Seeking at Least 10% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

What goes up must come down, right? It works with gravity – but for the past couple of years the stock markets haven’t seemed to operate that way. The bull run shows no signs of ending – unless veteran investment strategist David Roche is right in his most recent predictions.

Roche is predicting that three factors will act together to bring the bulls to a halt by next year: disappointing rate cuts from the Federal Reserve; lower-than-expected earnings in the second half of this year; and a coming bust as investors realize that the AI boom is a classic bubble. Taking these together, Roche says, “I think there is enough in those three factors to cause a bear market of minus 20% in 2025, maybe starting at the end of this year.”

That, then, is a reminder for investors to start making defensive moves, and that will naturally turn attention to the dividend stocks.

These classic defensive plays offer the benefit of a steady income stream no matter how the markets turn – and with the high-yield div stocks, that income stream is more than enough to beat inflation. The Street’s analysts know this, and in the current environment they are recommending dividend payers with yields of at least 10%. That’s a solid return by any standard, and one that’s always worth a closer look.

For additional color, we’ve used the database at TipRanks to look up the broader view on them. Here are the details.

AG Mortgage Investment Trust (MITT)

The first stock we’ll look at is that of AG Mortgage Investment Trust, one of the many REITs – real estate investment trust companies – that exist to both provide capital for and to profit from the real estate sector of the US economy. AG Mortgage is externally managed by an affiliate of the larger TPG Angelo Gordon company, one of the credit and real estate platforms with the larger TPG private equity firm based in Fort Worth, Texas. AG Mortgage operates as a pure-play residential mortgage REIT, and focuses its activities on building a risk-adjusted portfolio of residential mortgage-related assets in the US market.

According to the company’s fact sheet, AG’s investment portfolio was worth $6.9 billion as of June 30 this year. By far the largest portion, worth $5.6 billion, was in securitized loans, and 55% of the portfolio’s equity allocation was in residential mortgage assets. The portion of the company’s portfolio made up of securitized loans has been growing steadily over the past several years.

REITs are well-known as dividend champions, and AG Mortgage lives up to that. With the exception of several quarters in 2020, during the COVID pandemic period, the company has kept up its dividend payments since 2011. AG Mortgage resumed its payments at the end of 2020 and has not missed one since. The last dividend was paid out on July 31, at a rate of 19 cents per common share. This annualizes to $0.76 and gives a forward yield of 11.1%. AG Mortgage has a history of adjusting the dividend payment as needed to maintain reliability.

Turning to the company’s financials, we find that the dividend payment was supported by an earnings available for distribution (EAD) of 21 cents per common share in 2Q24. This was flat quarter-over-quarter, and up from 8 cents per share in the year-ago quarter.

For analyst Brad Capuzzi, of Piper Sandler, this REIT presents investors with a sound opportunity to buy in at a favorable point of entry. He writes of the company, “In our view, MITT is well positioned to see earnings growth throughout 2024 and 2025 as net interest income trends higher while scale and operating efficiencies show through from the WMC acquisition (completed last December). We currently forecast ~130% earnings growth in 2024 and an additional 27% earnings growth in 2025, generating ROEs in the low-teens as we exit 2025. There is a scenario where our estimates could skew conservative if MITT sees better spreads in the securitization market, funding costs improve as rates decline, and if the company executes on additional share repurchases.”

Looking ahead, Capuzzi sums up his position in simple phrasing, saying, “In our view, this is an opportunistic time to buy the stock as MITT shows significant earnings expansion and starts to close the valuation gap between peers.”

