Move Over, Nvidia: Billionaires Have a New Favorite Artificial Intelligence (AI) Stock

Over the last 30 years, no shortage of next-big-thing investment trends have graced Wall Street. Since the advent of the internet in the mid-1990s, no innovation, technology, or trend has come close to having the impact on corporate growth rates as the internet… until now.

According to the analysts at PwC, the artificial intelligence (AI) revolution has the ability to increase global gross domestic product by more than $15 trillion in 2030. This is a mammoth addressable market that can support multiple big-time winners.

Yet in spite of the euphoria surrounding AI on Wall Street, quarterly filed Form 13Fs with the Securities and Exchange Commission point to mixed feelings for artificial intelligence-inspired stocks. A 13F provides investors with a concise snapshot of which stocks the smartest and most-successful money managers have been buying and selling.

In the June-ended quarter, billionaire investors sent shares of AI leader Nvidia (NASDAQ: NVDA) to the chopping block and decisively piled into what can be considered their new favorite artificial intelligence stock.

Nvidia had billionaires running for the exit for a third consecutive quarter

What’s particularly interesting about the selling activity in Nvidia is it marks the third straight quarter of selling by at least a half-dozen prominent billionaires. The June-ended quarter saw seven billionaire investors lighten their load, including (total shares sold in parenthesis):

-

Ken Griffin of Citadel Advisors (9,282,018 shares)

-

David Tepper of Appaloosa (3,730,000 shares)

-

Stanley Druckenmiller of Duquesne Family Office (1,545,370 shares)

-

Cliff Asness of AQR Capital Management (1,360,215 shares)

-

Israel Englander of Millennium Management (676,242 shares)

-

Steven Cohen of Point72 Asset Management (409,042 shares)

-

Philippe Laffont of Coatue Management (96,963 shares)

Profit-taking and the need to diversify are two possible answers as to why some or all of these billionaires felt the need to reduce their stakes in Nvidia.

Since 2023 began, Nvidia’s market cap has grown by $2.75 trillion, as of the closing bell on Aug. 23, 2024, which led to the company’s largest-ever stock split (10-for-1) in June. This increase is due to the company’s H100 graphics processing unit (GPU) becoming the standard in AI-accelerated data centers, as well as Nvidia possessing jaw-dropping pricing power, which is reflective of enterprise demand for its AI-GPUs overwhelming supply.

But there are far more reasons than just profit-taking that might explain this ongoing billionaire exodus from Nvidia.

One of the more logical conclusions to draw is that at least some of these billionaires are concerned about competitive pressures following its parabolic climb. Advanced Micro Devices (NASDAQ: AMD) is ramping up production of its MI300X AI-GPU and doesn’t have the same chip-fabrication supply constraints as Nvidia. Further, AMD’s chip typically sells for $10,000 to $15,000, which is far below the $30,000 to $40,000 Nvidia is commanding for the H100.

Competitive pressures can manifest from within, as well. Nvidia’s four largest customers by net sales — Microsoft, Meta Platforms, Amazon, and Alphabet — have developed in-house AI-GPUs for use in their data centers. Even though these in-house chips won’t have the same computing capacity as Nvidia’s H100, they’re going to take up valuable data center “real estate” and minimize Nvidia’s opportunities moving forward.

These seven billionaire sellers might also be concerned about history. At no point over the last three decades has there been a hyped innovation, technology, or trend that managed to avoid an early stage bubble-bursting event. Without exception, investors always overestimate the utility and adoption of new innovations.

Despite all the buzz with artificial intelligence, very few businesses have well-defined game plans as to how they’re going to generate a positive return on their data center investment. This is a glaring warning that investors have, once again, overestimated the uptake of this technology. If and when the AI bubble bursts, no company is likely to be hit harder than Nvidia.

Move over, Nvidia: This is now the favorite AI stock of billionaire money managers

But while billionaires were showing shares of Nvidia to the door, they were avidly scooping up shares of what can arguably be described as their new favorite AI stock. A total of seven billionaire money managers were buyers of shares of AI networking solutions specialist Broadcom (NASDAQ: AVGO) during the second quarter, including (total shares purchased in parenthesis):

-

Ole Andreas Halvorsen of Viking Global Investors (2,930,970 shares)

-

Jeff Yass of Susquehanna International (2,347,500 shares)

-

Israel Englander of Millenium Management (2,096,440 shares)

-

Ken Griffin of Citadel Advisors (1,880,740 shares)

-

John Overdeck and David Siegel of Two Sigma Investments (1,332,230 shares)

-

Ken Fisher of Fisher Asset Management (865,090 shares)

Keep in mind that the above share counts have been adjusted for Broadcom’s 10-for-1 stock split, which occurred after the close of trading on July 12.

Just as Nvidia’s hardware has become a staple in high-compute data centers, Broadcom has quickly asserted its dominance as a key AI networking solutions provider. For instance, its Jericho3-AI fabric is capable of connecting up to 32,000 GPUs, with the goal of reducing tail latency and maximizing the computing capacity of these chips.

While AI has undoubtedly been a catalyst, the reason I suspect billionaires have made Broadcom their favorite AI stock is that, unlike Nvidia, it’s not entirely reliant on AI for growth. If the AI bubble bursts, Broadcom has a multitude of other revenue channels it can turn to as a cushion.

For example, Broadcom has a leading position as a provider of wireless chips and accessories used in next-generation smartphones. Wireless companies have willingly spent billions to upgrade their networks to support 5G download speeds. In turn, this has led to a steady device-replacement cycle that’s spurred demand for Broadcom’s products.

Beyond smartphones, you’ll find Broadcom supplying networking solutions to businesses from all sectors and industries, along with cybersecurity solutions and financial software, to name some of its other ventures.

