Financial giants have made a conspicuous bullish move on JD.com. Our analysis of options history for JD.com JD revealed 13 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 23% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $239,770, and 8 were calls, valued at $534,150.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $45.0 for JD.com over the recent three months.

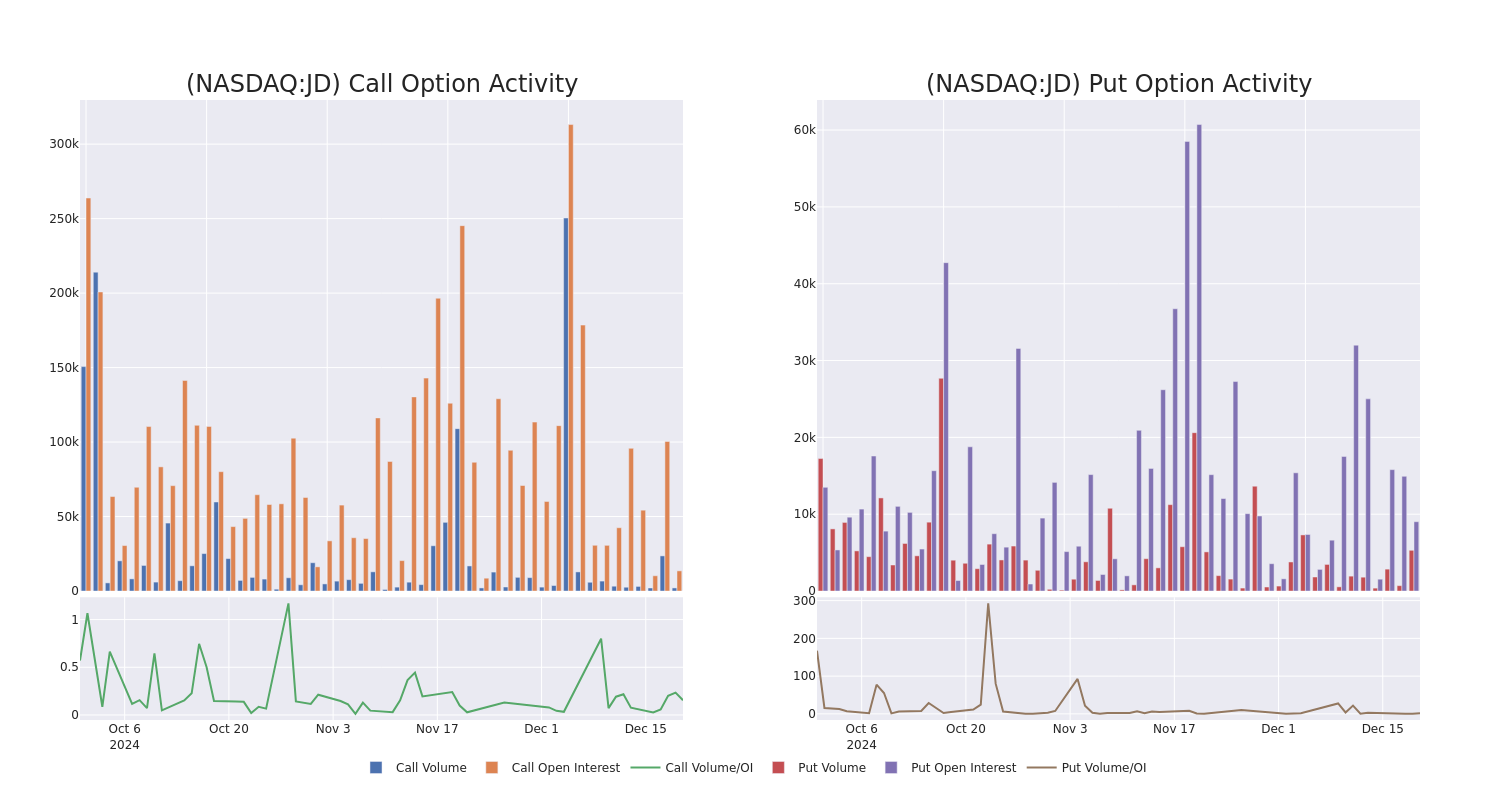

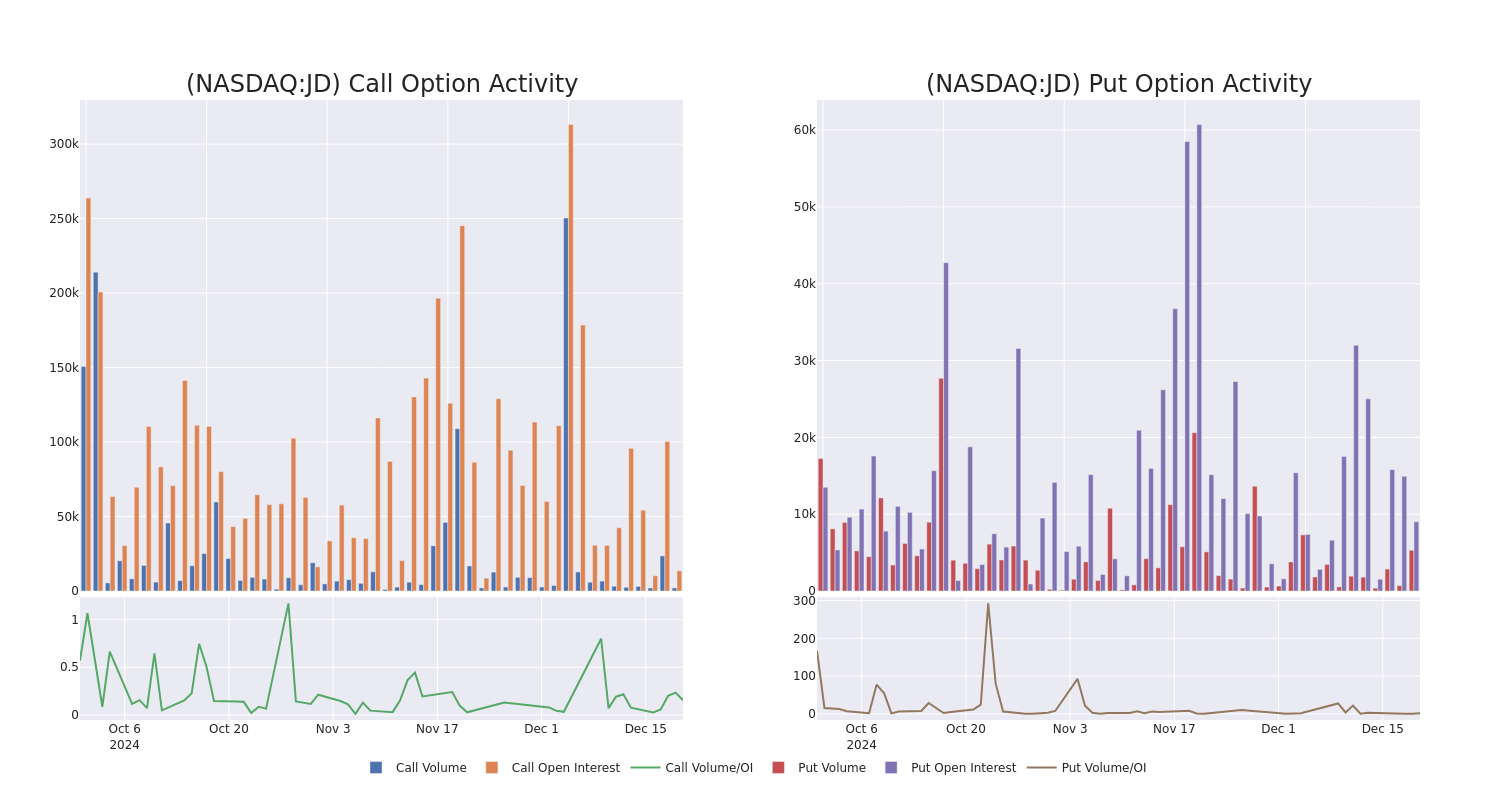

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in JD.com's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to JD.com's substantial trades, within a strike price spectrum from $30.0 to $45.0 over the preceding 30 days.

JD.com 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | CALL | TRADE | NEUTRAL | 04/17/25 | $7.25 | $7.15 | $7.2 | $30.00 | $215.2K | 1.2K | 300 |

| JD | CALL | SWEEP | BULLISH | 01/15/27 | $6.4 | $6.3 | $6.4 | $45.00 | $96.6K | 417 | 151 |

| JD | PUT | TRADE | NEUTRAL | 09/19/25 | $13.6 | $10.9 | $12.0 | $45.00 | $60.0K | 1.1K | 50 |

| JD | PUT | TRADE | BULLISH | 06/20/25 | $3.95 | $3.8 | $3.85 | $34.00 | $57.7K | 1.7K | 200 |

| JD | PUT | TRADE | BULLISH | 06/20/25 | $3.85 | $3.8 | $3.8 | $34.00 | $57.0K | 1.7K | 200 |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

After a thorough review of the options trading surrounding JD.com, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

JD.com's Current Market Status

- With a volume of 4,164,540, the price of JD is down -0.56% at $35.71.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 75 days.

What The Experts Say On JD.com

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $46.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Bernstein has elevated its stance to Outperform, setting a new price target at $46.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest JD.com options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.