Argentina Ships Gold Bars Abroad to Be Financially Certified

(Bloomberg) — Argentina’s central bank sent part of its gold reserves abroad in recent weeks to be validated for financial use, a move that could give the country some much-needed flexibility, according to people with direct knowledge of the matter.

Most Read from Bloomberg

Once certified, the gold could eventually be used as collateral to obtain financing, according to one of the people, who asked not to be identified discussing private information. Before the move, about half of Argentina’s gold was in domestic vaults with the other half in London, another person said.

Officials from the central bank, known by its Spanish acronym BCRA, declined to comment on the matter.

The monetary authority separately confirmed Monday it had sent gold between its accounts, mentioning both ones in the country and others abroad. However, the bank didn’t say how much of its nearly $5 billion in gold was shipped, for what reason or to where.

Bank officials also criticized what they called “irresponsible” reports about the gold going abroad, emphasizing that management of reserves has always been kept confidential.

Newspaper Pagina 12 published a video Aug. 19 of a truck emblazoned with the BCRA logo driving on the highway, reporting that it was en route to the main international airport in Buenos Aires with $250 million of gold bars.

The gold maneuvers highlight the long-term challenges Argentine President Javier Milei faces. Precariously low international reserves are impeding his ability to lift currency controls and raising investor concern about his administration’s ability to pay down its debts.

Economy Minister Luis Caputo said last week that the government would make debt payments due in January 2025, but wouldn’t seek new international financing until early 2026.

It’s not clear how Caputo and Central Bank Governor Santiago Bausili will use the gold that’s been transferred abroad to be certified. But the economy minister has already said the government is negotiating a special purchase vehicle, or repo agreement, with commercial banks.

To be considered valid for financial use, gold must meet standards set by the London Bullion Market Association. Once certified, bars can be traded freely between institutions within the market, according to the LBMA website.

Argentina’s central bank has more liabilities than cash, a problem known as net negative reserves. A balance sheet in the red has long fueled investor distrust of the peso and kept most sovereign debt hovering below 60 cents to the dollar, though it’s rallied since Milei won power last year. Net reserves are currently at about negative $6.9 billion, according to local brokerage Portfolio Personal Inversiones.

The central bank already used some of its gold during Federico Sturzenegger’s tenure as head of the institution from 2015 to 2018. At the time, it carried out futures operations to earn returns on a portion of its gold reserves.

Caputo defended sending the precious metal abroad in a July interview with local television channel LN+. “If you have gold abroad, you can obtain a return — and the country needs to maximize the returns of its assets,” he said.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Want to Outperform 88% of Professional Fund Managers? Use This Simple Investment Strategy.

Becoming a professional fund manager isn’t easy, but it turns out that beating the returns of some of the best fund managers in the world is. It’s a quirk of stock market mechanics that makes a simple investment strategy far better than the average actively managed mutual fund. While it might be possible for many professional funds to outperform over the short run, it gets harder and harder as time goes on.

There’s a big drag on active funds’ investment returns: fees. As a result, just 12% of active mutual funds outperformed the S&P 500 index over the past 15 years, according to S&P Global‘s SPIVA scorecard. Identifying those 12% ahead of time is practically impossible, so the best strategy to outperform professional fund managers is to buy a simple S&P 500 index fund like the Vanguard S&P 500 ETF (NYSEMKT: VOO).

It’s not going to turn heads when you mention it at your next dinner party, but it does offer one of the highest expected returns of any single investment you can buy. And it’ll do far better than an actively managed mutual fund picked by random chance.

Why it’s so hard for professionals to outperform

By and large, institutional investors account for the vast majority of trading volume, especially among large-cap stocks. Institutional investors typically account for 85% of trading volume. Individual investors aren’t nearly as active in the market, and they hold much less capital.

In other words, professionals, as a group, are extremely representative of the overall market. As such, the average professional investor should only expect to produce returns in line with the overall market returns.

The underperformance problem arises because professional fund managers charge high fees for their services. These fees come in the form of expense ratios and fund loads. The median expense ratio on an actively managed mutual fund last year was 1.01%.

A 1% drag on average investment returns leads to significant underperformance over time. That’s why the SPIVA scorecard shows over 40% of fund managers outperforming over the past year, but just 12% outperforming over the past 15 years.

Yes, there are fund managers that can consistently outperform the index in most years, earning their fees. However, it’s hard to determine who those fund managers are ahead of time. Basing an investment decision on past performance rarely works out. Of the large-cap funds that were in the top quartile of performers in 2019, not a single one remained in the top quartile over the next four years. In fact, fund performance is less persistent than what’s expected under random distribution.

Lower your cost of market participation

Several investors have expounded on the keys to successful investing, but by far one of the biggest factors is controlling your cost of participation. Vanguard founder Jack Bogle coined the idea of the cost matters hypothesis: “Gross returns in the financial market minus the costs of financial intermediation equal the net returns actually delivered to investors.”

