new AI features that Apple unveiled in June are primarily focused on this on-device processing. Many other companies will look to emulate Apple in that regard. Qualcomm stresses the idea that its PC chips can handle AI applications on devices without an internet connection. And AI applications in automobiles and IoT networks will need to be able to run quickly and locally as well. Those trends bode well for sales of Qualcomm’s high-end chips.

Qualcomm trades at a forward price-to-earnings multiple of just 15.5. That’s well below the S&P 500’s multiple despite the fact that strong demand from smartphone manufacturers should drive the company’s revenue and profits in the short to medium term and AI PC chips could be a long-term growth story for the company. At this valuation, Qualcomm stock looks like a great buy.

3. Alphabet ($165/share)

Alphabet owns the world’s most popular search engine (Google) and video-sharing website (YouTube). Those properties are part of a family of internet services that supports the company’s core advertising business.

Despite some regulatory pushback, it’s unlikely Google’s dominance of the internet search market is going anywhere. Additionally, AI assistants like ChatGPT have failed to make a significant dent in its business. In fact, Google is integrating AI into search with its latest feature, AI Overviews, and seeing excellent engagement and satisfaction with the results.

While AI is changing its core business, it’s fueling growth for Google’s cloud computing unit. Google Cloud is the third-largest public cloud platform, and it’s growing quickly. The company is investing heavily in AI capabilities with its custom chip designs (helped by Broadcom) and expanding its computing capacity. That has helped it win major contracts with big developers, including Apple, which trained its large language model on Google Cloud’s TPUs.

Management says its generative AI services generated billions in revenue during the first six months of 2024, attracting more than 2 million developers. But there’s still a long runway for growth. Google benefits from being able to spend on its own AI development while renting out cloud computing capacity to other developers as well, ensuring it can get the most out of its capital investments.

The stock currently trades at a forward P/E ratio of 21.8. That’s in line with the S&P 500, but Alphabet arguably deserves a premium valuation as it benefits from the secular growth of digital advertising and the huge boom in AI cloud spending. Meanwhile, it’s using its massive cash flow to buy back shares, providing a boost to earnings per share. As such, earnings growth should remain strong. It looks like a great AI stock to buy while its shares remain below $200.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Levy has positions in Alphabet, Apple, Meta Platforms, and Qualcomm. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, and Qualcomm. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

3 No-Brainer Artificial Intelligence (AI) Stocks to Buy With $200 Right Now was originally published by The Motley Fool

Analyst Predicts Arbor Realty (ABR) Dividend Cut is Imminent as Legal and Financial Woes Mount- Hagens Berman

SAN FRANCISCO, Sept. 02, 2024 (GLOBE NEWSWIRE) — Hagens Berman urges Arbor Realty Trust, Inc. ABR investors who suffered substantial losses to submit your losses now.

Class Period: May 7, 2021 – July 11, 2024

Lead Plaintiff Deadline: Sept. 30, 2024

Visit: www.hbsslaw.com/investor-fraud/ABR

Contact the Firm Now: ABR@hbsslaw.com

844-916-0895

Securities Class Action Against Arbor Realty Trust, Inc. (ABR):

Arbor Realty Trust is facing intensifying scrutiny as a series of damning reports and legal actions cast doubt on the company’s financial health and business practices. The latest salvo came from analyst Bashar Issa, who on August 17 predicted the multifamily lender will be unable to cover its dividend by year-end.

Issa, in a report published on Seeking Alpha, cited a ballooning payout ratio, shrinking balance sheet, and the potential impact of a Federal Reserve rate cut as key factors behind his bearish outlook. The analyst warned risk-averse investors to stay clear of Arbor.

The new concerns follow closely on the heels of a series of blistering reports from activist short seller Viceroy Research, which accused Arbor of misleading investors about the quality of its loan book and engaging in “window-dressing” to obscure financial troubles. The most recent report, released earlier in August, pointed to a 10% surge in delinquent loans to $1 billion as evidence of the company’s deteriorating financial condition.

