Let’s be honest – lately, watching the markets has felt a bit like waiting for the other shoe to drop. Everyone’s been on edge about inflation rebounding, the Fed tightening further, or some surprise data point blowing up the calm. But this week? Something different happened.

We got a little bit of relief. And not just from one report.

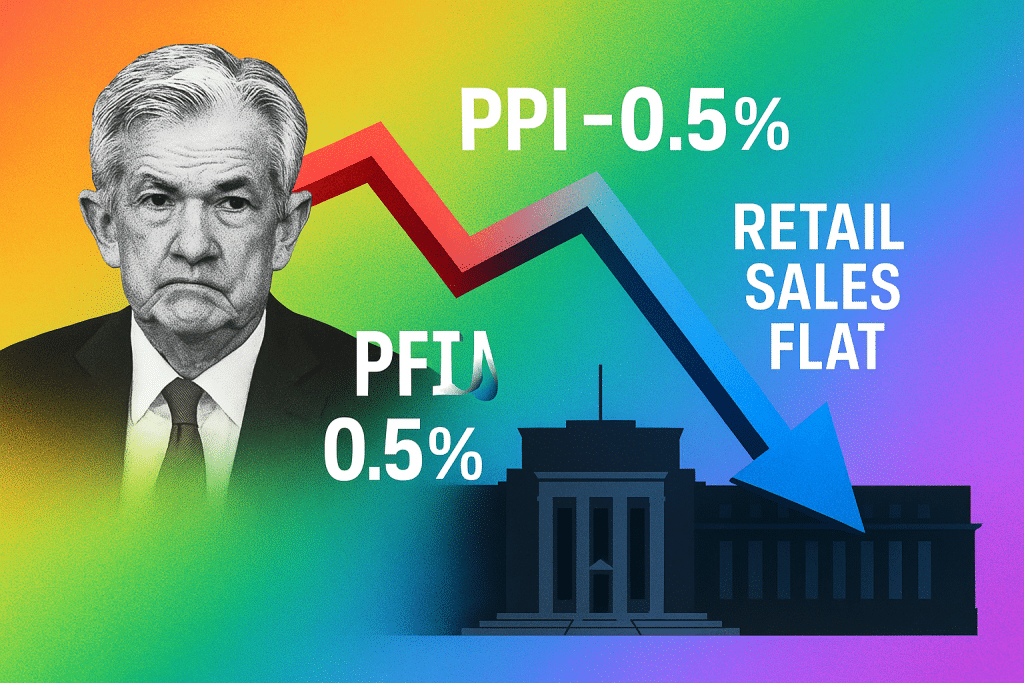

From a surprise plunge in producer prices to slower retail sales and a new tone from Fed Chair Jerome Powell, the mood shifted. It’s not a pivot – but it’s definitely a pause. And that’s something Wall Street can work with.

Producer Prices: The Big Surprise

The real shock came from April’s Producer Price Index (PPI). Economists had expected a modest increase of +0.2%, but instead, prices fell 0.5% month-over-month – the biggest monthly drop for services since 2009.

Let that sink in.

In a world where every hot inflation print gets magnified, this was the opposite. Not just a cooldown, but a full-on ice bath. And it wasn’t a fluke. The 12-month PPI also cooled to +2.4%, reinforcing the trend we started seeing with CPI earlier this month.

So what does that mean?

Well, the PPI is often considered a leading indicator for consumer prices. If companies are paying less to produce things, there’s a good chance those lower costs will trickle down to consumers – eventually. And markets know it.

Stocks rallied on the news. Bond yields dipped. And suddenly, all those “maybe one more hike” whispers got a little quieter.

Retail Sales: Not the Best, But Maybe That’s Good?

In normal times, weak retail sales would spook investors. After all, less spending usually points to slowing growth. But this time, it kind of worked in the market’s favor.

April retail sales came in flat, way below the expected +0.1% gain. That’s not exactly a collapse, but it does show consumer demand is losing steam. Combine that with cooler PPI and CPI readings, and you’ve got a narrative that inflation may be easing across the board – not just in one weird pocket of the economy.

It’s one of those cases where “bad news is good news.” Lower demand means fewer price pressures, which means less reason for the Fed to tighten policy further. And in a rate-sensitive market, that’s all investors needed to hear.

Jerome Powell: Subtle, But Telling

Just hours after the PPI and retail sales numbers dropped, Fed Chair Jerome Powell spoke at a conference – and while he didn’t throw out any bombshells, his tone was… different.

Here’s what stood out:

- Powell said the Fed is “reconsidering key elements” of its policy framework in light of the recent inflation data.

- He suggested April core PCE inflation (the Fed’s preferred metric) is tracking near 2.2%, calling it a “tepid” reading.

- At the same time, he warned that tariff-driven price pressures – like the new 100%+ tariffs on Chinese EVs – could complicate the outlook.

But the main takeaway? The Fed’s staying put. Rates remain on hold at 4.25–4.50%, and Powell made it clear that officials are in no rush to make a move until they get a better sense of how the data unfolds.

For investors who’ve been bracing for another rate hike – or hoping for a cut – this is the kind of ambiguity they can live with. No panic. No pivot. Just… wait and see.

And right now, “wait and see” is a lot better than “tighten more.”

What Investors Are Watching Next

Of course, this doesn’t mean we’re in the clear. One good month (or two) of soft inflation data isn’t a trend. And traders know that.

As one analyst told Reuters, the market is “still waiting for that inflation pop” – meaning there’s a constant undercurrent of caution. If next month’s data reverses course, everything could shift again.

So what’s on the radar now?

- May CPI & PPI (mid-June): Can the cooler trend hold?

- Core PCE (late May): Will it stick near that 2.2% level Powell mentioned?

- Jobs data: The Fed still sees labor tightness as a risk to inflation.

- Tariff impact: If new import duties start to push up prices, inflation could rebound quickly.

- Consumer spending: Weak sales are helpful now, but if they collapse, recession fears will return.

In other words: yes, markets are breathing a little easier – but nobody’s exhaling completely.

The Bigger Picture: A Market Still on Edge, But Hopeful

The rally we saw in response to the PPI and Powell’s comments wasn’t euphoria. It was relief. A sign that maybe – just maybe – the Fed’s rate campaign has done enough. And maybe inflation is trending in the right direction without wrecking the economy in the process.

That’s a narrow path. But for now, it’s still open.

And in this kind of environment, clarity – even partial clarity – is currency. Investors don’t need the Fed to cut rates tomorrow. They just need confidence that the worst is behind us. And this week? They got a little of that.

So if you’re a long-term investor, a trader trying to read the tape, or just someone trying to understand why the market popped after “bad” retail sales – remember this:

Soft inflation means breathing room.

And right now, the market is just grateful to breathe.