PDD Stock Dives 25% On Revenue Miss. Temu Parent Says Competition Intensifying.

PDD Holdings (PDD) stock sank early Monday after the Temu parent company reported slower-than-expected sales growth for its second quarter. The China-based PDD, which also operates Pinduoduo, warned that increased competition will challenge its run of rapid revenue growth.

↑

X

Nvidia Earnings Are A Key Test For The Stock Market Rally. Here’s What To Expect.

For its quarter ended June 30, PDD Holdings said it earned an adjusted 23.24 yuan per American depositary share (ADS) from sales of 97.06 billion yuan, or $13.64 billion. Analysts polled by FactSet expected earnings of 20.43 yuan per ADS on sales of 100.2 billion yuan, or $14.1 billion

Adjusted earnings increased 122% year-over-year while sales increased 86% year-over-year in local currency. The sales growth marked a slowdown from the 131% rate PDD Holdings recorded in the first quarter of the year.

“Looking ahead, revenue growth will inevitably face pressure due to intensified competition and external challenges,” PDD Vice President of Finance Jun Liu said in a news release. “Profitability will also likely to be impacted as we continue to invest resolutely.”

In morning action on the stock market today, PDD stock is down more than 28% at 99.94, gapping down well below its 50-day and 200-day lines.

PDD Leadership Expects ‘Short-Term Sacrifices’

PDD stock surged last year, helped by the rapid rise of its international discount shopping site Temu, which has emerged as a challenger to Amazon (AMZN). Temu facilitates direct sales from Chinese manufacturers in dozens of countries and was the most downloaded app in the U.S. last year.

In China, Pinduoduo has challenged incumbents such as Alibaba (BABA) and JD.com (JD) by offering discounted items at a time consumer spending has been sluggish. Both Alibaba and JD have focused in recent quarter on offering discounts and promotions.

Even as it spent billions on advertising to grow Temu, PDD racked up strong earnings growth throughout 2023. Adjusted earnings per share jumped 70% year-over-year in for all of 2023, to 46.51 yuan per ADS.

But PDD Holdings is telling investors it may need to trade earnings growth to continue improve and grow its products.

“We will invest heavily in the platform’s trust and safety, support high-quality merchants, and relentlessly improve the merchant ecosystem,” Co-Chief Executive Lei Chen said in a news release. “We are prepared to accept short-term sacrifices and potential decline in profitability.”

Growing Competition

The pronouncement comes as consumers continue to pullback on spending in China. Both Alibaba and JD posted slower sales growth for their June quarters.

PDD is also competing with Alibaba’s AliExpress business in international markets, along with fast-fashion rival Shein and TikTok parent company ByteDance. Meanwhile, competitors who appeared caught off guard by Temu’s rise are starting to adapt.

In late June, The Information reported that Amazon was readying a Temu challenger. For the U.S. tech giant, Temu is a competitive threat for discount-hungry shoppers and for merchants selling out of China. A new section of Amazon’s website would reportedly sell goods directly from merchants in China. Similar to Temu’s operations, the section would offer cheaper prices but with longer shipping times.

Meanwhile, Temu’s direct-from-China model is under regulatory scrutiny. A bipartisan group of lawmakers unveiled legislation earlier this month that could change the “de minimis” provision U.S. trade policy. Currently, parcels valued under $800 can enter the U.S. duty-free, as long as they are addressed to an individual person.

European lawmakers are considering changing similar exemptions in EU trade policy, Bloomberg News reported last month.

The provisions have helped Temu keep costs down. PDD has previously acknowledged in regulatory filings that its operations could “materially and adversely affected” if existing tariff exemptions were no longer available.

On its earnings call Monday, Chen said that PDD’s global business is “still evolving” and had reached 70 markets.

“As our business develops, we have noticed that the changes in the external environment are accelerating and our operations are increasingly affected by some nonbusiness factors and we are seeing a significant increase in uncertainty,” Chen told analysts, according to a FactSet transcript. “Meanwhile, competition is a constant theme in the e-commerce industry and is expected to intensify.”

PDD Stock Sinks

Entering earnings Monday, PDD stock was down about 4% on the year but had bounced back from a slump earlier in the year. But Monday’s tumble has pushed PDD stock to its lowest levels since October 2023.

The stock sank below PDD stock’s 21-day, 50-day and 200-day moving averages.

Helped by its strong run of earnings growth, PDD stock entered trading Monday with a best-possible IBD Composite Rating of 99, according to IBD Stock Checkup. The score combines five separate proprietary ratings into one rating. The best growth stocks have a Composite Rating of 90 or better.

Further, PDD shares had an IBD Relative Strength Rating of 87 out of 99.

YOU MAY ALSO LIKE:

China Tech Giant Baidu Credits AI As Earnings Beat Expectations

IBD Live: Learn And Analyze Growth Stocks With The Pros

A booming stock market isn't stopping bears from sounding the alarm on a potential crash. Here's what they're worried about.

-

Bearish strategists are warning of a potential stock market plunge as the economy cools down.

-

Indicators like the Sahm Rule and job market weakness suggest a looming recession, the bears say.

-

One strategist predicts that a recession could cause a 70% stock market decline amid lofty valuations.

Bearish strategists are sounding the alarm about a potential stock market crash as the economy shows signs of cooling down.

While the stock market doesn’t seem to care about these predictions as the S&P 500 is less than 1% away from hitting record highs, there’s still plenty to be worried about, according to Wall Street’s biggest bears.

Reliable recession indicators like the Sahm Rule have flashed recently, the job market is seeing growth decelerate, and any interest rate cuts from the Federal Reserve may not be enough to prevent a downturn, downbeat forecasters say.

From a possible recession to a 70% decline in the stock market, here’s a roundup of the most recent bearish forecasts coming from Wall Street.

Mark Mobius: Economic warning sign flashes for first time in over 90 years

Billionaire investor Mark Mobius told CNBC this week that the decline in M2 money supply since it peaked in 2022 represents the largest drawdown in the total money supply in nearly a century.

