Cloud computing has become one of the most transformative forces in the global technology landscape. What once started as a way for companies to move some of their data and services online has evolved into a foundational technology that drives nearly every sector — from finance and healthcare to entertainment and manufacturing. As we look ahead to 2025, cloud computing stocks continue to capture investor attention, offering strong growth potential and innovation opportunities.

This article spotlights the top cloud computing stocks to watch in 2025 and explains why the sector remains a critical pillar for long-term technology-focused portfolios.

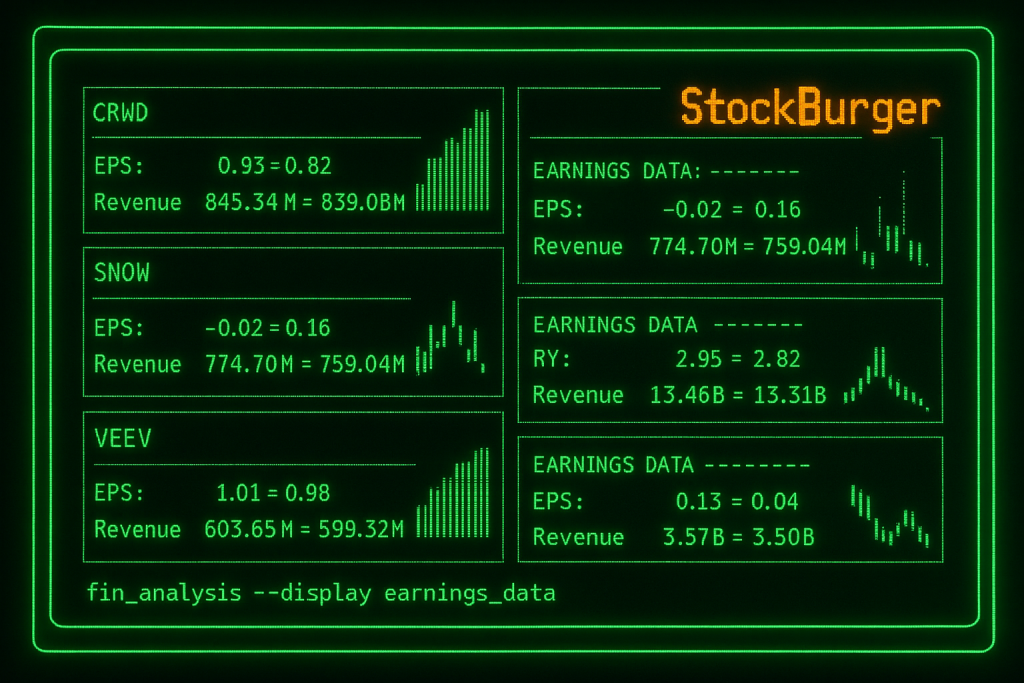

Top Cloud Computing Stock Picks for 2025

**Note: This image was generated using AI for illustrative purposes only. It does not depict an actual product, location, event, or individual.

Amazon Web Services

Amazon Web Services (AWS), the cloud computing arm of Amazon, is the clear market leader in global cloud infrastructure. AWS has built a vast network of data centers and offers a broad range of services, including storage, computing power, and AI tools. Its market dominance comes from years of innovation, scale, and customer trust. In 2025, AWS is expected to maintain its leadership position as more businesses move their operations to the cloud, especially in industries like media streaming, e-commerce, and artificial intelligence.

Microsoft Azure

Microsoft Azure is the second-largest player in the global cloud market and has gained significant traction thanks to strong enterprise adoption. Microsoft’s established relationships with large corporations and government agencies give it a competitive edge. Azure’s integration with Microsoft’s suite of software products, including Office 365, Dynamics, and Teams, makes it a preferred choice for companies seeking seamless cloud solutions. As hybrid cloud environments become the norm, Azure’s flexibility and deep enterprise roots position it well for continued growth.

Google Cloud

Google Cloud is steadily gaining market share, focusing heavily on artificial intelligence, data analytics, and open-source technologies. With tools like BigQuery, TensorFlow, and Vertex AI, Google Cloud has become a go-to platform for companies looking to leverage machine learning and advanced data processing. While it still trails AWS and Azure in market share, Google Cloud’s innovation-driven approach and heavy investment in AI services make it a serious contender to watch in 2025.

Snowflake

Snowflake specializes in cloud-based data warehousing and analytics, offering a unique “data cloud” that allows organizations to store, manage, and analyze large volumes of data seamlessly across multiple cloud platforms. Its platform-agnostic approach enables companies to break down data silos and improve business intelligence. Snowflake’s rapid growth, expanding customer base, and focus on data sharing and collaboration have made it one of the most talked-about cloud stocks in recent years. In 2025, Snowflake is expected to continue capitalizing on the growing demand for scalable data solutions.

Salesforce

Salesforce is the global leader in cloud-based customer relationship management (CRM) software. Its platform enables companies to manage customer interactions, sales pipelines, marketing campaigns, and service operations from a unified cloud interface. Over the years, Salesforce has expanded its offerings through strategic acquisitions, including MuleSoft and Tableau, adding integration and analytics capabilities. As businesses increasingly prioritize customer experience and data-driven insights, Salesforce remains a central player in the cloud ecosystem.

Why Cloud Computing Still Matters

Cloud computing is no longer just a technological upgrade; it is a strategic imperative for companies seeking to remain competitive. As Emily Zhang, cloud strategist at TechWave, explains, “Cloud computing is now a foundational technology for global business.”

There are several key reasons why cloud services remain central to business operations in 2025:

- Scalability and Flexibility: Cloud platforms allow companies to scale operations up or down depending on demand, avoiding the high capital costs of physical infrastructure. This flexibility supports innovation and rapid response to market changes.

- AI and Machine Learning Integration: Advanced technologies like AI, natural language processing, and machine learning depend on the computing power and data storage capacity provided by cloud platforms. Companies that want to stay at the forefront of these innovations need robust cloud backbones.

- Security and Compliance: As data privacy regulations tighten, companies are under pressure to ensure that their cloud providers offer secure environments and meet global compliance standards. This has made security a key market differentiator among cloud providers.

Analyst Perspectives and Investment Strategies

Analysts recommend that investors focus on cloud companies with strong recurring revenue models. Subscription-based cloud services, such as those offered by Microsoft, Salesforce, and Amazon, provide a steady stream of income, making these companies more resilient to market fluctuations.

“Subscription-based cloud services provide financial resilience and predictable growth,” said Rahul Mehta, tech analyst at CloudEdge. He points out that companies able to lock in long-term contracts and retain customers through integrated services are positioned for stable, ongoing expansion.

Moreover, analysts advise paying attention to smaller, specialized players like Snowflake that target niche opportunities within the larger cloud ecosystem. These companies often have higher growth potential, although they may come with greater volatility.

Conclusion: Cloud Stocks Remain Essential in 2025

Cloud computing stocks continue to represent some of the most promising opportunities in the technology sector. As businesses worldwide increase their reliance on scalable, flexible, and secure cloud solutions, the companies driving this transformation stand to benefit from long-term structural trends.

Whether through established giants like Amazon and Microsoft or through innovative specialists like Snowflake and Google Cloud, investors have a range of options to gain exposure to the continued rise of cloud computing. With strong recurring revenues, expanding service offerings, and deep integration with emerging technologies like AI, cloud stocks remain a cornerstone of any well-balanced, technology-focused investment portfolio.