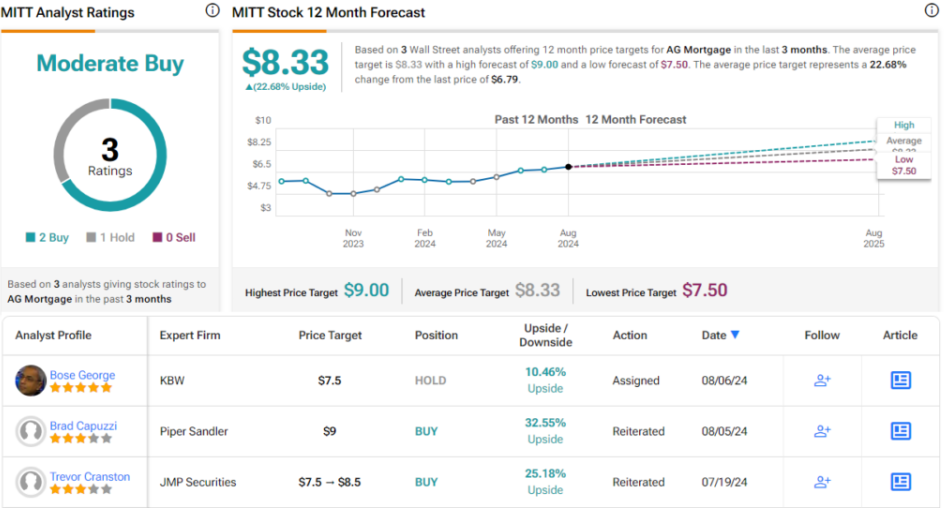

These comments back up Capuzzi’s Overweight (Buy) rating on MITT shares, and his $9 price target suggests that the stock will gain 32.5% in the coming year. Combined with the dividend potential, that gives a possible return of 43% over the next 12 months. (To watch Capuzzi’s track record, click here)

Overall, this stock has a Moderate Buy consensus rating from the Street, based on 3 recent reviews that include 2 Buys and 1 Hold. The shares are priced at $6.79 and their $8.33 average target price implies a one-year gain of almost 23%. (See MITT stock forecast)

Seven Hills Realty Trust (SEVN)

Next up is Seven Hills Realty Trust, another REIT in the US market. Seven Hills’ activities are aimed mainly at the commercial real estate market in the US, and the company has marked preference for ‘middle market and transitional real estate’ in the commercial market. The company defines middle market commercial real estate as properties with values up to $100 million and defines the transitional side of the business as investments in commercial properties that are subject to either redevelopment or repositioning that will increase the property values.

The company generated Distributable Earnings of $5.6 million in Q2, translating to 38 cents per diluted share. This was 4 cents per share better than had been expected.

These earnings results backed up the company’s dividend payment, which was last sent out on August 15 at a rate of 35 cents per common share. This was the seventh consecutive quarter with the dividend at this rate. The 35-cent payment annualizes to $1.40 per common share and equates to a forward yield of 10.5%.

Covering this stock for Janney, analyst Jason Stewart is quick to explain why Seven Hills should attract investor attention. He particularly notes the company’s success in navigating the COVID era, and strategic turn away from the office properties in the commercial real estate market. Stewart writes, “In its relatively short history as a public company, SEVN has managed a portfolio of CRE loans through the COVID-19 pandemic and one of the largest rate hike cycles in history with exceptionally good credit performance. The company has proactively reduced office exposure in its portfolio (though the remaining credits still represent meaningful exposure and deserve watching), loan origination activity is set to accelerate, current vintage loans will produce cyclically high ROEs, and the dividend is covered by earnings. At 72% of 2Q24 BVPS and a [10.4%] yield, shares are overly discounted.”

In-line with this outlook, Stewart puts a Buy rating on these shares, which he complements with a $15 price target, implying a 13% gain in the next 12 months. Add the dividend yield, and the one-year total return reaches 23.5%. (To watch Stewart’s track record, click here)

There are only two recent analyst reviews on SEVN shares, but they both agree that this is a stock to buy – giving the shares a Moderate Buy consensus rating. The stock’s $13.23 trading price and $14.75 average price target together indicate potential for an 11.5% gain in the year ahead. (See SEVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Ginkgo Bioworks to Hold Special Meeting of Shareholders

Special meeting to take place virtually on August 14, 2024 at 4:00 pm ET

BOSTON, Aug. 2, 2024 /PRNewswire/ — Ginkgo Bioworks Holdings, Inc. DNA “, Ginkgo”, ))), which is building the leading platform for cell programming and biosecurity, will be holding a special meeting of shareholders virtually on August 14, 2024 at 4:00 pm ET to vote to permit, at the discretion of the Board of Directors, a reverse stock split of the issued and outstanding shares of Class A common stock and Class B common stock in a range of not less than one-for-twenty (1:20) and not more than one-for-forty (1:40), with the final ratio to be determined by the Board of Directors. Shareholders will also vote to approve Ginkgo’s Amended and Restated Certificate of Incorporation, which has been updated to permit officer exculpation and remove provisions related to our merger with Soaring Eagle Acquisition Corp. and our domestication process, which are no longer relevant to our business.