Warren Buffett echoes the idea in his 2005 letter to shareholders where he tells the parable of the Gotrocks family. The family once owned every American corporation, but saw their wealth destroyed by “helpers” promising to help individual family members outperform their relatives for just a small fee. He concluded with a simple analogy to Newton’s laws of motion: “For investors as a whole, returns decrease as motion increases.”

The simplest way to reduce motion and keep your helper fees low is to buy an index fund. The Vanguard S&P 500 ETF has an expense ratio of just 0.03% and and extremely low tracking error. It only trades when changes are made to the S&P 500 index each quarter, and it rarely produces a taxable event for its shareholders. The results are net returns extremely close to the gross returns of the constituents of the S&P 500 index.

While a hot, actively managed mutual fund and a star fund manager may look attractive, digging into the data suggests it’s probably not a smart investment. On average, things will work out much better if you focus on the fund with the lowest fees over the past year instead of the fund with the best performance.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends S&P Global and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Want to Outperform 88% of Professional Fund Managers? Use This Simple Investment Strategy. was originally published by The Motley Fool

Watch These Intel Stock Levels as CEO Reportedly Preparing Plans to Sell Assets, Cut Costs

Key Takeaways

-

Intel shares remain in focus this week after Reuters reported on Sunday that CEO Pat Gelsinger and other senior executives are expected to present plans later this month that involve shedding assets and reducing capital expenditures, as part of an effort to turn the company’s fortunes around.

-

Since gapping down more than 26% in early August following the company’s quarterly results, Intel shares have carved out two troughs, raising the possibility of a double bottom, a chart pattern that typically marks a trend reversal back to the upside.

-

Investors should watch key overhead chart levels in Intel shares at $25, $30, $32.25, and $37.

Intel (INTC) shares remain in focus this week after Reuters reported on Sunday that CEO Pat Gelsinger and other senior executives are expected to present plans later this month that involve shedding assets and reducing capital expenditures in an effort to turn the company’s fortunes around.

On Friday the stock surged more than 9% after Bloomberg reported that the chipmaker is considering spinning off or selling its foundry business, a loss-making division that makes chips for third party customers. However, sources told Reuters that the company does not yet have plans to sell its contract manufacturing operation, but was considering divesting its Altera programmable chip unit.

Even after Friday’s jump, Intel shares have tumbled more than 56% since the start of the year, with falls accelerating last month after the chipmaker’s disappointing second-quarter earnings report. The company also announced a pause to its dividend payment and a 15% workforce reduction aimed at saving $10 billion.

Below, we’ll take a closer look at Intel chart and use technical analysis to point out important price levels to watch.

Double Bottom Pattern in Play

Since gapping down more than 26% in early August following the company’s quarterly results, Intel shares have carved out two troughs, raising the possibility of a double bottom, a chart formation that typically marks a trend reversal back to the upside.

Although the chipmaker’s stock closed above the pattern’s neckline on Friday on above-average trading volume, investors should watch for a more decisive breakout this week for added confirmation of a valid signal.

Watch These Key Overhead Intel Chart Levels

Amid further bullish price action in the stock, market participants should monitor four specific overhead chart levels likely to attract interest.

The first sits around $25, a region where investors who bought near recent lows may look to lock in profits near two prominent troughs that formed in October 2022 and February 2023.

Further upside could see a move up to $30, a location that may encounter resistance from a horizontal line linking multiple peaks and troughs in the stock between November 2022 and July this year.

A successful close above this level could see the shares climb to the $32.25 area, where they may run into selling pressure near a trendline joining the August and October 2023 swing lows with more recent trading levels from May to July this year.

Ongoing buying may see the stock rally to $37. This area currently finds a confluence of resistance from downward sloping 200-day moving average (MA) and multiple price peaks that formed on the chart between June 2023 and July 2024.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info.

As of the date this article was written, the author does not own any of the above securities.

Read the original article on Investopedia.

This Risk Weighs on Investors' Minds as Nvidia Continues to See Explosive Growth. Is the Stock Still a Buy?

Over the past few years, Nvidia (NASDAQ: NVDA) has been one of the hottest stocks, thanks to its astronomical growth. However, the stock fell after the chipmaker announced its fiscal second quarter earnings last week, despite incredible growth that surpassed analysts’ expectations. The market wasn’t impressed.

Let’s take a closer look at the company’s latest quarterly results and the one risk that appears to be weighing on investors’ minds.

Outstanding revenue growth continues

For its fiscal second quarter, Nvidia saw sales soar 122% year over year to $30 billion. Adjusted earnings per share (EPS) came in at $0.68, up 152%. Now admittedly that was a slowdown from the 262% revenue growth and 461% adjusted EPS growth it saw in Q1, but still incredible growth.

