MDB INVESTOR ALERT: Bronstein, Gewirtz & Grossman LLC Announces that MongoDB, Inc. Investors with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK, Sept. 02, 2024 (GLOBE NEWSWIRE) — Attorney Advertising–Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against MongoDB, Inc. (“MongoDB” or “the Company”) MDB and certain of its officers.

Class Definition

This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired MongoDB securities between August 23, 2023, and May 30, 2024, inclusive (the “Class Period”). Such investors are encouraged to join this case by visiting the firm’s site: bgandg.com/MDB.

Case Details

The complaint alleges that on March 7, 2024, MongoDB reported strong Q4 2024 results and then announced lower-than-expected full-year guidance for 2025. The Complaint adds that the Company attributed this to a change in its “sales incentive structure,” which led to a decrease in revenue related to “unused commitments and multi-year licensing deals.” Following this news, MongoDB’s stock dropped $28.59 per share to close at $383.42. Then, on May 30, 2024, MongoDB further lowered its guidance for the full year 2025, attributing it to “macro impacting consumption growth.” Analysts commenting on the reduced guidance questioned whether changes to the Company’s marketing strategy “led to change in customer behavior and usage patterns.” Following this news, MongoDB’s stock dropped $73.94 per share to close at $236.06.

What’s Next?

A class action lawsuit has already been filed. If you wish to review a copy of the Complaint, you can visit the firm’s site: bgandg.com/MDB or you may contact Peretz Bronstein, Esq. or his Client Relations Manager, Nathan Miller, of Bronstein, Gewirtz & Grossman, LLC at 332-239-2660. If you suffered a loss in MongoDB you have until September 9, 2024, to request that the Court appoint you as lead plaintiff. Your ability to share in any recovery doesn’t require that you serve as lead plaintiff.

There is No Cost to You

We represent investors in class actions on a contingency fee basis. That means we will ask the court to reimburse us for out-of-pocket expenses and attorneys’ fees, usually a percentage of the total recovery, only if we are successful.

Why Bronstein, Gewirtz & Grossman

Bronstein, Gewirtz & Grossman, LLC is a nationally recognized firm that represents investors in securities fraud class actions and shareholder derivative suits. Our firm has recovered hundreds of millions of dollars for investors nationwide.

Attorney advertising. Prior results do not guarantee similar outcomes.

Contact

Bronstein, Gewirtz & Grossman, LLC

Peretz Bronstein or Nathan Miller

332-239-2660 | info@bgandg.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Growth Stock Down 81% to Buy Right Now

Not that long ago, Etsy (NASDAQ: ETSY) was one of the top companies that investors could have owned. From the pandemic low in March 2020 to their all-time high in November 2021, shares skyrocketed 837%.

But slowing growth and the market’s disdain for growth tech stocks pressured investor sentiment. Etsy currently trades 81% below its peak price. But it’s still a smart buying opportunity right now.

Zoom in

Etsy’s growth was through the roof in 2020 and 2021. The company was adding buyers and sellers to its platform. Its gross merchandise sales (GMS) were soaring. Demand was very strong.

However, the normalization of consumer behavior, with people starting to leave their homes to shop again, created the perfect headwind for Etsy. It also didn’t help that inflation started to rear its ugly head about three years ago.

The slowdown has continued. In the most recent quarter (Q2 2024, ended June 30), Etsy posted a 2.1% year-over-year GMS decline. That figure was slightly lower than in the same period three years before. It makes sense that consumers are pulling back on discretionary spending when it seems like the price of everything has gone up in the past couple of years.

GMS is expected to fall again in the current quarter.

Zoom out

It’s understandable for investors to get caught up in quarterly financial figures. But if you’re a long-term stock market participant, then it’s always best to zoom out and focus on the bigger picture. With this perspective, it’s easy to still have a favorable view of Etsy’s business.

The company is truly differentiating itself. There are wide product assortments in various categories, like home furnishings, apparel, jewelry, and craft supplies tailored to specific needs. According to a survey, 83% of buyers agreed that Etsy sold items that they couldn’t find anywhere else.

The retail sector broadly, and the e-commerce niche specifically, is hyper-competitive. All companies operating in the industry must constantly worry about Amazon‘s presence. But while the tech titan thrives when it comes to mass-produced goods and fast shipping, Etsy draws in shoppers looking for unique offerings. This is a key competitive strength.

What’s more, Etsy’s two-sided ecosystem, as demonstrated by its 96.6 million active buyers and 8.8 million active sellers, is supported by network effects. Consumers want to come to the site because there are so many specialized goods being sold. Small merchants and entrepreneurs looking to showcase their craft might find no better platform to set up shop to target a global customer base.

