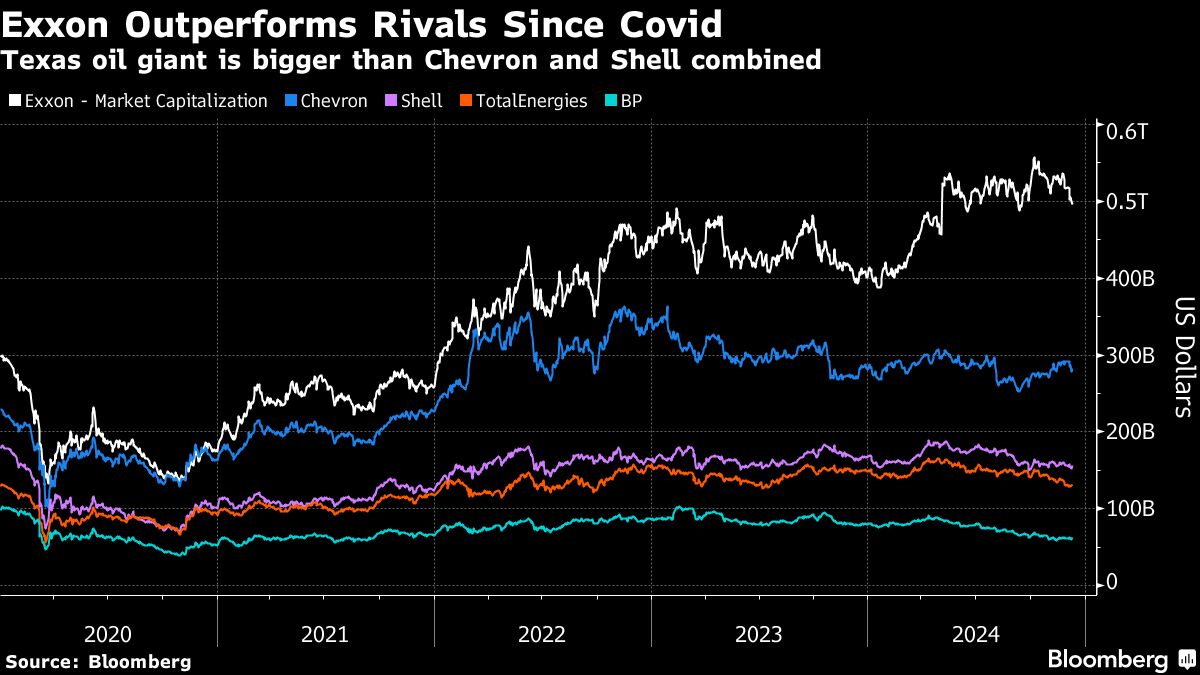

Exxon Raises Capital Spending as Worldwide Oil Glut Looms

(Bloomberg) -- Exxon Mobil Corp. will raise capital spending next year as its $60 billion purchase of Pioneer Natural Resources Co. increases its oil-production plans, threatening to worsen next year’s expected crude glut.

Most Read from Bloomberg

Exxon plans to spend between $27 billion and $29 billion of cash in 2025, North America’s largest energy explorer said in a statement Wednesday. Annual outlays will rise to about $30.5 billion in the following five years compared with roughly $24.5 billion before the Pioneer deal.

Exxon’s outlook is in direct contrast to other oil-industry players. OPEC cut its 2024 demand-growth forecast for a fifth straight month on Wednesday, less than a week after the cartel and allies extended plans to withhold crude from the market into next year as prices struggle amid a looming surplus. Meanwhile, Chevron Corp. last week announced the first cut to annual expenditures since 2021 as it prioritizes profits over production.

Exxon expects to pump the equivalent of 5.4 million barrels a day by 2030, the most in the company’s modern history. Cost savings from the Pioneer deal that closed in May were raised by 50% to more than $3 billion. The oil driller expects to save $7 billion in corporate overhead by 2030, amounting to about half of dividend payouts.

Exxon shares dropped as much as 0.6% to $111.92 in pre-market US trading.

Chief Executive Officer Darren Woods is investing in what he calls “advantaged” projects that can produce oil and natural gas for such low cost that they will be profitable well into the future even if major economies transition away from fossil fuels, denting prices. Nearly all future investments, including those in the US Permian Basin and Guyana, will deliver 10% returns at less than $35 a barrel, about half the current oil price, Exxon said.

Exxon announced two new developments in Guyana, almost tripling daily production capacity to 1.7 million barrels from current levels. Company-wide, low-carbon investments were raised to $30 billion through 2030, up from $20 billion through 2027.

“The portfolio of advantaged assets we’ve built is the envy of the industry,” Woods said in November.

Woods’ strategy may make sense for shareholders in the long term, but analysts fear Exxon’s increasing oil production may add to a global oversupply forecast for next year. That, in turn, would complicate efforts by the Organization of Petroleum Exporting Countries and its allies to contain the surfeit and buoy crude prices.

Breaking news

See all