CrowdStrike Holdings Inc. announced that U.S. officials have requested information regarding the accounting of certain customer deals, and the cybersecurity firm is cooperating fully with the inquiry.

The Austin-based company disclosed in a filing Wednesday that both the U.S. Department of Justice and the Securities and Exchange Commission have sought details about how CrowdStrike recognizes revenue and reports annual recurring revenue (ARR) from transactions with specific customers. ARR is a key metric reflecting subscription-based earnings.

Federal investigators have also requested information related to a CrowdStrike software update last year that caused widespread Windows system crashes globally.

“The company is cooperating and providing information in response to these requests,” the filing states.

Prosecutors and regulators have been probing a $32 million contract between CrowdStrike and technology distributor Carahsoft Technology Corp. to supply cybersecurity tools to the Internal Revenue Service, Bloomberg first reported in February. The IRS reportedly never received or purchased the products.

The investigation is focusing on what senior CrowdStrike executives knew about the deal, as well as reviewing other transactions by the company, according to Bloomberg reports from May.

When asked about the filing, CrowdStrike spokesperson Brian Merrill said, “As we have told Bloomberg repeatedly, this is old news and we stand by the accounting of the transaction.”

Carahsoft’s legal representative previously declined to comment on the investigation, and the company has not responded to recent requests for comment.

CrowdStrike shares dropped about 5% in after-hours trading on Tuesday following the company’s revenue forecast that fell short of expectations.

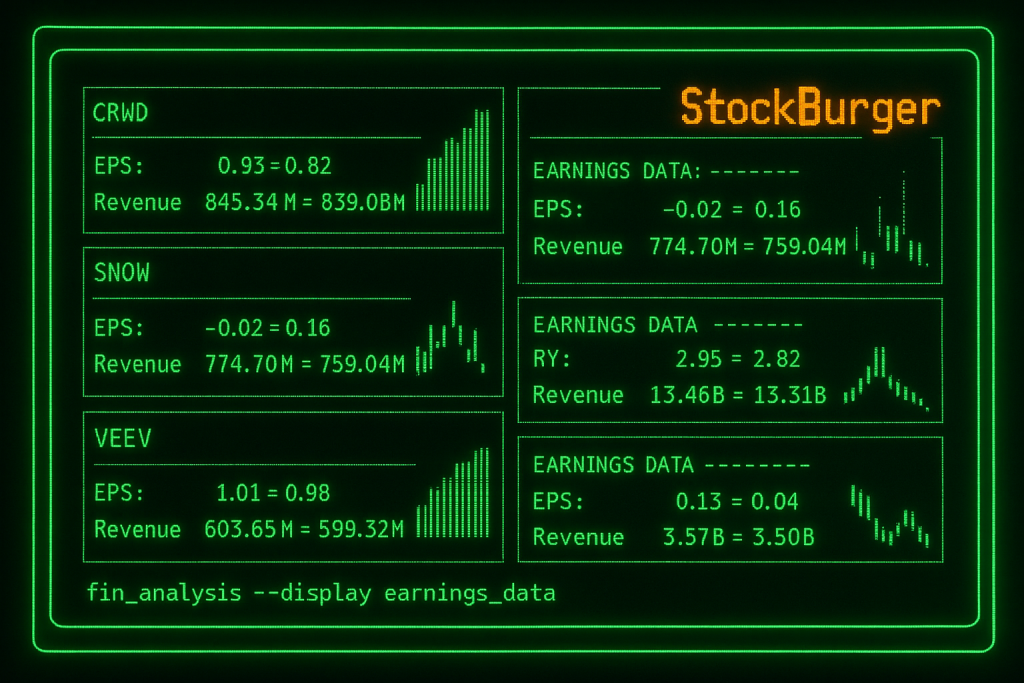

Here’s how CrowdStrike’s results compared to LSEG consensus estimates:

-

Adjusted earnings per share: 73 cents vs. 65 cents expected

-

Revenue: $1.10 billion, in line with expectations

Revenue grew nearly 20% in the fiscal first quarter ending April 30, the company said. However, it reported a net loss of $110.2 million, or 44 cents per share, compared to a net income of $42.8 million, or 17 cents per share, in the same quarter last year.

Rising costs in sales and marketing, research and development, and administration weighed on results, partly due to a major software outage last summer.

For the current quarter, CrowdStrike forecast adjusted earnings per share between 82 and 84 cents, with revenue of $1.14 billion to $1.15 billion. Analysts surveyed by LSEG expected 81 cents per share and $1.16 billion in revenue.

The company raised its full-year earnings outlook but kept its revenue guidance steady, projecting adjusted EPS of $3.44 to $3.56 and revenue of $4.74 billion to $4.81 billion. This compares with LSEG consensus estimates of $3.43 per share and $4.77 billion in revenue. In March, CrowdStrike had forecast adjusted earnings between $3.33 and $3.45 per share.

On Tuesday, CrowdStrike also announced a $1 billion share buyback program.

“Today’s announced share repurchase reflects our confidence in CrowdStrike’s future and unwavering mission of stopping breaches,” CEO George Kurtz said.

In May, the company revealed plans to cut 500 jobs—about 5% of its workforce. CrowdStrike’s CFO, Burt Podbere, said on a conference call that the company now expects a free cash flow margin above 30% for fiscal year 2027.

As of Tuesday’s close, CrowdStrike’s stock had gained 43% year-to-date, outperforming the S&P 500, which rose less than 2%.