Prediction: This Under-the-Radar Tech Stock Will Outperform Nvidia and Apple by 2030

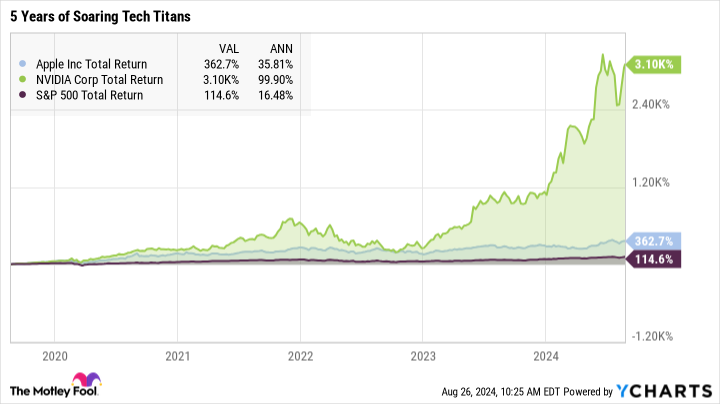

Tech giants Apple (NASDAQ: AAPL) and Nvidia (NASDAQ: NVDA) are on top of the world nowadays. They are the two most valuable stocks on the market, looking back at market-beating returns in the past five years. Apple’s total returns delivered a compound average growth rate (CAGR) of 36% in that period. Nvidia soared even higher with a 100% five-year CAGR. The artificial intelligence (AI) boom has been mighty kind to Nvidia’s investors.

They achieved these massive gains in a strong era for the general market, but the S&P 500 index looks downright sleepy by comparison:

It would be cool if Nvidia and Apple were poised to continue their market-beating ways from here. Invest in the biggest, baddest names on the market, sit back and relax, and let them deliver more of the same good stuff for years to come. Unfortunately, I’m afraid that both stocks are a bit overvalued at today’s massive market caps — $3.1 trillion for Nvidia and $3.4 trillion for Apple. I know it’s like comparing mountains of cash to rivers of revenues, but these two market caps add up to about 23% of America’s gross domestic product.

I think that’s too much. Apple and Nvidia may be overdue for a painful correction. At best, I don’t expect them to rise much higher in the foreseeable future.

At the same time, good old International Business Machines (NYSE: IBM) is gaining ground in the AI space, and its stock is undervalued today. I don’t expect IBM’s stock to pass the trillion-dollar mark in the next five years, but it should most certainly rise as Big Blue’s enterprise-class AI tools add value to the stock. Most investors don’t see this traditional computing giant as a promising AI investment yet. That’s a big mistake.

Don’t forget IBM’s cash-profit chops

IBM’s valuation ratios don’t look terribly exciting at first glance. The stock is changing hands at 22 times trailing earnings and 2.9 times sales. Those are perfectly acceptable middle-of-the-road values for mature companies, just below the averages seen in the S&P 500 and Dow Jones Industrial Average market indices.

Then your eye slides over to IBM’s price-to-free cash flow (P/FCF) ratio, and the stock suddenly looks different. When you calculate IBM’s values based on its massive cash profit, the stock seems to belong in Wall Street’s bargain bin instead. This ratio stops at 14 times free cash flows, just over half of the S&P 500’s or Dow Jones‘ readings.

Cash is king, and IBM has plenty of it. The company’s rich cash profits and relatively modest bottom-line earnings show that Big Blue’s accountants are very good at lowering taxable profits while putting lots of real greenbacks in the bank. I see cash flow as a higher-quality measure of profitability, so it’s easy to look away from IBM’s moderate price-to-earnings ratio.

IBM’s place in the AI boom

Remember the five-year chart I showed you? IBM’s chart for the same period is a different animal:

The stock has underperformed broad market indices for many years as it transformed a hardware-heavy business model into a more profitable software and services plan. In particular, you should know that the revamped Big Blue comes with a heavy focus on cloud computing, data security, and AI tools.

Yes, this company was a leading AI researcher long before ChatGPT’s release opened the floodgates for AI investments. Many investors seem to have missed that connection since IBM’s business results didn’t immediately skyrocket in this soaring AI era. The big AI contracts are coming, just a bit late.

You see, IBM is happy to leave consumer-friendly ideas such as ChatGPT-style chatbots to other tech providers. This company will always go after large corporate contracts instead, adding extra layers of security, business-friendly data analytics, and lawsuit-repellant data tracking to the mix. Potential clients may take several quarters to test and approve the resulting AI recipe, but the end result is a lucrative long-term deal that won’t be easy to replace.