“The main concern is that if the M2 money supply has declined since April 2022 and hasn’t kept pace with economic growth, there could be less capital available for the discretionary spending that has driven the current economic expansion and bull market on Wall Street,” Mobius said.

Mobius recommends investors hold 20% in cash to be ready to buy a potential decline in stock prices, and

“Look for companies with little or no debt, moderate earnings growth, and high return on capital, and get ready to re-enter the market,” Mobius said.

Steve Hanke: A recession is likely in early 2025

Economist Steve Hanke warned this week that in addition to the contraction in M2 Money Supply highlighted by Mobius, other signs suggest a recession will arrive in early 2025.

“We will enter a recession either late this year or early next year in the United States, and that’s why we think the inflation numbers will keep coming down,” Hanke predicted in an interview with the wealth advisory firm Wealthion.

Those micro-level indicators include the steady rise in the unemployment rate to 4.3%, representing the highest level since the pandemic, an ongoing slowdown in retail sales, and sluggish activity in the housing market and manufacturing activity.

“If you look at the microdata, it’s kind of consistent with this macro monetary picture that I just gave you of slowing down, going into recession, inflation continuing to come down. That picture is, if you look micro, individual companies or sectors of the economy… the sectors look like a slowdown is in the wind,” Hanke said.

Jon Wolfenbarger: A recession could send stocks plunging 70%

Investors could experience a 70% decline in the stock market if a painful recession hits the economy at a time when valuations are elevated, according to Jon Wolfenbarger, founder of BullAndBearProfits.com.

In a recent note, Wolfenbarger highlighted that it’s not just an inverted yield curve and flashing of the Sahm Rule that suggests a recession is imminent.

There are other under-the-radar signals that suggest the jobs market is cooling in a way that is consistent with economic downturns, according to Wolfenbarger.

That includes the year-over-year rate of change in employment growth dropping to 0%. In the past, a negative reading in the year-over-year change in employment growth has signaled a recession, according to Wolfenbarger.

Another job market concern is the ongoing decline in average weekly hours worked, which sits at around 34.2. Any further decline in this indicator would flash a signal not seen since 2008 and 2020, two years when a painful recession hit the US economy.

Finally, a steady decline in manufacturing employment, based on the ISM Index, suggests the unemployment rate could have more room to run, according to Wolfenbarger.

Considering elevated stock market valuations, these factors suggest to Wolfenbarger that the S&P 500 could ultimately fall as much as 70% from current levels.

The counterpoint: A bullish take to balance out the doomsayers

While the job market shows signs of slowing, not everyone on Wall Street is concerned about a potential recession or stock market crash.

Goldman Sachs called recession fears “overblown” in a recent note, highlighting that US consumers remain strong and corporate earnings growth continues to deliver.

“Reports of concern over the US consumer are greatly exaggerated,” Goldman’s Jan Hatzius said. “Our quantitative measure of sentiment around the consumer on earnings calls improved sequentially, sales growth at consumer-facing companies slowed bt remains healthy, and real income growth appears solidly positive across all income groups.”

And it doesn’t hurt that the Federal Reserve is shifting to a more dovish stance, with imminent interest rate cuts looking likely.

The bank also said that trillions of dollars of cash on the sidelines could flood the stock market and push the S&P 500 7% higher to 6,000 once investors know the winner of the Presidential election in November.

“SPX $6K – new highs in Q4, led by November and December months,” Goldman Sachs said.

Read the original article on Business Insider

Walmart Just Dropped a Major Hint: Is A U.S. Recession Closer Than You Think? Home Depot's Dire Warning Adds Fuel To The Fire

Walmart’s second-quarter sales were stronger than expected, boosting optimism that a U.S. recession could be averted. This was quite the opposite of what Home Depot told investors some time ago. The good news from the world’s biggest retailer helped restore confidence among investors and other analysts.

Don’t Miss:

Walmart – probably the best gauge of American spending, as it took one dollar in every twelve spent by shoppers in U.S. stores during the quarter – announced that sales went up 4.2% in the quarter to June. These results were much better than expected, and the company’s shares rose by 6% in early trading. That rally follows more than 30% year-to-date gains in Walmart’s shares, which generally set the tone for the broader economy.

Walmart CEO Doug McMillon further instilled confidence in retailer performance and the overall economic outlook on an earnings call with analysts. “We’re not seeing a weaker consumer overall,” he said, pointing out that consumers can still spend resiliently despite ongoing economic challenges.

Trending: This startup aims to convince the FDA that Cannabis and Psilocybin can be a better alternative to synthetic pharmaceuticals on the market. Right now you can can invest in while it’s still less than $2/share.

He also emphasized that Walmart can maintain strong sales without slowdowns in other industries. The better-than-expected outcome has led the company to increase its expectations for the remainder of the year, underpinning confidence in the U.S. economy’s capacity to avoid a downturn.

That Walmart news was timely and gave the stock market a much-needed boost, with the S&P 500 gaining 1.5% and the Nasdaq surging 2.3%. Investors are optimistic that the economy can bounce back, and some analysts speculate that the Federal Reserve will cut interest rates as early as September. The possibility of rate cuts added to the momentum of the market’s trajectory, given that lower interest rates would support the economy.

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

“We’re back to an environment where good news is good news and bad news is bad news,” said Bret Kenwell, an analyst at eToro. He noted that while investors and consumers cheer for lower inflation, it shouldn’t come at the cost of the economy.

Kenwell added that robust retail sales – tempering fears of an imminent recession – might give the Fed more time before deciding on rate cuts. He mentioned that the Fed is walking a tightrope between fighting off inflationary pressures and boosting economic growth.

Trending: Will Cannabis and Psilocybin drug development lead the way in disrupting the $678 billion pharmaceutical industry? This start up is betting on it and you can be an early investor too, with just $250 for under $2/share

In marked contrast, Home depot issued a less encouraging report, warning that sales slid 3.6% in the last quarter due to fears of increasing interest rates straining consumers. The home improvement giant attributed the bad performance to consumer pullback in renovation spending. An earlier warning from Home Depot had added to fears of a possible recession in the U.S. economy, with higher borrowing costs and tighter budgets straining consumers. Those fears, though, have been eased by the upbeat figures from Walmart and data on recent jobless claims.

