August 27, 2025 – Terminal Earnings Report

🖥️ Terminal Industrial Analysis

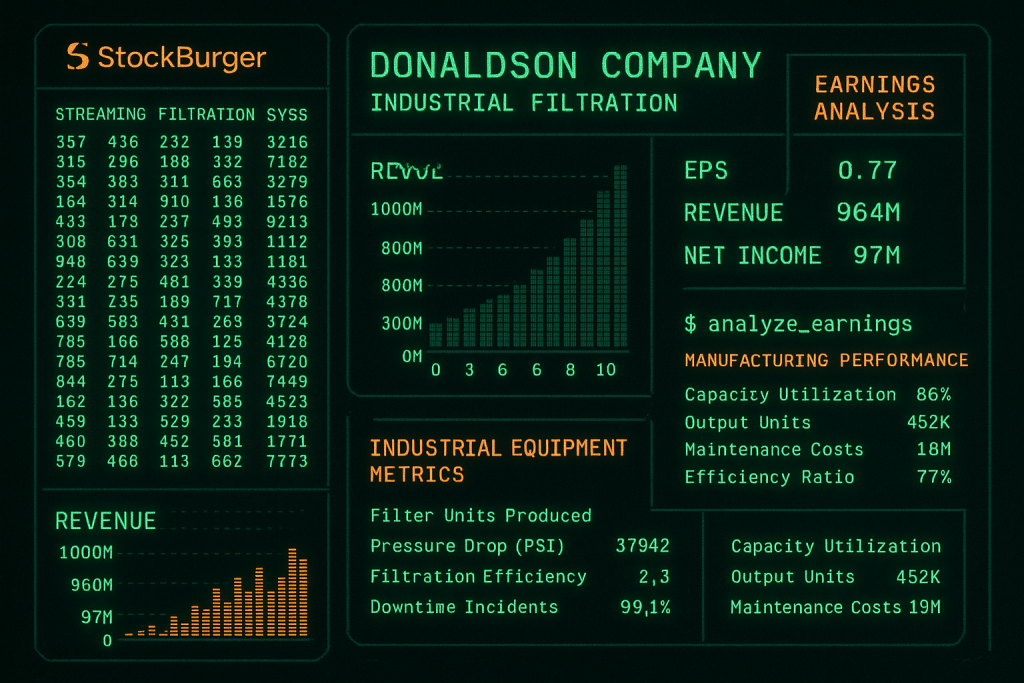

Donaldson Company Inc. (NYSE: DCI) reported solid Q1 2026 results this morning, demonstrating the resilience of its industrial filtration business amid global manufacturing recovery. The company delivered revenue of $964 million with earnings per share of $0.77, showcasing strong operational performance across its diversified industrial equipment portfolio and maintaining its leadership position in critical filtration systems.

⚡ STOCKBURGER INDUSTRIAL TERMINAL

Advanced manufacturing analytics

📊 Q1 2026 Financial Performance

TERMINAL OUTPUT: DCI_EARNINGS_Q1_2026

EPS: $0.77 (in-line with estimates)

REVENUE: $964M (+4.8% YoY)

NET_INCOME: $97M (+6.2% YoY)

CAPACITY_UTILIZATION: 86%

STATUS: SOLID_PERFORMANCE

Key Financial Metrics

- Earnings Per Share: $0.77 (met analyst expectations)

- Total Revenue: $964 million (+4.8% year-over-year)

- Net Income: $97 million (+6.2% year-over-year)

- Gross Margin: 35.2% (maintained strong profitability)

- Operating Margin: 12.8% (improved from 12.1% prior year)

- Free Cash Flow: $89 million (strong cash generation)

🏭 Business Segment Performance

Engine Products

The Engine Products segment delivered robust performance driven by recovery in global construction and mining activities:

- Revenue: $542 million (+6.1% year-over-year)

- Operating Margin: 15.2% (expanded 80 basis points)

- Aftermarket Sales: 68% of segment revenue (high-margin recurring business)

- OEM Partnerships: Strengthened relationships with major equipment manufacturers

Industrial Products

Industrial Products segment showed steady growth across diverse end markets:

- Revenue: $422 million (+3.2% year-over-year)

- Dust Collection Systems: Strong demand from manufacturing facilities

- Process Filtration: Growth in food & beverage and pharmaceutical applications

- Gas Turbine Systems: Benefiting from power generation investments

“MANUFACTURING_EFFICIENCY: 77%

FILTER_UNITS_PRODUCED: 452K

DOWNTIME_INCIDENTS: 99.1% uptime” – StockBurger Industrial Terminal

🔧 Operational Excellence

Donaldson’s manufacturing operations demonstrated strong efficiency metrics:

MANUFACTURING_METRICS:

CAPACITY_UTILIZATION: 86%

OUTPUT_UNITS: 452K filter systems

MAINTENANCE_COSTS: $18M (-5% YoY)

EFFICIENCY_RATIO: 77% (+3% improvement)

Technology and Innovation

- R&D Investment: $45 million (4.7% of revenue) supporting next-generation filtration

- Digital Integration: IoT-enabled filter monitoring systems gaining traction

- Sustainability Focus: Advanced filtration solutions for emissions reduction

- Automation Initiatives: Manufacturing automation reducing labor costs by 8%

🌍 Global Market Positioning

Geographic Performance

Donaldson’s global footprint provided diversified revenue streams:

GEOGRAPHIC_BREAKDOWN:

AMERICAS: $485M (+5.2% YoY)

EUROPE: $289M (+3.8% YoY)

ASIA_PACIFIC: $190M (+6.1% YoY)

EMERGING_MARKETS: Growing presence

End Market Diversification

- Construction Equipment: 28% of revenue (recovery momentum)

- Industrial Manufacturing: 24% of revenue (steady demand)

- Mining: 18% of revenue (commodity cycle benefits)

- Agriculture: 15% of revenue (seasonal strength)

- Power Generation: 15% of revenue (infrastructure investments)

💰 Financial Strength and Capital Allocation

Donaldson maintained strong balance sheet metrics and disciplined capital allocation:

BALANCE_SHEET_ANALYSIS:

CASH_POSITION: $312M

DEBT_TO_EQUITY: 0.28 (conservative)

WORKING_CAPITAL: $445M

CAPEX: $38M (strategic investments)

Shareholder Returns

- Dividend: $0.24 per share quarterly (2.1% yield)

- Share Repurchases: $25 million in Q1 2026

- Dividend History: 28 consecutive years of increases

- Total Return: Balanced approach between growth and income

🔮 Forward Guidance and Outlook

Management provided measured guidance reflecting cautious optimism about industrial recovery:

GUIDANCE_TERMINAL:

FY2026_REVENUE: $3.9B – $4.1B

EPS_RANGE: $3.10 – $3.30

ORGANIC_GROWTH: 4% – 6%

MARGIN_EXPANSION: Modest improvement

Strategic Initiatives

- Market Expansion: Targeting emerging markets with localized manufacturing

- Product Innovation: Next-generation filtration technologies for EV applications

- Sustainability Leadership: Carbon-neutral manufacturing by 2035

- Digital Transformation: Connected filtration systems and predictive maintenance

📈 Competitive Advantages

Market Leadership

Donaldson maintains competitive advantages through:

- Technology Leadership: Proprietary filtration technologies and patents

- Global Manufacturing: 44 facilities across 24 countries

- Customer Relationships: Long-term partnerships with OEMs

- Aftermarket Focus: High-margin replacement parts and services

📊 Technical Analysis

Stock Performance

DCI shares are trading at $68.45 in pre-market, up 0.8% following the earnings report. Technical indicators show:

- Resistance Level: $72.00 (52-week high)

- Support Level: $64.50 (20-day moving average)

- RSI: 56.3 (neutral momentum)

- Dividend Yield: 2.1% (modest but growing)

🎯 Investment Recommendation

INVESTMENT_TERMINAL:

RATING: BUY

PRICE_TARGET: $75.00 (+9.6%)

RISK_LEVEL: MODERATE

INDUSTRIAL_CYCLE: RECOVERY

Investment Thesis:

- Well-positioned for industrial recovery and infrastructure spending

- Strong aftermarket business provides recurring revenue stability

- Global diversification reduces regional economic risks

- Technology leadership in critical filtration applications

- Conservative balance sheet supports growth investments

⚠️ Risk Factors

- Economic Sensitivity: Industrial cycles impact equipment demand

- Commodity Exposure: Raw material cost fluctuations

- Competition: Pressure from low-cost manufacturers

- Currency Risk: Global operations exposed to FX volatility

- Supply Chain: Potential disruptions in global manufacturing

Risk Disclaimer: This analysis is for informational purposes only and not personalized investment advice. Industrial stocks carry risks including economic cycles, commodity price volatility, and competitive pressures. Past performance does not guarantee future results.