Can Walmart Stock Hit a $1 Trillion Market Cap in 2025?

Walmart (NYSE: WMT) is coming off an incredibly strong 2024. Its share price rose by more than 70%, easily outperforming the S&P 500 and its 24% returns. And with the increase in value, that has pushed its valuation up to a market cap of around $730 billion.

Below, I'll look at how likely it is for Walmart's stock to join the $1 trillion club in 2025 based on its fundamentals, growth prospects, and valuation.

Walmart's performance this past year hasn't been exceptional; sales haven't been skyrocketing by double digits as if it were a hot growth stock again. But simply finding ways to grow its business by single-digit percentages is impressive these days as many retailers have been fighting to keep customers. Rising costs are turning people away and even discount retailers are struggling.

Walmart, however, has been a resilient retailer. A big part of it is likely it being an easy one-stop shop for consumers, who appreciate being able to buy groceries and day-to-day essentials in one place. And with discount retailers even having to raise prices due to inflation, consumers may not see a benefit to going to their local dollar store anymore when the savings compared to Walmart may be negligible or non-existent.

Through the first nine months of fiscal 2025, ended Oct. 31, Walmart's sales rose by over 5% to $500.4 billion. The company's operating income during that period also rose by nearly 9% to $21.5 billion. These aren't numbers that are going to make it the next hot growth stock, but the stability of Walmart's results is what may be attracting investors' attention these days.

Plus, a catalyst to watch out for is the impact the recent acquisition of TV maker Vizio may have on its business. Walmart wrapped up the deal in early December and it gives the company a way to reach customers through Vizio's SmartCast platform, which has more than 19 million active accounts. It's a big opportunity for Walmart to expand its advertising business into streaming and rake in more sales.

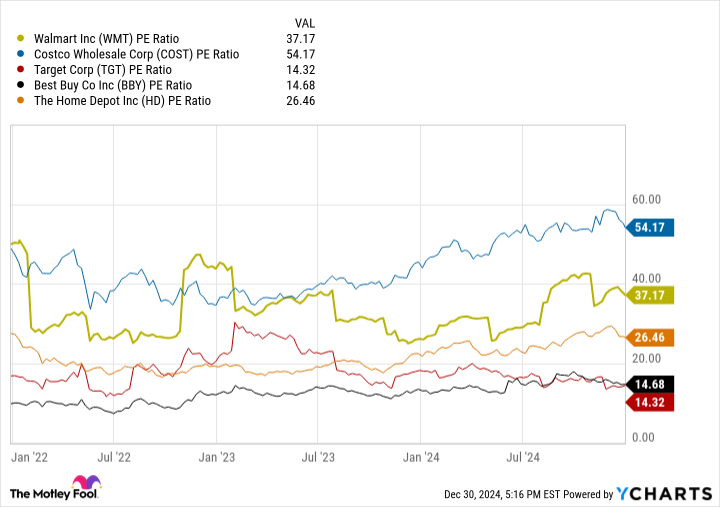

One possible impediment to the stock's growth may be Walmart's valuation. Any time a stock rises so much so quickly, it inevitably ends up trading at a premium. Currently, Walmart's stock is trading at 37 times its trailing earnings. Here's how that compares to some other top retail stocks.

Walmart's stock is on the higher end of this group, with Costco Wholesale being the only one investors are paying more of a premium for.

Breaking news

See all