EchoStar is reportedly exploring a potential Chapter 11 bankruptcy filing as it seeks to protect its valuable wireless spectrum licenses from possible revocation by federal regulators, according to a Wall Street Journal report on Friday citing sources familiar with the matter.

The company declined to comment on the report.

Last month, the Federal Communications Commission (FCC) notified EchoStar that it was investigating the company’s compliance with federal requirements to deploy 5G services in the U.S. The inquiry questions the validity of EchoStar’s buildout extension and its mobile-satellite service obligations.

EchoStar is skipping hundreds of millions in interest payments even as it moves forward with plans to expand its Dish TV service—blaming “uncertainty” stemming from an ongoing investigation by the Federal Communications Commission (FCC).

The company recently missed a $183 million interest payment, according to The Wall Street Journal on Monday, following a previously reported $326 million payment missed last week, per Bloomberg. The missed payments have sparked speculation that EchoStar may be preparing to file for bankruptcy protection, SpaceNews reports.

Despite its financial troubles, EchoStar continues to invest in its television operations. Maxar Space Systems announced this week that it has been commissioned to build EchoStar XXVI, a new communications satellite designed to provide Dish TV service across all 50 U.S. states and Puerto Rico. The satellite is expected to be completed by 2028.

The FCC is currently investigating whether EchoStar is meeting its obligations to deploy 5G service—a requirement for retaining its valuable spectrum licenses. The probe has cast a cloud over the company’s strategy, particularly its efforts to grow Boost Mobile, which Dish merged back into EchoStar last year as part of a broader plan to compete with wireless giants like Verizon, AT&T, and T-Mobile. According to the Journal, the regulatory scrutiny has effectively “frozen” key decision-making related to Boost.

EchoStar is also in a spectrum battle with rival SpaceX. In an April FCC filing, Elon Musk’s company argued that EchoStar’s use of the contested 2 GHz band is “de minimis at best,” while EchoStar has accused SpaceX of attempting a “land grab,” the Journal reported last month.

Neither Dish Network nor EchoStar responded to The Verge’s request for comment.

In a recent regulatory filing, EchoStar stated that the FCC’s actions have significantly hindered its ability to make strategic decisions, particularly around investments in its Boost Mobile unit.

The company previously disclosed it missed approximately $500 million in interest payments, attributing the lapse to uncertainty surrounding the FCC’s ongoing review—raising concerns about a potential default.

EchoStar’s challenges have deepened following DirecTV’s decision last year to terminate its agreement to acquire EchoStar’s satellite TV business, which includes Dish TV, after a failed debt-exchange proposal.

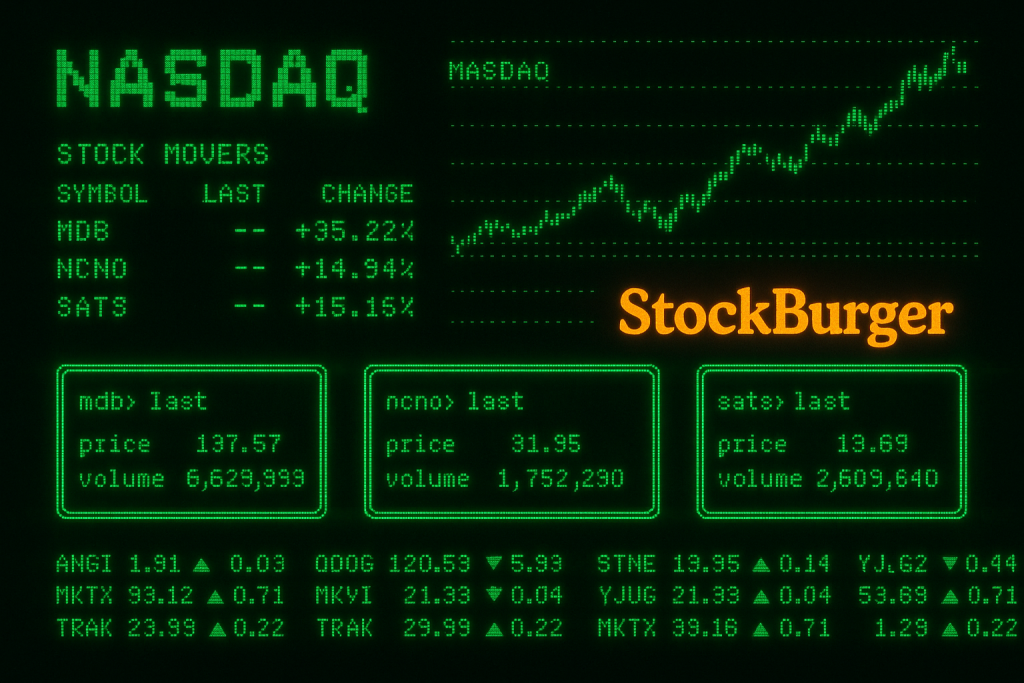

Shares of EchoStar Corp (SATS) fell 14.2% in post-market trading after news of the potential bankruptcy emerged. Despite recent volatility, Wall Street analysts maintain a cautiously optimistic outlook. The average one-year price target stands at $27.33, with projections ranging from a high of $42.00 to a low of $14.00—implying a potential upside of 56.37% from the current price of $17.48.