Stocks tiptoe towards US manufacturing, jobs data

By Tom Westbrook

SINGAPORE (Reuters) – Asian stocks slipped and investors bought dollars and yen on Tuesday in a drift toward safe-haven assets ahead of a raft of data that may determine how deeply the U.S. will cut interest rates later this month.

The U.S. ISM manufacturing survey due later in the day and particularly jobs data due on Friday will be crucial for whether the Federal Reserve cuts by 25 basis points or 50 on Sept. 18.

Ten-year Treasury yields were slightly higher at 3.915% and two-year yields hovered at 3.931% as trade resumed in Asia following a U.S. holiday.

MSCI’s broadest index of Asia-Pacific shares outside Japan ticked 0.5% lower as falling profits weighed on China’s banking sector. [.SS] Japan’s Nikkei fell 0.3%% and S&P 500 futures eased 0.2%.

The yen rose about 0.5% to 146.24 per dollar, while the dollar rose on the euro, sterling and the Antipodean currencies, reflecting a little less confidence that the Fed may opt for a 50 bp cut later in the month.

“It really boils down to Friday’s number,” said Raisah Rasid, global market strategist at J.P. Morgan Asset Management in Singapore, with policymakers looking for a cooling labour market to clear the way for rate cuts.

“We don’t see any stress or indications that would necessitate a 50 basis point cut … the question is how long will risk assets continue to rally?”

Economists forecast the ISM survey improving but remaining in contractionary territory at 47.5 in August. On Friday analysts are looking for a rise of 160,000 in non-farm payrolls (NFP) and a dip in the unemployment rate to 4.2%.

“If NFP comes in on target, or close it it, that’s probably going to lock in that 25-bps cut and I think because of that we’ll probably see some more dollar appreciation,” said Nick Twidale, chief market analyst at ATFX Global in Sydney.

The dollar rose about 0.2% to $1.1054 per euro and rallies in the Australian and New Zealand dollars paused for breath, with the Aussie knocked down nearly 0.8% to $0.6740 and the kiwi down 0.7% to $0.6192. [AUD/]

In Hong Kong, shares in property company New World Development slumped to a two-decade low after the company estimated a $2.6 billion loss for the year to June.

China’s banking index fell 1.8% as four of the country’s five largest lenders reported lower second-quarter profit, weighed by the property sector crisis.

Gold hovered at $2,494 an ounce after hitting a record high above $2,500 in August.

Oil prices have struggled for traction as demand worries weigh against tensions in the Middle East, and Brent crude futures slipped 0.5% to $77.13 a barrel.

(Reporting by Tom Westbrook; Editing by Shri Navaratnam and Kim Coghill)

Shaq Refused To Pay $80,000 For Security And Made A Surprising Choice. He Invested In A Company Bezos Later Bought For $1 Billion

Shaquille O’Neal is known for his dominance on the basketball court, but his business moves off the court are just as impressive. One of the most surprising stories about Shaq isn’t about a slam dunk or a championship win — it’s about how he turned a simple home security issue into a multi-million-dollar investment.

Don’t Miss:

Shaq has three homes in Atlanta, where he’s lived for years, and he needed a new security system for one of them. When he contacted a security company, they quoted him $80,000. Even though he’s worth millions, Shaq knew that price was way too high. So, he did what many of us would do and looked for a cheaper solution. While shopping at Best Buy, he spotted some Ring cameras and decided to buy one.

“The crazy thing about it is I hooked it up myself,” Shaq said, clearly proud of his DIY skills. He installed the camera, and then, while traveling in China, he realized just how powerful the system was. He could see and talk to someone at his front door from halfway around the world. That’s when it clicked for Shaq — this wasn’t just a good product but a game-changer.

Trending: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

Excited about what he had discovered, Shaq decided to take things a step further. He tracked down the company’s booth at a tech conference and made a bold offer to the CEO. “I said, ‘Hey, my name is Shaquille O’Neal. I want to invest in your company, and you’re going to pay me to do commercials, and then whatever happens happens,'” Shaq recounted. The CEO agreed, and Shaq became an early investor in Ring.