According to the Commerce Department, U.S. retail sales surged by 1% in July – the largest since January 2023 – with gains in autos, electronics, and appliances. This indicates that the typical American consumer was perhaps more resilient than some had feared.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Walmart Just Dropped a Major Hint: Is A U.S. Recession Closer Than You Think? Home Depot’s Dire Warning Adds Fuel To The Fire originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Lockheed Martin and General Dynamics Just Declared War on Rocket Engines

What do Iranian drones have in common with Russian hypersonic missiles and China’s DF-21D “aircraft carrier killer” rocket? All three pose a clear and present danger to U.S. forces and their allies, and all three require air defense missiles to protect against this threat.

That’s a problem for the U.S. and allied militaries, though, and for defense companies like Lockheed Martin (NYSE: LMT) and RTX Corporation, makers of the famous PATRIOT air defense missile (as well as many other missiles, such as the just as famous HIMARS rocket in use today in Ukraine).

Defense products, you see, involve long supply chains — similar to what one sees in the automotive industry — where one company may produce a final product (like a PATRIOT) but depends on subcontractors to produce the components that go into that final product. You probably recall how shortages of low-tech automotive semiconductor chips resulted in widespread shortages of cars during the pandemic, for example. Well, today, slow shortages of rocket engines pose a bottleneck to the production of rockets by America’s defense companies, too.

From problem to solution

The Wall Street Journal reports that Northrop Grumman and L3Harris are the two defense giants that dominate the production of missile engines. Both have caught flak from Lockheed and RTX for their failure to produce enough to meet demand. To remedy this situation, Lockheed Martin has proposed that it get into the rocket engine-making business itself.

It’s a big job, though, and Lockheed can’t do it alone. Last week, the company confirmed it would form a joint venture with defense rival General Dynamics (NYSE: GD), aiming to develop a new generation of military missile motors to supplement the constrained supply produced by Northrop and L3Harris.

In this partnership, Lockheed will apparently act largely as a silent partner (and exclusive customer), although assisting with the design and testing of the engines. General Dynamics will do the actual manufacturing at its Camden, Arkansas, munitions factory and then ship them next door to Lockheed Martin’s Guided Multiple Launch Rocket System (GMLRS) rocket assembly plant. GMLRS is one of the primary weapons launched by HIMARS rocket launchers. Having General Dynamics fulfill all of Lockheed’s motor needs for this one type of missile should diminish demand for motors for other missiles, thus helping to unkink the supply chain both for Lockheed — and for everyone else.

What it means for Northrop and L3Harris

In the long term, the joint venture could expand its production to provide motors of other missile types produced by Lockheed and by other buyers, as well — creating a permanent rival to Northrop and L3Harris in the missile engine market.

L3Harris’s Aerojet Rocketdyne subsidiary supplies only 5.4% of the company’s total annual revenue, according to data from S&P Global Market Intelligence, limiting its exposure to this new threat. The effect on Northrop Grumman is harder to parse. Rocket motors are part of the company’s space systems division (which is quite large, accounting for 35% of Northrop’s annual revenue).

It’s hard to tell, however, how much of this revenue comes from rocket motors in particular.

What it means for Lockheed Martin and General Dynamics

What does seem clear is that the new joint venture has the potential to benefit Lockheed Martin and General Dynamics quite a lot. Northrop Grumman earns a respectable 8.7% operating profit margin on its “space” business, while L3Harris’s Aerojet unit generates even better profit margins of 11.6%.

Those aren’t bad numbers at all, assuming a Lockheed-GD joint venture can duplicate them. Moreover, if expanding the production of rocket engines helps Lockheed to sell more complete missiles to its customers, the operating margins at Lockheed’s missiles and fire control division average 12.9%! Growing sales in that unit would clearly be a big boost to its business.

As for General Dynamics, the fourth part of this four-way dynamic could benefit most of all. GD’s combat systems division would do the heavy lifting in building all these new rocket engines (I should also point out that Lockheed wants to grow GMLRS production by 40% this year). GD already earns 13.9% operating profit margins on its combat systems sales — making it easily the company’s most profitable business.

Simply put, if this deal comes together, General Dynamics stock will be the biggest beneficiary of all.

Should you invest $1,000 in General Dynamics right now?

Before you buy stock in General Dynamics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and General Dynamics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Rich Smith has no position in any of the stocks mentioned. The Motley Fool recommends Lockheed Martin and RTX. The Motley Fool has a disclosure policy.

Why Lockheed Martin and General Dynamics Just Declared War on Rocket Engines was originally published by The Motley Fool

Why the Air Force Is Paying Boeing $2.6 Billion for Just 2 Airplanes

Boeing (NYSE: BA) might end up selling its defense unit — but it’s not out of the defense business yet. In a huge announcement that might give a clue to the company’s future, the U.S. Air Force (USAF) confirmed last week that it has awarded Boeing $2.56 billion to build for it “two operationally representative prototype E-7A weapons systems.”

The contract was the single biggest award listed on the Department of Defense’s daily contracts update Aug. 9 — by a factor of four. (Second place went to a Lockheed Martin contract for Navy radar systems worth $611 million.) Even more important than the dollar value is the fact that Boeing’s contract has a lot of room to grow.

What the Air Force is buying from Boeing

Boeing’s E-7A Wedgetail aircraft is designed for Airborne Early Warning and Control (AEW&C) of moving targets. The most famous example of this technology is the Air Force’s E-3 Sentry AWACS (an acronym of “Airborne Warning and Control System”), which was first introduced in 1977, and which the Air Force intends to gradually upgrade and replace.

Boeing is already producing an E-7 Wedgetail (introduced in 2012, and based on the airplane maker’s 737 Next Generation airliner), primarily for foreign militaries. The E-7A will be an upgrade of that platform, and the Air Force wants Boeing to expedite its development by producing a couple of “rapid prototypes” — hence the supersize contract.