The approvals are rolling in now, building a robust revenue stream for the long run. Market makers are still not paying attention, so IBM’s stock keeps trading at incredibly low cash flow ratios. I can’t wait to see what happens in a couple of years, when the AI contracts have become generous and highly profitable revenue streams.

One more thing…

I’ll admit that Nvidia and Apple are making solid cash profits, too. However, their sky-high stock prices already account for these high-quality profits. Apple’s P/FCF ratio stands at 33 today, and Nvidia’s is soaring at 79 times free cash flows.

Thanks, but no thanks. I’d much rather buy IBM’s undervalued stock instead.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Anders Bylund has positions in International Business Machines and Nvidia. The Motley Fool has positions in and recommends Apple and Nvidia. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

Prediction: This Under-the-Radar Tech Stock Will Outperform Nvidia and Apple by 2030 was originally published by The Motley Fool

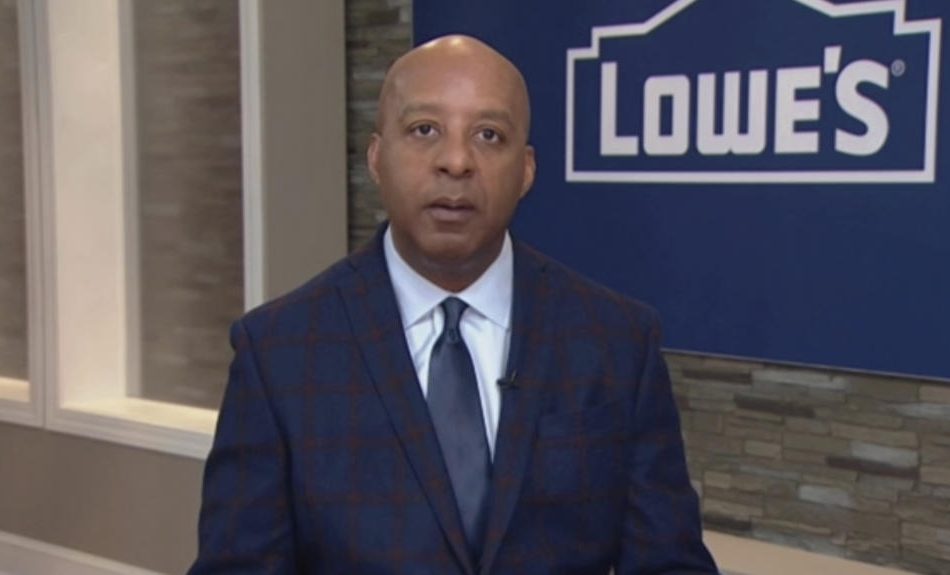

Lowe's becomes latest company to scrap DEI policies amid 'woke' backlash

Lowe’s (LOW) is scaling back some of its diversity initiatives, becoming one of the largest companies yet to make such an about-face as activist pressure mounts.

The home improvement retailer reportedly communicated a decision to stop participating in diversity surveys issued by LGBTQ civil rights advocate Human Rights Campaign in a memo to employees Monday.

Lowe’s also reportedly told employees in the memo that the company would stop sponsoring and participating in community parades, festivals, and fairs.

Similar changes discarding so-called DEI (diversity, equity, and inclusion) initiatives have been picking up momentum at major US corporations in recent months as critics target what they describe as “woke” policies.

In June, under pressure from shareholders, rural retailer Tractor Supply (TSCO) announced that it would retire its DEI goals. In July, tractor maker John Deere (DE) announced that it would continue to track workforce diversity but end participation in cultural and social awareness-focused events.

Harley-Davidson, Jack Daniel’s maker Brown-Foreman (BF-A), Polaris (PII), and its motorcycle subsidiary Indian Motorcycle have also scrapped DEI policies.

Lowe’s reversal is the only one from a company run by a black CEO. Its boss, Marvin Ellison, is the only black executive to have run two Fortune 500 companies: Lowe’s and JCPenney.

Conservative activist Robby Starbuck said in a post on X that Lowe’s and the other companies that discarded diversity initiatives did so after he communicated plans to “expose” woke policies.

“So far you’ve helped me change corporate policy at Tractor Supply, John Deere, Harley Davidson, Polaris, Indian Motorcycle and now Lowe’s,” Starbuck wrote Monday in a post on X.

Lowe’s did not respond to Yahoo Finance’s request for comment.