Cheap stock

The S&P 500 has climbed 19% since Etsy hit its all-time high. However, the e-commerce stock has lost 81% of its value during the same time. That’s an alarming trend.

However, it means that shares are cheap. They trade at a forward price-to-earnings ratio of 12.2, the lowest valuation in almost the last three years. This depressed multiple suggests that Etsy is a terrible business. And that’s just not true. I already talked about its differentiated marketplace offerings and the presence of network effects.

Also, consider the total addressable market, which management estimates is $500 billion (counting online sales of all relevant product categories) in its six core geographies, which includes the U.S., U.K., Canada, Australia, France, and Germany.

Plus, Etsy is a consistently profitable enterprise that rakes in lots of free cash flow every quarter. This reduces financial risk.

Depending on the state of the economy and the direction of interest rates and inflation, the fear is that the difficult times for Etsy could last for a few more quarters before things start to improve. But this is precisely where the opportunity lies for investors. I believe that three to five years down the road, this stock could be a big winner for your portfolio.

Should you invest $1,000 in Etsy right now?

Before you buy stock in Etsy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Etsy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Etsy. The Motley Fool has a disclosure policy.

1 Growth Stock Down 81% to Buy Right Now was originally published by The Motley Fool

UBS Sees the S&P 500 Surging to 6,200 by Next Year — Here Are 2 Stocks to Ride the Wave

As summer draws to a close, market watchers are witnessing a mix of resilience and challenges. The S&P 500 has showcased its strength with an 18% year-to-date gain, currently just 19 points shy of its all-time high. However, with uncertainties around US growth and the November elections, investors are carefully weighing their next moves.

So, where might the markets go from here? This is what every investor wants to know, and what every savvy analyst is striving to predict.

In a recent note, UBS’ investment office shared its forecast for the market’s direction in the coming months, noting: “We see room for US equities to rise further in a constructive environment driven by Fed rate cuts, the growth story around artificial intelligence (AI), and healthy earnings growth. We forecast the S&P 500 to rise to 5,900 by year-end and 6,200 by June 2025.”

The stock analysts at UBS are backing up this outlook by selecting the stocks they believe will ride this wave to gains. Let’s dive into two of their picks, each with a potential upside of at least 50%.

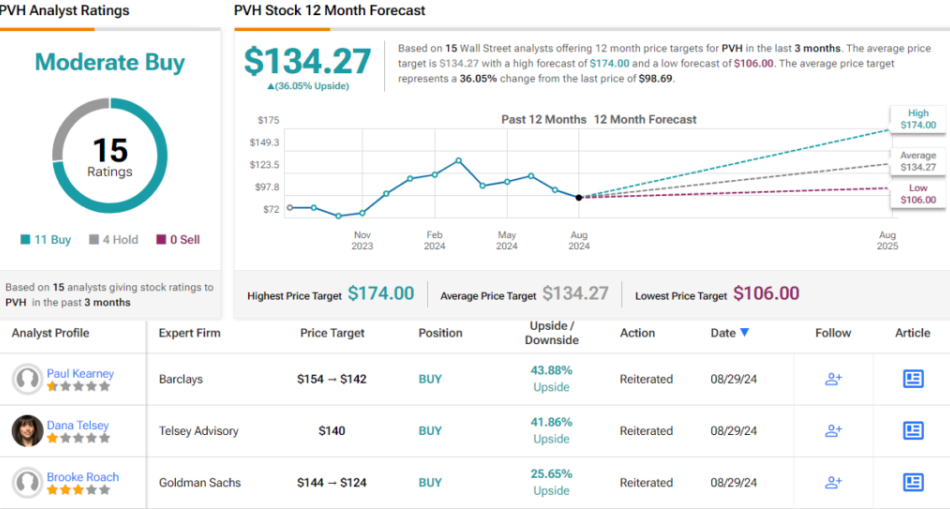

PVH Corporation (PVH)

The first stock we’ll look at is PVH, a clothing company that traces its roots, in part, to the garment industry of New York City in the 1880s and 1890s. Today, the company is the owner of the popular Tommy Hilfiger and Calvin Klein clothing lines, marketing these brands, and others, through department stores and branded retail locations. The company is truly international, generating more than 65% of its revenue outside of the US markets, and operating in over 40 countries around the world.

PVH’s goal is simple: the company aims to make Hilfiger and Calvin into the world’s most desirable lifestyle brands. The company has a detailed plan to accomplish this, including developing the best products and the best customer engagement, and using data-driven operations and efficiencies to win in a digital world. PVH’s activities are split among three main regions: North America, Europe, and the Asia-Pacific.