Its data center business once again led the way with revenue surging 154% to $26.2 billion. The company credited its growth to its Hopper graphics processing unit (GPU) computing platform, and in the quarter in began ramping up its newest H200 Hopper chip.

Gross margins fell sequentially as Nvidia scaled up its new Blackwell chips, but still remained a robust 75.1%. That was down from 78.4% in Q1.

Nvidia is also generating an enormous amount of cash, with operating cash flow of $14.5 billion in the quarter. Free cash flow came in at $13.5 billion.

It ended the quarter with net cash and marketable securities of $26.3 billion. It also announced a new $50 billion share repurchase program.

Looking ahead, the company guided for Q3 revenue of $32.5 billion, led by Hopper growth and the shipping of samples of its new Blackwell architecture. It called demand for Blackwell “incredible” and said that the transition to its next-generation architecture will be smooth, with demand for both Hopper and Blackwell chips expected to remain strong.

Nvidia noted that it did have to make a change to Blackwell to improve production yields but that it expects production to ramp up in the fourth quarter. It said no functional changes were necessary. Last quarter, it indicated production would ramp up in Q3. It is now expecting to recognize several billion dollars in Blackwell revenue in Q4. This is good news and assuages fears that there could have been a longer delay.

It predicted that its data center business would continue to grow strong into next year and beyond. It noted that computing power for next-generation large language models (LLMs) would require 10 to even 40 times the computing power as the prior generation and that the need for more and more computing power would persist.

Is now the time to buy the stock?

Despite its spectacular growth, robust gross margins, and opportunities in front of it, Nvidia trades at a relatively modest valuation, with a forward price-to-earnings ratio (P/E) of just 30 times next year’s analyst estimates.

Given the need for ever-increasing computing power to train more complex AI models and the spending large tech companies are doing to advance AI, Nvidia appears to still have a long runway of growth in front of it. Combine that with a very reasonable valuation, and the stock looks like a buy.

The one big risk the stock faces and the question on many investors’ minds is if all the spending on AI will result in a payoff for the companies doing the spending. Now, companies with cloud computing segments like Microsoft, Alphabet, and Amazon are seeing some benefits, and companies like Meta Platforms and Apple are also investing heavily in AI.

However, these benefits will also need to trickle down to software companies that are developing AI applications and their customers. Right now, a lot of money is being spent on AI infrastructure to the benefit of Nvidia, but there is still an ongoing debate as to whether other companies will see these investments pay off. If they do not, then the spending on AI infrastructure could ultimately slow down significantly.

So while Nvidia continues to look like a buy, the one thing investors should really monitor is if software company growth can begin to increase due to AI. If these companies do not begin seeing growth ramp up in the next year or so, that could be the proverbial canary in the coal mine regarding Nvidia’s valuation.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This Risk Weighs on Investors’ Minds as Nvidia Continues to See Explosive Growth. Is the Stock Still a Buy? was originally published by The Motley Fool

Investigating Microsoft's Standing In Software Industry Compared To Competitors

In today’s rapidly changing and fiercely competitive business landscape, it is vital for investors and industry enthusiasts to carefully evaluate companies. In this article, we will perform a comprehensive industry comparison, evaluating Microsoft MSFT against its key competitors in the Software industry. By analyzing important financial metrics, market position, and growth prospects, we aim to provide valuable insights for investors and shed light on company’s performance within the industry.

Microsoft Background

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Microsoft Corp | 35.01 | 11.44 | 12.59 | 8.45% | $34.33 | $45.04 | 15.2% |

| Oracle Corp | 37.58 | 44.14 | 7.43 | 43.89% | $6.21 | $10.36 | 3.26% |

| ServiceNow Inc | 150.59 | 19.75 | 17.29 | 3.12% | $0.48 | $2.08 | 22.19% |

| Palo Alto Networks Inc | 49.20 | 22.53 | 15.80 | 7.42% | $0.32 | $1.62 | 10.31% |

| CrowdStrike Holdings Inc | 393.72 | 23.34 | 19.18 | 1.75% | $0.12 | $0.73 | 31.74% |

| Fortinet Inc | 45.13 | 202.43 | 10.69 | 504.05% | $0.5 | $1.16 | 10.95% |

| Gen Digital Inc | 27.52 | 8.25 | 4.40 | 8.69% | $0.54 | $0.78 | 2.33% |

| Monday.Com Ltd | 321.89 | 14.46 | 15.74 | 1.62% | $0.0 | $0.21 | 34.4% |

| Dolby Laboratories Inc | 32.82 | 2.80 | 5.54 | 1.58% | $0.06 | $0.25 | -3.2% |

| CommVault Systems Inc | 39.34 | 23.67 | 7.95 | 6.62% | $0.02 | $0.18 | 13.38% |

| Qualys Inc | 27.75 | 10.82 | 8.14 | 10.52% | $0.05 | $0.12 | 8.38% |

| Teradata Corp | 44.19 | 36.24 | 1.58 | 57.36% | $0.09 | $0.27 | -5.63% |

| Progress Software Corp | 35.74 | 6.20 | 3.65 | 3.75% | $0.05 | $0.14 | -1.78% |

| N-able Inc | 71.67 | 3.30 | 5.38 | 1.32% | $0.03 | $0.1 | 12.6% |

| Average | 98.24 | 32.15 | 9.44 | 50.13% | $0.65 | $1.38 | 10.69% |

After examining Microsoft, the following trends can be inferred:

-

With a Price to Earnings ratio of 35.01, which is 0.36x less than the industry average, the stock shows potential for growth at a reasonable price, making it an interesting consideration for market participants.

-

Considering a Price to Book ratio of 11.44, which is well below the industry average by 0.36x, the stock may be undervalued based on its book value compared to its peers.

-

The stock’s relatively high Price to Sales ratio of 12.59, surpassing the industry average by 1.33x, may indicate an aspect of overvaluation in terms of sales performance.

-

The company has a lower Return on Equity (ROE) of 8.45%, which is 41.68% below the industry average. This indicates potential inefficiency in utilizing equity to generate profits, which could be attributed to various factors.

-

The company exhibits higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $34.33 Billion, which is 52.82x above the industry average, implying stronger profitability and robust cash flow generation.

-

The company has higher gross profit of $45.04 Billion, which indicates 32.64x above the industry average, indicating stronger profitability and higher earnings from its core operations.

-

The company’s revenue growth of 15.2% is notably higher compared to the industry average of 10.69%, showcasing exceptional sales performance and strong demand for its products or services.

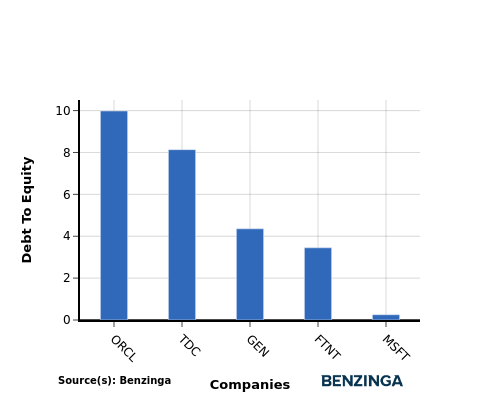

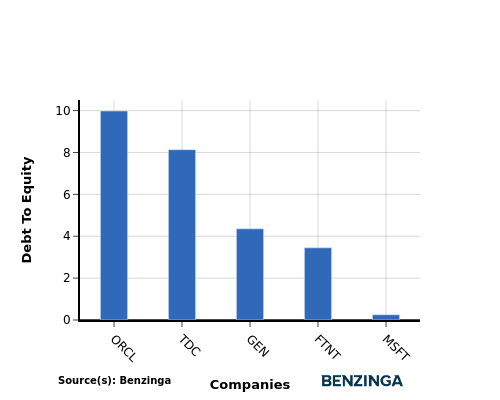

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a key indicator of a company’s financial health and its reliance on debt financing.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

In light of the Debt-to-Equity ratio, a comparison between Microsoft and its top 4 peers reveals the following information:

-

Microsoft is in a relatively stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.25.

-

This implies that the company relies less on debt financing and has a more favorable balance between debt and equity.

Key Takeaways

For Microsoft in the Software industry, the PE and PB ratios suggest the stock is undervalued compared to peers, indicating potential for growth. However, the high PS ratio implies the stock may be overvalued based on revenue. In terms of ROE, EBITDA, and gross profit, Microsoft shows strong performance, indicating efficient operations and profitability. The high revenue growth further supports Microsoft’s competitive position in the industry.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'The Time Has Come to Adjust' — Cheaper Mortgage Rates Could Be Just Weeks Away, But It All Hinges On This Data

The era of interest rates at two-decade highs may be drawing to a close, with Federal Reserve Chair Jerome Powell hinting at possible cuts as early as September. But for hopeful homebuyers eyeing cheaper mortgages, the path forward is still unclear.

Don’t Miss:

Last week, at the central bank’s annual gathering in Jackson Hole, Wyoming, Powell struck a cautiously optimistic tone. “The time has come for policy to adjust,” he said, confirming the Fed’s intention to begin easing its monetary stance.

