Intel (INTC) shares jumped more than 4% Monday ahead of CEO Lip-Bu Tan’s reported White House meeting, following President Trump’s recent call for Tan’s resignation.

According to unnamed sources cited by the Wall Street Journal over the weekend, Tan is expected to meet with Trump on Monday to discuss his personal and professional background and propose ways for Intel and the government to collaborate.

Intel’s stock (NasdaqGS: INTC) was trading up 4.36% as of early Monday afternoon.

Intel has not immediately responded to Yahoo Finance’s inquiries about the planned meeting.

Last week, Trump publicly demanded Tan’s resignation in a Truth Social post, shortly after Fox Business highlighted Republican Senator Tom Cotton’s criticism of Tan’s ties to China. In a letter to Intel, Cotton expressed “concern about the security and integrity of Intel’s operations” due to Tan’s investments in Chinese companies via his venture capital firm, Walden International.

Trump’s post last Thursday read, “The CEO of INTEL is highly CONFLICTED and must resign, immediately.”

Tan pushed back against the criticism, stating reports about his career contained “misinformation.”

“There has been a lot of misinformation circulating about my past roles … I want to be absolutely clear: Over 40+ years in the industry, I’ve built relationships around the world and across our diverse ecosystem — and I have always operated within the highest legal and ethical standards,” Tan wrote in a memo to Intel employees.

Intel also released a statement following Trump’s comments, underscoring its commitment to “advancing US national and economic security interests” and making investments “aligned with the President’s America First agenda,” including domestic semiconductor manufacturing.

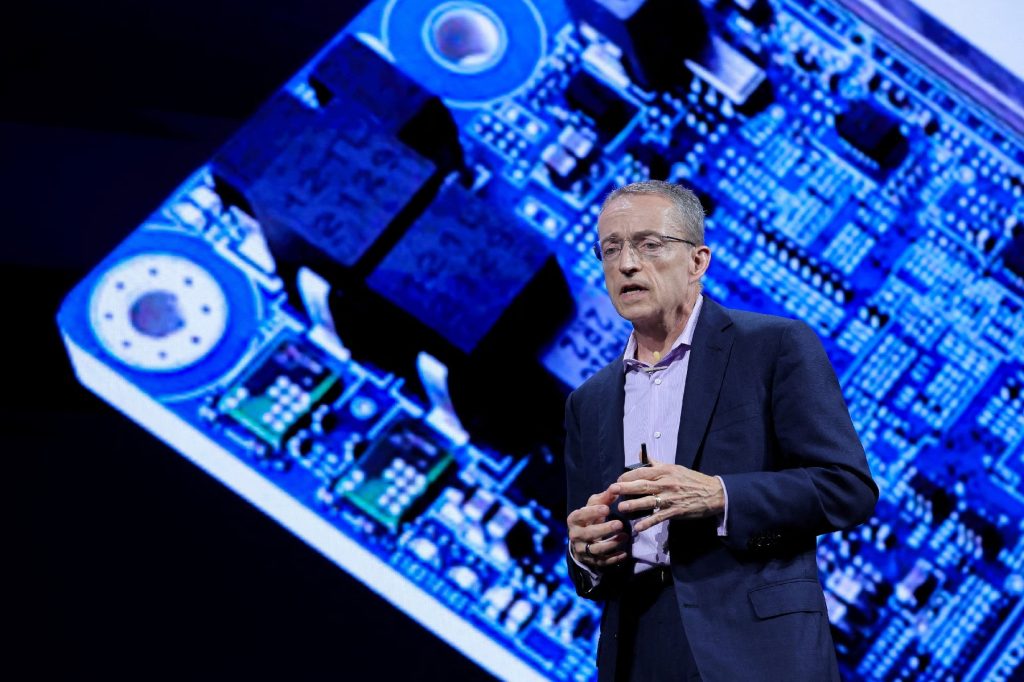

Tan took over as Intel’s CEO in March, succeeding Pat Gelsinger, who was ousted by the board last year. The company has been grappling with manufacturing losses, declining market share in its traditional computer chip segment, and the need to develop a competitive AI strategy.

Investors initially reacted positively to Tan’s appointment, with the stock rising as much as 15% following the announcement. Wall Street analysts, along with current and former executives and employees, viewed Tan as the best candidate to lead Intel’s turnaround.

Despite Monday’s gains, Intel shares are up nearly 4% year-to-date, trailing chipmakers like Nvidia (NVDA) and Advanced Micro Devices (AMD), which have gained roughly 36% and 47% in 2025, respectively. Intel’s modest recovery this year follows a steep 60% drop in 2024.