Let’s talk about what just happened with HCW Biologics (NASDAQ: HCWB). If you checked your screener on May 13, 2025, and saw this small-cap biotech stock suddenly explode over 180%, you probably thought, “What did I miss?”

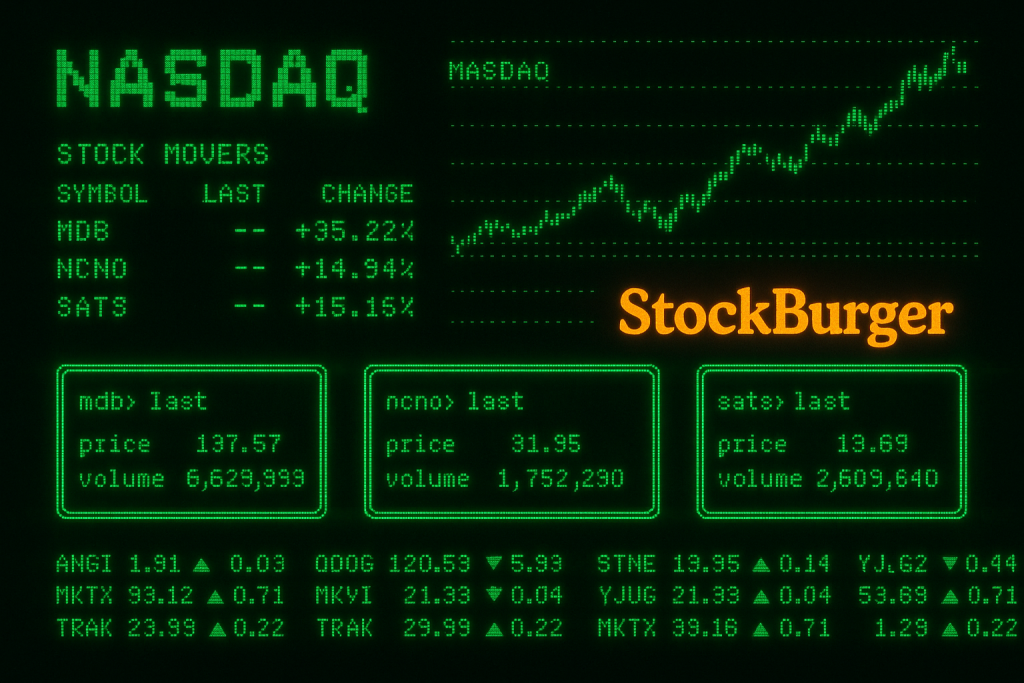

Spoiler: you didn’t miss anything – if you had Stockburger’s stock alert system, you saw it early.

This case study walks through what caused the move, how our Pump Radar system caught it before the breakout, and why this is a prime example of how one clinical-stage catalyst can ignite massive trading interest.

**Note: This image was generated using AI for illustrative purposes only. It does not depict an actual product, location, event, or individual.

The Setup

Let’s back up. HCW Biologics is a clinical-stage biopharma company. No FDA-approved drugs yet. No revenue. But what it does have is research in motion – focused on immunotherapy treatments targeting inflammation, aging, and cancer.

The company’s platform revolves around enhancing the immune system’s T-cell function using proprietary proteins. This includes work in CAR-T therapies – cutting-edge treatments that engineer a patient’s immune cells to fight off disease, especially tumors.

And normally, a stock like HCWB doesn’t move unless there’s a really big catalyst.

The Catalyst: HCW9206 Goes Public

That catalyst came on May 13. HCW Biologics presented new clinical data on its HCW9206 compound at the AAI 2025 conference in Honolulu – a major event in the immunology research space.

According to their findings, HCW9206 outperformed standard methods for producing CAR-T cells. The company claimed it could generate longer-lasting, high-functioning T-cells with superior cancer-fighting capability.

But that wasn’t all.

The company also announced that the reagent is now FDA-registered and open for licensing and research partnerships.

In biotech terms, that’s the perfect combination: scientific validation + commercial viability. And when it’s coming from a micro-cap name? It’s exactly the kind of event that can move a stock from under $6 to over $14 in a single session.

The Alert: How Stockburger Spotted It

Now, here’s where things get interesting.

Stockburger’s proprietary Pump Radar system flagged HCWB pre-market, as volume spiked over 4700% above its 10-day average and sentiment began surging across social channels.

Pump Radar works by scanning real-time data – price, volume, technical formations, and social media momentum – to detect unusual activity early, before the broader market reacts.

At 7:00 AM ET, our system picked up:

- Surging volume far above baseline

- Pre-market breakout structure (clean break over prior resistance)

- A flood of discussions on Reddit, Twitter, and StockTwits around the HCW9206 data and FDA mention

- A news headline referencing AAI 2025

The result? An automated Strong Buy stock alert was triggered for HCWB at $5.21, with a special tag for “Clinical Catalyst + FDA trigger.”

By the time regular trading began, HCWB was trading at $11.40. And by 10:02 AM ET? It was sitting at $14.95, up over 182% on the day.

Why This One Exploded

Let’s break down why this move mattered and why it unfolded the way it did:

1. A Clear Scientific Edge

This wasn’t hype – it was data. HCW9206 reportedly outperformed standard CAR-T cell creation methods. That’s a bold claim, and if it holds up in trials, it could redefine a part of the immunotherapy market.

2. FDA Registration

The compound isn’t just theoretical anymore. It’s FDA-registered. That matters. It means the company is ready to scale production, license the tech, or partner for trials.

3. Smart Timing

Releasing the news at a respected immunology conference gives the story credibility. It’s not just a press release – it’s peer-reviewed context.

4. Momentum + Buzz

HCWB quickly reached over 1,500 mentions in under 24 hours. Sentiment tools turned sharply bullish. Retail traders jumped in, and algorithms likely followed. It had the narrative, the data, and the volume.

The Risks (Because Every Biotech Play Has Them)

Let’s be real. HCW Biologics is still very much in the speculative phase. Here’s what traders need to remember:

- No revenue yet. Every dollar comes from funding, not sales.

- No approved drugs, which means the company’s value is entirely tied to research progress.

- High dilution risk, especially after a big move. Many small biotechs use rallies to raise cash.

- Extreme volatility. A 180% run can retrace just as fast.

This isn’t a “buy and forget” stock. It’s a “buy, monitor, and react” stock – one where every headline, filing, and trial update matters.

What to Watch Next

If you’re still tracking HCWB (and let’s be honest, a lot of people are now), here’s what to keep your eyes on:

- Volume sustainability: Can it hold 15M+ shares traded as the session continues?

- Continuation above $16.00: Psychological and technical resistance sits near $16.50–18.00.

- Pullback support: Zones near $13.00 and $11.00 will matter if momentum slows.

- Follow-up news: Watch for partnership announcements, licensing deals, or expanded trials.

- SEC filings: A sudden S-1 or offering statement could cool off the move.

Bottom Line

This was the kind of breakout that traders look for – but rarely catch in time. If you had Stockburger’s alert system on, though, you saw it hours before it hit the top gainers list.

HCWB delivered a real catalyst – clinical news, regulatory readiness, and open commercial intent. The Pump Radar alert wasn’t a prediction. It was an early signal that something real was building. And this time, it built into one of the biggest biotech moves of the quarter.

Whether you’re a biotech bull or just chasing clean setups, HCWB on May 13 proved one thing: momentum loves a good story, but real data turns it into a move.

And spotting it early? That’s the edge we build for.