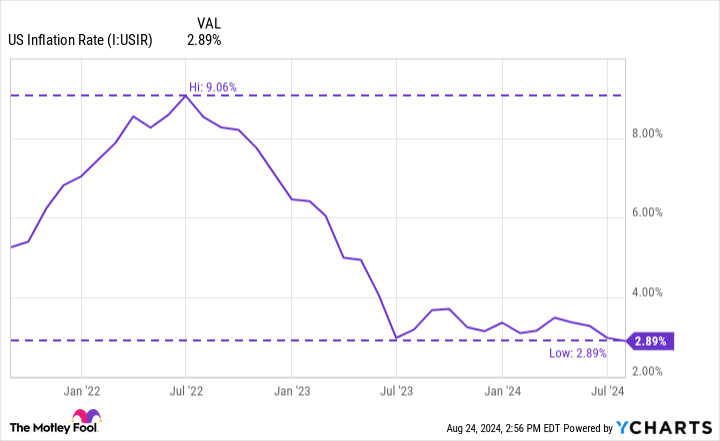

The shift departs from the aggressive rate-hiking campaign of the past two years, designed to tame runaway inflation. Now, with price increases cooling, the Fed faces the challenge of supporting economic growth without reigniting inflationary pressures.

Trending:

While Powell’s remarks clearly signaled that rate cuts are on the horizon, the timing and pace remain uncertain. “The direction of travel is clear,” he said, “but the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

The key variable in this is the labor market.

The Sept. 6 jobs report looms large on the Fed’s radar. A softer-than-expected report could push the central bank toward a more aggressive 50-basis point cut at its Sept. 18 meeting. A resilient job market, however, might prompt a more measured approach.

That uncertainty has left financial markets in a state of cautious optimism. Futures markets are currently split, with a two-thirds probability of a standard 25-basis point cut in September and a one-third chance of a bolder 50-basis point reduction.

See Also:

For potential homebuyers, that translates into a waiting game. While mortgage rates edged down in response to Powell’s remarks, steeper drops may not materialize immediately.

“Additional weak labor market data leading to a series of larger than 25 bps cuts will mean that mortgage rates will fall through the end of the year,” noted Chen Zhao, economics team lead at Redfin. “But a stable, or even falling, unemployment rate will allow the Fed to cut 25 bps at a time and may lead to mortgage rates ticking up a bit from today’s lows through the end of the year.”

Trending:

The Fed’s evolving stance reflects a growing confidence in its battle against inflation. Powell acknowledged that inflation, measured by the Fed’s preferred gauge, has fallen to 2.5%.

“My confidence has grown that inflation is on a sustainable path back to 2%,” he said during his speech, hinting at the possibility of achieving the much sought-after “soft landing.”

The Fed chair also said policymakers had miscalculated the inflationary threat when it emerged in 2020. “The good ship Transitory was a crowded one,” he said, referring to the widespread initial belief that price pressures would be short-lived.

Read Next:

As the Fed navigates the next phase, the housing market grapples with affordability challenges, even as the prospect of lower rates offers some hope.

For now, investors will turn to the upcoming jobs report.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 "Magnificent Seven" Stock That Could Go Parabolic if the Fed Cuts Rates in September

The “Magnificent Seven” is a moniker used to collectively describe the world’s largest technology businesses — Apple, Microsoft, Nvidia, Alphabet, Amazon (NASDAQ: AMZN), Meta, and Tesla.

An interesting characteristic of the Magnificent Seven is that each business is so diverse and spans so many different end markets that this megacap cohort can shed a lot of light on the overall health of the economy.

Investors know that two prominent themes of the macro environment over the last couple of years are lingering inflation and high interest rates. But just a couple of days ago at the Economic Policy Symposium in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell said, “The time has come for policy to adjust.”

That sounds like interest rate cuts to me. Should the Fed begin tapering rates, I think there’s a good case to be made that each of the Magnificent Seven stocks will continue roaring.

However, I see Amazon as the candidate with the most upside. Let’s explore how changes in monetary policy could supercharge Amazon and assess why now looks like a lucrative opportunity to buy the stock.

A new spark for e-commerce

Amazon’s largest source of revenue stems from its e-commerce marketplace. The table below illustrates annual revenue growth trends related to Amazon’s online marketplace over the last year.

|

Category |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|---|---|---|---|---|---|

|

Online stores |

5% |

6% |

8% |

7% |

6% |

|

Physical stores |

7% |

6% |

4% |

6% |

4% |

|

Third-party seller services |

18% |

18% |

19% |

16% |

13% |

|

Subscription services |

14% |

13% |

13% |

11% |

11% |

Data source: Investor Relations.

Notice any patterns? Growth over the last year among physical stores, commissions from third-party sellers, and subscriptions such as Amazon Prime have all decelerated. While sales from online sales have improved modestly, the quarterly results have been pretty inconsistent.

This shouldn’t come across as a surprise, though. Although inflation cooled dramatically in 2023, inflation still lingers. Goods and services are continuing to rise in price, just not as rapidly. When you layer abnormally high inflation with rising interest rates, it’s not entirely surprising to see a slowdown in online shopping and subscription services.

