US Jobs Data Will Help the Fed Gauge the Extent of Its Moderation

(Bloomberg) — Upcoming readouts on the US labor market, including the monthly payrolls report, will give Federal Reserve policymakers insight into the need for further interest-rate reductions after an all-but-certain cut in a little more than two weeks.

Most Read from Bloomberg

With inflation slowing — although still running faster than the Fed’s goal — Chair Jerome Powell has telegraphed a September rate cut and said that officials “do not seek or welcome” further cooling in the labor market. Weeks earlier, government figures showed lower-than-expected July job growth and the highest unemployment rate in nearly three years.

This coming Friday, the August jobs report is expected to show payrolls in the world’s largest economy increased by about 165,000, based on the median estimate in a Bloomberg survey of economists.

While above the modest 114,000 gain in July, average payrolls growth over the most recent three months would ease to a little more than 150,000 — the smallest since the start of 2021. The jobless rate probably edged down in August, to 4.2% from 4.3%.

Two days before Friday’s report, the government will issue figures on July job vacancies. The number of open positions, a measure of labor demand, is seen easing to a three-month low of 8.1 million — just above a more than three-year low.

The number of vacancies per unemployed worker, a ratio the Fed watches closely, currently stands at 1.2, similar to pre-pandemic levels and a sign labor demand is roughly in line with supply. At its peak in 2022, the ratio was 2 to 1.

Also included in the job openings report are data on lay-offs and discharges. Any large increase could add to Fed officials’ concerns about a weakening labor market.

Other labor-related reports in the upcoming holiday-shortened week include weekly jobless claims and ADP Research Institute’s August snapshot of private payrolls. In addition, the Fed will issue its Beige Book of regional economic conditions, while the Institute for Supply Management reports purchasing managers indexes for manufacturing and services.

What Bloomberg Economics Says:

“Non-farm payrolls will likely improve from July’s disappointing reading – but the 818k downward revision in the BLS’s early estimate for the March 2024 benchmark period probably leaves Fed officials less willing to take the initial prints at face value.”

— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full analysis, click here

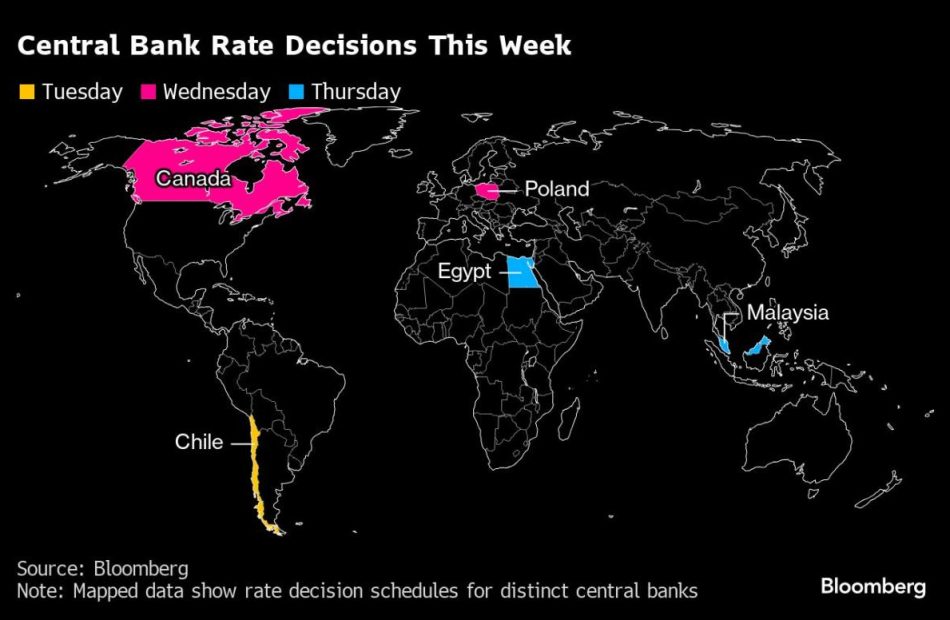

Elsewhere, the Bank of Canada is widely expected to deliver a third straight rate cut, as inflation that’s been within its target range all year allows officials to shift focus to weakness in the job market.

Purchasing manager indexes from around Asia, German industrial numbers and gross domestic product from Brazil are among other highlights.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

Asia begins the week with a wave of August manufacturing PMI data – including from Indonesia, South Korea, Malaysia, Thailand, Taiwan and the Philippines – following on from China’s official figures at the weekend.

China’s Caixin manufacturing PMI is also out on Monday, and is expected to show a return to expansion after a dip below 50 in July.

Japan on Monday gets a report on corporate performance in the second quarter. Capital investment may recover a tad after slipping in the three months through March, data that will feed into revised economic growth figures the following week.

In Australia, attention falls on current account figures that will also likely affect gross domestic product data. Those figures, due Wednesday, are expected to show that economic growth accelerated slightly from the prior quarter.

South Korea revises its second-quarter GDP the following day, and the region also gets a flurry of inflation updates. Trade data for August — published Sunday — showed that export growth returned to a double-digit clip, an outcome that bodes well for the economic outlook and reflects the resilience of global demand for technology products.

Vietnam’s consumer price gains may slow below 4% for the first time since March, while consumer-price data are also due from South Korea, Thailand, Taiwan, Indonesia and the Philippines. Trade statistics will be published in Australia, Vietnam and Pakistan.

Among central banks, Malaysia sets its overnight policy rate on Thursday and Reserve Bank of Australia Governor Michele Bullock delivers a speech the same day.

Europe, Middle East, Africa

Euro-zone policymakers have until the close of play on Wednesday to make comments before a blackout period kicks in ahead of their Sept. 12 decision.

With inflation now at a three-year low, a second rate cut for the newly-minted easing cycle looks increasingly likely. Central bank chiefs from Germany and France are among those scheduled for appearances.

The calendar for data is relatively light, with Germany likely to be a highlight. Factory orders on Wednesday and industrial production the following day will reveal the state of the country’s struggling manufacturers at the start of the third quarter.

Among regional reports on the agenda, a second reading of the euro-zone’s GDP measurement for the three months through June will be released.

The UK is likely to be similarly quiet, with final takes on August purchasing manager indexes for manufacturing and services scheduled for Monday and Wednesday respectively.

Consumer-price data in Switzerland may draw eyeballs in advance of the Swiss National Bank’s rate decision later this month. Inflation may stick at 1.3% for a third month, comfortably below the 2% ceiling for policymakers.

Turning east, in Poland — where data on Aug. 30 showed the fastest inflation so far this year — the central bank is widely expected to keep its key rate unchanged at 5.75% on Wednesday. Governor Adam Glapinski will speak at a news conference the following day.