Broadcom has also leaned on acquisitions as a way to expand its product and service ecosystem, promote cross-selling opportunities, and grow its bottom line. Its $69 billion buyout of cloud virtualization software provider VMware, which closed in November, is a perfect example of Broadcom broadening its reach in private and hybrid enterprise clouds.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Move Over, Nvidia: Billionaires Have a New Favorite Artificial Intelligence (AI) Stock was originally published by The Motley Fool

If I Could Only Buy 1 Artificial Intelligence (AI) Semiconductor Stock Over the Next Decade, This Would Be It (Hint: It's Not Nvidia)

Believe it or not, semiconductor chips are used for applications well beyond powering smart devices and electronics. For this reason, it’s not entirely surprising that semiconductor stocks have been particularly big winners as the artificial intelligence (AI) revolution pushes forward.

Among leading chip companies, Nvidia (NASDAQ: NVDA) stands out as the 800-pound gorilla right now. But with shares up 651% since August 2022, investors may want to consider what opportunities exist in the chip realm besides Nvidia.

Let’s dig into how Nvidia propelled itself into being the world’s top chip business, and assess why another stock may be the better buy in the long run.

Nvidia is great, but …

Chips known as graphics processing units (GPUs) are used for a host of AI-powered applications such as training large language models, developing autonomous driving software, and machine learning. Nvidia’s GPU roster includes its highly popular H100 and A100 chips, and the company’s new Blackwell series is already forecast to be a smash hit (but more on that later).

Indeed, Nvidia looks downright unstoppable, with a nearly 80% share of the AI-powered chip market.

Nevertheless, I caution investors about going all-in on one company — even if it is the de facto leader. Below, I’ll break down in detail why Nvidia’s time at the top may be drawing to a close.

The competitive landscape is beginning to intensify

Many of the world’s largest companies are currently customers of Nvidia. In fact, many “Magnificent Seven” companies, such as Microsoft, Tesla, Amazon, Meta, and Alphabet, have been touted as some of Nvidia’s largest customers.

Although a customer roster of that caliber is impressive, I question whether it’s encouraging. Tesla CEO Elon Musk recently explained to investors that his electric vehicle company is exploring ways to compete with Nvidia more directly as Tesla looks to move away from a heavy reliance on H100 chips.

Furthermore, many of the Magnificent Seven companies referenced above have made it clear that they too are investing significantly into capital expenditures (capex) to develop in-house chips.

For example, I see Amazon’s $11 billion data center infrastructure project as a clear sign that the company is looking to increase investment in its Trainium and Inferentia chips.

What’s amazing is that all of the competitors analyzed above are tangential to Nvidia. Designing semiconductors isn’t a core component of any of their businesses.

Perhaps Nvidia’s most direct competitor at the moment is Advanced Micro Devices (NASDAQ: AMD). While AMD’s growth during the AI revolution hasn’t even been in the same universe as Nvidia’s, I think those dynamics may soon change.

Nvidia’s momentum has hit some turbulence following a recent announcement that the new Blackwell chips will be delayed due to a design flaw. Although I suspect Nvidia will still sell out of these chips when they finally do hit the market, I think AMD has an opportunity to capture some new business right now.

With all this said, I think it’s only a matter of time before Nvidia’s growth begins to decelerate. Subsequently, I would not be surprised to see the stock give back some of its record gains.

This company stands to win regardless

Given the sheer number of competitors and the risks that come with commercializing new products and services, you’re probably wondering which chip stock I actually do have full confidence in.

Enter chip manufacturing company Taiwan Semiconductor (NYSE: TSM). You see, Nvidia, AMD, and many others do very little of their own manufacturing. Instead, after designing next-generation hardware, they outsource the actual manufacturing capability to Taiwan Semiconductor.

Taiwan Semiconductor makes products for Nvidia, AMD, Amazon, Broadcom, Intel, Qualcomm, Sony, and many more.

According to data from Market.us, the total addressable market (TAM) for the global AI chip market is expected to grow at a compound annual growth rate (CAGR) of 31.2% between 2024 and 2033 — reaching a size of $341 billion.

To me, Taiwan Semiconductor stands to benefit no matter what company is selling out their chips. Moreover, given the high likelihood of additional GPUs coming to market from big tech and the bullish forecast for the AI chip market more broadly, I see Taiwan Semiconductor as a clear winner over the next several years.

Investors with a long-term horizon who are looking for alternatives to AI’s most obvious opportunities among mega-cap tech may want to seriously consider a position in Taiwan Semiconductor right now.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

If I Could Only Buy 1 Artificial Intelligence (AI) Semiconductor Stock Over the Next Decade, This Would Be It (Hint: It’s Not Nvidia) was originally published by The Motley Fool

Insiders Are Selling These REITs This Week — Cause For Concern?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Investors pay close attention whenever reports emerge of insider transactions on their stocks Some traders may sell the stock if it’s reported that an insider sold numerous shares. However, it’s widely held that insider buys are far more significant than insider sales. Insiders only buy shares because they expect the company stock will go up. On the other hand, insiders may sell for reasons that have nothing to do with present or future company performance.

Perhaps the insider is purchasing a new home, paying for a child’s college or wedding or rebalancing a portfolio. Investors rarely know the motivation for the sale, so assumptions that the company has gone bad may be misleading.

If a shareholder learns that an insider has sold shares of that stock, the transaction can be investigated further by checking the U.S. Securities and Exchange Commission (SEC) Form 4. This is the form that company insiders or their legal representatives must fill out when buying or selling company stock.

Trending Now:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Anyone can access Form 4 from the SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) database at sec.gov. by clicking on search filings and full-text search and supplying the company name. Some brokerage platforms also include the link to Form 4 when reporting an insider transaction.

On Form 4, sometimes an explanation is given for the sale. For example, “This transaction was effected pursuant to a rule 10b5-1 trading plan adopted by the reporting person dated as of July 1, 2024.”

Rule 10b5-1 was adopted in 2000 to provide an affirmative defense to insider trading liability and is intended to show circumstances in which an insider has a written plan in place well in advance to sell shares of the company stock. For example, an insider may have an automatic sell plan twice a year, regardless of the stock price or company performance.