Arbor is also battling a class-action lawsuit alleging securities fraud. The suit, filed in late July, accuses the company of painting a misleadingly rosy picture of its business performance.

Investor concerns about Arbor’s financial health first emerged in Mar. 2023 when NINGI Research questioned the value of the company’s real estate holdings, particularly its mobile home portfolio.

Then, in Dec. 2023, Viceroy Research released a report alleging widespread issues with the company’s loan book.

Finally, on July 12, 2024, reports of a federal investigation into the company’s lending practices broke.

Each of these revelations caused the price of Arbor shares to decline sharply.

These allegations have prompted prominent shareholder rights firm Hagens Berman to commence an investigation into potential securities fraud.

“We are investigating whether Arbor Realty may have misled investors about its financial health and the quality of its loan book,” said Reed Kathrein, a partner at Hagens Berman. “Investors deserve to know the truth about their investments, and we are committed to holding companies accountable.”

If you invested in Arbor and have substantial losses, or have knowledge that may assist the firm’s investigation, submit your losses now »

If you’d like more information and answers to frequently asked questions about the Arbor case and our investigation, read more »

Whistleblowers: Persons with non-public information regarding Arbor should consider their options to help in the investigation or take advantage of the SEC Whistleblower program. Under the new program, whistleblowers who provide original information may receive rewards totaling up to 30 percent of any successful recovery made by the SEC. For more information, call Reed Kathrein at 844-916-0895 or email ABR@hbsslaw.com.

About Hagens Berman

Hagens Berman is a global plaintiffs’ rights complex litigation firm focusing on corporate accountability. The firm is home to a robust practice and represents investors as well as whistleblowers, workers, consumers and others in cases achieving real results for those harmed by corporate negligence and other wrongdoings. Hagens Berman’s team has secured more than $2.9 billion in this area of law. More about the firm and its successes can be found at hbsslaw.com. Follow the firm for updates and news at @ClassActionLaw.

Contact:

Reed Kathrein, 844-916-0895

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks tiptoe towards US manufacturing, jobs data

By Tom Westbrook

SINGAPORE (Reuters) – Asian stocks slipped and investors bought dollars and yen on Tuesday in a drift toward safe-haven assets ahead of a raft of data that may determine how deeply the U.S. will cut interest rates later this month.

The U.S. ISM manufacturing survey due later in the day and particularly jobs data due on Friday will be crucial for whether the Federal Reserve cuts by 25 basis points or 50 on Sept. 18.

Ten-year Treasury yields were slightly higher at 3.915% and two-year yields hovered at 3.931% as trade resumed in Asia following a U.S. holiday.

MSCI’s broadest index of Asia-Pacific shares outside Japan ticked 0.5% lower as falling profits weighed on China’s banking sector. [.SS] Japan’s Nikkei fell 0.3%% and S&P 500 futures eased 0.2%.

The yen rose about 0.5% to 146.24 per dollar, while the dollar rose on the euro, sterling and the Antipodean currencies, reflecting a little less confidence that the Fed may opt for a 50 bp cut later in the month.

“It really boils down to Friday’s number,” said Raisah Rasid, global market strategist at J.P. Morgan Asset Management in Singapore, with policymakers looking for a cooling labour market to clear the way for rate cuts.

“We don’t see any stress or indications that would necessitate a 50 basis point cut … the question is how long will risk assets continue to rally?”

Economists forecast the ISM survey improving but remaining in contractionary territory at 47.5 in August. On Friday analysts are looking for a rise of 160,000 in non-farm payrolls (NFP) and a dip in the unemployment rate to 4.2%.

“If NFP comes in on target, or close it it, that’s probably going to lock in that 25-bps cut and I think because of that we’ll probably see some more dollar appreciation,” said Nick Twidale, chief market analyst at ATFX Global in Sydney.

The dollar rose about 0.2% to $1.1054 per euro and rallies in the Australian and New Zealand dollars paused for breath, with the Aussie knocked down nearly 0.8% to $0.6740 and the kiwi down 0.7% to $0.6192. [AUD/]

In Hong Kong, shares in property company New World Development slumped to a two-decade low after the company estimated a $2.6 billion loss for the year to June.