Additional information regarding the special meeting, including how to vote, are available via proxy materials filed by Ginkgo with the U.S. Securities and Exchange Commission (the “SEC”), and can be found here.

About Ginkgo Bioworks

Ginkgo Bioworks is the leading horizontal platform for cell programming, providing flexible, end-to-end services that solve challenges for organizations across diverse markets, from food and agriculture to pharmaceuticals to industrial and specialty chemicals. Ginkgo Biosecurity is building and deploying the next-generation infrastructure and technologies that global leaders need to predict, detect, and respond to a wide variety of biological threats. For more information, visit ginkgobioworks.com and ginkgobiosecurity.com, read our blog, or follow us on social media channels such as X (@Ginkgo and @Ginkgo_Biosec), Instagram (@GinkgoBioworks), Threads (@GinkgoBioworks) or LinkedIn.

Ginkgo Bioworks Contacts:

INVESTOR CONTACT:

MEDIA CONTACT:

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ginkgo-bioworks-to-hold-special-meeting-of-shareholders-302210173.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ginkgo-bioworks-to-hold-special-meeting-of-shareholders-302210173.html

SOURCE Ginkgo Bioworks

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Siyata Announces Reverse Stock Split

Reverse Stock-Split to be effective on August 2, 2024

VANCOUVER, BC, July 31, 2024 /PRNewswire/ — Siyata Mobile Inc. SYTA SYTAW))) (“Siyata” or the “Company“), a global vendor of Push-to-Talk over Cellular (PoC) devices and cellular signal booster systems, today announced that it will effect a 1-for-18 reverse stock split (“Reverse Stock Split”) of its common share, no par value per share (“Common Share”). The Reverse Stock Split will become effective at 12:01 a.m. Eastern Time on Friday, August 2, 2024, and the Company’s Common Share will commence trading on the Nasdaq Capital Market on a post-split basis at the opening of the market on August 2, 2024. The Company’s Common Share will continue to trade on the Nasdaq Capital Market under the Company’s existing trading symbol, “SYTA,” and a new CUSIP number 83013Q 806 has been assigned as a result of the Reverse Stock Split.

The Reverse Stock Split is primarily intended to bring the Company into compliance with the $1.00 minimum bid price requirement for maintaining its listing on Nasdaq. There is no guarantee the Company will meet the minimum bid price requirement.

The 1-for-18 reverse stock split (the “Ratio”) will automatically combine and convert 18 current shares of the Company’s Common Share into one issued and outstanding new share of Common Share. Each outstanding stock option, pre-funded warrant, share purchase warrant, and other convertible security of the Company convertible into pre-Reverse Stock Split Common Shares that has not been exercised or cancelled prior to the effective date of the implementation of the Reverse Stock Split will be adjusted pursuant to the terms of the instrument or plan governing such security on the same Reverse Stock Split Ratio described above, and each holder of such pre-Reverse Stock Split convertible securities will become entitled to receive post-Reverse Stock Split Common Shares pursuant to such adjusted terms. The Reverse Stock Split will not change the par value of the Common Share nor the authorized number of shares of Common Share, preferred stock or any series of preferred stock.

No fractional shares will be issued in connection with the Reverse Stock Split. All fractional shares will be rounded up to the next higher whole number.

The Company’s transfer agent, Computershare, will serve as exchange for the Reverse Stock Split. Registered shareholders holding pre-split shares of the Company’s Common Share electronically in book-entry form are not required to take any action to receive post-split shares. Shareholders owning shares via a broker, bank, trust or other nominee will have their positions automatically adjusted to reflect the Reverse Stock Split, subject to such broker’s particular processes, and will not be required to take any action in connection with the Reverse Stock Split. Holders of stock certificates will need to send their old physical certificates with a letter of transmittal to receive their new post-Reverse Stock Split certificate.

About Siyata Mobile

Siyata Mobile Inc. is a B2B global vendor of next generation Push-To-Talk over Cellular devices, cellular booster systems, and video monitoring solutions. Its portfolio of in-vehicle and rugged devices enable first responders and enterprise workers to instantly communicate, over a nationwide cellular network of choice, to increase situational awareness and save lives.

Its portfolio of enterprise grade and consumer cellular booster systems enables first responders and enterprise workers to amplify cellular signals in remote areas, inside structural buildings where signals are weak and within vehicles for the maximum cellular signal strength possible.