Despite some recent challenges, including a decline in revenue due to sluggish sales, PVH has managed to remain highly profitable. In its latest report for fiscal 2Q24, PVH posted a 6.3% year-over-year revenue decline, bringing in $2.07 billion. While this represented a dip from the previous year, it was in line with expectations. On the earnings front, PVH delivered strong results, with a non-GAAP EPS of $3.01 per share, surpassing forecasts by 73 cents.

Furthermore, PVH has been able to shore up its cash position. In the prior-year quarter, the company reported $372.8 million in cash liquid assets; in the current report, that figure was up significantly, to $610 million.

The sound cash balance and the ability to maintain earnings growth caught the attention of UBS analyst Jay Sole, who writes about the company: “We think PVH has the brand strength and balance sheet to drive earnings growth over the long term. We forecast the company delivering a 10.5% 5-yr. EPS CAGR. We also expect major margin unlocks in the next few years, as CEO Stefan Larsson’s PVH+ Plan goes into full effect. As PVH’s earnings rebound and long-term drivers become clear, we expect stock’s ~8x FY2 P/E to expand towards our ~12x target valuation.”

For Sole, PVH deserves a clear Buy rating, with a $174 price target that implies a one-year upside potential of 76%. (To watch Sole’s track record, click here)

Overall, PVH has earned a Moderate Buy rating from the Street’s analyst consensus, based on 15 recent reviews, including 11 Buys and 4 Holds. Currently trading at $98.69, the stock has an average target price of $134.27, suggesting a 36% gain over the next 12 months. (See PVH stock forecast)

Dayforce, Inc. (DAY)

The next UBS pick we’ll look at is Dayforce, an HCM software company. Until earlier this year, the company was called Ceridian; this past February, it changed its branding to Dayforce, which lines up with its chief product, the Dayforce HCM software platform.

HCM, or human capital management, is the moniker for a holistic approach to human resources in business. The Dayforce platform allows its users to manage vital functions of HR, payroll, and workforce management in a single, unified platform. The company has been in business since the early 1990s and generated more than $1.5 billion in revenue last year.

The company achieved that by offering a solid product that is tailored for today’s complex digital world. Dayforce promotes its platform as a solution to diverse HCM needs, leveraging AI technology to address complex issues and adapt to evolving challenges. Known for delivering ‘simplicity at scale,’ Dayforce facilitates easy management of functions and clear visibility of results. With over 6 million users globally, the platform serves a broad array of prominent organizations, including the City of Columbus, Danone, Gannett, and others. It’s available in more than 200 countries and territories, making it a truly global solution.

In its last reported financial results for Q2 2024, Dayforce achieved total revenues of $423.3 million, marking a nearly 16% year-over-year increase and surpassing forecasts by $5.87 million. Recurring revenue accounted for $321.6 million of this total, comprising nearly 76% of the revenue and growing 20% year-over-year. Net cash from operations also saw a significant year-over-year increase of 16%, reaching $108.3 million. At the bottom line, Dayforce delivered non-GAAP earnings of 48 cents per share, outperforming expectations by 12 cents per share.

UBS analyst Kevin McVeigh takes an unabashedly positive view of Dayforce, writing: “We continue to have substantial confidence in our thesis as we believe DAY stock is poised to outperform on cloud revenue remix + improving free cash flow conversion—we believe recent underperformance is mostly due to risk-off sentiment amid higher treasury yields and macro concerns. We believe this is more than discounted in the stock, which is poised to benefit on more constructive 10-year yields + fundamental performance.”

McVeigh’s optimism is reflected in his Buy rating for Dayforce stock, accompanied by a $90 price target – indicating a potential 57% gain in the months ahead. (To watch McVeigh’s track record, click here)

That’s the UBS perspective, but what does the broader Street think about Dayforce? With 8 additional Buys and 4 Holds, the stock claims a Moderate Buy consensus rating. The average target price of $68.92 suggests a potential 20.5% gain over the next year. (See Dayforce stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Warren Buffett's Career Advice: 'Don't Think About Money, Take The Job That You Would Take If You Didn't Need The Job'

Billionaire investor Warren Buffett shared some career advice as his company, Berkshire Hathaway, hit a $1 trillion market cap – a milestone that coincides with Buffett’s 94th birthday.

What Happened: The “Oracle of Omaha” has had a significant week. Berkshire Hathaway reached a market capitalization of $1 trillion on Wednesday. Buffett also celebrated his 94th birthday on Friday, with no intentions of retiring.

Buffett, who has led Berkshire Hathaway since 1965, offered his unique viewpoint on career decisions. He suggested to those seeking employment to “take the job that you would take if you didn’t need the job.”

Don’t Miss:

“You want to be doing something you would do if you didn’t need the money. And most people do need the money. But if you’re in the position where you don’t, you should be doing what you would if you didn’t need the money,” Buffett once told Fortune.