Early editions of any new weapons system tend to cost more than once the system has reached scaled production. But the price on this contract still seems quite high. For context, a 2012 contract to build four plain vanilla E-7 Wedgetails for South Korea cost that country only $1.7 billion — barely $400 million per plane. In contrast, the Air Force will paying roughly 3 times as much for each of its first two E-7As.

The urgency of the Air Force’s request for rapid prototypes — needed to make a production decision in 2026 — probably helps to explain why it’s willing to pay so much more for these aircraft. But even so, “rapid” seems a rather flexible term. According to the Air Force itself, Boeing isn’t expected to deliver the prototype E-7As before 2028 — two years after the production decision will be made!

What it means for Boeing

A lot is riding on how that decision goes for Boeing (and for Northrop Grumman (NYSE: NOC), too, which builds the E-7A’s radar). Beyond the first two aircraft, the Air Force aims to buy two dozen more Wedgetails — 26 in all. And beyond just USAF, Breaking Defense notes global demand for the E-7A could grow the program perhaps 2 to 3 times in size. Ultimately, Boeing could end up selling 50 to 70 units of this new AWACS, and building as many as six planes per year once production is fully ramped up.

How much money that ultimately means for Boeing remains to be seen. Breaking Defense quoted Air Force acquisition head Andrew Hunter commending Boeing’s willingness to “get their pencils out and sharpen them and do a good job to bring the cost of the rapid prototyping program down” — albeit not quite down to the level the Koreans paid 12 years ago.

Until we know the final price, though, all we’ve really got to work with is the prototype price: $1.3 billion per bird. So what might that be worth to Boeing?

Well, with the strong caveat that this is probably a ceiling value on what the contract could be worth, $1.3 billion per plane, times a maximum of 70 Wedgetails total, implies a total program value of $91 billion for Boeing. Investors should of course temper that expectation with the realization that prices will come down as production scales up — and with the understanding that if Boeing is only building at most six planes per year, then this $91 billion would be spread out over more than a decade of production.

Even so, the final number could still end up looking very attractive, on the order of perhaps $8 billion or $9 billion a year, or roughly one-third of the revenue Boeing’s defense unit produces today, according to data from S&P Global Market Intelligence. And that doesn’t even count the ongoing revenue Boeing can expect to accrue from servicing, maintaining, and upgrading the planes over years to come. Recall that the E-3 Sentries the Wedgetail is replacing have been flying for nearly 50 years now.

All things considered, this seems to be pretty great news for Boeing. With contracts like this one, maybe Boeing should consider hanging onto its defense business after all.

Should you invest $1,000 in Boeing right now?

Before you buy stock in Boeing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Boeing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Rich Smith has no position in any of the stocks mentioned. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

Why the Air Force Is Paying Boeing $2.6 Billion for Just 2 Airplanes was originally published by The Motley Fool

Prediction: SoundHound AI Will Soar Over the Next 7 Years. Here's 1 Reason Why.

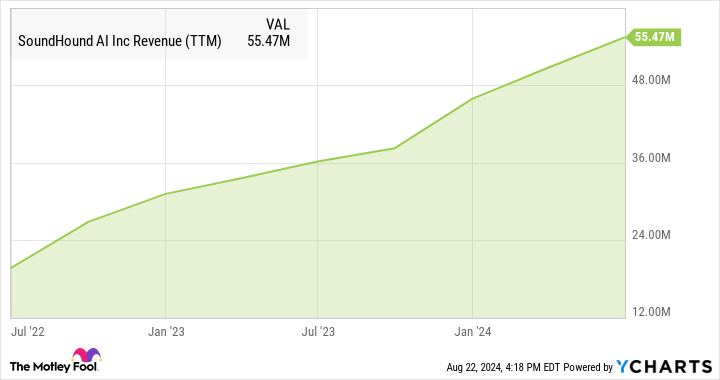

There is one very simple reason I expect SoundHound AI (NASDAQ: SOUN) stock to beat the market over the next seven years. The company has a huge backlog of long-term contracts and other unfilled orders, just waiting to convert into cash-based revenues. Market makers seem to have missed this as-yet untapped source of future sales — and the average contract in SoundHound AI’s backlog pool is a seven-year deal.

The backlog was worth $723 million in the second quarter. That’s up from $682 million in the previous quarter and $339 million in the year-ago period. In the summer of 2023, the backlog was growing at a 20% annual rate. Now, the rate of year-over-year growth has accelerated to 113%. The company is busy securing new contracts.

Meanwhile, SoundHound AI has started to collect subscription fees and other revenues from previously dormant contracts. As a result, its revenues are skyrocketing right now:

Where SoundHound AI’s customers are coming from

So far, most of SoundHound AI’s voice control sales rest on the twin pillars of automotive and restaurant customers.

-

Fiat, Chrysler, and Maserati parent Stellantis (NYSE: STLA) is rolling out SoundHound AI voice controls with ChatGPT integration across its brands in Europe and Japan these days. American installations shouldn’t be far behind.

-

Recent restaurant deals include popular fast-food chain White Castle, sandwich-slinger Jersey Mike’s, and sports bar chain Beef ‘O’ Brady’s. The names are getting familiar, and you might have already interacted with SoundHound AI’s computer-controlled voice ordering systems.

-

The company is making strategic buyouts in the artificial intelligence (AI) space for voice controls and e-commerce integration. These deals should firm up SoundHound AI’s grip on its core target industries while expanding its reach into new sectors.

This little AI expert is going places, and the revenue collection is just getting started. Keep an eye on SoundHound AI’s order backlog as it converts into a proper revenue stream over the next few years. As the company’s sales soar, the stock price should follow suit.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Anders Bylund has positions in SoundHound AI. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

Prediction: SoundHound AI Will Soar Over the Next 7 Years. Here’s 1 Reason Why. was originally published by The Motley Fool

Nvidia earnings highlight a busy end of August: What to know this week

Federal Reserve Chair Jerome Powell told investors on Friday “time has come for policy to adjust.”

