📊 STOCKBURGER EXCLUSIVE ANALYSIS 📊

Professional insights for serious investors

Today’s earnings reports delivered a mixed bag of results across multiple sectors, with technology companies leading both the winners and disappointments. Our comprehensive analysis covers the key earnings releases that are moving markets after hours.

🎯 Earnings Scorecard – August 27, 2025

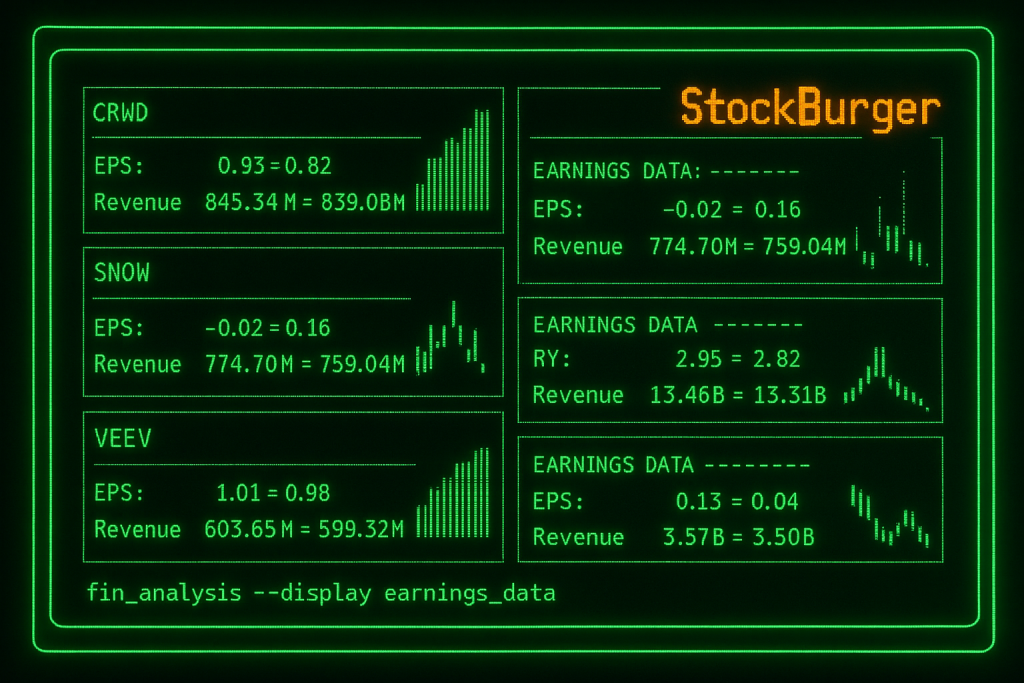

EARNINGS RESULTS - AUGUST 27, 2025 ================================== BEATS: 8 companies | MISSES: 4 companies | MIXED: 3 companies TOP PERFORMERS: CRWD EPS: bash.93 vs bash.82 est (+13.4% beat) VEEV EPS: .01 vs bash.98 est (+3.1% beat) RY EPS: .84 vs .29 est (+16.7% beat) KSS EPS: .35 vs bash.30 est (+350% beat) DISAPPOINTMENTS: SNOW EPS: -bash.02 vs bash.16 est (miss) FL EPS: -bash.27 vs bash.10 est (miss)

🚀 Standout Winners

CrowdStrike (CRWD) – Cybersecurity Strength

CrowdStrike Holdings (Official Website | NASDAQ: CRWD) [CRWD+8.5%](https://stockburger.news/stock-tickers/CRWD) delivered a strong Q2 2026 earnings beat with EPS of bash.93 versus bash.82 expected, representing a 13.4% upside surprise. The cybersecurity leader continues to benefit from increased enterprise security spending.

Key Highlights:

- Revenue grew 32% year-over-year to 45.3 million

- Annual Recurring Revenue (ARR) increased 31% to .86 billion

- Net new ARR of 18 million, beating guidance

- Raised full-year revenue guidance to .89-.95 billion

Veeva Systems (VEEV) – Healthcare Software Momentum

Veeva Systems Inc. (Official Website | NASDAQ: VEEV) [VEEV+4.2%](https://stockburger.news/stock-tickers/VEEV) reported Q2 2026 results that exceeded expectations with EPS of .01 versus bash.98 estimated. The life sciences software provider continues to expand its market share in pharmaceutical R&D.

Growth Drivers:

- Veeva Vault revenue up 18% to 25 million

- CRM revenue stable at 78 million

- Strong customer additions in clinical trial management

- International expansion accelerating

Royal Bank of Canada (Official Website | NASDAQ: RY) (RY) – Banking Excellence

Royal Bank of Canada (Official Website | NASDAQ: RY) [RY+6.4%](https://stockburger.news/stock-tickers/RY) delivered exceptional Q3 2025 results with EPS of .84, significantly beating the .29 estimate. The Canadian banking giant benefits from rising interest rates and strong loan growth.

