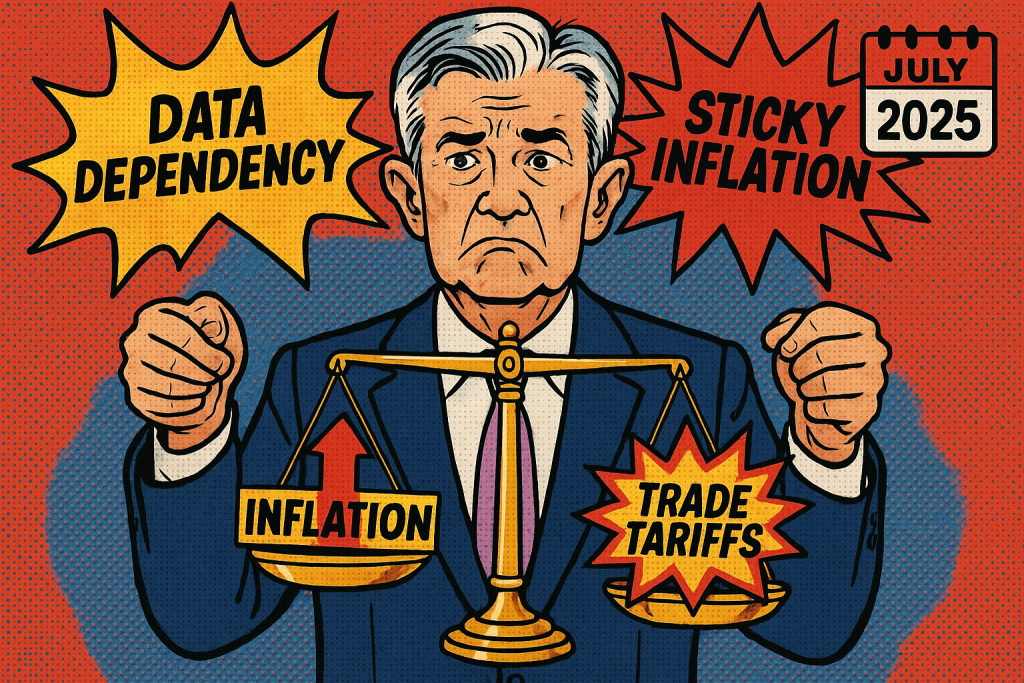

As the heat of July rolls in, so do the economic crosscurrents. At the center: a Federal Reserve in wait mode, sticky inflation that just won’t budge, and a political climate reintroducing trade tariffs into the inflation equation. It’s a macroeconomic cocktail that has Wall Street holding its breath – and retail traders wondering if the rate cut dream will get iced.

So here’s the big question: With tariffs back in the headlines and inflation still running hot, will the Fed stay on the sidelines?

Let’s unpack what’s really going on – and what it means for the markets this summer.

Powell at Sintra: Patience, Not Panic

Fed Chair Jerome Powell just wrapped up a speech at the European Central Bank forum in Sintra, Portugal. His tone? Ambiguous but steady. He didn’t promise rate cuts, didn’t rule them out either – and made it clear that tariffs are a wild card.

“We went on hold when we saw the size of the tariffs, and inflation forecasts moved materially,” Powell said.

Translation: the Fed was leaning dovish, but fiscal surprises – like a new round of trade tariffs – are keeping policymakers cautious. Powell reiterated the now-familiar refrain that decisions will be made “meeting by meeting” and are “data dependent.” No firm guidance, no big moves – just quiet monitoring.

So far, the Fed’s inaction has been interpreted as a sign of confidence. But in reality, it’s a tactical pause. Powell and his team are waiting for more clarity on how tariffs will ripple through the economy – and whether inflation will finally bend.

The Sticky Truth About Inflation

If Powell’s comments were the appetizer, the real entrée is the core PCE inflation data – the Fed’s favorite price measure.

And the numbers? Still sticky.

Core PCE has been hovering between 2.6% and 2.8%, above the Fed’s 2% target. Monthly readings in May came in at 0.3%, frustrating economists who expected more deceleration. Service inflation, in particular, is proving stubborn – driven by housing and wage growth.

The market shrugged off the latest PCE print, but the Fed didn’t. Rising costs of goods and services, compounded by tariff pressure, are keeping inflation elevated just enough to delay rate cuts.

In fact, economists now think September is the earliest possible window for a cut – and even that depends on how trade and employment data unfold this month.

Tariffs: The Unexpected Spoiler

At the core of this pause is a resurgent risk: trade tariffs.

The U.S. and China are once again circling the trade war drain, with a July 9 deadline looming for renewed negotiations. The Biden administration has signaled it may increase tariffs on semiconductors, EV components, and AI software – all in an effort to limit China’s dominance in high-tech sectors.

While this might score political points, the economic consequences are real. Tariffs tend to raise import prices, which then feed into consumer inflation. Powell’s own language suggests the Fed is bracing for a second wave of tariff-induced inflation this summer.

If that happens, the Fed’s hands may be tied. Even if growth slows, rate cuts may remain off the table simply because inflation won’t allow it.

Fed Governors: A House Divided

Adding to the uncertainty is the split within the Fed itself.

Some officials – notably from the Atlanta, Chicago, and Richmond branches – are ready to cut. They argue that inflation is easing on a trend basis and that further delays risk overtightening.

Others, like Mary Daly and Tom Barkin, remain cautious. Their concern? The Fed could cut too early, only to see inflation rebound under the weight of new tariffs and fiscal expansion.

This internal debate matters because the “dot plot” still shows two cuts this year – but they’ve been pushed to later in the calendar. Unless something breaks (like the labor market), the July meeting looks like a pause.

Investors: Caught in the Middle

What does this all mean for markets?

For now, it’s a waiting game. Equities have been climbing on hopes of lower rates, but those hopes are now tangled with trade risks and political noise. Treasury yields have stabilized, but any unexpected move from the Fed – or a spike in inflation data – could cause a swift repricing.

Here’s how traders are thinking about it:

- No cut in July is now the base case.

- September is the new focus – but conditional on wage growth slowing and tariffs not inflating costs too aggressively.

- Volatility could increase, especially if trade negotiations deteriorate.

This is not the time to chase high-beta stocks or load up on leveraged plays. The market is pricing in a Goldilocks scenario – soft landing, falling inflation, and a Fed ready to cut.

But that’s a fragile setup.

What to Watch This Week

Here’s your macro cheat sheet:

- July 9 – U.S.–China trade talks deadline. Any new tariffs could reshape the inflation path instantly.

- July 12–15 – Updated CPI and PPI data drop.

- Mid-July – Revised PCE estimates due. Any uptick here could kill September cut hopes.

- Fed commentary – More speeches expected next week, especially from Governor Waller and Daly.

Bottom Line

The Fed is on the sidelines – but not because it’s confident. It’s cautious. Sticky inflation, new tariffs, and a split Fed make it nearly impossible to forecast the next move with certainty.

If you’re an investor, the takeaway is simple: stay nimble.

This isn’t the time for hero trades or overexposure to rate-sensitive sectors. It’s a time to monitor, hedge, and prepare for a macro landscape that could shift quickly if just one domino falls.

Because if there’s one thing this Fed has taught us in 2025, it’s this: they’d rather be late than wrong.