For its video monitoring system, Siyata integrates software that we license with off-the-shelf hardware providing our customers with an integrated advanced camera system for management and visual monitoring of their fleet vehicles.

Siyata’s Common Shares trade on the Nasdaq under the symbol “SYTA” and its previously issued warrants trade on the Nasdaq under the symbol “SYTAW.”

Visit siyatamobile.com and unidencellular.com to learn more.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and other Federal securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements. Because such statements deal with future events and are based on Siyata’s current expectations, they are subject to various risks and uncertainties and actual results, performance or achievements of Siyata could differ materially from those described in or implied by the statements in this press release. The forward-looking statements contained or implied in this press release are subject to other risks and uncertainties, including those discussed under the heading “Risk Factors” in Siyata’s filings with the Securities and Exchange Commission (“SEC”), and in any subsequent filings with the SEC. Except as otherwise required by law, Siyata undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. References and links to websites and social media have been provided as a convenience, and the information contained on such websites or social media is not incorporated by reference into this press release.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/siyata-announces-reverse-stock-split-302210778.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/siyata-announces-reverse-stock-split-302210778.html

SOURCE Siyata Mobile Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASHFORD INC. ANNOUNCES EFFECTUATION OF REVERSE STOCK SPLIT AND FORWARD STOCK SPLIT

DALLAS, July 31, 2024 /PRNewswire/ — Ashford Inc. AINC (“Ashford” or the “Company”), today announced that in connection with its previously announced plan to withdraw and delist its common stock from trading on the NYSE American LLC stock exchange (the “NYSE American”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company effected a 1-for-10,000 reverse stock split of the Company’s common stock (the “Reverse Stock Split”) followed immediately by a 10,000-for-1 forward stock split of the Company’s common stock (the “Forward Stock Split,” together with the Reverse Stock Split, the “Transaction”), on July 29, 2024 at 5:01 p.m. Eastern Time and 5:02 p.m. Eastern Time, respectively. Following the Transaction, there were 2,066,860 shares outstanding.

The NYSE American has filed with the Securities and Exchange Commission (the “SEC”) a Form 25 to effectuate the removal of the Company’s common stock from listing on the NYSE American and to deregister the common stock under Section 12(b) of the Exchange Act. As a result, Ashford common stock will no longer be listed on the NYSE American. The Company intends to terminate the registration of common stock under the Exchange Act and cease reporting as a public company.

For more information regarding the Company’s deregistration and delisting transaction, please refer to the definitive proxy statement on Schedule 14A filed with the SEC on June 21, 2024.

![]() View original content:https://www.prnewswire.com/news-releases/ashford-inc-announces-effectuation-of-reverse-stock-split-and-forward-stock-split-302211008.html

View original content:https://www.prnewswire.com/news-releases/ashford-inc-announces-effectuation-of-reverse-stock-split-and-forward-stock-split-302211008.html

SOURCE Ashford Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Evogene Announces Expected Implementation of 1-for-10 Reverse Share Split

Following the reverse share split, the Company will have approximately 5,079,000 Ordinary Shares issued and

outstanding

REHOVOT, Israel, July 23, 2024 /PRNewswire/ — Evogene Ltd. EVGN EVGN (the “Company” or “Evogene”), a leading computational biology company targeting to revolutionize life-science-based product discovery and development utilizing cutting edge computational biology technologies, across multiple market segments, announced today that a reverse share split of its issued and outstanding Ordinary Shares, at a ratio of 1-for-10, is expected to be implemented after market close on July 24, 2024. The Company’s Ordinary Shares will begin trading on the Nasdaq Capital Market on a post-reverse split basis at the market open on July 25, 2024, and on the Tel Aviv Stock Exchange at the market open on July 28, 2024, in each case under the Company’s existing trading symbol “EVGN”.

The reverse share split was approved by the Company’s shareholders at the Company’s Annual Meeting of Shareholders held on June 13, 2024, to be effected at the board of directors’ discretion within approved parameters.

Following the implementation of the reverse split, the Company’s registered share capital under the Company’s amended and restated articles of association, as currently in effect (the “Articles”), which as of the date hereof consists of NIS 3,000,000 divided into 150,000,000 Ordinary Shares of NIS 0.02 par value each, will be adjusted to consist of NIS 3,000,000 divided into 15,000,000 Ordinary Shares of NIS 0.2 par value each. The reverse split will adjust the number of issued and outstanding Ordinary Shares of the Company from approximately 50,790,000 Ordinary Shares to approximately 5,079,000 Ordinary Shares (subject to any further adjustments based on the treatment of fractional shares).