Big news: I messaged @Lowes executives last week to let them know that I planned to expose their woke policies. This morning I woke up to an email where they preemptively made big changes.

Here are the changes:

• Ending participation in the @HRC’s woke Corporate Equality Index… pic.twitter.com/qOUr2JLGV7

— Robby Starbuck (@robbystarbuck) August 26, 2024

A US Supreme Court ruling last year has been cited as a factor in corporate decisions to alter diversity policies.

The court specifically ruled against race-conscious student admissions programs at Harvard University and the University of North Carolina, saying the programs violated the Equal Protection Clause of the Fourteenth Amendment.

Lowe’s reportedly cited this ruling in its memo to employees, saying that it began reviewing its programs following that decision.

Ellison, Lowe’s CEO, has diversified the executive ranks of Lowe’s since becoming the boss and also had meetings with employees to discuss race following the police killing of George Floyd.

Ellison is also a member of the Business Roundtable, an association of more than 200 CEOs that posted an essay this month re-endorsing a stance that a company’s purpose is to serve “all” stakeholders.

That philosophy adopted in 2019 includes shareholders, customers, employees, and suppliers, along with the communities where a company operates.

Business Roundtable CEO Joshua Bolten said that purpose has been misinterpreted as an endorsement for ESG (environmental, social, and governance) initiatives, which include DEI.

The ideological left and right both incorrectly interpreted the position to mean that companies had decided to commit resources to solving every societal ill, he added.

“Right from the beginning, there’s been a fair amount of misunderstanding about what the statement was about,” he said.

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on X @alexiskweed.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Correction: A previous version of this article had a misspelling of Joshua Bolten’s name. We regret the error.

US senator presses Intel CEO on chips award after job cut plan

By David Shepardson

WASHINGTON (Reuters) – Republican Senator Rick Scott on Wednesday asked Intel CEO Pat Gelsinger for more details on the company’s plans to cut more than 15,000 jobs despite being set to receive nearly $20 billion in U.S. grants and loans to boost chip production.

In a letter seen by Reuters, Scott questioned if the Commerce Department’s planned awards had failed “to include real metrics that would protect taxpayer dollars from going to companies that could not meet high standards for U.S. manufacturing and job creation.”

The Commerce Department in May announced a preliminary agreement for $8.5 billion in grants and up to $11 billion in loans for Intel as well as access to a 25% investment tax credit. The chips award has not been finalized.

The agency declined to comment on Scott’s letter and Intel did not immediately respond to requests for comment.

The Commerce Department said in May the funding will support the creation of more than 10,000 manufacturing jobs and nearly 20,000 construction jobs for projects in Arizona, New Mexico, Ohio and Oregon.

Intel said this month it would cut costs by $10 billion in 2025 and reduce its workforce by more than 15%, with a majority of the exits completed this year.

Gelsinger said at the time Intel’s workforce is 10% larger than it was in 2020, when its revenue was $24 billion higher than in 2023 and he needed fewer people at headquarters and more in the field supporting customers.

Scott wants Intel to detail how many U.S. employees will lose their jobs and whether the cuts will impact Intel’s planned semiconductor manufacturing investments.

“What is Intel trying to achieve with these job cuts, and why have billions of U.S. taxpayer dollars in investments not been sufficient support to avert the need for lay-offs?” Scott asked.

(Reporting by David Shepardson; Editing by Jamie Freed)

Prediction: These Will Be the 3 Largest Artificial Intelligence (AI) Companies by 2035

A lot can happen in 11 years. Think back to 2013. That was the year that Frozen debuted in theaters, Barack Obama began his second term as president, and Twitter debuted on the New York Stock Exchange.

So, looking ahead to 2035, which artificial intelligence (AI) stocks will be the three largest in the world? Here are my predictions.

1. Microsoft

Although it is often the world’s second-largest company, Microsoft (NASDAQ: MSFT) should grow even larger over the next 11 years thanks to its numerous AI initiatives.

To start with, its cloud services segment, Microsoft Azure, should benefit immensely from the AI revolution. Azure, already the world’s second-largest cloud services business, is well positioned to capture additional revenue as organizations ramp up their cloud and AI spending. The unit’s machine learning tools and prebuilt AI models should attract even more revenue for its Intelligent Cloud segment, which already generates more than $100 billion in revenue annually.

What’s more, the next decade should see Microsoft integrate even more AI-powered features into its iconic software suite. Copilot AI integrations have already kicked off, and as AI tools continue to improve, the company should be able to extract even more revenue from its software suite and the AI add-ons that are incorporated into it.

