📊 STOCKBURGER EXCLUSIVE ANALYSIS 📊

Professional insights for serious investors

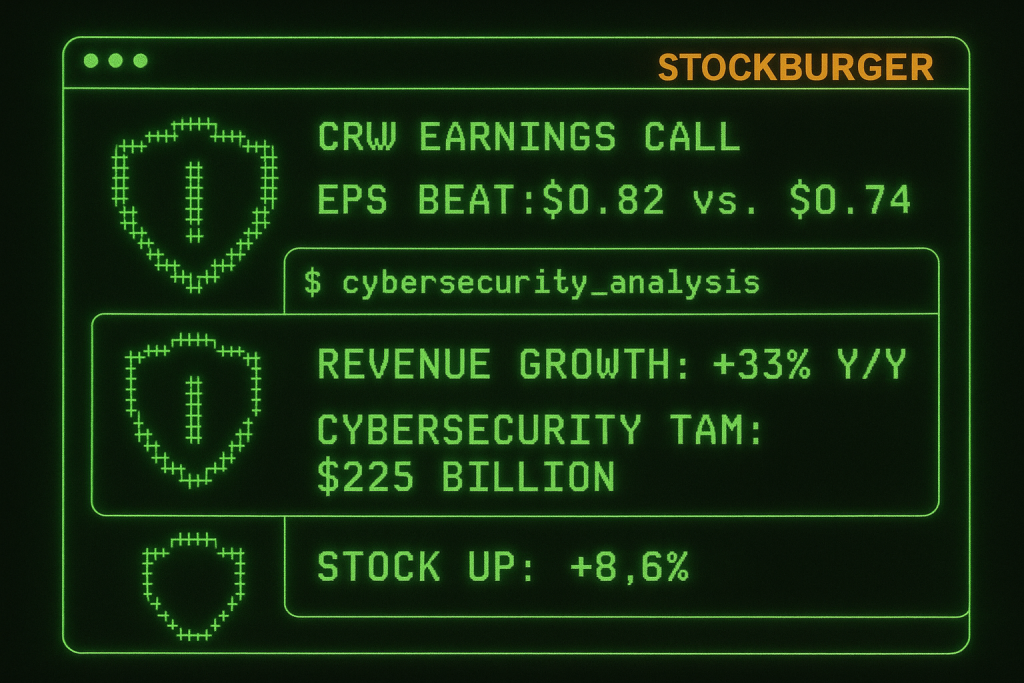

CrowdStrike Holdings delivered another stellar earnings performance today, crushing analyst expectations and reinforcing its position as the undisputed leader in cloud-native cybersecurity. The company’s Q2 2026 results showcase the resilience and growth potential of the cybersecurity sector in an increasingly digital world.

🎯 Earnings Call Highlights

CROWDSTRIKE Q2 2026 EARNINGS RESULTS ==================================== EPS: bash.82 vs bash.74 expected (+10.8% beat) Revenue: 45.3M vs 25.1M expected (+2.4% beat) YoY Revenue Growth: +33.2% Subscription Revenue: 98.4M (+34.1% YoY) ARR (Annual Recurring Revenue): .86B (+31% YoY) KEY METRICS: - Net New ARR: 18M (vs 95M guidance) - Dollar-Based Net Retention: 119% - Gross Retention Rate: 98.1% - Free Cash Flow: 85.6M (+42% YoY) - Customers: 29,104 (+27% YoY)

CrowdStrike Holdings Inc. – Cybersecurity Dominance

CrowdStrike Holdings Inc. (Investor Relations | NASDAQ: CRWD) continues to demonstrate why it’s considered the gold standard in endpoint security and threat intelligence.

Earnings Call Key Takeaways:

- CEO George Kurtz emphasized the company’s AI-powered Falcon platform advantage

- Strong enterprise adoption with 89% of new customers choosing 4+ modules

- International expansion driving 45% of new business growth

- Zero-trust architecture demand accelerating across all verticals

📈 Financial Performance Deep Dive

StockBurger Earnings Analysis

CrowdStrike’s Q2 results demonstrate the power of its land-and-expand strategy. The company not only acquired 1,847 new customers but also successfully upsold existing clients to additional modules, driving impressive dollar-based net retention of 119%.