Data from South Africa on Tuesday will likely show that the continent’s most industrialized economy skirted recession. Analysts expect the economy to have grown 0.5% in the second quarter after contracting 0.1% in the prior three months, helped by improved power supplies.

In Turkey, data is expected to show the inflation rate dropped by about 10 percentage points in August, to 52% from 62%. The central bank is hoping it declines to about 40% by year-end.

From Wednesday to Friday, African heads of and Chinese President Xi Jinping will gather in Beijing for the Forum on China–Africa Cooperation, where they’re expected to discuss new investment opportunities.

On Thursday, Egypt’s central bank is widely expected to hold its main rate at 27.5%. Some analysts, though, think it may opt to start the easing process now given the steady retreat in price pressures over the past year.

Latin America

Brazil on Tuesday will report second-quarter economic growth figures likely to reinforce that demand is shaking off the effects of tight monetary policy.

GDP is expected to have risen 0.9% quarter-on-quarter, more than during the first three months of the year, as a tight labor market and strong consumption propel activity.

The release will likely boost leftist President Luiz Inacio Lula da Silva, who’s raised public spending while pledging to improve living standards for ordinary citizens in Latin America’s largest economy. It could further pressure the central bank for interest rate increases as soon as in September.

The coming week will be crucial for economic data releases in Chile. On Tuesday, the nation’s central bank is likely to cut its key rate by a quarter-point, to 5.5%, after having paused the easing cycle at its prior meeting.

The next day, Chilean central bankers will publish their quarterly monetary policy report, with updated estimates on economic growth, inflation, and the future path for borrowing costs.

On Friday, the government will report August consumer price data, which is expected to show inflation accelerating further above the 3% target due to a series of electricity tariff hikes.

–With assistance from Matthew Malinowski, Piotr Skolimowski, Laura Dhillon Kane, Brian Fowler and Monique Vanek.

(Updates with South Korea trade in Asia section)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Hong Kong Property Pain Worsens for New World and Scion CEO

(Bloomberg) — Hong Kong’s property downturn is taking a growing toll on New World Development Co., the firm owned by the billionaire Cheng family.

Most Read from Bloomberg

The company said late on Friday it expects to post a loss of as much as HK$20 billion ($2.6 billion) for the financial year ended in June — its first annual loss in two decades. Its share price plunged 13% on Monday to the lowest level since 1986, when Bloomberg started tracking the data.

New World has been grappling with higher debt levels than its peers — adding pressure on 44-year-old Chief Executive Officer Adrian Cheng, the third generation to oversee the business, to turn things around.

The developer cited asset impairment, losses on investments and higher interest rates for the decline. A revaluation of the group’s investment and development properties including a goodwill assessment will lead to a non-cash loss of HK$8.5 billion to HK$9.5 billion, the company said. Meanwhile, core operating profit is expected to drop as much as 23%.

New World’s 5.25% perpetual dollar bond fell 3.2 cents to 83.6 cents on the dollar Monday, the largest drop in a day since September 2023, according to Bloomberg-compiled prices.

The sizable asset writedowns “could raise its leverage ratio and hurt the developer’s deleveraging plan,” said Patrick Wong, a real estate analyst at Bloomberg Intelligence. “This could also raise investors’ concerns about potential risk of further valuation decline of its investment properties particularly Hong Kong office buildings.”

The company said in an email that the writedown was a proactive move to position the company “for the upcoming interest rate cut cycle where the overall property market is expected to rebound.”

The developer has been under scrutiny in recent years over its high level of borrowings. Net debt to equity was 82.7% as of the end of last year, compared with 41.4% at rival Henderson Land Development Co. and 21.2% at Sun Hung Kai Properties Ltd., according to BI.

New World’s writedown reflects a broader problem among developers. Hong Kong’s residential prices have plummeted to an eight-year low. Office and retail sectors remain weak, reducing rental income and hence the value of developers’ investment properties.

The city’s most prestigious office towers have seen value decline significantly in the past few years. CK Asset Holdings Ltd.’s landmark Cheung Kong Center, for instance, lost one-third of its rental value over the four years ending in 2023.

The lackluster residential market also limits New World’s potential income from selling apartments. It’s putting pressure on developers to discount their projects in order to lure buyers. New World priced a new project in the middle-class neighborhood of Kai Tak In July at the cheapest level for the district since 2016.

New World’s situation is “severe” and the company needs to sell assets, according to Sam Wong, an equity analyst at Jefferies LLC. “They also have to consider whether they have to be more realistic” in terms of pricing, he added.

Despite the headwinds, Cheng has been ramping up efforts to improve the firm’s financial situation. The company recently completed more than HK$16 billion in loan arrangements and debt repayments in July and August, including early refinancing of some loans due in 2025. The company said in the email that it has completed more than HK$50 billion of debt arrangements and repayments this year.

New World is also offloading lower-tier assets to raise cash, and said in February it was planning to dispose HK$8 billion of non-core assets for the fiscal year ended in June 2024.

New World’s profit warning coincided with executive appointments on the same night at the Chengs’ private investment vehicle, putting the family’s succession plan back into the spotlight. The clan announced that one of Adrian’s brothers had been appointed as co-CEO at Chow Tai Fook Enterprises Ltd., taking charge of the North Asia region for the family’s deep-pocketed investment firm. That means four of the siblings now each effectively controls a key part of the family business.

–With assistance from Shirley Zhao, Lorretta Chen and Shikhar Balwani.

(Updates with share, bond price change and an analyst quote.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Savings interest rates today, August 31, 2024 (best account provides 5.50% APY)

Today’s savings account interest rates are some of the highest we’ve seen in more than a decade due to several rate hikes by the Federal Reserve. Even so, savings interest rates vary widely by bank, so it’s important to be sure you’re getting the best rate possible when shopping around for a savings account. The following is a breakdown of savings interest rates today and where to find the best offers.

Overview of savings interest rates today

The national average savings account rate stands at 0.46%, according to the FDIC. This might not seem like much, but consider that just two years ago, it was just 0.07%, reflecting a sharp rise in a short period of time.

This is largely due to monetary policy decisions by the Fed, which began raising its benchmark rate in March 2022 to combat skyrocketing inflation. Since then, the Fed increased rates 11 times, though it paused further rate hikes in 2024. Experts believe the Fed will eventually begin to lower its target rate in September, which means deposit account rates, including savings interest rates, will likely begin to fall.

Although the national average savings interest rate is fairly low compared to other types of accounts (such as CDs) and investments, the best savings rates on the market today are much higher. In fact, some of the top accounts are currently offering upwards of 5% APY.

Poppy Bank, for instance, is currently offering the highest savings account rate today at 5.50% APY for its Premier Online savings account. The minimum opening deposit is $1,000 and this rate is guaranteed for three months.

Betterment also offers an account with 5.50% APY. However, this is a cash management account for brokerage customers and not a traditional savings account. There is no minimum opening deposit required.