In summary, Microsoft’s diverse business segments should reap many benefits from the AI revolution over the next 11 years. That, in turn, will keep it firmly within the list of top 3 AI stocks by market cap.

2. Amazon

Like Microsoft, Amazon (NASDAQ: AMZN) operates one of the world’s premier cloud services businesses, Amazon Web Services (AWS). And just like its foremost rival, AWS already generates more than $100 billion in annual revenue.

Yet, that figure will surely rise over the next 11 years due to the AI revolution. AWS offers a broad range of AI-powered services. Developers and organizations can use these tools to build, train, and deploy AI models.

Beyond AWS, Amazon will use AI to power its other core business: e-commerce. The company already utilizes AI to power its massive logistics network. AI helps the company predict purchasing patterns, proactively stock its fulfillment centers, and determine the fastest and cheapest routes for shipping. On top of that, Amazon already uses close to 1 million robots within its facilities. That figure should skyrocket in the coming years, particularly as its robots become more effective and as labor costs continue to rise.

With a current market cap of $1.9 trillion, Amazon has some work to do to catch Apple, which currently has a market cap of $3.4 trillion. Yet, as noted above, 11 years is a long time, and I believe that Amazon can leapfrog the iPhone maker by 2035.

3. Nvidia

Finally, there’s Nvidia (NASDAQ: NVDA). It should come as no surprise that the king of graphic processing units (GPUs) makes the cut.

First of all, Nvidia’s dominance of the GPU marketplace will be the main reason the company maintains its spot as one of the most valuable companies in the world. Its chips are sought after by developers for their speed and ease of use — and that’s unlikely to change anytime soon. In addition, AI developers are comfortable working with the company’s CUDA parallel computing platform. That creates a barrier to entry for Nvidia’s competitors, as developers may be unfamiliar or uncomfortable with their offerings.

However, Nvidia will excel over the long term for other reasons, too. Assuming autonomous driving capabilities improve and demand for them takes off, Nvidia could benefit. Furthermore, innovative gaming developments could bolster demand for its GPUs in the video game space, as could renewed interest in virtual reality simulations or the metaverse.

All in all, Nvidia remains a solid choice to be the top AI company for a reason — its hardware is the go-to choice for developers working on the cutting edge of innovation. No one knows how the next 11 years will unfold, but it’s easy to see that Nvidia is as well positioned for them as any company today.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Amazon and Nvidia. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: These Will Be the 3 Largest Artificial Intelligence (AI) Companies by 2035 was originally published by The Motley Fool

Why Sonoma Pharmaceuticals (SNOA) Stock Is Moving

Sonoma Pharmaceuticals Inc SNOA shares are trading lower by 11.9% to $0.19 Wednesday morning after the company announced a 1-for-20 reverse stock split.

The stock will trade on a split-adjusted basis starting August 30, 2024. This move aims to meet Nasdaq’s $1.00 minimum bid price requirement. As a result, every 20 shares of Sonoma’s common stock will be consolidated into one share, reducing the total outstanding shares from 20 million to 1 million.

No fractional shares will be issued; instead, shareholders will receive cash for any fractions. The authorized shares will also increase from 24 million to 50 million.

Should I Sell My SNOA Stock?

Whether to sell or hold a stock largely depends on an investor’s strategy and risk tolerance. Swing traders may sell an outperforming stock to lock in a capital gain, while long-term investors might ride out the turbulence in anticipation of further share price growth.

Similarly, traders willing to minimize losses may sell a stock that falls a certain percentage, while long-term investors may see this as an opportunity to buy more shares at a discounted price.

Shares of Sonoma Pharmaceuticals have lost 75.9% year to date. This compares to the average annual return of -66.61%, meaning the stock has underperformed its historical averages. Investors can compare a stock’s movement to its historical performance to gauge whether this is a normal movement or a potential trading opportunity.

For analysis tools, charting data and access to exclusive stock news, check out Benzinga PRO. Try it for free.

SNOA has a 52-week high of $1.02 and a 52-week low of $0.12.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Shares Secrets To Making 'Very Significant Sums' With Small Investment — 'You Will Find Something, There's No Question About It'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Warren Buffett continues to impress investors with his foresight and prescient stock-picking skills. How does he do it? Is there a secret behind Buffett’s investing style? Buffett is probably asked this question at nearly every annual Berkshire Hathaway meeting since they began decades ago.

