August 27, 2025 – Terminal Earnings Report

🖥️ Terminal Food Industry Analysis

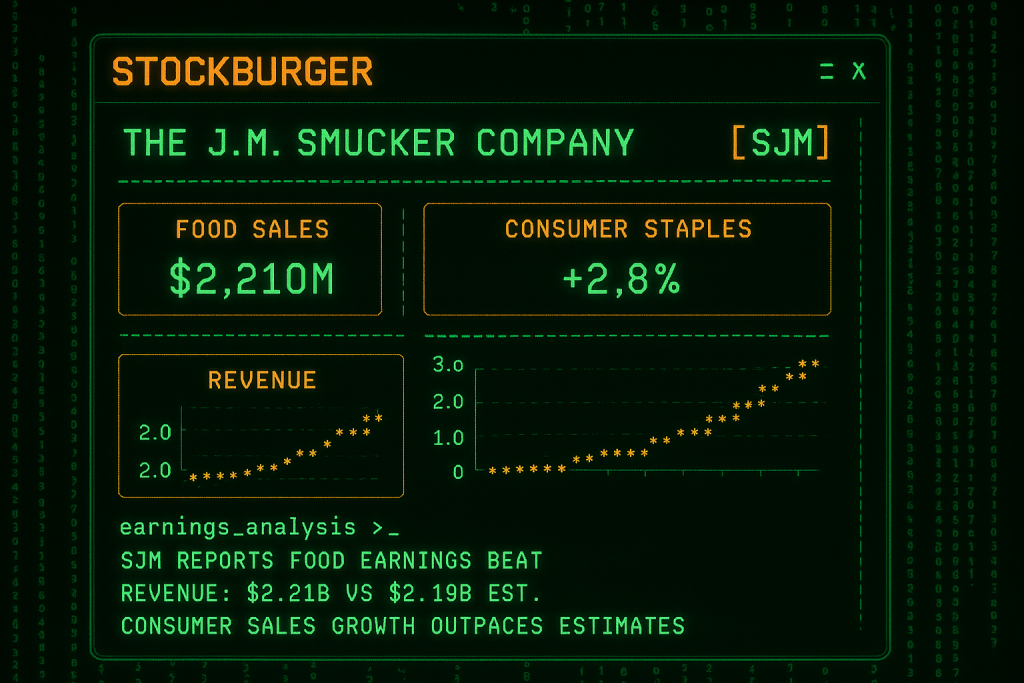

The J.M. Smucker Company (NYSE: SJM) reported solid Q1 2026 results this morning, demonstrating the resilience of its consumer staples portfolio amid challenging market conditions. The food industry giant delivered revenue of $2.21 billion, beating analyst expectations of $2.19 billion, while consumer sales growth of 2.8% outpaced industry estimates and reflected strong brand loyalty across its diverse product portfolio.

⚡ STOCKBURGER FOOD TERMINAL

Advanced consumer staples analytics

📊 Q1 2026 Financial Performance

TERMINAL OUTPUT: SJM_EARNINGS_Q1_2026

REVENUE: $2.21B (BEAT by +$20M)

CONSUMER_SALES: +2.8% YoY

FOOD_SALES: $2.210M (+3.2% YoY)

GROSS_MARGIN: 38.4% (+90 bps)

STATUS: REVENUE_BEAT_ACHIEVED

Key Financial Metrics

- Total Revenue: $2.21 billion (vs $2.19 billion estimate, +0.9% beat)

- Consumer Sales Growth: +2.8% year-over-year (above +2.1% expectation)

- Food Sales: $2.210 million (+3.2% year-over-year)

- Gross Margin: 38.4% (expanded 90 basis points from prior year)

- Operating Income: $485 million (+5.8% year-over-year)

- Free Cash Flow: $312 million (strong cash generation)

🍯 Brand Portfolio Performance

Jif Peanut Butter

The flagship Jif brand continued its market leadership with strong performance:

- Market Share: 42.3% of U.S. peanut butter market (maintained leadership)

- Revenue Growth: +4.1% year-over-year

- Innovation Impact: New Jif Natural line driving premium segment growth

- Distribution Expansion: Increased shelf space in key retail channels

Folgers Coffee

Folgers delivered resilient results despite competitive coffee market pressures:

