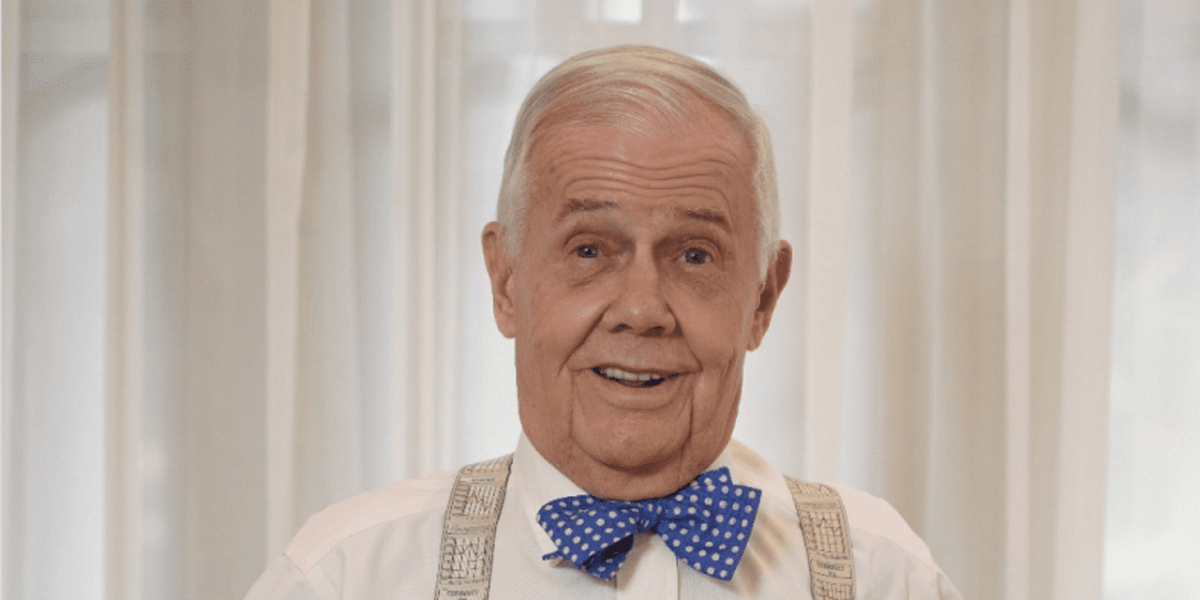

The U.S. economy is getting closer to suffering an “extremely bad” recession — one that’ll lead investors to seek out precious metals, Jim Rogers told MarketWatch during a Zoom interview this week. But the veteran investor said he’s more likely to buy silver than gold as a way to “hide” from the economic turmoil.

History would indicate we’re getting closer to a recession, “but I don’t know when,” said Rogers, chairman of Beeland Interests Inc., who co-founded the legendary Quantum Fund with billionaire George Soros in the 1970s. “I do know there’s going to be a recession again, and I do know it’s going to be extremely bad.”

He believes “America’s never gone this long without a recession in its history,” and it’s “overdue” for more economic problems .

If the economy does have serious problems, Rogers, who’s based in Singapore, believes gold and silver will do well, along with commodities in general.

When there are economic issues, that leads to money-printing and inflation, and people will want to have ”somewhere to hide in assets that will hold their value,” he said. “Commodities usually hold their value when there’s a lot of inflation and money-printing.”

Gold and silver, in particular, have “always been places for people to hide during economic turmoil,” Rogers said. “So I would suspect gold and silver would do well.”

“Gold is already doing well. Silver’s doing not bad,” he said.

Gold futures saw their most-active December contract GC00 GCZ24 settle Tuesday at a record high of $2,759.80 an ounce on Comex and notched an all-time intraday high of $2,772.60 on Wednesday.

Silver, meanwhile, settled at its highest price in 12 years on Tuesday, with its December contract SI00 SIZ24 at $35.04 an ounce. Silver’s record-high settlement was $48.70 on Jan. 17, 1980.

Read: Silver’s scarcity factor is helping it catch up to gold’s record run

“If we’re going to have serious economic problems and more money-printing and more inflation, then…silver and gold will be a place to hide again,” Rogers said. “If you were buying one today, you would probably buy silver because it’s down from its all-time high, and gold is near its all-time high.”

Read: Gold may not reach a price ceiling anytime soon. Here’s why.

Rogers, however, emphasized that he does own “plenty” of both metals.

Still, gold’s performance seems to be saying that there’s a possibility of more money-printing and all sorts of potential problems out there, he said. “Look out the window — you might see war out the window, you might see money-printing out the window. Gold is afraid of both of those things, always has been.”

Opinion: Stocks and gold are both at all-time highs. Only one of them can be right.