We found an old recording of a Q&A session of a Berkshire Hathaway annual meeting, where Buffett was asked about something that’s extremely relevant to beginner investors today.

Check It Out:

-

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Buffett’s 29% Returns Vs. Just 7% For The Dow

A listener mentioned that Buffett’s top performance came in from 1956 through 1969, when he returned 29% annually compared with just 7% for the Dow. He reminded Buffett that back in the day his investing approach was to look at many undervalued stocks with “less attention” to long-term economics and sell them quickly. However, according to the fan, Buffett later changed his approach to investing in undervalued companies with strong businesses and holding on to them for the long term. He asked the Oracle of Omaha his key question:

“If you are investing a small sum today, which approach would you use?”

What Would Buffett Do In Today’s Market With A Small Investment?

Here’s how Buffett started his response:

“I would use the approach that I think I am using now of trying to search out businesses where I think they are selling at the lowest price relative to the discounted cash that they would produce in the future.”

The Benefit Of Having A Small Investment

Buffett said more than once during his response that having a small amount of money to invest expands the “universe” of potential opportunities and “ideas.”

Buffett’s Performance Was 37 Points Better Than The Dow In A Decade

The audience member mentioned that Buffett’s best returns came between 1956 through 1969.

Buffett corrected the listener, saying his best performance was before that.

“From right after I met Ben Graham in early 1951, but from the end of 1950 through the next ten years, actual returns averaged about 50% a year and I think they were 37 points better than the Dow, or something like that.”

Buffett’s Process of Investing $10,000 – $15,000 In A Company

How was Buffett able to post those returns? He said that at that time he was working with a “tiny, tiny, tiny” amount of money.

“So I would pour through volumes of businesses and I would find one or two that I could put $10,000 or $15,000 into; they were ridiculously cheap.”

Buffett said that as the money increased over time, the “universe of possible ideas” started shrinking “dramatically.”

He also said that those times were also “better” in terms of investments.

Buffett Says You Can Still Make “Very Significant Sums”

“If you are working with a small amount of money, with exactly the same background that Charlie and I have, the same ideas, same whatever ability we have, you know I think you could make very significant sums.”

Buffett repeated that as soon as the money goes into “millions” or “many millions,” the curve of returns “falls off” quickly.

Keep Reading:

How Did Buffett Find Undervalued Companies?

Buffett also said that when you have opportunities in which you’d put millions, there would be a lot of competition. The billionaire also emphasized the importance of doing hard work.

“When I started, I went through the pages of the manuals, page by page, I might have gone through 20,000 pages in the Moody’s industrials, transportation, banks and finance manuals. And I did it twice.”

However, Buffett said that this method would not be practical when you are investing millions of dollars.

“You Will Find Some Things”

“If you are working with a small sum of money, and you are really interested in the business and willing to do the work, you will find something. There’s no question about it. You will find some things that promise very large returns compared to what we will be able to deliver with large sums of money.”

Charlie Munger’s Advice: Look For “Obscure” Stocks

After this comment, Buffett requested Charlie Munger to share his thoughts on the topic. Munger agreed with Buffett and said if you have a limited amount of capital, you should be looking at “obscure stocks” and “unusual mispriced” opportunities.

Buffett said that during bull markets some people begin to think that making money in the stock market is easy. He said that he knew some people starting hedge funds while based on their track record and ability they should be “mowing lawns.”

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a minimum investment of $5,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

This article Warren Buffett Shares Secrets To Making ‘Very Significant Sums’ With Small Investment — ‘You Will Find Something, There’s No Question About It’ originally appeared on Benzinga.com

2 Monster Growth Stocks to Buy Before Sales Soar 94% and 136%, According to Wall Street

Stocks are often valued based on earnings or cash flow, but both metrics are ultimately limited by sales. For that reason, strong sales growth often goes hand-in-hand with share-price appreciation, and analysts anticipate strong sales growth from Shopify (NYSE: SHOP) and Cloudflare (NYSE: NET) in the coming years.

-

Shopify reported $7.7 billion in revenue during the last 12 months. Wall Street expects sales to increase 94% to $14.9 billion in 2027, implying annual growth of 21%.

-

Cloudflare reported $1.48 billion in revenue during the last 12 months. Wall Street expects sales to increase 136% to $3.5 billion in 2027, implying annual growth of 28%.

Read on to learn more about these monster growth stocks.

