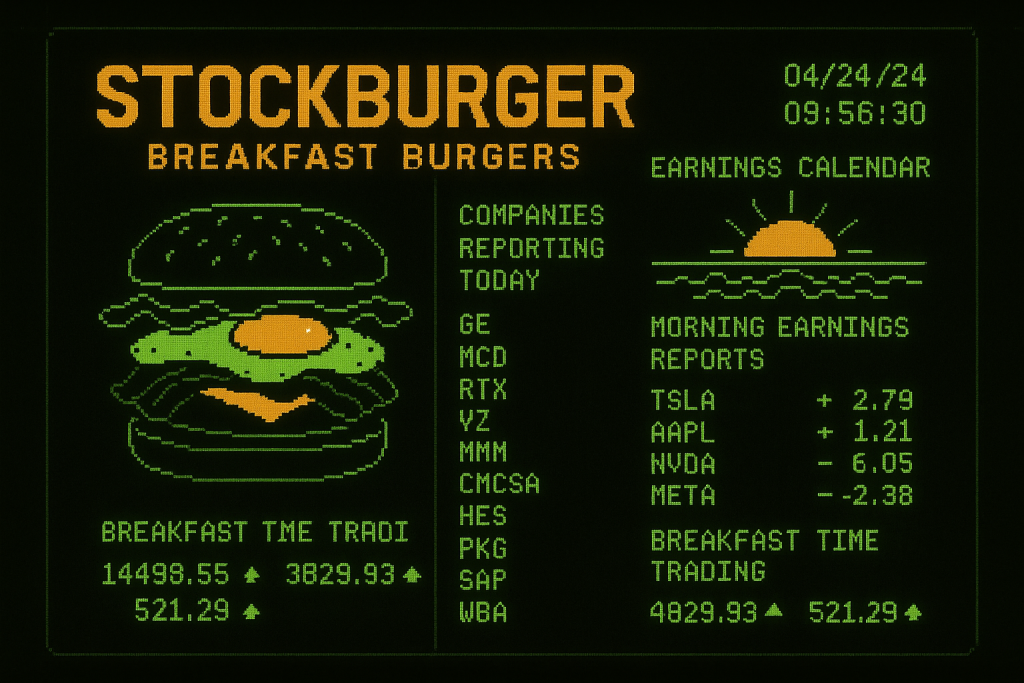

STOCKBURGER BREAKFAST BURGERS

Earnings reports and stocks poised to move today

Good morning and welcome to StockBurger Breakfast Burgers – because who says you can’t have burgers for breakfast? We’re serving up the hottest earnings reports and identifying the stocks most likely to make major moves in today’s trading session. Grab your coffee and let’s dig into today’s breakfast menu of market opportunities.

Today’s Breakfast Menu – Earnings Reports

STOCKBURGER BREAKFAST BURGERS - AUG 29, 2025 ============================================ COMPANIES REPORTING EARNINGS TODAY FRONTLINE PLC (FRO): Q2 2025 - BMO NEW FORTRESS ENERGY (NFE): Q2 2025 - AMC BARNES & NOBLE EDUCATION (BNED): Q4 2025 - AMC WALDENCAST PLC (WALD): Q2 2025 - AMC LAVORO LIMITED (LVRO): Q3 2025 - AMC PRE-MARKET MOVERS: TSLA: +2.79% | AAPL: +1.21% | NVDA: -6.05% | META: -2.38% BREAKFAST TIME TRADING: 4829.93 points

Frontline PLC – Maritime Breakfast Special

Frontline plc (Investor Relations | NASDAQ: FRO) kicks off our breakfast menu with Q2 2025 earnings before market open. The oil tanker operator is expected to report EPS of bash.53.

- Market Cap: .61B

- EPS Estimate: bash.53

- Reporting Time: Before Market Open (BMO)

- Sector: Energy – Oil & Gas Transportation

- Key Metrics: Fleet utilization rates and day rates

New Fortress Energy – Energy Infrastructure Burger

New Fortress Energy Inc. (Investor Relations | NASDAQ: NFE) serves up Q2 2025 results after market close, with analysts expecting an EPS loss of -bash.63.

- Market Cap: 21.14M

- EPS Estimate: -bash.63

- Reporting Time: After Market Close (AMC)

- Sector: Energy Infrastructure

- Key Focus: LNG terminal development and operations

Barnes & Noble Education – Retail Education Play

Barnes & Noble Education, Inc. (Investor Relations | NASDAQ: BNED) reports Q4 2025 earnings after close, with an estimated EPS loss of -bash.81.

- Market Cap: 92.52M

- EPS Estimate: -bash.81

- Reporting Time: After Market Close (AMC)

- Sector: Education Services

- Key Metrics: Textbook sales and digital platform adoption

Stocks Poised to Move – Pre-Market Analysis

StockBurger Breakfast Analysis

This morning’s pre-market action is setting up some interesting breakfast opportunities. Tesla’s gaining momentum while NVIDIA is digesting yesterday’s massive gains. The breakfast burger approach means looking for stocks with the right ingredients: earnings catalysts, technical setups, and institutional interest.