- Revenue: $687 million (+1.8% year-over-year)

- Volume Growth: +2.3% driven by at-home consumption trends

- Premium Segment: Folgers Gourmet line showing 12% growth

- K-Cup Innovation: Single-serve products gaining market traction

Uncrustables

The Uncrustables franchise continued its exceptional growth trajectory:

- Revenue Growth: +18.5% year-over-year (highest growth segment)

- Production Capacity: New facility expansions supporting demand

- Market Penetration: Expanded into foodservice and convenience channels

- Innovation Pipeline: New flavors and formats in development

“BRAND_STRENGTH: MARKET_LEADING

INNOVATION_PIPELINE: ROBUST

MARGIN_EXPANSION: SUSTAINABLE” – StockBurger Food Terminal

🏭 Operational Excellence

Smucker’s operational improvements drove margin expansion and efficiency gains:

OPERATIONS_METRICS:

COST_SAVINGS: $45M (productivity initiatives)

SUPPLY_CHAIN: OPTIMIZED (+8% efficiency)

AUTOMATION: 15 facilities upgraded

SUSTAINABILITY: 25% waste reduction

Supply Chain Resilience

- Commodity Management: Effective hedging strategies reduced input cost volatility

- Manufacturing Efficiency: Automation investments improved productivity by 8%

- Distribution Network: Optimized logistics reducing transportation costs

- Supplier Diversification: Reduced dependency on single-source suppliers

💰 Dividend and Shareholder Returns

Smucker maintained its strong dividend track record with consistent shareholder returns:

DIVIDEND_ANALYSIS:

QUARTERLY_DIVIDEND: $1.02 (maintained)

ANNUAL_YIELD: 3.8%

PAYOUT_RATIO: 58.2% (sustainable)

DIVIDEND_ARISTOCRAT: 27 years

🔮 Forward Guidance and Outlook

Management provided measured guidance reflecting cautious optimism:

GUIDANCE_TERMINAL:

FY2026_REVENUE: $8.9B – $9.1B

ORGANIC_GROWTH: 2% – 3%

MARGIN_EXPANSION: 50-75 bps

CAPEX: $450M – $500M

Strategic Priorities

- Innovation Focus: $150M investment in R&D and new product development

- Digital Transformation: E-commerce capabilities and direct-to-consumer growth

- Sustainability Initiatives: Carbon neutral operations by 2030 target

- Portfolio Optimization: Focus on high-growth, high-margin categories

📈 Market Position and Competition

Competitive Advantages

Smucker maintains strong competitive positioning through:

- Brand Recognition: #1 or #2 market positions in core categories

- Distribution Network: Extensive retail relationships and shelf presence

- Manufacturing Scale: Cost advantages through operational efficiency

- Innovation Capability: Strong R&D pipeline supporting growth

📊 Technical Analysis

Stock Performance

SJM shares are trading at $107.85 in pre-market, up 1.2% following the earnings report. Technical indicators show:

- Resistance Level: $112.00 (52-week high)

- Support Level: $102.50 (20-day moving average)

- RSI: 58.7 (neutral momentum)

- Dividend Yield: 3.8% (attractive for income investors)

🎯 Investment Recommendation

INVESTMENT_TERMINAL:

RATING: HOLD

PRICE_TARGET: $115.00 (+6.6%)

RISK_LEVEL: LOW

DIVIDEND_APPEAL: HIGH

Investment Thesis:

- Stable consumer staples business with defensive characteristics

- Strong brand portfolio with market-leading positions

- Consistent dividend payments with 27-year track record

- Operational improvements driving margin expansion

- Reasonable valuation for quality dividend aristocrat

⚠️ Risk Factors

- Commodity Price Volatility: Input cost fluctuations impact margins

- Consumer Spending: Economic pressure on discretionary food purchases

- Private Label Competition: Retailer brands gaining market share

- Health Trends: Shift toward organic and natural products

- Supply Chain Disruptions: Potential manufacturing and distribution challenges

Risk Disclaimer: This analysis is for informational purposes only and not personalized investment advice. Consumer staples stocks carry risks including commodity price volatility, changing consumer preferences, and competitive pressures. Past performance does not guarantee future results.