1. Shopify

Shopify is the market leader in e-commerce software, and its enterprise-grade platform Shopify Plus is the leading omnichannel-commerce software. That success stems from its ability to simplify retail. Shopify provides a turnkey solution that lets merchants build and manage their businesses across physical and digital storefronts. It also provides adjacent services for payments, marketing, and logistics.

Shopify reported excellent financial results in the second quarter, beating expectations on the top and bottom lines. Revenue increased 20% to $2 billion driven by particularly strong growth in subscription-software sales, though merchant-services sales also climbed at a steady clip. Meanwhile, non-GAAP net income surged 94% to $345 million.

Investors have good reason to believe Shopify can maintain its momentum. Management estimates its addressable market at $849 billion. The company is well positioned to capitalize on that opportunity given that Shopify merchants account for 10% of online retail sales in the United States and 6% of online retail sales in Western Europe.

Additionally, investments in more sophisticated tools — custom-storefront capabilities, wholesale-commerce features, machine learning-driven market software — targeting larger brands are paying off. For instance, gross merchandise volume (GMV) from wholesale-commerce features rose 140% in Q2 driven by more merchants adopting Shopify Plus. That is noteworthy because the wholesale e-commerce market is growing faster than retail e-commerce.

As mentioned, Wall Street expects Shopify to grow sales at 21% annually through 2027. That estimate makes the current valuation of 12.6 times sales seem fair despite being a premium to the two-year average of 11.4 times sales. Investors with a time horizon of at least three years should consider buying a small position in this growth stock today.

2. Cloudflare

Cloudflare provides a range of cloud services that accelerate and protect IT infrastructure, while eliminating the cost and complexity of on-premises network hardware. Specifically, its portfolio comprises application performance and security services, zero trust network-security services, and developer tools. Engineering expertise and scale have helped the company secure a strong presence across all three verticals.

To elaborate, Cloudflare operates the fastest cloud network on the planet, and it powers about 20% of the web. That affords the company deep insight into performance issues and security threats across the internet, creating a network effect whereby each new data point enhances its ability to route traffic quickly and securely.

Industry analysts have praised Cloudflare for its technology. For instance, the International Data Corp. has recognized its leadership in content-delivery network software and zero trust network access, and Forrester Research has named the company a leader in edge-development platforms. Those accolades tell potential customers Cloudflare is worth consideration.

The company reported solid financial results in Q2. Its customer count rose 21% to surpass 210,000, and existing customers spent 12% more. In turn, revenue climbed 30% to $401 million, and non-GAAP net income soared 106% to $69 million.

Investors have good reason to believe that momentum will continue. Cloudflare has hardly dented its $176 billion addressable market, and investments in go-to-market capabilities are bearing fruit. Management said sales productivity showed double-digit improvement during the quarter.

As mentioned, Wall Street expects the company’s sales to grow at 28% annually through 2027. That makes the current valuation of 18.7 times sales seem reasonable, especially when the two-year average is 19.5 times sales. Investors with a time horizon of at least three years should consider buying a small position in Cloudflare stock today.

Should you invest $1,000 in Shopify right now?

Before you buy stock in Shopify, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shopify wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Trevor Jennewine has positions in Shopify. The Motley Fool has positions in and recommends Cloudflare and Shopify. The Motley Fool has a disclosure policy.

2 Monster Growth Stocks to Buy Before Sales Soar 94% and 136%, According to Wall Street was originally published by The Motley Fool

Mark Cuban Invests $400K In Company He Doesn't Understand — Because His Daughters Do

Mark Cuban invested more than $20 million in companies during his time on “Shark Tank,” a show he will be leaving after the upcoming 16th season.

Cuban was known for his quick bids and exits, sometimes offering to buy companies outright for products he believed in. During a 2023 episode in season 14, Cuban broke one of his investing rules for the show.

Don’t Miss:

What Happened: Cuban typically invests in companies offering products he can envision himself using or that might benefit the Dallas Mavericks, the NBA team he partly owns.

However, in a 2023 episode of “Shark Tank,” Cuban made an offer for a company whose products he likely won’t ever personally use.

In Season 14, Episode 15 of “Shark Tank,” which aired in early March, makeup brand Youthforia presented its pitch.

Youthforia, founded in April 2021, had already achieved $2 million in sales before appearing on the show, as reported by CNBC. The brand gained significant traction on TikTok, particularly for its color-changing oil blush that adjusts to match and blend with customers’ skin tones. On TikTok, Youthforia boasts over 130,000 followers and more than three million likes.