Another situation arises when the insider sells shares to cover the taxes generated by the settlement of vested restricted stock awards. Often, a company may withhold some shares when giving its executive team bonus stock. Those shares are automatically sold to cover the taxes.

This week insiders at three real estate investment trusts (REITs) from different sub-sectors sold a large block of shares. Does this mean those stocks or REITs in general are about to collapse? Take a look.

Prologis

Prologis Inc (NYSE:PLD) is a San Francisco, California-based industrial REIT that owns/manages approximately 1.2 billion square feet in 5,618 industrial logistics properties throughout the U.S. and 18 other countries. Prologis leases space and supplies equipment, robotics and other services to its customers.

On Aug. 26, 2024, Joseph Ghazal, the Chief Investment Officer at Prologis, sold 5,200 shares of Prologis at $129.07 for a total of $671,164. However, Mr. Ghazal still had approximately 13,187 shares remaining following this transaction and there have been no other insider sales of Prologis stock this year, despite it being down year-to-date. Those are positive signs.

Omega Healthcare Investors

Omega Healthcare Investors (NYSE:OHI) is a Hunt Valley, Maryland-based triple-net equity healthcare REIT that provides financing, capital and triple-net leasing to 77 different operators among approximately 900 senior housing, skilled nursing and assisted living facilities across 42 states throughout the U.S. and the United Kingdom.

On Aug. 26, Daniel Booth, Chief Operating Officer at Omega Healthcare, sold 25,000 shares of Omega company stock at a weighted average price of $38.7072, for a total value of $967,680.

This sale is troubling because the same day, Robert O. Stephenson, Omega’s CFO, also sold 30,000 shares at the weighted average price of $38.784 for a total of $1,163,520.

Director Dr. Lisa Egbuonu-Davis, sold 1,352 shares at $38 on Aug. 13, for $51,376. Davis still owns 16,766.

When more than one insider is selling, that does carry additional weight. Omega Healthcare has risen 48.4% since its low in early February, and insiders might be securing profits near a peak.

Read More:

BXP

BXP Inc (NYSE:BXP), formerly Boston Properties, is a Boston-based office REIT that owns and operates 186 properties of 53.5 million square feet in New York, Boston, Los Angeles and San Francisco. In August 2024, 89.1% of in-service properties are presently leased, with a weighted average lease term (WALT) of 7.5 years. BXP is a member of the S&P 500.

On Aug. 26, Peter V. Otteni, the Executive Vice President of BXP, sold 4,785 shares of BXP stock at an average price of $73.4422, for a total value of $351,420.

BXP has had a successful run-up since June, gaining about 33.5%. Company executives often trim positions after such gains. However, one interesting note is that this is the second time Mr. Otteni has sold a significant number of shares in the last three months, and Form 4 shows that he has no remaining shares. However, these are the only recent insider sales so this is likely a personal decision, rather than BXP not doing well.

This summer, there were two insider sales at residential REIT, UDR Inc (NYSE:UDR). One insider sold 90,000 shares at $39.52 per share, and the other sold 45,000 shares at $37.90. However, their timing was off because UDR has since reported excellent Q2 earnings and received several analyst price target increases. It recently traded at $44.

Several other REITs with a recent insider sale include Brixmor Property Group (NYSE:BXR), CBL & Associates (NYSE:CBL), Equity Lifestyle Properties (NYSE:ELP) and AvalonBay Communities Inc (NYSE:AVB).

The National Association of Real Estate Investment Trusts (NAREIT) identifies 171 REITs, so a handful of REITs with insider sales do not make up an entire sector. With the Fed expected to cut interest rates in September, REITs could be poised to make significant gains over the next 12 months.

So, sleep well, investors, and don’t worry when you hear that an insider has sold shares of company stock. It’s best to seek additional information on the SEC’s Form 4 before leaping to conclusions about insider motivation.

Better Yields Than Some REITs?

The current high-interest-rate environment has created an incredible opportunity for income-seeking investors to earn massive yields, but not through REITs.

Arrived Homes, the Jeff Bezos-backed investment platform has launched its Private Credit Fund, which provides access to a pool of short-term loans backed by residential real estate with a target 7% to 9% net annual yield paid to investors monthly. It paid 8.1% in July. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

As long-term rates go down and short-term rates stay high, there’s a unique chance to invest in fix & flip loans before yields drop. Check out Benzinga’s favorite high-yield offerings.

This article Insiders Are Selling These REITs This Week — Cause For Concern? originally appeared on Benzinga.com

The Market Just Made a Big Mistake About SoFi. Here's Why

SoFi Technologies (NASDAQ: SOFI) stock’s decline has got to be one of the biggest disappointments of the year. It came into 2024 on a high, having more than doubled last year and with the company sporting profitability for the first time.

It continues to report strong growth, and it posted its third straight quarterly profit, but SoFi stock is down more than 20% this year. The market is making a mistake, and you can benefit from the stock drop before the market gets clued in.

SoFi is disrupting traditional banking

SoFi is a full financial services platform that offers lending services, banking products, and more on its digital app. It has no physical branches, and it targets the student and young professional population. This cohort appreciates a digital, consumer-focused experience. SoFi is attracting millions of members who are looking for a better product, and since these customers skew younger, it has a long growth runway as this market matures and increases engagement with SoFi’s platform.

The Q2 earnings update was chock-full of positive news. Members increased 41% year over year to nearly 8.8 million, adjusted net revenue increased 20%, and it produced net income of $18 million in accordance with generally accepted accounting principles (GAAP). Management raised its outlook for 2024 adjusted net revenue and earnings per share (EPS), and it’s expecting positive net income for the third quarter and the full year.

SoFi is more than a lender

It’s not obvious at first glance exactly what’s bugging the market, although concerns about slowing loan growth probably figure in the share price decline. But what it looks like is that while SoFi is eager to show off its newer segments and how they hedge against pressure in lending, they’re not yet taking over for the credit business yet.