He added that he still finds joy in his role at Berkshire Hathaway, despite not needing to continue to work out of financial necessity.

Buffett admitted that his energy levels aren’t as high as they used to be, but feels lucky to be in an industry that allows him to continue working. He also confirmed that Greg Abel, his chosen successor, will assume control when he chooses to retire.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

“I am fortunately in a business where even though my muscles are gone, my balance is gone, my stamina is gone, it doesn’t make any difference in what I do, so I am very lucky in that way,” Buffett added.

Why It Matters: Buffett’s career advice comes at a time when his company has reached a significant milestone. His insights, drawn from decades of experience in the industry, could be invaluable for those navigating their career paths.

Furthermore, the confirmation of Greg Abel as his successor provides a sense of continuity for Berkshire Hathaway, ensuring that the company is in capable hands when Buffett decides to step down.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Warren Buffett’s Career Advice: ‘Don’t Think About Money, Take The Job That You Would Take If You Didn’t Need The Job’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Blackstone buys stake in $1.2 billion European logistics fund

LONDON (Reuters) – Private equity giant Blackstone has agreed to buy an 80% stake in a European warehouse portfolio run by landlord Burstone, the latest push by the U.S. investment manager into warehouses that have boomed alongside the rise of e-commerce.

The Johannesburg-listed company – formerly Investec’s property fund – has agreed to sell the controlling stake in the 1.1 billion euros ($1.2 billion) portfolio with properties in seven countries including Germany, France and the Netherlands to Blackstone, according to a Burstone stock exchange announcement.

Burstone will receive immediate cash proceeds of 250 million euros from the sale, the statement said, adding that the deal would help it fund expansion of the business. Burstone will retain a 20% interest in the portfolio and its European team will continue to manage it.

Blackstone has made a series of investments in European warehouse businesses in recent years including under the brand Mileway, a last-mile logistics company which Blackstone and existing investors recapitalised in 2022.

Logistics including warehouses have been a bright spot in a struggling commercial real estate market, as the boom in e-commerce creates demand for more space.

($1 = 0.9035 euros)

(Reporting by Iain Withers,; Editing by Tommy Reggiori Wilkes and Ed Osmond)

Warren Buffett's Favorite Stock to Buy Just Hit a Milestone That Only 8 Public Companies Have Ever Achieved

For nearly six decades, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has been put on a pedestal by Wall Street — and with good reason.

Since the “Oracle of Omaha,” as Buffett has come to be known, took the reins in the mid-1960s, he’s overseen a greater than 5,710,000% cumulative return in Berkshire’s Class A shares (BRK.A), as of the closing bell on Aug. 29. He’s also practically doubled up the annualized total return, including dividends, of the widely followed S&P 500 over the same span.

Riding Buffett’s coattails has been a winning strategy for long-term-minded investors. Thanks to quarterly filed Form 13Fs — a 13F allows investors an over-the-shoulder look at which stocks Wall Street’s top money managers bought and sold in the most recent quarter — mirroring the trading activity of Berkshire’s brightest minds, which includes Warren Buffett and his two investing “lieutenants,” Todd Combs and Ted Weschler, can be done with ease.

However, the true apple of Buffett’s eye, and the stock that recently hit a milestone just eight other public companies have ever achieved, won’t be found in Berkshire’s quarterly 13Fs.

The Oracle of Omaha has been a selective buyer of late

Despite being an avid proponent of the U.S. economy and American businesses, what Buffett and his team do over short periods doesn’t always mesh with the long-term ethos that Charlie Munger built at Berkshire Hathaway.

Based on both public 13Fs and Berkshire’s quarterly cash flow statements, investors will see that Buffett’s company has been a net-seller of equities for seven consecutive quarters, to the tune of almost $132 billion. With Buffett overseeing the sale of around $5.4 billion worth of Bank of America shares since mid-July, there’s a good chance we’ll witness this net-equity selling activity extend to an eighth quarter.

While Buffett has unwavering faith in the American economy over the long haul, he’s also a value investor at heart. He wants to pay a “fair price” for “wonderful companies,” and he’s willing to sit on his hands and wait until stock valuations make sense.

But this doesn’t mean Buffett’s buying activity has been nonexistent — it’s just very selective.

For instance, he’s been purchasing shares of integrated oil and gas company Occidental Petroleum (NYSE: OXY) with some degree of consistency since the start of 2022. Aside from providing in-demand energy commodities, Occidental is highly levered to its drilling segment. Generating a higher percentage of its revenue from drilling than other integrated operators can allow Occidental to enjoy an outsized operating cash flow benefit if the spot price for crude oil remains elevated.