Trending: General Motors and other leaders revealed to be investing in this revolutionary lithium start-up — allowing easy entry by launching at just $9.50/share with a $1,000 minimum.

The Sharks liked the TikTok success and were also impressed with the company’s founder and CEO Fiona Co Chan.

Kevin O’Leary offered Co Chan $100,000 for 20% of the company along with a $300,000 loan and a cut of distribution pay.

“It’s a bet on the jockey on this deal,” O’Leary said of Co Chan. “You’re really impressive.”

Co Chan wanted to hear from the other Sharks, with Cuban and Barbara Corcoran not putting out bids yet. Co Chan tried to lure them in by saying there was a launch of more shades of blush coming, which neither was thrilled about.

Trending: This startup’s stem cell research aims to reduce reliance on animal testing — Sees 55% uptick in YTD sales and only costs $3 per share for early investors.

“When you have something that’s completely differentiated, you ride that, and you don’t do anything else, because that just dilutes your efforts,” Cuban said. “Sometimes, you shouldn’t listen to your customers.”

Co Chan turned to O’Leary and offered 5% equity for $400,000 and a 50 cent royalty for each unit sold by the company up to $500,000.

O’Leary countered with an $800,000 offer for 10% equity and a $1 royalty on each unit.

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

This is when Cuban decided to step in, offering $400,000 for 10% without a royalty and said the reason he was interested in the makeup brand was because his daughters and wife would “understand” the product, which he didn’t.

Cuban offered to wear the color-changing blush himself as part of demos.

O’Leary countered with a $400,000 offer for 7.5% and a 75 cent royalty on sales up to $1 million.

Ultimately, Cuban got Co Chan to accept with his final offer of $400,000 for 8% and no royalties, which he offered “just to prove a point” and ended up beating O’Leary.

Did You Know?

Why It’s Important: The company and Co Chan drew praise from the Sharks during portions of the pitch and after Cuban’s offer was accepted.

Herjavec and Corcoran, who sat out on the offers, said they were impressed with Co Chan’s negotiating skills.

“Kevin, you have to get up and leave the ‘Shark Tank,'” Herjavec said. “Fiona’s taking your chair.”

The offer for Youthforia that was accepted makes the first deal Cuban has ever done with a makeup brand, which could provide several lessons. Cuban has often stuck to his principles in investing in products that he would use himself or the Mavericks would use.

Hearing how much the other Sharks loved the company’s CEO and the product going viral on TikTok, Cuban trusted in his family and made the investment because he could see his daughters and wife using the product.

Youthforia is available on Amazon.com and also at Ulta Beauty (NASDAQ:ULTA) stores. While we won’t likely see the makeup products at Mavericks games in the future, they could end up becoming a staple in the Cuban household.

This article was previously published by Benzinga on Benzinga Inspire and has been updated.

Check This Out:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Mark Cuban Invests $400K In Company He Doesn’t Understand — Because His Daughters Do originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia's forecast dampens AI enthusiasm in other tech stocks

By Noel Randewich and Saqib Iqbal Ahmed

(Reuters) -Shares of Nvidia and other technology heavyweights fell late on Wednesday, a discouraging sign for investors betting that a strong forecast from the dominant seller of AI chips would fuel fresh gains in Wall Street’s most valuable companies.

Nasdaq futures fell about 1% following Nvidia’s quarterly earnings report, suggesting traders expect tech stocks to lose ground on Thursday.

Nvidia dropped almost 7% and lost $200 billion in stock market value after it forecast third-quarter gross margins that could miss market estimates and revenue that was largely in line. A handful of other AI-related companies shed around $100 billion in combined value.

Shares of Broadcom and Advanced Micro Devices were each down about 2%. Microsoft and Amazon each dipped almost 1%.

If Wednesday’s late-day dip in Nvidia shares extends into Thursday, it would be well short of the 11% price swing the options market had priced for the shares, according to data from options analytics firm ORATS.

Surging demand for its AI chips helped Nvidia crush consensus analyst estimates for several quarters, a trend that led investors to expect the company to exceed forecasts by higher and higher margins.

Nvidia’s soft forecasts overshadowed a beat on second-quarter revenue and adjusted earnings as well as the unveiling of a $50 billion share buyback.

“They beat but this was just one of those situations where expectations were so high. I don’t know that they could have had a good enough number for people to be happy,” said JJ Kinahan, CEO of IG North America and president of online broker Tastytrade.