If the Fed does introduce a rate cut in September, I think such a move will be very well received. Even a modest reduction to borrowing costs can go a long way for consumer purchasing power. I think rate cuts will serve as a catalyst for Amazon’s e-commerce segment and ignite some newfound growth for the company’s largest business.

Moreover, I think Amazon’s e-commerce partnerships with social media powerhouses look all the more savvy now that rate cuts appear to be drawing closer.

More investments in artificial intelligence (AI)

Even though Amazon’s e-commerce business has faced an uphill battle over the last year, the company has been able to generate growth from other sources. Namely, cloud computing platform Amazon Web Services (AWS) has been a major beneficiary of the artificial intelligence (AI) revolution.

Similar to my e-commerce thesis, I think rate cuts will provide corporations of all sizes with some newfound financial flexibility. In turn, AWS looks poised for some acceleration as businesses continue to increase investments in AI applications.

Why Amazon stock looks primed to thrive right now

For the trailing 12 months ended June 30, Amazon generated $53 billion of free cash flow — an increase of 572% year over year. Considering Amazon’s total revenue is only growing 10% year over year, it’s incredible to see such a significant increase in profitability metrics.

Over the last 10 years, Amazon’s market capitalization has risen about 1,140%. Over this same time frame, the company’s free cash flow has grown roughly fourfold.

Amazon’s current price to free cash flow (P/FCF) ratio is 38.9. By comparison, the company’s 10-year average P/FCF ratio is about 84. This means that Amazon stock is technically more reasonably priced today than it was a decade ago, despite evolving into a much larger, complex enterprise spanning a multitude of new market opportunities.

To me, investors are really overlooking Amazon stock right now and not entirely capturing just how quickly the company can mint new levels of profitability. Amazon has managed to grow free cash flow exponentially even during a time of unpredictable sales growth, but I don’t think the current valuation fully reflects this dynamic.

With loads of cash on the balance sheet and the possibility of interest rate cuts looming, I think Amazon’s business is about to be supercharged by rejuvenated consumers and corporations alike, and see now as a terrific time to load up on shares.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 “Magnificent Seven” Stock That Could Go Parabolic if the Fed Cuts Rates in September was originally published by The Motley Fool

Market rises into Labor Day, but falls well short of Fourth of July

This week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 35 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 35 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Tender volumes close August higher than where they began

After the sluggish start to August, tender volumes have been trending higher throughout the month. August will follow a trend similar to last year when tender volumes will close the month higher than they began the month. With import levels still being extremely elevated, eventually the freight will move to the truckload market, it is more a matter of timing of when that happens.

To learn more about FreightWaves SONAR, click here.

The Outbound Tender Volume Index, a measure of national freight demand that tracks shippers’ requests for trucking capacity, is 1.87% higher week over week, the largest increase since the impacts of Fourth of July. The gap with year-ago levels rebounded over the past week as volumes continued to inch higher. Volumes are currently 3.13% higher year over year.

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volume (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see an increase of 1.39% w/w, a slightly smaller increase than OTVI as tender rejection rates moved higher over the past week. Accepted tender volumes are up 1.41% y/y.

Earnings reports in the retail space have continued to show that comp sales remain challenged, but retailers have been able to control costs extremely well. A prime example of this was at Best Buy, a company that needs strong discretionary spending for electronic purchases. In the company’s second quarter earnings release, comparable sales declined by 2.3%, but the company’s non-GAAP diluted EPS was 9.8% higher y/y.

With the increase in imports, it appears that retailers, especially big box retailers, are expecting a strong fourth quarter from a consumer spending perspective.

To learn more about FreightWaves SONAR, click here.

Volume increases took hold across the majority of the country as 74 of the 135 freight markets tracked within FreightWaves SONAR showed week-over-week increases in volumes.

Even with the uptick in volumes over the past week, the largest freight markets in the country experienced tender volumes decline. Tender volumes in Ontario, California fell by 0.69% w/w. Moving east into Dallas, tender volumes were 1.37% lower w/w. In the southeast, the decline was even more severe as tender volumes in Atlanta fell by 4.04% w/w.

To learn more about FreightWaves SONAR, click here.

By mode: Dry volumes are now almost up to Fourth of July volumes, which is a positive as August comes to a close. The Van Outbound Tender Volume Index increased by 2.76% w/w. Dry van volumes are 3.93% higher y/y, as the gap with 2023 levels continues to widen after coming in line with 2023 levels in early August.

The reefer market continues to show that it is trending higher, but with more hiccups along the way. Over the past week, the Reefer Outbound Tender Volume Index increased by 2.31%. Despite the weekly increase, reefer volumes are still down 3.82% y/y.

Rejection rates inch higher for Labor Day weekend

Tender rejection rates have reacted to the Labor Day holiday weekend, but the reaction has been fairly muted in comparison to the Fourth of July holiday week. Tender rejection rates moved higher over the past week, approaching 5%, but that’s over 200 basis points lower than the Fourth of July peak.