A few years later, Jeff Bezos bought Ring for $1 billion. Shaq’s decision to invest in this still relatively unknown company saved him money on his home security and made him a lot of money in return. How much exactly? He never disclosed.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

But this wasn’t Shaq’s first smart investment. In 1999, while still in his NBA prime, Shaq’s agent introduced him to Ron Conway, a top venture capitalist. During a lunch at the Four Seasons, Conway pitched him on investing in a little-known company called Google. Shaq invested $250,000, which grew significantly as Google became a tech giant.

He said, “We had a meeting with them and it looked good, and I put some money in and forgot about it.”

Shaq’s portfolio doesn’t stop there. He’s also invested in companies like Lyft, Apple and Vitaminwater. With Lyft, he jumped in just a year after it was founded, and when the company went public in 2019, it was valued at $22 billion.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Shaq Refused To Pay $80,000 For Security And Made A Surprising Choice. He Invested In A Company Bezos Later Bought For $1 Billion originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Tech Stock Has Gone Parabolic, and You Should Consider Buying It Before It Soars Even Higher

Fortinet (NASDAQ: FTNT) released its second-quarter 2024 results on Aug. 6, and the stock has witnessed a massive surge of 35% since then thanks to impressive growth in its revenue and earnings that were enough to help it beat Wall Street’s expectations.

The cybersecurity specialist also raised its full-year revenue guidance. This further explains why the stock has made a parabolic move, a phenomenon that refers to the rapid increase in the share price of a company within a short time, just like the right side of a parabolic curve.

The good news for investors is that Fortinet stock could continue to head higher thanks to the company’s focus on tapping fast-growing niches of the cybersecurity market, which should allow it to profit from a massive addressable market in the long run.

Fortinet’s growth is likely to improve

Fortinet delivered Q2 revenue of $1.43 billion, an increase of 11% from the same quarter last year. Its non-GAAP net income grew at a much faster pace of 50% from the year-ago quarter, to $0.57 per share, thanks to a reduced share count due to buybacks, lower indirect costs, and the growing demand for its higher-margin security subscription offerings.

Fortinet’s non-GAAP operating margin jumped from 26.9% to 35.1% as the proportion of service-based revenue increased on a year-over-year basis. More specifically, Fortinet’s service revenue increased nearly 20% year over year to $982 million, accounting for 69% of its top line. That was an improvement from the same quarter last year when service revenue accounted for 63% of its top line.

There is still a lot of room for growth in Fortinet’s service revenue, which also means that the company’s margin profile could continue to improve. The good part is that the improvement in Fortinet’s deferred revenue indicates that its revenue from sales of security subscriptions could continue improving.

The company’s deferred revenue increased 15% year over year to $5.9 billion in the second quarter, outpacing the growth in its top line. This metric refers to the money that’s collected in advance by a company for services that will be rendered in the future. Once Fortinet delivers those services, it will be able to recognize the deferred revenue on the income statement as actual revenue.

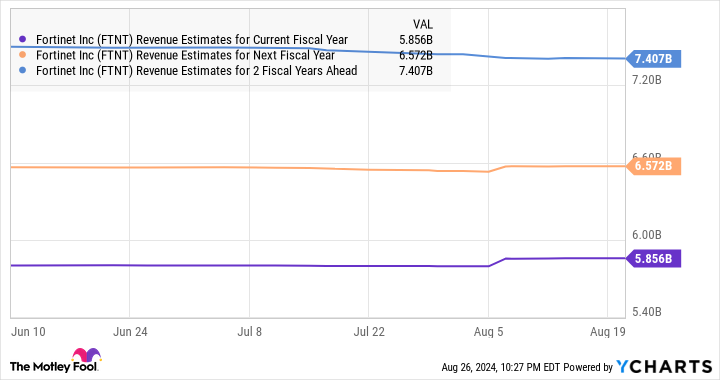

Given that the company expects its addressable market to jump to a whopping $228 billion in 2028, there is a lot of room for Fortinet to grow, considering that it is expecting its 2024 revenue to land at $5.85 billion. That would be a 10% jump from last year, but as the following chart indicates, Fortinet’s growth is expected to pick up going forward.