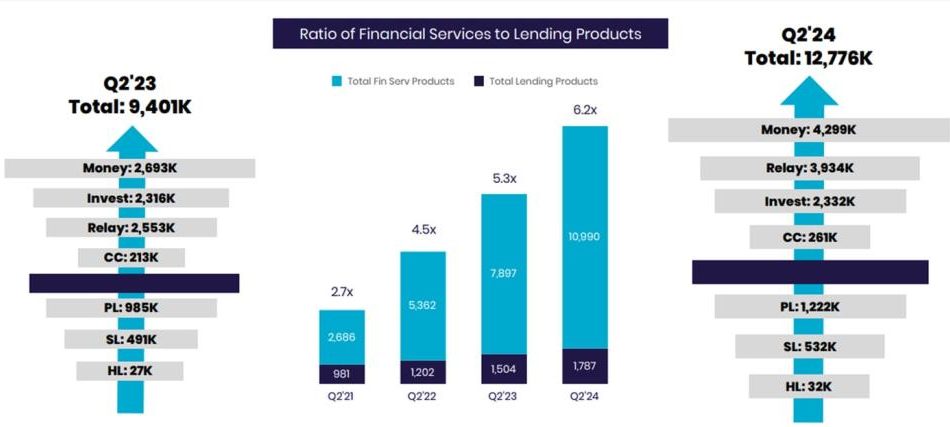

SoFi has been expanding its business to encompass a wider array of services. Outside of its core lending segment, it now has two other segments: Tech platform, or the white-label financial infrastructure services under the Galileo brand, and financial services, which are the non-lending services.

These two business are growing at a much faster rate than lending, and they appeal to a large population even during challenging conditions when the lending business is under pressure. They add more revenue and ease the lending pressure, but what they really accomplish is creating a wider service base from which members can increase engagement. The positive results of this model are already in, but they’ll be even more beneficial over time as more members join the platform.

However, the lending segment remains much bigger. It accounted for 55% of revenue in Q2, so while the other segments are booming, the core segment isn’t growing very much. Lending segment revenue was $341 million in Q2, a 3% increase from last year. The other two segments increased 46% year over year in Q2, but they’re still much smaller.

Lending contribution profit was $198 million, or 8% more than last year. Together, financial services and tech platform contribution profit was $86 million. That’s where you really see the value of the lending platform for SoFi’s business. So when the lending contribution is up only 8%, that looks concerning, even though the tech platform’s contribution increased 82% and financial services switched from a loss to a gain.

Overall, the company reported a profit. But that profit is largely coming from a slowing lending business. Until these other segments take over a larger portion of the business and contribute more to the consolidated results, the market senses trouble.

Wake up before the market does

Fortunately for SoFi and its shareholders, the pessimism that the market is pricing in looks unwarranted when you consider the long-term opportunity. The market isn’t ready to be confident about SoFi’s new business potential, even though it’s already demonstrating results. This is a visual representation of how the non-lending segments are growing.

SoFi’s expansion plan is working, and the new members and increased engagement should eventually eclipse the short-term weakness in the lending segment. However, interest rates are probably going to be cut before that, and when that happens, SoFi’s lending segment should rebound. Together, that makes for a dynamite long-term investment.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The Market Just Made a Big Mistake About SoFi. Here’s Why was originally published by The Motley Fool

Retiring abroad? Why the best, happiest places to grow older and retire are not where you’d expect.

Those international “best places to retire” surveys typically point to warm, low-cost countries in Central and South America. But, in many ways, beautiful northern places like Norway, Denmark, Finland and Iceland may be even better.

That’s my conclusion after poring over the 2024 World Happiness Report, the Natixis 2023 Global Retirement Index and the Mercer CFA Institute Global Pension Index 2023, as well as speaking to their creators.

Most Read from MarketWatch

And after vacationing in Norway where I talked with an old friend who is a semi-retired U.S. expat married to a retired Norwegian, I came away even more persuaded that you might want to consider the Nordic region if you’re thinking about retiring abroad.

Really.

‘I’m happy to pay my taxes’

“To me, Norway is a magical place,” my pal Nina Berglund, a digital editor and former Californian, said. “We have good pensions and I feel very well taken care of here. But we also have contributed a lot [in taxes] of course.”

Added her husband Morten Most, a retired journalist: “You often hear Norwegians say, ‘I’m happy to pay my taxes,’ and to a certain extent that is true because of the expectation that your taxes will be worth it.”

Those steep Norwegian sales taxes, an annual wealth tax of 1.1% on assets over $160,000 and the national Norwegian Oil Fund help pay for government-provided retirement pensions plus nearly free health care, long-term care and college educations. Employers must provide pensions, too.

In Norway, Berglund said, if you need home care or a nursing home, “everything is covered.” The copay for a doctor’s appointment is around $25, she noted. Hospital stays, X-rays, MRIs and CAT scans are mostly covered by government health care.

Retirees living in Norway only pay taxes on income they earn there (22% to 39%). There’s no inheritance tax and property taxes are low by U.S. standards.

“I don’t feel stressed at all,” said Most. “Time flies very fast. I have a good retirement.”

Read MarketWatch’s Where Should I Retire? column

High rankings for retirement and happiness among people 60+

Indeed, Norway ranked No. 1 in Natixis’ Global Retirement Index for the third straight year. That index measures retirement security by looking at health, finances in retirement, quality of life and material wellbeing.

Norway was also the third happiest country for people 60 and older in the World Happiness Report, based on residents’ assessments of their lives. Denmark topped the World Happiness Report and the U.S. ranked No. 10.

Along with nearby Sweden, Norway scored a B in the Global Pension Index, calculated by crunching data on the adequacy, sustainability and integrity of each nation’s retirement income system. Denmark nailed an A.

Some Nordic countries are remarkably safe, too. In Numbeo’s 2024 Global Safety Index, Iceland ranked 18, Denmark 20, Finland 23, Norway 39; the United States is 88.

What makes the countries score so well

Why do Scandinavian countries of Norway, Denmark and Sweden plus Nordic ones like Finland and Iceland consistently show up so well in these types of surveys?