During the COVID-19 pandemic, global energy majors were forced to slash their capital expenditures (capex) due to an energy commodity demand cliff and unprecedented uncertainty. Even with capex levels now back to normal, crude oil supply constraints remain, which may help buoy its spot price.

Warren Buffett and his crew have also been buyers of satellite-radio operator Sirius XM Holdings (NASDAQ: SIRI) and Liberty Media’s Sirius XM tracking stock, Liberty Sirius XM Group (NASDAQ: LSXMA)(NASDAQ: LSXMK).

In a little over a week, Sirius XM and Liberty Sirius XM Group will merge to create one class of shares. Sirius XM is also effecting a reverse 1-for-10 stock split upon consummation of the merger to lower its outstanding share count, increase its share price, and hopefully draw more institutional investor interest.

The merger between legal satellite-radio monopoly Sirius XM and Liberty Sirius XM Group has all the hallmarks of a rare arbitrage play from the Oracle of Omaha.

Warren Buffett’s favorite stock to buy just joined exclusive company

But at the end of the day, neither Occidental Petroleum nor Sirius XM are Warren Buffett’s favorite stock to buy. “Favorite stock” is a term reserved for the company the Oracle of Omaha has purchased for 24 consecutive quarters.

As stated earlier, this “favorite stock” isn’t going to be found in quarterly 13Fs. Rather, you’ll need to dig into Berkshire’s Hathaway’s quarterly operating results, which provide to-the-cent buying activity of Warren Buffett’s favorite stock. Near the end of each report, just prior to the executive certifications, you’ll find detailed information on share repurchase activity and come to the realization that the stock Buffett buys more than any other is (drum roll) shares of his own company.

Before mid-July 2018, share buyback activity at Berkshire was nonexistent. The guidelines in place only allowed shares to be repurchased if Berkshire Hathaway’s stock fell to or below 120% of book value, as of the most recent quarter. With shares not falling to or below this line-in-the-sand threshold, Buffett and right-hand man Charlie Munger (who passed away in November 2023) were forced to sit on their hands.

On July 17, 2018, Berkshire’s board amended the criteria governing share repurchases to allow Buffett and Munger to get in the game. Berkshire’s board set no ceiling or end date to buyback activity as long as:

-

The company has at least $30 billion in cash, cash equivalents, and U.S. Treasuries on its balance sheet; and

-

Buffett believes shares are intrinsically cheap.

Although the second point is entirely subjective, Berkshire sitting on almost $277 billion in cash is a sizable buffer that allows Buffett to regularly repurchase shares of his own company. Over six years, he’s overseen close to $78 billion in buybacks.

It just so happens that Buffett’s favorite stock to buy hit a milestone last week that only eight other companies throughout history have ever achieved. As of the closing bell on Aug. 28, Berkshire became only the ninth public company to end a trading session with a market cap of at least $1 trillion. Seven of these eight exclusive companies are members of the “Magnificent Seven,” while the eighth is oil goliath Saudi Aramco, which isn’t traded on U.S. exchanges.

Because Berkshire doesn’t pay a dividend, leaning on share buybacks is Buffett’s way of rewarding his company’s shareholders. Reducing Berkshire’s outstanding share count by nearly 12.7% over the last six years has steadily increased the ownership stakes of its remaining investors. More importantly, it drives home the importance of long-term investing, which is something Charlie Munger preached in his decades at Berkshire.

Furthermore, companies with steady or growing net income and a declining outstanding share count via buybacks tend to see their earnings per share (EPS) rise. Over time, share repurchases have made Berkshire’s stock more fundamentally attractive to investors.

It can also be argued that overseeing nearly $78 billion in cumulative buybacks in six years is a testament to Warren Buffett’s faith in the company he’s overseen for almost 60 years.

Berkshire owns around five dozen businesses, and the Oracle of Omaha is overseeing a 45-stock, $318 billion investment portfolio that’s predominantly comprised of cyclical businesses. In other words, Buffett and his team have strongly wagered on the U.S. economy and top-tier American businesses expanding over time. It’s a simple numbers game that undeniably favors long-term optimists.

Although Berkshire Hathaway’s $1 trillion market cap is a big number, there’s no reason to believe shares won’t head even higher.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America and Sirius XM. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett’s Favorite Stock to Buy Just Hit a Milestone That Only 8 Public Companies Have Ever Achieved was originally published by The Motley Fool

Intel CEO to propose cost reduction measures

Intel CEO Pat Gelsinger, along with senior executives, is set to propose a strategy to the board of directors aimed at divesting non-essential business units and reshaping capital expenditure, reports Reuters.

This move is part of an effort to rejuvenate the chipmaker’s financial performance.