No fractional Ordinary Shares will be issued as a result of the reverse split. In accordance with the Company’s Articles, all fractional shares shall be rounded to the nearest whole ordinary share, such that only shareholders holding fractional consolidated shares of more than half of the number of shares which consolidation constitutes one whole share, shall be entitled to receive one consolidated share. No cash will be paid with respect to any fractional shares. In addition, proportionate adjustments will be made to the number of shares issuable upon the exercise of all outstanding options entitling the holders to purchase Ordinary Shares (with a reciprocal increase in the per share exercise price) and to the number of Ordinary Shares underlying outstanding Restricted Share Units (RSUs).

About Evogene Ltd.:

Evogene Ltd. EVGN EVGN is a computational biology company leveraging big data and artificial intelligence, aiming to revolutionize the development of life-science-based products by utilizing cutting-edge technologies to increase the probability of success while reducing development time and cost.

Evogene established three unique tech-engines – MicroBoost AI, ChemPass AI and GeneRator AI. Each tech-engine is focused on the discovery and development of products based on one of the following core components: microbes (MicroBoost AI), small molecules (ChemPass AI), and genetic elements (GeneRator AI).

Evogene uses its tech-engines to develop products through strategic partnerships and collaborations, and its five subsidiaries including:

- Biomica Ltd. (www.biomicamed.com) developing and advancing novel microbiome-based therapeutics to treat human disorders powered by MicroBoost AI;

- Lavie Bio Ltd. (www.lavie-bio.com) – developing and commercially advancing, microbiome based ag-biologicals powered by MicroBoost AI;

- AgPlenus Ltd. (www.agplenus.com) -developing next generation ag chemicals for effective and sustainable crop protection powered by ChemPass AI;

- Casterra Ag Ltd. (www.casterra.co)– developing and marketing superior castor seed varieties producing high yield and high-grade oil content, on an industrial scale for the biofuel and other industries powered by GeneRator AI.

For more information, please visit: www.evogene.com.

Forward Looking Statements

This press release contains “forward-looking statements” relating to future events. These statements may be identified by words such as “may”, “could”, “expects”, “hopes” “intends”, “anticipates”, “plans”, “believes”, “scheduled”, “estimates”, “demonstrates” or words of similar meaning. For example, Evogene is using forward-looking statements in this press release when it discusses its plan to effectuate a reverse share split of its ordinary shares and the timing related to such reverse share split. Such statements are based on current expectations, estimates, projections and assumptions, describe opinions about future events, involve certain risks and uncertainties which are difficult to predict and are not guarantees of future performance. Therefore, actual future results, performance or achievements of Evogene and its subsidiaries may differ materially from what is expressed or implied by such forward-looking statements due to a variety of factors, many of which are beyond the control of Evogene and its subsidiaries, including, without limitation, the current war between Israel and each of Hamas and Hezbollah, the possibility of escalation to a wider regional war, and any worsening of the situation in Israel such as further mobilizations or escalation in the northern border of Israel and those risk factors contained in Evogene’s reports filed with the applicable securities authority. In addition, Evogene and its subsidiaries rely, and expect to continue to rely, on third parties to conduct certain activities, such as their field-trials and pre-clinical studies, and if these third parties do not successfully carry out their contractual duties, comply with regulatory requirements or meet expected deadlines, Evogene and its subsidiaries may experience significant delays in the conduct of their activities. Evogene and its subsidiaries disclaim any obligation or commitment to update these forward-looking statements to reflect future events or developments or changes in expectations, estimates, projections and assumptions.

Investor Relations Contact

Rachel Pomerantz Gerber I Head of Investor Relations at Evogene

rachel.pomerantz@evogene.com I Tel: +972-8-9311901

Logo – https://stockburger.news/wp-content/uploads/2024/08/Evogene_Logo.jpg

![]() View original content:https://www.prnewswire.com/news-releases/evogene-announces-expected-implementation-of-1-for-10-reverse-share-split-302204000.html

View original content:https://www.prnewswire.com/news-releases/evogene-announces-expected-implementation-of-1-for-10-reverse-share-split-302204000.html

SOURCE Evogene

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.