Is the stock worth buying right now?

Fortinet is now trading at 44 times trailing earnings following its red-hot rally. That is a bit lower than the U.S. technology sector’s average price-to-earnings ratio of almost 46. Fortinet’s forward earnings multiple of 39 points toward an improvement in its bottom line, and the good part is that analysts are now expecting a stronger bottom-line performance from the company.

The forecast for the next five years is also bright, with Fortinet expected to clock an annual earnings growth rate of 15%. So, let’s do some math.

Assuming it can indeed notch such solid growth on the back of the huge addressable opportunity it is sitting on, its earnings could jump to $4.10 per share after five years (using fiscal 2024’s projected earnings of $2.04 per share as the base).

The Nasdaq-100 index has an average forward price-to-earnings ratio of 29 (using the index as a proxy for tech stocks). Assuming Fortinet trades at a similar multiple after five years (which would be a significant discount to its current earnings multiple), its stock price could jump to $119 (based on the projected earnings of $4.10 per share calculated above).

These calculations point toward a 58% jump from current levels, which is why investors might want to consider buying this cybersecurity stock despite the terrific gains that it has clocked of late.

Should you invest $1,000 in Fortinet right now?

Before you buy stock in Fortinet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fortinet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Fortinet. The Motley Fool has a disclosure policy.

This Tech Stock Has Gone Parabolic, and You Should Consider Buying It Before It Soars Even Higher was originally published by The Motley Fool

54-Year-Old Woman With No 401(k) And Only $12,000 In Savings Seeks Suze Orman's Advice, Orman Says 'Put $8,000 Into A Roth IRA'

Suze Orman frequently offers financial advice to those who write into her “Women & Money” podcast. Recently, 54-year-old Kim reached out about how to make the most of her $12,000 savings.

Don’t Miss:

Kim disclosed that she doesn’t have any retirement plans or investment assets. The only money she has saved is that $12,000. Her employer offers a 401(k), but they don’t offer a match on it, so she hasn’t started it. The only debt she has is $4,000 left on a car loan. “I want to create the most security for my future, especially at my age,” Kim wrote.

See Also: The number of ‘401(k)’ Millionaires is up 43% from last year — Here are three ways to join the club.

Immediately, Orman advised against starting the employer 401(k). “Given the fact that your company does not match the 401(k), I don’t want you to put a penny in their 401(k). Useless.”

From there, Orman outlines three things Kim should do to maximize her savings. First, Orman tells Kim to put $8,000 into a Roth IRA. She recommends putting it into a money market account, making around 4%.

In 2024, the contribution limit for Roth IRAs is $8,000 if you’re 50 or older ($7,000 if you’re younger than 50). The benefit of this strategy is that Kim can still access her contributions tax and penalty-free, as long as she doesn’t touch her earnings on those contributions.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

The second piece of advice Orman gives Kim is to open an Ultimate Opportunity Savings Account with Alliant Credit Union. “I would put $100 a month in every single month,” Orman says. “It will be earning 3.1 percent interest. Again, if you need it, you can get it any time you want, but it will be earning 3.1 percent interest. But at the end of those 12 months, they will give you $100.”

The last thing Orman addressed was Kim’s car loan. She advised Kim to pay that off quickly with anything she had left. The fewer expenses Kim has, the more she’ll be able to save and put toward securing her financial future.

Trending: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

Kim isn’t alone in this situation. According to an AARP survey, 20% of Americans ages 50 and up don’t have retirement savings. And 61% of this demographic are worried they won’t have enough money to support themselves in retirement.

“America is facing a serious retirement crisis. AARP has a long history of supporting legislation to expand access to retirement savings. Still, Congress must act more swiftly to provide the financial support older Americans need and deserve,” said Nancy LeaMond, AARP Executive Vice President and Chief Advocacy & Engagement Officer.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 54-Year-Old Woman With No 401(k) And Only $12,000 In Savings Seeks Suze Orman’s Advice, Orman Says ‘Put $8,000 Into A Roth IRA’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Argentina Ships Gold Bars Abroad to Be Financially Certified

(Bloomberg) — Argentina’s central bank sent part of its gold reserves abroad in recent weeks to be validated for financial use, a move that could give the country some much-needed flexibility, according to people with direct knowledge of the matter.