Tesla – Electric Breakfast Champion

Tesla, Inc. (Investor Relations | NASDAQ: TSLA) is up +2.79% in pre-market trading, continuing its recovery narrative from recent production updates.

- Pre-Market Move: +2.79%

- Catalyst: Production ramp updates and EV market optimism

- Technical Setup: Breaking above key resistance levels

- Volume: Above average pre-market activity

Apple – Morning Tech Strength

Apple Inc. (Investor Relations | NASDAQ: AAPL) is gaining +1.21% in pre-market as iPhone 16 launch momentum continues building.

- Pre-Market Move: +1.21%

- Catalyst: iPhone 16 pre-order strength and AI features

- Services Growth: App Store and subscription revenue expansion

- China Recovery: Market share gains in key region

Breakfast Burger Watchlist – Stocks Ready to Sizzle

BREAKFAST BURGER WATCHLIST - READY TO MOVE ========================================== HIGH PROBABILITY MOVERS: FRO - Frontline PLC EARNINGS BMO NFE - New Fortress Energy EARNINGS AMC TSLA - Tesla Inc. PRE-MKT +2.79% AAPL - Apple Inc. PRE-MKT +1.21% BNED - Barnes & Noble Ed. EARNINGS AMC TECHNICAL SETUPS: TSLA: Breaking 70 resistance AAPL: Testing 75 breakout level FRO: Earnings volatility play

Economic Data Breakfast Side Orders

Today’s economic calendar serves up some important side dishes to complement our earnings main course:

8:30 AM ET – Personal Income & Spending

- Personal Income: Expected +0.3% (Previous +0.2%)

- Personal Spending: Expected +0.4% (Previous +0.3%)

- Core PCE Price Index: Expected +0.2% (Key Fed inflation metric)

- Market Impact: Could influence Fed policy expectations

10:00 AM ET – Consumer Sentiment

- University of Michigan Sentiment: Expected 68.5 (Previous 67.8)

- Consumer Expectations: Key for retail and discretionary spending

- Inflation Expectations: Fed closely monitors this data

Sector Breakfast Specials

Energy Sector – Maritime & Infrastructure Focus

With Frontline and New Fortress Energy reporting, the energy sector gets breakfast spotlight:

- Oil Tanker Rates: Frontline benefits from strong day rates

- LNG Infrastructure: New Fortress positioned for energy transition

- Energy Independence: Both companies benefit from geopolitical trends

Technology Sector – Continued Leadership

Pre-market strength in Tesla and Apple suggests tech leadership continues:

- EV Revolution: Tesla leading electric vehicle adoption

- AI Integration: Apple’s iPhone 16 features driving upgrade cycle

- Innovation Premium: Market rewarding technological advancement

StockBurger’s Breakfast Burger Pick

Today’s Breakfast Burger Special: Tesla (TSLA)

Why Tesla Deserves the Breakfast Treatment: +2.79% pre-market gain with strong technical setup and EV momentum

Price Target: 85 | Pre-Market Price: 72.45 | Upside: 4.6%

Risk Level: Moderate – Volatile but strong fundamentals

Trading Strategy – Breakfast Game Plan

StockBurger Breakfast Strategy

Opening Play: Focus on earnings reactions and pre-market momentum continuation

Earnings Trades: Watch for volatility in FRO, NFE, and BNED around earnings

Momentum Plays: Tesla and Apple showing pre-market strength

Economic Data: PCE inflation at 8:30 AM could impact Fed expectations

Risk Factors – Breakfast Cautions

Breakfast Burger Risk Assessment

- Earnings Volatility: Small-cap earnings can create significant price swings

- Economic Data Risk: PCE inflation surprise could impact market sentiment

- Pre-Market Gaps: Low volume can create false signals

- End of Month: Portfolio rebalancing may create unusual flows

Stock Tickers and Breakfast Menu

FEATURED BREAKFAST BURGERS STOCK TICKERS: FRO - Frontline plc NFE - New Fortress Energy Inc. BNED - Barnes & Noble Education, Inc. WALD - Waldencast plc LVRO - Lavoro Limited TSLA - Tesla, Inc. AAPL - Apple Inc. NVDA - NVIDIA Corporation META - Meta Platforms, Inc. MSFT - Microsoft Corporation

International Market Breakfast Influence

Overnight international markets are setting the breakfast table:

Asian Markets Overnight

- Nikkei 225: +0.4% – Japanese tech following US strength

- Hang Seng: +0.2% – Hong Kong cautiously optimistic

- Shanghai Composite: -0.1% – Mixed Chinese sentiment

European Pre-Market

- FTSE 100: +0.3% – London following overnight gains

- DAX: +0.4% – German tech strength

- CAC 40: +0.2% – French markets steady

The StockBurger Breakfast Burgers menu is loaded with opportunities today. From Frontline’s maritime earnings to Tesla’s pre-market strength, we’re serving up a full breakfast of trading possibilities. Remember, breakfast is the most important meal of the day – and in trading, the morning session often sets the tone for the entire day.

Disclaimer: This Breakfast Burgers analysis is for informational purposes only and not financial advice. Earnings reports can create significant volatility. Always conduct your own research and consider your risk tolerance before making investment decisions.