In response, stocks finished the week near record highs. The S&P 500 (^GSPC), the Nasdaq Composite (^IXIC), and the Dow Jones Industrial Average (^DJI) all rose more than 1% on the week. The S&P 500 is now within 1% of a record closing high.

But the market’s rebound from August lows will be put to the test this week with a highly anticipated earnings release from AI leader Nvidia (NVDA) after the bell on Wednesday.

Earnings from Salesforce (CRM), Best Buy (BBY), Dell (DELL), and Lululemon (LULU) will also be in focus, while a key reading of the Fed’s preferred inflation gauge will highlight the economic calendar.

A done deal

On Friday, Powell made clear to investors that interest rate cuts are coming in September.

But he did not explicitly signal how aggressively the central bank will slash rates as it gets this easing cycle underway.

Powell noted the timing and pace of cuts will “depend on incoming data,” and markets quickly moved to fully price in four rate cuts of 0.25% by the end of 2024 on Friday morning after the Fed chair said the central bank has “ample room” to maneuver as policy enters its next phase.

With only three Fed meetings left in 2024, the looming question remains when the Fed would cut rates by 0.50% in a single meeting to reach current forecasts.

“We continue to think that if instead the August [jobs] report is weaker than we expect, then a 50bp cut would be likely [on Sept. 18],” Goldman Sachs’ economics team led by Jan Hatzius wrote in a note to clients.

As of Friday afternoon, markets were pricing in a 38.5% chance the Fed cuts by 50 basis points by the end of its September meeting, up from a roughly 24% chance seen the day prior, per the CME’s FedWatch Tool.

Capital Economics’ deputy chief markets economist Jonas Goltermann argued the Fed cutting deeper than 0.25% because of weakness in the labor market may not be a welcome sign for investors.

“Investors may reasonably worry that if the FOMC feels the need to front-load policy easing … it may be because the economy is slowing by more than the still very rosy outlook discounted in equity and credit markets implies,” Goltermann wrote in a note to clients on Friday.

“As such, it may well be that a 25bp cut in September is in fact the preferable outcome for equity markets.”

While Powell spent a large part of his Friday speech emphasizing the downside risks to the labor market, the Fed will still have its eyes on an important inflation update on Friday.

Economists expect annual “core” PCE — which excludes the volatile categories of food and energy — to have clocked in at 2.7% in July, up from the 2.6% seen in June. Over the prior month, economists project “core” PCE rose 0.2%, in line with the month-over-month increase seen in June.

Powell said on Friday his confidence has “grown that inflation is on a sustainable path back to 2%.”

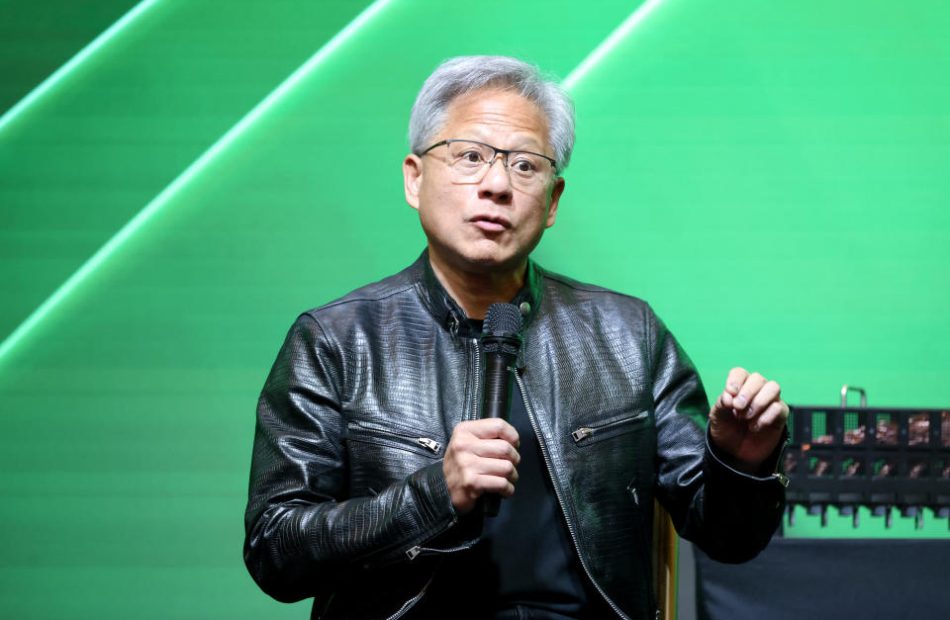

All eyes on Nvidia

With nearly all members of the S&P 500 done reporting earnings, one massive report has been looming: Nvidia.

As has been the case since the chip giant supercharged an AI-driven stock market rally with its earnings report back in May 2023, expectations for Jensen Huang’s company are sky-high.

Wall Street expects Nvidia grew earnings by roughly 109% year over year with revenue also jumping 99% compared to the same quarter a year ago. Updates on any potential delays for Nvidia’s new Blackwell chip will be in particular focus.

The stock enters the print up roughly 160% year to date.

“We believe modest expectations for Blackwell shipments in FQ3 have been backfilled with higher Hopper bookings,” KeyBanc analyst John Vinh wrote in a recent note.”We expect NVDA to report beat/raise results, in which upside will be driven by strong demand for Hopper GPUs.”

Vinh, who has a $180 price target on Nvidia, told Yahoo Finance on Thursday that the stock still looks attractive even after a recent 30% rally.

“Being one of the best-positioned semiconductor companies, obviously levered to one of the strongest product cycles in AI right now, we think it’s still attractively valued at these levels,” Vinh said.

Charles Schwab Asset Management CEO and chief investment office Omar Aguilar said the release will be a “very anticipated” release for the broader market too.

“What I think is going to be expected by the market is to hear what is the outlook for AI and what is the demand for chips going forward as people continue to spend money in AI technologies,” Aguilar told Yahoo Finance on Friday.