Most Read from Bloomberg

Once certified, the gold could eventually be used as collateral to obtain financing, according to one of the people, who asked not to be identified discussing private information. Before the move, about half of Argentina’s gold was in domestic vaults with the other half in London, another person said.

Officials from the central bank, known by its Spanish acronym BCRA, declined to comment on the matter.

The monetary authority separately confirmed Monday it had sent gold between its accounts, mentioning both ones in the country and others abroad. However, the bank didn’t say how much of its nearly $5 billion in gold was shipped, for what reason or to where.

Bank officials also criticized what they called “irresponsible” reports about the gold going abroad, emphasizing that management of reserves has always been kept confidential.

Newspaper Pagina 12 published a video Aug. 19 of a truck emblazoned with the BCRA logo driving on the highway, reporting that it was en route to the main international airport in Buenos Aires with $250 million of gold bars.

The gold maneuvers highlight the long-term challenges Argentine President Javier Milei faces. Precariously low international reserves are impeding his ability to lift currency controls and raising investor concern about his administration’s ability to pay down its debts.

Economy Minister Luis Caputo said last week that the government would make debt payments due in January 2025, but wouldn’t seek new international financing until early 2026.

It’s not clear how Caputo and Central Bank Governor Santiago Bausili will use the gold that’s been transferred abroad to be certified. But the economy minister has already said the government is negotiating a special purchase vehicle, or repo agreement, with commercial banks.

To be considered valid for financial use, gold must meet standards set by the London Bullion Market Association. Once certified, bars can be traded freely between institutions within the market, according to the LBMA website.

Argentina’s central bank has more liabilities than cash, a problem known as net negative reserves. A balance sheet in the red has long fueled investor distrust of the peso and kept most sovereign debt hovering below 60 cents to the dollar, though it’s rallied since Milei won power last year. Net reserves are currently at about negative $6.9 billion, according to local brokerage Portfolio Personal Inversiones.

The central bank already used some of its gold during Federico Sturzenegger’s tenure as head of the institution from 2015 to 2018. At the time, it carried out futures operations to earn returns on a portion of its gold reserves.

Caputo defended sending the precious metal abroad in a July interview with local television channel LN+. “If you have gold abroad, you can obtain a return — and the country needs to maximize the returns of its assets,” he said.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Want to Outperform 88% of Professional Fund Managers? Use This Simple Investment Strategy.

Becoming a professional fund manager isn’t easy, but it turns out that beating the returns of some of the best fund managers in the world is. It’s a quirk of stock market mechanics that makes a simple investment strategy far better than the average actively managed mutual fund. While it might be possible for many professional funds to outperform over the short run, it gets harder and harder as time goes on.

There’s a big drag on active funds’ investment returns: fees. As a result, just 12% of active mutual funds outperformed the S&P 500 index over the past 15 years, according to S&P Global‘s SPIVA scorecard. Identifying those 12% ahead of time is practically impossible, so the best strategy to outperform professional fund managers is to buy a simple S&P 500 index fund like the Vanguard S&P 500 ETF (NYSEMKT: VOO).

It’s not going to turn heads when you mention it at your next dinner party, but it does offer one of the highest expected returns of any single investment you can buy. And it’ll do far better than an actively managed mutual fund picked by random chance.

Why it’s so hard for professionals to outperform

By and large, institutional investors account for the vast majority of trading volume, especially among large-cap stocks. Institutional investors typically account for 85% of trading volume. Individual investors aren’t nearly as active in the market, and they hold much less capital.

In other words, professionals, as a group, are extremely representative of the overall market. As such, the average professional investor should only expect to produce returns in line with the overall market returns.

The underperformance problem arises because professional fund managers charge high fees for their services. These fees come in the form of expense ratios and fund loads. The median expense ratio on an actively managed mutual fund last year was 1.01%.

A 1% drag on average investment returns leads to significant underperformance over time. That’s why the SPIVA scorecard shows over 40% of fund managers outperforming over the past year, but just 12% outperforming over the past 15 years.