Since these rates may not be around much longer, consider opening a high-yield savings account now to take advantage of today’s high rates.

Here is a look at some of the best savings rates available today from our verified partners:

Related: 10 best high-yield savings accounts today>>

How much interest can I earn with a savings account?

The amount of interest you can earn from a savings account depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (savings account interest typically compounds daily).

Say you put $1,000 in a savings account at the average interest rate of 0.45% with daily compounding. At the end of one year, your balance would grow to $1,004.51 — your initial $1,000 deposit, plus just $4.51 in interest.

Now let’s say you choose a high-yield savings account that offers 5% APY instead. In this case, your balance would grow to $1,051.27 over the same period, which includes $51.27 in interest.

The more you deposit in a savings account, the more you stand to earn. If we took our same example of a high-yield savings account at 5% APY, but deposit $10,000, your total balance after one year would be $10,512.67, meaning you’d earn $512.67 in interest.

Read more: What is a good savings account rate?

Asian Stocks Decline as China’s Economy Falters: Markets Wrap

(Bloomberg) — Global equities began September on the back foot as investors prepared for what’s typically considered the most challenging month for stocks.

Most Read from Bloomberg

Europe’s Stoxx 600 fell 0.2% from Friday’s record high, with the automotive and consumer goods sectors particularly affected. This downturn followed data showing a fourth consecutive month of contraction in Chinese manufacturing activity, alongside a deepening slump in the country’s residential property market.

Similarly, mining giants such as Rio Tinto Plc and BHP Group Ltd. saw declines after iron ore prices dropped. In London, Rightmove Plc surged more than 20% after Rupert Murdoch’s REA Group Ltd. said it’s exploring a possible cash and share offer.

US equity futures softened after the S&P 500 came close to an all-time high on Friday. The dollar was steady, while cash Treasuries were closed for the US Labor Day holiday.

September has been a notably poor month for stocks over the past four years, while the dollar typically outperforms, according to data compiled by Bloomberg. Wall Street’s fear gauge – the Cboe Volatility Index, or VIX – has risen each September since 2021.

The trend may continue, especially with the upcoming US jobs report on Friday, serving as a guide to how quick, or slow, the Federal Reserve will cut rates and as the US election campaign gets into full swing. Traders are pricing the US easing cycle will begin this month, with a roughly one-in-four chance of a 50 basis-point cut, according to data compiled by Bloomberg.

“I think the market is pretty well versed with what it thinks is going to happen — there will be some kind of cut,” Fiona Boal, global head of equities at S&P Dow Jones Indices, told Bloomberg Television. “As we move through autumn, we will see the VIX move more to thinking about the markets, thinking about political issues.”

Two days before Friday’s report, the government will issue figures on July job vacancies. The number of open positions, a measure of labor demand, is seen easing to a three-month low of 8.1 million — just above a more than three-year low.

The equity-market rally may stall even if the Federal Reserve starts its rate-cutting cycle, according to JPMorgan Chase & Co. strategists.

Any policy easing would be in response to slowing growth, while the seasonal trend for September would be another impediment, the team led by Mislav Matejka wrote in a note.

“We are not out of the woods yet,” Matejka said, reiterating his preference for defensive sectors against the backdrop of a pullback in bond yields. “Sentiment and positioning indicators look far from attractive, political and geopolitical uncertainty is elevated, and seasonals are more challenging.”

Elsewhere, German Chancellor Olaf Scholz’s ruling coalition was punished in two regional elections on Sunday, with the far right clinching its first triumph in a state ballot since World War II. Still, political parties moved to block the Alternative for Germany from power in the eastern states of Thuringia and Saxony.

China Woes

In Asian markets, multiple rounds of stimulus have failed to revive growth in China, where a prolonged property market slump is curbing domestic demand in the world’s second-largest economy.

“I think there’s a huge problem — by now everybody recognizes that,” Hao Ong, chief economist at Grow Investment Group, told Bloomberg’s David Ingles and Yvonne Man in an interview. “The government needs to do substantially more.”

In commodities, oil steadied as traders weigh a planned production increase from OPEC+ next month against currently lower output in Libya, while staying mindful of economic headwinds in China.

Key events this week:

-

US markets closed for Labor Day holiday, Monday

-

South Korea CPI, Tuesday

-

Switzerland GDP, CPI, Tuesday

-

South Africa GDP, Tuesday

-

US construction spending, ISM Manufacturing index, Tuesday

-

Mexico unemployment, Tuesday

-

Brazil GDP, Tuesday

-

Chile rate decision, Tuesday

-

Australia GDP, Wednesday

-

China Caixin services PMI, Wednesday

-

Bloomberg CEO Forum in Jakarta, Wednesday

-

Eurozone HCOB services PMI, PPI, Wednesday

-

Poland rate decision, Wednesday

-

Fed’s Beige Book, Wednesday

-

Canada rate decision, Wednesday

-

South Korea GDP, Thursday

-

Malaysia rate decision, Thursday

-

Philippines CPI, Thursday

-

Taiwan CPI, Thursday

-

Thailand CPI, Thursday

-

Eurozone retail sales, Thursday

-

Germany factory orders, Thursday

-

US initial jobless claims, ADP employment, ISM services index, Thursday

-

Eurozone GDP, Friday

-

US nonfarm payrolls, Friday

-

Canada unemployment, Friday

-

Chile CPI, Friday

-

Colombia CPI, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 8:08 a.m. New York time

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The Stoxx Europe 600 fell 0.2%

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro rose 0.1% to $1.1063

-

The British pound was little changed at $1.3135

-

The Japanese yen fell 0.5% to 146.96 per dollar

Cryptocurrencies

-

Bitcoin rose 0.1% to $58,486.53

-

Ether rose 0.7% to $2,520.17

Bonds

-

The yield on 10-year Treasuries was little changed at 3.90%

-

Germany’s 10-year yield advanced three basis points to 2.33%

-

Britain’s 10-year yield advanced four basis points to 4.05%

Commodities

-

West Texas Intermediate crude fell 0.1% to $73.47 a barrel

-

Spot gold fell 0.1% to $2,500.86 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Catherine Bosley and Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Best credit cards for wedding expenses (September 2024)

It takes a lot of work — and money — to plan a wedding today. The average wedding today has around a $30,000 price tag, according to survey data from wedding industry sites like The Knot, The Wedding Report, and Zola. That’s why it pays to have the right credit card before deposits, bookings, and service fees roll in. With this list of best cards for weddings, you can get significant savings on your spending throughout your wedding planning process.