Countries at the top of the World Happiness rankings, said John Helliwell, a lead researcher for that study, are well-off and people have “good connections, high trust and high caring for each other.”

“I tend to think that it’s the holistic view of things they have,” said David Goodsell, executive director of the global research program, Natixis Center for Investor Insight, which publishes the Global Retirement Index. “If you’re not worried about your healthcare or about wanting to [afford to] go back to school in retirement,” he added, “those things are going to impact how you feel.”

David Knox, who heads up Mercer’s Global Pension Index, cites what he calls the “social compact” of these countries between their residents as well as between the residents and their governments.

“Each generation expects to support, and then receive from, the next generation,” he said. “It’s a less individualistic society” than in the United States, Knox added.

Two other factors Goodsell cited: stable economies and small populations — combined, Nordic countries have fewer people than Canada.

When setting retirement policies, said Knox, “I think it’s easier for a relatively smaller country to say: ‘This is what we are going to do.’”

Employers tend to be paternalistic in Nordic countries, too, which helps in retirement. “In Denmark, more than 80% of the working-age population has a pension account,” said Knox. “That’s much higher than in America.”

Good retirement systems, happy residents

Knox isn’t surprised that many Scandinavian and Nordic countries score so well in both the World Happiness Report and his Global Pension Index.

As people approach retirement, he said, if their government is under pressure financially, “they may worry, ‘Will they cut the state pension and can I afford to retire?’ But if I’m in a system like Norway, which has the confidence of the Oil Fund, there’s an element of ‘I’m happy I’m going to retire here’ and that there will be support from the government, whether it’s in pensions or health care or whatever.”

Absent from ‘best places to retire’ rankings

Interestingly, the annual Best Places to Retire surveys from International Living and Live and Invest Overseas don’t even include Nordic countries in their rankings. I asked their creators why.

Donal Lucey, head of digital content at International Living, cited the cost of living which, he said, “can be prohibitive for retirees.”

It’s true that gasoline and groceries can be high in that part of the world, but rents are significantly lower in Oslo, Copenhagen and Stockholm than New York City, according to Numbeo.

Lucey called visa and residency requirements in Nordic countries “stringent,” since these nations don’t have retirement visa programs like in Portugal and Mexico.

“U.S. retirees would need to navigate complex immigration laws,” said Lucey. “And without significant financial means, securing long-term residency can be difficult,” he said. In Norway, it takes three years to become a resident.

Live and Invest Overseas publisher Kathleen Peddicord said: “My quick, maybe flippant, response is that we don’t talk about that region because the weather is awful and the cost of everything is very high.”

“As a retiree shopping the world map for options for where to live better on whatever budget you’ve got,” she added, “you’ve got many better choices than those cold, dark, overpriced countries in Northern Europe that don’t really want you there anyway.”

That’s something of an overstatement.

Cold? Often, but not in the summer. “I love the change of seasons,” said Berglund. “We’re still very active. We go skiing.” But, she conceded, “winter for many elderly, and a lot of Norwegians, is very hard.”

Dark? Yes, in some parts of the year, but not others.

Don’t want you there? That wasn’t my experience as a tourist, nor what I heard from my expat friend and her husband.

It helps, however, to live by what the Danish call “hygge” — enjoying the simple pleasures in life.

Advice for pre-retirees

World Happiness Report researcher Halliwell said that instead of looking for a great place in the world to retire, visit some of the happiest countries to see what explains that feeling and then try to emulate it after returning home.

“Apply the Nordic lessons where you already live,” he said. “It shouldn’t be about where you can get the most bang for your buck.”

Most Read from MarketWatch

A boomer who has had cancer and gets $2,200 a month in Social Security can't retire comfortably: 'It's a catch-22'

-

Wendy Jones, 71, and her husband, who has disabilities, face financial struggles despite Social Security.

-

Jones, a former paralegal, stopped working after a brain-tumor diagnosis in the mid-2000s.

-

They rely on a reverse mortgage and part-time work but worry about further medical costs.

Wendy Jones, 71, has been her husband Roy’s caregiver for the past three decades — even after her brain-tumor diagnosis. But the couple, who live in Palm Beach County, Florida, are running low on cash and are worried about how they’ll put food on the table.

Jones, who worked as a paralegal for decades, stopped working in the mid-2000s after being diagnosed with a brain tumor. Her husband was permanently disabled in a workplace accident in 1992. Even though both get Social Security payments, their savings have fallen over the years as they’ve paid thousands of dollars out of pocket in medical expenses, even with insurance, according to financial documents viewed by Business Insider.

Jones is one of millions of older Americans with health issues who are relying on Social Security to get by. Dozens of older Americans have told BI in recent months that they must continue working to supplement their Social Security and pensions, though it’s difficult for Jones and many others to hold a job given their medical conditions.

Jones, who works part time, said she and her husband resorted to buying only frozen food and getting a reverse mortgage loan. Still, she’s fearful that one more emergency medical expense could put them into the red.

Breadwinner of the family

Jones grew up in Fort Lauderdale, Florida, with three siblings, and she had a “very happy, normal, healthy upbringing,” she said. She became a civil trial paralegal in West Palm Beach, married, and had four children.

Her husband worked as a mechanic and liked to hunt in his free time. Jones said they were both very active and healthy for the first two decades of their careers.

In 1992, however, Roy was injured in a workplace accident and then got into a car crash. He was left permanently disabled and wasn’t able to return to work, receiving income from Social Security Disability Insurance. He had multiple major surgeries and took various medications, some of which they paid for out of pocket.

Jones was the sole breadwinner of the family, and her employer was accommodating when she needed to tend to her husband, she said. She received bonus payments, one of which she used for a down payment on a new home. She said she made between $70,000 and $90,000 a year, including bonuses, in the 1990s and early 2000s.

Still, she and her husband were worried about making ends meet. She said they always had food when her children were teenagers, but there were times when they would resort to ramen noodles or mac and cheese.