Subscription Revenue Momentum

The cybersecurity leader’s subscription-based model continues to deliver predictable, high-margin revenue growth:

- Subscription Revenue: 98.4 million, representing 94.4% of total revenue

- Professional Services: 6.9 million, supporting customer implementation

- Gross Margin: 78.2%, demonstrating operational efficiency

- Operating Margin: 24.1%, showing path to profitability

Customer Acquisition & Expansion

CrowdStrike’s ability to both acquire new customers and expand within existing accounts drives sustainable growth:

- Total Customers: 29,104 (+27% year-over-year)

- M+ ARR Customers: 2,738 (+42% year-over-year)

- Module Adoption: 89% of new customers purchase 4+ modules

- Platform Stickiness: 98.1% gross retention rate

🛡️ Competitive Positioning

CYBERSECURITY MARKET LEADERSHIP =============================== Market Share: #1 in Endpoint Security Platform Modules: 28 integrated solutions Threat Detection: 2.1 trillion events/week Response Time: Sub-second threat response AI/ML Models: 500+ proprietary algorithms COMPETITIVE ADVANTAGES: - Single-agent architecture - Cloud-native platform - Real-time threat intelligence - Zero-trust security framework - Comprehensive module ecosystem

🎯 Management Guidance & Outlook

CrowdStrike management provided strong forward guidance, reflecting confidence in the cybersecurity market opportunity:

Q3 2026 Guidance

- Revenue: 75-85 million (vs 65M consensus)

- Non-GAAP EPS: bash.86-bash.88 (vs bash.84 consensus)

- Net New ARR: 00-10 million

Full Year 2026 Guidance (Raised)

- Revenue: .89-.95 billion (raised from .85-.90B)

- Non-GAAP EPS: .74-.80 (raised from .65-.75)

- Free Cash Flow Margin: 32-33% (industry-leading)

⚡ STOCKBURGER INVESTMENT RATING

💡 StockBurger Pro Rating: STRONG BUY

Price Target: 50 | Current Price: 85 | Upside: 22.8%

Investment Thesis: Dominant cybersecurity platform with sustainable competitive advantages

Risk Level: Moderate – Execution risk in competitive market

🔍 Earnings Call Key Quotes

CEO George Kurtz on AI Integration:

“Our AI-powered Falcon platform processed over 2.1 trillion security events this quarter, demonstrating the scale and sophistication of our threat detection capabilities. We’re not just using AI as a buzzword – it’s fundamental to our competitive advantage.”

CFO Burt Podbere on Financial Performance:

“Our 119% dollar-based net retention rate reflects the stickiness of our platform and the value customers derive from our expanding module ecosystem. This metric has remained consistently above 115% for 16 consecutive quarters.”

📊 Technical Analysis Post-Earnings

CRWD TECHNICAL OUTLOOK POST-EARNINGS ==================================== Pre-Earnings: 62.45 After-Hours: 09.75 (+18.0%) Resistance Levels: 20, 40, 65 Support Levels: 85, 60, 40 MOMENTUM INDICATORS: - RSI: 68 (bullish but approaching overbought) - Volume: 3.2M shares (5x average) - Options Flow: Heavy call buying - Analyst Upgrades: 3 price target increases BREAKOUT PATTERN: - Cup and handle formation complete - Volume confirmation on earnings beat - Next target: 40-50 range

🌐 Cybersecurity Market Trends

CrowdStrike’s strong performance reflects broader cybersecurity market dynamics:

Market Drivers

- Threat Landscape: Cyber attacks increasing 35% year-over-year

- Remote Work: Distributed workforce expanding attack surface

- Cloud Migration: Traditional perimeter security becoming obsolete

- Regulatory Compliance: Stricter data protection requirements

Industry Consolidation

- Platform Approach: Customers preferring integrated solutions

- Point Solution Fatigue: IT teams seeking vendor consolidation

- AI Integration: Machine learning becoming table stakes

- Zero Trust: Architecture shift driving platform adoption

📈 Stock Tickers & Performance

FEATURED CYBERSECURITY STOCK TICKERS: CRWD - CrowdStrike Holdings Inc. ZS - Zscaler, Inc. OKTA - Okta, Inc. PANW - Palo Alto Networks, Inc. FTNT - Fortinet, Inc. S - SentinelOne, Inc. CYBR - CyberArk Software Ltd. TENB - Tenable Holdings, Inc. QLYS - Qualys, Inc. VRNS - Varonis Systems, Inc.

🎯 Investment Strategy

💡 StockBurger Pro Strategy

Long-term Hold: CrowdStrike’s platform approach and market leadership position it for sustained growth

Entry Points: Any pullback below 80 presents buying opportunity

Risk Management: Stop loss at 40 to protect against broader market volatility

Sector Play: Consider cybersecurity ETF (HACK) for diversified exposure

CrowdStrike’s exceptional Q2 2026 earnings results reinforce its position as the premier cybersecurity investment. With accelerating growth, expanding margins, and a massive addressable market, CRWD remains a core holding for technology-focused portfolios.

Disclaimer: This analysis is for informational purposes only and not financial advice. Cybersecurity stocks can be volatile and subject to market and regulatory risks. Always conduct your own research and consider your risk tolerance before investing.