Best credit cards for weddings for September 2024

-

Annual fee: $95

-

Welcome offer: Enjoy a $250 credit to use on Capital One Travel in your first cardholder year, plus earn 75,000 miles after spending $4,000 within the first 3 months

-

Rewards:

-

Recommended credit score: Good to excellent

Why we like it: If you want to use your wedding expenses to help fund the honeymoon you’ll take afterward, the Capital One Venture is a great option. You’ll earn a flat 2x miles on every dollar you spend, so you don’t need to worry about the specific categories your wedding spending may fall into. If you have wedding-related travel expenses to book, you can get up to 5x miles on hotels and car rentals through the Capital One Travel portal.

For its $95 annual fee, the Capital One Venture Card also comes with up to a $100 fee credit for TSA PreCheck or Global Entry, experience credits, and other benefits when you book The Lifestyle Collection hotels, and Five Star status with Hertz.

When you’re ready to use the miles you earn, put them toward Capital One Travel bookings, redeem them for any travel purchases made with your card within 90 days, or transfer them to Capital One airline and hotel partners.

Why we like it: The Wells Fargo Reflect card’s 21-month 0% intro APR is one of the longest you’ll find from any credit card today. For wedding expenses, you’ll likely get the most use out of the intro offer for new purchases. You can charge your wedding spending over the intro period, and won’t accrue any interest until nearly two years from account opening.

Say you have $12,000 in wedding expenses you can charge to a credit card. Given the full 21 months interest-free, you can pay down that entire balance with monthly payments of just over $571. It’s essential to pay as much as possible before the intro period ends if you want to avoid your remaining balance accruing interest at the ongoing variable APR between 18.24% and 29.99%.

You may also use the Wells Fargo Reflect Card to pay down debt with a balance transfer (made within 120 days of opening). If you’ve already taken on some debt from earlier venue deposits and vendor bookings, for example, this is a good way to avoid the high interest rate on your current card.

The downside is the lack of rewards options. You won’t earn points or cash back on purchases, and there’s no cash welcome offer for new cardholders. One long-term benefit is cell phone protection which covers up to $600 (with a $25 deductible) against damage or theft.

Why we like it: Discover it Miles is another travel credit card with a flat rate on each purchase you make. By earning 1.5x miles on every purchase, you’ll maximize all your credit card wedding spending without worrying about eligible categories.

This card’s unique sign-up bonus offer makes it even more valuable for expensive wedding costs. At the end of your first year, Discover will match every mile you earn with the card, essentially doubling your first-year rewards.

Say, for example, you spend $12,000 in wedding expenses with the Discover it Miles card, and another $5,000 in regular purchases over the remainder of the year. That $17,000 could net you 25,500 miles — with the match, you’d total 51,000 miles in your first year. For a no annual fee card, more than $500 in rewards value over the first year is incredible.

You can redeem your miles toward travel purchases you make with your card from hotels, rideshares, restaurants, and more; or redeem for cash as a payment toward your balance or deposit into a bank account. Finally, the Discover it Miles also comes with an introductory 0% APR on new purchases — another valuable benefit for helping to pay down costly wedding spending over time.

-

Annual fee: $695 (see rates and fees)

-

Welcome offer: Earn 80,000 points after spending $8,000 within the first 6 months

-

Rewards:

-

5x points on flights booked directly with airlines or through Amex Travel (up to $500,000 spent per calendar year)

-

5x points on prepaid hotels booked through Amex Travel

-

1x points on all other purchases

-

-

Recommended credit score: Good to excellent

Why we like it: If you’re planning your honeymoon as a once-in-a-lifetime, bucket list vacation, the Platinum Card from American Express is a powerful tool for booking and while traveling. To start, the valuable welcome bonus can go toward up to $800 in travel expenses — and those costly wedding expenses may help you meet the minimum spending requirement. Rewards points on airfare and hotel bookings can also help to offset any travel costs required for the wedding.

Then, use the American Express Platinum Card’s many benefits to upgrade your honeymoon travel. These include up to $200 in annual statement credits for eligible prepaid hotel bookings through Amex Travel, airport lounge access across the globe, and up to $200 in annual statement credits for incidental fees with your choice airline. Plus, get up to $199 annual CLEAR Plus credit per calendar year on your membership (subject to auto-renewal), experience credits and other perks when you book The Hotel Collection or Fine Hotels + Resorts, concierge services, automatic status with Marriott Bonvoy and Hilton Honors, travel protections, and much more.

Between the rewards you’ll earn on travel and savings on travel spending, you can use this card to make your honeymoon more comfortable and efficient — while minimizing the price tag. You can redeem Membership Rewards points for travel through Amex Travel (you’ll generally get the best value on flights or select hotels) or transfer them to your preferred Amex partner airline or hotel program.

Read more: See our picks for the best American Express credit cards

-

Annual fee: $0

-

Welcome offer: Earn an extra 1.5% cash back on every purchase for the first year (up to $20,000 in eligible spending)

-

Rewards:

-

5% cash back on travel through Chase Travel℠

-

3% cash back on dining

-

3% cash back at drugstores

-

1.5% cash back on all other purchases

-

-

Recommended credit score: Good to excellent

Why we like it: Chase Freedom Unlimited offers a valuable cash-back rewards combo for taking on costly wedding expenses. Not only can you earn a flat 1.5% on every purchase (regardless of category), but you’ll also get an enhanced rate throughout the first year — up to $20,000 in spending for a maximum $300 extra back. Plus, there’s an introductory 0% APR you can use to finance your wedding purchases and pay them off over time.

Like the examples above, say you have $12,000 of wedding purchases you can put on a credit card. If you open a new Chase Freedom Unlimited with the current welcome offer, you can earn a minimum of 1.5% cash back on that spending, plus another 1.5% cash back over the first year. That’s a total of $360 back on those purchases alone. If some of your wedding purchases fall into the boosted rewards categories, or you spend more before reaching the $20,000 first-year limit, you’ll earn even more.

The rewards you earn with this card are even more lucrative if you also have a Chase Sapphire Preferred® Card or Chase Sapphire Reserve®. While you’ll earn rewards as cash back, you can also redeem them toward travel purchases through Chase Travel. If you have one of the Sapphire cards, combine your rewards under that card account and get the boosted 25% (for Chase Sapphire Preferred) or 50% (for Chase Sapphire Reserve) Chase Travel redemption rate — a great way to maximize rewards toward your honeymoon or another upcoming trip.

More options to consider: co-branded hotel credit cards

If you choose a hotel as your wedding venue, you might get the most value and savings from a co-branded hotel credit card. On top of the boosted credit card rewards, some hotel chains offer added incentives for weddings, like bonus points or discounts for your honeymoon.

These are a few current offers from popular hotel brands:

Marriott

When you book a qualifying event with Marriott Bonvoy, you can earn up to 60,000 bonus points. If you have elite status within the Bonvoy program, you’ll earn even more. You can use the program’s points calculator to estimate how many bonus points you could earn for your specific event and spending.