Yes, there are fund managers that can consistently outperform the index in most years, earning their fees. However, it’s hard to determine who those fund managers are ahead of time. Basing an investment decision on past performance rarely works out. Of the large-cap funds that were in the top quartile of performers in 2019, not a single one remained in the top quartile over the next four years. In fact, fund performance is less persistent than what’s expected under random distribution.

Lower your cost of market participation

Several investors have expounded on the keys to successful investing, but by far one of the biggest factors is controlling your cost of participation. Vanguard founder Jack Bogle coined the idea of the cost matters hypothesis: “Gross returns in the financial market minus the costs of financial intermediation equal the net returns actually delivered to investors.”

Warren Buffett echoes the idea in his 2005 letter to shareholders where he tells the parable of the Gotrocks family. The family once owned every American corporation, but saw their wealth destroyed by “helpers” promising to help individual family members outperform their relatives for just a small fee. He concluded with a simple analogy to Newton’s laws of motion: “For investors as a whole, returns decrease as motion increases.”

The simplest way to reduce motion and keep your helper fees low is to buy an index fund. The Vanguard S&P 500 ETF has an expense ratio of just 0.03% and and extremely low tracking error. It only trades when changes are made to the S&P 500 index each quarter, and it rarely produces a taxable event for its shareholders. The results are net returns extremely close to the gross returns of the constituents of the S&P 500 index.

While a hot, actively managed mutual fund and a star fund manager may look attractive, digging into the data suggests it’s probably not a smart investment. On average, things will work out much better if you focus on the fund with the lowest fees over the past year instead of the fund with the best performance.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends S&P Global and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Want to Outperform 88% of Professional Fund Managers? Use This Simple Investment Strategy. was originally published by The Motley Fool

Watch These Intel Stock Levels as CEO Reportedly Preparing Plans to Sell Assets, Cut Costs

Key Takeaways

-

Intel shares remain in focus this week after Reuters reported on Sunday that CEO Pat Gelsinger and other senior executives are expected to present plans later this month that involve shedding assets and reducing capital expenditures, as part of an effort to turn the company’s fortunes around.

-

Since gapping down more than 26% in early August following the company’s quarterly results, Intel shares have carved out two troughs, raising the possibility of a double bottom, a chart pattern that typically marks a trend reversal back to the upside.

-

Investors should watch key overhead chart levels in Intel shares at $25, $30, $32.25, and $37.

Intel (INTC) shares remain in focus this week after Reuters reported on Sunday that CEO Pat Gelsinger and other senior executives are expected to present plans later this month that involve shedding assets and reducing capital expenditures in an effort to turn the company’s fortunes around.

On Friday the stock surged more than 9% after Bloomberg reported that the chipmaker is considering spinning off or selling its foundry business, a loss-making division that makes chips for third party customers. However, sources told Reuters that the company does not yet have plans to sell its contract manufacturing operation, but was considering divesting its Altera programmable chip unit.

Even after Friday’s jump, Intel shares have tumbled more than 56% since the start of the year, with falls accelerating last month after the chipmaker’s disappointing second-quarter earnings report. The company also announced a pause to its dividend payment and a 15% workforce reduction aimed at saving $10 billion.

Below, we’ll take a closer look at Intel chart and use technical analysis to point out important price levels to watch.

Double Bottom Pattern in Play

Since gapping down more than 26% in early August following the company’s quarterly results, Intel shares have carved out two troughs, raising the possibility of a double bottom, a chart formation that typically marks a trend reversal back to the upside.

Although the chipmaker’s stock closed above the pattern’s neckline on Friday on above-average trading volume, investors should watch for a more decisive breakout this week for added confirmation of a valid signal.

Watch These Key Overhead Intel Chart Levels

Amid further bullish price action in the stock, market participants should monitor four specific overhead chart levels likely to attract interest.

The first sits around $25, a region where investors who bought near recent lows may look to lock in profits near two prominent troughs that formed in October 2022 and February 2023.

Further upside could see a move up to $30, a location that may encounter resistance from a horizontal line linking multiple peaks and troughs in the stock between November 2022 and July this year.