Once her children were in college or moved out of the house, she felt better about her and her husband’s finances, she said, adding that their 401(k)s, insurance, mortgage, and other financial components were “very secure.” Her children now range from 43 to 51 years old, and three went to college on full-ride scholarships or with help from their grandparents.

“They all went off on their own, got married, went to college, and so we thought things would get slower and easier for us,” Jones said. “The way things worked out, that didn’t happen.”

A devastating diagnosis

In the mid-2000s, Jones started having vision and concentration problems. She would sometimes pass out at her desk or blank out for minutes at a time. She was diagnosed with a brain tumor, but she said the cost of the insurance co-payments wasn’t a “horrible burden.” Eleven months after her first surgery, however, she got agonizing migraines again that felt like “a sword going through my head,” and she had to take more medication.

After three years of working on and off between medical appointments, she was forced to leave her job and went on disability. She said she was lucky to get approved on her first attempt, though it typically takes six to eight months for an initial decision after months of collecting all the paperwork.

“Somehow, I thought it would be the same as what I was making, but it was two-thirds of the income, so a huge cut there,” Jones said. “The insurance didn’t cover so much, so that’s when I had to start eating into my savings. The 401(k) went really quickly. I have really good health insurance, but nothing covers everything, apparently.”

She also waited two years after being approved for SSDI before she became eligible for Medicare, meaning she had to pay $500 a month out of pocket for one medication. She spent hours on the phone trying to get affordable insulin for her husband, who has diabetes, and the attorneys at her previous firm helped her secure additional assistance. They had to declare bankruptcy during this period.

“If I wasn’t educated and didn’t speak English, I couldn’t imagine ever getting any of this assistance,” Jones said. “I struggle with the forms and applications. I don’t know how people do that. People my age often don’t know how to use a computer.”

She said preparing for unexpected medical costs from the various forms of cancer she’d been diagnosed with over the past two decades had been perhaps the most difficult aspect of their finances. Recently, she’s had multiple ambulance bills charging her as much as $900 with insurance.

Recently, they got a letter saying their Medicare premiums weren’t being covered by the state of Florida anymore. Jones suspects it’s because she put money her mom gave her before she died into a savings account to pay for their home and car for this year. Though she gets $2,200 a month in Social Security, and her husband gets about $1,000, they’re forced to buy frozen entrées and vegetables, as cooking is a challenge, and they can’t afford meat. They also cut back to one car to save money.

Just scraping by

Though their credit is good now, Jones said a few years ago, she would get calls from bill collectors many times daily. She and her husband live much leaner now than a few years ago.

Despite everything, they were able to keep their “very tiny” house, though the cost of living in Palm Beach has risen fast over the past few years. They got a reverse mortgage loan, which lets older homeowners access some of their home’s equity for tax-free payments. Jones said it was their only option to cling onto their house — she estimated their mortgage would have been $1,500 to $2,000 a month. They haven’t been able to afford to fix their sprinkler system, and when they had a pipe burst, they shelled out nearly $1,200.

She said it was “horrendous” having to pay her car insurance, property tax, and homeowners insurance in the same month. Their homeowner’s insurance is $4,000 yearly, their property tax is nearly $2,000, and their car insurance is $1,900.

“People have suggested we move, but we have lived here 35 years,” Jones said. “Besides emotional and social support, moving is very expensive.”

Jones works a minimum-wage, part-time job at a bird clinic — one of the few jobs she could do given her medical conditions. She gets at most $300 a month, which she said was handy. She knows if she quits her job, she will qualify for extra assistance, but she said she would rather work for her money — and get discounts on food for her birds at home.

“It’s a catch-22: People say, just get a job, but I tried that, and everything else was taken away from me,” Jones said, adding that she would work as long as she could drive, walk, and answer phones. “I didn’t get ahead. I wasn’t able to save or progress in any way whatsoever.”

Her children have helped her fund vacations, allowing her to attend a memorial service for her mother in the Outer Banks or travel to Alaska. Her children give them financial advice and frequently check in on them.

Jones said she was taking one day at a time, especially because her oncologist gave her a worrisome update at her last appointment. She said her goal going forward was to make sure her husband was taken care of, as he was dealing with depression and pain.

“I’m trying to find a way that we can live comfortably without making somebody else uncomfortable,” Jones said.

Are you worried about retirement? Reach out to this reporter at nsheidlower@businessinsider.com.

Read the original article on Business Insider

Prediction: 1 Semiconductor Stock That Will Catch Up to Nvidia Within 10 Years

Semiconductor stocks have captivated Wall Street since the start of 2023. Advances in the chip market have allowed dozens of other industries to take their technologies to the next level. Sectors like artificial intelligence (AI), cloud computing, virtual/augmented reality, consumer tech, self-driving cars, and more have all benefited from new chip designs from companies like Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD). As a result, semiconductor companies have become some of the best options for investing in tech.

Nvidia’s and AMD’s stocks have climbed 782% and 132% since the start of 2023, when a boom in AI kicked off. Nvidia managed to get a headstart in the industry and was able to immediately begin supplying its chips to AI developers worldwide. Meanwhile, AMD required more time to produce competitive hardware.

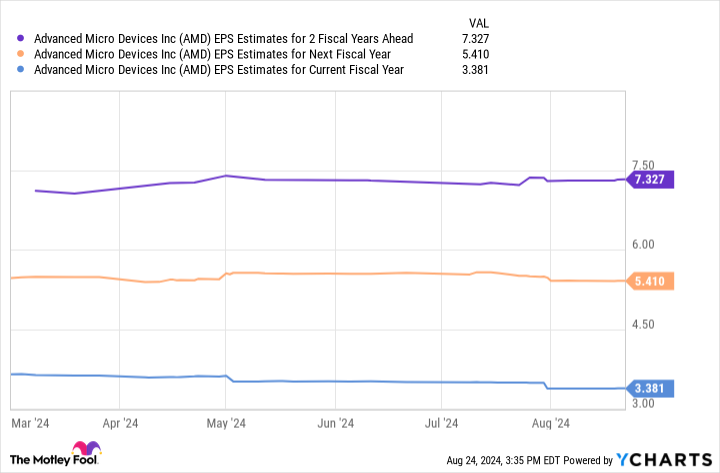

However, AMD has made promising strides in AI in 2024 and could be on track to deliver significant gains in the coming years. It’s one semiconductor stock that I predict will catch up to Nvidia’s market cap of $3 trillion within 10 years.