These are some Marriott Bonvoy credit cards available today, which you can use to maximize your spending at Marriott, get complimentary elite status, and more perks:

Hilton

You’ll earn 2x Hilton Honors points for weddings at Hilton properties. But you can also save even more with special offers from Hilton — though these offers vary depending on when you book and your wedding dates.

As an example, you can currently earn 100,000 bonus points when you book an eligible all-inclusive wedding at a participating Hilton resort. There are specific windows when you must reserve and when you’ll travel, as well as a $3,000 minimum cost and minimum of 10 rooms booked for two nights.

For more points and member perks on your wedding at a Hilton hotel, consider these cards:

Hyatt

If you choose a participating Hyatt hotel or resort for your wedding, you can earn World of Hyatt bonus points to use toward a free night on your honeymoon. The number of points you earn depends on the estimated spending amount in your contract with the hotel. Earn 30,000 points when you spend the minimum $5,000 and up to 150,000 points for a wedding totaling $40,000. You’ll also earn two tier-qualifying night credits toward elite status for every $5,000 you spend.

To qualify, request to include the offer code HMOON in your contract with the wedding vendor by Dec. 31, 2024 and pay a minimum $5,000 for your event to qualify.

To earn more bonus points with your Hyatt spending, free night awards, and more, consider this credit card from the program:

What to look for in a credit card for your wedding

Here are some card details to consider if you want to open a new credit card before taking on wedding expenses this year:

Welcome offer

A great welcome offer is always a big incentive for new cardholders. But with the added costs you’ll likely take on while wedding planning, you may be able to more easily budget for and meet the purchase minimum required to score a sign-up valuable bonus.

Just make sure you time your card application so that you do the bulk of your wedding spending (at least the spending you can charge to a credit card) during the three- to six-month period you’ll have to earn the sign-up bonus after account opening.

Rewards

In addition to the one-time welcome bonus, consider the most valuable ongoing credit card rewards for your wedding and your longer-term spending. Cards with flat rewards, like 1.5x points or 2% cash back, may be ideal for this, since you’ll earn the same amount on your purchases regardless of whether they fit into common credit card rewards categories.

But this can also vary depending on the details of your wedding and your lifestyle. If you’re planning a destination wedding, for example, you might get much more value from a travel rewards card that earns maximum points on flights and hotels. Or maybe you dine out a lot regularly and you’re holding your reception at a local restaurant — then you’ll likely get more value from a card with dining rewards.

The best rewards credit card for you offers the maximum return on your largest and most frequent purchases alike.

Intro APR

A credit card with an introductory 0% APR on new purchases can offer savings on your wedding costs if you don’t have cash already saved before planning. The right intro offer will help you avoid taking on a lasting personal loan or charging purchases you can’t pay off to a card with a regular variable APR.

Plan ahead before you choose your 0% APR card by estimating the overall cost of the wedding expenses you’ll charge to the card. You can use that number to decide what intro period length makes sense for the amount you can contribute each month to have the entire balance — or at least as much as possible — paid down before you begin accruing interest at the card’s ongoing rate.

More benefits and perks

Plenty of additional credit card perks may help you save on wedding expenses too.

Purchase protections and extended warranties offer an added sense of security for your large purchases. You can use travel protections and travel insurance benefits, as well, for getting to your venue or for the honeymoon. If you’re planning an international wedding, you can save on the purchases you make abroad with a no foreign transaction fee card.

Many credit card issuers also offer rotating discounts with specific brands or on particular purchases. You can use Amex Offers, My Wells Fargo Deals, Chase Offers, and similar programs to get targeted savings with brands you may already use. Look for your card’s specific offers within your online or mobile account.

Pros and cons of using a credit card for wedding expenses

Knowing the benefits and drawbacks of charging your wedding expenses to a credit card can help you choose the right one for your budget and avoid potential risks.

Pros

-

Cash back and points rewards: While planning a wedding, you’re likely to spend much more money than you usually would. Take advantage of the planned extra expenses by maximizing your credit card rewards — so you can use them in the future toward travel or reduce the overall cost of your big day.

-

More time to pay down expenses: Introductory 0% APR credit cards can help you avoid going into credit card debt for any wedding costs you haven’t already saved for. With zero interest periods lasting 12, 15, or even 21 months, you’ll have a long time to pay down your balance before interest does kick in. You can even find many credit cards that offer both competitive introductory periods and solid rewards on spending.

Cons

-

Risk of taking on debt: When you charge several costly purchases to a credit card, there’s always a risk of high-interest debt balances. You can avoid that debt by paying your balances in full before each monthly due date. But you will need to stay diligent in tracking your expenses and budgeting for extra costs so you don’t risk quickly-mounting debt balances or a hit to your credit score.

-

Potential added fees: Not all wedding vendors will accept credit card payments. But even if your wedding vendors do allow you to pay with a card, watch out for added fees they may charge that negate your rewards. If, for example, your caterer charges a 4% fee for paying with a card and you’ll only earn 2% back on the purchase, you might end up paying more than you get back in the long run.

Our methodology

To create our list of best credit cards for wedding expenses, we first focused on the superlatives that we believe are most useful to couples planning a wedding — generalizing for budget, location, savings. Knowing we couldn’t cover every type of wedding or expense, we focused on categories that appeal to a broad general range of wedding expenses and offer great savings no matter what your specific ceremony looks like.

Continuing that theme with our specific card picks, we looked for credit cards with features like flat rewards rates, introductory 0% APRs, no foreign transaction fees, and more — even when that benefit wasn’t necessary for the card’s specific superlative. We believe these universally useful card features can benefit a broad range of weddings. Because weddings are already expensive, we also prioritized cards with low or no annual fees (except the luxury travel category).

Our final picks include the cards we believe best fit the superlative categories and the specific details we sought. They’re also among the top-rated within their categories using our proprietary rating system. These ratings account for details like APR, annual fee, rewards, benefits, security, mobile app functionality, issuer customer service, and more.

This article was edited by Rebecca McCracken

Editorial Disclosure: The information in this article has not been reviewed or approved by any advertiser. All opinions belong solely to Yahoo Finance and are not those of any other entity. The details on financial products, including card rates and fees, are accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information. This site doesn’t include all currently available offers. Credit score alone does not guarantee or imply approval for any financial product.

BRI deeply integrated into African development; more pragmatic cooperation expected in FOCAC

BEIJING, Sept. 2, 2024 /PRNewswire/ — The joint construction of the Belt and Road Initiative (BRI) by China and Africa has provided a high-level cooperation platform for Africa’s development.

From Uganda and Egypt to Senegal and Nigeria, infrastructure, industrial parks and economic zones built by Chinese companies have mushroomed and become a strong engine driving Africa’s integration into the global industrial chain.

