Tesla (TSLA) CEO Elon Musk is doubling down on the company’s long-stated vision that humanoid robots could play a central role in its future. In a post on his X social media account Monday, Musk suggested that roughly 80% of Tesla’s overall value could eventually come from its Optimus humanoid robots. He did not specify a timeline for when this transformation might occur, but the statement came shortly after Tesla released its latest “Master Plan,” which prominently features Optimus for the first time.

In “Master Plan Part IV,” Tesla described Optimus as “changing not only the perception of labor itself but its availability and capability,” highlighting the company’s ambitions to redefine manufacturing and automation. The robots have yet to be sold commercially, but Musk has indicated they could be available to other companies as early as next year, with consumer sales to follow. Each unit is expected to be priced between $20,000 and $30,000.

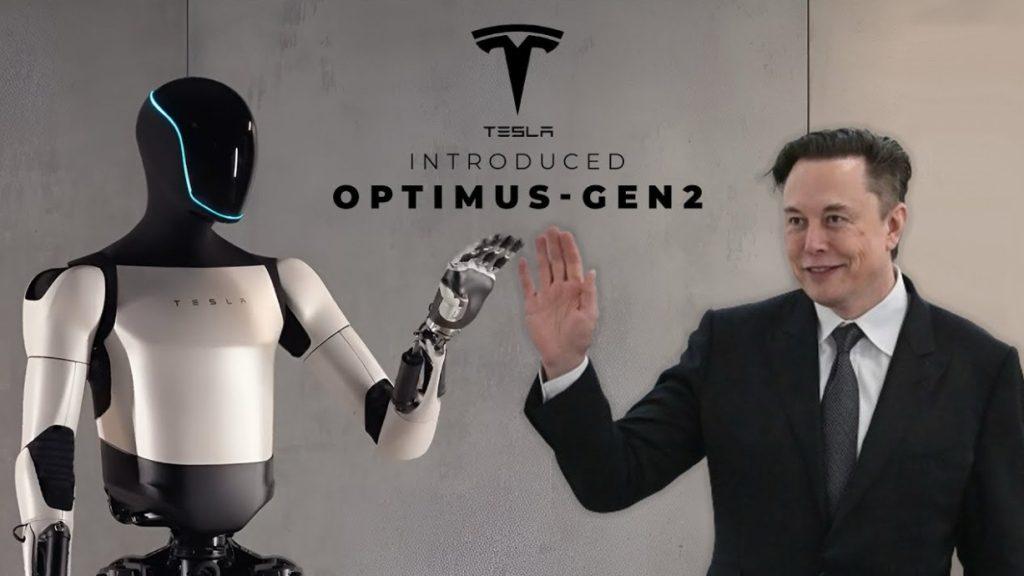

Currently, Optimus robots are performing basic factory tasks at Tesla facilities. Musk has said he expects “thousands” of the robots to be deployed in Tesla factories by the end of 2025. Looking further ahead, the company anticipates producing as many as 1 million robots annually by 2030. During Tesla’s second-quarter earnings call in July, Musk noted that prototypes of Optimus 3 could be completed by the end of 2025, with large-scale production set to begin next year.

Despite the ambitious robotics push, Tesla’s core electric vehicle business continues to face challenges. The company reported second-quarter revenue of $22.5 billion, down 12% year-over-year and below analyst expectations. Musk warned that Tesla could face “a few rough quarters” ahead, noting that the expiration of EV tax credits later this month—following the passage of President Trump’s “One Big Beautiful Bill” in July—may put additional pressure on vehicle demand.

Tesla shares fell about 2% in recent trading on Tuesday, weighed down by broader market declines and ongoing uncertainty around tariffs. The stock has now lost nearly 20% of its value year-to-date. Analysts note that while the EV business faces short-term headwinds, Musk’s long-term vision for Optimus could dramatically reshape Tesla’s revenue mix and investor expectations, positioning the company as a potential leader in robotics and automation.