AMD is scaling up to better meet AI demand

AMD stock has popped 12% since its second quarter of 2024 earnings were released on July 30, rallying investors with a win in AI that proves the market has become its biggest growth driver.

Total revenue increased 7% year over year to just under $6 billion, mainly fueled by a 115% spike in its AI-driven data center segment and a 49% increase in its client division. The quarter benefited from a ramp-up in AI graphics processing unit (GPU) and central processing unit (CPU) sales.

Over the last year, AMD has gone full force into AI, expanding into multiple areas of the industry that will likely pay over the next decade. The company has unveiled its most powerful GPUs to date and announced plans to purchase server builder ZT systems for $5 billion. Both moves make the company more competitive against Nvidia, with the acquisition allowing AMD to more quickly roll out its AI GPUs at a scale necessary for cloud providers.

AMD’s chips have already attracted some of AI’s biggest players, with the company signing on Microsoft‘s Azure, Meta Platforms, and Oracle as clients. These cloud giants are in steep competition with each other, requiring powerful hardware to stay competitive. As a result, AI chip demand is only likely to continue rising for the foreseeable future, with AMD well-positioned to enjoy major gains.

AI opportunities outside of GPUs

In addition to GPUs, AMD is planting seeds throughout the AI market to diversify its positions and profit from growth catalysts far into the future.

The company has a massive opportunity in AI central processing units. CPUs have been AMD’s specialty for years, with its CPU market share rising from 18% in 2017 to 34% this year, as it has consistently taken market share from Intel. Meanwhile, data from Verified Market Reports shows that the AI CPU sector was valued at $15 billion last year and is projected to hit $410 billion by the end of the decade, expanding at a compound annual growth rate (CAGR) of 29%.

Expertise in CPUs also grants AMD a potentially lucrative role in the quickly expanding AI-capable PC market. As demand for AI services has risen, so has the need for more powerful hardware. As a result, AI-enabled PCs are projected to make up about 40% of all global PC shipments in 2025, with the market developing at a CAGR of 44% through 2028.

Nvidia’s market cap was $359 billion at the start of 2023. Yet, it hit $3 trillion in June 2024, just 18 months later, after a rally that boosted its stock by 738%. The company’s success was primarily fueled by a massive spike in its AI GPU sales. Nvidia has shown what is possible with success in one facet of AI. Meanwhile, AMD has laid the foundation in multiple areas of the industry that could deliver significant stock gains.

AMD’s market cap is currently about $251 billion. The company’s stock would need to rise 1,200% to hit $3 trillion over the next 10 years. It’s a lofty target, but not an unreachable one. Since AMD’s stock is up more than 3,000% since 2014, it might not be too far a reach.

The chart above projects AMD’s earnings to hit just over $7 per share by fiscal 2026. Multiplying this figure by the company’s forward price-to-earnings ratio of 46 yields a share price of $336, projecting potential stock growth near 115% by 2026.

Yet, Nvidia’s spectacular rise in AI and AMD’s performance over the last 10 years suggest that growth could be conservative. As a result, AMD could be on a growth path to achieve that coveted $3 trillion market cap over the next decade. The company is expanding quickly, and you won’t want to miss out.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Prediction: 1 Semiconductor Stock That Will Catch Up to Nvidia Within 10 Years was originally published by The Motley Fool

Trump vs. Harris: 4 ways the next president could impact your bank accounts

Last month, President Biden announced the end of his presidential reelection campaign. This move not only changed the dynamics of the 2024 presidential race but also opened the door for new ideas and political agendas — some of which will directly impact your finances.

With fewer than 70 days until voters head to the polls, Republican presidential nominee and former President Donald Trump and Democratic presidential nominee and current Vice President Kamala Harris have been laser-focused on gaining support from voters, sharing some of their key policy initiatives as we approach Election Day.

It should be noted that Harris was confirmed as the Democratic nominee less than a month ago. So, many of her policies and plans have yet to be formally revealed.

Still, both candidates have shared ideas about what they envision for the next four years. And the next president will undoubtedly have a major influence on your financial life and the banking industry as a whole.

4 ways the next president could influence banking

We can’t predict how the election will play out, but we can examine each candidate’s statements around banking and finance to surmise how their policies may impact Americans’ wallets if elected.

Banking regulation

Trump and Harris differ on many issues, and banking regulation is one of them.

Trump favors a more relaxed approach; he will likely work to reinstate his deregulation policies that were originally signed into law in 2018. The legislation was meant to ease regulatory rules and requirements placed on small and medium-size institutions by the Dodd-Frank Act, which aimed to curb risky lending practices and increase bank oversight in light of the 2008 financial crisis.

“President Trump’s pro-growth, deregulatory agenda ignited the greatest economy in history,” wrote Karoline Leavitt, national press secretary for the Trump campaign, in an email to Reuters.

However, critics have claimed that this deregulation has weakened the stability of the banking industry and led to recent bank failures like that of Silicon Valley Bank.

The Biden-Harris administration has pushed to reinstate “common sense” banking oversight, and Harris has a track record of voting against deregulation. However, while her campaign speech, which revealed her economic agenda, focused on plans to tackle price gouging, housing issues, capping prescription drug costs, and a new child tax credit, she did not mention a plan to address banking regulation specifically.

Read more: How do banks make money?

Bank fees

Between 2018 and 2020, Americans paid roughly $120 billion per year in credit card interest and fees, according to the Consumer Financial Protection Bureau (CFPB). That translates to an average of $1,000 annually for each American household.