A successful close above this level could see the shares climb to the $32.25 area, where they may run into selling pressure near a trendline joining the August and October 2023 swing lows with more recent trading levels from May to July this year.

Ongoing buying may see the stock rally to $37. This area currently finds a confluence of resistance from downward sloping 200-day moving average (MA) and multiple price peaks that formed on the chart between June 2023 and July 2024.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info.

As of the date this article was written, the author does not own any of the above securities.

Read the original article on Investopedia.

This Risk Weighs on Investors' Minds as Nvidia Continues to See Explosive Growth. Is the Stock Still a Buy?

Over the past few years, Nvidia (NASDAQ: NVDA) has been one of the hottest stocks, thanks to its astronomical growth. However, the stock fell after the chipmaker announced its fiscal second quarter earnings last week, despite incredible growth that surpassed analysts’ expectations. The market wasn’t impressed.

Let’s take a closer look at the company’s latest quarterly results and the one risk that appears to be weighing on investors’ minds.

Outstanding revenue growth continues

For its fiscal second quarter, Nvidia saw sales soar 122% year over year to $30 billion. Adjusted earnings per share (EPS) came in at $0.68, up 152%. Now admittedly that was a slowdown from the 262% revenue growth and 461% adjusted EPS growth it saw in Q1, but still incredible growth.

Its data center business once again led the way with revenue surging 154% to $26.2 billion. The company credited its growth to its Hopper graphics processing unit (GPU) computing platform, and in the quarter in began ramping up its newest H200 Hopper chip.

Gross margins fell sequentially as Nvidia scaled up its new Blackwell chips, but still remained a robust 75.1%. That was down from 78.4% in Q1.

Nvidia is also generating an enormous amount of cash, with operating cash flow of $14.5 billion in the quarter. Free cash flow came in at $13.5 billion.

It ended the quarter with net cash and marketable securities of $26.3 billion. It also announced a new $50 billion share repurchase program.

Looking ahead, the company guided for Q3 revenue of $32.5 billion, led by Hopper growth and the shipping of samples of its new Blackwell architecture. It called demand for Blackwell “incredible” and said that the transition to its next-generation architecture will be smooth, with demand for both Hopper and Blackwell chips expected to remain strong.

Nvidia noted that it did have to make a change to Blackwell to improve production yields but that it expects production to ramp up in the fourth quarter. It said no functional changes were necessary. Last quarter, it indicated production would ramp up in Q3. It is now expecting to recognize several billion dollars in Blackwell revenue in Q4. This is good news and assuages fears that there could have been a longer delay.

It predicted that its data center business would continue to grow strong into next year and beyond. It noted that computing power for next-generation large language models (LLMs) would require 10 to even 40 times the computing power as the prior generation and that the need for more and more computing power would persist.

Is now the time to buy the stock?

Despite its spectacular growth, robust gross margins, and opportunities in front of it, Nvidia trades at a relatively modest valuation, with a forward price-to-earnings ratio (P/E) of just 30 times next year’s analyst estimates.

Given the need for ever-increasing computing power to train more complex AI models and the spending large tech companies are doing to advance AI, Nvidia appears to still have a long runway of growth in front of it. Combine that with a very reasonable valuation, and the stock looks like a buy.

The one big risk the stock faces and the question on many investors’ minds is if all the spending on AI will result in a payoff for the companies doing the spending. Now, companies with cloud computing segments like Microsoft, Alphabet, and Amazon are seeing some benefits, and companies like Meta Platforms and Apple are also investing heavily in AI.

However, these benefits will also need to trickle down to software companies that are developing AI applications and their customers. Right now, a lot of money is being spent on AI infrastructure to the benefit of Nvidia, but there is still an ongoing debate as to whether other companies will see these investments pay off. If they do not, then the spending on AI infrastructure could ultimately slow down significantly.