To learn more about FreightWaves SONAR, click here.

Within the past week, the Outbound Tender Reject Index (OTRI), which measures relative capacity in the market, increased by 45 basis points to 4.86%. The increase was the largest weekly increase since the Fourth of July holiday and very similar to the increase leading into Labor Day last year. Tender rejection rates continue to run slightly higher than they were this time last year, currently 47 basis points higher y/y. Compared to 2019, the year in which the current direction aligns with the most, tender rejection rates are currently 18 bps higher.

To learn more about FreightWaves SONAR, click here.

The map above shows the Outbound Tender Reject Index — Weekly Change for the 135 markets across the country. Markets shaded in blue are those where tender rejection rates have increased over the past week, while those in red have seen rejection rates decline. The bolder the color, the more significant the change.

Of the 135 markets, 96 reported higher rejection rates over the past week, an increase from 76 in last week’s report.

The Detroit, Michigan market experienced the largest increase in tender rejection rates of the largest freight markets. Tender rejection rates in Detroit increased by 169 bps w/w.

The Pacific Northwest is seeing rejection rates increase over the past week, including Seattle where rejection rates were 204 bps higher w/w.

To learn more about FreightWaves SONAR, click here.

By mode: Dry van rejection rates did move higher over the past week, but haven’t eclipsed the levels experienced earlier in August. Over the past week, the Van Outbound Tender Reject Index rose by 18 bps to 4.47%. Dry van rejection rates are 62 bps higher than they were this time last year.

The reefer market is being far more volatile than the dry van market as reefer rejection rates are on the rise. The Reefer Outbound Tender Reject Index has increased by 230 basis points to 10.73%. Reefer rejection rates are 57 basis points higher than they were this time last year.

Flatbed rejection rates continue to be under pressure, largely due to the higher interest rate environment. With interest rate cuts on the horizon, it is likely that the last four months of the year will see some muted activity until industrial and manufacturing companies deploy capital that has been on the sidelines. Over the past week, the Flatbed Outbound Tender Reject Index fell by 87 basis points to 6%. Flatbed tender rejection rates are 68 basis points lower y/y, as the higher interest rate environment had a lagging impact to the market.

Spot rates have limited movement into Labor Day

Spot rates have leveled out at Memorial Day holiday levels, which is a positive sign for the market moving into the final stanza of the year. At the same time, contract rates have been moving higher since late June, which signals that significant cost savings have already been realized.

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index (NTI) — which includes fuel surcharge and various accessorials — was unchanged over the past week at $2.27 per mile. Compared to this time last year, the NTI is up 1 cent per mile. The linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — was up 1 cent per mile this week at $1.70. The NTIL is 12 cents per mile higher than it was at this time last year. The discrepancy in the NTIL and NTI is solely the changes in fuel, which was far more expensive in 2023 than currently. The average diesel truck spot price per gallon is 73 cents per gallon, or 16.4%, lower than it was last year.

Initially reported dry van contract rates remain in a fairly tight range, increased by 5 cents per mile over the past week at $2.33. Throughout 2024, contract rates have been in a tight range, an indication that the extreme cost savings are in the rearview mirror and service is now coming to the forefront. Initially reported contract rates are down 5 cents per mile from this time last year, about a 2% decline.

To learn more about FreightWaves SONAR, click here.

The chart above shows the spread between the NTIL and dry van contract rates is trending back to pre-pandemic levels. The spread widened over the past week as van contract rates increased while spot rates were fairly stable. If spot rates move higher over the next week as any disruption from the Labor Day holiday works itself out, it will narrow the spread.

To learn more about FreightWaves TRAC, click here.

The FreightWaves Trusted Rate Assessment Consortium spot rate from Los Angeles to Dallas fell by 2 cents per mile over the past week to $2.22 per mile.

To learn more about FreightWaves TRAC, click here.

From Chicago to Atlanta, the TRAC rate was stable over the past week, remaining at $2.44 per mile. Contract rates along this lane increased at the start of the week, widening the spread to nearly 50 cents.

The post Market rises into Labor Day, but falls well short of Fourth of July appeared first on FreightWaves.

HP confirms it will pursue Mike Lynch’s grieving family for $4 billion

Hewlett Packard has confirmed it will continue to pursue Mike Lynch’s family for up to $4 billion as it seeks to conclude a 13-year legal battle.

The Silicon Valley-based tech group has been at odds with Lynch since 2011, when its $11.7 billion acquisition of his Autonomy group turned sour. Hewlett Packard Enterprise (HPE) wrote down the deal’s value by $8.8 billion, citing “accounting irregularities.”

HPE, formerly known as HP, won a civil trial against Lynch in the U.K. in 2022 after a judge ruled that he was likely aware of accounting fraud at the company.

