You know that feeling when your phone finally cools down after overheating all day? That’s exactly what happened to inflation in April – and the stock market felt it too.

The cooling inflation tech rally began the moment April’s CPI report dropped. After months of hot prints, inflation finally showed signs of easing—and the market wasted no time reacting. And if you’re anything like me – a tech-heavy investor who’s been quietly suffering through rate hikes and multiple compression – this feels like a long-overdue break.

Let’s Talk About the Numbers (Without the Jargon)

The latest CPI print? Pretty encouraging.

- Headline inflation: Up 2.3% YoY, lower than Wall Street’s 2.4% forecast

- Core inflation (excluding food & energy): Rose 2.8%, matching expectations

- Shelter costs: Still up, but slowing – +0.3% MoM

- Energy prices: Actually down this time

Translation: Inflation is still here, but it’s cooling. And more importantly, it came in softer than expected. That’s the first real “good news” CPI in a while.

Why Does This Matter?

Because the Fed watches CPI like a hawk. Slower inflation means the Fed can take its foot off the brake. And if interest rates stop climbing – or even come down – that’s rocket fuel for one sector in particular: tech.

Tech stocks love low rates. Why?

- Their valuations are based on future earnings. Lower rates make those future earnings more valuable today.

- A lot of tech companies borrow money to grow. Cheaper borrowing = more room to innovate.

- And let’s be honest: tech thrives on optimism. Lower inflation? Rate cuts? That’s a mood shift.

**Note: This image was generated using AI for illustrative purposes only. It does not depict an actual product, location, event, or individual.

I Felt It in My Own Portfolio

Let me get personal for a second.

Back in January, I was sitting in a coffee shop, watching Nvidia (NVDA) drop 4% in a single morning. I had just rebalanced my retirement accountb – leaning into AI, chips, and cloud stocks – thinking I was ahead of the curve. But inflation came in hotter than expected, and the Nasdaq got slapped. Again.

I’m not ashamed to say I closed my laptop and just stared into my oat milk latte for 10 minutes.

Fast-forward to this week, and it feels like the tide is turning.

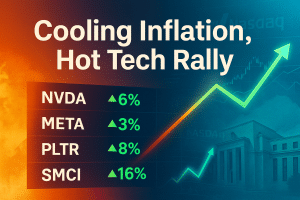

Then, when the CPI report dropped, Nvidia jumped 6% before I could finish my second cup of coffee. Meta was up 3%. Even old-school tech like IBM and Cisco caught a bid. And me? I felt like I could breathe again.

The Market Reacted – Fast

Here’s what happened in the hours after the CPI numbers hit:

- NASDAQ Composite: +1.6%

- S&P 500: +0.7%

- ARK Innovation ETF : +4.2%

- Semiconductors ETF : +2.9%

This wasn’t just mega-cap tech either. Smaller, high-beta names like Palantir and Super Micro Computer rallied hard – 8% and 16%, respectively.

And if you were wondering, yes, the futures market started pricing in a September Fed rate cut almost immediately.

What Does This Mean for Tech?

If you’ve been waiting on the sidelines, this could be the early innings of a real trend shift.

Why?

- Capital gets cheaper: When rates go down, companies can borrow more to fund R&D and expansion.

- Valuations get air: A lower discount rate boosts the present value of future earnings.

- Momentum builds: Tech is sentiment-driven. When investors get optimistic, flows follow fast.

Now, I’m not saying everything’s sunshine and NVDA moonshots. Inflation isn’t “gone,” and we’ve seen false dawns before. But this time, there’s substance behind the optimism.

A Word of Caution

Before we all start popping champagne, let’s keep a few things in mind:

- Tariff pressure: The recent 145% tariff on Chinese EV imports could still work its way into CPI data in the coming months.

- Sticky services inflation: Housing, healthcare, and insurance costs are still climbing.

- The Fed’s not done: Powell has made it clear – he wants “sustained progress,” not a one-off report.

So, while the trend looks encouraging, this could still be a zig-zag recovery.

What I’m Watching Next

Here’s what’s on my radar (and maybe should be on yours too):

- Next CPI print (June 12): Does the trend continue?

- Q2 earnings season: Especially forward guidance from tech CEOs

- Fed minutes and speeches: Any dovish shift in tone

- AI and cloud infrastructure plays: This is where the money is quietly rotating

- Retail data: Consumer health matters more than ever

If we get another soft CPI in June and earnings hold up, this rally could accelerate fast.

Is This the Start of a Lasting Cooling Inflation Tech Rally?

Look, I’ve sat through a lot of ugly CPI days. As a tech-focused investor, the last two years have tested every bit of my conviction. But April’s CPI print was the first time in a long while where the market felt aligned with the data.

It wasn’t about FOMO or hype. It was about logic.

And for anyone who’s stuck with solid growth names, built around real earnings and real innovation, this could be the moment we’ve been waiting for.

So yeah – I’m still cautious. Still hedged. But for the first time in a while, I’m not just watching tech. I’m leaning back in.

Because when inflation cools, tech heats up. And this time, it’s not just a reaction. It might be a reset.