The plan, which is expected to be presented in mid-September 2024, includes selling businesses such as the programmable chip unit Altera to reduce overall costs.

Intel has faced challenges as it seeks to regain its footing in the artificial intelligence (AI) chip market, currently dominated by Nvidia.

Its market capitalisation has fallen below $100bn following its second-quarter earnings report.

The forthcoming proposal may suggest a reduction in capital spending on factory expansion, potentially pausing or halting the $32bn (€28.8bn) factory project in Germany, which has experienced delays.

Intel has already separated its foundry business from its design division, maintaining confidentiality between the two to protect technology secrets.

Despite the restructuring, there are no current plans to sell the foundry operations, which could have interested buyers such as Taiwan Semiconductor Manufacturing Company, the report said.

To assist with the strategic review, Intel has hired financial advisors from Morgan Stanley and Goldman Sachs.

These advisors will help determine which assets are viable for sale and which are essential to retain.

While no formal bids have been requested for the product units, this is expected to occur following board approval of the proposed strategy, Reuter’s report noted.

Altera, acquired by Intel for $16.7bn in 2015, is one such asset under consideration for sale.

Intel has already taken steps to spin off Altera as a separate entity and has discussed a future IPO, though no date has been set.

Alternatively, the entire business could be sold, with companies like Marvell potentially interested in such a transaction, the sources said.

In August 2024, the technology major announced plans to layoff 15% of its workforce as part of its $10bn cost cutting plan.

“Intel CEO to propose cost reduction measures” was originally created and published by Verdict, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

Eli Lilly Launches Discounted Mounjaro And Zepbound As Fight Against Compounded Imitations Escalates Amid Ongoing FDA Shortage Status Debate

Eli Lilly LLY is intensifying its efforts to combat imitation versions of its popular appetite-suppressing drugs, Mounjaro and Zepbound.

What Happened: The pharmaceutical giant is seeking to end a regulatory designation that has permitted cheaper, off-brand versions to thrive. Lawyers for Eli Lilly have notified healthcare providers that shortages of Mounjaro and Zepbound are effectively over, despite the FDA not yet confirming this status, reported The Washington Post.

On Tuesday, Eli Lilly launched a discounted product, presenting it as a safer alternative to the off-brand medications. This move comes as the company faces competition from compounding pharmacies that have been making copies of its top-selling diabetes and weight-loss drugs since 2022.

The FDA placed the active ingredients in Mounjaro and Zepbound on its shortage list, allowing specialized pharmacies to create their own versions. Eli Lilly has been working to boost its supplies and claims that its drugs are now “commercially available.”

However, only the FDA can officially determine when a shortage is resolved. The agency is currently evaluating whether the supply of tirzepatide, the active ingredient, meets their criteria for a resolved shortage.

Meanwhile, Eli Lilly continues to advocate for patient safety, urging the FDA to remove the shortage designation and warning against the use of compounded versions of its drugs, according to the report.

See Also: Trump Claims Ivanka Rejected UN Ambassador Role, Instead Hired ‘Millions Of People’

Why It Matters: The battle over weight-loss drugs is heating up as Eli Lilly faces increasing competition from compounding pharmacies. The company has been proactive in addressing the issue by launching cheaper versions of its own drugs.

On Tuesday, Eli Lilly released low-dose vials of Zepbound, priced up to 50% lower, to enhance accessibility and meet the high demand for its weight-loss medication. This move aims to counter the proliferation of off-brand versions and ensure patient safety.

Adding to the competitive landscape, Novo Nordisk NVO recently published promising data on its weight-loss drug Wegovy, showing a 31% reduction in the risk of cardiovascular death or worsening heart failure events. This development underscores the intense rivalry in the weight-loss drug market, as companies strive to demonstrate the efficacy and safety of their products.

Furthermore, Eli Lilly has been compared to NVIDIA Corp in the weight-loss and GLP-1 space by Roundhill Investments CEO Dave Mazza. He emphasized the company’s market leadership and growth potential, attributing its success to the high demand and limited supply of its drugs.

In addition to its weight-loss drugs, Eli Lilly is also navigating challenges in other areas. The company’s Alzheimer’s drug, donanemab, faces potential rejection by the U.K.’s National Health Service due to safety concerns and high costs. This situation underscores the broader regulatory and market challenges that pharmaceutical companies must navigate.

Price Action: Eli Lilly and Co closed at $960.02 on Friday, marking a gain of 2.11% for the day. After hours, the stock saw a slight dip of 0.0021%. Year-to-date, Eli Lilly’s stock has surged 62.11%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Great Value Stocks That Are Screaming Buys in September

It’s a good idea to buy stocks that have solid upside potential and limited downside. And I think automation technology company Emerson Electric (NYSE: EMR), water products company Pentair (NYSE: PNR), and industrial conglomerate 3M (NYSE: MMM) are ideal candidates in this regard. Here’s why.

