Morgan Stanley Predicts up to 220% Jump for These 2 ‘Strong Buy’ Stocks

Despite a rocky start in August, investor sentiment has remained resilient, with the S&P 500 rallying nearly 9% since its August 5th low.

This upward momentum has been driven by a series of positive economic data releases, including better-than-expected initial jobless claims and strong retail sales figures.

Wall Street also reacted favorably to Federal Reserve Chair Jerome Powell’s comments on Friday, signaling that the Fed is prepared to cut interest rates as the labor market softens and inflation approaches the Fed’s 2% annual target.

With this bullish surge in play, the key question is: how can you spot the next hot stock in this environment? One effective strategy is to focus on high-upside stocks endorsed by analysts from top-tier investment banks like Morgan Stanley. These experts bring valuable experience and in-depth knowledge to the table.

In fact, the analysts at Morgan Stanley have highlighted two stocks they believe are poised for significant gains in the coming year – with potential upside as high as 220% in one case. If that’s not enticing enough, according to the TipRanks database, both stocks are also rated as Strong Buys by the analyst consensus. Let’s see what’s driving the unanimous praise from analysts.

COMPASS Pathways (CMPS)

The first Morgan Stanley pick we’ll look at is COMPASS Pathways, a biopharma firm developing innovative treatments for hard-to-treat mental health disorders by leveraging the psychedelic effect of psilocybin. As the active compound in ‘magic mushrooms,’ psilocybin has garnered attention in psychiatric circles for its potential to effectively treat a wide range of mental health conditions.

COMPASS has developed a synthetic psilocybin formulation, known as COMP360, designed to be used in conjunction with psychological support and therapy. The treatment process involves an initial series of sessions where the patient and therapist build rapport, followed by controlled drug administration sessions where the patient receives psilocybin. During these sessions, the patient is closely monitored, and post-session discussions with the therapist help process the experience.

Currently, COMPASS’s most advanced trial program focuses on using psilocybin to treat patients with treatment-resistant depression (TRD), a severe mental health condition that significantly diminishes quality of life. The company is investigating the COMP360 treatment in two Phase 3 clinical trials (COMP005 and COMP006); COMP005 is evaluating the effects of a single-dose monotherapy in 255 participants, with top-line data expected by Q4 2024 or early 2025. Meanwhile, COMP006 is focusing on fixed repeat dose monotherapy in a larger cohort of 568 participants, with top-line results anticipated by mid-2025.

In addition to this late-stage study on TRD, the company’s COMP360 treatment has also been the subject of an open-label Phase 2 study in the treatment of PTSD. The study involved 22 patients, focused on safety and tolerability, and positive results were announced during the second quarter of this year. Building on these results, the company is now evaluating the best approach to advancing its PTSD treatment.

Morgan Stanley analyst Vikram Purohit, who covers the stock, sees CMPS as presenting a compelling risk-reward opportunity. He highlights the company’s leading clinical program, stating, “Progress continues with the PhIII program for COMP360 in TRD, where the next fundamental milestone is top-line data from the PhIII COMP005 trial in 4Q24… The PhII data for COMP360 in TRD is competitive, KOL feedback on the data and uptake potential for COMP360 is positive, and the commercial opportunity in TRD is well-defined.”

“Based on the data generated & stage of development for COMP360, CMPS appears significantly undervalued and we find the risk/reward skewed positive into data catalysts in 2024/2025 that we believe could drive significant appreciation in shares,” the analyst added.

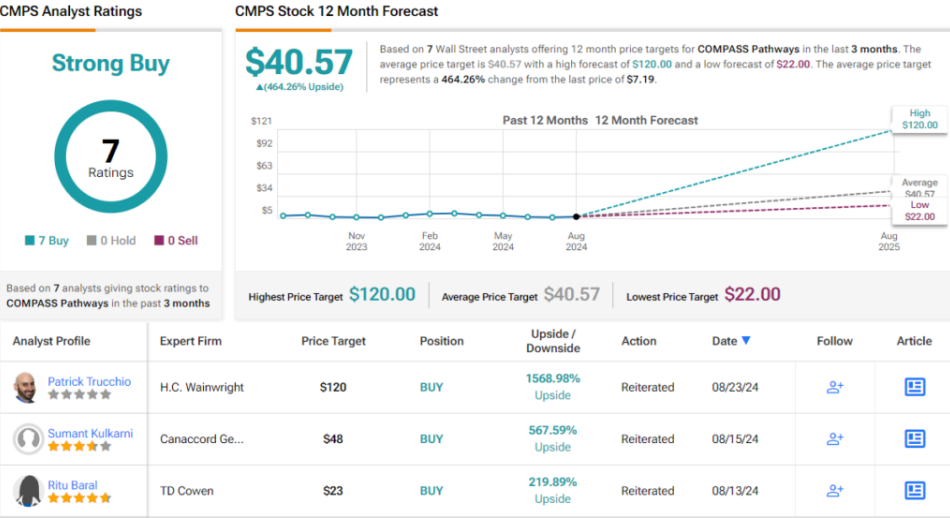

To this end, Purohit rates CMPS shares an Overweight (i.e. Buy), and his $23 price target points toward a robust one-year upside potential of ~220%. (To watch Purohit’s track record, click here)

The broader analyst community shares Purohit’s optimism. Based solely on Buy recommendations – 7 in total – analysts collectively rate CMPS as a Strong Buy. With the stock currently trading at $7.19, the average price target of $40.57 implies an impressive upside potential of 464% over the next year. (See CMPS stock forecast)

Rocket Pharmaceuticals (RCKT)

Next up on Morgan Stanley’s list is Rocket Pharmaceuticals, a biotech company at the forefront of gene therapy. Rocket employs adeno-associated (AAV) and lentiviral (LVV) vectors to pioneer treatments for complex, rare hematologic and cardiovascular conditions, areas with significant unmet medical needs and limited treatment options.

Rocket’s most advanced programs focus on hematology. The company is advancing LV RP-L102, a drug candidate designed to treat Fanconi anemia, and Kresladi, a potential treatment for LAD-1.

On the Fanconi track, Rocket recently released positive data from its Phase 1/2 study and confirmed that regulatory filings remain on schedule.

Conversely, the company faced a setback in June when the FDA issued a Complete Response Letter for the Biologics License Application for Kresladi, requesting additional CMC information to complete its review. Rocket’s management has assured that the review process is ongoing and that they are actively collaborating with senior leaders and reviewers at the FDA’s Center for Biologics Evaluation and Research to resolve the issue.

On the cardiovascular front, Rocket’s research programs are progressing well. Among the most prominent candidates are PR-A501 and RP-A601. PR-A501, a potential treatment for Danon disease, is currently in a Phase 2 pivotal study, while RP-A601, targeting PKP2 arrhythmogenic cardiomyopathy, is enrolling patients for a Phase 1 study.

Rocket’s large and varied pipeline has caught the attention of Morgan Stanley analyst Michael Ulz, who is particularly impressed by the cardiovascular advancements.

“Our Overweight rating is based on Rocket’s position as a leader in the gene therapy field combined with a robust pipeline and experienced management team. We view RP-A501 (AAV) in Danon disease as a key driver with blockbuster potential and see broader potential from the cardiovascular pipeline (PKP2 and BAG3). While we expect focus on the cardiovascular pipeline, we believe the more advanced hematology (LV) franchise provides near term opportunity,” Ulz opined.

Ulz complements his Overweight (i.e. Buy) rating on RCKT with a $45 price target, implying a 142% gain for the stock in the coming 12 months. (To watch Ulz’s track record, click here)

No one is arguing with that take on Wall Street. The stock’s Strong Buy consensus rating is based on Buy recommendations only – 8, in total. The forecast calls for one-year gains of ~147%, considering the average price target stands at $45.86. (See RCKT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

2 Game-Changing Artificial Intelligence (AI) Stocks to Buy Now That Could Help Set You Up for Life

The artificial intelligence (AI) boom will create fortunes for savvy investors. Here are two innovative AI leaders that are set to deliver wealth-building returns to their shareholders.

AI stock to buy No. 1: SoundHound AI

SoundHound AI‘s (NASDAQ: SOUN) state-of-the-art voice technology can interpret speech in a similar manner to the human brain. Its conversational AI provides a faster and more accurate experience than competing platforms — at a time when companies are rushing to harness the power of this game-changing tech.

Restaurants use SoundHound AI’s tools to create custom voice assistants. Its smart answering and ordering solutions eliminate customer wait times by processing multiple orders simultaneously. The tech can also boost profitability by enabling a restaurant to process more orders and reduce labor costs. Customers include Papa John’s, Casey’s, and Chipotle.

Automotive titans are also racing to adopt SoundHound’s technology. The voice AI pioneer’s speech recognition software integrates with generative AI models like OpenAI’s ChatGPT. It provides access to a vast amount of real-time information like navigation, weather, and maintenance updates conveniently delivered via hands-free controls. Leading automakers, including Mercedes Benz, Stellantis, and Honda, count among SoundHound’s growing list of clients.

SoundHound’s sales, in turn, are expanding at a torrid clip. The company’s revenue jumped by 54% year over year to $13.5 million in the second quarter.

Profitability should come as the small-cap company continues to scale its operations. SoundHound’s recent move to acquire enterprise AI software provider Amelia ought to help in this regard. Management expects the deal to boost SoundHound’s earnings by the second half of 2025.

AI stock to buy No. 2: Advanced Micro Devices

Nvidia‘s (NASDAQ: NVDA) AI chips are selling like hotcakes. So much so that the semiconductor designer has struggled to meet the booming demand for this increasingly crucial technology. These shortfalls have kept prices elevated and delayed the AI plans of many companies. Chip buyers clearly want more supply. They’re eager to embrace a new competitor to Nvidia — and Advanced Micro Devices (NASDAQ: AMD) is up to the task.

AMD’s data center revenue soared 115% to $2.8 billion in the second quarter. These gains were fueled by strong sales of the company’s new AI accelerators, which help to quicken machine learning workloads.

CEO Lisa Su sees revenue for AMD’s new AI chips surging to more than $4.5 billion in 2024. Yet the chipmaker is just scratching the surface of its long-term market opportunity. Su predicts that global AI chip sales will grow to a whopping $400 billion by 2027.

AMD could capture 20% of this rapidly expanding market by 2028, according to analysts at Piper Sandler. Large chip buyers, such as Microsoft and Meta Platforms, are reportedly planning to integrate AMD’s AI accelerators into their cloud computing operations.

Like SoundHound, AMD is using acquisitions to strengthen its competitive position and accelerate its expansion. The tech leader completed its $665 million purchase of Silo AI on Aug. 12. Europe’s largest private AI lab comes with a team of experienced scientists and engineers who will work to bolster AMD’s model and software development efforts.

Just days later, AMD struck a deal to acquire ZT Systems for $4.9 billion. The AI infrastructure provider should fortify AMD’s ability to design and deploy large-scale cloud computing systems for its customers.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Chipotle Mexican Grill, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Casey’s General Stores and Stellantis and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

2 Game-Changing Artificial Intelligence (AI) Stocks to Buy Now That Could Help Set You Up for Life was originally published by The Motley Fool

Is the Stock Market Going to Crash? I Don't Know. That's Why I Own This High-Yield Stock.

Markets that go up have always been followed by markets that go down. It’s the typical bull/bear cycle that investors have to deal with.

Right now, the market is up near historic highs, which is why I’m happy to own some boring necessity stocks. One of my favorites is utility Black Hills (NYSE: BKH). Here’s why I own this high-yield stock and why you might want to buy it, too.

What does Black Hills do?

With a market cap of just $4 billion or so, Black Hills is not a particularly large utility. In fact, it is dwarfed by industry giant NextEra Energy (NYSE: NEE), which has a market cap of $160 billion. Compared to that, Black Hills is just a rounding error! Yet it still provides a necessity of modern life.

The company has around 1.3 million natural gas and electric customers across parts of Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Without the energy Black Hills supplies, these customers would be operating in the Dark Ages.

The business is regulated, so it has to get its rates and capital spending plans approved by the government. However, being regulated also means it has a monopoly in the regions it serves. Those 1.3 million customers have nowhere else to turn for their energy needs.

Black Hills is a bit of a tortoise, given the business, but with the market near all-time highs, I’m happy to have a few reliable tortoises in my portfolio. Because of its small size, however, many investors have never heard about Black Hills. This is too bad because it has handily outperformed the industry giants on one key metric: dividends.

Black Hills is a Dividend King

NextEra Energy, which most investors have heard of, has increased its dividend annually for 30 years. That’s a very impressive streak, but it pales in comparison to the 54 consecutive years of annual dividend increases that Black Hills has accumulated. It is one of the longest dividend streaks in the utility sector, making it a highly elite Dividend King.

Think about the last five decades: The list of bad times includes the pandemic, the Great Recession, the dot.com bust/recession, Black Monday, and the raging inflation and oil crisis of the 1970s.

And that’s just the highlight reel. There were smaller ups and downs on Wall Street and in the economy, too. Through it all, Black Hills continued to reward investors with annual dividend increases. That is the type of consistency I want to have in my income portfolio when the market is hovering at lofty levels.

But there’s more to the story than just the dividend. For example, Black Hills’ customer base is growing nearly three times faster than the broader U.S. population. That should support solid growth as the utility invests to serve that expanding customer base.

To put some numbers on that, the five-year capital investment plan is $4.3 billion, which management expects to translate into earnings growth between 4% and 6% a year.

The dividend will likely track along with earnings growth, meaning roughly 5% dividend growth is the target. That’s a solid number for a utility and just happens to be the annualized rate of dividend growth Black Hills has achieved over the past decade. So basically, it expects to keep doing what it has done for years: supplying customers with reliable power, and investors with reliable dividend growth.

Black Hills is a boring and reliable dividend stock

I’m not going to brag to anyone about owning Black Hills; it isn’t that kind of stock. It is a foundational investment that I can comfortably own through good times and bad knowing that its essential service will always be in demand. Along the way, I can collect a lofty 4.5% dividend yield, one of the highest in the utility sector, backed by a growing dividend (for reference, NextEra’s yield is just around 2.6%).

If Wall Street hits the ceiling and a bear market comes along, I’m not going to lose any sleep owning Black Hills. If you are a conservative dividend investor, that will probably sound attractive to you, too.

Should you invest $1,000 in Black Hills right now?

Before you buy stock in Black Hills, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Black Hills wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Reuben Gregg Brewer has positions in Black Hills, Dominion Energy, and Southern Company. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool recommends Dominion Energy and Duke Energy. The Motley Fool has a disclosure policy.

Is the Stock Market Going to Crash? I Don’t Know. That’s Why I Own This High-Yield Stock. was originally published by The Motley Fool

1 Magnificent Dividend Stock Down 40% to Buy and Hold Forever

Rexford Industrial (NYSE: REXR) is offering a 3.3% dividend yield today, which is more than twice the yield of the S&P 500 index. It has increased its dividend annually for a decade and at a rapid pace of more than 10% a year. The stock is still 40% below the highs reached in 2022, despite continued strong operating performance. Here’s why you might want to buy this real estate investment trust (REIT) and hold on to it for the long term.

What does Rexford Industrial do?

As Rexford Industrial’s name implies, it owns industrial real estate. The list includes both warehouses and manufacturing assets, which is pretty typical of an industrial REIT. Rexford currently owns over 420 properties and has around 720 buildings. It has roughly 1,600 lessees. It is one of the larger industrial REITs, sporting a market cap of $11 billion.

The biggest difference between Rexford and other industrial REITs is that Rexford is entirely concentrated on a single geographic region, Southern California. For investors who focus on owning diversified businesses, this REIT may be a hard sell. But don’t write it off before you understand a little bit more about the Southern California region.

Southern California is the largest industrial market in the United States. If you pulled it out by itself, it would be the fourth largest industrial market in the world. In other words, it is a highly attractive region in which to operate. Southern California also happens to have the lowest industrial vacancy rate in the United States. If you had to focus on one industrial region, this would probably be the one you would choose.

What’s going on with Rexford’s business?

From a big picture perspective, the industrial real estate sector isn’t doing quite as well as it was just a few years ago. For example, while Southern California has the lowest vacancy rate for industrial assets, the vacancy rate has more than doubled to nearly 4% since hitting a low point in 2023. There has been a similar spike in vacancy rates in other regions as well, which has investors worried about the entire industrial REIT sector.

That could be an opportunity for investors, given that Rexford’s stock has fallen so hard. Indeed, despite the headwind of rising vacancy rates, Rexford’s portfolio was 96.9% occupied in the second quarter. And it was still able to increase lease rates by a huge 67% on leases that were rolling over in Q2. That is a clear indication that demand for its properties remains high.

This strong leasing performance, meanwhile, resulted in funds from operations (FFO) per share rising by an impressive 11% year over year in the quarter. There’s reason to believe that this strong performance will continue. For starters, lease rollovers will likely allow for material rent boosts for several more years. But there’s more.

Rexford has notable plans to upgrade its assets (which will allow it to charge higher rents), and there are rent bumps built into its existing leases, too. On top of that, Rexford continues to acquire new properties, expanding its portfolio. In other words, there are internal and external growth levers that management is using to drive continued strong performance. So, despite the stock drop, Rexford is still operating at a high level.

Rexford is a buy and hold

To be fair, Rexford’s dividend yield might not be high enough to entice investors focused on maximizing current income. But the impressive dividend growth rate here should make it highly attractive to dividend growth investors. While the stock price is down because the industrial sector is, indeed, softening, Rexford continues to operate at a very high level, at least partly because of its unique geographic focus. If you can see the value in this REIT’s approach, Rexford Industrial is the kind of dividend stock you’ll likely be happy you bought while others were selling.

Should you invest $1,000 in Rexford Industrial Realty right now?

Before you buy stock in Rexford Industrial Realty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rexford Industrial Realty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Rexford Industrial Realty. The Motley Fool has a disclosure policy.

1 Magnificent Dividend Stock Down 40% to Buy and Hold Forever was originally published by The Motley Fool

Should You Buy CrowdStrike Stock Before Aug. 28?

CrowdStrike Holdings (NASDAQ: CRWD) stock was battered badly last month, losing close to 40% of its value in July after it emerged that the cybersecurity specialist’s defective software update caused a massive outage. While CrowdStrike moved speedily to correct its mistake, the negative press and threats of lawsuits seem to have largely kept investors from buying the dip.

However, the fast-growing cybersecurity company is set to release its fiscal 2025 second-quarter earnings report (for the three months ended July 31) on Aug. 28. Will the report be solid enough to spark a turnaround in its fortunes? In other words, should investors consider buying CrowdStrike stock before Aug. 28 in the hope of better-than-expected results and guidance?

CrowdStrike’s upcoming results could reveal the extent of the damage it faces

The CrowdStrike incident that occurred on July 19 reportedly cost $5.4 billion of losses for Fortune 500 companies. Microsoft-based IT systems went down across the globe, while Delta Air Lines reportedly took a $500 million hit. Wall Street analysts believe that CrowdStrike is likely to undertake a long damage-control exercise to win back customer confidence.

As a result, CrowdStrike may have to offer its solutions at discounts, provide compensation to customers who lost revenue because of the outage, or even offer credits to customers. The details of the real extent of the damage that CrowdStrike may face should be evident in the earnings report.

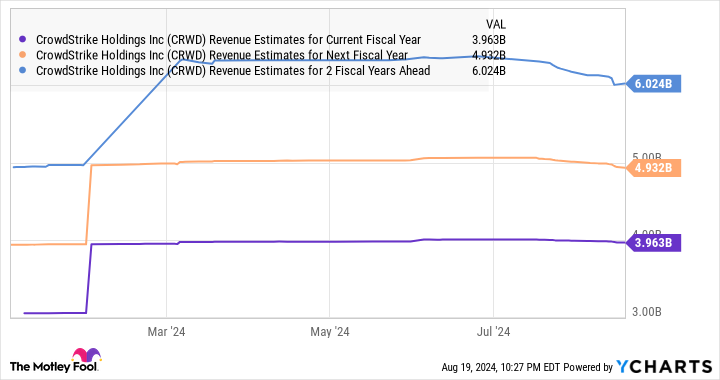

It’s worth noting that CrowdStrike previously guided for fiscal Q2 revenue of almost $960 million (at the midpoint), or a year-over-year increase of 31%. The company’s full-year revenue guidance stands at $3.99 billion, up 30% from the previous year. However, analysts have slightly lowered their fiscal 2025 revenue estimates and expect CrowdStrike to fall short of its full-year guidance. Their revenue estimates for fiscal 2026 and 2027 fell even further.

Adding to this uncertainty, the stock’s valuation isn’t exactly cheap.

The stock remains richly valued despite the pullback

CrowdStrike stock is currently trading at 20.5 times sales. That’s well above the U.S. technology sector’s average price-to-sales ratio of 7.8. For a company that’s coming off a major incident that could negatively impact its balance sheet and growth for years, timing an investment in CrowdStrike before the earnings report is too risky a move.

Investors would do well to stay away from this cybersecurity stock until the real extent of the damage it faces due to last month’s events emerges on Aug. 28.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $19,939!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,912!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,348!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 22, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and Microsoft. The Motley Fool recommends Delta Air Lines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Should You Buy CrowdStrike Stock Before Aug. 28? was originally published by The Motley Fool

3 Vanguard ETFs to Buy Hand Over Fist if the Fed Cuts Rates in September

If we asked a Magic 8 Ball whether the Federal Reserve will cut interest rates in September, I’m pretty sure the answer would be “signs point to yes” or maybe even “most likely.” At least, those would be the answers if the Magic 8 Ball were functioning correctly.

Many economists and investors are expecting a rate cut next month as the minutes from the latest Federal Reserve meeting indicate that lower interest rates are on the way.

What should investors do if a Fed rate cut does occur? Here are three Vanguard exchange-traded funds (ETFs) to buy hand over fist.

1. Vanguard Long-Term Bond ETF

When interest rates fall, bond prices rise. And the prices of long-term bonds rise more than shorter-term bonds. This makes sense. Rate cuts spur institutional investors and income investors to buy bonds that pay higher yields for the longest amount of time. This buying pressure drives the prices of the bonds higher.

There’s one Vanguard ETF that’s ideal for taking advantage of this inverse correlation between interest rates and bond prices: the Vanguard Long-Term Bond ETF (NYSEMKT: BLV). This ETF currently owns 3,095 long-term bonds.

How long-term are we talking about? The average effective maturity of the bonds in the ETF is 22.5 years. Nearly half of the bonds are issued by the U.S. government.

Vanguard funds are known for their low costs. The Vanguard Long-Term Bond ETF doesn’t disappoint on that front. Its annual expense ratio if only 0.04%, a fraction of the 0.83% average expense ratio of similar funds.

2. Vanguard Real Estate ETF

Long-term bonds aren’t the only beneficiaries of lower interest rates. The share prices of real estate investment trusts (REITs) also typically increase as rates decline. These companies rely on borrowing to fund the purchases of new properties, and lower rates can translate to increased profitability.

The Vanguard Real Estate ETF (NYSEMKT: VNQ) allows investors to buy 155 REIT stocks in one fell swoop. The median market cap of these REITs is $32 billion. The ETF’s top holdings include Vanguard Real Estate II Index Fund (a Vanguard mutual fund), Prologis, American Tower, Equinix, and Welltower.

One big plus for this Vanguard ETF is its high forward dividend yield of roughly 4%. REITs must return at least 90% of their earnings to shareholders as dividends and this gives the Vanguard Real Estate ETF plenty of income to distribute each quarter.

Another advantage of the ETF is its annual expense ratio of 0.13%. Although this is higher than the Vanguard Long-Term Bond ETF’s cost, it’s still much lower than the 1.07% average for similar real estate funds.

3. Vanguard Small-Cap Value ETF

Small-cap stocks also tend to move higher when interest rates decline. Like REITs, smaller businesses often must borrow money to fund their growth. Lower rates can therefore boost the profitability of small-cap companies.

Vanguard offers several small-cap funds. I especially like the Vanguard Small-Cap Value ETF (NYSEMKT: VBR). This ETF tries to track the performance of the CRSP US Small Cap Value Index, which features stocks with relatively low market caps and valuations.

The Vanguard Small-Cap Value ETF currently owns 848 stocks. The average price-to-earnings ratio for these stocks is 15.6, significantly lower than the earnings multiple of nearly 27.5 for the large-cap stocks in the S&P 500.

You won’t pay through the nose to own this Vanguard ETF, either. Its annual expense ratio is 0.07% compared to an average expense ratio of 1.11% for similar funds.

Should you invest $1,000 in Vanguard Long-Term Bond ETF right now?

Before you buy stock in Vanguard Long-Term Bond ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Long-Term Bond ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Keith Speights has positions in Vanguard Small-Cap Value ETF. The Motley Fool has positions in and recommends American Tower, Equinix, Prologis, and Vanguard Real Estate ETF. The Motley Fool recommends the following options: long January 2026 $180 calls on American Tower, long January 2026 $90 calls on Prologis, and short January 2026 $185 calls on American Tower. The Motley Fool has a disclosure policy.

3 Vanguard ETFs to Buy Hand Over Fist if the Fed Cuts Rates in September was originally published by The Motley Fool

2 Ultra-High-Yield Real Estate Stocks to Buy Hand Over Fist and 1 to Avoid

Real estate investment trusts (REITs) can be great income-producing investments. They tend to offer much higher dividend yields (4% on average these days compared to a sub-1.5% dividend yield on the S&P 500). Meanwhile, the best ones aim to consistently increase their payments.

W.P. Carey (NYSE: WPC) and EPR Properties (NYSE: EPR) are ideal REITs for those seeking a sustainable and growing income stream. They’re much better options than the much higher-yielding Annaly Capital Management (NYSE: NLY), which might need to cut its dividend once again.

A high-risk, high-yield dividend stock

Annaly Capital Management currently offers a jaw-dropping dividend yield of nearly 13%. That’s almost 10 times higher than the S&P 500. While mortgage REITs like Annaly tend to have higher yields, this one seems to be at a higher risk of reduction than others in the sector.

The concern is the continued decline in Annaly’s earnings available for distribution (EAD). The REIT’s EAD was $0.68 per share in the second quarter, only slightly above its dividend payment. On a positive note, that was an improvement from the first-quarter level when EAD fell below the payout at $0.64 per share. However, it’s well below the year-ago level ($0.72 per share) and where it was at the end of 2022 ($0.89 per share). The company’s declining EAD forced it to cut its dividend by 26% in early 2023.

That wasn’t Annaly’s first dividend reduction. It likely won’t be its last, given the continued decline in its EAD. Because of that, income-focused investors should avoid this REIT.

Back on a growth trajectory

W.P. Carey is a diversified REIT focused on owning operationally critical properties net leased to high-quality tenants. It owns nearly 1,300 single-tenant industrial, warehouse, and retail properties across North America and Europe. It also owns 89 self-storage operating properties. The REIT’s net leases provide it with stable income that grows each year due to built-in rental escalation clauses that either raise rents at a fixed rate or one linked to inflation. That stable income supports the REIT’s nearly 6%-yielding dividend.

Until last year, W.P. Carey had a sterling record of increasing its dividend. However, it made the strategic decision to exit the office sector by spinning off and selling all its office properties. As a result, it also reset its dividend to reflect its lower income level and a desire to have a more conservative dividend payout ratio.

W.P. Carey has been steadily rebuilding its portfolio since then, focusing on property sectors with better long-term fundamentals, like industrial real estate. It expects to invest $1.25 billion to $1.75 billion in new properties this year (it had already secured $641 million of new investments by the end of July), which puts it on track to start growing its cash flow per share in the second half of the year. These new investments have enabled the REIT to already start rebuilding its payout, raising it twice this year. That steady upward trend should continue in the future as it acquires more income-generating properties.

An exciting income stream

EPR Properties is a specialty REIT focused on experiential real estate like theaters, attractions, fitness and wellness facilities, and experiential lodging properties. It also has a small portfolio of educational properties (early childhood education centers and private schools). It net leases these properties back to their operators. Those leases supply it with steady income to cover its more than 7%-yielding monthly dividend.

Like W.P. Carey, EPR Properties had to reset its dividend in recent years (it suspended its payout during the pandemic and then reinstated it at a lower rate). That lower payment level allows the REIT to retain more cash to fund new investments. It expects to invest about $200 million to $300 million per year, which it can fund through retained cash flow, property sales, and its strong balance sheet. EPR Properties had completed $132.7 million of investments by the end of the first half and has $180 million of development and redevelopment projects under construction that it expects to fund over the next two years. It also selectively acquires experiential properties when the right opportunities arise.

EPR Properties’ growing portfolio and cash flow will allow it to increase its dividend. It has already raised its payout a few times since the great reset following the pandemic, including by 3.6% earlier this year.

Better options for a sustainable and growing income stream

While Annaly Capital Management offers an eye-popping dividend yield, that payout doesn’t seem sustainable. Because of that, income-seeking investors should avoid that REIT and buy W.P. Carey or EPR Properties instead. While their yields aren’t quite as high, they’re well above average. Further, those REITs will likely continue increasing their payouts, making them better options for those seeking a sustainable and steadily rising passive income stream.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Matt DiLallo has positions in EPR Properties and W. P. Carey. The Motley Fool recommends EPR Properties. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Real Estate Stocks to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool

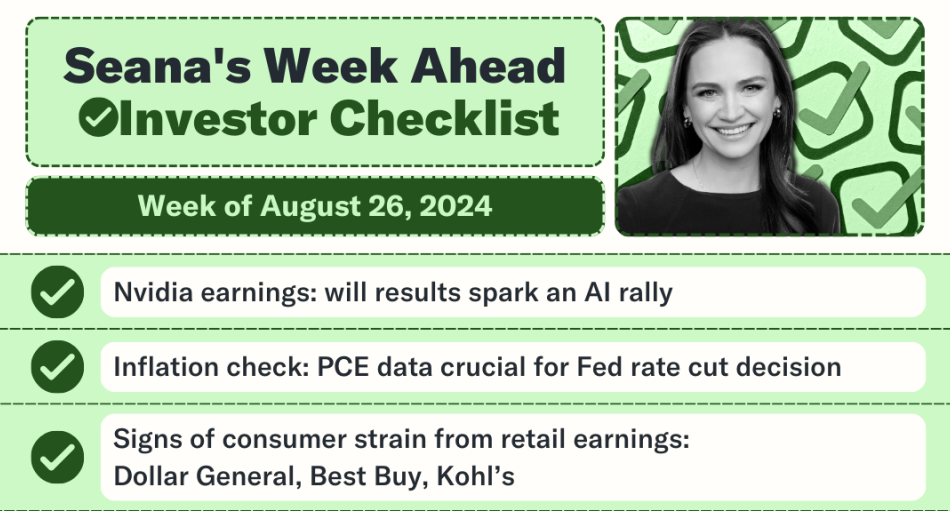

Nvidia earnings 'absolutely key to the AI infrastructure trade'

Nvidia stock (NVDA) is back. But it’s about to be put to the test again.

The next big event for the market is the chip darling’s earnings report, set for after the bell Wednesday.

And it’s not just Nvidia stock that’s on the line: Nvidia’s results will set the pace for other AI players.

“Nvidia’s report and guidance will be absolutely key to the AI infrastructure trade,” tech investor Paul Meeks told Yahoo Finance.

The past several weeks have been a roller-coaster ride for tech investors. Shares of AI giants Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL) are down over the past three months, with Alphabet falling more than 6% and both Amazon and Microsoft down more than 3%.

And second-tier AI players are struggling to regain traction as well. AMD (AMD) has fallen more than 16% since mid-July while Marvell Technology (MRVL) is off nearly 6% in the same period.

But strong results from Nvidia could reignite some of that lost momentum, according to Wedbush’s Dan Ives.

“Nvidia is the heart and lungs of this bullish tech trade as the AI Revolution takes hold,” Ives told Yahoo Finance.

Ives, who expects a “shock and awe” quarter from Nvidia, says continued strong demand for the company’s chips will have ripple effects across the industry. In a recent note to clients, Ives estimated that for every dollar spent on a Nvidia GPU chip, there is an $8 to $10 multiplier across the tech sector.

Bernstein’s Mark Shmulik, who covers many of Nvidia’s biggest customers including Meta, Amazon, and Google, told me the chip giant’s results will be a critical driver of Big Tech’s next move.

“Nvidia is a bellwether of the Magnificent Seven and AI trade,” Shmulik explained. “If there is any softness, maybe rotation out of the Mag 7 picks up a little bit of steam, but listening to other tech earnings, core fundamentals keep delivering.”

So far this year, Nvidia’s stock has soared. Shares are up 180% over the past year and up nearly 2,900% over the past five years — setting the bar very high for earnings this quarter.

Estimates are for Nvidia’s revenue to grow 112% in its latest quarter, marking a dramatic slowdown from over 250% growth one year ago. For Wall Street, consensus remains bullish. KeyBanc, Citi, and Goldman Sachs were among those on the street who reiterated their Buy ratings on the stock this week ahead of results.

While only time will tell whether Nvidia lives up to the hype this earnings season, it’s safe to say the stakes are high.

Seana Smith is an anchor at Yahoo Finance. Follow Smith on Twitter @SeanaNSmith. Tips on deals, mergers, activist situations, or anything else? Email seanasmith@yahooinc.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

Want $2,000 in Annual Dividends? Invest $30,000 in These 3 High-Yielding Stocks

Dividend stocks can be a great source of cash flow for your portfolio. You don’t need to settle for stocks that pay just a few percentage points, either. Some fairly safe, high-yielding stocks pay far more than the S&P 500 average of 1.3%.

Pfizer (NYSE: PFE), BCE (NYSE: BCE), and AT&T (NYSE: T) could all make for good income investments to add to your portfolio right now, as they all pay more than 5% and are fairly safe buys. Here’s how investing $30,000 across these stocks could generate $2,000 in annual dividends for your portfolio.

1. Pfizer

Healthcare giant Pfizer pays an attractive dividend that yields 5.9%. If you were to invest $10,000 into the stock, it would generate more than $590 in dividends over the course of a full year. Investors have been bearish on Pfizer of late, seeing it as a business that got a boost due to its COVID vaccine and pill but whose future is much less certain.

While it’s true that its COVID revenue is declining, the stock is arguably worth more than the 11 times estimated future earnings (based on analyst projections) it’s trading at right now. It has been loading up on acquisitions to enhance its growth prospects.

Its $43 billion acquisition of Seagen last year has the potential to be transformative for the company, making oncology a much larger part of its operations in the years ahead. It also has an underrated opportunity in the promising weight loss market as it works on developing a daily pill to help people lose weight.

Pfizer is in cost-cutting mode, and while it has incurred losses in recent quarters due to restructuring and impairment charges, investors shouldn’t discount it as a top dividend stock to own.

2. BCE

Canadian media and telecom company BCE makes for another stable dividend stock to buy and hold. It likely won’t generate significant capital gains for investors, but given its dominance and leadership position in the Canadian telecom industry, it’s not a stock you’ll have to worry about over the long haul.

At 8.4%, its yield is abnormally high as investors have been bearish on telecom stocks this year due to rising interest rates. But as those rates start to come down, BCE and similar stocks may start to rally. In the meantime, investing $10,000 into the stock could help net you $840 in annual dividends while the payout remains high.

The company is expecting minimal growth this year (between 0% and 4%). Still, its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) will also expand by up to 4.5%, a great sign the business is still moving forward despite less-than-ideal economic conditions. The stock trades at just 16 times its estimated future earnings and could make for another solid income investment to buy and hold.

3. AT&T

Rounding out this list of high-yielding dividend stocks is AT&T. Its 5.8% yield is the lowest on this list, but it wasn’t all that long ago that the payout was even higher. Investors have been more bullish on the telecom provider of late as it has been generating strong results, putting to rest many fears investors had about its operations and high dividend.

As with BCE, you’re getting another fairly slow-growing business in AT&T. This year, it projects its wireless service revenue to grow by 3%, but it expects a higher 7% growth rate in its broadband operations. Adjusted EBITDA growth is also expected to be at around 3%.

Despite its recent rally, investors are still arguably discounting the stock a bit too much as AT&T trades at a forward price-to-earnings multiple of 9. The company is slowly winning investors over with its results and proving it is not a value trap, but it’s still a cheap-looking investment to own right now.

Another $10,000 invested in the company would give you $580 in annual dividends. When combined with the other payouts on this list, that would put your total annual dividend at approximately $2,010 from a total investment of $30,000.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Want $2,000 in Annual Dividends? Invest $30,000 in These 3 High-Yielding Stocks was originally published by The Motley Fool

Meet the Supercharged Growth Stock That Could Join Apple, Microsoft, and Nvidia in the $3 Trillion Club by 2031

One of the most notable transitions in recent decades has been the ascent of technology purveyors among the world’s most valuable companies. It was just two decades ago that industrial and energy stalwarts General Electric and ExxonMobil topped the list in terms of market cap, valued at $319 billion and $283 billion, respectively. Now, just 20 years later, it’s technology that dominates the list.

Leading the way are three of the most recognizable tech companies in the world. Apple currently tops the list at $3.4 trillion. Microsoft and Nvidia are close behind, each valued of $3 trillion.

With a market cap of just $1.3 trillion, it might seem premature to suggest that Meta Platforms (NASDAQ: META) is on track to join the $3 trillion club. However, the stock has gained 163% over the past year and 495% over the past five years (as of this writing), driven by strong operating results that should continue.

Meta has several distinct advantages, and its ever-expanding social media empire, market dominance, and strategic adoption of AI could drive its membership in this elite fraternity.

An ongoing and robust recovery

While Meta Platforms was punished during the economic downturn, the stock has come roaring back, propelled higher by impressive financial results. In the second quarter, revenue of $39 billion climbed 22% year over year, while diluted earnings per share (EPS) of $5.16 jumped 73%.

The financial results were driven by solid user metrics. The number of people who paid daily visits one of Meta’s family of social media sites — which includes Facebook, Instagram, Threads, and WhatsApp — grew to 3.27 billion, up 7% year over year.

Helping fuel the robust results was the ongoing rebound in online marketing, which is improving thanks to gains in the overall economy. Meta’s social media ecosystem plays host to the company’s digital advertising.

The online ad arena is dominated by the industry’s two leading players. In 2023, Alphabet‘s Google controlled an estimated 39% of the worldwide digital ad revenue, followed by Meta with 18%, according to data compiled by business intelligence platform Statista.

As the world’s second-largest digital advertiser, Meta Platforms is well positioned to reap the benefits of the rebound, which could be substantial.

Multiple growth drivers

Worldwide ad spending is expected to rise by 8% to more than $1 trillion in 2024, according to ad industry researcher WARC Media. Social media is expected to be the fastest-growing medium in digital advertising, capturing nearly 22% of total ad spending, according to the report. It goes on to say that Meta is “on course to record oversized gains in the coming months.”

Beyond advertising, however, is Meta’s strategy to profit from the windfall of artificial intelligence (AI). The company has leveraged the data it captures from the billions of users on its social media platforms to develop its own state-of-the-art large language models, which forms the foundation of generative AI.

The result is Llama (Large Language Model Meta AI), which feeds its flagship Meta AI chatbot. Earlier this year, the company unveiled Llama 3, declaring Meta AI as “one of the world’s leading AI assistants.” The company made this system free to individual users (collecting even more data) while it charges the largest cloud infrastructure providers for the privilege of including it in their offerings.

While there’s a great deal of emphasis on AI, it isn’t the only growth driver that could push Meta higher. Meta’s Reality Labs — home of its Oculus virtual reality (VR) business, Quest VR headsets, and its ever-changing metaverse blueprint — has had little to show for its efforts thus far. However, CEO Mark Zuckerberg is convinced these investments will bear fruit, ultimately boosting Meta’s profits.

Given the rebounding ad market, multiple growth drivers, and the tailwinds driving generative AI, it shouldn’t take long for Meta Platforms to earn its membership in the $3 trillion club.

The path to $3 trillion

Meta currently boasts a market cap of roughly $1.35 trillion, which means it will take stock price gains of roughly 123% to drive its value to $3 trillion. According to Wall Street, Meta is expected to generate revenue of $161.6 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 8.3. Assuming its P/S remains constant, Meta would have to grow its revenue to roughly $360 billion annually to support a $3 trillion market cap.

Wall Street is currently forecasting revenue growth for Meta of 14% annually over the next five years. If the company achieves that benchmark, it could achieve a $3 trillion market cap as soon as 2031. It’s worth noting that Meta has grown its annual revenue by nearly 1,000% over the past decade, so those expectations could well be conservative.

Furthermore, at 27 times earnings, Meta is selling for a discount compared to a multiple of 29 for the S&P 500. That’s an attractive price to pay for a company with a dominant market share, strong momentum, and multiple ways to win.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Supercharged Growth Stock That Could Join Apple, Microsoft, and Nvidia in the $3 Trillion Club by 2031 was originally published by The Motley Fool