China’s banking index fell 1.8% as four of the country’s five largest lenders reported lower second-quarter profit, weighed by the property sector crisis.

Gold hovered at $2,494 an ounce after hitting a record high above $2,500 in August.

Oil prices have struggled for traction as demand worries weigh against tensions in the Middle East, and Brent crude futures slipped 0.5% to $77.13 a barrel.

(Reporting by Tom Westbrook; Editing by Shri Navaratnam and Kim Coghill)

Shaq Refused To Pay $80,000 For Security And Made A Surprising Choice. He Invested In A Company Bezos Later Bought For $1 Billion

Shaquille O’Neal is known for his dominance on the basketball court, but his business moves off the court are just as impressive. One of the most surprising stories about Shaq isn’t about a slam dunk or a championship win — it’s about how he turned a simple home security issue into a multi-million-dollar investment.

Don’t Miss:

Shaq has three homes in Atlanta, where he’s lived for years, and he needed a new security system for one of them. When he contacted a security company, they quoted him $80,000. Even though he’s worth millions, Shaq knew that price was way too high. So, he did what many of us would do and looked for a cheaper solution. While shopping at Best Buy, he spotted some Ring cameras and decided to buy one.

“The crazy thing about it is I hooked it up myself,” Shaq said, clearly proud of his DIY skills. He installed the camera, and then, while traveling in China, he realized just how powerful the system was. He could see and talk to someone at his front door from halfway around the world. That’s when it clicked for Shaq — this wasn’t just a good product but a game-changer.

Trending: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

Excited about what he had discovered, Shaq decided to take things a step further. He tracked down the company’s booth at a tech conference and made a bold offer to the CEO. “I said, ‘Hey, my name is Shaquille O’Neal. I want to invest in your company, and you’re going to pay me to do commercials, and then whatever happens happens,'” Shaq recounted. The CEO agreed, and Shaq became an early investor in Ring.

A few years later, Jeff Bezos bought Ring for $1 billion. Shaq’s decision to invest in this still relatively unknown company saved him money on his home security and made him a lot of money in return. How much exactly? He never disclosed.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

But this wasn’t Shaq’s first smart investment. In 1999, while still in his NBA prime, Shaq’s agent introduced him to Ron Conway, a top venture capitalist. During a lunch at the Four Seasons, Conway pitched him on investing in a little-known company called Google. Shaq invested $250,000, which grew significantly as Google became a tech giant.

He said, “We had a meeting with them and it looked good, and I put some money in and forgot about it.”

Shaq’s portfolio doesn’t stop there. He’s also invested in companies like Lyft, Apple and Vitaminwater. With Lyft, he jumped in just a year after it was founded, and when the company went public in 2019, it was valued at $22 billion.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Shaq Refused To Pay $80,000 For Security And Made A Surprising Choice. He Invested In A Company Bezos Later Bought For $1 Billion originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Tech Stock Has Gone Parabolic, and You Should Consider Buying It Before It Soars Even Higher

Fortinet (NASDAQ: FTNT) released its second-quarter 2024 results on Aug. 6, and the stock has witnessed a massive surge of 35% since then thanks to impressive growth in its revenue and earnings that were enough to help it beat Wall Street’s expectations.

The cybersecurity specialist also raised its full-year revenue guidance. This further explains why the stock has made a parabolic move, a phenomenon that refers to the rapid increase in the share price of a company within a short time, just like the right side of a parabolic curve.

The good news for investors is that Fortinet stock could continue to head higher thanks to the company’s focus on tapping fast-growing niches of the cybersecurity market, which should allow it to profit from a massive addressable market in the long run.

Fortinet’s growth is likely to improve

Fortinet delivered Q2 revenue of $1.43 billion, an increase of 11% from the same quarter last year. Its non-GAAP net income grew at a much faster pace of 50% from the year-ago quarter, to $0.57 per share, thanks to a reduced share count due to buybacks, lower indirect costs, and the growing demand for its higher-margin security subscription offerings.