The lackluster response to Nvidia’s earnings report could help set the tone for market sentiment heading into what is historically a volatile time of the year. The S&P 500 has fallen in September by an average of 0.8% since World War Two, the worst performance of any month, according to CFRA data.

Investors are also watching next week’s U.S. employment report for signs on whether the labor market weakness that roiled stocks in early August has dissipated.

Optimism about AI technology, in part due to Nvidia’s explosive growth, has fueled gains on Wall Street over the past year.

However, confidence in that rally has wavered in recent weeks following an earnings season that saw investors punish shares of tech companies whose results failed to justify rich valuations.

Investors have also become concerned about increases in already hefty spending by Microsoft, Alphabet and other major players in the race to dominate emerging AI technology. Microsoft and Alphabet’s stocks remain down since their reports last month.

Nvidia forecast revenue of $32.5 billion, plus or minus 2%, for its fiscal third quarter, compared with analysts’ average estimate of $31.8 billion, according to LSEG data. That revenue forecast implies 80% growth from the year-ago quarter.

The Santa Clara, California-based company expects adjusted gross margin of 75%, plus or minus 50 basis points, in the third quarter. Analysts on average forecast gross margin to be 75.5%, according to LSEG data.

Nvidia’s stock dropped 2.1% in Wednesday’s session, ahead of its report. It remains up about 150% so far in 2024, making it the biggest winner in Wall Street’s AI rally.

Nvidia’s stock was valued at 36 times earnings ahead of its quarterly report, inexpensive compared to its average of 41 over the past five years. The S&P 500 is trading at 21 times expected earnings, compared to a five-year average of 18.

(Reporting by Noel Randewich in San Francisco; Additional reporting by Saqib Ahmed in New York; Editing by Ira Iosebashvili and Lisa Shumaker)

DJT sinks to new low: Why Trump Media investors are feeling less bullish

As a trading concern, Donald Trump’s social media company has become a way for investors to bet on the former president’s odds of retaking the White House.

Since going public through a special-purpose acquisition company merger in March, shares of Trump Media & Technology Group have fluctuated wildly alongside its namesake’s political fortunes.

Following Vice President Kamala Harris’ ascension to the top of the Democratic ticket, Trump has slipped in the polls and so, too, have shares of Trump Media, which owns the GOP nominee’s social media bullhorn of choice, Truth Social.

The stock drifted to a new post-merger low Tuesday, closing at $20.99. In the last 30 trading days, it has lost more than 40% of its value.

What happens if Trump sells DJT shares

In regulatory filings, Trump Media has telegraphed how critical Trump is to the company’s brand, warning that its value “may diminish” if Trump’s popularity falters.

Now another factor is weighing on the stock. Trump is less than a month away from being able to cash out his paper wealth. Trump Media has also cited Trump’s divestment of DJT stock as one of the top risks to its business.

Trump Media is a major contributor to Trump’s net worth. Its market value is hovering around $4 billion even though the company is losing money and has nearly no revenue.

Your wallet, explained. Sign up for USA TODAY’s Daily Money newsletter.

Trump owns about 60% of the company’s outstanding stock. He is expected to be able to start selling shares as soon as Sept. 20 when a six-month lockup period that has prevented insiders from unloading their holdings is expected to lift.

Trump has not indicated if he intends to sell shares in Trump Media and his campaign declined to comment.

Cashing in shares could help Trump pay his mounting legal bills but could antagonize supporters who have shoveled money into the stock and could be viewed as a vote of no confidence in the company.

The prosecutor in Trump’s federal election interference case secured a new indictment against Trump on Tuesday.

What more Trump Media shares mean for investors

Another key factor in the Trump Media stock decline is a deal Trump Media reached in July with Yorkville Advisors to register and sell up to $2.5 billion worth of new shares, says University of Florida finance professor Jay Ritter.

On the one hand, the deal could boost cash per share on the company’s balance sheet from $1.50 per share to about $4.50 per share, Ritter said.

“This increase would reduce the downside potential for the stock,” he said.

But there’s a caveat.

“Any upside for the company is dependent on coming up with a business strategy to generate revenue and profits,” Ritter said. “So far, the company has failed to find a successful strategy.”

What’s more, additional shares issued through the Yorkville agreement could be putting downward pressure on the stock price, according to Ritter.

Even if Trump does not sell shares when the lock-up period ends, other insiders may, increasing the public float even more, he added.

“The price might be drifting down partly in anticipation of these share sales,” Ritter said.

This article originally appeared on USA TODAY: DJT decline: Why Trump Media is falling out with investors