Emerson Electric is an outstanding value stock

Management’s decision to focus the company on automation and adjacent markets like industrial software and test and measurement is set to pay off in the coming years. Having recently completed the sale of its remaining 40% interest in its heating, ventilation, air-conditioning, and refrigeration (HVACR) joint venture, Copeland, Emerson Electric is ready to accelerate its growth into its targeted end markets.

Its core business of automation has been mixed in 2024, with process automation (oil and gas, mining, chemicals, etc.) and hybrid (food, life sciences, etc.) growing solidly with mid-single-digit orders growth in the recent third quarter, offset by a low-single-digit decline in orders in discrete (factory automation).

Still, as its peer Rockwell Automation noted, discrete automation is experiencing an inventory correction. Distributors are reducing inventory from previously elevated levels caused by lengthening product lead times during the supply chain crisis. Emerson’s automation performance is expected to improve once the inventory correction is completed and interest rates decrease.

Moreover, its 55% ownership of industrial software company Aspen Technology exposes Emerson to positive spending trends in energy, utilities, and smart grid solutions. Lastly, its acquisition of test and measurement company NI last year looks well-timed. Emerson, and its test and measurement peer Keysight Technologies, is expecting a growth recovery in 2025.

Thinking longer-term, Emerson’s automation solutions are critical to keeping its customers’ operations cost-effective, a crucial concern for plants operated outside low labor-cost countries. Trading at 17.5 times Wall Street earnings estimates for 2025, Emerson Electric stock has plenty of upside potential, while the downside is limited by the fact that its markets are bottoming in 2024.

Pentair is set for sales and margin growth

Pentair is a water products company servicing the industrial, commercial, and residential markets. It is one of the most compelling stocks on the market today. There are three key reasons why:

-

Through transformational initiatives, the company aims to increase its operating profit margin from 20.8% in 2023 to 24% in 2026.

-

Despite a slowdown in new residential pool construction in 2024, the installed base of pools is still growing and will support growth in maintenance spending on pools in the future.

-

A lower interest rate environment should support a recovery in new pool construction.

As such, Pentair combines underlying growth from company restructuring with the upside potential from a lower interest rate environment.

Both factors are significant. For example, its transformational initiative includes pricing adjustments, improving sourcing relationships to reduce costs, consolidating its manufacturing footprint, and initiating 80/20 focused sales. The latter refers to the principle whereby 20% of customers generate 80% of sales, allowing companies to focus their products, pricing, and marketing strategy on their most profitable customers.

The company can also cut costs by reducing its focus on smaller customers that generate minimal sales. I’ve previously discussed the initiatives for those who want to get into more detail, and valuation matters, too. Like Emerson Electric, Pentair’s end markets look like they are bottoming in 2024. The company is primed for solid growth in 2025, with some upside kicker from a lower interest rate environment.

3M’s recovery starts here

After years of lackluster sales growth and mediocre margin performance, 3M finally has management in place to improve matters. The spinoff of its healthcare business, Solventum, raised cash to support its legal settlements and rid 3M of a company it had invested substantial time, money, and effort without notable achievement.

Moreover, new CEO William Brown is committed to improving the company’s research and development capability to get the company back to producing new products that command market share and pricing power. While that will take time to come to fruition, Brown is also working on a fundamental restructuring to improve its supply chain, leverage its buying power in sourcing, and rationalize its factory and distribution footprint.

As part of his plans, Brown plans to reduce the time 3M holds inventory for sale, resulting in a potential $1 billion improvement in free cash flow — that alone could be worth 28% more on the stock price.

As with Pentair, 3M offers upside from management’s restructuring initiatives and a cyclical improvement in its end markets, which, in 3M’s case, includes semiconductors, automotives, consumer electronics, and construction materials.

Should you invest $1,000 in 3M right now?

Before you buy stock in 3M, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and 3M wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Emerson Electric. The Motley Fool recommends 3M and Solventum. The Motley Fool has a disclosure policy.

3 Great Value Stocks That Are Screaming Buys in September was originally published by The Motley Fool

Stocks Hover as Traders Brace for September Swings: Markets Wrap

(Bloomberg) — Global equities hovered near record highs on Monday as investors prepared for what’s typically considered the most challenging month for stocks.

Most Read from Bloomberg

Europe’s Stoxx 600 index pared most losses from earlier in the session after closing at an all-time high on Friday. Volkswagen AG rose 1.3% after the automaker said it’s considering unprecedented factory closures in Germany, while Rightmove Plc surged 27% in London on the back of takeover interest from Rupert Murdoch’s REA Group Ltd.