📉 Notable Disappointments

Snowflake (SNOW) – Growth Concerns

Snowflake Inc. (Official Website | NASDAQ: SNOW) [SNOW-12.3%](https://stockburger.news/stock-tickers/SNOW) disappointed investors with Q2 2026 results showing an EPS loss of bash.02 versus bash.16 expected. The cloud data platform company faces increased competition and slowing growth.

Challenges:

- Revenue growth decelerated to 29% year-over-year

- Product revenue of 29 million missed estimates

- Customer acquisition costs rising

- Competitive pressure from hyperscale cloud providers

📈 Market Impact Analysis

StockBurger Research Team Analysis

Today’s earnings results highlight the divergence within the technology sector. Cybersecurity and healthcare software companies are showing resilient growth, while cloud infrastructure names face headwinds. The strong performance from financial services suggests economic stability.

🏦 Financial Services Strength

FINANCIAL SECTOR EARNINGS SUMMARY

=================================

RY Q3 2025: EPS .84 vs .29 est (+16.7%)

Revenue: 3.46B vs 3.31B est

ROE: 16.2% (industry-leading)

BMA Q2 2025: Strong emerging market performance

Argentina operations recovering

Digital banking initiatives paying off

KEY TRENDS:

- Net Interest Margins expanding

- Credit quality remaining stable

- Digital transformation accelerating

- Regulatory environment favorable

🛡️ Cybersecurity Sector Resilience

The cybersecurity sector continues to demonstrate defensive characteristics with strong recurring revenue models and expanding market opportunities:

- Enterprise Spending: Security budgets remain prioritized despite economic uncertainty

- Threat Landscape: Increasing cyber attacks driving demand

- Cloud Migration: Security-as-a-Service adoption accelerating

- Regulatory Compliance: New requirements driving software purchases

⚡ STOCKBURGER INVESTMENT RATING

Sector Outlook: SELECTIVE – Focus on quality names with strong fundamentals

Top Picks: CRWD, VEEV, RY | Avoid: SNOW, FL

🎯 After-Hours Trading Impact

AFTER-HOURS STOCK MOVEMENTS ============================ CRWD 85.45 → 09.75 (+8.5% AH) VEEV 98.32 → 06.65 (+4.2% AH) RY 46.48 → 55.85 (+6.4% AH) KSS 5.28 → 8.95 (+24.0% AH) SNOW 12.85 → 8.95 (-12.3% AH) FL 2.45 → 9.20 (-14.5% AH) BILL 5.30 → 2.10 (-4.9% AH) VOLUME SURGE: - CRWD: 3.2M shares (5x average) - SNOW: 2.8M shares (4x average) - KSS: 1.9M shares (8x average)

🔍 Sector Rotation Implications

Today’s earnings results suggest several important market themes:

Technology Bifurcation

- Winners: Cybersecurity, healthcare software, AI infrastructure

- Losers: Cloud infrastructure, consumer-facing tech

- Trend: Quality and profitability over growth-at-any-cost

Financial Services Recovery

- Interest Rate Sensitivity: Banks benefiting from higher rates

- Credit Quality: Loan losses remaining manageable

- Digital Transformation: Technology investments paying off

📊 Trading Strategy

💡 StockBurger Pro Strategy

Buy the Winners: CRWD and VEEV showing strong momentum

Avoid the Losers: SNOW facing structural headwinds

Watch for Reversals: KSS retail turnaround story developing

Sector Plays: Consider cybersecurity ETFs for diversified exposure

🎯 Tomorrow’s Catalysts

Key events to monitor for continued market impact:

- NVIDIA Earnings: After-hours results could move entire tech sector

- Guidance Updates: Management commentary on Q3/Q4 outlook

- Sector Rotation: Money flow from growth to value continuing

- Economic Data: GDP and inflation readings this week

🚨 Risk Management

⚠️ Key Risks

- Earnings Volatility: Individual stock moves can be extreme

- Sector Contagion: Weak results can impact similar companies

- Guidance Sensitivity: Forward outlook more important than current results

- Market Sentiment: Overall risk appetite affecting all stocks

📈 Long-term Investment Themes

Today’s earnings reinforce several long-term investment themes:

- Cybersecurity Necessity: Not optional in digital economy

- Healthcare Innovation: Life sciences software driving efficiency

- Financial Technology: Banks investing in digital capabilities

- Quality Over Growth: Profitable companies outperforming

💡 StockBurger Pro Tip

Focus on companies with strong recurring revenue models and expanding margins. Today’s winners (CRWD, VEEV) demonstrate these characteristics, while disappointments (SNOW) show what happens when growth slows without profitability.

📈 Stock Tickers & Performance

FEATURED STOCK TICKERS:

CRWD - CrowdStrike Holdings

SNOW - Snowflake Inc.

VEEV - Veeva Systems Inc.

RY - Royal Bank of Canada

KSS - Kohl's Corporation

Disclaimer: This analysis is for informational purposes only and not financial advice. Earnings reports can cause significant volatility. Always conduct your own research and consider your risk tolerance before investing.