So while Nvidia continues to look like a buy, the one thing investors should really monitor is if software company growth can begin to increase due to AI. If these companies do not begin seeing growth ramp up in the next year or so, that could be the proverbial canary in the coal mine regarding Nvidia’s valuation.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This Risk Weighs on Investors’ Minds as Nvidia Continues to See Explosive Growth. Is the Stock Still a Buy? was originally published by The Motley Fool

Investigating Microsoft's Standing In Software Industry Compared To Competitors

In today’s rapidly changing and fiercely competitive business landscape, it is vital for investors and industry enthusiasts to carefully evaluate companies. In this article, we will perform a comprehensive industry comparison, evaluating Microsoft MSFT against its key competitors in the Software industry. By analyzing important financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company’s performance within the industry.

Microsoft Background

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Microsoft Corp | 35.01 | 11.44 | 12.59 | 8.45% | $34.33 | $45.04 | 15.2% |

| Oracle Corp | 37.58 | 44.14 | 7.43 | 43.89% | $6.21 | $10.36 | 3.26% |

| ServiceNow Inc | 150.59 | 19.75 | 17.29 | 3.12% | $0.48 | $2.08 | 22.19% |

| Palo Alto Networks Inc | 49.20 | 22.53 | 15.80 | 7.42% | $0.32 | $1.62 | 10.31% |

| CrowdStrike Holdings Inc | 393.72 | 23.34 | 19.18 | 1.75% | $0.12 | $0.73 | 31.74% |

| Fortinet Inc | 45.13 | 202.43 | 10.69 | 504.05% | $0.5 | $1.16 | 10.95% |

| Gen Digital Inc | 27.52 | 8.25 | 4.40 | 8.69% | $0.54 | $0.78 | 2.33% |

| Monday.Com Ltd | 321.89 | 14.46 | 15.74 | 1.62% | $0.0 | $0.21 | 34.4% |

| Dolby Laboratories Inc | 32.82 | 2.80 | 5.54 | 1.58% | $0.06 | $0.25 | -3.2% |

| CommVault Systems Inc | 39.34 | 23.67 | 7.95 | 6.62% | $0.02 | $0.18 | 13.38% |

| Qualys Inc | 27.75 | 10.82 | 8.14 | 10.52% | $0.05 | $0.12 | 8.38% |

| Teradata Corp | 44.19 | 36.24 | 1.58 | 57.36% | $0.09 | $0.27 | -5.63% |

| Progress Software Corp | 35.74 | 6.20 | 3.65 | 3.75% | $0.05 | $0.14 | -1.78% |

| N-able Inc | 71.67 | 3.30 | 5.38 | 1.32% | $0.03 | $0.1 | 12.6% |

| Average | 98.24 | 32.15 | 9.44 | 50.13% | $0.65 | $1.38 | 10.69% |

After examining Microsoft, the following trends can be inferred:

-

With a Price to Earnings ratio of 35.01, which is 0.36x less than the industry average, the stock shows potential for growth at a reasonable price, making it an interesting consideration for market participants.

-

Considering a Price to Book ratio of 11.44, which is well below the industry average by 0.36x, the stock may be undervalued based on its book value compared to its peers.

-

The stock’s relatively high Price to Sales ratio of 12.59, surpassing the industry average by 1.33x, may indicate an aspect of overvaluation in terms of sales performance.

-

The company has a lower Return on Equity (ROE) of 8.45%, which is 41.68% below the industry average. This indicates potential inefficiency in utilizing equity to generate profits, which could be attributed to various factors.

-

The company exhibits higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $34.33 Billion, which is 52.82x above the industry average, implying stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $45.04 Billion, which indicates 32.64x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 15.2% is notably higher compared to the industry average of 10.69%, showcasing exceptional sales performance and strong demand for its products or services.