Tech volatility could be ‘behind us’

Whipsaw movements in Nvidia and the other “Magnificent Seven” tech stocks have been a feature of the market’s recent drawdown and subsequent bounce back.

Goldman Sachs equity strategist Ben Snider told Yahoo Finance this week that the back-and-forth action could be primed to settle down.

“I think most of the short-term volatility in [the Magnificent Seven] stocks is behind us,” Snider said.

The rally in this group — which consists of Apple (AAPL), Alphabet (GOOGL, GOOG), Microsoft (MSFT), Amazon (AMZN), Meta (META), and Tesla (TSLA), along with Nvidia — between Aug. 5 and Aug. 19 added more than $1.4 trillion to their collective market cap.

“The trajectory of sales and earnings growth has been resilient, more resilient than a lot of investors feared coming into the second quarter,” Snider added. “Valuations are by no means low compared to history, but they’re lower than they were several weeks ago, and we won’t get another earnings report for a few months now.”

For the first time since the start of 2022, hedge funds trimmed exposure to many Magnificent Seven tech stocks to end the second quarter, according to Snider’s recent analysis of securities filings for the end of the second quarter. Amazon and Apple were exceptions.

Snider said this move “speaks to the anxiety we were hearing from investors heading into the second quarter earnings season.”

He added that investors felt the stocks had benefited from the excitement around AI but also expressed “some concern that that AI investment boom was coming to an end.”

“In my conversations with investors, including hedge fund clients, there was very clearly excitement at the opportunity to buy some stocks that they already liked at lower valuations given the sell-off,” Snider said.

Now, after the snapback in tech stocks, investors aren’t as convicted as they were when buying the dip in early August. “I would call sentiment [around megacap tech] cautiously optimistic,” Snider said.

Nothing like price to change an investor’s feelings.

Weekly Calendar

Monday

Economic data: Durable goods orders, July preliminary (+4.2% expected, -6.7% previously); Dallas Fed manufacturing activity, August (-16 expected, -17.5 previously)

Earnings: Trip.com (TCOM)

Tuesday

Economic data: Conference Board Consumer Confidence, August (100.1 expected, 100.3 previously); S&P CoreLogic Case-Shiller, 20-City Composite home price index, month-over-month, June (+0.3% expected, +0.34% previously); S&P CoreLogic Case-Shiller 20-City Composite home price index, year-over-year, June (+6.81% previously); Richmond Fed manufacturing index, August (-17 previously)

Earnings: Bank of Montreal (BMO), Box (BOX), Nordstrom (JWN)

Wednesday

Economic data: MBA Mortgage Applications, week ending Aug. 23 (-10.1% prior)

Earnings: Nvidia (NVDA), Abercrombie & Fitch (ANF), Affirm (AFRM), Bath & Body Works (BBWI), CrowdStrike (CRWD), Chewy (CHWY), Foot Locker (FL), Five Below (FIVE), HP (HPQ), Kohl’s (KSS), Okta (OKTA), RBC (RBC), Salesforce (CRM), The J.M. Smucker Company (SJM)

Thursday

Economic data: Initial jobless claims, week ended Aug. 24 (235,000 expected, 232,000 previously); Personal income, month-over-month, January (+0.5% expected, +0.3% previously); Second quarter GDP, second estimate (+2.8% expected, +2.8% prior); Wholesale inventories, month-over-month, July preliminary (+0.2% prior); Pending home sales, month-over-month, July (+0.4% expected, +4.8% prior)

Earnings: American Eagle Outfitters (AEO), Best Buy (BBY), Birkenstock (BIRK), Burlington Stores (BURL), Campbell’s (CPB), Dell (DELL), Dollar General (DG), Gap (GAP), Lululemon (LULU), Marvell Technology (MRVL), MongoDB (MDB), Ulta Beauty (ULTA)

Friday

Economic news: Personal spending, month-over-month, July (+0.5% expected, +0.3% previously); PCE inflation, month-over-month, July (+0.2% expected, +0.1% previously); PCE inflation, year-over-year, July (+2.6% expected, +2.5% previously); “Core” PCE, month-over-month, July (+0.2% expected, +0.2% previously); “Core” PCE, year-over-year, July (+2.7% expected; +2.6% previously); MNI Chicago PMI, August (44.5 expected, 45.3 prior); University of Mich. consumer sentiment, August final (67.9 expected, 67.8 prior)

Earnings: No notable earnings.

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

2 Tech Stocks You Can Buy and Hold for the Next Decade

It’s been another great year for the stock market. As of this writing, the benchmark index, the S&P 500, is up nearly 18%.

Yet, if you know where to look, there are even better long-term buy-and-hold opportunities out there. Let’s cover two tech stocks that are each up more than 50% year to date.

Spotify Technologies

Spotify Technologies (NYSE: SPOT) tops the list of tech stocks you can buy and hold for the next decade. The company, which operates the world’s largest audio streaming platform, continues to impress.

Since the start of 2023, shares of Spotify are up 339%, making it one of the top-performing stocks over that period. The secret to its stock market success? Spotify has combined revenue growth with cost-cutting. When done right, that’s a powerful combination.

Spotify’s trailing-12-month revenue has increased to $15.7 billion, up from $13.6 billion one year ago. Similarly, 12-month net income has increased to $500 million versus a nearly $800 million loss a year earlier.

In terms of revenue, the company relies on its premium users to provide roughly 90% of its sales. Those users pay a subscription fee for access to ad-free music, podcasts, and audiobooks. Meanwhile, the company derives about 10% of its total revenue from ad-based listening.

Regarding its expenses, Spotify has embarked on a series of cost-cutting measures over the last few years, including reducing staff levels, trimming its marketing budget, and canceling some content projects.

In turn, the company is firing on all cylinders. Granted, Spotify operates in a competitive field, with Apple, Amazon, and Alphabet all offering their own form of audio streaming.

However, Spotify has more than held its own. With over 600 million listeners and almost 250 million subscribers, Spotify has established itself within the audio streaming market. Investors looking for a growth stock with legs should consider Spotify.

Meta Platforms

Next is Meta Platforms (NASDAQ: META), the operator of Facebook and Instagram.

Granted, I’ve had my concerns with Meta, particularly around the tens of billions of dollars the company chose to spend on the Metaverse. However, one fact is undeniable: Meta generates cash at an almost unbelievable level. This company can afford to take some expensive risks. And I’m sure that’s one of the reasons Meta CEO Mark Zuckerberg felt comfortable pouring $46 billion into the company’s Reality Labs segment — money that heretofore has not generated any return.

At any rate, let’s take a closer look at Meta’s cash flow. In the last 12 months, the company has generated $50 billion in free cash flow.

META Free Cash Flow data by YCharts

It’s a staggering sum, and it puts Meta into rarified air. Its $50 billion in free cash flow, for example, is comparable to the total free cash flows from energy giants ExxonMobil and Chevron — combined.

No wonder the company initiated its first-ever regular dividend payment this year. After all, finding the cash to pay for those dividends is no problem. The new payout policy shows that Facebook has plenty of surplus cash profits on hand, in search of a shareholder-friendly cash management policy.

What’s more, as long as Meta Platforms remains disciplined in its spending, there’s plenty more cash flow on the way. Analysts expect the company to grow its sales by 20% this year and a further 13% in 2025. Those rising revenue figures should support even more free cash flow and perhaps even higher dividend payouts at some point. All of this should make investors happy to own Meta Platforms for the next decade.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon, ExxonMobil, and Spotify Technology. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Chevron, Meta Platforms, and Spotify Technology. The Motley Fool has a disclosure policy.

2 Tech Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool

A Once-in-a-Decade Investment Opportunity: 2 Artificial Intelligence (AI) Stocks to Buy Now

During a CNBC interview, Wedbush Securities analyst Dan Ives called artificial intelligence (AI) the fourth industrial revolution. He drew parallels between the burgeoning AI market, the creation of the internet in 1995, and the launch of the iPhone in 2007. Ives expects an “AI spending tidal wave” to supercharge the technology sector in the coming years.

Similarly, billionaire fund manager Dan Loeb told clients that AI “has matured to the point that it is driving a transformational technology platform shift similar to those seen roughly once per decade: the personal computer in the 1980s, the internet in 1990s, mobile in the 2000s, and cloud in the 2010s.”

In short, AI is a once-in-a-decade investment opportunity. That doesn’t mean the so-called AI bubble — a phenomenon whereby numerous AI stocks have gained substantial value over a short period — will never burst. There will undoubtedly be setbacks and drawdowns along the way. But smart investors will ignore temporary hurdles because they know interest in AI is here to stay.

Here’s why Amazon (NASDAQ: AMZN) and Docebo (NASDAQ: DCBO) could help investors capitalize on this once-in-a-decade opportunity.

1. Amazon

Amazon reported mixed financial results in the second quarter, with its top line growing a little more slowly than analysts anticipated. Specifically, revenue increased 10% to $148 billion, but Wall Street expected $148.6 billion. However, generally accepted accounting principles (GAAP) net income surged 94% to $1.26 per diluted share, easily exceeding the consensus estimate of $1.03 per diluted share.

Unfortunately, Wall Street was also disappointed with the guidance. Management said operating income would increase between 3% and 34% in the third quarter, but analysts anticipated 37% growth. However, the shortfall is due to investments in AI infrastructure and fulfillment capacity for the holidays, as well as digital content costs associated with NFL Thursday Night Football, all of which are worthwhile expenses.

Looking ahead, Amazon should continue to benefit as e-commerce spending increases, but its largest opportunities lie in digital advertising and cloud computing. Amazon is the third-largest digital advertiser worldwide, and the company is gaining share so quickly that it could overtake second-place Meta Platforms by the end of the decade, according to eMarketer.

Amazon Web Services (AWS) runs the largest public cloud in the world, and it widened its lead by a percentage point over Microsoft Azure and Alphabet‘s Google Cloud Platform in the second quarter. AI is one reason AWS is gaining market share. New products like generative AI development platform Amazon Bedrock and coding assistant Amazon Q are gaining customer traction.

CEO Andy Jassy recently told analysts, “Our AI business continues to grow dramatically with a multibillion-dollar revenue run rate despite it being such early days.” AWS is perfectly positioned to meet the demand for AI cloud services because it operates the largest public cloud and spends heavily on product development, from custom AI chips to software.

Looking ahead, Wall Street expects Amazon to grow earnings per share at 25% annually through 2025. That consensus estimate makes the current valuation of 42 times earnings look reasonable. Those figures give a price/earnings-to-growth (PEG) ratio of 1.7, a material discount to the three-year average of 2.9. Investors should feel comfortable buying a small position in this stock today.

2. Docebo

Docebo specializes in corporate learning software. Its learning management system lets businesses create, curate, deliver, and measure the impact of training across internal and external use cases. To elaborate, businesses can use the platform to train employees and partners and to embed customer-facing education into their products.

Docebo has differentiated itself with two innovative applications. Docebo Flow lets users integrate learning content into other applications, enabling employees to learn during the normal flow of work. Docebo Shape uses generative AI to turn source materials, like online articles, corporate documents, and case studies, into learning content.

In a note to clients, Morgan Stanley analysts Josh Baer and Keith Weiss wrote, “Docebo is not only disrupting the internal learning management system (LMS) market, taking share from legacy vendors, but it is also leading the market in a greenfield external learning opportunity.”

Docebo reported solid financial results in the second quarter that beat expectations on the top and bottom lines. Its customer count climbed 9%, and the average contract value rose 10%. In turn, revenue increased 22% to $53 million, and adjusted net income surged 86% to $0.26 per diluted share. Interim CEO Alessio Artuffo told analysts, “Our leadership in the learning industry, along with the effective use of AI, continue to set us apart from legacy competitors.”

Looking ahead, Grand View Research estimates that LMS spending will compound at 19% annually through 2030. Docebo should match that pace, with potential upside arising from its generative AI application. Wall Street expects Docebo’s adjusted earnings to increase by 58% annually through 2025. That makes its current valuation of 83 times adjusted earnings look reasonable. Patient investors should feel comfortable buying a small position today.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Docebo, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

A Once-in-a-Decade Investment Opportunity: 2 Artificial Intelligence (AI) Stocks to Buy Now was originally published by The Motley Fool

Are a Recession and Bear Market Imminent? A Virtually Flawless Predictive Indicator Weighs In.

Although Wall Street’s major stock indexes don’t move higher in a straight line, there’s been no question that the bulls have been in firm control since the start of 2023.

Over a nearly 20-month stretch, the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) have respectively increased in value by 23%, 45%, and 68%, as well as surpassed their previous all-time highs on a multitude of occasions.

However, the party on Wall Street may be coming to a close. Even though investors were able to shrug off a 1,400-point, three-session plunge in the Nasdaq Composite to begin August, one predictive indicator, with a virtually flawless track record dating back to 1959, foreshadows trouble for the U.S. economy, as well as stocks.

This forecasting tool hasn’t been wrong in 58 years

Let me preface this discussion by pointing out that there is no such thing as a perfect predictive tool or metric. If there were a metric that could, with 100% accuracy, forecast short-term directional moves for stocks, every single professional and retail investor would be using it.

There are, however, a few economic data points and predictive metrics that have previously correlated very closely with big moves in the stock market’s major indexes. It’s these tools that investors are leaning on with the hope of gaining an edge in determining what comes next for Wall Street.

Recently, I’ve examined a number of these metrics and events that strongly correlate with moves lower in the Dow Jones, S&P 500, and Nasdaq Composite and/or portend trouble for the U.S. economy. This includes the first notable decline in U.S. M2 money supply since the Great Depression, one of the priciest S&P 500 Shiller price-to-earnings readings since the early 1870s, as well as the historic performance of stocks following the kickoff to a Federal Reserve rate-easing cycle. The nation’s central bank is expected to begin easing rates next month.

But it’s the Federal Reserve Bank of New York’s recession probability indicator that might be the most damning of them all.

The NY Fed’s recession tool measures the likelihood of a U.S. recession taking place over the next 12 months by examining the spread (i.e., difference in yield) between the 10-year Treasury bond and three-month Treasury bill.

When the U.S. economy is strong and investors are optimistic, the Treasury yield curve slopes up and to the right. This is to say that bonds set to mature in 10 or 30 years will have higher yields than Treasury bills that’ll mature in a year or less. It’s normal to receive a higher yield when your capital is tied up for a longer period of time.

Conversely, when there are concerns about the health of the U.S. economy, we see the yield curve invert, with short-term T-bills sporting higher yields than long-term T-bonds. Although not every yield-curve inversion means a U.S. recession is imminent, every U.S. recession since World War II has been preceded by a yield-curve inversion.

As you can see from the latest monthly update of the NY Fed’s recession-forecasting model, which highlights the longest continuous yield-curve inversion in history, there’s a 56.29% chance of a U.S. recession taking shape by July 2025.

Since 1959, there’s only been one instance (October 1966) where the probability of a U.S. recession surpassed 32% and an official economic contraction, as declared by the National Bureau of Economic Research (NBER), didn’t take place. In other words, a recession probability of 32% or greater over the last 58 years has, without fail, signaled a coming recession for the U.S. economy.

Although the economy and stock market aren’t tethered at the hip, the overall health of the economy does matter for corporate America. If the U.S. economy weakens and unemployment rises, it’s almost a lock to adversely impact corporate earnings.

Data collected and analyzed by Bank of America Global Research finds that approximately two-thirds of the S&P 500’s peak-to-trough drawdowns occur after, not prior to, a recession being declared by the NBER. With a key recession ingredient firmly in place, the implication is that stocks could head meaningfully lower — i.e., into a bear market — in the foreseeable future.

Patience isn’t just a virtue — it’s a necessary ingredient to success on Wall Street

As much as investors might dislike U.S. recessions and stock market corrections/bear markets, they’re normal and inevitable aspects of the economic and investing cycle.

But if you take a step back, widen your lens, and allow patience and perspective to be your guides, you’ll see that these occasional moments of panic and disappointment serve as opportunities for long-term-minded investors to take advantage of potential price dislocations in time-tested businesses on Wall Street.

The key thing to understand about the economic cycle is that it isn’t linear. While recessions may be inevitable, nine of the 12 official downturns since the end of World War II were resolved in under a year. Comparatively, almost every economic expansion has stuck around for multiple years, including two growth spurts that surpassed the decade mark. Betting on the U.S. economy to expand over time has unquestionably been the smarter move, even with the occasional recession sprinkled in.

The nonlinear nature of economic cycles also translates to Wall Street’s major stock indexes.

In June 2023, the researchers at Bespoke Investment Group posted a dataset to X (the social media platform formerly known as Twitter) that examined the calendar length of every bear and bull market in the broad-based S&P 500, dating back to the start of the Great Depression in September 1929.

Over a 94-year stretch, the average length of the 27 recorded S&P 500 bear markets was just 286 calendar days, or about 9.5 months. On the other hand, the typical S&P 500 bull market was 1,011 calendar days long, equating to roughly two years and nine months.

You’ll also note that the lengthiest bear market in the S&P 500’s history, which occurred between January 1973 and October 1974, is still shorter than 13 out of the 27 S&P 500 bull markets since September 1929.

At the end of the day, we’re never going to be able to precisely forecast when a correction or bear market will begin, how long it’ll last, or where the ultimate bottom will be. But history does conclusively point to patience and perspective being powerful tools for investors that can help them navigate whatever short-term turbulence or uncertainty Wall Street or the U.S. economy throws their way.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $19,939!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,912!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,348!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America. The Motley Fool has a disclosure policy.

Are a Recession and Bear Market Imminent? A Virtually Flawless Predictive Indicator Weighs In. was originally published by The Motley Fool