US equity futures were little changed. The dollar edged higher after its worst month this year, while cash Treasuries were closed for the US Labor Day holiday. Mexican stocks gained while Brazilian assets retreated.

Historically, September has been a particularly poor month for stocks over the past four years, according to data compiled by Bloomberg. Wall Street’s fear gauge – the Cboe Volatility Index, or VIX – has risen each September since 2021.

The trend could persist, especially with the upcoming US jobs report on Friday, which will provide crucial insights into how quickly or slowly the Federal Reserve might cut rates and as the US election campaign gets into full swing. Traders are pricing the US easing cycle will begin this month, with a roughly one-in-four chance of a 50 basis-point cut, according to data compiled by Bloomberg.

“I think the market is pretty well versed with what it thinks is going to happen — there will be some kind of cut,” Fiona Boal, global head of equities at S&P Dow Jones Indices, told Bloomberg Television. “As we move through autumn, we will see the VIX move more to thinking about the markets, thinking about political issues.”

JPMorgan Chase & Co. strategists cautioned that the equity market rally could stall even if the Fed initiates a rate cut. Any policy easing would be in response to slowing growth, while the seasonal trend for September would be another impediment, the team led by Mislav Matejka wrote in a note.

“We are not out of the woods yet,” Matejka said, reiterating his preference for defensive sectors against the backdrop of a pullback in bond yields. “Sentiment and positioning indicators look far from attractive, political and geopolitical uncertainty is elevated, and seasonals are more challenging.”

Jobs data potentially pointing to a very gradual cooling down of the US labor market could lead traders to adjust their expectations for rate cuts to the benefit of the dollar, according to to Valentin Marinov, head of G-10 FX strategy at Credit Agricole CIB.

“The markets may be leaning too dovish into the September Fed meeting,” Marinov told Bloomberg Television. “The dollar could recoup some ground once the markets realized that the Fed will move more cautiously.”

A gauge for Asian stocks retreated on the back of heightened concerns about the health of the economy in China, where a prolonged property market slump is curbing domestic demand.

“I think there’s a huge problem — by now everybody recognizes that,” Hao Ong, chief economist at Grow Investment Group, told Bloomberg’s David Ingles and Yvonne Man in an interview. “The government needs to do substantially more.”

In commodities, oil fluctuated between small gains and losses as traders weigh a planned production increase from OPEC+ next month, economic headwinds in China and lower output in Libya.

Key events this week:

-

US markets closed for Labor Day holiday, Monday

-

South Korea CPI, Tuesday

-

Switzerland GDP, CPI, Tuesday

-

South Africa GDP, Tuesday

-

US construction spending, ISM Manufacturing index, Tuesday

-

Mexico unemployment, Tuesday

-

Brazil GDP, Tuesday

-

Chile rate decision, Tuesday

-

Australia GDP, Wednesday

-

China Caixin services PMI, Wednesday

-

Bloomberg CEO Forum in Jakarta, Wednesday

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Poland rate decision, Wednesday

-

Fed’s Beige Book, Wednesday

-

Canada rate decision, Wednesday

-

South Korea GDP, Thursday

-

Malaysia rate decision, Thursday

-

Philippines CPI, Thursday

-

Taiwan CPI, Thursday

-

Thailand CPI, Thursday

-

Eurozone retail sales, Thursday

-

Germany factory orders, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Canada unemployment, Friday

-

Chile CPI, Friday

-

Colombia CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 2:27 p.m. New York time

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI World Index was little changed

-

Nasdaq 100 futures rose 0.1% to the highest since Aug. 27

-

The MSCI Asia Pacific Index fell 0.4%, more than any closing loss since Aug. 8

-

The MSCI Emerging Markets Index fell 0.3%, more than any closing loss since Aug. 27

-

S&P/BMV IPC rose 1.1%

-

The Ibovespa Index fell 0.7%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.2% to $1.1070

-

The British pound rose 0.1% to $1.3145

-

The Japanese yen weakened 0.5%, falling for the fourth straight day, the longest losing streak since June 21

-

The offshore yuan slipped 0.4%, more than any closing loss since Aug. 15

-

The Mexican peso fell 0.3% to 19.79

-

The Brazilian real weakened 0.2% to 5.6209

Cryptocurrencies

Bonds

-

The yield on 10-year Treasuries was little changed at 3.90%

-

Germany’s 10-year yield advanced four basis points to 2.34%

-

Britain’s 10-year yield advanced four basis points to 4.05%

Commodities

-

West Texas Intermediate crude rose 0.7% to $74.04 a barrel

-

Spot gold fell 0.2% to $2,499.34 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Catherine Bosley, Sagarika Jaisinghani and Sebastian Boyd.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.