Fortinet’s non-GAAP operating margin jumped from 26.9% to 35.1% as the proportion of service-based revenue increased on a year-over-year basis. More specifically, Fortinet’s service revenue increased nearly 20% year over year to $982 million, accounting for 69% of its top line. That was an improvement from the same quarter last year when service revenue accounted for 63% of its top line.

There is still a lot of room for growth in Fortinet’s service revenue, which also means that the company’s margin profile could continue to improve. The good part is that the improvement in Fortinet’s deferred revenue indicates that its revenue from sales of security subscriptions could continue improving.

The company’s deferred revenue increased 15% year over year to $5.9 billion in the second quarter, outpacing the growth in its top line. This metric refers to the money that’s collected in advance by a company for services that will be rendered in the future. Once Fortinet delivers those services, it will be able to recognize the deferred revenue on the income statement as actual revenue.

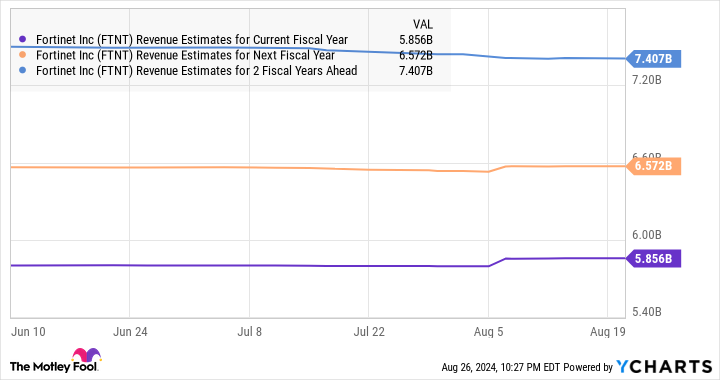

Given that the company expects its addressable market to jump to a whopping $228 billion in 2028, there is a lot of room for Fortinet to grow, considering that it is expecting its 2024 revenue to land at $5.85 billion. That would be a 10% jump from last year, but as the following chart indicates, Fortinet’s growth is expected to pick up going forward.

Is the stock worth buying right now?

Fortinet is now trading at 44 times trailing earnings following its red-hot rally. That is a bit lower than the U.S. technology sector’s average price-to-earnings ratio of almost 46. Fortinet’s forward earnings multiple of 39 points toward an improvement in its bottom line, and the good part is that analysts are now expecting a stronger bottom-line performance from the company.

The forecast for the next five years is also bright, with Fortinet expected to clock an annual earnings growth rate of 15%. So, let’s do some math.

Assuming it can indeed notch such solid growth on the back of the huge addressable opportunity it is sitting on, its earnings could jump to $4.10 per share after five years (using fiscal 2024’s projected earnings of $2.04 per share as the base).

The Nasdaq-100 index has an average forward price-to-earnings ratio of 29 (using the index as a proxy for tech stocks). Assuming Fortinet trades at a similar multiple after five years (which would be a significant discount to its current earnings multiple), its stock price could jump to $119 (based on the projected earnings of $4.10 per share calculated above).

These calculations point toward a 58% jump from current levels, which is why investors might want to consider buying this cybersecurity stock despite the terrific gains that it has clocked of late.

Should you invest $1,000 in Fortinet right now?

Before you buy stock in Fortinet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fortinet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Fortinet. The Motley Fool has a disclosure policy.

This Tech Stock Has Gone Parabolic, and You Should Consider Buying It Before It Soars Even Higher was originally published by The Motley Fool

54-Year-Old Woman With No 401(k) And Only $12,000 In Savings Seeks Suze Orman's Advice, Orman Says 'Put $8,000 Into A Roth IRA'

Suze Orman frequently offers financial advice to those who write into her “Women & Money” podcast. Recently, 54-year-old Kim reached out about how to make the most of her $12,000 savings.

Don’t Miss: