Snowflake Reports Widening Losses, Sending Its Stock Lower

Joan Cros / NurPhoto / Getty Images

Key Takeaways

-

Snowflake’s second-quarter revenue grew from the year-ago period and beat analysts’ projections, but losses widened as costs rose.

-

The company’s outlook also missed analysts’ estimates compiled by Visible Alpha.

-

Snowflake CEO Sridhar Ramaswamy highlighted the company’s opportunities related to artificial intelligence.

Snowflake’s (SNOW) second-quarter revenue grew from the year-ago period and beat analysts’ projections, but losses widened as costs rose.

The data cloud company reported second-quarter revenue of $868.82 million, a 30% jump from the year-ago period, and above analysts’ estimates compiled by Visible Alpha. However, Snowflake’s net loss of $317.77 million or 95 cents per share widened from the year prior and represented a more significant loss than analysts projected. Excluding one-time items, adjusted earnings of 18 cents per share beat expectations.

Snowflake’s Outlook Misses Projections

The company said it expects fiscal third-quarter revenue to be between $850 million and $855 million and raised its full-year outlook to $3.36 billion, though both missed analysts’ expectations.

“The quarter was hallmarked by innovation and product delivery, and great traction in the early stages of our new AI products,” Snowflake CEO Sridhar Ramaswamy said in a release, adding that “with the combination of our platform, the network effect of collaboration and our AI innovations, we have a huge opportunity ahead to deliver even greater value to our customers.”

Shares of Snowflake were down about 7% at $125.70 in extended trading Wednesday following the company’s earnings report.

Read the original article on Investopedia.

Is Pfizer Stock A Buy Or A Sell After Covid/Flu Shot Misses Its Mark?

Pfizer (PFE) stock edged close to a sell zone in mid-August after the company’s BioNTech-partnered Covid/flu shot missed its mark in a recent study.

↑

X

How Novo Nordisk, Wegovy And Ozempic Are Changing The Weight-Loss Game For Patients And Investors

On Aug. 16, shares dropped 1.4% after Pfizer said the vaccine outperformed existing shots that protect against influenza. Antibody responses to Covid strains were in line with the current shot, but participants in the final-phase study generated a lower number of antibodies capable of handling influenza B.

The company might now have to adjust its vaccine.

Promisingly, Pfizer posted a beat for its June quarter, helped by heart-disease drug Vyndaqel and cancer treatment Padcev. The latter was acquired alongside Seagen, a developer of antibody drug conjugates, or ADCs. Pfizer also hiked its guidance for the year by $1 billion at the midpoint.

Pfizer says it’s on track to deliver at least $4 billion in net cost savings by the end of the year.

Obesity Treatments In Focus

Investors remain highly focused on Pfizer’s efforts in obesity treatment. The company recently said it plans to advance danuglipron into additional testing. Danuglipron targets GLP-1, a hormone that slows how fast the stomach empties itself and improves markers of blood glucose. Unlike leading injectables Wegovy and Zepbound, danuglipron is an oral medicine.

In a conference call with analysts, Chief Executive Albert Bourla says danuglipron has a “very competitive” profile in terms of tolerability and effectiveness compared with other experimental oral obesity treatments. But Leerink Partners analyst David Risinger remains skeptical. Pfizer plans to have additional test results in the first quarter. He kept his market perform rating on Pfizer stock.

Notably, Pfizer has three clinical and several preclinical candidates for obesity treatment. The company previously scrapped development of a twice-daily version of danuglipron due to high rates of gastrointestinal side effects. Before that, the company stopped developing another once-daily pill that caused elevated liver enzymes.

Pfizer stock broke out on July 17 after Roche (RHHBY) unveiled promising results for its oral weight-loss drug.

But Pfizer also recently shut down a gene therapy study for children with a muscle-wasting disease known as Duchenne muscular dystrophy. Neither the primary goal of the study, nor secondary goals, met the bar for success. The firm did gain approval, however, for a hemophilia B gene therapy.

The company also announced the looming departure of Chief Scientific Officer Mikael Dolsten. Dolsten will stay in his position until the company finds his replacement.

So, is PFE stock a buy or a sell right now?

Pfizer Stock Fundamentals: Vyndaqel, Padcev Upside

During the second quarter, adjusted earnings came in at 60 cents per share, beating expectations for 46 cents, according to FactSet. Earnings declined 11% year over year. Sales rose 3% operationally to $13.3 billion, narrowly above forecasts for $13.03 billion.

Notably, revenue from heart-disease drug Vyndaqel surged 71% to $1.32 billion and topped forecasts for $1.01 billion. Padcev, which Pfizer acquired with Seagen, brought in $394 million, topping calls for $352.6 million.

As expected sales of Covid vaccine Comirnaty, developed with BioNTech (BNTX), fell 87% to $195 million. That missed expectations for $200 million. But Paxlovid, the Covid treatment, brought in $251 million, topping forecasts and soaring 79%.

For the third quarter, Pfizer stock analysts forecast earnings of 59 cents per share and $14.91 billion in sales. Earnings would reverse from a year-earlier decline of 17 cents a share. Sales would rise 12.7% and accelerate from single-digit sales growth in the second quarter.

Investors are encouraged to seek stocks with 20%-25% recent sales and earnings growth. Pfizer is not hitting those marks. Big institutional investors — who account for up to 70% of all market trades — usually look for stocks with accelerating earnings and sales growth.

Pharmaceutical Company’s Annual Metrics

Pfizer’s sales have fallen markedly since hitting a record in 2022. Last year, sales tumbled 42% to nearly $58.5 billion. Top sellers included Comirnaty and Paxlovid, which brought in $11.22 billion and $1.28 billion, though sales tumbled a respective 70% and 93% year over year.

Blood thinner Eliquis generated $6.75 billion in sales, up 4% on a strict, as-reported basis. Prevnar sales inched 2% ahead to $6.44 billion.

But other key products saw downfalls. Revenue from Xeljanz, which treats inflammatory conditions, fell 5% to $1.7 billion. Sales of Enbrel, developed with Amgen (AMGN), toppled 17% to $830 million. Pfizer sells Enbrel outside the U.S. and Canada.

Pfizer just hiked its outlook for 2024 and expects adjusted earnings of $2.45 to $2.65 per share and sales of $59.5 billion to $62.5 billion. At the midpoints, earnings would surge 39% as sales pop more than 4%.

Pfizer Stock And Recent News

The obesity treatment decision puts Pfizer back in the race vs. fellow Big Pharma names like Eli Lilly (LLY), Novo Nordisk (NVO), Roche and Amgen (AMGN). But Leerink’s Risinger doesn’t expect to see any effectiveness and safety results from Pfizer’s tests until 2026, at the earliest.

Further, a recent study of Elrexfio shows “compelling overall survival data,” Roger Dansey said in a written statement. Dansey is Pfizer’s chief development officer for oncology.

Pfizer tested Elrexfio in patients with relapsed or refractory multiple myeloma. This means the cancer has returned following treatment or isn’t susceptible to other treatments. Overall, patients lived for a median of 24.6 months, and their disease didn’t worsen for a median of 17.2 months.

In another study, Pfizer tested its Seagen-acquired drug, Adcetris, in patients with diffuse large B-cell lymphoma. This is the third type of lymphoma in which Adcetris has had an overall survival benefit.

But the gene therapy study was a pockmark for Pfizer stock. The company scrapped its study after the Duchenne muscular dystrophy treatment failed to improve motor function in boys age 4 to 7. Boys are more likely to have Duchenne.

Secondary goals, including 10-meter run/walk and time to rise from the floor also didn’t meet the bar for success. Pfizer’s dropout means Sarepta Therapeutics (SRPT) has one fewer competitor for its newly approved gene therapy, Elevidys.

Technical Analysis: PFE Stock Tops 50-Day Line

Pfizer stock is above its 50-day and 200-day moving averages, and broke out of a flat base with a buy point at 29.73, MarketSurge shows. But shares tiptoed close to a sell zone on Aug. 16, falling 6.3% below their entry. Savvy investors are encouraged to cut their losses when a stock falls 7% to 8% below is entry.

(Related: Keep tabs on chart patterns by visiting IBD’s MarketSurge.)

Shares of Pfizer have a Composite Rating of 43 out of a best-possible 99. The measure weighs a stock’s key growth metrics against all other stocks. Leading stocks tend to have Composite Ratings of 95 or better, according to IBD Digital.

Pfizer stock has a Relative Strength Rating of 27 out of 99. The RS Rating measures a stock’s 12-month running performance against all other stocks. That RS Rating means Pfizer stock ranks in the lowest 27% of all stocks in terms of performance over the last year.

The pharmaceutical company’s EPS Rating, a measure of profitability, is 34 out of 99. The EPS Rating compares a stock’s recent and longer-term earnings growth against all other stocks.

Is PFE Stock A Buy Or A Sell?

Based on savvy rules of investing, PFE stock is no longer a buy. Shares have fallen below their buy zone. The stock could be considered a buy if it returns to the 5% chase zone.

Pfizer stock also isn’t considered a sell. It hasn’t fallen 7% to 8% below its entry — triggering a sell rule that tells investors to cut their losses — nor has it undercut its key moving averages.

But Pfizer stock still has to prove its fundamental and technical merit.

It will be important to watch how Pfizer stock performs as the company shores up its pipeline and seeks new approvals in its efforts to move beyond the astronomical growth it saw at the height of the pandemic. Though it has a booster Covid shot, like rivals Moderna (MRNA) and Novavax (NVAX), analysts don’t expect sales to ever hit their pandemic-era growth.

Instead, the Street is closely watching the adult RSV vaccine, which hit the market at the same time as a competitor from GSK (GSK). Pfizer’s efforts now that it owns Seagen could also be key to future growth.

To find the best stocks to buy and watch, check out IBD Stock Lists. Make sure to also keep tabs on stocks to buy or sell.

Follow Allison Gatlin on Twitter at @IBD_AGatlin.

YOU MAY ALSO LIKE:

Biotech Stocks To Watch And Pharma Industry News

Want To Get Quick Profits And Avoid Big Losses? Try SwingTrader

IBD Stock Of The Day: See How To Find, Track And Buy The Best Stocks

Watch IBD’s Investing Strategies Show For Actionable Market Insights

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

SenesTech Announces Reverse Stock Split

Common Stock Will Begin Trading on a Split-Adjusted Basis on July 25, 2024

PHOENIX, July 23, 2024 /PRNewswire/ — SenesTech, Inc. SNES “, SenesTech”, or the “, Company”, ))) (www.senestech.com) the leader in fertility control to manage animal pest populations, today announced that it intends to effect a reverse stock split of its common stock at a ratio of 1 post-split share for every 10 pre-split shares. The reverse stock split will become effective at 4:01 p.m, Eastern Time, on July 24, 2024. The Company’s common stock will continue to be traded on the Nasdaq Capital Market under the symbol “SNES” and will begin trading on a split-adjusted basis when the market opens on July 25, 2024.

At the annual meeting of stockholders held on July 11, 2024, the Company’s stockholders granted the Company’s Board of Directors the discretion to effect a reverse stock split of the Company’s common stock through an amendment to its Amended and Restated Certificate of Incorporation, as amended, at a ratio of not less than 1-for-2 and not more than 1-for-20, with such ratio to be determined by the Company’s Board of Directors.

At the effective time of the reverse stock split, every 10 shares of the Company’s issued common stock will be converted automatically into one issued share of common stock without any change in the par value per share. Stockholders holding shares through a brokerage account will have their shares automatically adjusted to reflect the 1-for-10 reverse stock split. It is not necessary for stockholders holding shares of the Company’s common stock in certificated form to exchange their existing stock certificates for new stock certificates of the Company in connection with the reverse stock split, although stockholders may do so if they wish.

The reverse stock split will affect all stockholders uniformly and will not alter any stockholder’s percentage interest in the Company’s equity, except to the extent that the reverse stock split would result in a stockholder owning a fractional share. Any fractional share of a stockholder resulting from the reverse stock split will either be (i) rounded up to the nearest whole share of common stock, if such shares of common stock are held directly; or (ii) rounded down to the nearest whole share of common stock, if such shares are subject to an award granted under the Company’s 2018 Equity Incentive Plan, in order to comply with the requirements of Sections 409A and 424 of the Internal Revenue Code of 1986. The reverse stock split will reduce the number of issued shares of the Company’s common stock from 5,144,632 shares to approximately 514,464 shares. Proportional adjustments will be made to the number of shares of the Company’s common stock issuable upon exercise or conversion of SenesTech’s equity awards and warrants, as well as the applicable exercise price. Stockholders whose shares are held in brokerage accounts should direct any questions concerning the reverse stock split to their broker. All stockholders of record may direct questions to the Company’s transfer agent, Transfer Online, Inc., at (503) 227-2950.

About SenesTech

We are committed to improving the health of the world by humanely managing animal pest populations through fertility control. We are experts in fertility control to manage animal pest populations. We invented ContraPest®, the only U.S. EPA-registered contraceptive for male and female rats, and Evolve™, an EPA-designated minimum risk contraceptive currently offered for rats. ContraPest and Evolve fit seamlessly into all integrated pest management programs, significantly improving the overall goal of effective pest management. We strive for clean cities, efficient businesses, and happy households – with a product designed to be humane, effective and sustainable.

For more information visit https://senestech.com/.

Safe Harbor Statement

This press release contains “forward-looking statements” within the meaning of federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. Such forward-looking statements include, among others, the expected timing of the reverse stock split and number of shares outstanding after the reverse stock split. Forward-looking statements may describe future expectations, plans, results or strategies and are often, but not always, made through the use of words such as “believe,” “may,” “future,” “plan,” “will,” “should,” “expect,” “anticipate,” “eventually,” “project,” “estimate,” “continuing,” “intend” and similar words or phrases. You are cautioned that such statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those reflected by such forward-looking statements. Such factors include, among others, the successful commercialization of our products; market acceptance of our products; our financial performance, including our ability to fund operations; our ability to regain and maintain compliance with Nasdaq’s continued listing requirements; and regulatory approval and regulation of our products and other factors and risks identified from time to time in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. All forward-looking statements contained in this press release speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. Except as required by law, we do not undertake any obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events or otherwise.

CONTACT:

Investors: Robert Blum, Lytham Partners, LLC, 602-889-9700, senestech@lythampartners.com

Company: Tom Chesterman, Chief Financial Officer, SenesTech, Inc., 928-779-4143

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/senestech-announces-reverse-stock-split-302204232.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/senestech-announces-reverse-stock-split-302204232.html

SOURCE SenesTech, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shares of Trump's media firm sink to record low

By Chibuike Oguh

NEW YORK (Reuters) -Shares of Trump Media & Technology Group, which is majority-owned by former U.S. President Donald Trump, sank to record lows on Tuesday, following the Republican presidential candidate’s recent return to rival social media platform X.

Trump Media shares dropped to as low as $21.33, down more than 4%. The stock finished down 3.7% at $21.42, marking the eighth consecutive session of losses.

Trump’s dwindling lead in polls and election betting markets in recent weeks has also hit the stock, which has been seen by some retail traders as a bet on whether Trump would win a second term.

“I’ve always looked at Truth Social and DJT as a voting mechanism versus an investment mechanism,” said Lou Basenese, president and chief market strategist at MDB Capital in New York. “The valuation never made sense in relation to the fundamentals.”

The stock had reached an all-time high of $79.38 during their Nasdaq debut on March 26 following a merger with blank-check company Digital World Acquisition Corp.

Earlier this month, Trump Media – whose main asset is the Truth Social app – reported a quarterly loss of $16.4 million and revenue of just $837,000. The company has a market value of about $4.3 billion, down from over $8 billion earlier this year.

Trump is expected to be eligible to begin cashing out his nearly 60% stake – or 114.75 million shares – in his social media company when the insider lockup period expires next month.

“It’s always traded in line with his odds of winning or losing, and that’s what we’re seeing now that the race is tight and the probability of him winning has narrowed. And I think it’s hitting record lows also because you’re coming up against the insider lockup,” Basenese added.

Trump began posting on the X platform last week for the first time in nearly a year, coinciding with an interview with owner Elon Musk.

Trump in recent weeks has lost his sizeable lead in polls against Vice President Kamala Harris, the Democratic candidate.

With 78 days to go before the Nov. 5 vote, contracts for a Harris victory are trading at 56 cents, with a potential $1 payout, on the PredictIt politics betting platform.

Trump contracts are at 46 cents, down from as much as 69 cents in mid-July.

(Reporting by Chibuike Oguh in New York; Editing by Daniel Wallis)

Stock-Split Watch: 3 Artificial Intelligence (AI) Stocks That Look Ready to Split

The past few months have seen a bunch of artificial intelligence (AI)-related technology companies announce stock splits. In fact, of the five potential AI stock splits I wrote about back in May, four have already either executed or announced imminent splits.

Remember, a stock split doesn’t change the intrinsic value of a stock one iota. But it can open up the stock to more retail investors and/or employees who would like to buy shares in lower dollar amounts, and who don’t have access to fractional share buying.

With stock-split fever in the air and the Nasdaq recovering from its late-July slump, even more AI-related stocks are seeing their share prices soar. With a high share price and the likelihood of more AI-fueled growth ahead, these three are the next candidates to split their stock in the near to medium term.

Meta Platforms

One might not think of Meta Platforms (NASDAQ: META) as an AI leader, but don’t underestimate CEO Mark Zuckerberg and his management team: Meta actually has the potential to beat current market leaders such as OpenAI and others at their own game.

Meta obviously has the financial resources to invest in leading AI infrastructure, but its competitive advantage may be in Zuckerberg’s decision to open-source the company’s Llama model code. Open source essentially means giving away the code for free, but that allows outside developers to optimize and make improvements to the underlying model. That decision has the potential to increase Llama’s innovation faster than closed-source competitors like OpenAI or the models coming from other “Magnificent Seven” stocks.

Meta can afford to do this because selling direct access to its AI large language model isn’t its core business. Rather, its core social media platforms all benefit from the increased potency of AI, which has shown the ability to increase user engagement and better target ads, which leads to more revenue per ad.

That was on display in the second quarter. Despite Meta’s already enormous size, the company was able to grow daily active people by 7%, while increasing revenue by 22% and operating income by a whopping 58%.

Of course, one day, Llama should become a revenue generator, as Zuckerberg has identified potential future use cases, such as agents automating a lot of tasks for creators, inserting ads into AI interactions, or potentially directly charging for higher, more advanced levels of AI modeling and compute. But for now, Meta can afford to take its time and develop those services.

Meta is currently the only Magnificent Seven stock to have never split its stock. But with its share price already north of $525 per share and a very reasonable valuation at 26 times earnings, it’s not far-fetched that a stock split may be in the near future. After all, this year has already seen another first for Meta, as the company initiated a dividend for the first time back in February.

KLA Corporation

KLA Corporation (NASDAQ: KLAC) has seen its stock surge in anticipation of an artificial intelligence investment boom. As the dominant player in process control equipment, which helps chipmakers check chip wafers for defects at multiple steps of the chipmaking process, KLA seems set for growth as leading-edge AI chips and memory become more and more complex.

KLA has a dominant market share in the metrology and inspection end market, with its share as high as 55% in some verticals. That market dominance of a crucial semiconductor process enables high margins and free cash flow, with the company’s operating margin coming in at a whopping 41% last quarter.

KLA’s killer combination of growth and profitability is the reason it has raised its dividend at a 15% annualized rate since 2006. And it’s also why the stock price has surged to $820 per share, making it ripe for a stock split.

Semiconductor capital equipment peer Lam Research announced it would be splitting its stock back in May, to take effect in October, and its shares trade around the same price as KLA’s today. Like KLA, Lam dominates a certain part of the chipmaking process, but a different step in etch and deposition. So, these two aren’t really competitors, but they have similar high profit margins due to a lack of competition. Given their similar characteristics and the chip industry seemingly on the brink of an upturn, it’s not unthinkable KLA Corporation may announce a split sometime soon.

Arista Networks

At $350 per share, Arista Networks (NYSE: ANET) may not undergo a 10-for-1 stock split like some of its tech peers have recently done, but it could split 2 or 3 for 1.

Arista was a disruptive company at the advent of the cloud computing age. Its new-age networking switch architecture fashioned data center switches out of best-of-breed merchant third-party hardware, lowering internal costs. Arista’s EOS software is what ties it all together, enabling high performance, system intelligence, and lightning-fast speeds at lower costs than traditional switches.

Arista’s software focus and huge scale affords it very high margins. Last quarter, Arista’s revenue grew 15.9%, and its operating margin reached over 41% over the past 12 months, with an admirable return on equity of 34.5%. Those are top-tier levels of profitability and solid growth.

Artificial intelligence needs efficient switching and routing as traditional data centers do, but on a bigger and more complex scale. So Arista is a natural beneficiary of the theme. But earlier this year, some may have grown concerned that in-house networking solutions from Nvidia, based on Infiniband technology, might become a competitive threat.

But Ethernet-based Arista seems to have put that to bed with recent results. In fact, Arista even unveiled a new holistic AI data center solution in collaboration with Nvidia on its recent earnings release, showing that the leading AI chipmaker still values collaboration with Arista and its leading ethernet-based solutions.

Look for Arista to continue to innovate its EOS software and switching architecture for super-large AI clusters. With a bright future, expect Arista to continue riding the AI wave higher, and for a potential eventual stock split.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $796,586!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Billy Duberstein and/or his clients have positions in KLA, Lam Research, and Meta Platforms. The Motley Fool has positions in and recommends Arista Networks, Lam Research, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Stock-Split Watch: 3 Artificial Intelligence (AI) Stocks That Look Ready to Split was originally published by The Motley Fool

Here Are All 45 Stocks Warren Buffett Holds for Berkshire Hathaway's $314 Billion Portfolio

Although most investors were laser-focused on the release of the July inflation report last week, they may have missed what could be described as the most insightful data dump of the third quarter.

On Aug. 14, institutional investors with at least $100 million in assets under management were required to file Form 13F with the Securities and Exchange Commission. A 13F is the filing that alerts investors to the stocks, exchange-traded funds, and (occasionally) options that Wall Street’s smartest money managers bought and sold in the latest quarter (in this instance, the June-ended quarter).

No asset manager garners more attention on Wall Street than Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) billionaire CEO Warren Buffett. That’s because Buffett has overseen an increase in his company’s Class A shares (BRK.A) of more than 5,387,000% since becoming CEO in 1965. When you run circles around Wall Street’s major stock indexes, investors of all walks will want to ride your coattails.

According to Berkshire’s newest 13F, the appropriately named “Oracle of Omaha” and his investment lieutenants, Todd Combs and Ted Weschler, are overseeing a 45-stock portfolio spread across $314 billion of invested assets. Make note that this figure excludes the two index funds Berkshire currently holds small stakes in — the Vanguard S&P 500 ETF and SPDR S&P 500 ETF Trust — because index funds are comprised of baskets of securities and aren’t themselves stocks.

Here’s a thorough breakdown of Warren Buffett’s portfolio at Berkshire Hathaway.

Buffett’s portfolio is highly concentrated in eight core investments

At quick glance, you’d assume Buffett, Combs, and Weschler were well diversified, given that their company has $314 billion spread out across 45 stocks — but you’d be sorely mistaken. In reality, more than 79% of Berkshire’s invested assets can be traced back to eight core holdings.

-

Apple (NASDAQ: AAPL): $90,420,000,000 in market value (as of Aug. 16)

-

American Express: $38,161,929,297

-

Bank of America (NYSE: BAC): $37,075,191,558

-

Coca-Cola: $27,672,000,000

-

Chevron (NYSE: CVX): $17,467,773,342

-

Occidental Petroleum (NYSE: OXY): $14,706,768,598

-

Moody’s: $11,513,878,788

-

Kraft Heinz: $11,273,477,399

Despite Berkshire’s team being big net-sellers of equities over the last seven quarters, these eight investments make crystal clear that Buffett prefers to have an outsized percentage of his company’s capital put to work in his best ideas.

Perhaps the biggest surprise here is energy stocks accounting for a double-digit percentage of invested assets. Buffett has overseen the purchase of more than 255.2 million shares of Occidental Petroleum since the start of 2022 and also holds around 118.6 million shares of Chevron.

Historically, energy stocks haven’t played a key role in Buffett’s portfolio. But in the wake of the COVID-19 pandemic, multiple years of capital underinvestment by global energy majors (including Chevron) has led to tight global oil supply. When the supply of an in-demand commodity is constrained, this often means its spot price receives a boost. Occidental Petroleum, in particular, generates the bulk of its revenue from its drilling segment, and would be a prime beneficiary of a sustainably higher spot price for crude oil.

It is worth noting that Buffett and his crew have sold well over 500 million shares of their top holding, Apple, since Oct. 1, 2023, and they recently dumped north of $3.8 billion worth of Bank of America stock over 12 consecutive trading sessions (July 17 – Aug. 1).

Though it’s highly unlikely Buffett has lost faith in the management teams of either company, Berkshire is sitting on mammoth unrealized gains in Apple and Bank of America. With the stock market at historically pricey levels, and Buffett opining during his company’s annual shareholder meeting in May that he believes corporate tax rates will climb, locking in some gains makes perfect sense.

The Oracle of Omaha has 20 additional billion-dollar wagers

Even though the lion’s share of Berkshire Hathaway’s invested assets can be traced back to the aforementioned eight brand-name companies, it doesn’t mean there aren’t sizable wagers elsewhere. As of the closing bell on Aug. 16, there were 20 holdings that ranged in value between $1.2 billion and $7.4 billion.

-

Chubb (NYSE: CB): $7,391,306,883

-

Mitsubishi (OTC: MSBHF)(OTC: MTSU.Y): $7,357,559,195

-

Itochu (OTC: ITOCY)(OTC: ITOCF): $5,744,464,819

-

DaVita: $5,425,164,171

-

Mitsui (OTC: MITSY)(OTC: MITSF): $5,390,943,959

-

Citigroup: $3,392,030,536

-

Kroger: $2,659,500,000

-

Marubeni (OTC: MARUY): $2,416,778,056

-

Sumitomo (OTC: SSUM.Y)(OTC: SSUM.F): $2,388,438,078

-

VeriSign: $2,305,016,154

-

Visa: $2,218,574,855

-

Mastercard: $1,869,259,514

-

Amazon: $1,770,600,000

-

BYD: $1,550,124,061

-

Liberty Sirius XM Group Series C (NASDAQ: LSXMK): $1,540,063,734

-

Nu Holdings: $1,509,303,667

-

Capital One Financial: $1,370,346,897

-

Aon: $1,361,405,000

-

Charter Communications: $1,352,803,145

-

Ally Financial: $1,218,870,000

One of the interesting quirks about Buffett’s “other” billion-dollar investments is that this section contains five of the eight companies he described as “indefinite” holdings in his most recent annual letter to shareholders.

Aside from longtime holdings Coca-Cola and American Express, as well as Occidental Petroleum, Buffett listed the five Japanese trading houses (Mitsubishi, Itochu, Mitsui, Marubeni, and Sumitomo) as forever-type holdings for his company. The only reason Buffett hasn’t purchased an even larger stake in these businesses is because he has to keep Berkshire Hathaway’s stake in all five companies below 10%.

The “why?” behind Mitsubishi, Itochu, Mitsui, Marubeni, and Sumitomo has everything to do with these companies being cyclical and cheap. The Oracle of Omaha is a big fan of diversified companies able to take advantage of long-winded periods of economic expansion. When those businesses have single-digit price-to-earnings ratios, hearty capital-return programs, and CEOs with reasonably low compensation packages, Buffett tends to be a happy camper.

There’s also a sizable presence of financial stocks among Buffett’s billion-dollar ventures. It’s here we find insurer Chubb, which was the confidential stock Berkshire’s brightest minds began building a position in last summer. Insurers typically possess strong premium pricing power, and they’ve notably benefited from higher net interest income on their float (i.e., premium collected that hasn’t been paid out via claims) over the last two years.

Warren Buffett’s smaller holdings

To round things out, the roughly $314 billion portfolio overseen by Buffett, Combs, and Weschler also has 17 “smaller” holdings, ranging in market value from a little over $9 million to as much as $918 million.

-

T-Mobile: $918,328,320

-

Liberty Sirius XM Group Series A (NASDAQ: LSXMA): $774,712,462

-

Liberty Formula One Series C: $594,705,952

-

Louisiana-Pacific: $561,167,725

-

Liberty Live Series C: $430,810,903

-

Floor & Décor: $418,352,588

-

Sirius XM Holdings (NASDAQ: SIRI): $398,634,639

-

Ulta Beauty (NASDAQ: ULTA): $260,328,686

-

HEICO Class A: $195,471,660

-

Liberty Live Series A: $192,282,833

-

NVR: $96,329,150

-

Diageo: $29,293,205

-

Liberty Latin America Series A: $25,650,222

-

Jefferies Financial Group: $24,946,927

-

Lennar Class B: $24,352,017

-

Liberty Latin America Series C: $12,570,556

-

Atlanta Braves Holdings Series C: $9,370,726

If there’s a prevailing theme to these sub-$1 billion wagers, it’s that these companies were likely purchased, and/or are actively overseen, by Combs and Weschler.

For instance, Wall Street has been crowing about Berkshire’s purchase of more than 690,000 shares of Ulta Beauty following the release of Berkshire’s second-quarter 13F. While Ulta’s chain of cosmetics stores have been a popular launch point for a number of beauty products, cosmetics are well outside the realm of where Buffett focuses his research. This makes it highly likely that Combs and/or Weschler is behind this trade.

You can also see a potential arbitrage opportunity at play among these smaller holdings. In particular, Berkshire’s stake in Sirius XM Holdings has more than tripled over the last three months. By the end of September, Sirius XM is expected to complete its merger with Liberty Media’s Sirius XM tracking stock, Liberty Sirius XM Group, to create a single class of shares. Sirius XM will also conduct a 1-for-10 reverse split upon consummation of the merger.

Differences in price between Sirius XM and Liberty Sirius XM Group may be opening the door for Buffett and his investing lieutenants to take advantage.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $796,586!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Ally is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Citigroup is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Amazon, Bank of America, Mastercard, Sirius XM, and Visa. The Motley Fool has positions in and recommends Amazon, Apple, BYD Company, Bank of America, Berkshire Hathaway, Chevron, Jefferies Financial Group, Lennar, Mastercard, Moody’s, NVR, Ulta Beauty, Vanguard S&P 500 ETF, VeriSign, and Visa. The Motley Fool recommends Diageo Plc, Heico, Kraft Heinz, Kroger, Nu Holdings, Occidental Petroleum, and T-Mobile US and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

Here Are All 45 Stocks Warren Buffett Holds for Berkshire Hathaway’s $314 Billion Portfolio was originally published by The Motley Fool

Subway’s $5 footlong is now the $15 footlong. Customers want the old deal back.

It’s been years since Subway offered a $5 footlong sandwich, a deal celebrated with an ear-catching jingle. Now, the sandwiches can cost up to $15.

And the chain’s regular customers are none too happy about the inflationary state of affairs.

Most Read from MarketWatch

“People too broke for $15 subs,” one Reddit user said.

“I made my own sandwich last night. I calculated it cost me ~$3-$4 worth of ingredients.” another Reddit user noted.

The discussion about Subway’s pricing has been a hot topic of late, especially since news broke that the chain was reportedly having a large-scale meeting with North American franchisees about ways to boost business.

Naturally, customers want to see a return to the good ol’ days of those $5 footlongs and say that’s the best path forward to win their business. “It’s that easy,” another Reddit user said.

The $5 deal ended in 2014, and Subway’s footlongs currently range from around $8 to $15, though prices vary by location. A sandwich combo meal with chips and a drink adds a few dollars to the tab. Extras like more meat and cheese also increase the price.

Admittedly, few fast-food industry watchers predict the $5 deal will ever return. But Subway franchisees told MarketWatch that bargain offerings are still important sales boosters.

“Promotions can only help us increase traffic,” said Monica Laldin, a Subway franchisee in Georgia with seven locations.

Subway does have offers that bring down the cost of a sandwich below the $10 mark, such as a current buy-one-footlong-get-one-free deal. But the chain — which generates around $10 billion in annual sales, and was purchased last year by Roark Capital in a reported $9.6 billion transaction — faces pushback from some franchisees because the offers can cut into profits.

Subway is far from the only fast-food chain dealing with a difficult financial environment, driven in recent years by higher food and labor costs. As chains have increased prices to counter these developments, inflation-weary customers have voiced their displeasure and have often opted not to frequent establishments as much.

McDonald’s MCD has become something of a focal point in this regard, especially when word spread of one location charging nearly $18 for a Big Mac meal. In a recent letter to customers, McDonald’s U.S. President Joe Erlinger indicated that was more the exception than the rule, though he did note that the price for a Big Mac has risen 21% since 2019.

“Inflationary pressures have affected all sectors of the economy, including ours,” Erlinger said.

To woo customers back, fast-food chains have begun offering a wave of deals and discounts, as exemplified by the McDonald’s $5 value meal — which includes a McDouble cheeseburger or McChicken sandwich, a four-piece order of Chicken McNuggets, a small order of french fries and a small soft drink. All items on the McDonald’s $5 meal deal used to be on its dollar menu, which no longer exists.

A Subway spokesperson told MarketWatch that it’s indeed “challenging times for the entire restaurant industry. Our approach to value is thoughtful and strategic, based on data to help balance consumer needs while protecting franchisee profits.”

In some ways, Subway was a victim of its own success with the triumph of the $5 footlong deal and its accompanying jingle, industry experts say. It cemented the idea of the chain as a low-cost leader and arguably left it with less wiggle room to raise prices without facing consumer backlash.

Plus, as Arlene Spiegel, a New York-based hospitality consultant, argues, consumers can find top-of-the-line sandwich options at those higher price levels, so why should they opt for a chain sub that could cost as much as $15?

“Not when you can go to a mom-and-pop Italian deli and get a sandwich with freshly sliced prosciutto,” Spiegel said.

Adding to Subway’s woes: One of its other major marketing campaigns promoted the low-calorie aspect of some of its offerings and spotlighted Jared Fogle, who reportedly lost 245 pounds on a diet of Subway sandwiches. But Fogle later pled guilty in a child sex-abuse case, which damaged the Subway brand, experts say.

“There are still people who won’t go because of the Jared fiasco,” said Mark Kalinowski, a veteran fast-food industry analyst.

Add it all up and Kalinowski said it should come as no surprise that Subway has seen its U.S. store count drop considerably, from 27,129 in 2015 to 20,133 last year. Yet Kalinowski remains relatively bullish about Subway, even with the growing competition it faces from other sandwich chains.

The bottom line: Plenty of people still like their Subway footlongs regardless of how much they cost, he said: “Subway will be around for decades to come.”

Most Read from MarketWatch

Should You Buy Chevron While It's Below $150?

Chevron (NYSE: CVX) has a lot going for it as an energy investment, not least of which is the dividend, which has been increased annually for 37 consecutive years and supports a lofty 4.4% dividend yield at present. With the stock more than 20% below its most recent highs, should you buy Chevron? Here are some important factors to consider before making the final call.

What does Chevron do in the energy industry?

The headline is actually a trick question because Chevron pretty much does everything, which is why it is classified as an integrated energy company. But to be more specific, it has operations in the upstream segment (energy production), the midstream arena (pipelines and other transportation and storage infrastructure), and the downstream niche (chemicals and refining). Each segment of the broader energy sector operates a little differently and has different market dynamics.

Putting upstream, midstream, and downstream businesses all under one roof not only creates a diversified company, which is further enhanced by Chevron’s global reach, but tends to help soften the ups and downs of the energy cycle. Commodity prices are the main driver of Chevron’s top and bottom lines, but the inherent swings won’t be quite as material as they would be if it were solely focused on the upstream.

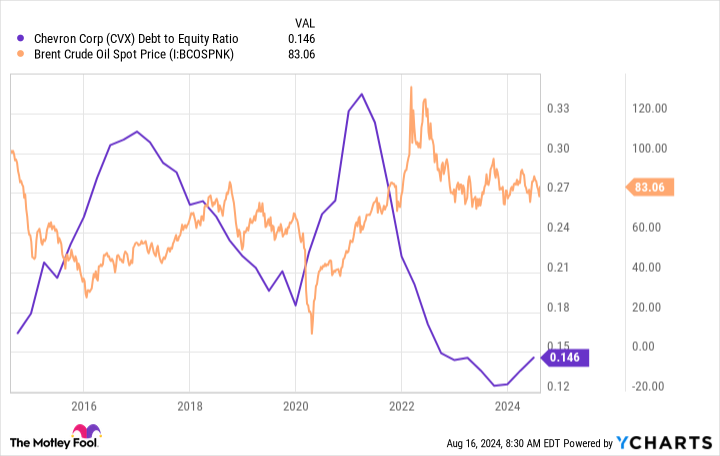

Chevron is also keenly focused on the strength of its balance sheet. To put a number on that, Chevron’s debt-to-equity ratio is a minuscule 0.15 today. That would be a low number for any company, but it also happens to be the lowest figure relative to Chevron’s closest peers. This gives Chevron more leeway to take on leverage to support its business and dividend during the inevitable oil downturns it will face. Simply put, Chevron is a conservative way to invest in the energy sector.

Is Chevron a buy under $150?

Chevron’s stock is under $150 today, which represents a roughly 20% decline from the recent price peak of roughly $188 per share in late 2022. That could be seen as a solid entry point for dividend investors who want to add energy exposure to their portfolios, noting the stock’s attractive 4.4% yield. After all, the S&P 500 index is only yielding around 1.2% or so, and the average energy stock, using Energy Select Sector SPDR ETF as a proxy, is yielding about 3.1%.

Now add in Chevron’s strong financial position, diversified business, and long history of weathering energy downturns while continuing to reward investors with regular dividend increases. You can see where a conservative type would be making a wise choice to buy the stock if they are looking for an energy investment right now.

But there’s one problem: Oil prices are actually fairly high right now. Sure, they’ve been higher, but they’ve also been a lot lower. Given the nature of the oil industry, it is highly likely that Chevron will have to deal with materially lower energy prices at some point in the not-too-distant future.

Chevron is ready, noting its very low debt-to-equity ratio, but that won’t change the fact that revenue and earnings fall when energy prices decline. That, in turn, will lead investors to sell the stock.

In fact, over the past decade, Chevron’s stock has dipped below $80 a share three times. The dividend yield, meanwhile, has risen as high as 9% at one point. That was an extreme peak related to the coronavirus pandemic. But 6% isn’t out of bounds, having been reached three times as well.

It wouldn’t be at all shocking to see a deep oil downturn that leads to a deep drawdown in Chevron’s stock and pushes the yield up to materially more attractive levels. Or to put it another way, if you are looking to buy Chevron at a bargain price, you’ll want to wait until the next big oil sell-off.

Chevron is a good company

Here’s the thing: For long-term investors with an income focus, Chevron is probably a good choice right now. You won’t be getting the best possible price, but you are probably buying it at a fair level if you add the stock below $150.

However, if you are willing to watch and wait, you can probably buy it at a much better price at some point in the future, given the inherent volatility of the energy sector. The one caveat here is that you should get to know the company today and create a concrete plan for when you want to buy it (perhaps when the yield hits 6%).

Indeed, the best time to buy Chevron is likely to be when the fear of owning it seems highest, and if you don’t plan ahead, fear might lead you to miss the opportunity.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $779,735!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

Should You Buy Chevron While It’s Below $150? was originally published by The Motley Fool

TD Takes $2.6 Billion Hit on US Probe, Sells Schwab Shares

(Bloomberg) — Toronto-Dominion Bank is setting aside $2.6 billion to cover fines it expects to pay for failures in its money-laundering controls, and the company sold part of its stake in Charles Schwab Corp. to fund it.

Most Read from Bloomberg

Including a $450 million provision announced in April, the lender now estimates it will pay $3 billion related to its US compliance lapses.

“The bank expects that a global resolution will be finalized by calendar year-end,” Toronto-Dominion said in a statement after markets closed Wednesday.

Canada’s second-biggest bank said its ownership interest in Schwab will fall to 10.1% from 12.3% after selling 40.5 million shares of the discount broker. Toronto-Dominion acquired that stake in 2020 as part of a transaction to sell its interest in online brokerage TD Ameritrade Holding Corp. to Schwab.

The shares were being marketed at $61.35 to $62.65 each, according to terms of the deal seen by Bloomberg News. The range represents a potential discount of as much as 5% to Wednesday’s closing price of $64.57 apiece, Bloomberg calculations show.

Analysts and investors had speculated that Toronto-Dominion could sell some or all of its interest in Schwab to help cover the financial penalties it’s facing in the criminal and regulatory money-laundering matters.

“We recognize the seriousness of our US AML program deficiencies,” Chief Executive Officer Bharat Masrani said in the statement, adding, “The work required to meet our obligations and responsibilities is of paramount importance to me, our senior leaders, and our boards.”

Bribe Allegations

Last year, Toronto-Dominion’s landmark $13.4 billion deal to acquire First Horizon Corp. collapsed, with the Canadian lender saying it was unclear regulators would ever approve the deal. Soon after, TD acknowledged that it was receiving inquiries from the US Department of Justice, in addition to financial regulators and the Treasury Department.

The core allegations are that it failed to catch money laundering and other financial crimes at several US branches where customer-facing employees took bribes to help move money. So far, federal prosecutors in New Jersey have filed at least four cases alleging serious misconduct by branch employees in New York, New Jersey and Florida. The bank has said it fired about a dozen front-line workers for code-of-conduct breaches.

TD also replaced about 10 senior leaders in compliance and legal roles in the wake of the money-laundering allegations. But Masrani, who has been CEO for almost a decade, remains in his post despite swirling speculation that the board could look to replace him.

On top of fines, analysts have suggested the bank could also face years of restrictions on either organic growth or acquisitions in the US, where it has built a significant retail business. It has more than 10 million clients in the country and a network of almost 1,200 branches along the US east coast.

“While the market now has certainty surrounding the amount of the charge, this is offset by the fact that it is larger than expectations and the impact this has on capital,” Jefferies Financial Group Inc. analyst John Aiken said in a note to clients. “The valuation impact will hinge on tomorrow’s earnings, but it is already behind the eight-ball.”

Toronto-Dominion said the provision, which will be reflected in its fiscal third-quarter report on Thursday, will reduce its common equity tier 1 ratio to 12.%. That’s still above the 11% minimum ratio of capital to risk-weighted assets required by Canada’s bank regulator.

TD said the provision will further dent its CET1 ratio by 35 basis points in the fiscal fourth quarter, but that the Schwab sale will increase the ratio by 54 basis points in the period.

“The big question remains: What could the non-monetary penalties be? Hard to tell at this point in time,” Desjardins Capital Markets analyst Doug Young said in a report. “And we highly doubt that management will comment on this right now.”

–With assistance from Bre Bradham.

(Updates with compliance costs in second paragraph, analyst’s comment in third-to-last.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Why Evoke Pharma (EVOK) Stock Is Volatile

Evoke Pharma Inc EVOK shares ended Tuesday down 16.40% to 42 cents after the company announced a 1-for-12 reverse stock split of its common stock, set to take effect at 12:01 a.m. ET on August 1, 2024. After-hours trading has it up 12.44% at 47 cents.

The reverse stock split means that every 12 shares of the company’s existing common stock will be consolidated into one share. The stock will trade on a split-adjusted basis on NASDAQ under the same symbol, EVOK, starting Aug. 1.

This reverse split, approved by shareholders at the 2024 annual meeting, will not change the par value or the authorized number of shares. Fractional shares will not be issued; instead, shareholders will receive a cash payment for any fractional shares.

Should I Buy, Hold or Sell My EVOK Stock?

When deciding to buy, hold or sell a stock, investors should consider their time horizon, unrealized gains and total return.

Shares of Evoke Pharma have decreased by 75.13% in the past year. An investor who bought shares of Evoke Pharma at the beginning of the year would take a loss of $0.64 per share if they sold it today. The stock has fallen 16.7% over the past month, meaning an investor who bought shares on Jun. 1 would see a capital loss of $0.11.

Investors may also consider market dynamics. The Relative Strength Index can be used to indicate whether a stock is overbought or oversold. Evoke Pharma stock currently has an RSI of 28.29, indicating oversold conditions.

For access to advanced charting and analysis tools and stock data, check out Benzinga PRO. Try it for free.

EVOK has a 52-week high of $1.67 and a 52-week low of 36 cents.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.