China and Africa will renew their friendship and discuss plans for further pragmatic cooperation during the upcoming Forum on China-Africa Cooperation (FOCAC) to be held in Beijing from September 4 to 6. Chinese President Xi Jinping will attend the opening ceremony of FOCAC and deliver a keynote speech on September 5.

The cooperation between China and Africa under the BRI framework emphasizes precise alignment with Africa’s shared strategic framework – the African Union 2063 Agenda – one of whose priorities is the realization of industrialization in Africa.

In its issue of May 13, 2000, The Economist boldly described Africa as “the hopeless continent.” In the very same year, FOCAC was established.

The narrative on Africa now has shifted to “a rise in the continent.” When tracking momentum projects that have contributed to unlocking Africa’s development, you can trace the progress back to China’s flagship projects through BRI, Paul Frimpong, the executive director and senior research fellow of the Ghana-based Africa-China Centre for Policy and Advisory, told the Global Times.

As of 2023, a total of 52 African countries as well as the African Union have signed a memorandum of understanding with China to jointly build BRI cooperation.

For instance, the integrated steel manufacturing plant set up in Zimbabwe’s Midlands Province by Chinese firm Dinson Iron and Steel Company draws on upstream and downstream supply chains that go beyond Zimbabwe, benefiting its neighbors in areas such as employment generation, and also helps to meet the Southern African Development Community (SADC) region’s infrastructure construction needs, Munetsi Madakufamba, executive director of the Zimbabwe-based Southern African Research and Documentation Centre, told the Global Times.

Madakufamba also emphasized the driving role of green development in energy cooperation within the BRI. Media reports said that investment in the energy sector accounts for about 40 percent of Chinese investment in BRI partner countries and regions.

“China brings its modern technology while taking into account potential negative impacts on the environment. The clean-energy project, like the power generation of the Kariba South Hydroelectric Power Station, meets the sustainable development aspirations of African countries,” Madakufamba said.

African industrialization also requires the connection of facilities, which is where BRI is most visibly present in Africa.

“Most of the current tangible infrastructure, such as rails and ports, that you see in many countries, including my own country Ghana, has been built by China,” Frimpong said. “It is all part of the BRI.”

An early result of BRI, the Mombasa-Nairobi Standard Gauge Railway (SGR), is a flagship project.

Song Wei, a professor from the School of International Relations and Diplomacy at Beijing Foreign Studies University, said that “through the connection from the capital Nairobi to the port of Mombasa, Kenya will be further integrated into the global value chain. A lot of local workers have been absorbed to solve the local employment issue, and to promote the real improvement of local people’s living standards.”

In addition, a core focus on how China is actively promoting the realization of industrialization in Africa is the nurturing of talents required by the continent throughout this process, Song said.

For instance, we have established Luban Workshops in Africa to train the talents that African countries greatly require, Song noted.

China also supports Africa’s development through providing more opportunities in trade, which experts consider the most crucial tool for unlocking progress in the continent.

Song listed examples such as the China International Import Expo (CIIE), which has offered complimentary standard booths to less-developed countries, while some Chinese e-commerce companies have also helped train online shopkeepers in Africa, boosting local cross-border e-commerce.

“Mutual understanding, not based on imposition” – This is the sentence that Frimpong, the scholar from Ghana, used to describe China–Africa cooperation.

Echoing Frimpong, Rana Mohamed Abd El Aal Mazid, the head and associate professor of political science at Suez Canal University in Egypt, told the Global Times that the Chinese perspective is very different, with the keywords of “friends,” “let’s go together” and “Global South.”

China insists on not interfering in any country’s internal affairs and does not attach any conditions. When China cooperates with Africa, African countries are able to gain a level of respect and equality. This equal partnership has formed a model for how countries engage, Song concluded.

![]() View original content:https://www.prnewswire.com/news-releases/bri-deeply-integrated-into-african-development-more-pragmatic-cooperation-expected-in-focac-302235822.html

View original content:https://www.prnewswire.com/news-releases/bri-deeply-integrated-into-african-development-more-pragmatic-cooperation-expected-in-focac-302235822.html

SOURCE Global Times

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

U.S. Elections Market Impact: What Does History Show?

Economy

The relationship between the party affiliations of the U.S. presidents and economic growth has been a topic of extensive research and debate. Historically, some studies have suggested a correlation between the party in power and economic performance. For instance, data from the post-World War II era often shows that the U.S. economy has grown faster under Democratic presidents than Republican presidents. However, this correlation does not necessarily imply causation.

Kar Yong Ang, the Octa analyst, said: ‘Economic growth is a function of numerous variables, including global economic conditions, technological advancements, fiscal and monetary policies, and unforeseen events like natural disasters or pandemics. Therefore, attributing economic performance solely to the president’s party affiliation can be overly simplistic and potentially misleading.’

Indeed, the legislative branch also plays a crucial role in shaping economic policy. A president’s ability to implement their economic agenda often depends on the composition of Congress. For example, a president facing a divided government may struggle to pass significant economic reforms, regardless of party affiliation.

Still, there is widespread belief that Democratic administrations tend to focus more on fiscal stimulus and social welfare programs, which can boost consumer spending and economic growth in the short term. On the other hand, Republican administrations often emphasize tax cuts and deregulation, which can stimulate business investment and long-term economic growth.

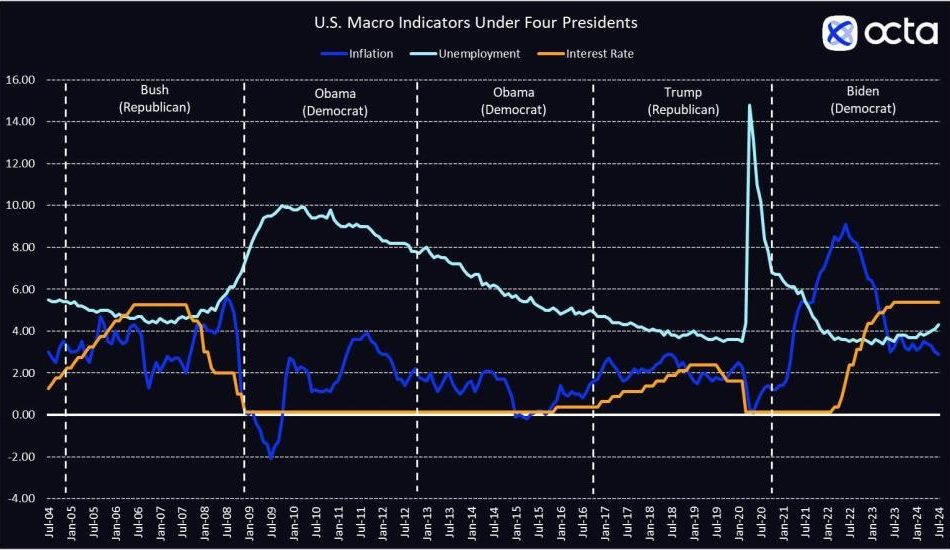

The U.S. Key macro indicators under four presidents (2004–2024)

Source: Octa

At the same time, both bad and good events happen, regardless of who is in the White House. ‘Quite frankly, sometimes it’s just pure luck that defines Presidents’ track record on the economy. For example, Obama entered the White House when the U.S. economy was just about to start recovering following the great financial crisis of 2007–2008, whereas Trump may be said to be less fortunate as he faced the unprecedented Covid crisis during the final year of his presidency’, says Kar Yong Ang, Octa’s analyst. Overall, judging by historical macro indicators, there is no definite conclusion to make about which President is better for the economy.