Also see: Gold’s record-breaking run comes as stocks hit fresh highs. Is it too late for investors?

Though he’s not buying physical gold or silver at the moment, Rogers said he “might buy some silver one day this week, if I get around to it — but not gold, not now,” unless prices move lower.

And when it comes to precious metals, Rogers said he prefers to “buy the real stuff” — physical bullion.

Buying commodity stocks is a “fabulous thing to do — if you have the time and the knowledge to do your research,” he said.

“You can make gigantic amounts of money if you buy the right stocks — gold and silver or anything — if you have the time to do your research,” said Rogers. You could “lose a gigantic amount of money very fast too, if you don’t know what you’re doing.”

Meanwhile, given the turmoil in the Middle East, worries about global supplies from the oil-rich region have grown, leading to another potential opportunity in the commodities sector.

“If there’s more war coming, you should own some oil,” said Rogers. He said he’s not actually buying oil right now but hopes that if oil prices fall, he’s “smart enough to buy more oil.”

U.S. benchmark West Texas Intermediate oil for December delivery CL.1 CLZ24 settled Wednesday at $70.77 a barrel on the New York Mercantile Exchange. It’s up 1.2% year to date.

“The market in oil is not finished,” Rogers said, contrary to some market expectations that demand will gradually diminish, in part, because of growth in electric-vehicle use and climate policies. “I assure you, the world needs oil.”

“The known supplies of oil continue to decline. Oil is a good place to be because we do have declining supply and perhaps increasing demand,” he said.

Concerns over the outlook for China’s economy have helped to weaken demand prospects for the commodities market, but Rogers isn’t too concerned.

China has a gigantic economy and it’s trying to make its economy stronger, he said. There are over a billion people in China and that’s “going to be more demand for many commodities, including oil.”

That nation has taken a number of steps to boost its economy recently, with the People’s Bank of China earlier this week lowering its benchmark lending rate.

On Tuesday, the International Monetary Fund’s Chief Economic Pierre-Olivier Gourinchas said China’s stimulus measures go in the right direction but are not sufficient to lift domestic growth in a substantially material way.

China is worried about its economy, said Rogers. “I’m not worried, but I’m watching. I know they want to make their economy stronger and they have the ability to do it, if they put their mind to it.”

Rogers said he owns Chinese shares but hasn’t bought any recently. “I would, certainly, if I came across something. I hope I’m smart enough to buy more shares in China” under the right circumstances.

In an interview with MarketWatch contributor Michael Sincere in July, Rogers warned that the U.S. stock market was showing all the signs of an aging bull, and that he anticipates a bear market.

Major U.S. stock indexes touched record highs earlier in October, but have been under pressure in the past week as bond yields rose and election jitters rattled markets.

This week, Rogers told MarketWatch that many markets are reaching all-time highs or are near all-time highs — and he doesn’t like buying things at all-time highs.

His basic investment strategy is “buy low and sell high.”

But most markets have been extremely strong, Rogers said. “This is like very few periods in history where everything has been strong. This has happened very rarely, which worries me. If everybody’s making money, I get worried.”

When asked this week how investors can safeguard their money against a worrisome backdrop of a persistent rise in the U.S. stock market, he replied: “I have cash. I have cash in U.S. dollars.”

He said he holds U.S. dollars, mainly, instead of another currency because “when there’s turmoil, people look for a safe haven, and many people think the U.S. dollar is a safe haven.”

However, “it’s not,” he said.

For historic reasons, people think it’s a safe haven so Rogers said he expects it to go up in value when the “next turmoil gets serious.” If that happens, he said he hopes he’s ”smart enough to sell it.”

Meahnwhile, he said he’s looking for another currency to “complete with the dollar.”

The U.S. is doing the same thing that Britain did roughly a century ago, he said. Britain was once the No. 1 country in the world and the pound sterling was the world’s currency, but Britain went bankrupt because it kept building up debt, he said.

“So I’m looking for something else to compete with the dollar” as the world’s reserve currency, Rogers said. “I don’t know what it is yet,” but it has to be something tradeable, he said, adding that the Chinese currency would be high on his list, but it’s not convertible and not freely tradeable.

When Rogers was asked what investment he’s most proud of in his decades-long career, his response was somewhat surprising, but also emphasized the importance of priorities.

“I would say that the best investment I’ve made so far in my life are these two girls,” he said. Rogers has two daughters, aged 16 and 21 — the first of which came along when he was 60 years old.

But, at least for now, his daughters have not indicated much interest in learning about investing.

“You should teach everybody, especially young people, about money and investing,” Rogers said. “Teach them that money is to be saved.”

Gregory Robb and Joy Wiltermuth contributed to this story.