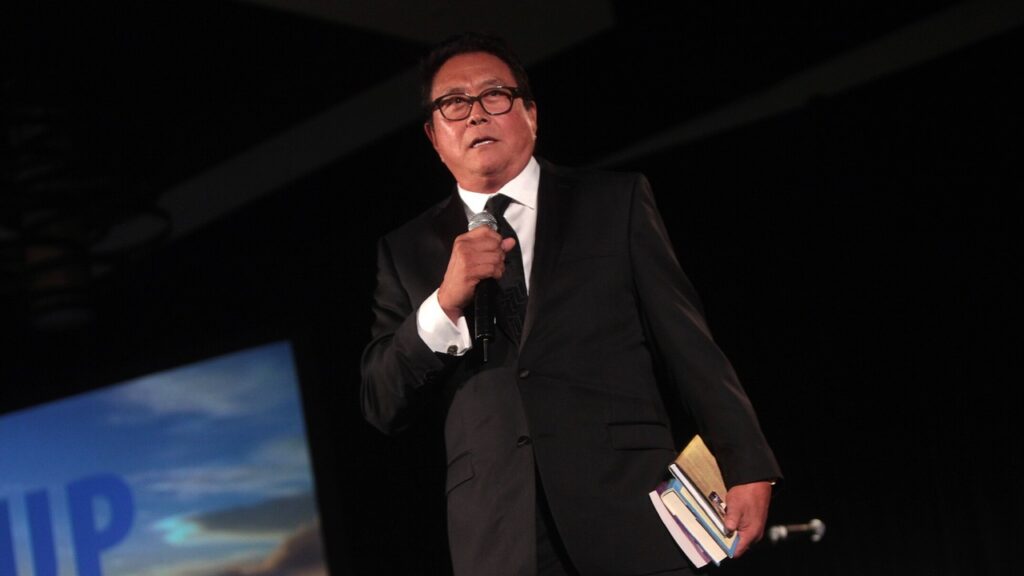

Everyone knows prices are skyrocketing, but when even a financial guru like Robert Kiyosaki balks at a $14 egg salad sandwich, you know something's up. Known for his often-dire warnings about the economy, Kiyosaki's latest post hits a little too close to home for many – especially Millennials, Gen X, and Gen Z, who are already feeling the pinch of inflation and stagnant wages.

Don't Miss:

In an October post on X, Kiyosaki shared he spent $14 on an egg salad sandwich in Waikiki. He said, "I can afford $14 yet the price still is hard to swallow." Now, imagine that price for someone trying to stretch a paycheck.

He tied this anecdote to something bigger – the Everything Bubble (a term he's used before) and how it's crushing younger generations. According to him, housing, living costs, and starting a family are getting further out of reach. "I feel for these generations," he said. "I empathize. I too, had the same personal doubts growing up in Hawaii."

See Also: Inspired by Uber and Airbnb – Deloitte's fastest-growing software company is transforming 7 billion smartphones into income-generating assets – with $1,000 you can invest at just $0.26/share!

So, how are young people surviving? According to the Census Bureau, the millennial homeownership rate will be just 45.5% in 2023. That's a dramatic contrast to older generations – by age 30, 55% of the Silent Generation owned homes, compared to just 33% of Millennials.

Inflation doesn't help either. While the current U.S. inflation rate is at 2.6% as of October 2024, it's still creating immense pressure on young people's finances. Rising housing, groceries, and health care costs mean more people live paycheck to paycheck. A recent Bankrate survey revealed that nearly two-thirds of Millennials (64%) and more than half Gen Zers (55%) have delayed major life milestones, like buying a home or starting a family, because of financial challenges.

That said, not all hope is lost. Gen Z is beginning to make small gains in homeownership, with about 27.8% of 24-year-old Gen Zers owning homes compared to 24.5% of Millennials at the same age. This glimmer of progress suggests that some young people are finding ways to navigate the tough economic climate.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

The X post wasn't just doom and gloom. Kiyosaki offered some advice for those struggling to get ahead. He emphasized the importance of financial education, encouraging people to seek out new teachers and mentors. "Find the teachers that talk to your body, mind, and spirit," he said, pointing to platforms like YouTube as a valuable resource for learning how to budget, invest, and build wealth.

And he didn't stop there. He stressed the importance of paying it forward: "Give back by teaching students who want to learn from you … the more you give, the more you receive." For Kiyosaki, sharing knowledge and experiences isn't just about helping others – it's about creating spiritual wealth, too.

So, while a $14 egg salad sandwich may seem like a small gripe, Kiyosaki's post raises much larger questions about the financial realities facing younger generations. The challenges are real, whether it's housing, inflation, or simply affording life's basics. But with education, resilience, and a willingness to adapt, Kiyosaki's message suggests that thriving – even in tough times – is still possible.

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.