Under the Biden administration, Harris has had a hand in tackling junk fees by capping credit card late fees and banning fees for essential bank account services, such as checking bank account balances, obtaining a payoff amount for a loan, or getting account information needed for applications.

Bank fees haven’t been a central topic in the current presidential race, and Trump has not said much about whether this will be a priority for his administration if elected. However, looking at Trump’s first term as president, it appears he favored leaving bank fee decisions in the hands of banks.

Read more: What are bank fees, and how do I avoid them?

Interest rates

The federal funds rate has been a major topic of discussion since the post-pandemic inflation rate reached a 40-year high and led to sharply increased costs for goods and services.

In an effort to control inflation, the Federal Reserve can raise or lower its target rate to influence the cost of everyday goods. The federal funds rate also influences the interest rates banks offer on savings accounts, credit cards, and loans.

Ultimately, the federal funds rate isn’t set by any one individual. The Federal Open Market Committee (FOMC) meets multiple times throughout the year to evaluate key economic indicators, gauge the overall health of the economy, and determine whether or not a rate change is appropriate.

While the president can nominate key Fed officials, appoint the chair, and discuss concerns related to monetary policy, presidents do not directly influence the Fed’s rate decisions.

But Trump has stated he believes the president should have a greater say in setting interest rates. “In my case, I made a lot of money, I was very successful, and I think I have a better instinct than, in many cases, people that would be on the Federal Reserve or the chairman,” the former president said during a recent press conference.

Harris countered this statement by saying, “the Fed is an independent entity, and as president, I would never interfere in the decisions that the Fed makes.”

Read more: How much control does the president have over the Fed and interest rates?

Cryptocurrency

Cryptocurrency is decentralized, meaning it isn’t backed by a central bank, agency, or government. This autonomy has been a major selling point for crypto enthusiasts who distrust traditional financial systems. On the other hand, some experts believe cryptocurrencies lack important safeguards, leaving users at risk and opening up the door to increased illegal activity.

Harris has yet to make an official statement about whether cryptocurrency legislation will be part of her platform. However, a policy adviser to her campaign said Harris will back measures to help grow digital assets during a Bloomberg News roundtable at the Democratic National Convention.

In the past, Trump referred to cryptocurrency as a scam. However, he has seemingly changed his mind, now holding an estimated $1 million in digital currency. In its official 2024 policy platform, Republicans vow to “end Democrats’ unlawful and unAmerican Crypto crackdown” and “defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their Digital Assets, and transact free from Government Surveillance and Control.”

It may come as no surprise then that crypto companies account for nearly half of the corporate money contributed to this year’s races, according to data from consumer rights advocacy nonprofit Public Citizen. Both candidates have been seemingly open to supporting regulatory frameworks and growth within this industry; the next president’s approach to crypto could shake things up in the banking sector and encourage more Americans to move toward digital currencies as an alternative to traditional banking.

Read more: Is this a good time to invest in bitcoin?

Trump Soon Free To Sell All His Stake In Trump Media. Here's What Happens If He Does – 'He's Stepped On Just About Every Rake'

Former President Donald Trump is about to face a major decision that could shake up the financial world and his fortune. By the end of September, Trump will be free to sell his entire stake in Trump Media & Technology Group, which owns his social media platform, Truth Social. But what happens if he decides to cash out?

Don’t Miss:

Trump currently owns more than 114 million shares in Trump Media, a stake valued at about $2.5 billion. That’s a big chunk of his estimated $4.3 billion net worth. Until now, he hasn’t been able to sell these shares because of a lockup agreement – a rule that prevents company insiders from selling their stock right after the company goes public. But that restriction is set to end in late September.

See Also: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

If Trump decides to sell, it could have major consequences. For one, the stock price might plummet. Financial experts are already worried that if Trump dumps his shares, there might not be enough buyers willing to snap them up, which could cause the stock to drop even more.

As Steve Sosnick, Chief Strategist at Interactive Brokers, pointed out, the overall stock market has been doing well, but Trump Media’s stock has been trending downward. It closed at $21.42 recently, its lowest since going public. “The rising tide hasn’t lifted that boat,” he said.

Trending: With over 15k units already sold, this female-owned dog waste startup is targeting the $147 billion pet industry – here’s how to invest early at just $1 per share.

Why is this happening? Trump Media’s fortunes are closely tied to Trump’s reputation and popularity. As the 2024 election heats up, Trump’s standing in the polls has taken a hit after Kamala Harris took the lead as the Democratic nominee.

Matthew Tuttle, CEO of Tuttle Capital Management, didn’t mince words, telling Politico that Trump has “stepped on just about every rake he possibly could” since his acceptance speech at the Republican National Convention. This has been “hammering the stock.”

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $100

According to its latest earnings report, the company is having a tough time financially, losing over $16 million in just three months. It’s clear to almost everyone that Trump Media’s future depends on the 2024 election. If Trump wins the election, that alone could boost the company’s stock and do a complete 180.

Investors are worried that Trump might sell his shares to cover his growing legal bills or fund his campaign. But selling such a large stake could flood the market with too many shares, pushing the price down further. And with Truth Social not generating much revenue compared to bigger platforms like X (formerly Twitter) and Facebook, Trump Media’s sky-high valuation doesn’t match its actual financial performance.

Trending: General Motors and other leaders revealed to be investing in this revolutionary lithium start-up — allowing easy entry by launching at just $9.50/share with a $1,000 minimum.

Trump hasn’t said what he plans to do once he’s free to sell his shares, and his team isn’t giving any hints. Meanwhile, Trump Media is trying to expand its business, recently adding in-app streaming to Truth Social. The company says it has $344 million in cash and no debt, which gives it some breathing room.

For now, all eyes are on Trump as he prepares to make a decision that could affect not just his fortune but also the future of his media empire and the investors who have big bets on him.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Trump Soon Free To Sell All His Stake In Trump Media. Here’s What Happens If He Does – ‘He’s Stepped On Just About Every Rake’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.