U.S. Stocks

The U.S. stocks tend to experience increased volatility in the months leading up to an election. This is largely due to the uncertainty surrounding potential policy changes that could affect international trade, economic growth, and geopolitical stability. Therefore, market participants often engage in ‘wait-and-see’ behaviour, holding off on major investment decisions until the election outcome is clear. Historically, the stock market tends to perform better in the year following an election, particularly if the incumbent party wins, as this suggests policy continuity.

While elections can certainly stir immediate reactions, historical data reveals that their long-term impact on financial markets tends to be limited. Market performance over the medium to long term is more often influenced by broader economic parameters like inflation trends rather than who wins the election.

Dow Jones Industrial Average (DJIA) performance under four presidents (2004–2024)

Source: Octa

Historically, sectors like healthcare, energy, technology, and finance react differently to election results due to their sensitivity to legislative changes. The 2016 U.S. election serves as a notable example of markets reacting strongly to the election results, anticipating tax cuts and regulatory reforms that boosted market sentiment.

U.S. Dollar

Both domestic and international perceptions of the candidates’ economic policies influence the U.S. dollar’s performance during the election years. A candidate perceived as fiscally conservative might strengthen the dollar due to expectations of reduced government spending and lower inflation. Conversely, a candidate favouring expansive fiscal policies could lead to a weaker dollar due to concerns over increased debt.

Trade policies are another crucial factor. A candidate with a protectionist stance might introduce tariffs or renegotiate trade deals, which can affect the dollar’s value. Protectionist policies can lead to a stronger dollar in the short term due to reduced imports, but they might also result in retaliatory measures from trade partners, which could weaken the dollar in the long run.

Geopolitical stability and foreign relations are additional aspects that can affect the dollar during the election periods. A candidate perceived as more stable and predictable in foreign policy might boost the investors’ confidence, leading to a stronger dollar. On the other hand, a candidate whose policies are seen as potentially destabilizing could lead to a weaker dollar as investors seek alternative assets.

The U.S Dollar Index (DXY) performance under four presidents (2004–2024)

Source: Octa

Over the past 20 years, the U.S. Dollar Index (DXY) has performed better under Democratic Presidents and had negative returns under Republican leadership. However, as with the U.S. stock indices, it’s crucial not to oversimplify this trend. The U.S. dollar is a global reserve currency influenced by a myriad of factors beyond just presidential policies.

Gold

Gold, considered a safe-haven asset, typically sees increased demand during election periods marked by uncertainty. Historical data indicates that on a micro level, gold prices tend to rise in the months leading up to an election and may continue to do so if the election results are contested or lead to significant policy shifts.

However, Kar Yong Ang, an Octa analyst, notes: ‘If we look at the bigger picture, we see that gold price just generally tends to increase in the long-term and the ideological stance of an incumbent U.S. President has very little or no impact on its performance’. Indeed, the value of gold almost doubled during President Obama’s first term in office but experienced a 30% decline during his second term.

The U.S Dollar Index (DXY) performance under four residents (2004–2024)

Source: Octa

According to a study by the World Gold Council (WGC), gold typically performs slightly better in the six months leading up to a Republican president’s election and stays flat afterwards. On the other hand, it tends to underperform before a Democratic president’s election and performs just below its long-term average in the six months post-election period.[1] However, WGC admits that these results are statistically insignificant and that gold is responding not to the party affiliation of an elected President but, more likely, to the expected effect of specific policies.

About Octa

Octa is an international broker that has been providing online trading services worldwide since 2011.

This article was originally posted on FX Empire

More From FXEMPIRE:

67% Of Investors Say Trump Is Better For Stocks Than Biden, But Market Predictions Are All Over The Map

In a landscape where economic policy and market performance often intersect, a CNBC survey found that investors prefer former President Donald Trump’s potential impact on the stock market.

The poll, which surveyed 400 investors, traders, and money managers, found that 67% believe Trump would benefit stocks more.

Don’t Miss:

CNBC said the sentiment appears to be rooted in historical performance. During Trump’s four-year tenure, the S&P 500 surged 68%, while the Nasdaq saw a 137% climb. In contrast, under Biden’s administration thus far, the same indexes have gained 44% and 34%, respectively.

However, the investment community is divided on the market’s near-term trajectory. The survey found an even split among respondents; a third anticipate a drop, another third expect gains, while the remaining third see a rangebound market.

Trending:

That uncertainty reflects the factors influencing today’s economic landscape. While presidential policies can sway market sentiment, other elements often play a more important role. As Kristina Hooper, chief global market strategist at Invesco, told the New York Times, “Markets are politically agnostic. With good reason: it doesn’t matter.”

See Also:

The recent market rally has been largely attributed to investor enthusiasm surrounding artificial intelligence (AI) rather than political developments. CNBC noted that Microsoft emerged as the front-runner in the AI race, with 50% of survey respondents viewing it as best positioned to capitalize on the tech. Surprisingly, Nvidia did not make the top of that list.

The Federal Reserve’s monetary policy decisions continue to be a factor. Two-thirds of those polled expect the Fed to cut interest rates before year’s end (with many seeing a rate cut as soon as September), a move that could impact the market.

Interestingly, despite the clear preference for Trump regarding market performance, investors showed concerns about the current state of the major indexes. Eighty percent of respondents admitted feeling uneasy about the heavy concentration of tech stocks in the benchmarks.

Trending:

Looking beyond equities, the survey highlighted India as the most attractive overseas market, followed by Japan and Europe. Corporate bonds emerged as the preferred investment vehicle in the absence of stocks.

As the 2024 election approaches, investors are reminded that while presidential rhetoric often ties market performance to administration policies, the reality is far more nuanced. Historical data shows that markets have generally trended upward regardless of which party occupies the White House.

Ultimately, as the survey results indicate, while investor sentiment may lean toward Trump for potential market gains, the road ahead for stocks appears as unpredictable as ever.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 67% Of Investors Say Trump Is Better For Stocks Than Biden, But Market Predictions Are All Over The Map originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Sweet Dividend Stocks to Buy for a Satisfying Passive Income Stream

The U.S. has a sweet tooth. Americans consume 34 teaspoons of sugar each day, according to the U.S. Department of Agriculture. That adds up to more than 100 pounds every year.

