The recently announced trade agreement between the European Union and the United States could impose a significant financial burden on the pharmaceutical industry, potentially adding $13 billion to $19 billion in costs as branded medications become subject to a new 15% tariff, analysts said Monday.

Historically exempt from such duties, pharmaceuticals represent the EU’s largest export category to the U.S. by value, with the bloc supplying roughly 60% of all pharmaceuticals imported into the country. Under the new deal, most branded drugs will face tariffs, though some generic medications are expected to remain duty-free.

European officials confirmed Sunday that pharmaceuticals were included in the 15% across-the-board tariff structure, sparking concern across the industry. The added expense could trickle down to consumers, especially if pharmaceutical companies are unable to offset the costs through other means.

“The added costs could raise prices for consumers unless pharmaceutical companies take action to mitigate the impact of the tariffs,” one analyst noted.

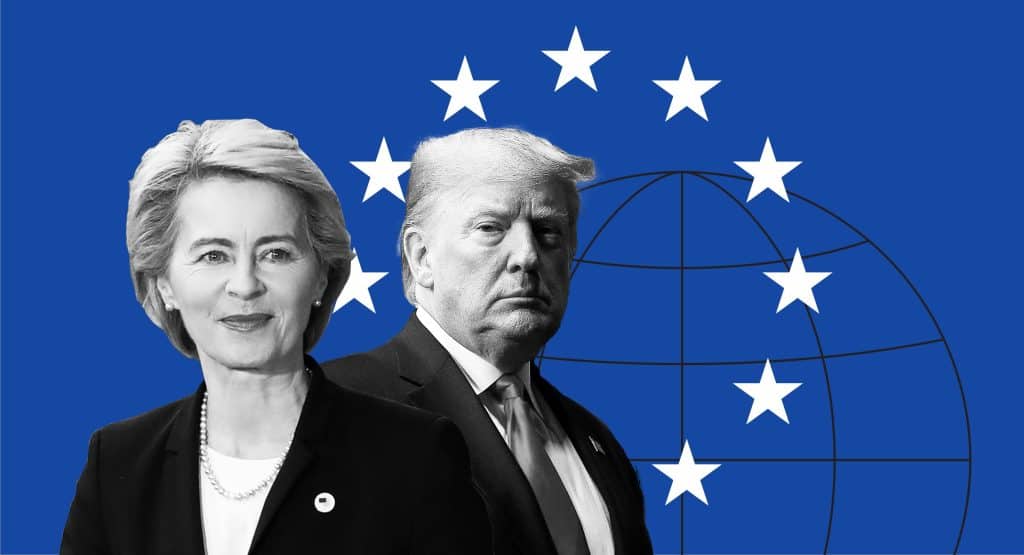

Complicating the outlook is a separate U.S. national security investigation into the pharmaceutical industry. President Donald Trump warned earlier this month that tariffs on pharma products could reach as high as 200%, heightening industry anxiety ahead of the EU trade pact.

Some analysts remain optimistic that additional tariffs tied to the investigation may not materialize. “UBS analyst Matthew Weston said that he expects details of the trade deal to include protective measures for EU pharma exports from the U.S. investigation, especially since such measures are being discussed in negotiations with the United Kingdom and Switzerland.”

Still, uncertainty remains. “ING analyst Diederik Stadig also said that while tariffs on top of the 15% were not expected, even after the conclusion of the national security investigations, nothing is completely clear ‘until a trade deal is inked.’”

Stadig estimates that the tariffs could add $13 billion to industry expenses without mitigation efforts. “Some of that could be ultimately borne by the consumer,” he added.

Bernstein analyst Courtney Breen puts the industry cost higher, estimating a $19 billion impact. However, she noted that some companies have already implemented strategies to reduce exposure. “Companies might be able to absorb some of the costs with the measures they have been implementing — such as stockpiling of drug products and new deals with contract researchers.”

Some pharmaceutical firms have taken proactive steps. Earlier this month, Sanofi announced the sale of a New Jersey manufacturing plant to Thermo Fisher, which will continue producing its therapies at the site. Roche CEO Thomas Schinecker stated last week that the company is boosting U.S. inventories to minimize potential disruption. Weston noted that while it remains unclear which generic drugs are exempt, the near-term impact on generic drugmaker Sandoz should be “mostly manageable.”

Shares of Sanofi, Roche, and Sandoz Group all finished higher on Monday, each rising between 0.5% and 1%.