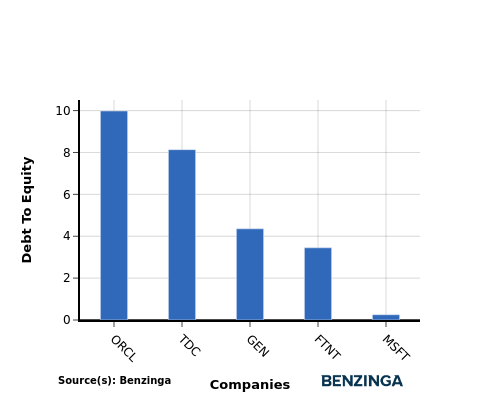

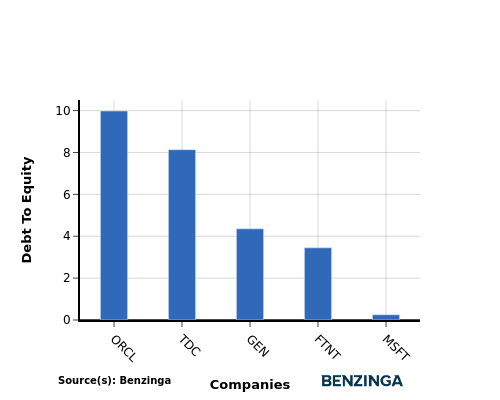

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company’s financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

In light of the Debt-to-Equity ratio, a comparison between Microsoft and its top 4 peers reveals the following information:

-

Microsoft is in a relatively stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.25.

-

This implies that the company relies less on debt financing and has a more favorable balance between debt and equity.

Key Takeaways

For Microsoft in the Software industry, the PE and PB ratios suggest the stock is undervalued compared to peers, indicating potential for growth. However, the high PS ratio implies the stock may be overvalued based on revenue. In terms of ROE, EBITDA, and gross profit, Microsoft shows strong performance, indicating efficient operations and profitability. The high revenue growth further supports Microsoft’s competitive position in the industry.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'The Time Has Come to Adjust' — Cheaper Mortgage Rates Could Be Just Weeks Away, But It All Hinges On This Data

The era of interest rates at two-decade highs may be drawing to a close, with Federal Reserve Chair Jerome Powell hinting at possible cuts as early as September. But for hopeful homebuyers eyeing cheaper mortgages, the path forward is still unclear.

Don’t Miss:

Last week, at the central bank’s annual gathering in Jackson Hole, Wyoming, Powell struck a cautiously optimistic tone. “The time has come for policy to adjust,” he said, confirming the Fed’s intention to begin easing its monetary stance.

The shift departs from the aggressive rate-hiking campaign of the past two years, designed to tame runaway inflation. Now, with price increases cooling, the Fed faces the challenge of supporting economic growth without reigniting inflationary pressures.

Trending:

While Powell’s remarks clearly signaled that rate cuts are on the horizon, the timing and pace remain uncertain. “The direction of travel is clear,” he said, “but the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

The key variable in this is the labor market.

The Sept. 6 jobs report looms large on the Fed’s radar. A softer-than-expected report could push the central bank toward a more aggressive 50-basis point cut at its Sept. 18 meeting. A resilient job market, however, might prompt a more measured approach.

That uncertainty has left financial markets in a state of cautious optimism. Futures markets are currently split, with a two-thirds probability of a standard 25-basis point cut in September and a one-third chance of a bolder 50-basis point reduction.

See Also:

For potential homebuyers, that translates into a waiting game. While mortgage rates edged down in response to Powell’s remarks, steeper drops may not materialize immediately.

“Additional weak labor market data leading to a series of larger than 25 bps cuts will mean that mortgage rates will fall through the end of the year,” noted Chen Zhao, economics team lead at Redfin. “But a stable, or even falling, unemployment rate will allow the Fed to cut 25 bps at a time and may lead to mortgage rates ticking up a bit from today’s lows through the end of the year.”

Trending:

The Fed’s evolving stance reflects a growing confidence in its battle against inflation. Powell acknowledged that inflation, measured by the Fed’s preferred gauge, has fallen to 2.5%.

“My confidence has grown that inflation is on a sustainable path back to 2%,” he said during his speech, hinting at the possibility of achieving the much sought-after “soft landing.”

The Fed chair also said policymakers had miscalculated the inflationary threat when it emerged in 2020. “The good ship Transitory was a crowded one,” he said, referring to the widespread initial belief that price pressures would be short-lived.

Read Next:

As the Fed navigates the next phase, the housing market grapples with affordability challenges, even as the prospect of lower rates offers some hope.

For now, investors will turn to the upcoming jobs report.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.