That much sugar consumption isn’t healthy. However, this sugar addiction is great for the bottom lines of companies focused on making sugary drinks, desserts, and snacks. They generate billions of dollars in profits each year. Many pay a large portion of their earnings to investors via dividend income.

Because of that, sugar stocks can be a great way to generate passive income. Coca-Cola (NYSE: KO), Hershey (NYSE: HSY), and Mondelez (NASDAQ: MDLZ) offer sweet dividends that can help satisfy any investor’s desire for passive income.

Add some pop to your passive income

Coca-Cola has an elite record of paying dividends. The beverage giant delivered its 62nd consecutive annual dividend increase in early 2024, raising its payout by 5.4% compared to the prior year’s level. That kept Coca-Cola in the elite group of Dividend Kings, companies with 50 or more years of consecutive dividend increases.

Coca-Cola paid $8 billion in dividends to its investors last year alone, boosting its total to $84.7 billion since January 2010. The beverage behemoth currently offers a dividend yield of around 2.7%. That’s more than double the S&P 500‘s dividend yield (recently around 1.3%).

The company is in a strong position to continue growing its dividend. Coca-Cola generates robust free cash flow ($9.2 billion expected in 2024 after covering capital expenditures) and has a cash-rich balance sheet ($17.4 billion of cash, equivalents, and short-term investments).

Meanwhile, the company expects its earnings to continue rising, driven by consumers’ sugar addiction and investments to grow its business. Its long-term target is to organically grow its revenue by 4% to 6% annually and deliver 7% to 9% earnings-per-share growth each year. That growing income stream should enable Coca-Cola to continue increasing its satisfying dividend.

A sweet income stream

Hershey has a long history of paying dividends. The chocolatier has increased its payout for 15 straight years, including giving investors a 15% raise earlier this year. Hershey currently offers a tasty dividend yield of 2.8%.

The iconic chocolate company owns top brands like its namesake, Reese’s, and KitKat. These brands generate billions of dollars in annual revenue and cash flow for the company. It has rung up more than $5 billion in sales during the first half of this year and nearly $1 billion in income.

Hershey has been investing heavily in growing its business, including adding more salty snacks to its growing mix of sweets. These investments are helping grow the company’s earnings and cash flow. Its long-term target is to grow net sales by 2% to 4% per year and deliver 6% to 8% adjusted earnings-per-share growth. Meanwhile, Hershey hopes to increase its dividend in line with its earnings over the long term.

This dividend hits the spot

Mondelez has delivered dividend increases for the past dozen years. The global snacking giant gave its investors an 11% raise in June and delivered double-digit dividend-per-share growth in each of the last five years. It now yields around 2.6%.

The company has a knack for satisfying consumers’ desire for a snack. About 88% of consumers have a snack each day, with most of them (76%) loyal to specific brands. Mondelez owns many beloved brands, including Oreo, Milka, Cadbury, Ritz, Chips Ahoy!, and Clif. It’s the world’s leading cookie/biscuit seller and the second-largest chocolate company.

Mondelez aims to grow its revenue by 3% to 5% per year, putting it on track to deliver high single-digit earnings-per-share growth and strong free cash flow ($3+ billion annually). The company plans to use its free cash flow to make acquisitions, repurchase shares, and continue paying a growing dividend.

These sweet payouts should continue rising

For better or worse, sugar is a big part of the American diet. That’s enabling companies that produce sugary drinks, snacks, and treats to earn huge profits each year. They’re returning some of that money to investors via dividends. That makes them great options for investors seeking to satisfy their craving for more passive income.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has positions in Coca-Cola and Hershey. The Motley Fool has positions in and recommends Hershey. The Motley Fool has a disclosure policy.

3 Sweet Dividend Stocks to Buy for a Satisfying Passive Income Stream was originally published by The Motley Fool

CD rates today, September 1, 2024 (up to 4.70% APY)

Today’s certificate of deposit (CD) interest rates are some of the highest we’ve seen in more than a decade thanks to several rate hikes by the Federal Reserve. Still, CD rates vary widely across financial institutions, so it’s important to ensure you’re getting the best rate possible when shopping around for a CD. The following is a breakdown of CD rates today and where to find the best offers.

Overview of CD rates today

Historically, longer-term CDs offered higher interest rates than shorter-term CDs. Generally, this is because banks would pay better rates to encourage savers to keep their money on deposit longer. However, in today’s economic climate, the opposite is true.

See our picks for the best CD accounts available today>>

As of September 1, 2024, CD rates remain competitive across the board. However, the highest CD rates can be found for shorter terms of around one year or less; the best rates stand at about 4% to 5% APY. The best CD rate today comes from Marcus by Goldman Sachs on its 1-year CD. Account holders can earn 4.70% APY with a minimum deposit of $500.

It’s certainly possible to find CDs with longer terms of two years or more that offer competitive rates, though they are closer to about 4% to 4.5% APY.

Here is a look at some of the best CD rates available today from our verified partners:

How much interest can I earn with a CD?

The amount of interest you can earn from a CD depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (CD interest typically compounds daily or monthly).

Say you invest $1,000 in a one-year CD at 1.85% APY (the current national average CD rate for a one-year term). At the end of that year, your balance would grow to $1,018.50 — your initial $1,000 deposit, plus $18.50 in interest.

Now let’s say you choose a one-year CD that offers 5% APY instead. In this case, your balance would grow to $1,051.16 over the same period, which includes $51.16 in interest.

The more you deposit in a CD, the more you stand to earn. If we took our same example of a one-year CD at 5% APY, but deposit $10,000, your total balance when the CD matures would be $10,511.62, meaning you’d earn $511.62 in interest.

Read more: What is a good CD rate?

Types of CDs

When choosing a CD, the interest rate is usually top of mind. However, the rate isn’t the only factor you should consider. There are several types of CDs that offer different benefits, though you may need to accept a slightly lower interest rate in exchange for more flexibility. Here’s a look at some of the common types of CDs you can consider beyond traditional CDs:

-

Bump-up CD: This type of CD allows you to request a higher interest rate if your bank’s rates go up during the account’s term. However, you’re usually allowed to “bump up” your rate just once.

-

No-penalty CD: Also known as a liquid CD, type of CD gives you the option to withdraw your funds before maturity without paying a penalty.

-

Jumbo CD: These CDs require a higher minimum deposit (usually $100,000 or more), and often offer higher interest rate in return. In today’s CD rate environment, however, the difference between traditional and jumbo CD rates may not be much.

-

Brokered CD: As the name suggests, these CDs are purchased through a brokerage rather than directly from a bank. Brokered CDs can sometimes offer higher rates or more flexible terms, but they also carry more risk and might not be FDIC-insured.