He was acquitted of fraud charges in a U.S. criminal trial in June and intended to use this verdict to appeal the civil ruling.

However, Lynch died on his wife Angela Bacares’s Bayesian superyacht in August after the boat ran into a storm. Bacares is now expected to inherit her late husband’s battle with the tech group.

There was speculation that HPE would be deterred from pursuing Lynch’s family for damages owing to the negative publicity such a move could create.

Robin Henry, partner and head of dispute resolution services at Collyer Bristow, told Fortune that HPE was stuck “on the horns of a dilemma” over whether it would be willing to face criticism for continuing with the proceedings.

However, HPE has now confirmed it will carry forward with the final stages of the trial.

“In 2022, an English High Court judge ruled that HPE had substantially succeeded in its civil fraud claims against Dr Lynch and Mr Hussain,” an HPE spokesperson told Fortune.

“A damages hearing was held in February 2024 and the judge’s decision regarding damages due to HPE will arrive in due course. It is HPE’s intention to follow the proceedings through to their conclusion.”

After ruling in HPE’s favor in the U.K. civil trial, the judge indicated that damages would be considerably less than the $4 billion HPE sought.

The total value of Lynch’s estate is unknown, but it isn’t likely to be anywhere near $4 billion. He reportedly collected £500 million (then around $800 million) for the Autonomy deal. He set up the venture capital fund Invoke Capital in 2012 and held a 3% stake in the British cybersecurity group Darktrace at the time of his death.

As a U.S.-listed company, HPE has a fiduciary duty to act in the best interests of its shareholders. The company will be mindful of this after being sued by shareholders in the wake of its Autonomy acquisition.

The process of pursuing a defendant’s family after they die is a macabre subject, but legally, it’s very straightforward.

“Following Mike Lynch’s tragic death, his executors ‘step into his shoes,’” Oliver Embley, a partner at Wedlake Bell, told Fortune last week.

“In the UK, all legal actions against a person survive against their estate following their death. Any judgment already made, as in the case of HPE’s High Court claim against Mr Lynch, is binding on his estate.”

It means Bacares, who is grieving both Lynch and their late 18-year-old daughter, Hannah, will likely take the wheel when the judge returns to conclude damages later this year.

This story was originally featured on Fortune.com

Global benchmarks are mixed in cautious trading ahead of US holiday and jobs report

TOKYO (AP) — Global shares were mixed in cautious trading Monday ahead of the Labor Day holiday in the U.S., when stock exchanges are closed.

France’s CAC 40 slipped 0.3% in early trading to 7,611.64, while Germany’s DAX fell 0.1% to 18,881.14. Britain’s FTSE 100 was little changed, down less than 0.1% at 8,370.39. U.S. shares were set to drift lower with Dow futures down 0.1% at 41,613.00. S&P 500 futures fell 0.1% to 5,654.25.

Investors were also looking ahead to the U.S. employment report set for release Friday for an indication of the strength of the American economy.

In Asia, Japan’s Nikkei 225 gained 0.1% to finish at 38,700.87, after the Finance Ministry reported capital spending by Japanese companies in the April-June quarter increased 7.4% from the previous year.

After a period of stagnation, Japan’s economy is showing signs of a recovery. Next week, Japan will release revised gross domestic product, or GDP, data, a measure of the value of a nation’s goods and services. The preliminary data released earlier showed the first growth in two quarters.

Australia’s S&P/ASX 200 rose 0.2% to 8,109.90, while South Korea’s Kospi gained nearly 0.3% to 2,681.00. Hong Kong’s Hang Seng slipped 1.7% to 17,691.97. The Shanghai Composite dipped 1.1% to 2,811.04.

A bit of pessimism rolled in over China’s growth prospects over the weekend, as its National Bureau of Statistics reported that August manufacturing PMI, a barometer of industrial output, fell from 49.4 to 49.1. That was weaker than market forecasts.

Recent reports on the U.S. economy, including inflation, consumer spending and income, have been encouraging. The Commerce Department said its personal consumption and expenditures report showed prices rose 0.2% from June to July, up slightly from the previous month’s 0.1% increase.

That means price rises are slowing down, and that’s likely to lead to the Federal Reserve cutting interest rates for the first time in more than four years. The market expects the Fed will start cutting rates later this month.

In other encouraging news, Friday’s Commerce Department report showed Americans stepped up their spending by 0.5% from June to July and incomes rose 0.3%, faster in July than the previous month.

In energy trading, benchmark U.S. crude rose 5 cents to $73.60 a barrel. Brent crude, the international standard, added 6 cents to $76.99 a barrel.

In currency trading, the U.S. dollar edged up to 146.68 Japanese yen from 146.18 yen. The euro cost $1.1071, up from $1.1053.

___

Yuri Kageyama is on X: https://x.com/yurikageyama